Global Agricultural Fumigants Market By Product Type(1,3 Dichloropropene, Chloropicrin, Methyl Bromide, Metam Potassium, Other Product Type), By Crop Type(Cereals and grains, Oilseeds and pulses, Fruits and vegetables, Others), By Pest control Method(Vacuum chamber fumigation, Tarpaulin, Structural, Non-tarp fumigation by injection, Others), By Form(Solid, Liquid, Gas), By Function(Insecticides, Fungicides, Nematicides, Herbicides), By Application, (Soil, Warehous), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 20427

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

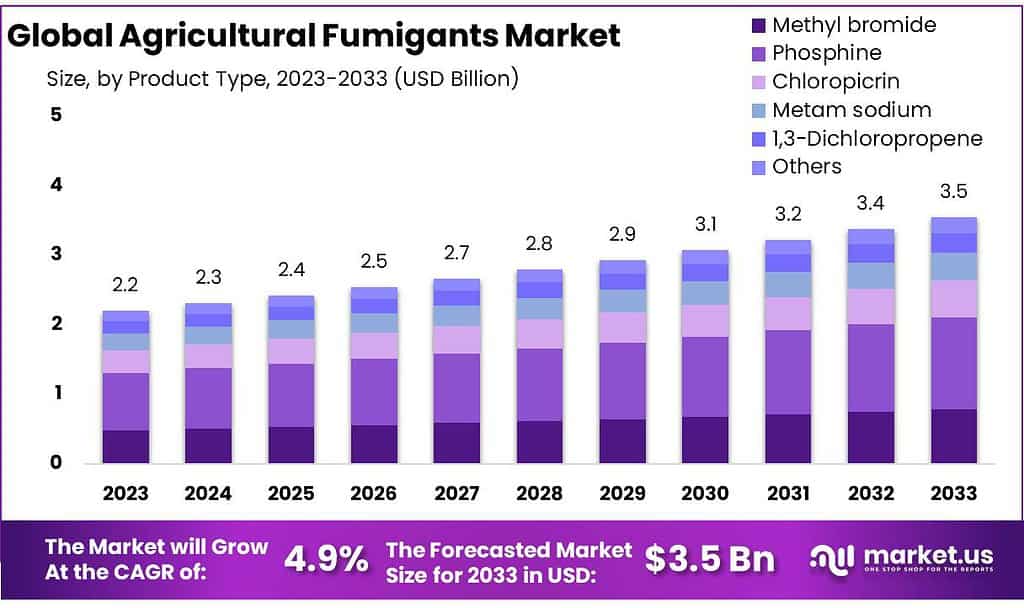

The global agricultural fumigants market size is expected to be worth around USD 3.5 billion by 2033, from USD 2.2 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The growth is driven by evolving requirements regarding crop protection techniques, post-harvest practices, and other factors. The agricultural fumigants market revolves around chemicals or compounds used to disinfect or sanitize soil, commodities, or agricultural produce to control pests, pathogens, and weeds.

Purpose and Use Agricultural fumigants are employed to eliminate or suppress pests, nematodes, fungi, bacteria, and weeds present in soil, stored commodities, or structures. They are crucial for pre-planting or post-harvest treatment to protect crops and ensure food safety.

Types of Fumigants Several types of chemicals are used as fumigants, including methyl bromide, phosphine, chloropicrin, 1,3-dichloropropene, and others. The choice of fumigant depends on the target pest, application method, environmental regulations, and effectiveness.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The global agricultural fumigants market is projected to reach approximately USD 3.5 billion by 2033, growing at a steady CAGR of 4.9% from USD 2.2 billion in 2023.

- Product Dynamics: Phosphine dominates the market with over 37.5% share due to its effectiveness in controlling pests. However, its toxicity and flammability require careful handling.

