Global Anti-Aging Products Market Size, By Product Type (Body Wash, Body Moisturizer, Eye Cream & Lotion, Facial Cream & Lotions, Facial Mask, and Other Product Types), By Ingredient (Retinol, Vitamin C, Hyaluronic Acid, Alpha Hydroxy Acids, Collagen, and Other Ingredients), By Distribution Channel (Offline and Online), By End-User (Men and Women), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 39590

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

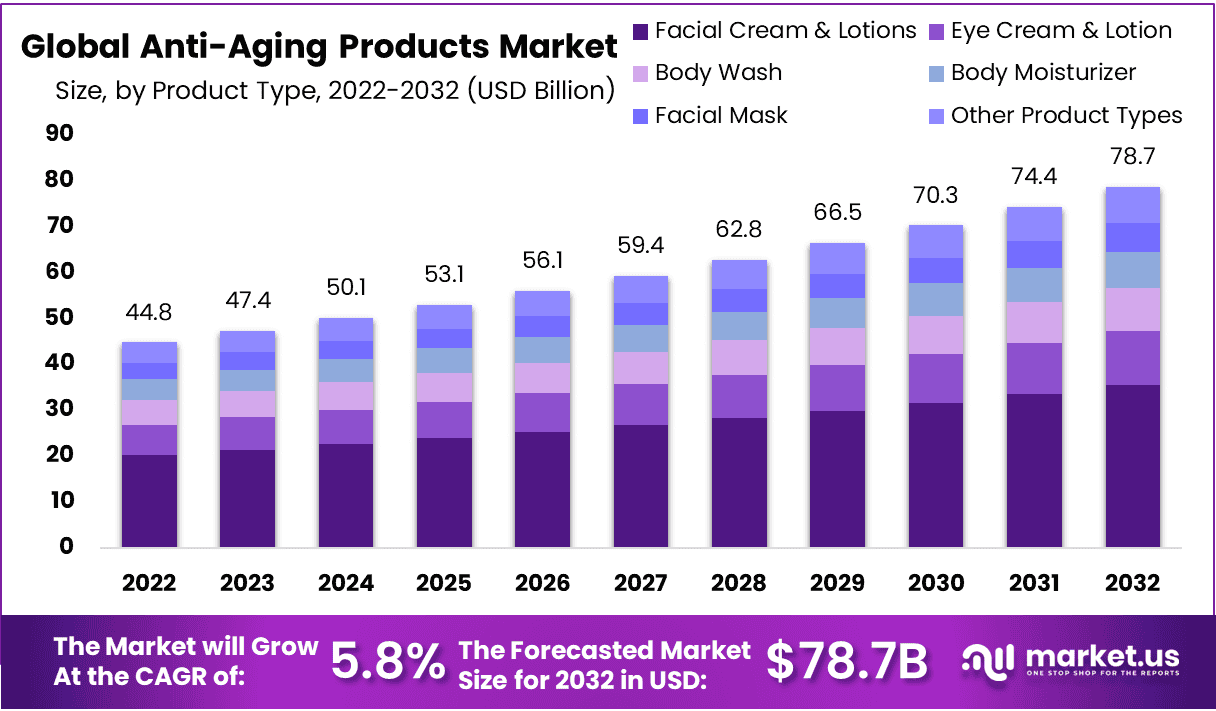

The Global Anti-Aging Products Market size is expected to be worth around USD 78.70 Billion by 2032 from USD 47.4 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2032.

The anti-aging products market includes a wide range of products designed to reduce or manage visible signs of aging. These products include skincare formulations, cosmetics, and treatments aimed at improving skin appearance, reducing wrinkles, and promoting overall skin health. The market is driven by the growing demand for products like anti-wrinkle creams, serums, and collagen-infused products, fueled by consumer focus on youthful skin.

The market is growing due to increased consumer awareness about skincare and advancements in dermatology. Rising aging populations, especially in developed regions, further drive the demand for anti-aging solutions. The convenience of online shopping has also improved market access, contributing to overall growth.

