Global Epoxy Resin Market By Physical Forms (Liquid, Solid, Solution), By End-use Industry (Paints & Coatings, Wind Turbines, Composites, Construction, Electrical & Electronics, Adhesives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 34396

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Epoxy Resin Market is anticipated to be USD 27.7 billion by 2033. It is estimated to record a steady CAGR of 8.9% in the Forecast period 2023 to 2033. It is likely to total USD 13.7 billion in 2023.

Epoxy resin is a kind of plastic that is created of chemicals known as epoxides. It is made by mixing two components which are a resin and a hardener. When the two components are mixed together, they go through a reaction that causes them to change into a tough and solid plastic.

Epoxy resins are extremely strong and durable plastics which can endure heat, chemical, and pressure. This makes them suitable in a variety of industrial applications. They are typically used for coatings, adhesives or composites as well as in mold casting. For instance epoxy resins are employed to create fiber-reinforced plastics that are used for skis, boats, and automotive parts.

Note: Actual Numbers Might Vary In The Final Report

The market for epoxy resin is an industry and economic activity relating to the manufacturing, purchasing and selling of products made from epoxy resin. The major players in this market are chemical firms that make various kinds of epoxy resins as well as hardeners. There are also companies that make use of epoxy resins to create products such as paints wind turbine blades electronics, and wind turbine blades.

The total size of the market for epoxy resins is determined by the total amount of revenue or sales produced by producers of epoxy resin and companies that make use of the resins. The market has been steadily growing since the last few years due to the demand from the end-user industries such as aerospace, automotive, construction and many more. Experts anticipate continued growth for the market for epoxy resin in the world in the coming five years.

Key Takeaways

- Market Size and Growth: The global Epoxy Resin Market is projected to reach USD 27.7 billion by 2032. It is expected to maintain a steady Compound Annual Growth Rate (CAGR) of 8.9%.

- Epoxy Resin Overview: Epoxy resin is a durable plastic made by mixing resins and hardeners. It is known for its strength, durability, and resistance to heat, chemicals, and pressure.

- Physical form: Solid epoxy resin had the largest market share (52.1%), known for its durability and versatility.

- End-Use Industries: Paints & Coatings segment dominated the market with a 37.7% share in 2023.

- Driving Factors: Booming construction industry drives demand for epoxy resins in bonding, sealing, and reinforcement.

- Challenges: Price volatility of raw materials like epichlorohydrin and bisphenol-A affects production costs.

- Growth Opportunities: Aerospace and automotive industries explore epoxy resins for weight reduction and performance.

- Key Market Trends: Shift towards waterborne epoxy resins for lower VOC emissions. Increasing use of epoxy resins in 3D printing.