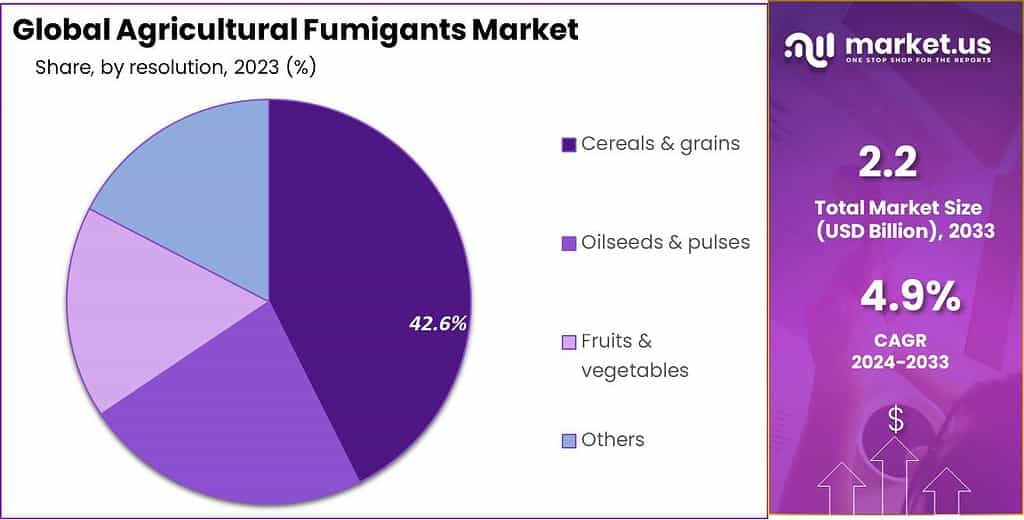

- Crop Impact: Cereals & grains claim the largest market share (42.6%) due to extensive fumigant usage in protecting staple crops like wheat, rice, and corn. Oilseeds & pulses follow closely, addressing pest susceptibilities in crops like soybeans and lentils.

- Pest Control Methods: Structural fumigation leads at 38.2%, effective in enclosed spaces like warehouses. Tarpaulin fumigation emerges prominently for field applications, while vacuum chamber fumigation secures a notable share for precise pest elimination.

- Form Utilization: Gaseous fumigants dominate at 48.6% due to their versatility across different crop stages. Solid forms offer safety but are less used, while liquid forms find application against insects and molds.

- Function Focus: Insecticides dominate (42.8%) for their effectiveness against insect threats, followed by fungicides and nematicides addressing fungal diseases and nematodes, respectively.

- Application Emphasis: Warehousing applications hold the highest share (55.4%), indicating a significant focus on post-harvest pest management and preserving stored agricultural produce quality.

- Drivers: Fumigation crucially contributes to reducing post-harvest losses, and ensuring food security by preserving crop quality. It also aids in maintaining cleanliness in storage areas, preventing spoilage.

- Challenges: Residue accumulation on treated materials poses challenges. Minimizing residue requires careful consideration of fumigation conditions and using compounds with lower persistence.

- Opportunities: The phasing out of methyl bromide has led to a search for effective alternatives. Companies are investing in research for new fumigants, emphasizing the need for innovative pest control methods.

