Global Antimicrobial Coatings Market Size, Share Analysis Report By Type (Metallic, Non-metallic), By Technology (Water-based, Solvent-based, Powder Coating, Aerosol, UV Curable), By End-use (Medical and Healthcare, Food and Beverage, Building and Construction, HVAC System, Protective Clothing, Automotive and Transportation, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 22402

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

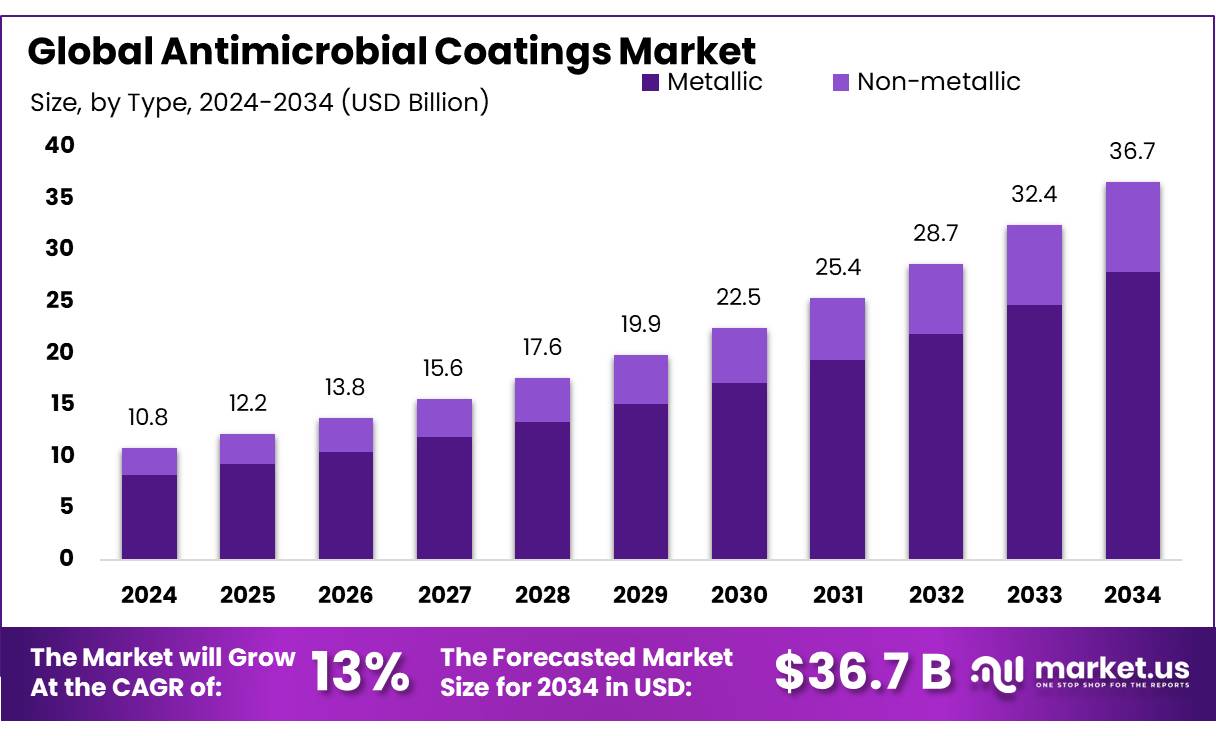

The Global Antimicrobial Coatings Market size is expected to be worth around USD 36.7 billion by 2034, from USD 10.8 billion in 2024, growing at a CAGR of 13.0% during the forecast period from 2025 to 2034.

The global antimicrobial coatings market is experiencing significant growth, driven by increasing awareness of hygiene, rising healthcare concerns, and expanding applications across various industries. Antimicrobial coatings are specialized formulations designed to inhibit the growth of bacteria, fungi, and viruses on surfaces, which helps reduce the risk of infections and contamination. These coatings are widely used in healthcare, food processing, construction, and consumer goods to enhance surface protection and longevity.

