Global Mushroom Market by Type (Button, Shiitake, Oyster), By Form (Fresh, Processed), By Distribution Channel, By End-user (Food, Pharmaceutical, Cosmetics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 28941

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

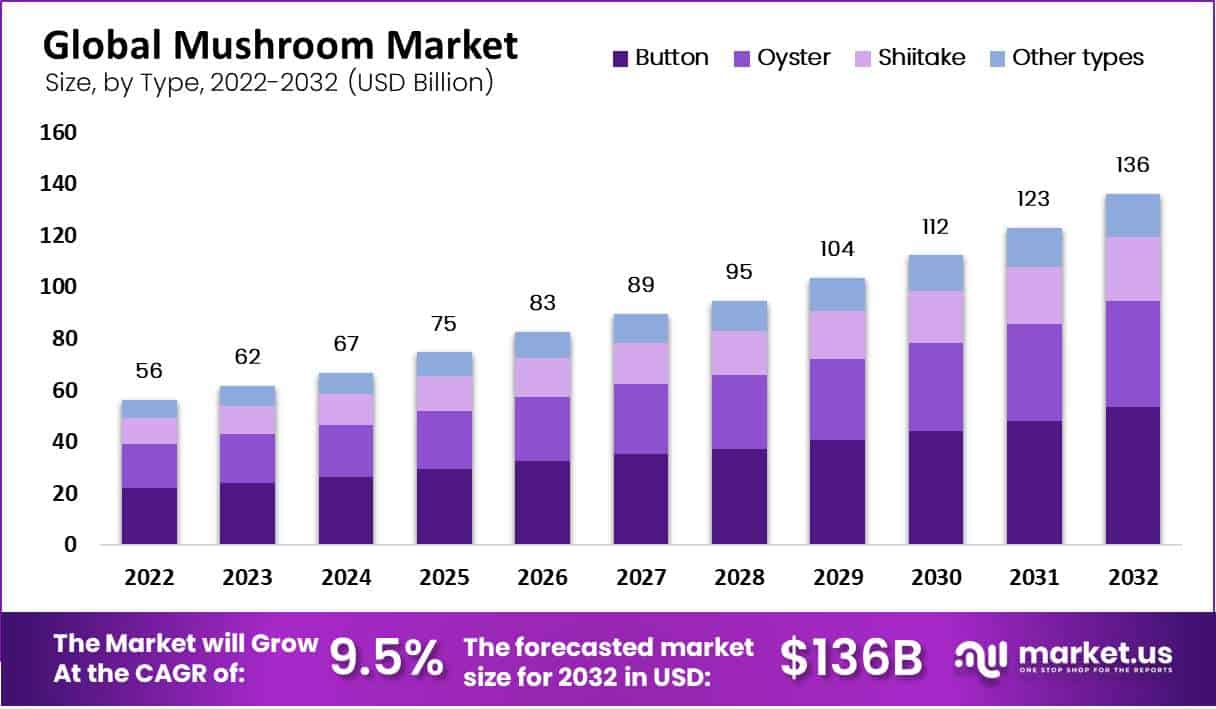

In 2022, the global Mushroom Market size was worth USD 56 billion. It is estimated to reach USD 136 billion in 2032 growing at a CAGR of 9.5% between 2023-2032. Although technically not plants, mushrooms, and toadstools are edible fungi (Agaricomycetes, Ascomycota) that are regarded as vegetables.

Mushrooms are a fairly underrated category of food that have been utilized and consumed medicinally for a very long time. Practitioners of traditional and folk medicine praise the bell-shaped fungi for their curative and purifying powers. All mushroom kinds are minimal in calories, and they also only include small levels of fiber and other minerals.

The non-nutritive plant components found in mushrooms, such as polysaccharides, polyphenols, carotenoids, and indoles, have been demonstrated in cell and animal experiments to have antioxidant, anti-inflammatory, and anticancer effects.

These components may be the most intriguing aspects of mushrooms. Over the course of the forecast period, the key drivers of the Mushroom market are anticipated to be the vegan population’s growing demand for a diet consisting of high amounts of proteins.

