Global Skin Care Products Market By Gender (Male, Female), By Product (Face Creams and Moisturizers, Cleansers and Face Wash, Sunscreen, Body Creams and Moisturizers, Shaving Lotions and Creams, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmacy and drugstore, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 55744

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

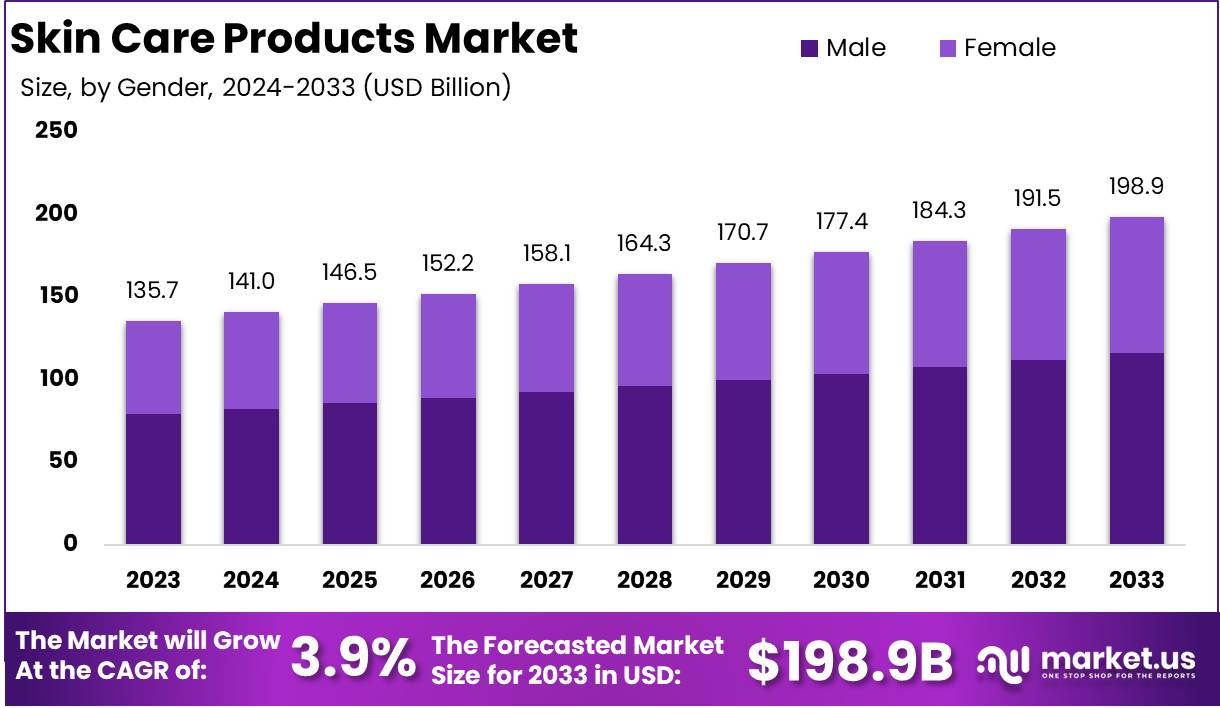

The Global Skin Care Products Market size is expected to be worth around USD 198.9 Billion by 2033, from USD 135.7 Billion in 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

Skin care products are formulations designed to cleanse, nourish, protect, and enhance the appearance and health of the skin. These products typically include a wide range of categories such as cleansers, moisturizers, serums, sunscreens, anti-aging creams, toners, masks, and exfoliators.

The primary goal of skin care products is to maintain or improve the skin’s health and appearance by addressing concerns such as dryness, acne, aging, and pigmentation. With growing awareness of the importance of skin health, these products have become essential in daily personal care routines, particularly as consumers increasingly seek solutions tailored to their skin types and concerns.

The skin care products market refers to the global industry involved in the production, distribution, and consumption of a wide variety of skin care items. It encompasses both mass-market products and premium offerings, catering to diverse consumer needs across demographic groups, including age, gender, income, and skin type.

The market has expanded significantly in recent years due to evolving consumer preferences, the rising focus on wellness and self-care, and increasing awareness of the impact of environmental factors on skin health. As a highly fragmented sector, it includes both multinational brands and local manufacturers, with distribution channels ranging from brick-and-mortar retail stores to e-commerce platforms.

The demand for skin care products is largely driven by evolving consumer preferences for personalized and specialized solutions. As consumers become more educated about the ingredients in their beauty products, they are seeking products that align with their values, such as cruelty-free, organic, or dermatologically tested.