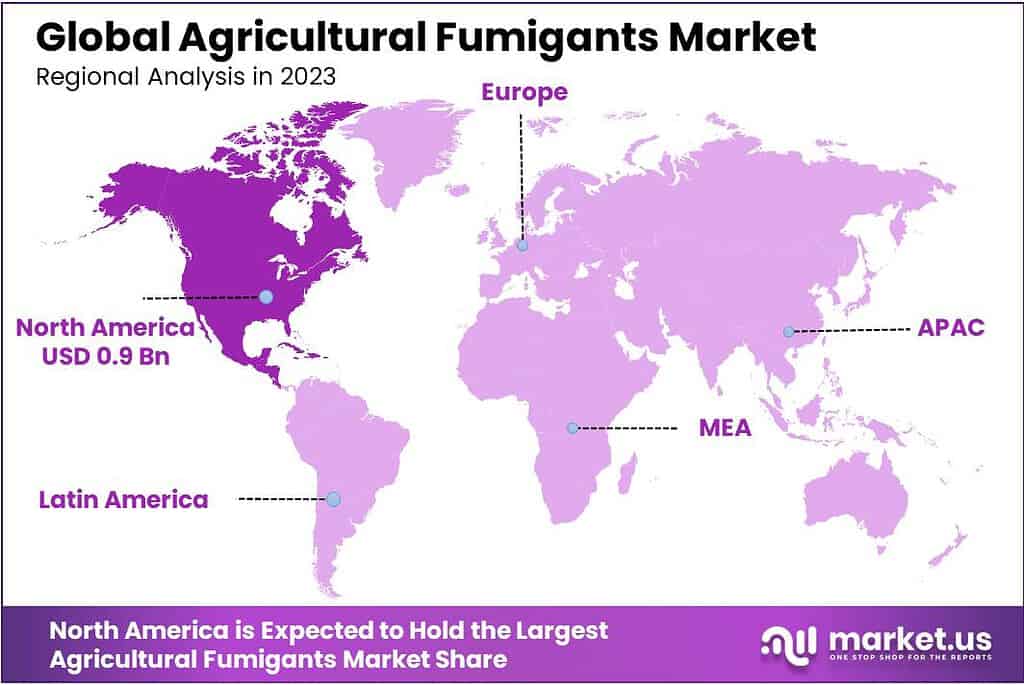

- Regional Insights: North America leads the market, but the Asia Pacific shows substantial potential due to high pest outbreaks, stringent regulations, and increased agricultural demands.

- Key Players: Major players like BASF SE, Syngenta, Nufarm, and others focus on expanding product reach, and bolstering regional dominance through strategic initiatives and acquisitions.

Product Analysis

In 2023, Phosphine was the top product type in the Agricultural Fumigants Market, owning over 37.5% of the market share. Its popularity stems from its effectiveness in controlling pests on various crops.

It has a lower vapor pressure and higher kHz, as well as higher degradation rates. It also has a higher sorption coefficient than 1,3-dichloro propene. Higher sorption coefficients eventually make the compound more stable in the soil.

Despite its potential for causing human health problems, phosphate is the fastest-growing product worldwide. This product is both toxic and flammable, so only authorized personnel should apply it. For best results, phosphate should only be applied for a prolonged period and in tightly sealed houses.

It is best to apply phosphate based on the area being treated, not the quantity of the commodity. This practice is strictly prohibited in areas that aren’t completely sealed as they can cause severe damage to humans and animals in the surroundings.

By Crop Type

In 2023, Cereals & grains stood out in the Agricultural Fumigants Market, grabbing over 42.6% of the market share.

The dominance of this segment reflects the extensive use of fumigants to protect staple crops like wheat, rice, and corn from pests and diseases. Following closely, the Oilseeds & pulses segment claimed a considerable market share due to the susceptibility of crops like soybeans and lentils to pests during growth and storage.

Fruits & vegetables emerged as another significant segment, driven by the need to safeguard perishable crops like tomatoes, strawberries, and potatoes. The “Others” category encompassed niche crops and specialty produce, contributing uniquely to the market with tailored fumigation solutions catering to specific crop requirements.

*Actual Numbers Might Vary In The Final Report

By Pest control Method

In 2023, Structural pest control methods led the Agricultural Fumigants Market, commanding over 38.2% of the market share. This segment’s dominance is due to its effectiveness in treating pests in enclosed spaces like warehouses, silos, and storage areas, safeguarding crops post-harvest.

Tarpaulin fumigation emerged as a prominent method, especially for field applications, offering a protective covering for targeted areas during fumigation processes.

