Global Ferrite Cores Market By Type(Soft Ferrite Cores, Hard Ferrite Cores), By Material(Manganese-Zinc (Mn-Zn) Ferrite Cores, Nickel-Zinc (Ni-Zn) Ferrite Cores), By Application(Transformers, Inductors, Antennas, Others), By End-Use(Consumer Electronics, Automotive, Power Generation and Distribution, Healthcare, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 30538

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

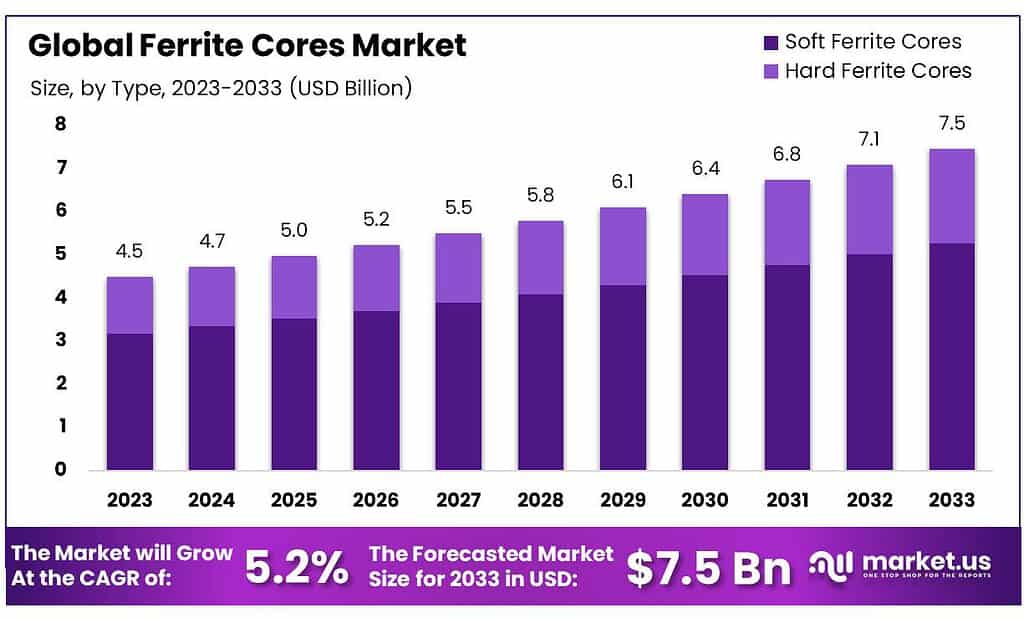

The global Ferrite Cores market size is expected to be worth around USD 7.5 billion by 2033, from USD 4.5 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

Ferrite cores are magnetic cores made from ferrite materials, which are ceramic compounds composed of iron oxide and other metal elements such as manganese, zinc, or nickel.

These cores are used in electronic components and devices to enhance and control the electromagnetic properties of coils and transformers. Ferrite cores play a crucial role in electronic circuits by providing magnetic coupling and preventing electromagnetic interference (EMI).

The unique magnetic properties of ferrite cores, including high magnetic permeability and low electrical conductivity, make them suitable for applications where efficient magnetic coupling is required without significant electrical losses. They are commonly employed in transformers, inductors, and chokes across various electronic devices such as power supplies, telecommunications equipment, and audio systems.

Ferrite cores come in different shapes and sizes, including toroidal, cylindrical, and E-shaped cores, to accommodate diverse applications. Their ability to operate at high frequencies and resist eddy current losses makes them particularly valuable in radio frequency (RF) applications.

By Type

In 2023, Soft Ferrite Cores dominated the market, holding a robust position with over 70.6% market share. Soft ferrite cores are favored for their magnetic properties, providing efficient performance in applications like transformers and inductors. Their widespread adoption is attributed to their flexibility in high-frequency operations, making them a go-to choice for various electronic devices.

On the other hand, Hard Ferrite Cores, while holding a smaller market share, have their niche. Known for their durability and stability, they find applications in sectors requiring robust magnetic components. This segment caters to industries where resistance to demagnetization is crucial, showcasing its significance in specific electronic applications.

The market dynamics reflect a preference for Soft Ferrite Cores, driven by their versatility and efficiency, especially in modern electronic devices demanding optimal electromagnetic performance. However, the presence of Hard Ferrite Cores indicates a diversified market catering to a spectrum of applications with distinct requirements.

