Global Chemical Bonded Nonwoven Market By Material Type(Polypropylene (PP), Polycarbonate (PC), Polyamide (PA), Biopolymers, Polyethylene (PE), Polyethylene Terephthalate (PET), Others), By Functionality(Disposable, Durable), By Process(Drylaid, Wetland, Spunbond, Meltblown), By Application(Hygiene and Personal Care, Medical, Household and Furnishings, Geotextiles, Filtration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 75979

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

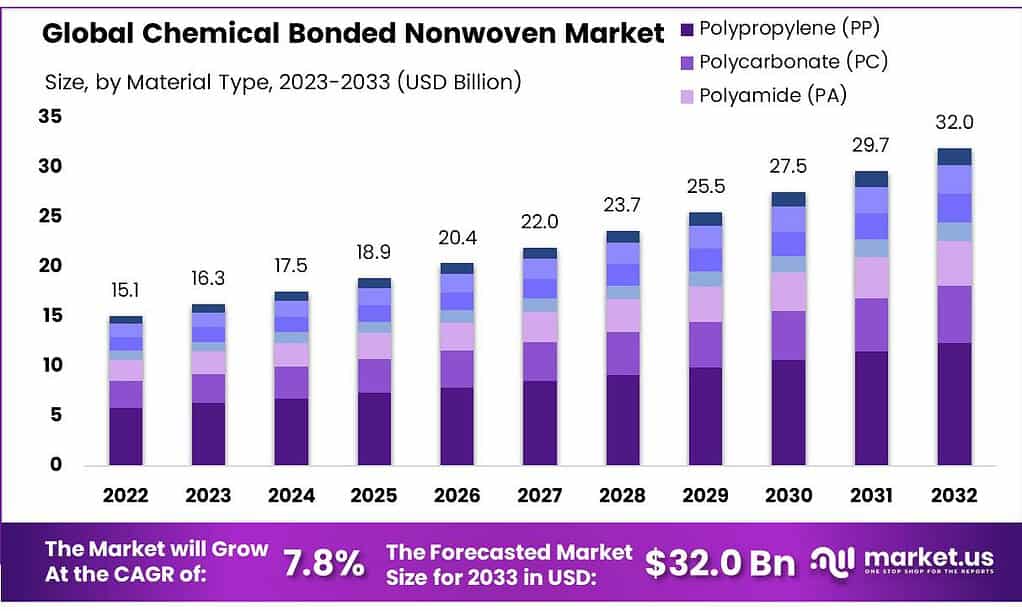

The global Chemical Bonded Nonwoven Market size is expected to be worth around USD 32.0 billion by 2033, from USD 15.1 billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2033.

Chemical-bonded nonwoven refers to a type of nonwoven fabric that is created by bonding fibers together using chemical processes. In the manufacturing of chemical bonded nonwovens, various chemical agents or binders are applied to the fibers to create a cohesive structure. These nonwovens are distinct from other types of nonwovens, such as thermal-bonded or spun-bonded, as they rely on the use of chemicals to achieve fiber bonding.

The chemical-bonded nonwoven market plays a crucial role in meeting the diverse demands of industries that require fabrics with specific characteristics. The ability to customize these nonwovens through the careful selection of fibers and binders makes them a versatile solution for various applications where strength, durability, and customization are paramount.

Key Takeaways

- Market Growth: Expected to reach USD 32.0 billion by 2033, with a 7.8% CAGR from USD 15.1 billion in 2023.

- Material Dominance: Polypropylene (PP) leads, capturing over 38.7% market share in 2023.

- Functional Preferences: Disposable functionality dominates, with over 65.4% market share in 2023.

- Manufacturing Processes: Drylaid processes hold over 40% market share in 2023.

- Application Diversity: Hygiene & Personal Care leads, accounting for over 37.5% market share in 2023.