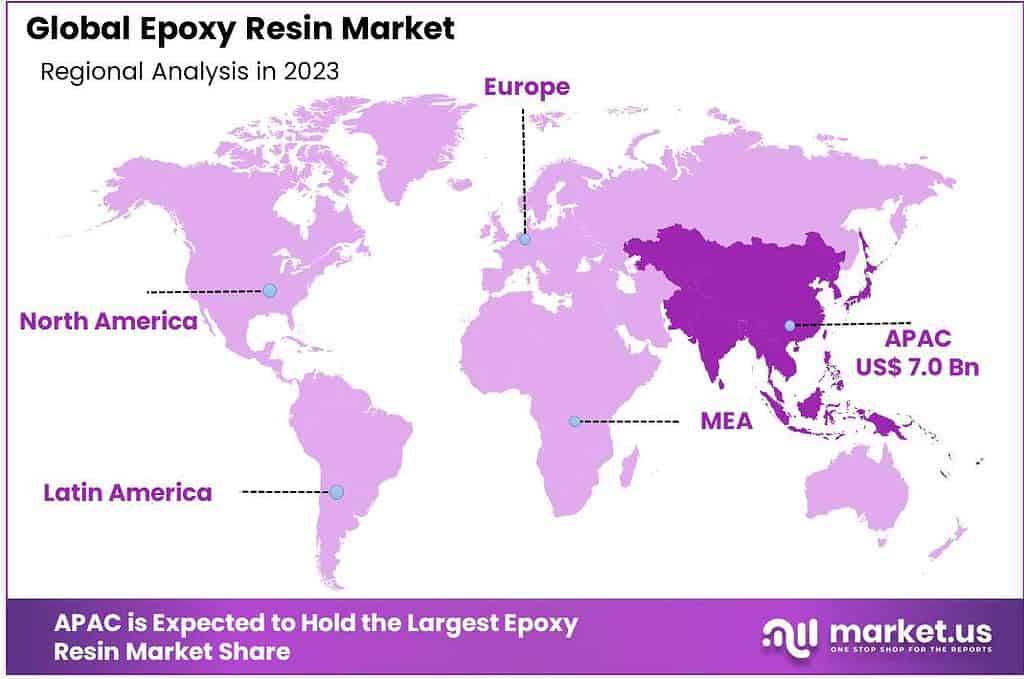

- Regional Analysis: Asia Pacific dominated the market (51.5% share) in 2023, driven by construction, manufacturing, and wind energy.

- Top Key Players: 3M, Aditya Birla Management Corp. Pvt. Ltd., Atul Ltd., BASF SE, Solvay, Huntsman International LLC, Kukdo Chemical Co., Ltd., Olin Corporation, Sika AG, Nan Ya Plastics Corp., Jiangsu Sanmu Group Co., Ltd., Jubail Chemical Industries LLC, China Petrochemical & Chemical Corporation (SINOPEC), Hexion, Kolon Industries, Inc., Techstorm, Nagase & Co., Ltd.

By Physical Form

In 2023, the Epoxy Resin market exhibited significant segmentation based on its physical form, including Solid, Liquid, and Solution variants. Each of these segments played a crucial role in shaping the market dynamics.

The Solid segment emerged as the frontrunner, securing a dominant market position by capturing more than a 52.1% share. The physical form of epoxy resin distinguished by its durability and stability. It is extensively used in a variety of applications due to its outstanding adhesion properties as well as its resistance to heat and chemicals. Industries such as construction, electrical & electronics, and composites rely heavily on solid epoxy resin due to its versatility and reliability. The solid form is favored by manufacturers for its ease of handling and long shelf life, making it a preferred choice in many demanding sectors.

However, it is the Liquid segment, though not as popular than the solid type was able to hold a significant portion of market share in 2023. The Liquid Epoxy resins are renowned for their easy application as well as their versatility in mold as well as coating. They find extensive use in industries such as paints & coatings, where their fluid nature allows for uniform and smooth finishes. Additionally, the liquid form is preferred in adhesive applications due to its ability to penetrate and bond various materials effectively.

The Solution segment, though smaller in market share compared to solids and liquids, serves specific niches within the epoxy resin market. These solutions are essentially blends of epoxy resins with solvents or diluents. They are tailored for applications requiring precise viscosity control and specialized properties. In 2023, this segment contributed to the market by catering to specific requirements in industries like adhesives and coatings, where customized formulations are essential.

End-Use Industry

In 2023, the Paints & Coatings segment emerged as a dominant force, capturing more than a 37.7% share of the market. This segment’s prominence is attributed to the widespread use of epoxy resins in protective coatings and decorative paints. Epoxy-based coatings are highly valued for their exceptional durability, corrosion resistance, and ability to provide a high-gloss finish. This has made them a preferred choice in applications ranging from automotive coatings to architectural paints.

Wind Turbines also stood out as a significant end-use industry, albeit with a slightly smaller market share. Epoxy resins play a crucial role in the manufacturing of wind turbine blades, where their high-strength properties are essential to withstand the rigors of wind energy production. As the global push towards renewable energy sources continues, the demand for epoxy resins in the wind energy sector is expected to maintain steady growth.

The Composites industry also contributed substantially to the market in 2023. Epoxy resins are a key component in composite materials, offering lightweight yet robust structural support. They are extensively used in aerospace, automotive, and sporting goods industries, among others. The versatility of epoxy resins in composite manufacturing makes them integral to the production of strong and lightweight components.

Construction, another vital sector, relies on epoxy resins for their adhesive and structural reinforcement properties. In 2023, this segment remained a significant consumer of epoxy resin products, particularly in applications such as concrete repair, flooring, and bonding.