The anti-aging products continues to rise, with consumers seeking quick and visible results. Both older and younger consumers are increasingly purchasing anti-aging products, with a preference for organic and personalized solutions. The shift toward preventive skincare has expanded the market, and brands offering natural ingredients are gaining popularity.

There are significant opportunities in emerging markets like Asia Pacific and Latin America, where growing disposable incomes are increasing skincare spending. Personalized skincare, powered by AI, presents a major growth area for brands. Additionally, the focus on sustainable products and eco-friendly packaging offers companies the chance to capture environmentally conscious consumers. Expanding into supplements and nutraceuticals also presents a promising opportunity.

There are significant opportunities in emerging markets like Asia Pacific and Latin America, where growing disposable incomes are increasing skincare spending. Personalized skincare, powered by AI, presents a major growth area for brands. Additionally, the focus on sustainable products and eco-friendly packaging offers companies the chance to capture environmentally conscious consumers. Expanding into supplements and nutraceuticals also presents a promising opportunity.The Anti-Aging Products Market is expanding as consumer demand for advanced skincare and preventive solutions rises. Innovations like Viome’s $86.5 million Series C funding in 2023, led by Khosla Ventures and Bold Capital Partners, demonstrate the market’s shift toward personalized, RNA-based testing and supplements for healthy aging. This focus on science-backed, tailored solutions is shaping the market’s growth, particularly in emerging regions and among eco-conscious consumers seeking sustainable and effective products.

The Russian government’s initiative, where President Vladimir Putin has mandated research institutes to develop anti-aging treatments as part of a strategy to enhance life expectancy and save 175,000 lives by 2030. This policy underscores the emphasis on advanced technologies for healthy aging, fueling innovation and investment in the sector.

The anti-aging products market is set for growth, driven by investments in personalized care solutions. ForeverYoung’s $30 million seed funding from Beauty Investors ABC aims to expand its clinic network and develop customized skincare regimens, targeting a 40% increase in its customer base. This reflects a broader industry trend towards personalization and service enhancement, suggesting that companies focusing on tailored experiences are strategically positioned to gain competitive advantage and market share.

The anti-aging products market is experiencing robust growth, with $4 billion invested by private sector players over the past five years. This substantial funding highlights confidence in innovative product development, catering to growing consumer demand for advanced skincare solutions. The sector presents strong opportunities as aging demographics and wellness trends drive sustained expansion.

Key Takeaways

- The global anti-aging products market is projected to grow from USD 47.4 billion in 2023 to USD 78.7 billion by 2032, with a CAGR of 5.8%, driven by rising consumer demand for advanced skincare solutions.

- Analyst Viewpoint Summary: Consumer preference for preventive and personalized skincare, combined with advancements in dermatology and technology, is significantly driving market growth across various regions, particularly in Asia Pacific and North America.

- Facial Creams & Lotions dominate with over 45% market share in 2022, driven by their effectiveness in reducing wrinkles and improving skin elasticity.

- Retinol leads with over 35% share due to its proven efficacy in improving skin texture and boosting collagen production.

- Anti-Wrinkle Treatment captures more than 27% share, fueled by the growing demand for non-invasive and advanced solutions for wrinkle reduction.

- Offline Channels hold over 57% market share, supported by the accessibility and personalized service offered by specialty stores and supermarkets.