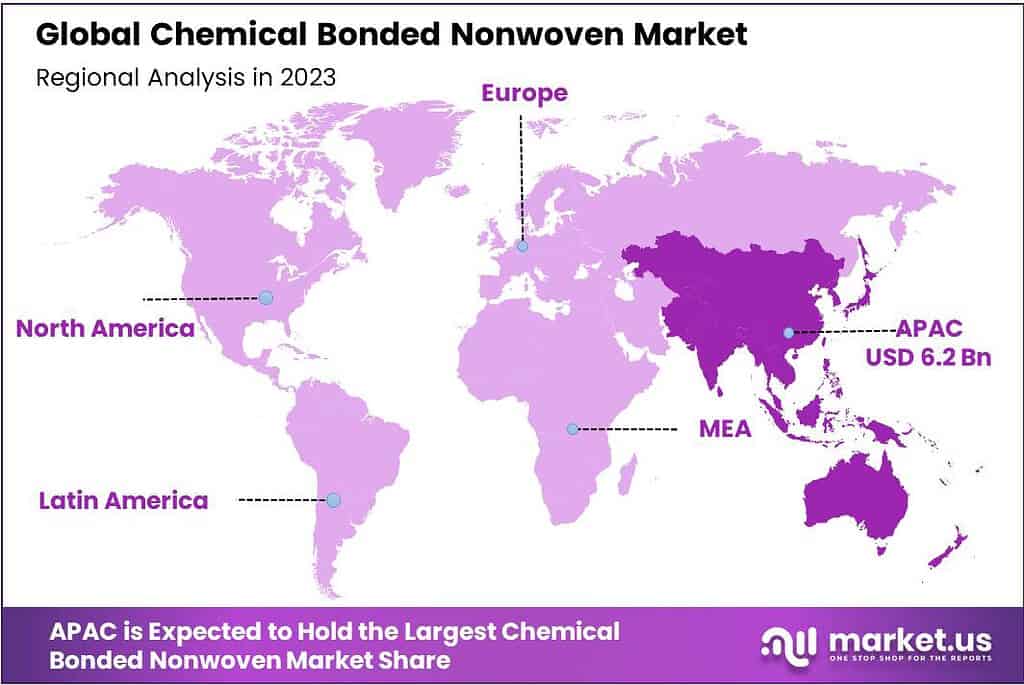

- Regional Dynamics: Asia Pacific leads, followed by North America and Europe, driven by economic factors.

By Material Type

In 2023, Polypropylene (PP) emerged as the frontrunner in the chemical bonded nonwoven market, securing a dominant market position by capturing more than a 38.7% share. This material type played a pivotal role in shaping the industry landscape, emphasizing its significant role and widespread adoption.

Polypropylene (PP) is favored for chemically bonded nonwovens due to its versatile properties. It offers excellent strength, durability, and resistance to moisture, making it suitable for diverse applications across industries. The dominant market position of PP in 2023 reflects its wide-ranging applications in hygiene products, filtration media, automotive interiors, and various industrial uses.

By Functionality

In 2023, the Chemical Bonded Nonwoven Market showcased a clear trend, with Disposable functionality securing a dominant market position by capturing more than a 65.4% share. This indicates a prevalent preference for disposable chemical-bonded nonwoven products across various industries.

Disposable chemical-bonded nonwovens are widely favored for their convenience and single-use applications. In 2023, their dominance signifies the strong demand in sectors such as hygiene products (like diapers and wipes), medical applications, and food packaging. The disposable segment’s substantial market share reflects the emphasis on cost-effectiveness, hygiene, and ease of use, making it a preferred choice for end-users.

While not as dominant as the disposable segment, Durable functionality carved out a notable market share in 2023. Durable chemical-bonded nonwovens find applications in sectors where long-lasting performance and robustness are essential, such as automotive interiors, industrial applications, and certain medical products. This segment’s presence reflects the diverse needs of industries seeking lasting solutions that can withstand wear and tear, contributing to the overall market dynamics.

By Process

In 2023, the Chemical Bonded Nonwoven Market showcased a significant market trend, with Drylaid processes securing a dominant position by capturing more than a 40% share. This indicates a prevalent preference for the dryland manufacturing method, reflecting its wide-ranging applications and effectiveness within the industry.