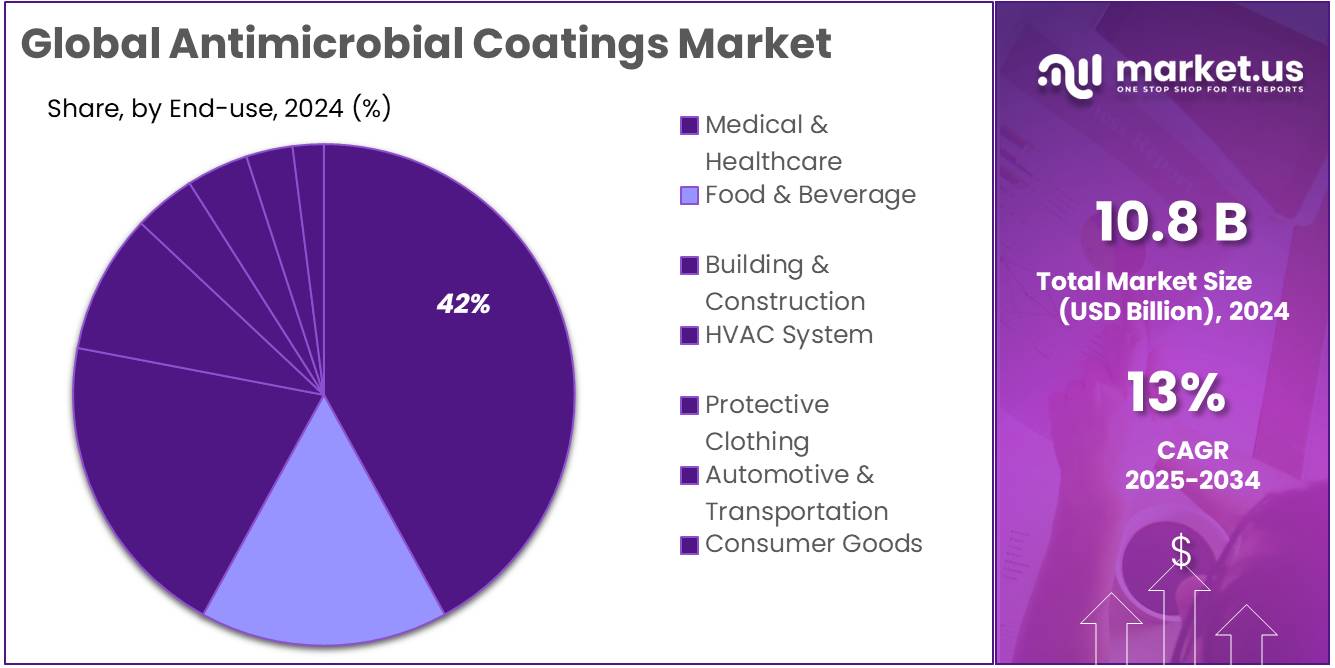

The antimicrobial coatings is characterized by stringent regulatory frameworks, technological advancements, and expanding applications across multiple sectors. The healthcare industry remains the dominant consumer, accounting for over 42.30% of the total market share, as hospitals, medical devices, and surgical equipment require antimicrobial protection to reduce hospital-acquired infections (HAIs).

HAIs affect an estimated 1.7 million patients annually in the U.S. alone, resulting in over 98,000 deaths and increasing healthcare costs. As a result, hospitals are investing in antimicrobial coatings for high-contact surfaces such as bed rails, IV stands, and catheters. The construction industry is another key adopter, with mold-resistant paints and antimicrobial HVAC system coatings gaining traction to improve indoor air quality.

The food and beverage sector is also integrating antimicrobial coatings in packaging and processing equipment to minimize contamination risks and extend shelf life. The transportation industry, including automotive, aerospace, and public transit, is increasingly utilizing antimicrobial coatings in vehicle interiors to enhance hygiene standards. North America leads the global market, driven by strict regulatory enforcement by agencies such as the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA).

Several factors are driving the expansion of the antimicrobial coatings market. The rising prevalence of infectious diseases and antimicrobial resistance has led to an increased adoption of antimicrobial coatings in hospitals, households, and public infrastructure. These coatings help mitigate the spread of harmful microorganisms in high-contact areas.

Silver-based coatings hold a significant market share due to their superior antibacterial properties and are widely used in healthcare and food-related applications. Copper and zinc-based coatings are also gaining traction as cost-effective alternatives. These materials are favored for their antimicrobial effectiveness and their ability to provide long-lasting protection against harmful pathogens.

Key Takeaways

- Antimicrobial Coatings Market size is expected to be worth around USD 36.7 billion by 2034, from USD 10.8 billion in 2024, growing at a CAGR of 13.0%.

- Metallic antimicrobial coatings held a dominant position in the market, capturing more than a 76.10% share.