Vacuum chamber fumigation, primarily used for high-value goods and sensitive products, secured a notable share by ensuring precise and controlled pest elimination. Non-tarp fumigation by injection methods, and employing localized pest control, also contributed significantly.

The “Others” category encompassed innovative and specialized techniques catering to distinct pest control needs in unique agricultural settings, offering diverse solutions beyond conventional methods.

Form Analysis

In 2023, Gas emerged as the leading form in the Agricultural Fumigants Market, capturing over 48.6% of the market share. Its dominance is due to the versatility and widespread application of gaseous fumigants in treating various pests across different stages of crop production.

The agricultural fumigants industry can be divided into three types based on their form: liquid, solid, and gas. To control pests and insects, the solid form can be used in powder, pellets, and tablets. Because it is easy to use and can be sprayed, this form is considered the safest. It is considered to be comparatively safer for the environment in most parts of the world.

Liquids can be used to kill insects and molds. They can be applied to the desired area with standard sprayers. The applicator can decide the volume of solvent to be dispersed. This type of fumigation is generally considered to be the safest if it is done in enclosed areas or outdoors.

Gaseous forms are typically applied in enclosed chambers that have a gas-proof cover to prevent gas leakage into the environment. This is also called space fumigation. It is done with care to limit gaseous dispersion into the surrounding environment because they contain substances such as methyl bromide, which can cause ozone depletion. They effectively kill termites, insects, nematodes, and weeds.

By Function

In 2023, Insecticides were the dominant function in the Agricultural Fumigants Market, securing over 42.8% of the market share. Their prominence stems from their effectiveness in controlling and eradicating insects that pose threats to crops during various growth stages.

Fungicides followed closely, offering solutions against fungal diseases that can damage plants and reduce yields. Nematicides held a notable market share, specifically targeting nematodes, which can cause substantial harm to crops, especially root vegetables.

Herbicides, though a smaller segment in the agricultural fumigants market, played a crucial role in managing weed growth, aiding in the healthy growth of crops by reducing competition for resources.

The dominance of insecticides highlighted the agricultural industry’s focus on combating insect-related threats to ensure better crop yields and quality.

By Application

In 2023, Warehousing applications dominated the Agricultural Fumigants Market, securing over 55.4% of the market share. This dominance reflects the significant use of fumigants in protecting stored crops within warehouses and silos from pest infestations during storage.

Soil applications, while crucial, held a smaller market share, emphasizing the importance of fumigation in pre-planting and soil treatment processes to control soil-borne pests and diseases.

The dominance of warehousing applications signifies the substantial emphasis placed on post-harvest pest management and the preservation of stored agricultural produce, ensuring its quality and market value.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- 1,3 Dichloropropene

- Chloropicrin

- Methyl Bromide

- Metam Potassium

- Other Product Type

By Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others

By Pest control Method

- Vacuum chamber fumigation

- Tarpaulin

- Structural

- Non-tarp fumigation by injection

- Others

By Form

- Solid

- Liquid

- Gas

By Function

- Insecticides

- Fungicides

- Nematicides

- Herbicides

By Application

- Soil

- Warehouse

Drivers

Reducing post-harvest losses stands as a pivotal goal for ensuring food security worldwide. These losses occur when freshly harvested crops change handling, leading to spoilage or diminished quality. To combat this, fumigation plays a critical role in pest prevention. For instance, ammonia gas fumigation effectively controls decay in citrus fruits post-harvest.

Common issues like green mold (caused by Penicillium digitatum) and blue mold (from Penicillium italicum) in lemons and oranges can be thwarted using this method. Essentially, fumigation technology acts as a shield, preserving the quality of agricultural produce and preventing losses.

Moreover, fumigation doesn’t just stop at pest control. It’s also instrumental in maintaining cleanliness in storage areas such as warehouses and silos. This thorough cleaning process is a preventive measure, especially crucial during pre-harvest activities for storing grains.