The dominance of the Drylaid process in 2023 underscores its popularity within the Chemical Bonded Nonwoven Market. Drylaid involves the mechanical or pneumatic deposition of fibers onto a moving conveyor, forming a web that is later bonded using chemical agents or thermal methods. This method’s widespread adoption is evident across various applications, including hygiene products, filtration media, and automotive interiors. Its efficiency and versatility contribute to its market dominance, meeting the demands for cost-effective and customizable nonwoven solutions.

While not as dominant as Drylaid, the Wetlaid process secured a notable market share in 2023. Wetlaid involves the suspension of fibers in water, forming a slurry that is then deposited on a moving conveyor and subsequently bonded. This process is often preferred for applications requiring a smoother surface and enhanced uniformity, such as specialty wipes, medical fabrics, and certain filtration media.

The Spunbond process, although holding a smaller market share, remains a significant contributor. This method involves extruding molten polymer through spinnerets, forming continuous filaments that are laid onto a moving conveyor and bonded. Spunbond nonwovens are known for their strength and breathability, making them suitable for applications like geotextiles, agriculture, and disposable medical products.

The Meltblown process, with its unique characteristics, also plays a noteworthy role in the market. This method entails the extrusion of molten polymer through fine nozzles, creating microfibers that are then collected to form a nonwoven web. Meltblown nonwovens are recognized for their fine filtration capabilities, finding applications in medical masks, air filtration, and oil sorbents.

By Application

In 2023, the Chemical Bonded Nonwoven Market exhibited a notable trend, with Hygiene & Personal Care applications holding a dominant market position by capturing more than a 37.5% share. This indicates a significant preference for chemical-bonded nonwovens in the hygiene and personal care sector, underlining the importance of these materials in daily-use products.

Hygiene & Personal Care: The dominance of Hygiene & Personal Care applications in 2023 highlights the widespread use of chemical-bonded nonwovens in products like diapers, wipes, feminine hygiene products, and adult incontinence items. The softness, absorbency, and cost-effectiveness of these nonwovens contribute to their market stronghold, meeting the demand for comfortable and efficient solutions in the hygiene and personal care industry.

Medical: Following closely is the Medical segment, which secured a substantial market share. Chemical-bonded nonwovens play a crucial role in medical applications, including surgical gowns, drapes, wound dressings, and disposable medical products. The durability, barrier properties, and customization options of these nonwovens contribute to their prevalence in the medical field.

Household & Furnishings: The Household & Furnishings segment also held a notable market share in 2023. Chemical-bonded nonwovens find application in items like cleaning wipes, tablecloths, and upholstery due to their versatility, durability, and ease of customization. This segment’s presence indicates the adoption of nonwovens as functional and aesthetic elements in household and furnishing products.

Geotextiles: Geotextiles, although not as dominant as some segments, play a significant role in the market. Chemical-bonded nonwovens in geotextiles offer properties such as strength, permeability, and erosion control, making them essential in construction and civil engineering projects, including road construction, drainage, and soil stabilization.

Filtration: The Filtration segment showcases the diverse applications of chemical-bonded nonwovens in air and liquid filtration. With a notable market share, these nonwovens are utilized in various filtration products, including automotive filters, HVAC systems, and water purification systems, benefiting from their effective particle retention and durability.

Market Key Segments

By Material Type

- Polypropylene (PP)

- Polycarbonate (PC)

- Polyamide (PA)

- Biopolymers

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Others

By Functionality

- Disposable

- Durable

By Process

- Drylaid

- Wetland

- Spunbond

- Meltblown

By Application

- Hygiene & Personal Care

- Medical

- Household & Furnishings

- Geotextiles

- Filtration

- Others

Drivers

Growing Demand in Hygiene and Personal Care Products:

One of the significant drivers propelling the Chemical Bonded Nonwoven Market is the increasing demand for hygiene and personal care products. Chemical-bonded nonwovens are extensively used in the manufacturing of diapers, wipes, feminine hygiene products, and adult incontinence items.