- Solvent-based antimicrobial coatings held a dominant market position, capturing more than a 32.40% share.

- Medical & Healthcare held a dominant market position, capturing more than a 42.30% share.

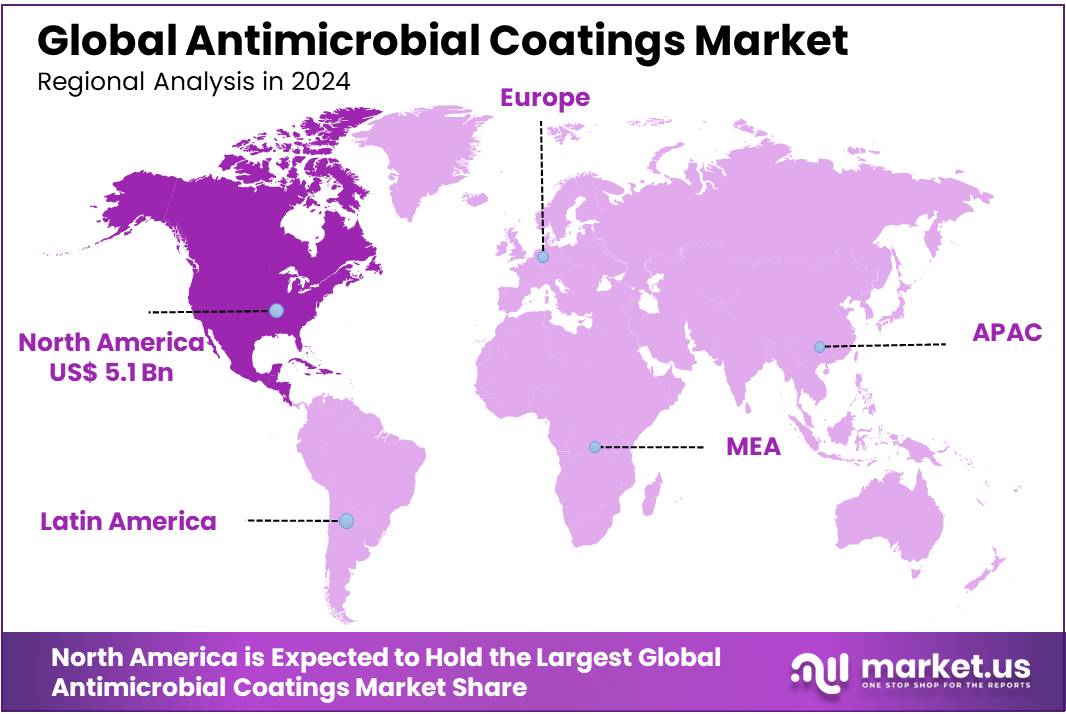

- North America held a dominant position in the antimicrobial coatings market, capturing more than 47.40% of the global share, valued at approximately USD 5.1 billion.

Type Analysis

In 2024, Metallic antimicrobial coatings held a dominant position in the market, capturing more than a 76.10% share. This segment’s growth is largely driven by the increasing demand for durable and long-lasting antimicrobial solutions, particularly in industries such as healthcare, automotive, and construction. Metallic coatings, which typically contain silver, copper, or zinc, are widely known for their superior antimicrobial properties, making them ideal for high-touch surfaces in environments that require stringent hygiene standards. Silver-based coatings, in particular, have seen a rise in adoption due to their proven effectiveness in combating bacteria and viruses.

Non-metallic antimicrobial coatings are also gaining traction, although at a slower pace compared to their metallic counterparts. In 2024, the non-metallic segment accounted for a smaller but steadily growing market share. These coatings are often preferred for their versatility and are commonly used in industries like textiles, packaging, and food processing, where metals may not always be suitable. Non-metallic coatings, often incorporating organic compounds, offer a more eco-friendly and cost-effective alternative to metallic coatings. They are increasingly seen as an attractive solution for applications that require specific performance characteristics, such as flexibility and ease of application.

By Technology Analysis

In 2024, Solvent-based antimicrobial coatings held a dominant market position, capturing more than a 32.40% share. The popularity of solvent-based coatings can be attributed to their strong adhesion properties and ability to form a durable, long-lasting finish. These coatings are commonly used in industrial applications, where high-performance protection against microbial growth is required.