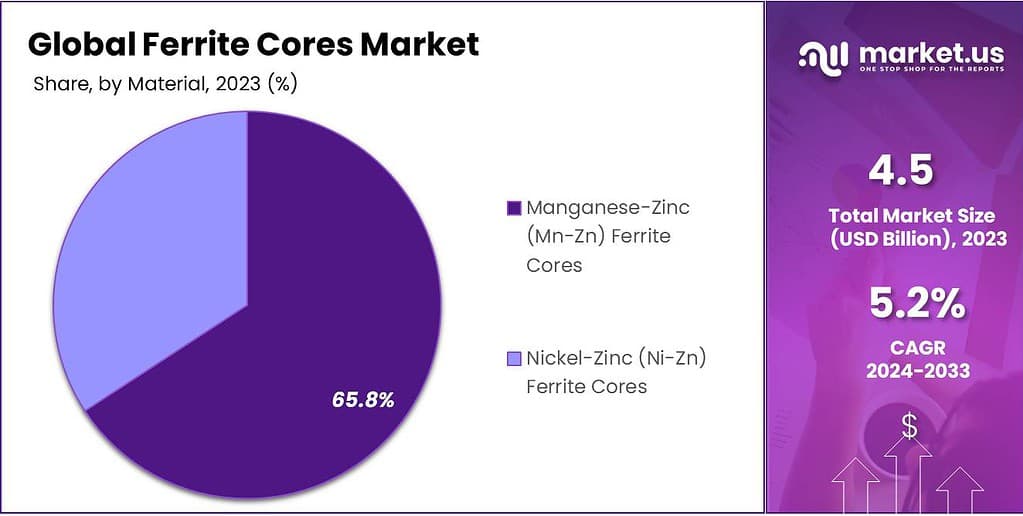

By Material

In 2023, Manganese-Zinc (Mn-Zn) Ferrite Cores took the lead in the market, securing a dominant position with over 65.8% market share. Mn-Zn ferrite cores are known for their versatile magnetic properties, making them a preferred choice in various electronic applications. This material excels in applications requiring high magnetic permeability, such as transformers and inductors.

Conversely, nickel-zinc (Ni-Zn) Ferrite Cores, though holding a smaller market share, play a crucial role. Recognized for their superior frequency characteristics, Ni-Zn ferrite cores find application in high-frequency devices like RF transformers. This segment caters to specific electronic needs where efficient electromagnetic performance at elevated frequencies is paramount.

The market landscape emphasizes the dominance of Manganese-Zinc Ferrite Cores, reflecting their broad utility and efficiency in diverse electronic devices. However, the presence of Nickel-Zinc Ferrite Cores underscores the market’s adaptability to specialized requirements, ensuring a comprehensive range of solutions for the electronics industry.

By Application

In 2023, Transformers secured a leading position in the market, commanding over 48.6% market share. The dominance of ferrite cores in transformers is a testament to their pivotal role in electrical energy conversion and distribution. These cores, with their magnetic properties, contribute to the efficient functioning of transformers, ensuring optimal performance in power transmission and distribution networks.

Inductors, another significant application segment, though holding a slightly smaller market share, showcase the versatility of ferrite cores. Their use in inductors, which store energy in magnetic fields, highlights their importance in electronic devices such as inductance coils and chokes, contributing to the stability of circuits.

Additionally, Antennas and other applications further diversify the market, illustrating the adaptability of ferrite cores across various electronic components. As technology evolves, the demand for ferrite cores in antennas for communication devices and other specialized applications continues to grow.

The market dynamics underscore the critical role of ferrite cores in Transformers, reflecting their widespread adoption in essential electrical systems. Meanwhile, their presence in Inductors, Antennas, and other applications reinforces their versatility and importance in powering diverse electronic devices.

By End-Use

In 2023, Power Generation and Distribution emerged as the leading end-use segment in the ferrite cores market, securing over 33.5% market share. The dominance in this sector highlights the crucial role of ferrite cores in transformers, where they play a key role in efficiently transmitting and distributing electrical energy across power grids.

The application in Inductors, while contributing to a slightly smaller market share, remains significant, particularly in electronic devices where inductance is essential. Ferrite cores enhance the performance of inductors, ensuring stability and reliability in various circuits.

Antennas and other end-use applications further diversify the market, showcasing the adaptability of ferrite cores in meeting the demands of modern technology. As an integral component in antennas for communication devices, ferrite cores contribute to efficient signal transmission.

The market landscape emphasizes the prominence of ferrite cores in Power Generation and Distribution, underscoring their indispensable role in the foundational elements of electrical systems. Simultaneously, their presence in Inductors and other applications reinforces their versatility across diverse end-use sectors.