The softness, absorbency, and cost-effectiveness of these nonwovens make them a preferred choice in the hygiene sector. As global awareness of personal hygiene rises, the demand for these products continues to grow, driving the market forward.

Rising Emphasis on Sustainable and Eco-Friendly Solutions:

The growing emphasis on sustainability is another key driver influencing the chemical bonded nonwoven market. With an increasing awareness of environmental issues, manufacturers and consumers alike are seeking sustainable alternatives.

Chemical-bonded nonwovens offer opportunities for using biodegradable materials and eco-friendly processes. As governments implement stricter environmental regulations and consumers prioritize eco-conscious choices, the market benefits from the shift toward sustainable practices and materials.

Restraints

Volatility in Raw Material Prices:

A significant restraint affecting the Chemical Bonded Nonwoven Market is the volatility in raw material prices. The industry relies on various polymers and fibers, and fluctuations in the prices of these raw materials can impact production costs.

Economic uncertainties, geopolitical factors, and changes in oil prices contribute to the unpredictability of raw material costs, posing challenges for manufacturers in maintaining stable pricing and profit margins.

Stringent Regulatory Compliance Requirements:

Stringent regulatory compliance requirements represent another restraint for the chemical bonded nonwoven industry. Adhering to regulations related to product safety, environmental impact, and worker health and safety adds complexity and costs to manufacturing processes.

Navigating a complex regulatory landscape can be challenging for companies, especially smaller players, impacting their ability to swiftly adapt to market changes and innovations.

Opportunity

Expanding Applications in the Medical and Healthcare Sector

An opportune area for the Chemical Bonded Nonwoven Market lies in the expanding applications in the medical and healthcare sectors. The demand for nonwovens in medical products, such as surgical drapes, gowns, and wound dressings, is on the rise.

The unique properties of chemically bonded nonwovens, including barrier performance and customization options, position them as valuable materials in the evolving healthcare landscape. Manufacturers have the opportunity to explore and invest in this growing segment.

Rising Adoption of Nonwovens in Industrial and Geotextile Applications

The rising adoption of nonwovens in industrial and geotextile applications presents a significant growth opportunity. Chemical-bonded nonwovens are increasingly used in industrial wipes, automotive interiors, and geotextiles for applications like soil stabilization and drainage.

The versatility, strength, and customization capabilities of chemically bonded nonwovens make them well-suited for addressing the diverse needs of industrial and geotextile applications. Manufacturers can capitalize on this opportunity by developing tailored solutions for these sectors.

Trends

Innovation in Material and Process Technologies

A notable trend in the Chemical Bonded Nonwoven Market is the continuous innovation in material and process technologies. Manufacturers are investing in research and development to enhance the properties of nonwovens, such as strength, softness, and breathability.

Additionally, there is a focus on developing novel bonding processes to improve efficiency and customization. This trend not only caters to the evolving needs of end-users but also contributes to the versatility of chemically bonded nonwovens, expanding their applications across different industries.

Integration of Industry 4.0 Technologies

The integration of Industry 4.0 technologies, including automation and data-driven manufacturing, is a prominent trend in the chemical bonded nonwoven sector. Smart manufacturing processes are being adopted to enhance production efficiency, reduce waste, and ensure consistent product quality.

This trend aligns with the broader digital transformation in manufacturing, fostering a more agile and responsive chemical-bonded nonwoven industry.

Regional Analysis

The Asia Pacific region commands a leading position in the chemical bonded nonwoven market, holding the largest market size and a substantial share of 41.3%. The region is expected to sustain strong growth, driven by escalating plastic consumption in vital sectors such as construction, automotive, conductive polymers, and packaging.

The significant increase in polymer production, particularly in countries like China, India, South Korea, Thailand, Malaysia, and Vietnam, acts as a primary catalyst for the thriving chemical bonded nonwoven market in the Asia Pacific region. The demand for chemically bonded nonwovens is intricately linked to the rising plastic production across diverse applications, with the Asia Pacific region emerging as a major contributor to this trend.

