Global Halal Meat Market Size, Share, And Business Benefits By Product (Poultry, Beef, Sheep and Goat, Others), By Type (Fresh, Processed(Sausages, Cold Cuts, Ready-to-eat Meat Meals, Others)), By Distribution Channel (B2B/Wholesaler, Supermarkets/Hypermarkets, Convenience Stores, Online Retail), By End-user (Food Service, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 105365

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

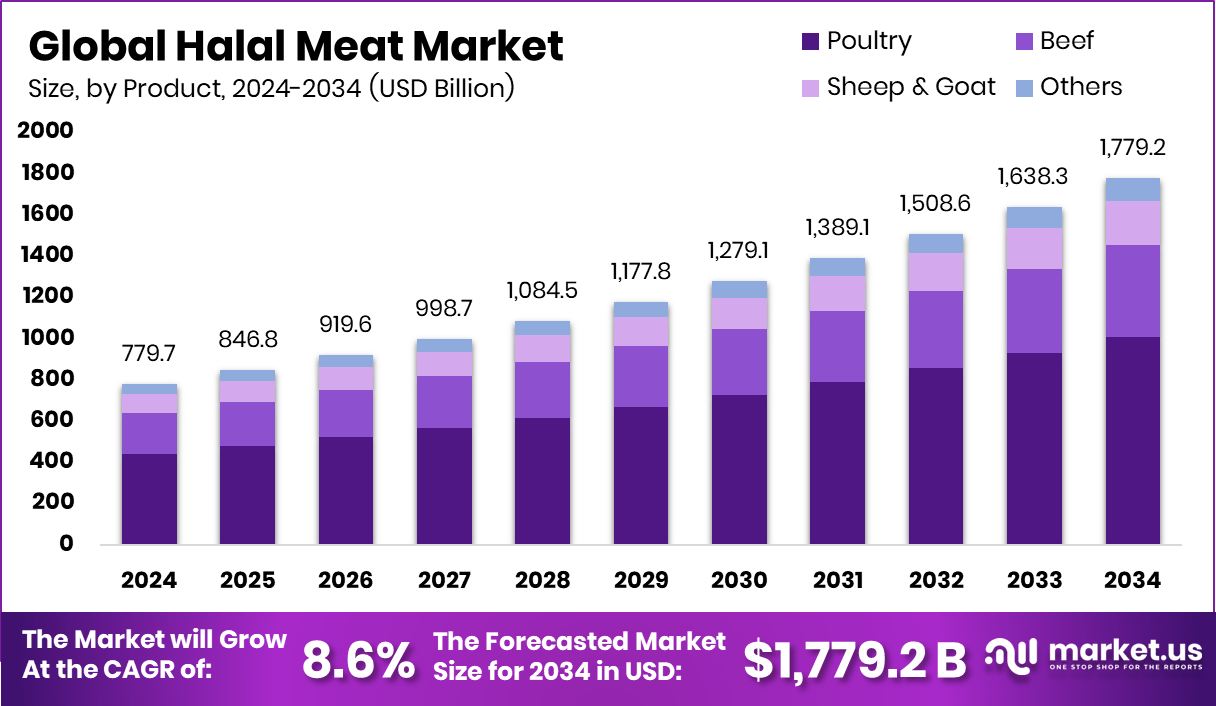

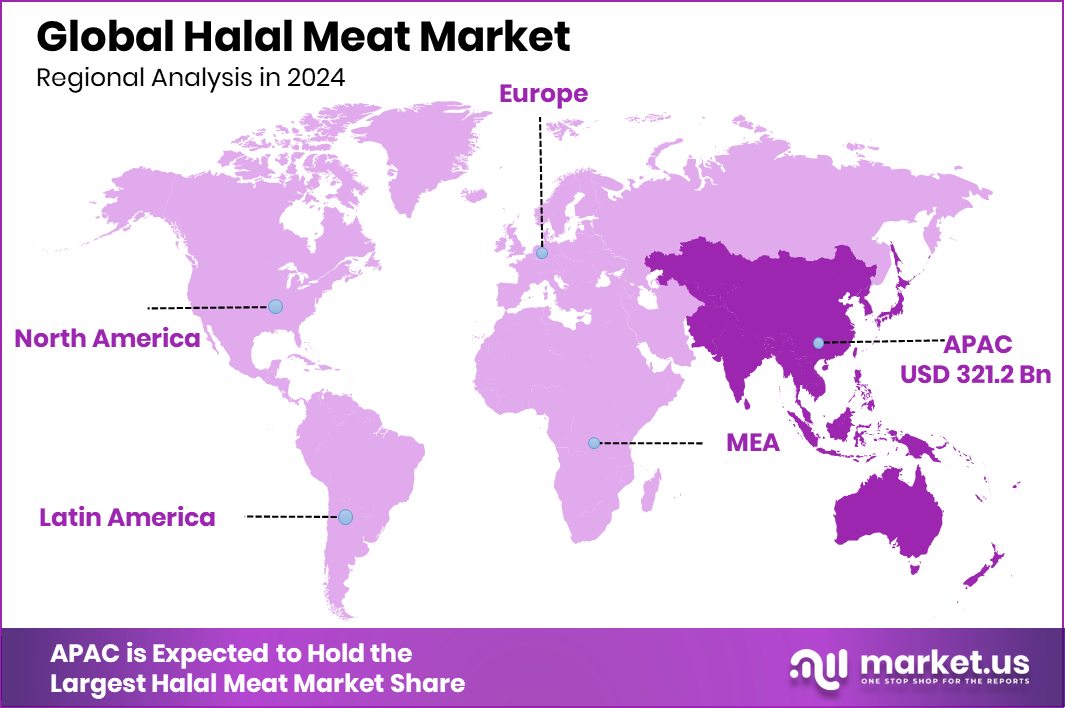

Global Halal Meat Market is expected to be worth around USD 1,779.2 billion by 2034, up from USD 779.7 billion in 2024, and grow at a CAGR of 8.6% from 2025 to 2034. With a 41.2% market share, Asia-Pacific’s Halal Meat Market reached USD 321.2 billion.

The Halal Meat Market refers to the segment of the food industry that supplies meat processed and prepared according to Islamic dietary laws. This market is growing as the global Muslim population increases and as more consumers seek ethical food options that are perceived as healthier and more hygienically processed.

One significant growth factor for the Halal Meat Market is the increasing awareness among Muslims and non-Muslims alike about Halal-certified food. This awareness is bolstered by the rising global travel and migration, which exposes diverse populations to Halal dietary principles, expanding the market’s demographic reach.

Demand for Halal meat is driven primarily by the growing Muslim populations in both traditional and non-traditional markets, such as Europe and North America. The younger demographic within these communities, who are particularly brand-conscious and quality-sensitive, significantly contributes to the sustained demand for certified Halal products.

The first largest producer of beef in the world is a country with a well-developed supply chain and significant global presence, contributing to its leadership in the international market, with a production of 12.89 million tons of beef in 2022. China, with a production of 7.18 million tons of beef in 2022 and a herd of more than 98 million heads, stands as the largest beef-consuming country in the world, with its production growing rapidly.

Key Takeaways

- Global Halal Meat Market is expected to be worth around USD 1,779.2 billion by 2034, up from USD 779.7 billion in 2024, and grow at a CAGR of 8.6% from 2025 to 2034.

- In the Halal Meat Market, poultry is notably predominant, holding a 56.7% share.

- Fresh halal meat is preferred, representing 62.3% of the market’s product type.

- B2B and wholesalers distribute 44.8% of halal meat, showcasing significant channel involvement.