The Electrical & Electronics industry also found epoxy resins indispensable, with applications ranging from encapsulation of electronic components to insulating materials. The stable electrical properties of epoxy resins make them a top choice in this sector, ensuring the safety and longevity of electronic devices.

Lastly, the ‘Others’ category encompasses various niche applications where epoxy resins are used, such as marine coatings, 3D printing, and dental materials. While individually, these applications may not command a substantial market share, collectively, they contribute to the overall growth and diversification of the epoxy resin market.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Increasing Demand in Construction: One of the primary driving factors for the Epoxy Resin market is the booming construction industry. Epoxy resins are extensively used in construction for bonding, sealing, and structural reinforcement due to their high strength and durability, aligning with the growing infrastructure development globally.

- Expanding Wind Energy Sector: The growth of the wind energy sector is propelling the demand for epoxy resins. Epoxy composites are crucial in manufacturing wind turbine blades, and as renewable energy sources gain prominence, this segment continues to provide a substantial market driver.

- Electronics Miniaturization: With the trend toward smaller and more compact electronic devices, epoxy resins are increasingly utilized for encapsulation and protection of delicate electronic components. The need for reliable insulation and protection drives the demand in the electrical and electronics sector.

- Eco-Friendly Formulations: Epoxy resins are evolving to meet environmental concerns. The development of eco-friendly epoxy formulations with reduced volatile organic compounds (VOCs) and improved sustainability is attracting environmentally conscious industries, contributing to market growth.

Restraining Factors

- Raw Material Price Volatility: The epoxy resin industry is susceptible to fluctuations in the prices of raw materials, such as epichlorohydrin and bisphenol-A. This volatility can lead to uncertain production costs and hinder market stability.

- Regulatory Compliance Challenges: Stringent regulations regarding the use of certain epoxy resin components, especially in food and medical applications, pose challenges for manufacturers. Compliance with these regulations can be costly and time-consuming.

- Competition from Alternatives: Epoxy resins face competition from alternative materials in various applications. For instance, in some coating applications, other resins or coatings may offer comparable performance, affecting market share.

- Global Supply Chain Disruptions: Events like the COVID-19 pandemic have highlighted vulnerabilities in global supply chains. Disruptions in the supply chain, including shortages of key raw materials and transportation challenges, can impact the epoxy resin market’s stability.

Growth Opportunities

- Advanced Composite Materials: The aerospace and automotive industries are increasingly exploring advanced composite materials for weight reduction and improved performance. Epoxy resins, with their superior properties, have significant growth opportunities in these sectors.

- Emerging Markets: Asia-Pacific region, especially China and India offers significant opportunities for growth. Rapid industrialization, urbanization and development of infrastructure in these areas increase the demand for epoxy resins in a variety of applications.

- Renewable Energy: The renewable energy market is growing and grow, there is a rising need for epoxy resin-based products for solar panels as well as storage systems for energy. This is a promising development opportunity for the industry.

- Customized Formulations: Tailoring epoxy resin formulations to meet specific industry needs, such as low-temperature curing or flame resistance, can unlock niche markets and cater to specialized applications, creating growth opportunities.

Key Market Trends

- Shift Towards Waterborne Epoxy Resins: Environmental concerns and regulatory pressures are driving a trend toward waterborne epoxy resins, which have lower VOC emissions and offer eco-friendly alternatives to traditional solvent-based epoxy formulations.

- 3D Printing Applications: Epoxy resins are finding increasing use in 3D printing for rapid prototyping and manufacturing of intricate parts. This trend aligns with the growing adoption of additive manufacturing technologies.

- Bio-Based Epoxy Resins: Market trends are leaning towards bio-based epoxy resins derived from sustainable sources. These resins are gaining attention due to their reduced environmental impact and potential for broader acceptance in eco-conscious industries.

- Digitalization and Industry 4.0: The integration of digitalization and Industry 4.0 concepts in manufacturing processes is influencing the epoxy resin market. Smart manufacturing and data-driven decision-making are becoming prevalent, enhancing efficiency and quality control.