By employing fumigation in cleaning procedures, it helps create a safe environment for storing crops, significantly reducing the likelihood of contamination or spoilage before and after storage.

Restraints

Fumigation is an effective means to controlling pests and maintaining agricultural produce quality, but can present its own unique set of challenges due to residue accumulation on treated materials. The amount of residue left after fumigation depends on several factors such as conditions during fumigation as well as how products were treated during fumigation.

Minimizing residue accumulation requires careful consideration of these variables before treatment. Fumigants with higher boiling points tend to linger as residues for extended periods compared to more volatile compounds. For instance, acrylonitrile may persist in wheat for several days, contrasting with the rapid dissipation of methyl bromide in just a few hours.

Moreover, fumigants that interact with components of plants or animals can leave significant residues. These residues, if present in high concentrations, might raise concerns regarding the quality or safety of the treated materials. Efforts to address residue accumulation involve balancing effective pest control with minimizing the impact on treated commodities.

Strategies to mitigate residues include optimizing fumigation conditions, using fumigants with lower persistence, and exploring alternative pest control methods that leave fewer or no residues. It’s crucial to strike a balance between pest management efficacy and reducing residues to ensure the safety and quality of agricultural products for consumption and trade.

Opportunities

The imminent phasing out of methyl bromide due to increased pest resistance has prompted a search for viable alternatives to manage stored products and quarantine pests effectively.

The change away from methyl bromide led to finding new things for fumigation, like phosphine, sulfuryl fluoride, carbonyl sulfide, ethyl formate, hydrogen cyanide, carbon disulfide, methyl iodide, and methyl isothiocyanate. Companies are spending lots on research to develop these alternatives.

They’re trying to figure out how these new things can fight pests well and replace methyl bromide because it’s getting harder to find. The goal is to create new and clever ways to fumigate that work against pests and deal with the problems of not having much methyl bromide around anymore.

This emphasis on new product launches underscores a concerted effort within the industry to adapt to changing regulatory landscapes and combat pest resistance effectively.

challenges

The application of volatile chemical-based fumigants for soil treatment undergoes stringent regulations governed by various authorities. Selecting the appropriate fumigant tailored to specific applications is pivotal.

However, employing these fumigants often incurs considerable labor costs, particularly when using handheld or manual injectors for application. The primary expenses associated with fumigation predominantly encompass the costs related to necessary equipment and the workforce involved.

Fumigation treatments are exclusively conducted by certified pest control specialists recognized as fumigators. This specialized process demands skilled operators proficient in using specialized tools and gas measurement devices, contributing significantly to the overall expenses incurred in executing fumigation procedures.

These collective challenges, including regulatory compliance, labor-intensive application methods, and the need for skilled personnel, amplify the overall costs associated with fumigation practices.

Regional Analysis

North America’s agricultural fumigants industry is expected to be the largest. However, North America’s agricultural fumigants market size accounts for over 41.2% of the revenue share and also growing at the highest rate of CAGR.

The Asia Pacific was the biggest consumer of the agricultural fumigants industry in 2023. This is due to the favorable climatic conditions that allow for high levels of pest and insect outbreaks in warehouses and other storage areas. Farmers use agricultural fumigants to avoid losses after harvest.

North America is the world’s largest agricultural hub. FAO reported that corn was the most popular crop in the region, with an annual production of more than 400 million tons. The Nature Conservancy is one of many conservancies that works with farmers in North America.

They work with them to develop scientific strategies for increasing agricultural productivity growth by reducing nutrient run-off by 20% while also educating them about sustainable grazing practices.

Given the abundance of agriculture-based economies, the Asia Pacific region offers huge opportunities for the expansion of the fumigants sector. In the last decade, the demand for wheat, maize, and rice has quadrupled.