Water-based coatings, however, are steadily gaining ground in the market. In 2024, water-based antimicrobial coatings accounted for a significant share of the market, driven by their eco-friendly nature and lower environmental impact. These coatings are increasingly being adopted in sectors where sustainability is a priority, including the construction and consumer goods industries.

Powder coating technology also continues to expand its presence in the antimicrobial coatings market. While it currently holds a smaller share, powder coatings offer a durable, high-quality finish without the use of solvents, making them a popular choice for large-scale applications like automotive and architectural coatings. The market share for powder coatings is expected to grow gradually as the demand for solvent-free, environmentally friendly alternatives increases.

Aerosol coatings, with their ease of use and convenience, are another growing segment. These coatings are ideal for small-scale applications and for consumers looking for quick, DIY solutions. Though the market share for aerosol-based antimicrobial coatings is relatively smaller compared to solvent- and water-based options, it is expected to see gradual growth as more people seek accessible, effective antimicrobial solutions.

UV curable coatings, which offer the advantage of fast curing times and minimal environmental impact, have also found a niche within the antimicrobial coatings market. While the segment is still in the early stages of adoption, it is expected to grow as industries that require fast and efficient coatings, such as electronics and packaging, begin to explore their benefits. UV curable coatings are especially appealing for applications where rapid production and minimal downtime are essential.

End Use Analysis

In 2024, Medical & Healthcare held a dominant market position, capturing more than a 42.30% share. This segment continues to lead due to the critical demand for antimicrobial coatings in hospitals, clinics, and medical devices. With increasing concerns over healthcare-associated infections (HAIs), the need for antimicrobial surfaces in patient rooms, surgical tools, and medical equipment has never been more urgent.

The Food & Beverage industry is another major end-use segment witnessing significant growth. In 2024, antimicrobial coatings for food processing equipment, packaging materials, and storage areas accounted for a sizable market share. The growing focus on food safety and the reduction of microbial contamination in food handling processes is propelling the demand for antimicrobial solutions.

Building & Construction is also seeing increased adoption of antimicrobial coatings. In 2024, this segment experienced significant growth due to the rising demand for coatings that can inhibit microbial growth in commercial and residential buildings, particularly in high-traffic areas. Antimicrobial coatings are increasingly used in surfaces like walls, floors, and ceilings, as well as in materials like paints and sealants.

HVAC Systems are another notable end-use sector in the antimicrobial coatings market. In 2024, the demand for antimicrobial coatings in HVAC systems surged, driven by the growing recognition of the role these systems play in maintaining indoor air quality. Protective Clothing is gaining traction in the antimicrobial coatings market as well.

The Automotive & Transportation sector is also seeing a rise in the use of antimicrobial coatings. In 2024, coatings used in vehicles and public transportation systems, including trains, buses, and aircraft, saw a steady increase in demand. Consumer Goods is another growing segment for antimicrobial coatings. In 2024, the use of antimicrobial coatings in everyday products, such as smartphones, kitchenware, and clothing, became more widespread. Consumers are increasingly looking for products that offer protection against harmful microbes, which has led to an uptick in demand for antimicrobial-treated consumer goods.

Key Market Segments

By Type

- Metallic

- Silver Based

- Copper Based

- Zinc Based

- Titanium Based

- Others

- Non-metallic

- Polymeric

- Organic

By Technology

- Water-based

- Solvent-based

- Powder Coating

- Aerosol

- UV Curable

By End-use

- Medical & Healthcare

- Catheters

- Implantable Devices

- Surgical Instruments

- Others

- Food & Beverage

- Building & Construction

- HVAC System

- Protective Clothing

- Automotive & Transportation

- Consumer Goods

- Others

Drivers

Increasing Demand for Food Safety and Hygiene Standards

The food and beverage industry, which includes everything from farms to restaurants, is increasingly adopting antimicrobial coatings to minimize the risk of contamination. These coatings are applied to food contact surfaces, processing equipment, packaging materials, and storage facilities to prevent the growth of harmful bacteria, molds, and viruses. With foodborne illnesses affecting millions of people each year, antimicrobial coatings are becoming a vital part of food safety programs.

According to the World Health Organization (WHO), nearly 600 million people—almost 1 in 10—fall ill after eating contaminated food, leading to an estimated 420,000 deaths annually. This statistic highlights the urgency of adopting more effective measures to combat microbial contamination in the food supply chain. In response to this growing public health issue, many countries are adopting stricter hygiene standards, prompting food manufacturers to implement advanced solutions, such as antimicrobial coatings, to enhance food safety and quality.