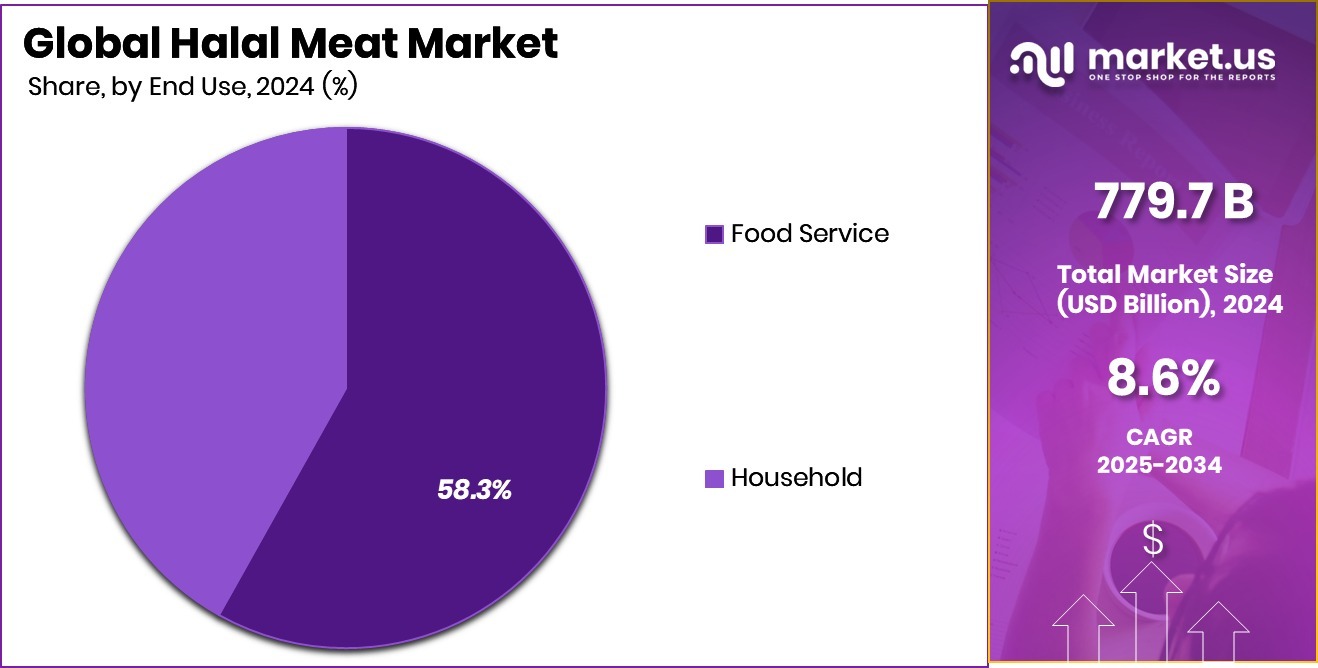

- The food service sector is a major consumer, accounting for 58.3% of the market.

- Asia-Pacific captured 41.2% of the Halal Meat Market, valued at USD 321.2 billion.

By Product Analysis

Poultry leads the Halal Meat Market with a 56.7% share.

In 2024, Poultry held a dominant market position in the By Product segment of the Halal Meat Market, with a 56.7% share. This substantial market presence can be attributed to the widespread consumption patterns and cultural acceptance of poultry within diverse communities observing halal dietary guidelines. As a primary source of affordable protein, poultry surpasses other meat types in accessibility and versatility, making it a staple in both household and commercial food preparations.

The market’s favorability towards poultry is also reinforced by its relative ease of production and lower environmental footprint compared to red meats, which aligns with the growing consumer emphasis on sustainable and ethical food choices. Additionally, advancements in halal certification processes have streamlined the supply chains, ensuring that poultry products meet the stringent halal standards demanded by consumers globally.

