Global Agricultural Adjuvants Market Size, Share, And Business Benefits Type (Activator Adjuvants (Surfactants, Oil-based Adjuvants), Utility Adjuvants (Compatibility Agents, Drift Control Agents, Buffering Agents, Defoaming Agents, Water Conditioning Agents, Others)), Formulation (Tank-Mix, In-Formulation), Crop Type (Cereal and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), Application (Herbicides, Insecticides, Fungicides, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 14787

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

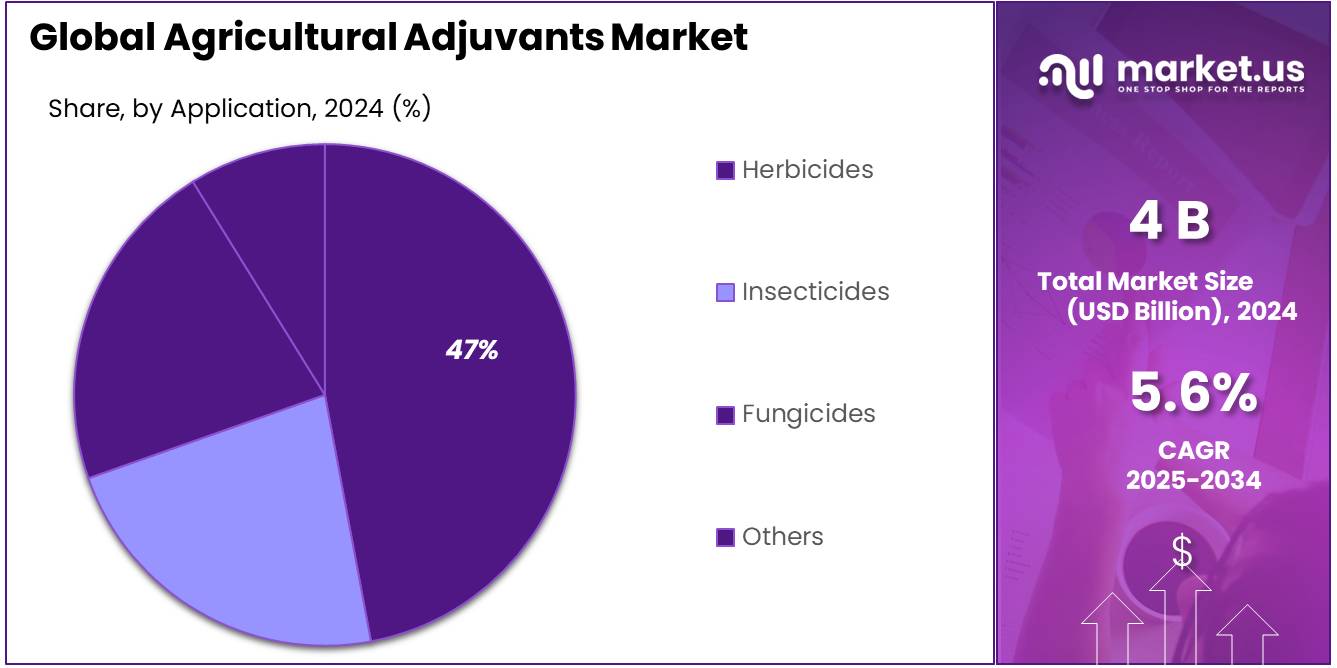

The global Agricultural Adjuvant market size is expected to be worth around USD 6.9 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

Agricultural adjuvants Market are substances added to pesticides, herbicides, fungicides, and fertilizers to enhance their effectiveness, improve coverage, and optimize performance. These adjuvants work by altering the physical properties of the spray solution, improving the spreading, sticking, and wetting of pesticides on plant surfaces.

An adjuvant is a supplemental substance added to a spray mixture to enhance the performance and/or physical properties of the desired chemical. Using the correct adjuvant can have benefits such as reducing or eliminating spray application problems, which would improve the overall efficacy of the applied formulation. Since adjuvants do not have pesticidal properties in their own right, they are not required to be registered by the U.S. Environmental Protection Agency (EPA) and the distribution of adjuvants is rarely regulated by the states.

Adjuvants are designed to perform specific functions involving the mixing and application of pesticides such as dispersing, emulsifying, spreading, sticking, and wetting. They can also reduce evaporation, foaming, spray drift, and volatilization. There is not one single adjuvant that can perform all of these functions, but different types of adjuvants can be combined to perform several different functions. As a result, using adjuvants can help reduce application problems while increasing pesticide efficacy.

The increasing global population and rising food demand have put pressure on farmers to maximize crop yields, leading to greater adoption of agrochemicals and, consequently, adjuvants. Additionally, the growing trend towards precision agriculture and sustainable farming practices has further boosted the demand for adjuvants that can optimize the use of crop protection products.