According to HAIR & SKIN, the demand for skincare products remains robust, driven by evolving consumer preferences. Notably, 21% of women report using five or more products in their morning skincare routine, dedicating an average of 22.4 minutes daily to this ritual.

Despite 73% of women using skincare products to reduce fine lines and wrinkles, only 15% believe these products are highly effective. A growing consumer awareness is evident, with 69% of people prioritizing ingredient transparency, although just 21% are familiar with the ingredients in their products.

The UK, in particular, is witnessing increased interest in natural and organic skincare options. Additionally, 47% of individuals aged 45 and above favor anti-aging products, while 42% of consumers incorporate after-sun care into their skincare routines, highlighting the broadening scope of consumer needs within the market.

According to The Conscious Insider, a study of 57,000 products from 500 companies revealed that 83% of the tested skin care products contained Titanium Dioxide, a known human carcinogen. This finding highlights growing concerns among consumers regarding the safety and transparency of personal care ingredients.

Moreover, women use an average of 12 products daily, which contain 168 different chemicals, while men use an average of six products, with 85 chemicals. Consumers are increasingly prioritizing natural ingredients, with 40.2% citing it as a key consideration when shopping for beauty and personal care products.

Additionally, 21% of U.S. adults now exclusively or nearly exclusively purchase organic makeup, underscoring a shift toward cleaner, more sustainable choices. With 17.6% of consumers also valuing environmental responsibility and 15.8% prioritizing recyclable packaging, the demand for safer and eco-conscious products continues to rise, shaping the future of the skin care market.

Key Takeaways

- The global skin care products market is expected to grow from USD 135.7 billion in 2023 to USD 198.9 billion by 2033, reflecting a CAGR of 3.9% during the forecast period.

- Female skincare products dominate the market with a 68.5% share in 2023, driven by increasing awareness of personal grooming and tailored product lines.

- Face creams & moisturizers capture the largest market share at 24.6% in 2023, benefiting from consumer demand for hydration, anti-aging, and multifunctional benefits.

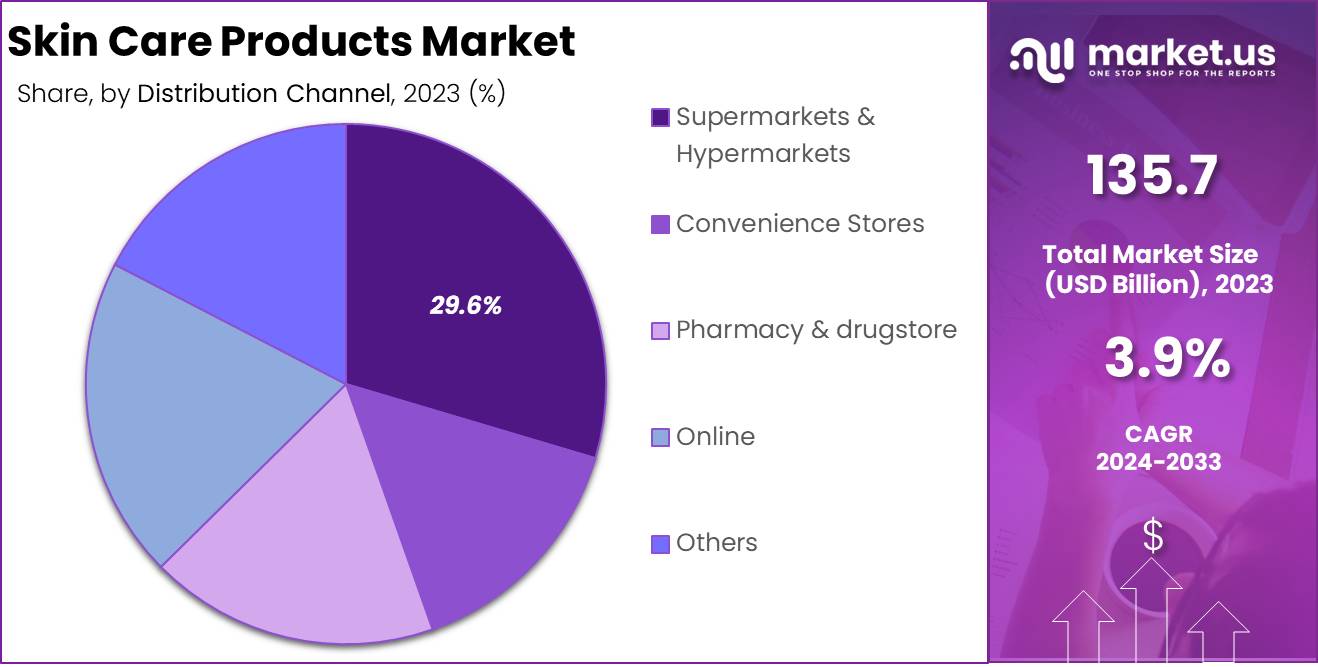

- Supermarkets & hypermarkets lead the distribution channel with 29.6% market share, offering convenience, competitive pricing, and a broad range of skincare products.