A superfood, mushrooms are regarded as such because of their nutritional value. Four essential nutrients—selenium, vitamin D, glutathione, and ergothioneine—are abundant in mushrooms.

These nutrients aid in reducing oxidative stress and lowering the risk of developing chronic illnesses like cancer, heart disease, and dementia. Additionally, it has a potent natural umami flavor that enables consumers to lower the salt content of mushroom meals by 30–40%, which is good for their health.

Key Takeaways

- Market Forecasts: It is projected that the mushroom market will experience a compound annual growth percentage between 2023-2032 of approximately 9.5%.

- Mushroom Industry Overview: The market for mushrooms both edible and medicinal varieties alike – places great significance on factors like production quality, market demand, and cultivation practices unique to mushroom products.

- Type Analysis: Button mushrooms provide numerous nutritional advantages, with short spore incubation times and cost-effective pricing anticipated to boost their market in the forecasted timeframe.

- From Analysis: In recent times, there has been a notable surge in the demand for fresh mushrooms, aligning with the increasing consumer focus on fresh, organic, and unprocessed food choices to optimize health benefits from the products.

- Distribution Channel: Developed regions like Europe and North America boast a robust presence of supermarkets and hypermarkets. This segment is expected to experience growth during the projected period due to the convenience and variety offered at a single location, making purchases easy for consumers.

- Market Drivers: Population growth, shifting dietary preferences and an emphasis on health and wellness are driving mushroom industry development. Furthermore, rising consumer awareness as well as demand for natural and organic products is propelling this market.

- Market Challenges: Mushroom industry challenges include market competition, seasonal variations in supply, and the need to adopt eco-friendly cultivation practices that support market expansion. Furthermore, economic fluctuations and regulatory changes present additional obstacles that inhibit its success.

- Recent Trends: Prominent global mushroom trends include an upsurge in demand for functional and medicinal mushrooms, sustainable cultivation practices, and their incorporation into various culinary and healthcare products.

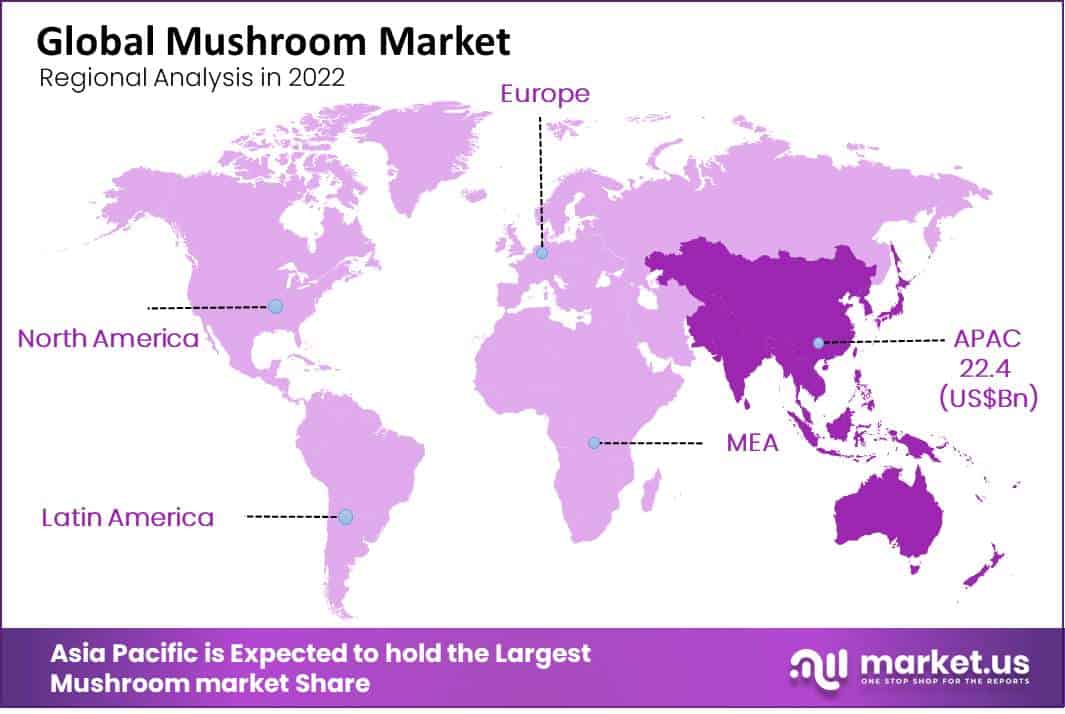

- Regional Analysis: The Asia Pacific region is expected to dominate the mushroom market, holding the largest share of 40% during the forecast period.