Key Market Segmentation

By Type

- Soft Ferrite Cores

- Hard Ferrite Cores

By Material

- Manganese-Zinc (Mn-Zn) Ferrite Cores

- Nickel-Zinc (Ni-Zn) Ferrite Cores

By Application

- Transformers

- Inductors

- Antennas

- Others

By End-Use

- Consumer Electronics

- Automotive

- Power Generation and Distribution

- Healthcare

- Others

Drivers

Growing Use in Electronics

One big reason why the Ferrite Cores market is doing well is because of how much we all use electronics these days. Think about all the gadgets we use, like phones, laptops, and TVs. They all need something to help control power and reduce interference from other devices.

That’s where ferrite cores come in. They’re a key part of making sure our devices work smoothly without messing up signals or using too much power. As more people buy and use electronics, the need for ferrite cores goes up. This is a big push for the market.

Also, as gadgets get smaller, they still need to work well without interference. Ferrite cores are great for this because they can fit into tight spaces and still do their job. This need for small, efficient parts in electronics is another reason why ferrite cores are in demand.

Restraints

Other Materials Also Competing

However, it’s not all smooth sailing. Ferrite cores face competition from other types of materials that can do similar jobs. Some new materials are being developed that might work better or be cheaper in certain situations. This competition means ferrite cores have to keep getting better or cheaper to stay ahead.

In industries where every penny counts, like in making cars or electronics, if there’s a cheaper option that works well enough, companies might use that instead. So, the ferrite core market has to deal with the challenge of keeping up with these alternatives.

Opportunity

Renewable Energy and Electric Cars

A big opportunity for ferrite cores is in the world of renewable energy and electric vehicles (EVs). As we look for cleaner energy sources, things like solar panels and wind turbines need efficient ways to convert and manage power. Ferrite cores are perfect for this. They help make sure that the power from renewable sources is used well and doesn’t go to waste.

The same goes for electric cars. These cars need efficient, reliable electronics to manage their power, from the battery to the motor. Ferrite cores can play a big part in making electric cars more efficient and reliable. As more people switch to electric cars and more countries invest in renewable energy, the demand for ferrite cores in these areas is expected to grow a lot. This is a huge chance for the market to expand into new, green technologies.

In simple terms, while there are challenges from competition and the need to keep innovating, the use of ferrite cores in our gadgets, renewable energy, and electric cars shows a lot of promise for growth in the market.

Trends

New Materials Making Things Better

There’s also a lot of exciting work happening with the materials used to make ferrite cores. Scientists and companies are coming up with new types of materials that make ferrite cores work even better, especially at high frequencies like in 5G networks or in renewable energy tech. This means ferrite cores can be used in more ways and in newer technologies, which is a big trend helping the market grow.

These new materials can handle more power and work more efficiently, which is great for all kinds of tech advancements. From making your phone’s battery last longer to helping electric cars charge faster, these improvements in ferrite cores are opening up new possibilities.