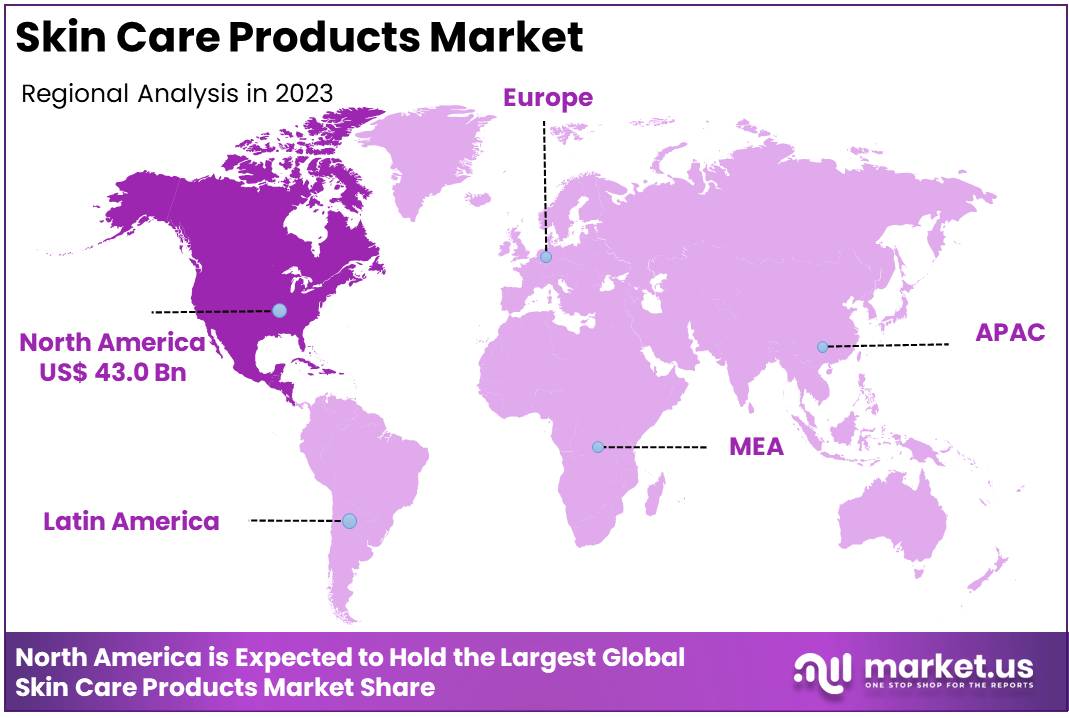

- North America dominates the global skincare market with a 31.7% share, representing USD 43.0 billion in 2023, supported by a strong consumer base and growing demand for advanced skincare solutions.

By Gender Analysis

Female Segment Dominating the Skin Care Products Market with 68.5% Share in 2023

In 2023, females held a dominant position in the skin care products market, capturing over 68.5% of the total market share. The strong preference among women for advanced skincare solutions, combined with the increasing availability of tailored products catering to diverse skin types and concerns, continues to drive this segment’s growth.

Rising awareness about skincare routines, the influence of social media, and product innovations such as anti-aging formulations, organic ingredients, and cruelty-free options further solidify the female segment’s leading role in the market.

While the male segment accounted for the remaining market share in 2023, it is witnessing significant growth due to changing consumer preferences and increased awareness about grooming and self-care among men.

The rise of gender-neutral marketing strategies and the introduction of male-specific product lines, such as anti-pollution creams, moisturizers, and beard care products, are contributing to the expansion of this segment. Though smaller than the female segment, the male skincare market presents promising opportunities for future growth.

By Product Analysis

Face Creams & Moisturizers Dominated the Skin Care Products Market with a 24.6% Share

In 2023, face creams and moisturizers secured a dominant market position in the skin care products segment, capturing over 24.6% of the total market share. This segment has consistently led the market due to its essential role in daily skincare routines. Consumers increasingly seek effective products for hydration, anti-aging, and overall skin health, driving demand for both premium and mass-market moisturizers.