- Key Players in the Mushroom Market: Prominent firms within the mushroom industry include cultivation firms, processing facilities, and distributors that emphasize collaborations, innovation, and strategic expansion to remain competitive within an expanding mushroom sector.

Driving Factors

Increasing demand for functional food

During the past 20 to 30 years, there has been a significant change in what individuals eat and how they live their lives.

This trend was driven by increasing urbanization, which resulted in a sharp increase in synthetic food consumption and an uptick in the prevalence of different lifestyle-associated diseases. People are therefore becoming more aware of these issues.

People are consequently gradually turning to functional meals and beverages that are known for offering advantages beyond simple nutrition. These food products provide adequate nourishment and lower the risk of diseases.

The popularity of functional meals is rising among consumers who are concerned about their health. Due to the fact that medicinal mushrooms are now being used in a variety of functional foods and beverages, it is anticipated that demand for these mushrooms will rise significantly throughout the forecasted period.

Rising vegan population

In 2022, in the United States, a diets and nutrition survey conducted found that around 5% of all surveyed respondents consumed a vegan diet. During the years 2016, 2019, and 2020, The Harris Poll and the Vegetarian Resource Group performed an online survey, and the results showed that around 3% of surveyed Americans were vegan.

Younger people and women are more likely than older persons and men to refrain from eating meat in the United Kingdom. In a survey of consumers in the United Kingdom conducted By, 3% of participants claimed to be vegans. By 2020, more than a quarter of respondents will identify as members of Generation Z.

Veganism was practiced by about 15% of Generation X and Millennial respondents from the United Kingdom. Therefore, an increase in the vegan population is likely to boost the demand for a vegan protein diet, which in turn would fuel the demand for mushrooms.

Investment in Smart Automation

The production of edible fungus is highly labor-intensive and accounts for around 30% of the entire production cost. Many commercial and industrial organizations have decided to spend and invest in automated processes for their processing systems and facilities due to this inspiration.

An advanced production facility was established in 2020 by an edible fungus manufacturing company named Panbo Systems B.V.

This facility combines new and efficient robotics and control systems to transfer or relocate pickers from growing zones and stimulate output by 300% and above. Robot trucks will be used along with this new system to aid in filling, picking, and emptying racks, as well as cameras to monitor growth.

This increases yields and lowers costs by optimizing crop areas and picking. Therefore, such important investments in smart automation to boost mushroom production are expected to accelerate the growth of the mushroom market over the forecast period.

Restraining Factors

High cost of production

An exceptionally higher level of administrative or management efficacy and participation is during the process of mushroom production. For obtaining high-quality yields, a specific treatment is very crucial. Conditions like humidity, temperature, and light have a significant effect on yield quality as well as production.

Especially in remote countryside regions, pests, insects, and animals can pose serious problems for farmers. Since some insects, such as fungus gnats, thrive in similar conditions, pest control is essential, which leads to an increase in the cost of production. Thus, high production and operational costs may restrain the mushroom market growth during the projected time period.

Low shelf-life

Due to their rapid rate of respiration and the fragile structure of the epidermis, mushrooms are extremely perishable by nature and start to degrade just one day after being harvested. Therefore, the shelf-life of freshly harvested mushrooms in ambient conditions is about 1-3 days. Therefore, the low shelf-life of mushrooms may limit the mushroom market growth during the forecast period.

By Type Analysis

Button mushrooms are the leading segment

Button mushrooms have numerous nutritional benefits and a shorter incubation time required by their spores. Meanwhile, their reduced cost in comparison to their competitors is likely to drive the mushroom market throughout the projection period.