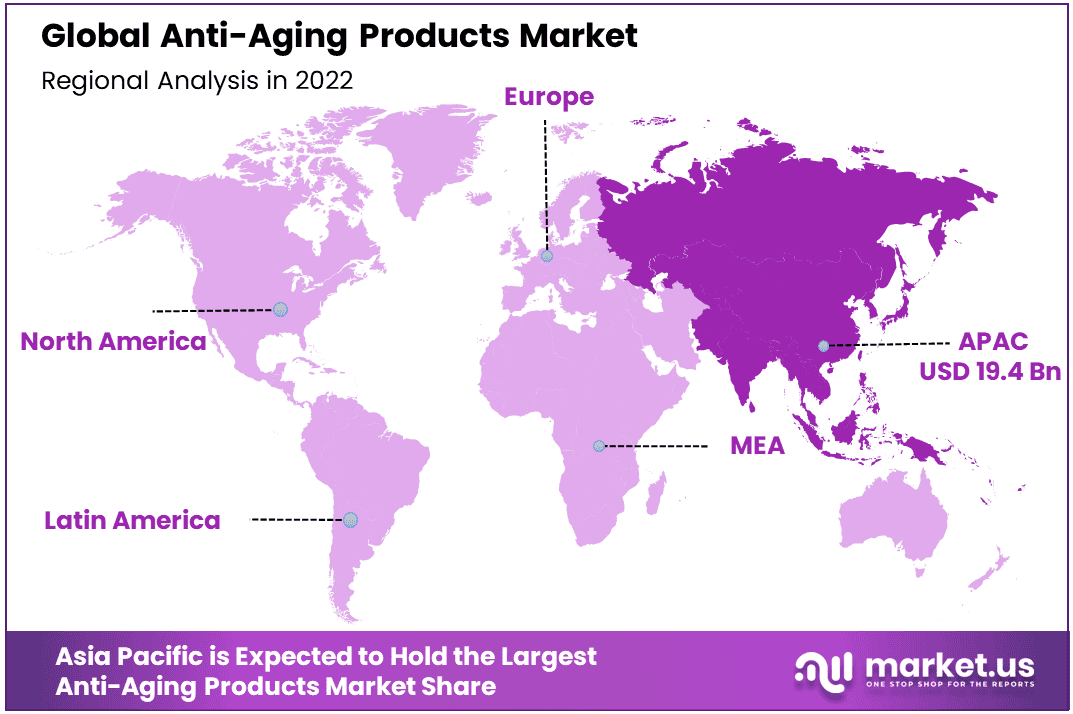

- Asia Pacific leads with a 43.5% market share, supported by high consumer demand for premium skincare and cultural emphasis on youthful

- Restraining Factor: The health risks associated with chemical ingredients like parabens and sulfates present challenges, as consumers and regulatory bodies push for safer, natural alternatives.

By Product Type Analysis

Facial Creams & Lotions Dominates the Anti-Aging Products Market with Over 45% Largest Market Share in 2022

In 2022, the Anti-aging Products Market saw a significant concentration in demand within the Facial Cream & Lotions segment, which held a commanding market share exceeding 45%. This segment’s prominence is primarily attributed to widespread consumer recognition of its benefits in reducing wrinkles and enhancing skin elasticity, which has driven substantial market penetration and consumer loyalty.

Concurrently, the Body Wash segment experienced moderate growth, driven by a rising consumer preference for anti-aging properties in daily hygiene routines. Body Moisturizers also observed steady growth, benefiting from increased consumer awareness regarding skin hydration as a preventive measure against aging.

The Eye Cream & Lotion segment, specifically designed for the delicate area around the eyes, continued to attract a dedicated customer base focused on targeted treatments against crow’s feet and under-eye bags. Meanwhile, Facial Masks gained traction as occasional treatments providing intensive care and immediate results, which is appealing for consumers seeking rapid enhancements.

Other Product Types, which include serums, oils, and integrated SPF products, cater to niche market demands with specialized solutions, each contributing marginally to the overall market diversity. Collectively, these segments complement the dominant Facial Cream & Lotions, providing consumers with a comprehensive suite of options to address various aging concerns effectively.

By Ingredient Analysis

Retinol Dominates the Anti-Aging Products Market with Over 35% Largest Market Share in 2022

In 2022, Retinol held a dominant market position, capturing more than a 35% share of the anti-aging products market. Known for its efficacy in reducing fine lines, boosting collagen production, and improving skin texture, Retinol continues to be a cornerstone ingredient for anti-aging formulations. Its broad compatibility with other active ingredients and proven track record in clinical studies make it a preferred choice among both consumers and dermatologists.

Vitamin C also accounted for a significant share of the market, driven by its antioxidant properties and role in brightening skin tone. Products containing Vitamin C are particularly popular for targeting hyperpigmentation and protecting the skin from environmental stressors, leading to its widespread adoption in serums and creams.