In North America, economic expansion plays a crucial role in stimulating the demand for chemical-bonded nonwovens. The substantial growth in the region’s automotive, polymer, and manufacturing industries results in an increased need for these nonwovens. The evolving industrial landscape and the growing utilization of polymers in various applications contribute to North America’s robust position in the chemical bonded nonwoven market.

Europe is also positioned for significant growth in the chemical bonded nonwoven market during the forecast period. The textile industry’s strong demand for chemically bonded nonwovens is a key factor propelling growth in the region. As industries undergo continuous evolution and place heightened importance on color consistency and performance in plastic products, the European market for chemically bonded nonwovens is anticipated to experience substantial expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Analyzing the key players in the Chemical Bonded Nonwoven Market provides insights into the competitive landscape, innovations, and strategies that shape the industry.

Market Key Players

- Freudenberg Performance Materials

- Kimberly-Clark Corporation

- DuPont

- Ahlstrom-Munksjö

- Glatfelter

- Johns Manville

- Fitesa

- Suominen Corporation

- Sandler AG

- TWE Group

- Berry Global Inc.

- Lydall Inc.

- Hollingsworth & Vose

- Avgol Nonwovens

- Mitsui Chemicals, Inc.

Recent Developments

- Freudenberg Performance Materials: Launched a new line of chemical bonded nonwovens with improved flame retardancy properties for automotive applications.

- Kimberly-Clark Corporation: Invested in expanding its production capacity for chemical-bonded nonwovens used in hygiene products.

- DuPont: Introduced a new bio-based binder technology for chemically bonded nonwovens, aiming for increased sustainability.

- Ahlstrom-Munksjö: Focused on developing new chemical bonded nonwovens for filtration applications, particularly in the air and water purification sectors.

Report Scope

Report Features Description Market Value (2022) US$ 15.1 Bn Forecast Revenue (2032) US$ 32.0 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type(Polypropylene (PP), Polycarbonate (PC), Polyamide (PA), Biopolymers, Polyethylene (PE), Polyethylene Terephthalate (PET), Others), By Functionality(Disposable, Durable), By Process(Drylaid, Wetland, Spunbond, Meltblown), By Application(Hygiene & Personal Care, Medical, Household & Furnishings, Geotextiles, Filtration, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Freudenberg Performance Materials, Kimberly-Clark Corporation, DuPont, Ahlstrom-Munksjö, Glatfelter, Johns Manville, Fitesa, Suominen Corporation, Sandler AG, TWE Group, Berry Global Inc., Lydall Inc., Hollingsworth & Vose, Avgol Nonwovens, Mitsui Chemicals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Chemical Bonded Nonwoven Market?Chemical Bonded Nonwoven Market size is expected to be worth around USD 32.0 billion by 2033, from USD 15.1 billion in 2023

What is the CAGR for the Chemical Bonded Nonwoven Market?The Chemical Bonded Nonwoven Market expected to grow at a CAGR of 7.8% during 2023-2032.Who are the key players in the Chemical Bonded Nonwoven Market?Freudenberg Performance Materials, Kimberly-Clark Corporation, DuPont, Ahlstrom-Munksjö, Glatfelter, Johns Manville, Fitesa, Suominen Corporation, Sandler AG, TWE Group, Berry Global Inc., Lydall Inc., Hollingsworth & Vose, Avgol Nonwovens, Mitsui Chemicals, Inc.

Global Chemical Bonded Nonwoven MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Global Chemical Bonded Nonwoven MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Freudenberg Performance Materials

- Kimberly-Clark Corporation

- DuPont

- Ahlstrom-Munksjö

- Glatfelter

- Johns Manville

- Fitesa

- Suominen Corporation

- Sandler AG

- TWE Group

- Berry Global Inc.

- Lydall Inc.

- Hollingsworth & Vose

- Avgol Nonwovens

- Mitsui Chemicals, Inc.