On the other hand, the oyster segment is expected to witness high growth during the estimated time period. Because of their delicate texture and mild-savory flavor, oyster mushrooms are widely used in a variety of cuisines and are especially popular in China, Japan, and Korea.

Furthermore, oysters contain an active chemical known as benzaldehyde, which decreases bacterial levels in the body and so serves as a natural anti-bacterial, generating demand from pharmaceutical applications.

By Form Analysis

Fresh from dominates the mushroom market

Nowadays, as more consumers are emphasizing fresh, organic, and unadulterated food intake to maximize the product’s health advantages, Fresh mushrooms have seen significant growth in demand in recent years.

Due to a smaller shelf life, fresh-form distribution is difficult for producers or distributors. However, technological improvements like the use of modified or alternative environment mushroom packaging market have reduced the concerns associated with mushrooms’ shorter shelf life, stimulating the demand for fresh mushrooms.

The processed form of mushrooms is expected to witness growth at a high rate. Dried, frozen, canned, pickled, and powdered varieties are examples of processed types. To extend the shelf life of mushrooms, further processing, such as canning, freezing, or drying, is required.

Manufacturing firms are progressively introducing packaged products to enter the processed and convenience food industries. Food and cosmetics producers’ increased use of powder form and extracts is predicted to drive the mushroom market growth throughout the forecast period.

By Distribution Channel

Supermarkets and hypermarkets are witnessing the highest demand

In developed regions such as Europe and North America, supermarkets and hypermarkets have a stronger presence. The availability of a wide range of this product in one location, as well as the simplicity of purchase, is likely to contribute to the growth of the segment during the projection period.

On the other hand, online stores are expected to witness high growth during the estimated time period. Because of the convenience and price advantages afforded by these channels, consumers all over the world choose to buy fresh produce online. This is a key factor driving the growth of the segment.