A key example of this shift can be seen in the United States, where the Food Safety Modernization Act (FSMA), implemented by the U.S. Food and Drug Administration (FDA), focuses on preventing food safety hazards rather than merely responding to contamination after the fact. The FSMA, which is the most sweeping reform of food safety laws in over 70 years, emphasizes the need for preventive controls in food manufacturing and processing, making it a key driver for the adoption of antimicrobial solutions.

The rise of consumer awareness around hygiene and food safety has also influenced market demand. Reports from the Food Marketing Institute show that 87% of consumers believe that food safety is an important factor when purchasing food products, and 65% are willing to pay more for food products that they believe are safe and free from contamination. This shift in consumer expectations has encouraged food producers to invest in advanced technologies, such as antimicrobial coatings, to meet these heightened demands.

Restraints

High Cost of Antimicrobial Coatings and its Impact on Widespread Adoption

One of the major restraining factors for the growth of the antimicrobial coatings market is the high cost associated with the development, production, and application of these coatings. While antimicrobial coatings offer significant benefits, such as reducing microbial contamination and improving product lifespan, their cost can be a barrier, particularly for smaller companies and industries with tight profit margins.

In the food and beverage industry, where hygiene is critical, the adoption of antimicrobial coatings is growing, but it’s not without challenges. According to the U.S. Department of Agriculture (USDA), food processors in the U.S. alone face significant financial pressures due to rising operational costs, including labor and materials.

In 2024, antimicrobial coatings can cost significantly more than traditional coatings or surface treatments. For instance, antimicrobial coatings that incorporate silver or copper particles, which are highly effective but expensive, can nearly triple the cost of standard coatings. This increased expense is due to the high cost of raw materials, as well as the specialized equipment required for the application of antimicrobial treatments. Furthermore, these coatings may require more frequent reapplication or maintenance, which can add to the long-term costs for businesses.

For the food industry, this cost becomes particularly difficult to manage. According to the Food and Agriculture Organization (FAO), the global food sector already faces tremendous cost pressures, particularly in regions with high labor costs. The FAO estimates that around one-third of food produced globally is wasted, a significant portion of which could be prevented with better hygiene practices during production and storage. However, the adoption of antimicrobial coatings as a solution to prevent spoilage or contamination comes at a price that many smaller players in the food industry may find unaffordable.

Moreover, despite growing consumer demand for safer, longer-lasting food products, the high cost of antimicrobial coatings may cause hesitation in widespread adoption. As consumer awareness of hygiene and food safety increases, so does the demand for antimicrobial-treated food packaging and surfaces. However, the balance between consumer demand and the cost to implement these solutions is not always straightforward.

Government initiatives aimed at improving food safety can also inadvertently exacerbate the cost issue. For example, the U.S. Food Safety Modernization Act (FSMA) has imposed stricter regulations on food producers to ensure safety and prevent contamination. While these regulations are beneficial for public health, they can place a financial burden on companies that need to comply. For smaller producers, the financial strain of meeting FSMA requirements, coupled with the added costs of antimicrobial coatings, could prove overwhelming.

Opportunity

Expansion in the Food Packaging Industry Driven by Consumer Demand for Safer Products

Foodborne illness is a significant global health issue, and the need for better solutions to prevent contamination during food storage and transport has never been more urgent. The World Health Organization (WHO) estimates that 1 in 10 people worldwide fall ill each year from eating contaminated food, with 420,000 of those cases resulting in death. This has pushed food safety to the forefront of consumer consciousness, leading many food producers and manufacturers to seek advanced solutions, such as antimicrobial-treated packaging, to reduce the risk of contamination and spoilage.

In 2024, antimicrobial coatings for food packaging were estimated to be a growing segment within the broader food packaging market, with industry experts predicting a steady rise in adoption. A report by the U.S. Food and Drug Administration (FDA) suggests that packaging materials treated with antimicrobial coatings could help extend the shelf life of food products by up to 50%, reducing food waste and improving food safety.

According to the Food Marketing Institute, 78% of consumers are now more likely to purchase products that they believe have a lower environmental impact. Additionally, 65% of consumers are willing to pay more for food packaging that offers enhanced safety features, such as antimicrobial protection. These changing consumer preferences are encouraging food manufacturers to invest in advanced packaging technologies that meet both safety and sustainability expectations.