Key Market Segments

By Form

- Solid

- Liquid

- Solution

By End-use Industry

- Paints & Coatings

- Wind Turbines

- Composites

- Construction

- Electrical & Electronics

- Adhesives

- Other Applications

Geopolitical and Recession Impact Analysis

Geopolitical Impact

- Supply chain disruptions: Epoxy resins production relies on complex global supply chains for raw materials and intermediate chemicals. Geopolitical tensions like the Russia-Ukraine war or US-China trade disputes could cause trade flow disruptions, affecting the supply-demand balance.

- Surging energy costs: Epoxy resin production is highly energy-intensive. Surging oil, gas and coal prices due to geopolitical uncertainties may make production more expensive. This could lead to higher epoxy resin prices.

- Sanctions on Russia: Since Russia is a key producer of epoxy resin raw materials, sanctions due to the Ukraine invasion may take a lot of supply offline. This supply crunch could create market tightness.

Recession Impact

- Slowing end-market demand: Industrial sectors like autos, aerospace, construction, paints & coatings are major epoxy resin consumers. An economic recession and lower consumer spending may directly dampen resin demand.

- Underutilized capacity: Lower demand growth from a recession could result in subdued capacity utilization rates. This may deter new investments and delay capacity expansion plans.

- Inventory de-stocking: Players all across the epoxy resin supply chain maintain stock Inventory for stable supply. In a prolonged recession, there may be de-stocking initiatives to save costs. This inventory correcting can amplify the demand decline.

Regional Analysis

In 2023, the regional analysis of the Epoxy Resin market revealed distinctive dynamics, with Asia Pacific emerging as the dominant player, capturing more than a commanding 51.5% share. The demand for Epoxy Resin in Asia Pacific was valued at USD 7.0 billion in 2023 and is anticipated to grow significantly in the forecast period.

The market’s strength can be attributed to many reasons. The growing construction industry in Asia Pacific which is fueled by rapid urbanization and expansion in nations like China and India which has resulted in an increased market for the use of epoxy resins for applications like coatings sealants, adhesives, and coatings. Furthermore, the region’s growing manufacturing sector for electronics, coupled with the growing market for wind energy has helped boost the demand of products made from epoxy resin. The availability of cost-effective labor and raw materials has also attracted epoxy resin manufacturers to set up production facilities in the region, contributing to its market dominance.

On the other hand, Europe showcased a mature and well-established epoxy resin market, accounting for a significant market share in 2023. The region’s strong focus on sustainable and environmentally friendly solutions has driven the demand for waterborne and bio-based epoxy resins. Additionally, the automotive and aerospace sectors in Europe continued to rely on epoxy composites for lightweight, high-performance materials. Stringent environmental regulations have encouraged the adoption of epoxy resin products with reduced volatile organic compounds (VOCs) in the European market.

In North America, the epoxy resin market exhibited steady growth, underpinned by the robust construction and automotive industries. The region’s emphasis on infrastructure upgrades and the production of fuel-efficient vehicles has driven the demand for epoxy-based coatings, adhesives, and composites. Moreover, the electronics and aerospace sectors in North America continued to fuel the consumption of epoxy resins, particularly for applications requiring advanced electronic encapsulation and lightweight structural materials.

Latin America displayed promising potential in the epoxy resin market, with growth opportunities stemming from its expanding construction and industrial sectors. The region’s focus on infrastructure development and renewable energy projects has spurred the demand for epoxy resin-based materials. Moreover, the automotive industry’s growth in countries like Brazil and Mexico has further contributed to the increasing consumption of epoxy resins for composite manufacturing and coatings.

In the Middle East and Africa, the epoxy resin market showcased gradual growth, primarily driven by the construction and oil & gas sectors. Epoxy resins are sought after for their durability and resistance to extreme conditions, making them valuable in protecting structures and equipment in these industries. The region’s ongoing infrastructure projects and the need for corrosion-resistant coatings and adhesives in the oil & gas sector have supported the demand for epoxy resin products.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The quality of the products offered by companies in the market is what makes them stand out. Market leaders compete on the basis of their product development capabilities as well as new technologies used in product formulations. Huntsman International LLC is one of the leading market players. They invest in developing sustainable and innovative solutions to create new resins. Huntsman International LLC, for example, launched the ARALDITE 2000 Adhesive core line in September 2020. It consists of three technologies: epoxy, acrylic, and polyurethane (PU). This allows businesses to maximize productivity by covering up to 80% of their bonding requirements.