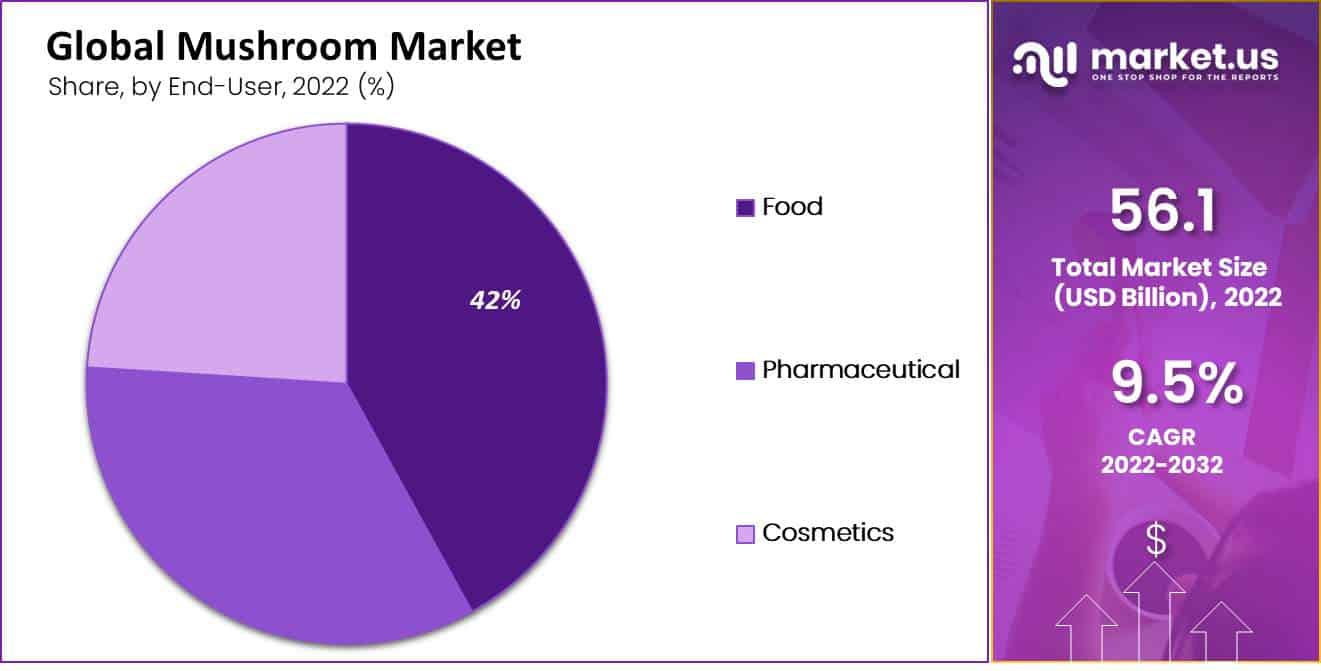

By End-User

The food sector accounts for the largest share

The food sector involves the use of processed and fresh mushroom forms by restaurants, food service providers, as well as households. Mushrooms have very little salt and gluten and have a low cholesterol and fat content. It also comprises key nutrients such as proteins, vitamins, minerals, etc. Therefore, it is receiving great attention among customers who are highly health-conscious.

Also, as more consumers are demanding healthier food products that offer quality nutrients derived from natural sources, it is expected to drive the demand for mushrooms in the food sector. Also, many food and beverage firms are introducing products with mushrooms as the main ingredient in an effort to cash in on this trend.

It is likely to contribute to the growth of the segment. For instance, functional beverages infused with mushrooms were introduced in February 2021 by FreshCap Mushrooms Ltd. of the United States.

Moreover, the pharmaceutical segment is anticipated to experience high growth over the projected time period. Mushrooms contain a wide range of bioactive substances, including triterpenes, polysaccharides, polyphenols, proteins, amino acids, and organic germanium.

As a result, the extracts are used in the formulation of numerous pharmaceutical or supplement items claimed to treat diseases like diabetes, hypertension, insomnia, cancer, immunity-boosting, vitality, hypercholesterolemia, etc.

Mushrooms consist of a great extent of phenolics, polyphenolics, selenium, terpenoids, vitamins, etc., all of which have moisturizing, antioxidant, anti-aging, skin brightening, and anti-wrinkle properties.

Furthermore, customers are responding positively to products with natural or clean label labels. Therefore, manufacturers of cosmetic products are increasingly producing mushroom-based skincare to meet evolving consumer preferences.

Key Market Segments

By Type

- Button

- Shiitake

- Oyster

- Other types

By Form

- Fresh

- Processed

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

By End-user

- Food

- Pharmaceutical

- Cosmetics

Growth Opportunity

Demand for meat substitutes

Plant-based meat, dairy, and egg demand soared during the 2020 lockdown due to extraordinary demand as consumers over the world stayed at home, cooked, concentrated on their health, and reconsidered the plate-to-planet impact.

Meati, a US-based new entrant in the food industry, has announced the launch of two new chicken alternatives through its direct-to-consumer channel. Meati is developing a chicken cutlet and breaded cutlet made from fermented mycelium, the root structure of mushrooms.

Also, Nature’s Fynd, a distributor of vegan products (meat alternatives and dairy products) derived from fermented fungi, has collaborated with Whole Foods Markets, a multinational grocery chain based in the United States, by signing its first national retail contract.

Thus, due to the rising demand for meat substitutes, many companies are introducing innovative food products, which is anticipated to fuel the demand for mushrooms and open many opportunities for the mushroom market in the coming years.

Latest Trends

Government initiatives in mushroom cultivation

In recent years, there has been a greater emphasis placed on nutritional security around the world. Mushrooms, as a healthy food, can help to supplement national efforts to combat hunger and malnutrition.

For the mushroom business to thrive, an enabling environment and regulatory support are required to incentivize private persons to pursue mushroom entrepreneurship.

In India, the federal and provincial governments have implemented a number of policies and initiatives to encourage businesses to invest in mushroom growth. There is a need for continual popularisation of these policies and schemes among entrepreneurs so that they can fully capitalize on the opportunity provided by the government’s initiatives to go into mushroom companies.

It is a promising trend that is expected to positively impact mushroom market growth in the upcoming years.

Regional Analysis

The Asia Pacific region is anticipated to hold the largest share of 40% in the mushroom market during the forecast period. Traditional medical systems, such as Ayurveda and Chinese medicine techniques, are more popular and prevalent in the entire Asia region, where different kinds of mushrooms are used to cure various conditions.

