Global Savory Snacks Market; By Type(Potato Chips, Corn and Tortilla Chips, Nuts and Seeds, Popcorn, Pretzels, Others), By Flavor(Barbeque, Spice, Salty, Plain/Unflavoured, Others), By Distribution Channel(Hypermarkets and Supermarkets, Convenience Stores, Online, Others) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2024-2033

- Published date: Dec 2023

- Report ID: 35549

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

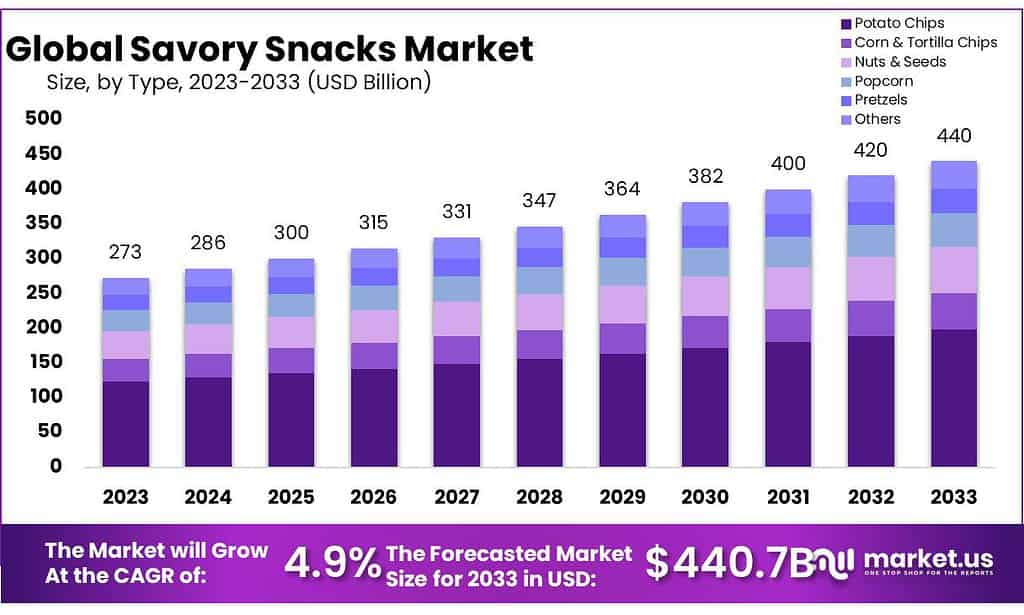

The Savory Snacks Market size is expected to be worth around USD 440 billion by 2033, from USD 273 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

Food manufacturers are trying to meet the growing demand from consumers for healthier snack options. Consumers are increasingly choosing lighter, more convenient snacks to replace main meals due to hectic lifestyles and the increasing levels of urbanization.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: By 2033, the market is expected to reach USD 440 billion, growing at a CAGR of 4.9% from USD 273 billion in 2023.

- Product Dominance: Potato Chips hold over 68.2% of the market share, followed by Corn and Tortilla Chips, Nuts and Seeds, Popcorn, and Pretzels.

- FlavorPreferences: Barbeque flavors lead with over 35% market share, followed by Spice, Salty, and Plain/Unflavored options.