Key Takeaways

- Agricultural Adjuvant market size is expected to be worth around USD 6.9 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 5.6%.

- Activator Adjuvants held a dominant market position, capturing more than a 68.6% share of the agricultural adjuvants market.

- Tank-Mix held a dominant market position, capturing more than a 78.5% share.

- Cereal & Grains held a dominant market position, capturing more than a 44.30% share.

- Herbicides held a dominant market position, capturing more than a 48.10% share of the global agricultural adjuvants market.

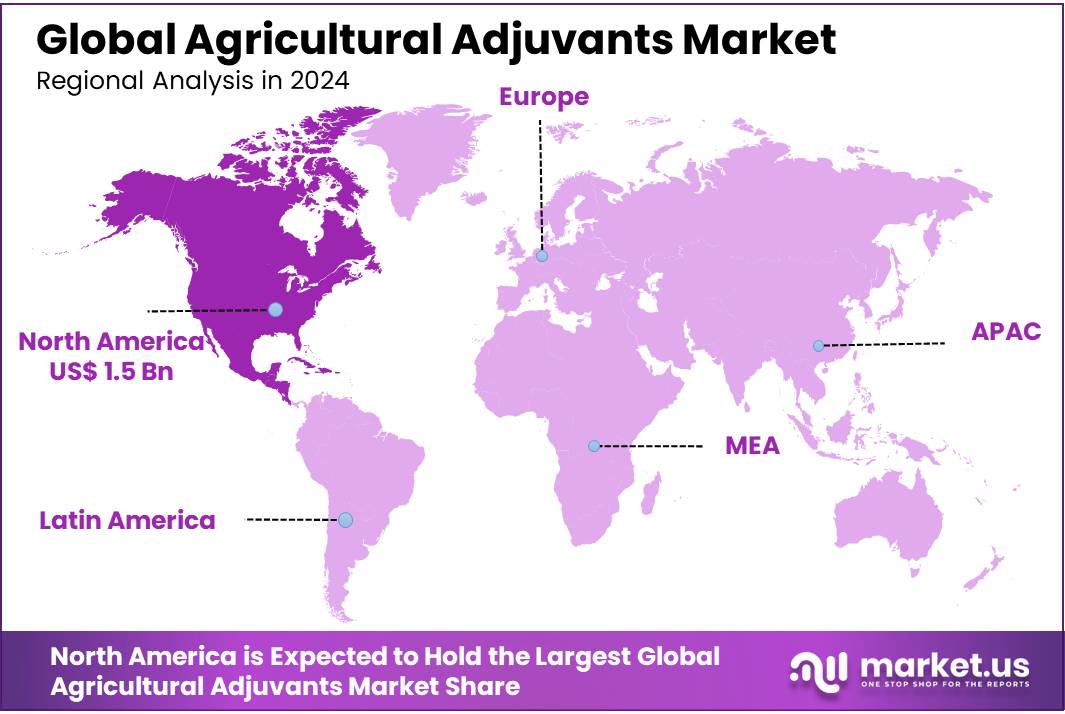

- Asia Pacific (APAC) dominated the global agricultural adjuvants market, holding a significant share of 38.60%, with a market value of approximately USD 1.5 billion.

Type Analysis

In 2024, Activator Adjuvants held a dominant market position, capturing more than a 68.6% share of the agricultural adjuvants market. These adjuvants are widely used to enhance the effectiveness of pesticides and herbicides by improving their absorption, spreading, and adherence to plant surfaces. The demand for activator adjuvants has been steadily growing due to their critical role in increasing the performance and efficiency of crop protection products.

Surfactants improve the wetting properties and spreadability of pesticide formulations, leading to better coverage and improved efficacy. As the market shifts towards more sustainable and environmentally friendly agricultural practices, demand for surfactants is expected to grow at a steady rate. The oil-based adjuvants segment is experiencing increased demand due to their ability to enhance the penetration and absorption of active ingredients in pesticide formulations, particularly in challenging environmental conditions.

Utility Adjuvants followed as another significant segment, though with a smaller share compared to activator adjuvants. Utility adjuvants include products like surfactants, spreaders, and stickers, which help improve the physical properties of pesticide sprays. These agents improve coverage, adhesion, and the uniform distribution of chemicals on the target area. Their use is growing steadily due to the increasing demand for more efficient and environmentally friendly agricultural practices.