Governments and regulatory bodies are also playing an important role in driving the growth of antimicrobial coatings in food packaging. The European Union, for example, has implemented the “Farm to Fork” strategy, which aims to make food systems fair, healthy, and environmentally-friendly by promoting sustainable practices, including food safety measures. This initiative has resulted in increased regulations surrounding food packaging, driving demand for antimicrobial solutions that comply with these new standards. Similarly, in the U.S., the FDA has established guidelines for the safe use of antimicrobial agents in food contact materials, further supporting the growing use of antimicrobial coatings in packaging.

As the demand for antimicrobial food packaging continues to rise, many leading companies in the food packaging sector, such as Amcor and Sealed Air, are investing in research and development to create more effective and cost-efficient antimicrobial coatings. These companies are exploring the use of natural antimicrobial agents, such as plant-based compounds, in addition to traditional substances like silver and copper, to meet growing consumer demand for more sustainable and eco-friendly packaging solutions.

Trending Factors

Rising Adoption of Sustainable and Natural Antimicrobial Coatings in the Food Industry

The push for sustainability is also being driven by increasing regulatory pressures. In Europe, the European Union’s “Farm to Fork” strategy, part of the European Green Deal, aims to reduce the environmental impact of food production and consumption. The strategy emphasizes the need for food safety practices that are not only effective but also environmentally sustainable. This includes reducing food waste, improving hygiene standards, and using safe, sustainable materials in food packaging.

In 2024, antimicrobial coatings made from natural ingredients were estimated to make up a growing portion of the market, especially in sectors like food packaging, where natural materials are in high demand. According to the U.S. Department of Agriculture (USDA), over 40% of U.S. consumers are actively seeking out products that are labeled as “natural” or “organic,” and this trend is driving the development of packaging solutions that use natural antimicrobial agents. This demand is particularly pronounced in products like organic food, fresh produce, and minimally processed items, where consumers expect the highest standards of food safety without the use of synthetic chemicals.

The use of sustainable antimicrobial coatings is also being influenced by consumer behavior, with growing concerns about the health implications of chemical exposure. The Clean Label Movement, which promotes transparency in food labeling and encourages the use of natural ingredients, has gained significant traction in recent years. A study by the Clean Label Project found that 62% of consumers are now more likely to purchase products that are labeled as free from artificial ingredients or chemicals, including those in packaging. This shift in consumer preferences has prompted food producers to adopt antimicrobial coatings that are made from safe, natural ingredients, ensuring both food safety and product appeal.

Government initiatives in both developed and developing nations are further driving the adoption of natural antimicrobial coatings. In the U.S., the Food and Drug Administration (FDA) has been increasingly supportive of research into natural food preservatives and antimicrobial coatings. The FDA’s guidelines for the use of natural substances in food contact materials are helping to create a more favorable regulatory environment for these products. Similarly, in Japan, the Ministry of Health, Labour and Welfare has been pushing for the use of safer, eco-friendly food packaging materials, which include coatings made from natural antimicrobial agents.

The growing focus on sustainable materials is not just driven by regulatory bodies and consumer demand but also by innovations in research and development. Major companies in the food industry, such as Nestlé and Danone, have committed to reducing their environmental impact by incorporating more sustainable practices in their supply chains. Nestlé, for example, has announced a goal to make 100% of its packaging recyclable or reusable by 2025, and this includes exploring the use of antimicrobial coatings made from sustainable, natural sources.

By 2025, it is anticipated that the market for natural antimicrobial coatings will continue to grow as both consumer expectations and regulatory standards evolve. Natural coatings are expected to play a pivotal role in the food industry’s shift toward more sustainable and safe practices, particularly in food packaging, storage, and processing. As new technologies emerge, the cost of natural antimicrobial coatings is likely to decrease, making them more accessible to a wider range of food producers.

Regional Analysis

North America Covers Major Share in Global Antimicrobial Coatings Market

In 2024, North America held a dominant position in the antimicrobial coatings market, capturing more than 47.40% of the global share, valued at approximately USD 5.1 billion. The region’s growth is primarily driven by stringent regulations, high demand for advanced technologies in healthcare, food safety, and growing awareness about hygiene. The U.S., in particular, plays a pivotal role in this growth, with industries like healthcare, food processing, and consumer goods increasingly adopting antimicrobial coatings to enhance safety and product longevity. Government initiatives, such as the Food Safety Modernization Act (FSMA), further encourage the widespread adoption of antimicrobial technologies in food packaging and processing sectors.