This has further solidified poultry’s position as a key player in the halal meat industry, driving growth and expanding its market reach through innovative product offerings and enhanced distribution strategies. These factors collectively underscore the segment’s robust performance and pivotal role in shaping the dynamics of the Halal Meat Market.

By Type Analysis

Fresh halal meat comprises 62.3% of the market type.

In 2024, Fresh held a dominant market position in the By Type segment of the Halal Meat Market, with a 62.3% share. This prominence is largely driven by consumer preferences for freshly processed meats, which are perceived as healthier and more flavorful compared to their frozen counterparts. The preference for fresh halal meat is particularly strong in regions with large Muslim populations, where there is a significant emphasis on the quality and freshness of meat, due to Islamic dietary laws.

The robust demand for fresh meat is supported by the development of rapid logistics and cold storage solutions that maintain the integrity of meat from slaughter through to retail. Furthermore, the increasing number of halal-certified slaughterhouses and improved regulatory frameworks across various countries have also contributed to the accessibility and trust in the fresh meat segment.

Retailers and butchers specializing in halal products have capitalized on this trend by emphasizing the superior quality and taste of fresh meat, conducting live butchery demonstrations, and engaging directly with consumers about the benefits of fresh halal meat. These marketing strategies have reinforced consumer trust and loyalty, driving the segment’s growth and solidifying its market dominance.

By Distribution Channel Analysis

B2B/Wholesalers distribute 44.8% of halal meat.

In 2024, B2B/Wholesaler held a dominant market position in the By Distribution Channel segment of the Halal Meat Market, with a 44.8% share. This leading position underscores the critical role of wholesalers in the distribution chain, serving as essential intermediaries between meat processors and retail outlets. Wholesalers are pivotal in managing large volumes of halal meat, ensuring that they reach various market segments efficiently, from small independent retailers to supermarkets and restaurants.

The strength of B2B/Wholesaler channels in the halal meat market is attributed to their ability to provide extensive logistics and storage solutions, which are vital for maintaining the integrity and halal status of the meats during transport and storage. Moreover, these wholesalers often have well-established relationships with halal certifiers to guarantee compliance with religious dietary laws, thereby instilling confidence among downstream retail partners and ultimately, the end consumers.

Additionally, the reliance on wholesalers is heightened by the expanding global demand for halal meat products, necessitating robust supply chains that can handle the complexities of international trade and regulatory compliance across borders.

By End-user Analysis

Food Service consumes 58.3% of the market.

In 2024, Food Service held a dominant market position in the By End-user segment of the Halal Meat Market, with a 58.3% share. This segment’s prominence reflects the extensive use of halal meat within the restaurant and catering industries, which cater to a growing global Muslim population keen on dining experiences that adhere to Islamic dietary laws.

The food service sector’s demand for halal meat is driven by the expansion of halal-certified dining establishments in both predominantly Muslim and non-Muslim countries, showcasing the broadening appeal and acceptance of halal food. These establishments not only serve to meet religious requirements but also attract a diverse clientele looking for ethical and quality food options.

Moreover, the segment benefits from the rising trend of gourmet and specialty dining that focuses on the provenance and ethical sourcing of ingredients, including halal-certified meats. Food service providers are increasingly promoting transparency in their halal meat sources, enhancing consumer trust and satisfaction.

Key Market Segments

By Product

- Poultry

- Beef

- Sheep and Goat

- Others

By Type

- Fresh

- Processed

- Sausages

- Cold Cuts

- Ready-to-eat Meat Meals

- Others

By Distribution Channel

- B2B/Wholesaler

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

By End-user

- Food Service

- Household

Driving Factors

Increasing Global Muslim Population Fuels Market Growth

The Halal Meat Market is primarily driven by the increasing global Muslim population, which is expanding at a significant rate. As the population grows, so does the demand for meat products that adhere to Islamic dietary laws, which is a key requirement for Muslims worldwide.