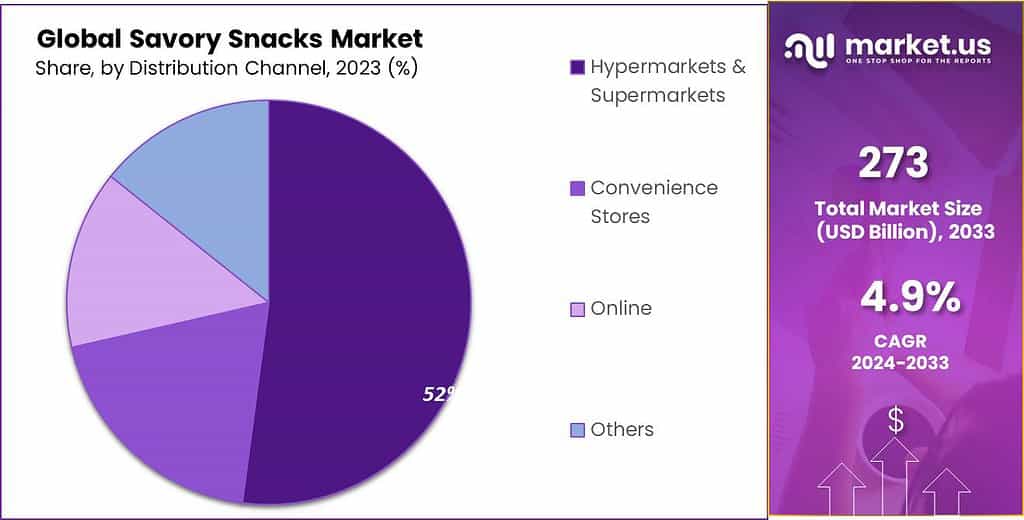

- Distribution Channels: Hypermarkets and supermarkets capture more than 62% of the market share, followed by Convenience Stores, Online, and other retail outlets.

- Market Drivers: Global expansion in retail industries, especially in developed regions like the US, Canada, UK, France, and Australia, contributes significantly to sales growth.

- Challenges and Opportunities: Health concerns about snack ingredients pose a restraint, but the rising demand for healthier options provides an opportunity for innovation.

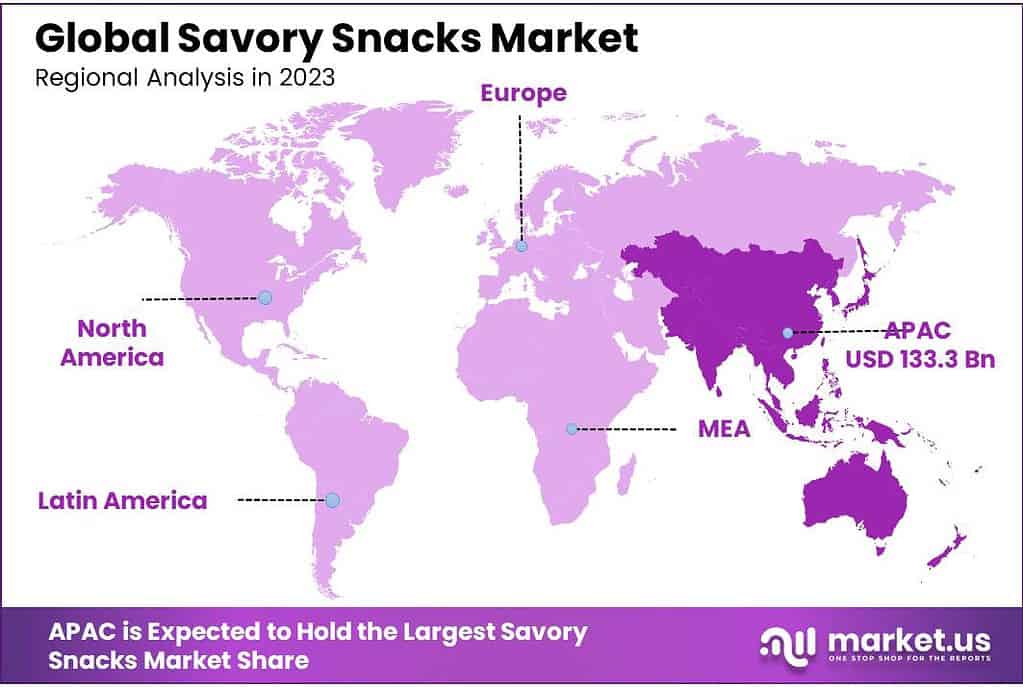

- Regional Insights: Asia Pacific holds the largest market share (48%), led by countries like India, Japan, and China. Europe, driven by Spain and the UK, also shows strong demand.

- Key Market Players: Companies like PepsiCo, The Kellogg Company, Kraft Heinz Company, Conagra Brands Inc., and ITC Limited actively innovate and expand.