Top Key Players

- 3M

- Aditya Birla Management Corp. Pvt. Ltd.

- Atul Ltd.

- BASF SE

- Solvay

- Huntsman International LLC

- Kukdo Chemical Co., Ltd.

- Olin Corporation

- Sika AG

- Nan Ya Plastics Corp.

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corporation (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- Nagase & Co., Ltd.

Recent Developments

- In February 2023, Huntsman, a prominent player in the chemical industry, unveiled a groundbreaking product known as JEFFAMINE M-3085 amine. This innovative offering represents a significant development in the realm of mono-polyether amines. Notably, JEFFAMINE M-3085 amine boasts a notably higher molecular weight when compared to commonly utilized amine variants like JEFFAMINE M-2070 amine and JEFFAMINE M-1000 amine. This strategic move by Huntsman underscores their commitment to innovation and meeting the evolving needs of the market.

- Shifting our focus to developments in February 2022, Westlake Chemical Corporation made a substantial announcement. The corporation successfully concluded its acquisition of Hexion Inc.’s global epoxy business. This strategic maneuver bolsters Westlake Chemical’s standing within the industry, fortifying its capabilities in the production and advancement of specialty resins, coatings, and composites. Such acquisitions are indicative of the dynamic landscape in the chemical sector, as companies seek to expand and diversify their portfolios.

- In March 2022, Aditya Birla Chemicals made a significant stride in its global presence and manufacturing capacity. The company disclosed plans to double its epoxy manufacturing capacity and embark on an expansion into international markets. This forward-looking initiative underscores Aditya Birla Chemicals’ commitment to strengthening its foothold in the global market. Such investments in capacity expansion are often aligned with the growth trends in the industry, reflecting a cautious optimism towards the future.

Report Scope

Report Features Description Market Value (2023) US$ 13.7 Bn Forecast Revenue (2032) US$ 27.7 Bn CAGR (2023-2032) 8.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Physical Forms (Liquid, Solid, Solution), By End-use Industry (Paints & Coatings, Wind Turbines, Composites, Construction, Electrical & Electronics, Adhesives, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape 3M, Aditya Birla Management Corp. Pvt. Ltd., Atul Ltd., BASF SE, Solvay, Huntsman International LLC, Kukdo Chemical Co., Ltd., Olin Corporation, Sika AG, Nan Ya Plastics Corp., Jiangsu Sanmu Group Co., Ltd., Jubail Chemical Industries LLC, China Petrochemical & Chemical Corporation (SINOPEC), Hexion, Kolon Industries, Inc., Techstorm, Nagase & Co., Ltd. Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is epoxy resin?Epoxy resin is a type of polymer that is widely used in various industries for its strong adhesive properties and durability. It is formed by the reaction of epoxide compounds with a curing agent.

Where is epoxy resin used?Epoxy resin finds applications in a wide range of industries, including construction, electronics, automotive, aerospace, and art. It is commonly used for adhesives, coatings, and as a matrix for composite materials.

How big is Epoxy Resin Market?The Global Epoxy Resin Market is anticipated to be USD 27.7 billion by 2033. It is estimated to record a steady CAGR of 8.9% in the Forecast period 2023 to 2033. It is likely to total USD 13.7 billion in 2023.

What are the key drivers of the epoxy resin market?The epoxy resin market is driven by factors such as increasing demand in the construction and automotive sectors, the growth of the electronics industry, and the versatility of epoxy resins in various applications.

What challenges does the epoxy resin market face?Challenges in the epoxy resin market include volatile raw material prices, environmental regulations, and the need for constant innovation to meet evolving industry requirements.

-

-

- 3M

- Aditya Birla Management Corp. Pvt. Ltd.

- Atul Ltd.

- BASF SE

- Solvay

- Huntsman International LLC

- Kukdo Chemical Co., Ltd.

- Olin Corporation

- Sika AG

- Nan Ya Plastics Corp.

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corporation (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- Nagase & Co., Ltd.