This has led to an increase in pesticides and fertilizers used for the protection of cultivated crops as well as safe storage in warehouses. The increase in agricultural fumigants market size has also led to an increase in greenhouse gas emissions. The Asia Pacific Department of Food and Agriculture Organization established stringent regulations to address the environmental damage caused by these chemicals.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The major regional agricultural fumigants markets are North America and the Asia Pacific. The agricultural fumigants market trends that the success is largely dependent on the country in which the products are grown and the laws that govern them.

These products are expected to be in demand due to the increasing population of the Asia Pacific. They play an important role in improving agricultural productivity. It is expected that the Asia Pacific industry will grow if there are more manufacturers from India and China.

The agricultural fumigants market trends including suppliers are an essential component of the value chain because they bridge the gap between manufacturers and reduce unnecessary expenditure. Because they are intermediaries for farmers in remote regions, suppliers can help expand the supply chain.

Manufacturers are primarily focused on expanding their product reach to help strengthen their regional dominance.

Маrkеt Кеу Рlауеrѕ

- BASF SE

- Syngenta

- Nufarm

- ADAMA

- SGS SA

- UPL

- Solvay

- Intertek

- AMVAC

- Tessenderlo Kerley, Inc.

- DEGESCH America, Inc.

- MustGrow Biologics, Inc

- Trinity Manufacturing, Inc.

- The Draslovka Group

- Douglas Products

- Royal Agro

- Imtrade CropScience

- Nippon Chemical Industrial Co., LTD.

- Ecotec Fumigation

- Arkema

Recent Development

In January 2022, UPL Ltd entered an agreement in which Bunge Ltd will acquire a 33% stake in Sinagro to strengthen its grain orientation strategy in Brazil.

In April 2023, Rollins Inc. acquired Fox Pest Control Company, a pest management company. It provides services to residential customers across 13 states. This acquisition will provide the company with a growth strategy in new geographies across the U.S. and its brands with new avenues of growth across several regions.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 3.5 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(1,3 Dichloropropene, Chloropicrin, Methyl Bromide, Metam Potassium, Other Product Type), By Crop Type(Cereals and grains, Oilseeds and pulses, Fruits and vegetables, Others), By Pest control Method(Vacuum chamber fumigation, Tarpaulin, Structural, Non-tarp fumigation by injection, Others), By Form(Solid, Liquid, Gas), By Function(Insecticides, Fungicides, Nematicides, Herbicides), By Application, (Soil, Warehous) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape BASF SE, Syngenta, Nufarm, ADAMA, SGS SA, UPL, Solvay, Intertek, AMVAC, Tessenderlo Kerley, Inc., DEGESCH America, Inc., MustGrow Biologics, Inc, Trinity Manufacturing, Inc., The Draslovka Group, Douglas Products, Royal Agro, Imtrade CropScience, Nippon Chemical Industrial Co., LTD., Ecotec Fumigation, Arkema Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are agricultural fumigants?Agricultural fumigants are chemicals or compounds used in agriculture to eliminate or control pests, pathogens, nematodes, weeds, and other harmful organisms in soil, stored commodities, or structures.

What is the purpose of using agricultural fumigants?Agricultural fumigants help farmers manage and prevent infestations of pests and pathogens that can damage crops, stored produce, or cause diseases in plants.

Are there safety concerns associated with agricultural fumigants?Yes, agricultural fumigants can be toxic to humans and the environment. Proper handling, application techniques, and adherence to safety regulations are essential to minimize risks to workers, consumers, and the environment.

Agricultural Fumigants MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Agricultural Fumigants MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Syngenta

- Nufarm

- ADAMA

- SGS SA

- UPL

- Solvay

- Intertek

- AMVAC

- Tessenderlo Kerley, Inc.

- DEGESCH America, Inc.

- MustGrow Biologics, Inc

- Trinity Manufacturing, Inc.

- The Draslovka Group

- Douglas Products

- Royal Agro

- Imtrade CropScience

- Nippon Chemical Industrial Co., LTD.

- Ecotec Fumigation

- Arkema