Product Analysis

In 2023, the dominance of the Potato Chips segment characterized the Savory Snacks market, capturing an extensive share of over 68.2%.

Potato Chips: Thinly sliced and deep-fried or baked potato slices, seasoned with various flavors like salt, spices, cheese, or herbs. They offer a crispy texture and a wide range of taste options. Corn & Tortilla Chips: Made from corn masa, these snacks come in various shapes and sizes. Tortilla chips are typically served alongside dips like salsa and guacamole, while corn chips can be enjoyed as standalone snacks.

Nuts & Seeds: Nuts and seeds provide a tasty snack option with their crunchy textures and are often packed full of essential vitamins and nutrients. They come in varieties such as peanuts, almonds, and cashews for example – offering plenty of crunch. Popcorn: Popcorn kernels are heated until they pop, becoming fluffy and crunchy. They’re often enjoyed with salt or various seasonings and sometimes coated with caramel or cheese for a sweet or savory flavor.

Pretzels: A type of baked snack made from dough, typically twisted into a knot-like shape. They’re often salted and have a crispy, crunchy texture. Others: This category may include a wide range of savory snacks that don’t fall into the main categories mentioned above. It could include items like pita chips, vegetable chips, or different regional or specialty snacks.

By Flavor

In 2023, Barbeque flavors ruled the savory snacks market, grabbing over 35% of the share. People just couldn’t get enough of that smoky, tangy taste! The irresistible BBQ flavor stood out, enticing snack lovers and dominating the market.

Spice flavors weren’t far behind, though, claiming a considerable slice of the savory snack pie. That spicy kick packed a punch, appealing to those who craved a fiery twist in their snacks.

Salty flavors also had a strong presence, offering that classic, satisfying taste that many snack enthusiasts adore. It’s the go-to choice for those seeking a simple yet savory snacking experience.

Plain/Unflavored options, surprisingly, maintained their position too. Sometimes, simplicity is king! While not as flashy as the flavored varieties, the plain and unflavored snacks found their place among consumers who preferred a more straightforward snacking option.

Other flavors also played a role, bringing in a mix of unique tastes and innovative combinations. These lesser-known flavors added diversity to the market, catering to niche preferences and adventurous snackers.

Each flavor segment had its charm, but in 2023, it was the irresistible allure of Barbeque that reigned supreme, captivating taste buds and dominating the savory snacks scene.

Distribution Channel Analysis

In 2023, hypermarkets & supermarkets were the big players, snagging more than 62% of the market share. These mega-stores were the go-to spots for savory snacks, offering a wide array of choices under one roof.

Hypermarkets & Supermarkets: These are the primary retail outlets for savory snacks, offering a wide variety of brands and flavors. They allow consumers to browse multiple options and often offer promotions or discounts.

Convenience Stores: Convenience stores cater to consumers seeking quick and convenient snack solutions on the go, offering limited brands of popular snacks from which customers can select.

Online: With e-commerce quickly expanding, more consumers prefer buying snacks online for convenience. Online platforms offer a vast array of choices, home delivery, and sometimes exclusive deals.

Others: This category may encompass various smaller outlets such as specialty snack shops, vending machines, or local grocery stores that carry a specific range of savory snacks.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Product

- Potato Chips

- Corn & Tortilla Chips

- Nuts & Seeds

- Popcorn

- Pretzels

- Others

By Flavor

- Barbeque

- Spice

- Salty

- Plain/Unflavoured

- Others

Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Drivers

Retail industry expansion worldwide serves as an influential driver in driving sales of savory snack products globally. Major developed regions, such as the US, Canada, UK France, and Australia boast large established markets that serve large portions of their population with supermarkets and hypermarkets serving as vital hubs to bring these snack offerings directly to consumers. This has proven particularly crucial when it comes to sales of these savory treats!