The popularity of multifunctional face creams that offer benefits such as SPF protection, anti-aging properties, and skin-brightening effects has further contributed to the segment’s dominance. With growing awareness about skin health and a strong preference for moisturizing products across various skin types, face creams and moisturizers are expected to maintain a leading role in the market.

Cleansers and face washes represent a key segment in the skin care market, accounting for 18.3% of the total market share in 2023. As the first step in any skincare routine, face cleansers are essential for removing dirt, oil, and impurities, contributing to their consistent demand.

The increasing adoption of skincare routines, particularly among younger consumers and men, has boosted the demand for specialized cleansers, such as gentle formulas, exfoliating cleansers, and those catering to sensitive skin. Additionally, the rise of natural and organic ingredients in cleansers aligns with growing consumer preferences for cleaner, more sustainable products.

Sunscreen products, encompassing both face and body formulas, hold a significant 15.2% share of the skin care market in 2023. The increasing focus on sun protection, driven by heightened awareness of skin cancer risks and premature aging, has propelled this segment’s growth.

Consumers are now more conscious of the need to protect their skin from harmful UV rays, leading to a surge in demand for sunscreens with high SPF ratings, water resistance, and broad-spectrum protection.

The segment has also seen innovation with products designed to be lightweight, non-greasy, and suitable for all skin types, further enhancing their appeal. In 2023, body creams and moisturizers accounted for 12.5% of the skin care market share. This segment remains strong, particularly as consumers seek out products that provide hydration and improve skin elasticity.

The increasing interest in self-care routines has contributed to the growth of body moisturizers, with consumers prioritizing products that not only moisturize but also offer additional benefits such as soothing, anti-aging, or firming effects.

Innovations in packaging and formulations, including products for specific skin concerns such as dryness, stretch marks, or eczema, have further expanded the appeal of body creams and moisturizers.

Shaving lotions and creams make up 9.8% of the skin care market share in 2023. While historically a smaller segment, shaving products have seen steady growth, particularly as men increasingly invest in high-quality grooming products.

Innovations in shaving lotions, such as those offering soothing, anti-irritant properties, and enriched with moisturizing ingredients, have helped boost the segment’s market share. The demand for premium shaving products that enhance the shaving experience is a key driver of growth in this category.

The Others category, which encompasses a range of niche skin care products including serums, exfoliators, masks, and specialty treatments, holds a 19.6% share of the market in 2023. While individual product categories within Others are smaller in comparison, the cumulative share reflects the diversity of consumer preferences and the rise of targeted skincare solutions.

The growing interest in personalized skin care, driven by factors like skin type, age, and environmental influences, has spurred the development of products within this category. As consumers continue to explore customized treatments, the Others segment is expected to witness sustained growth.

By Distribution Channel Analysis

In 2023, Supermarkets & Hypermarkets Dominated the Skin Care Products Market with a 29.6% Share

In 2023, Supermarkets & Hypermarkets captured the largest market share of 29.6% in the skin care products distribution channel. This dominance can be attributed to the wide reach and convenience these retail formats offer to consumers.

Shoppers prefer to purchase skin care products in large retail outlets due to the availability of a broad range of brands and products under one roof, coupled with the convenience of one-stop shopping for other household needs.

Competitive pricing, promotions, and the ability to view and test products in-store further enhance the attractiveness of supermarkets and hypermarkets as key distribution points for skin care items.

Convenience Stores accounted for 15.2% of the skin care products market in 2023. While smaller compared to supermarkets and hypermarkets, convenience stores continue to hold a niche but steady position due to their proximity to consumers and the quick, in-and-out shopping experience they provide.

The growing demand for travel-sized skin care products, as well as the increasing trend of on-the-go purchases, has contributed to the continued relevance of convenience stores. Additionally, many urban and suburban locations rely on these stores for quick replenishments of essential skincare items.

Pharmacies and drugstores represented 18.6% of the market in 2023. These outlets are preferred by consumers seeking dermatologist-recommended skin care products, particularly in categories such as acne treatment, anti-aging, and sensitive skin products.

The reputation of pharmacies and drugstores as trusted sources for health-related products, combined with their expanding range of skin care offerings, has helped them maintain a strong position in the market. Furthermore, the rise of private-label and pharmacy-exclusive skin care brands has boosted the appeal of these channels among health-conscious shoppers.

The Online channel saw significant growth in 2023, capturing 20.7% of the market. The increasing reliance on e-commerce platforms for purchasing skin care products is driven by convenience, the ability to compare products, and access to customer reviews. Online shopping allows consumers to explore a broader selection of brands, often with exclusive offers, subscription models, and direct-to-consumer pricing.