Regional Analysis

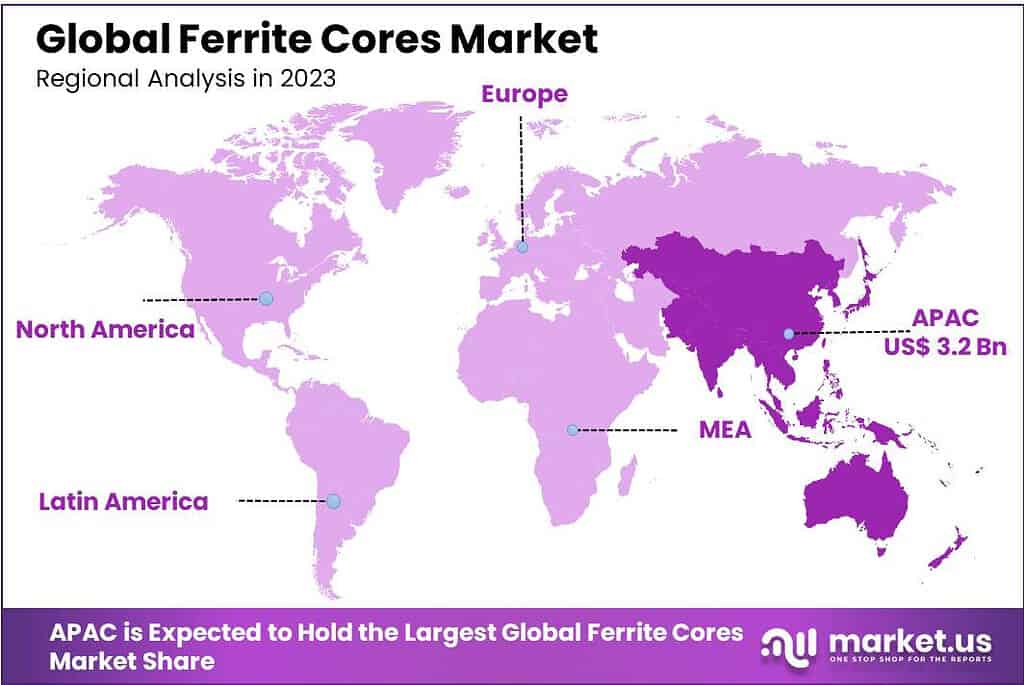

In 2023, Asia Pacific (APAC) dominated the Styrenic Polymers market with a significant revenue share of over 42.6%. This supremacy is attributed to robust regulatory support for renewable energy initiatives, particularly in the US and Canada, where government incentives and policies have made Power Purchase Agreements (PPAs) a compelling choice for both producers and consumers.

In North America, a record-high activity in clean power PPAs, with nearly 20 GW signed in 2022, underscores the mature and technologically advanced renewable energy sector. Meanwhile, Europe experienced the fastest growth rate in the Styrenic Polymers market, with a remarkable 36.6% CAGR during the forecasted period.

The region is anticipated to surpass North America in market share soon, driven by stringent environmental regulations and ambitious renewable energy targets set by the European Union. Recent reports highlight a record-breaking year in 2023 for the European PPA market, with contracted renewable power volumes exceeding 16.2 GW and forecasts projecting over 20 GW in 2024. The surge in demand for renewable PPAs in Europe aligns with the increasing corporate commitment to sustainability, reflecting companies’ goals to reduce their carbon footprint and ensure a sustainable energy future.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The Ferrite Cores market is competitive and features several prominent companies that play crucial roles in driving innovation, product development, and market expansion. These companies, through strategic research, product diversification, and technological advancements, significantly influence market dynamics.

Market Key Players

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Ferroxcube

- Magnetics

- Hitachi Metals, Ltd.

- Samsung Electro-Mechanics

- Sumida Corporation

- Fair-Rite Products Corp.

- MAGNETICS

- Cosmo Ferrites Limited

- Kaschke Components GmbH

- VACUUMSCHMELZE GmbH & Co. KG

- Delta Magnets Limited

- Magnetics, Inc.

- Fenghua Advanced Technology

Recent Developments

October 2023 TDK Corporation Launched high-efficiency ferrite EMI suppression filters for automotive applications.

November 2023 Murata Manufacturing Co., Ltd.: Developed high-performance EMI suppression filters for 5G smartphones.

Report Scope

Report Features Description Market Value (2023) US$ 4.5 Bn Forecast Revenue (2033) US$ 7.5 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Soft Ferrite Cores, Hard Ferrite Cores), By Material(Manganese-Zinc (Mn-Zn) Ferrite Cores, Nickel-Zinc (Ni-Zn) Ferrite Cores), By Application(Transformers, Inductors, Antennas, Others), By End-Use(Consumer Electronics, Automotive, Power Generation and Distribution, Healthcare, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape TDK Corporation, Murata Manufacturing Co., Ltd., Ferroxcube, Magnetics, Hitachi Metals, Ltd., Samsung Electro-Mechanics, Sumida Corporation, Fair-Rite Products Corp., MAGNETICS, Cosmo Ferrites Limited, Kaschke Components GmbH, VACUUMSCHMELZE GmbH & Co. KG, Delta Magnets Limited, Magnetics, Inc., Fenghua Advanced Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Ferrite Cores Market?Ferrite Cores market size is expected to be worth around USD 7.5 billion by 2033, from USD 4.5 billion in 2023

What CAGR is projected for the Ferrite Cores Market?The Ferrite Cores Market is expected to grow at 5.2% CAGR (2023-2032).

Name the major industry players in the Ferrite Cores Market?TDK Corporation, Murata Manufacturing Co., Ltd., Ferroxcube, Magnetics, Hitachi Metals, Ltd., Samsung Electro-Mechanics, Sumida Corporation, Fair-Rite Products Corp., MAGNETICS , Cosmo Ferrites Limited, Kaschke Components GmbH, VACUUMSCHMELZE GmbH & Co. KG , Delta Magnets Limited, Magnetics, Inc., Fenghua Advanced Technology

-

-

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Ferroxcube

- Magnetics

- Hitachi Metals, Ltd.

- Samsung Electro-Mechanics

- Sumida Corporation

- Fair-Rite Products Corp.

- MAGNETICS

- Cosmo Ferrites Limited

- Kaschke Components GmbH

- VACUUMSCHMELZE GmbH & Co. KG

- Delta Magnets Limited

- Magnetics, Inc.

- Fenghua Advanced Technology