This demographic trend is pivotal because it not only boosts the consumption of halal meat within Muslim-majority countries but also influences food culture in non-Muslim nations where multicultural inclusivity is becoming more prevalent.

As a result, food producers and suppliers are increasingly seeking halal certification to tap into this lucrative market, ensuring that their products are permissible under Islamic law. This demographic expansion is a cornerstone for the market’s growth, compelling retailers, restaurateurs, and meat processors to adapt their offerings to meet this rising demand effectively.

Restraining Factors

Stringent Certification Standards Limit Market Entry

One of the primary restraining factors for the Halal Meat Market is the stringent certification standards required to label products as halal. These rigorous standards, which ensure compliance with Islamic dietary laws, pose significant challenges for new entrants and existing players looking to expand their market reach.

The process of obtaining halal certification can be complex, time-consuming, and costly, involving detailed inspections of the entire supply chain—from slaughter methods to processing and packaging. This level of scrutiny is necessary to maintain the integrity of halal products, but can act as a barrier for smaller producers or those new to the halal market.

Additionally, the lack of a unified global standard for halal certification can lead to confusion and inconsistency, further complicating market entry for companies. This factor significantly impacts the market dynamics by restricting the number and diversity of market players.

Growth Opportunity

Expansion into Non-Muslim Regions Offers Potential

A significant growth opportunity for the Halal Meat Market lies in its expansion into non-Muslim regions. As global awareness and acceptance of halal products increase, there is a rising interest among non-Muslim consumers who value the ethical, quality, and safety standards associated with halal certification. This broader consumer base presents a lucrative opportunity for producers to diversify their market and enhance their global reach.

By entering markets in Europe, North America, and parts of Asia where Muslims are not the majority, halal meat providers can tap into a new segment that appreciates the meticulous processing and perceived health benefits of halal meat. Strategic marketing and educational campaigns can further aid in breaking down cultural barriers, making halal meat a mainstream option in these regions.

Latest Trends

Rise of E-commerce Platforms Boosts Halal Sales

A notable trend in the Halal Meat Market is the rise of e-commerce platforms specializing in halal products. With the increasing penetration of the internet and mobile technology, online grocery shopping has become more prevalent, including the purchase of halal meats.

This digital shift allows consumers, particularly those in regions with fewer halal physical stores, to access a variety of halal-certified products conveniently. E-commerce platforms offer detailed product information, transparency, and verification of halal certification, which enhances consumer trust.

Additionally, these platforms often provide broader selections and competitive pricing, which are attractive to a cost-conscious demographic. The convenience of home delivery and the ability to reach a wider audience are transforming how halal meat is marketed and consumed globally, reflecting a significant shift towards digital consumption channels.

Regional Analysis

In 2024, Asia-Pacific led the Halal Meat Market with a 41.2% share, USD 321.2 Bn.

In 2024, Asia-Pacific held a dominant position in the global Halal Meat Market, accounting for 41.2% of the overall share, valued at USD 321.2 billion. The region’s dominance is primarily driven by its large Muslim population, increasing urbanization, and strong demand for certified halal food products across countries like Indonesia, Malaysia, and India.

North America represents a key market as well, supported by growing halal awareness among non-Muslim consumers and the expanding Muslim immigrant population across the United States and Canada. Europe also shows considerable growth, with rising demand for halal-certified meat products, especially in countries like France, Germany, and the United Kingdom.

Meanwhile, the Middle East & Africa region remains a traditional stronghold for halal meat consumption, bolstered by religious and cultural adherence, although market expansion is relatively stable compared to emerging regions. Latin America is witnessing gradual growth, with Brazil emerging as a notable halal meat exporter to Muslim-majority countries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BRF Global maintained a strong position in the global Halal Meat Market through its continuous investment in halal-certified production and international market expansion. The company’s focus on adhering to strict halal standards and targeting Muslim-majority countries has strengthened its portfolio, especially across Asia-Pacific and the Middle East. BRF’s brands are recognized for quality and compliance, allowing it to maintain competitive leadership despite rising regional competition.