The region’s demand for mushrooms is most likely to be driven by benefits offered by medical mushrooms, like their nutritional and low-calorie benefits, as well as their immunity-boosting effects.

Europe region comprises a large consumer base that relies on imports to a great extent. Higher per capita income in the region’s developed nations is likely to generate high demand for exotic mushrooms, which are considered gourmet items. In 2019, mushroom imports in the region were valued at around USD 183 million.

The North American region is anticipated to witness high growth during the estimated time period. In nations like the U.S. and Canada, more consumers have expressed interest in paying a higher price for quality products made with natural and organic ingredients.

Furthermore, rising veganism in the region is likely to boost demand for meat substitutes such as mushrooms in the food and dietary supplement industries over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Mushroom market is considerably fragmented, as major small and large-sized players account for a large share of the overall revenue. The market is growing at a moderate to high pace due to rising demand for nutritional foods.

Also, strategic investments promoting mushroom cultivation by governments are one of the main factors boosting competition among major industry players. Additionally, new strategic agreements, mergers and acquisitions, and the launch of new products by key market players are likely to have a positive impact on market growth in the upcoming years.

Top Key Players

- Costa Group

- Drinkwater Mushrooms

- Bonduelle Group

- CMP Mushroom

- Menterey Mushroom, Inc

- Greenyard

- The Mushroom Company

- Monaghan Group

- Shanghai Fengke Biological Technology Co., Ltd

- OKECHAMP S.A

- Other Key Players

Recent developments

- February ’21: Nammex’s advanced extract facility offered online service when mushroom demand increased in the aftermath of the COVID-19 outbreak. Nammex’s new facility has the capacity to create around 25 tonnes of mushroom extract powders per month, including Reishi, Maitake, Chaga, and Shitake, among others. All of the extracts are USDA-certified organic and Kosher.

- January ’21: Yukigini Maitake Co., Ltd., a company engaged in the production and sale of maitake mushrooms, in collaboration with ROBIT INC, which uses artificial intelligence technologies in robotics to offer solutions to a variety of societal concerns, reported its accomplishment for developing automation technology for the cutting process of maitake mushrooms.

Report Scope

Report Features Description Market Value (2022) USD 56 Bn Forecast Revenue (2032) USD 132 Bn CAGR (2023-2032) 9.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Button, Shiitake, Oyster, and Other types, By Form- Fresh, Processed; by Distribution Channel- Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Stores; and by End-user – Food, Pharmaceutical, Cosmetics Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Costa Group, Drinkwater Mushrooms, Bonduelle Group, CMP Mushroom, Menterey Mushroom, Inc, Greenyard, The Mushroom Company, Monaghan Group, Shanghai Fengke Biological Technology Co., Ltd, OKECHAMP S.A and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Mushroom Market?In 2022, the global Mushroom Market was valued at USD 56 billion.

What will be the market size for Mushroom Market in 2032?In 2032, the Mushroom Market will reach USD 136 billion.

What CAGR is projected for the Mushroom Market?The Mushroom Market is expected to grow at 9.5% CAGR (2023-2032).

List the segments encompassed in this report on the Mushroom Market?Market.US has segmented the Mushroom Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Button, Shiitake, Oyster and Other types. By Form, the market has been further divided into Fresh and Processed.

Which segment dominate the Mushroom industry?With respect to the Mushroom industry, vendors can expect to leverage greater prospective business opportunities through the Button mushrooms segment, as this dominate this industry.

Name the major industry players in the Mushroom Market.Costa Group, Drinkwater Mushrooms, Bonduelle Group, CMP Mushroom, Menterey Mushroom Inc, Greenyard and Other Key Players are the main vendors in this market.

-

-

- Costa Group

- Drinkwater Mushrooms

- Bonduelle Group

- CMP Mushroom

- Menterey Mushroom, Inc

- Greenyard

- The Mushroom Company

- Monaghan Group

- Shanghai Fengke Biological Technology Co., Ltd

- OKECHAMP S.A

- Other Key Players