Formulation Analysis

In 2024, Tank-Mix held a dominant market position, capturing more than a 78.5% share of the agricultural adjuvants market. This formulation is favored for its ability to combine multiple chemicals, including pesticides, herbicides, and fungicides, into a single mixture, optimizing the application process. Tank-mix formulations have become increasingly popular because they simplify the handling and application of crop protection products, saving time and reducing the need for multiple treatments. Additionally, the growing trend of integrated pest management (IPM) and precision agriculture has further boosted the demand for tank-mix solutions, as they enable more effective, tailored treatments.

In-Formulation adjuvants have a smaller share in the market but are gradually gaining traction. These adjuvants are pre-blended into the crop protection products themselves, offering convenience and consistency for farmers. They are designed to work synergistically with the active ingredients in the formulation, improving overall performance. In 2024, the in-formulation segment represented a smaller portion of the market compared to tank-mix adjuvants, but it is expected to grow at a moderate pace over the next few years as manufacturers focus on creating more advanced, all-in-one solutions for crop protection.

Crop Type Analysis

In 2024, Cereal & Grains held a dominant market position, capturing more than a 44.30% share of the global agricultural adjuvants market. This segment includes major crops like wheat, rice, corn, and barley, which are essential staples in global agriculture. The significant demand for adjuvants in this category is largely driven by the need for effective crop protection and yield enhancement. As cereals and grains are highly susceptible to pests and diseases, the use of adjuvants to improve the effectiveness of herbicides and fungicides is increasingly vital. Moreover, the growing demand for food security and sustainable farming practices has led to a rise in the adoption of agricultural adjuvants in this sector.

Oilseeds & Pulses followed closely, accounting for a substantial share of the market. This segment includes crops such as soybeans, canola, sunflower, and lentils, which are vital for both food and industrial applications. As the global demand for plant-based proteins and oils continues to increase, the use of agricultural adjuvants in oilseeds and pulses is on the rise. Adjuvants play a critical role in ensuring higher crop yields by improving the performance of crop protection products, particularly herbicides. The market for adjuvants in this segment has seen steady growth, with an increasing focus on maximizing crop output and reducing production costs.

The Fruits & Vegetables segment, while growing, holds a smaller share of the overall market. These crops, including tomatoes, apples, berries, and leafy greens, require specialized care due to their vulnerability to pests, diseases, and environmental factors. Adjuvants used in this category are typically focused on improving the effectiveness of fungicides, insecticides, and nutrients. As consumer demand for fresh and organic produce continues to rise, the application of agricultural adjuvants in this segment is expected to grow at a moderate pace, particularly in regions focused on high-value crops.

Application Analysis

In 2024, Herbicides held a dominant market position, capturing more than a 48.10% share of the global agricultural adjuvants market. This significant market share can be attributed to the widespread use of herbicides in both conventional and organic farming practices. Herbicides are crucial in managing unwanted weeds that compete with crops for nutrients, water, and sunlight. The use of adjuvants in herbicide formulations improves their performance by enhancing the spread, adhesion, and absorption of the active ingredients. The growing emphasis on weed resistance management and the demand for higher crop yields have driven the increased use of adjuvants in herbicide applications.

Insecticides followed as the second-largest application segment, with steady growth observed in 2024. Adjuvants in insecticide formulations help improve the efficacy of active ingredients by promoting better coverage on target pests, leading to improved pest control. As farmers face growing challenges from insect resistance, the role of adjuvants in enhancing insecticide effectiveness has become more critical. The shift towards integrated pest management (IPM) strategies is expected to continue driving growth in the insecticide adjuvant market.

Fungicides, while a smaller segment compared to herbicides and insecticides, have also shown promising growth in 2024. The use of adjuvants in fungicides enhances their ability to penetrate plant surfaces, ensuring better protection against fungal diseases. As climate change and unpredictable weather patterns increase the prevalence of fungal infections, the demand for effective fungicide treatments, aided by adjuvants, is rising.

Key Market Segments

Type

- Activator Adjuvants

- Surfactants

- Non-ionic

- Anionic

- Cationic

- Oil-based Adjuvants

- Surfactants

- Utility Adjuvants

- Compatibility Agents

- Drift Control Agents

- Buffering Agents

- Defoaming Agents

- Water Conditioning Agents

- Others

Formulation

- Tank-Mix

- In-Formulation

Crop Type

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Application

- Herbicides

- Insecticides

- Fungicides

- Others

Driving Factors

Rising Demand for Sustainable Agricultural Practices Driving Agricultural Adjuvants Growth

One of the primary driving factors for the growth of the agricultural adjuvants market is the increasing global demand for sustainable farming practices. With the global population steadily increasing, the need for food production has never been greater. However, farmers are facing numerous challenges, such as the need to produce more food with fewer resources while minimizing the environmental impact. This has led to the widespread adoption of adjuvants in crop protection chemicals to improve the efficiency and effectiveness of pesticides, herbicides, fungicides, and other agricultural treatments.