Thomas International also demonstrated a notable presence in the 2024 Halal Meat Market by concentrating on diversified halal meat offerings and tapping into niche halal consumer segments. The company’s strategy focused on offering customized halal solutions to cater to varying religious and cultural preferences across regions like North America and Europe. By prioritizing transparency in sourcing and certifications, Thomas International positioned itself as a trusted supplier in a rapidly evolving halal ecosystem.

Tyson Foods, Inc. further expanded its halal product lines to address the surging global demand for halal-certified proteins. Tyson’s commitment to capturing the growing halal meat consumer base in the United States and selected international markets led to a stronger brand positioning in 2024. The company leveraged its vast supply chain capabilities to ensure consistent halal meat quality, gaining traction among multicultural populations seeking authentic and certified halal options.

Top Key Players in the Market

- BRF Global

- Thomas International

- Tyson Foods, Inc.

- Hormel Foods Corp

- Nema Halal

- Crescent Foods

- Harris Ranch Beef Co.

- Midamar Corporation

- Danish Crown

- Vion

- Bigard

- Al Kabeer Group ME

- Amana Foods

- Al Islami Foods

- Tariq Halal

- Tahira Foods Ltd

- Saffron Road

- American Foods Group, LLC

- Tallgrass Beef

- Ena Meat Packing

- Al-Aqsa

- SIS Company

- Prairie Halal Foods

- DOUX

- Other Key Players

Recent Developments

- In April 2025, BRF announced plans to invest approximately $160 million in building a new halal food plant in Jeddah, Saudi Arabia. The facility is expected to start operations by mid-2026 and will focus on producing processed halal foods, with an initial capacity of about 40,000 metric tons per year.

- In March 2025, Thomas Foods International USA introduced new halal-certified goat meat products to the U.S. market. These offerings include value-added options like goat cubes, which are high in protein, low in fat and cholesterol, free-range, and contain no added hormones or antibiotics. These products cater to the growing demand for halal meat among American consumers.

- In November 2024, Crescent Foods updated its chicken product packaging to enhance convenience and visibility. The new features include clear, recyclable trays for better product visibility, bold typography for easy identification, resealable bags with on-package recipes, and packaging tailored for club stores.

Report Scope

Report Features Description Market Value (2024) USD 779.7 Billion Forecast Revenue (2034) USD 1,779.2 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Poultry, Beef, Sheep and Goat, Others), By Type (Fresh, Processed(Sausages, Cold Cuts, Ready-to-eat Meat Meals, Others)), By Distribution Channel (B2B/Wholesaler, Supermarkets/Hypermarkets, Convenience Stores, Online Retail), By End-user (Food Service, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BRF Global, Thomas International, Tyson Foods, Inc., Hormel Foods Corp, Nema Halal, Crescent Foods, Harris Ranch Beef Co., Midamar Corporation, Danish Crown, Vion, Bigard, Al Kabeer Group ME, Amana Foods, Al Islami Foods, Tariq Halal, Tahira Foods Ltd, Saffron Road, American Foods Group, LLC, Tallgrass Beef, Ena Meat Packing, Al-Aqsa, SIS Company, Prairie Halal Foods, DOUX, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BRF Global

- Thomas International

- Tyson Foods, Inc.

- Hormel Foods Corp

- Nema Halal

- Crescent Foods

- Harris Ranch Beef Co.

- Midamar Corporation

- Danish Crown

- Vion

- Bigard

- Al Kabeer Group ME

- Amana Foods

- Al Islami Foods

- Tariq Halal

- Tahira Foods Ltd

- Saffron Road

- American Foods Group, LLC

- Tallgrass Beef

- Ena Meat Packing

- Al-Aqsa

- SIS Company

- Prairie Halal Foods

- DOUX

- Other Key Players