Additionally, supermarkets and hypermarkets are experiencing dynamic changes, particularly in developing nations such as India, China, and Brazil. Here, retailers with substantial resources are actively investing to broaden their foothold; this strategy includes opening more stores with modern retail formats in emerging markets like these to take advantage of growing consumer demand for snack products while providing convenient accessibility through retail outlets.

Expanding retail infrastructure in developing nations presents the savory snack market with an invaluable opportunity. Not only does it meet changing consumer preferences, but it also opens up doors for manufacturers and suppliers looking to broaden their reach in these fast-growing economies – further driving sales of these savory snacks across diverse geographical regions.

Restraints

Health concerns surrounding ingredients commonly used in savory snack products, including wheat, corn, vegetable oil, salt, sugar, and artificial additives are a significant impediment to market growth. While integral to their taste and production of snacks, these ingredients have raised red flags due to potential health implications.

Health issues related to weight and associated conditions pose a substantial threat to the savory snack products market globally. With consumers prioritizing health-conscious choices, awareness regarding ingredients and nutritional content of snacks has grown considerably – prompting many individuals to switch over to healthier snack alternatives or reduce consumption altogether.

As consumer health concerns continue to influence consumer decisions and regulatory bodies put more focus on encouraging healthier dietary habits, the market for savory snack products faces unique challenges. Manufacturers face pressure to innovate and reformulate products to reflect changing consumer tastes for healthier and more nutritious snack options. Overcoming health-related restrictions requires concerted efforts from the industry in responding with offerings that provide both taste and health benefits – an effort that must take into account changing consumer tastes while still meeting the demand for both aspects simultaneously.

Opportunity

Low intakes of essential nutrients have been linked with higher risks of chronic illnesses like high blood pressure, cancer, obesity, and diabetes. With globalization and exposure to multiple cultures – specifically Western lifestyles – becoming more widespread, eating habits worldwide have changed, leading to snacking across age groups.

This shift in dietary habits opens up a significant opportunity for the market of healthy snacks.With greater awareness of how food choices impact health, there is an escalating demand for snacks that go beyond taste to provide essential nutrition that may reduce risks associated with chronic diseases. Consumers increasingly look for snack options with nutritional value in mind when making their choices for a snack snack option.

Demand for healthy snacks reflects an overall shift toward wellness-minded lifestyles. People are looking for convenient yet nutritious snack options, prompting manufacturers to develop and promote snacks that not only tantalize taste buds but also contribute to overall health. This presents an opportune moment for the industry to innovate and introduce healthier snack choices that resonate with consumers’ evolving preferences for healthier living.

Challenges

The surge in demand for ready-to-eat snacks, driven by busier lifestyles and improved living standards, has led to a heightened need for increased production of savory snack products. However, the savory snack products market is notably fragmented, particularly in Asian and European regions. This fragmentation has paved the way for the emergence of numerous local snack product manufacturers.

These local players often opt for lower-cost equipment, impacting the quality of their products. As a result, their offerings, infused with local flavors and spices, are often priced lower and cater to specific tastes prevalent in the local market. Leveraging their understanding of consumer tastes and preferences, these local snack manufacturers excel in providing flavors that resonate with traditional food habits, earning better acceptance among local consumers.

This scenario poses a considerable challenge for established players in the savory snack market. The intense competition from these unorganized, local manufacturers creates pressure on larger companies to not only maintain product quality but also to innovate and adapt their offerings to meet evolving consumer preferences.

Local manufacturers’ ability to tap into traditional tastes and preferences often gives them an edge in their respective markets, making it crucial for larger players to navigate this competition while preserving their brand value and quality standards.

This fierce competition from unorganized players emphasizes the need for established brands to continually enhance their strategies, product innovation, and understanding of local tastes to maintain a competitive edge in these fragmented markets.

Regional Analysis

In terms of revenue, the Asia Pacific accounted for the largest savory snacks market share of this global market (48%). As a result of growing concerns about childhood obesity, countries like India, Japan, and China are spearheading this market’s growth in the Asia Pacific. Segments like popcorn, which have indexed a significant growth in sales, are now more readily available.