Hyaluronic Acid emerged as another high-demand ingredient, thanks to its ability to retain moisture and provide deep hydration, which is essential for maintaining skin elasticity and smoothness. As a result, it is frequently incorporated into a variety of anti-aging formulations, including moisturizers and serums.

Alpha Hydroxy Acids (AHAs), while holding a smaller share, remain a critical ingredient category for their exfoliating benefits, which help improve skin texture and reduce signs of aging. AHAs are commonly used in combination with other active ingredients to enhance the overall effectiveness of anti-aging regimens.

Collagen-based products also captured a notable portion of the market. With increasing consumer awareness of collagen’s role in skin health and firmness, formulations containing both topical collagen and collagen-boosting ingredients have seen growing traction.

Other ingredients, such as peptides, niacinamide, and botanical extracts, collectively make up the remaining market share. These ingredients are valued for their complementary benefits and are often used in combination with the primary anti-aging agents to provide a comprehensive approach to skin rejuvenation and maintenance.

By Treatment Analysis

Anti-Wrinkle Treatment Dominates Anti-Aging Products Market with Over 27% Largest Market Share in 2022

In 2022, Anti-Wrinkle Treatment held a dominant market position, capturing more than a 27% share. This segment’s prominence is attributed to the increasing consumer demand for minimally invasive and non-invasive solutions aimed at reducing the appearance of fine lines and wrinkles. The adoption of advanced formulations and technologies, such as botulinum toxin injections and retinoid-based creams, has further propelled growth in this category.

Meanwhile, the Anti-Pigmentation Treatment segment is gaining traction, driven by a rising awareness of hyperpigmentation issues and the growing demand for products addressing age spots and skin discoloration. Products such as topical creams containing ingredients like hydroquinone and laser therapies are central to this segment’s expansion.

The Skin Resurfacing segment, encompassing procedures such as microdermabrasion, chemical peels, and laser treatments, also demonstrates strong growth potential. This segment is bolstered by advancements in dermatological technologies and a growing consumer focus on achieving smoother, youthful skin textures.

Lastly, Other Treatments, including products and procedures such as anti-cellulite creams, lip treatments, and skin tightening solutions, continue to contribute to market diversity. Though currently representing a smaller market share, these treatments are expected to gain momentum as they cater to niche consumer needs and preferences.

By Distribution Channel Analysis

Offline Channel Leads Anti-Aging Products Market with Over 57% Largest Market Share in 2022

In 2022, the Offline distribution channel held a dominant market position, capturing more than a 57% share. This segment’s strength is primarily driven by the widespread presence and accessibility of Specialty Stores and Supermarkets/Hypermarkets, which offer a hands-on shopping experience and immediate product availability.

Specialty stores, in particular, cater to consumers seeking personalized recommendations and professional advice, enhancing customer loyalty and repeat purchases. Supermarkets and hypermarkets, with their broad product ranges and competitive pricing strategies, further reinforce the dominance of offline channels by catering to a diverse consumer base.

The Online segment, however, is rapidly expanding, propelled by the increasing convenience of E-commerce Websites and Company-owned Websites. E-commerce platforms benefit from growing digital penetration and the trend toward home delivery, offering a vast array of products, exclusive deals, and consumer reviews. Company-owned websites are also gaining prominence as brands invest in direct-to-consumer strategies, aiming to build stronger brand-customer relationships and leverage personalized marketing.

While online channels currently represent a smaller share compared to offline, they are expected to grow significantly in the coming years, driven by digital transformation and evolving consumer preferences for convenient, contactless shopping experiences.

By End-User Analysis

Women Dominate Anti-Aging Products Market with Over 80% Share in 2022

In 2022, Women held a dominant market position in the anti-aging products market, capturing more than an 80% share. This substantial dominance is attributed to the high consumer demand among women for skincare and beauty solutions designed to address signs of aging, including wrinkles, fine lines, and pigmentation.