Europe, the second-largest market, accounts for a significant share due to the region’s robust regulatory framework around food safety and environmental sustainability. The European Union’s “Farm to Fork” strategy and its focus on reducing foodborne illnesses are major drivers of growth in food-related applications, including packaging and processing. The region’s demand for eco-friendly, sustainable antimicrobial coatings is also rising, with consumer preference shifting toward natural, safe ingredients in food packaging.

Asia Pacific is expected to witness rapid growth over the forecast period, driven by the increasing industrialization of emerging economies like China and India. The expanding healthcare and construction sectors in the region contribute to this growth. The Middle East & Africa and Latin America, while smaller in comparison, are showing steady adoption, particularly in healthcare and consumer goods sectors as industries in these regions adopt antimicrobial coatings to enhance product hygiene and safety.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The antimicrobial coatings market is highly competitive, with several key players leading the way in product innovation and regional expansion. BASF SE, The Sherwin-Williams Company, and PPG Industries, Inc. are among the dominant companies in the market, offering a wide range of antimicrobial coating solutions for various industries, including healthcare, food processing, and consumer goods.

Additionally, Akzo Nobel N.V., Axalta Coating Systems, and Nippon Paint Holdings Co. Ltd. are significant players, particularly in the architectural and industrial coatings segments, where demand for antimicrobial protection is rising due to increased focus on hygiene and safety.

Sika AG, Lanxess AG, and Lonza, are also contributing to the growth of the market through strategic partnerships, acquisitions, and the development of specialized antimicrobial solutions. Troy Corporation and Burke Industrial Coatings offer innovative antimicrobial technologies tailored to industrial applications, while companies like Jotun, Hempel A/S, and Brillux Industrial Coatings are focusing on enhancing the durability and performance of their coatings for both commercial and residential sectors.

Emerging players like Covalon OEM Technologies and Sono-Tek Corporation are making strides in niche applications such as medical devices and packaging, where antimicrobial coatings are essential for preventing contamination and prolonging shelf life. Together, these companies are driving the global expansion of antimicrobial coatings across a variety of sectors.

Market Key Players

- Akzo Nobel N.V.

- BASF SE

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems

- DSM

- Sika AG

- Lanxess AG

- Lonza

- Burke Industrial Coatings

- Jotun

- Hempel A/S

- Brillux Industrial Coatings

- Nippon Paint Holdings Co. Ltd

- Covalon OEM Technologies

- Troy Corporation

- AST Products Inc.

- Sono-Tek Corporation

- Other Key Players

Recent Developments

- In 2024 BASF SE revenue in the coatings segment is projected to be approximately USD 5.8 billion, driven by increasing demand for hygiene-focused applications and stricter food safety regulations globally.

- In 2024 The Sherwin-Williams Company, the company’s coatings division is expected to generate approximately USD 6.4 billion in revenue, driven by the rising demand for antimicrobial protection due to stricter health regulations and consumer preferences for safer, cleaner environments.

Report Scope

Report Features Description Market Value (2024) US$ 10.8 Bn Forecast Revenue (2034) US$ 36.7 Bn CAGR (2025-2034) 13% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Metallic, Non-metallic), By Technology (Water-based, Solvent-based, Powder Coating, Aerosol, UV Curable), By End-use (Medical and Healthcare, Food and Beverage, Building and Construction, HVAC System, Protective Clothing, Automotive and Transportation, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, The Sherwin-Williams Company, PPG Industries, Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, DSM, Sika AG, Lanxess AG, Akzo Nobel N.V., Lonza, Burke Industrial Coatings, Jotun, Hempel A/S, Brillux Industrial Coatings, Nippon Paint Holdings Co. Ltd, Covalon OEM Technologies, Troy Corporation, AST Products Inc., Sono-Tek Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antimicrobial Coating MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Coating MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel N.V.

- BASF SE

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems

- DSM

- Sika AG

- Lanxess AG

- Lonza

- Burke Industrial Coatings

- Jotun

- Hempel A/S

- Brillux Industrial Coatings

- Nippon Paint Holdings Co. Ltd

- Covalon OEM Technologies

- Troy Corporation

- AST Products Inc.

- Sono-Tek Corporation

- Other Key Players