In 2023, the global demand for crop protection chemicals was valued at approximately USD 75 billion and is expected to grow further, with agricultural adjuvants playing a critical role in ensuring the efficient use of these chemicals. Adjuvants are used to enhance the performance of pesticides and other chemicals by improving their spreading, adhesion, absorption, and overall efficacy. This reduces the overall volume of chemicals needed, which is crucial for minimizing environmental harm and reducing the costs associated with chemical usage. For instance, herbicide-resistant weed management has become a growing challenge, and adjuvants are proving essential in making herbicides more effective, especially when dealing with tough-to-control weed species.

Government initiatives and regulations aimed at promoting sustainability are also influencing this trend. The U.S. Environmental Protection Agency (EPA) has introduced guidelines and incentive programs encouraging farmers to use crop protection chemicals in an environmentally responsible way. These initiatives are pushing the adoption of adjuvants that enable more efficient use of herbicides and pesticides, which is not only beneficial for the environment but also helps farmers reduce costs in the long run. According to the EPA, sustainable farming practices, including the use of integrated pest management (IPM) and reduced chemical application, could reduce pesticide use by up to 30%, which directly benefits the adjuvant market.

In Europe, the European Union (EU) has taken proactive steps to promote sustainability within agriculture through the Farm to Fork Strategy. This strategy aims to make food systems fair, healthy, and environmentally-friendly. As part of this, the EU has called for reducing pesticide use by 50% by 2030, creating a need for more efficient pest control strategies and, by extension, for the use of agricultural adjuvants to make those strategies more effective. The EU’s commitment to sustainable practices is expected to further drive the demand for adjuvants in the region.

These products are becoming increasingly popular, particularly in regions where regulatory bodies are imposing stricter limits on chemical use. According to the Food and Agriculture Organization (FAO), sustainable farming practices are essential to ensuring food security and mitigating the impact of climate change, and adjuvants play a critical role in achieving these goals.

Restraining Factors

Stringent Regulations and Safety Concerns Hindering Agricultural Adjuvants Market Growth

A key restraining factor in the agricultural adjuvants market is the increasing scrutiny and regulatory challenges surrounding the use of chemical compounds in agriculture. As environmental and health concerns rise globally, governments and regulatory bodies have implemented stricter rules regarding the safety, approval, and use of agricultural chemicals, including adjuvants. This has made it more difficult and expensive for manufacturers to bring new adjuvant formulations to market, slowing the overall growth of the sector.

In the United States, the Environmental Protection Agency (EPA) plays a pivotal role in regulating agricultural chemicals. The agency evaluates the safety of chemicals used in farming, including adjuvants, to ensure that they do not harm human health, wildlife, or the environment. According to the EPA, it takes an average of 2-3 years to evaluate a new pesticide formulation, with some adjuvants facing lengthy approval processes due to their potential risks. The regulatory costs associated with the approval process for a new chemical product can range from $1 million to over $5 million, depending on the complexity of the formulation and the intended use. These high costs act as a significant barrier, especially for smaller companies with limited resources.

In Europe, the European Food Safety Authority (EFSA) is responsible for ensuring that agricultural products, including adjuvants, comply with stringent safety standards. The European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires that companies provide detailed safety data on chemicals used in agriculture before they can be marketed. As a result, manufacturers often face long delays and high compliance costs, making it harder to innovate or expand product offerings.

Moreover, many farmers are becoming increasingly conscious of the long-term environmental impact of using chemical-based products. While adjuvants can improve the efficacy of pesticides and herbicides, their overuse or misuse can lead to issues such as water contamination, soil degradation, and harm to non-target organisms, including beneficial insects. This growing awareness has led to a shift in consumer preferences toward organic and eco-friendly products, pushing governments to impose stricter regulations on the use of chemical adjuvants. According to the Organic Trade Association, sales of organic food in the U.S. reached approximately USD 62 billion in 2022, and this demand for organic produce is expected to rise, further limiting the market for conventional agricultural adjuvants.

In emerging economies, regulatory frameworks are still evolving, and many countries are in the process of drafting and implementing laws governing the use of agricultural chemicals. However, these regulations may not always be as stringent as in developed nations, and the lack of standardized enforcement can pose challenges for multinational companies seeking to market their products globally.

Growth Opportunities

Agricultural Adjuvants MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Adjuvants MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Clariant AG

- Croda International Plc

- Ingevity

- Solvay

- Bayer

- Nufarm

- Evonik Industries AG

- Corteva

- Miller Chemical & Fertilizer, LLC

- Helena Agri-Enterprises, LLC

- WinField United

- Stepan Company

- CHS Inc.

- Kalo

- Other Key Players