Women remain the primary consumers of anti-aging products, driven by a greater focus on personal grooming and appearance, as well as a wider array of product offerings targeted specifically toward female skincare needs. The presence of diverse formulations, ranging from serums and creams to cosmetic procedures, further supports the segment’s robust growth.

On the other hand, the Men segment, while smaller in comparison, is steadily gaining momentum. The growth in this segment is fueled by a rising awareness among men about skincare, supported by increasing marketing campaigns and product innovations tailored to men’s skin types. This segment is expected to expand as societal attitudes shift, and men increasingly prioritize grooming and skincare routines aimed at maintaining a youthful appearance.

Key Market Segments

By Product Type

- Body Wash

- Body Moisturizer

- Eye Cream & Lotion

- Facial Cream & Lotions

- Facial Mask

- Other Product Types

By Ingredient

- Retinol

- Vitamin C

- Hyaluronic Acid

- Alpha Hydroxy Acids

- Collagen

- Other Ingredients

By Treatment

- Anti-Wrinkle Treatment

- Anti-Pigmentation Treatment

- Skin Resurfacing

- Other Treatments

By Distribution Channel

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Others

- Online

- E-commerce Websites

- Company-owned Websites

By End-User

- Men

- Women

Driver

Increasing Aging Population

The rising aging population is one of the most significant drivers of growth within the anti-aging products market. As global demographics shift, the number of individuals aged 60 and above is expected to double from 1 billion in 2020 to 2.1 billion by 2050, according to the United Nations.

This surge in the elderly population has created a vast consumer base that increasingly seeks solutions to mitigate signs of aging, such as wrinkles, loss of skin elasticity, and age-related skin conditions.

The growing desire among older adults to maintain a youthful appearance and enhance their quality of life fuels demand for a broad range of anti-aging products, including skincare creams, serums, and supplements. The market is also supported by the increasing spending power of baby boomers and seniors who prioritize health and wellness, thus contributing significantly to revenue growth.

Furthermore, this demographic trend intersects with advancements in cosmetic and dermatological technology. The influx of innovative products, such as non-invasive treatments (e.g., hyaluronic acid fillers and peptide-based formulations), is tailored to meet the needs of this aging demographic.

These technological developments not only cater to the demands of an older population but also attract younger consumers seeking preventive anti-aging solutions, thus broadening the market’s appeal and accelerating its growth trajectory.

Restraint

Health Risks Associated with Chemical Ingredients

Health risks linked to chemical ingredients are a significant restraint on the growth of the anti-aging products market. As consumers become increasingly aware of potential hazards associated with certain synthetic compounds such as parabens, phthalates, and sulfates used in skincare and cosmetic products, there is growing skepticism and caution regarding the safety of anti-aging solutions.

Reports have highlighted that these chemicals can cause allergic reactions, skin irritation, and, in some cases, long-term health risks like hormonal disruption or carcinogenic effects. Such concerns prompt regulatory bodies, including the FDA and the European Union, to impose stringent safety standards and testing requirements, which can slow down product development and increase costs for manufacturers.

This heightened consumer vigilance, coupled with regulatory pressures, not only deters the use of certain chemicals but also shifts market dynamics, pushing companies to reformulate products or invest heavily in developing alternative, safe, and natural ingredients. While this transition may lead to innovation, it also increases production costs and timelines, ultimately posing challenges for companies to maintain profitability and scalability in a highly competitive market.

Opportunity

Preference for Natural and Organic Products

The rising consumer preference for natural and organic products. Today’s consumers are increasingly educated about the potential adverse effects of synthetic ingredients and chemicals, which has shifted demand toward products with naturally derived formulations.

Leading companies that pivot to organic and natural anti-aging solutions, incorporating botanicals, antioxidants, and other plant-based extracts, can capture a significant share of this growing market segment.

Furthermore, regulatory bodies worldwide are increasingly supporting the use of clean, natural ingredients, which aligns with consumer expectations and strengthens the legitimacy of these offerings. Brands investing in research and development to innovate within this space can leverage these evolving preferences to drive growth, build loyalty, and command premium pricing.