A survey conducted by Harris Poll for MondelA”z International in February 2022 found that 250 Indian respondents were interested in snacking. It concluded that 74% prefer small meals per day and that snacking is healthier than large meals.

Europe is a hot market for savory snacks, as they are enjoyed on many occasions by people in this region. This industry is driven by Spain and the U.K., where consumers eat on the go instead of whole meals. In countries like Germany, Norway, and the Netherlands, there is a rapid increase in the demand for savory snacks.

New product launches, mergers, acquisitions, and other market activity are all good signs for regional growth. In November 2020, the Savourists, a UK-based brand, launched a savory bar in two flavors: Black Olive and nori Seaweed and Sundried Tomato and herb. Further options for the bar range will be available in Sainsbury’s “Taste of Future Bay”.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Due to a large number of players, both small and established, this industry is very competitive. In the savory snacks sector, industry players are constantly involved in product development and new flavor introductions. Companies’ profitability is dependent on effective marketing, well-trained sales staff, and efficient operations. Due to the growing number of health-conscious Consumers, manufacturers are diversifying their product lines.

Kazoo introduced the first water-saving tortilla chip in September 2021. The snacks are made from 40% corn germ and corn starch.

Future Group announces plans to sell Terra Chips from the United States by March 2021 in India. Hain Celestial Group formed a joint venture to produce Terra Chips in India.

Pretzel Pete-snacks manufacturer added Seasoned Pretzel Pieces to its product line of gourmet pretzel snacks in December 2020. These products are made from wheat flour and come in three flavors: Buffalo blue, Smokey bacon, and Cinnamon brown sugar.

Key Market Players

- PepsiCo

- The Kellogg Company

- Kraft Heinz Company

- Conagra Brands Inc.

- ITC Limited

- ConAgra Foods

- Kellogg Co.

- General Mills Inc.

- Hain Celestial

- Blue Diamond Growers

Recent Development

In January 2022, Hain Celestial agreed to acquire ParmCrisps, a fast-growing, better-for-you brand offering delicious, convenient products that are consumer favorites from Clearlake Capital Group. The acquisition deepens Hain’s position in the snacking category and represents a significant step in establishing Hain as a high-growth, global healthy food company.

In January 2022, Mondelez International completed the acquisition of Chipita Global S.A. The acquisition marks a milestone in the strategic plan, focused on accelerating growth in core snacking adjacencies while expanding its footprint in key markets.

Report Scope

Report Features Description Market Value (2023) USD 273 Billion Forecast Revenue (2033) USD 440 Billion CAGR (2023-2032) 4.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Potato Chips, Corn and Tortilla Chips, Nuts and Seeds, Popcorn, Pretzels, Others), By Flavor(Barbeque, Spice, Salty, Plain/Unflavoured, Others), By Distribution Channel(Hypermarkets and Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PepsiCo, The Kellogg Company, Kraft Heinz Company, Conagra Brands Inc., ITC Limited, ConAgra Foods, Kellogg Co., General Mills Inc., Hain Celestial, Blue Diamond Growers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What Are Savory Snacks?Savory snacks are food items typically consumed between meals. They come in various forms such as chips, pretzels, popcorn, nuts, and other flavorful bites. These snacks offer savory or salty tastes compared to sweet snacks.

What Types of Savory Snacks Are Popular?The market offers a diverse range of savory snacks, including potato chips, tortilla chips, pretzels, popcorn, nuts, crackers, and meat-based snacks like jerky. Each type comes in multiple flavors and varieties.

What Drives the Savory Snacks Market?Factors driving this market include changing consumer lifestyles, busy schedules, increased snacking habits, demand for convenience foods, innovative flavors and product offerings, and a growing preference for healthier snack options.

-

-

- PepsiCo

- The Kellogg Company

- Kraft Heinz Company

- Conagra Brands Inc.

- ITC Limited

- ConAgra Foods

- Kellogg Co.

- General Mills Inc.

- Hain Celestial

- Blue Diamond Growers

- Other Key Players