Trends

Shift Toward Natural and Organic Ingredients

The 2024 anti-aging products market is witnessing a significant shift towards natural and organic formulations as consumers increasingly prioritize health-conscious and sustainable skincare options. This trend reflects a growing awareness of the potential side effects associated with synthetic ingredients, such as parabens, sulfates, and artificial fragrances, which are commonly used in conventional anti-aging products.

Consumers, particularly millennials and Gen Z, are demanding transparency and seeking out products that contain plant-based, cruelty-free, and eco-friendly ingredients. Brands are responding by reformulating existing lines and launching new products that emphasize the use of organic extracts, antioxidants, and naturally derived peptides.

These ingredients are positioned to offer benefits such as improved skin hydration, collagen synthesis, and protection against environmental stressors without the adverse effects linked to chemicals. Companies are also investing in certifications like ECOCERT and USDA Organic to build trust and authenticity with consumers.

Regional Analysis

Asia Pacific Dominant Market with 43.5% Market Share

The Asia Pacific region commands the largest share of the global anti-aging products market, valued at USD 19.4 billion in 2022, representing 43.5% of the market. This dominance is largely driven by cultural norms that emphasize skincare and maintaining a youthful appearance, strongly influencing consumer behavior across the region.

Countries such as South Korea and Japan are at the forefront of global skincare innovation. Trends like K-Beauty and J-Beauty promote multi-step skincare routines, integrating anti-aging products such as serums, essences, and masks. The rising demand for premium skincare solutions, coupled with the expanding middle-class demographic, further solidifies the market position in this region.

North America, with the U.S. and Canada in focus, exhibits significant growth potential, fueled by a rapidly aging population. Approximately 37% of American women use anti-aging products, with the highest adoption rate (47%) among women aged 55 and above. High disposable income levels and increasing consumer awareness contribute to making this region the fastest-growing segment in the global market.

Europe remains a mature market, with a strong emphasis on premium and organic skincare. Countries like France and Germany are key contributors, as the region’s aging population and preference for natural ingredients continue to drive demand, especially for high-end solutions that address both skincare and overall wellness.

Latin America, particularly Brazil and Mexico, is an emerging market characterized by rising disposable incomes and urbanization. Interest in international skincare trends is increasing, especially among younger demographics, which supports the demand for affordable yet effective anti-aging products.

In the Middle East, the market is evolving, with the UAE and Saudi Arabia as focal points due to their high-income levels and a preference for luxury skincare products. Africa’s market is developing at a slower pace, but growth is expected to accelerate as awareness and access to anti-aging products expand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Report Scope

Report Features Description Market Value (2023) US$ 47.4 Billion Forecast Revenue (2032) US$ 78.7 Billion CAGR (2023-2032) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type: Body Wash, Body Moisturizer, Eye Cream & Lotion, Facial Cream and lotions, Facial Mask, and Other Product Types; By Ingredient: Retinol, Vitamin C, Hyaluronic Acid, Alpha Hydroxy Acids, Collagen, and Other Ingredients; By Distribution Channel: Offline and Online; By End-User: Men and Women. Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Procter & Gamble, Johnson & Johnson, Unilever, Shiseido, L’Oréal Paris, Estée Lauder, Beiersdorf, Coty Inc., Allergan, Valeant Pharmaceuticals, Merz Group, Galderma, Nu Skin Enterprises, Mary Kay, Avon Products, Herbalife Nutrition, Amway, Forever Living Products, Natura Cosméticos, LVMH Moët Hennessy Louis Vuitton, and other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Johnson & Johnson

- Unilever

- Shiseido

- L’Oréal Paris

- Estée Lauder

- Beiersdorf

- Coty Inc.

- Allergan

- Valeant Pharmaceuticals

- Merz Group

- Galderma

- Nu Skin Enterprises

- Mary Kay

- Avon Products

- Herbalife Nutrition

- Amway

- Forever Living Products

- Natura Cosméticos

- LVMH Moët Hennessy Louis Vuitton

- Other Key Players