The growth of social media marketing and influencer collaborations has further bolstered online sales, particularly among younger, tech-savvy consumers who prefer the ease of home delivery. E-commerce giants, as well as specialty beauty and skincare online stores, have become major players in this segment.

The Others category, which includes direct sales, specialty retailers, and other non-traditional distribution channels, accounted for 15.9% of the skin care products market in 2023. This segment includes direct-to-consumer models (such as subscription boxes or brand-specific online stores), beauty salons, and pop-up stores.

Although not as dominant as traditional retail channels, the Others segment is emerging as a growing force, driven by innovative and personalized purchasing experiences. As consumers become more interested in tailored skincare solutions and personalized customer service, alternative distribution channels are expected to continue their upward trajectory.

Key Market Segments

By Gender

- Male

- Female

By Product

- Face Creams & Moisturizers

- Cleansers & Face Wash

- Sunscreen

- Body Creams & Moisturizers

- Shaving Lotions & Creams

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacy & drugstore

- Online

- Others

Driver

Growing Consumer Demand for Natural and Organic Ingredients

One of the key drivers propelling the global skincare market in 2024 is the increasing consumer demand for natural and organic ingredients in skincare products. As consumers become more health-conscious, they are prioritizing products that are free from synthetic chemicals and artificial additives, which are often associated with skin irritation or long-term adverse effects.

This shift in consumer preference is driving manufacturers to reformulate products with plant-based, cruelty-free, and eco-friendly ingredients. Organic skincare products, particularly those containing botanical extracts, essential oils, and natural minerals, are rapidly gaining popularity due to their perceived safety and sustainability.

The growing focus on wellness and sustainability has also influenced buying decisions. Consumers, particularly millennials and Gen Z, are more inclined to purchase products that align with their ethical values, including sustainability in production and packaging. This demand is supported by a broader cultural shift towards eco-consciousness and an increasing awareness of the environmental impact of conventional skincare production.

As a result, companies in the skincare sector are investing heavily in research and development to create new formulations that cater to these needs, often highlighting certifications such as organic, cruelty-free, or vegan on their product labels.

This trend has led to significant market growth, as consumers are willing to pay a premium for products that reflect their personal values and concerns about skin health and environmental responsibility.

Restraint

High Cost of Premium Skincare Products

While the global skincare market is expanding rapidly, one major restraint hindering growth is the high cost of premium skincare products, particularly those formulated with advanced ingredients or natural, organic components. Premium skincare products are often priced significantly higher than conventional products due to the quality and rarity of ingredients used, as well as the sophisticated manufacturing processes involved.

This pricing structure can be a barrier for a large segment of the consumer population, especially in emerging markets where disposable income is lower. The price sensitivity in these regions may limit the potential for widespread adoption of high-end skincare solutions, despite their growing global appeal.

Additionally, the high price of premium skincare products may restrict the purchasing power of middle-income consumers, leading them to opt for more affordable alternatives that may not offer the same perceived benefits.

This situation creates a dichotomy in the market, where high-income consumers may continue to drive growth in the premium segment, while mass-market products dominate the wider consumer base. Brands aiming to address this restraint must find innovative ways to balance product efficacy, ethical sourcing, and affordability to ensure they remain accessible to a broader audience while still capitalizing on the premium segment’s growth.

Opportunity

Technological Advancements in Skincare Innovation

The continuous evolution of technology presents a significant opportunity for growth in the global skincare market in 2024. Advances in skincare technology, including the use of artificial intelligence (AI), personalized skincare solutions, and cutting-edge dermatological treatments, are revolutionizing the way consumers approach their skincare routines.

AI-driven skincare apps that analyze an individual’s skin condition and recommend tailored products or regimens are becoming increasingly popular, offering a highly personalized experience that resonates with today’s consumers. This level of customization enhances the effectiveness of skincare solutions, driving consumer confidence and brand loyalty.

Moreover, the rise of smart skincare devices, such as LED masks, facial cleansing brushes, and ultrasonic tools, is further fueling market growth. These devices offer consumers at-home treatments that were once available only in professional dermatology clinics, creating a new category of skincare solutions.

Additionally, breakthroughs in biotechnology are leading to the development of new active ingredients that offer enhanced anti-aging, hydrating, and skin-repairing benefits. This intersection of skincare and technology is paving the way for innovative products that meet specific skin concerns, which is expected to contribute significantly to the market’s expansion in the coming years.

Trends

Rise of Skincare as Self-Care and Wellness

A prominent trend shaping the skincare market in 2024 is the growing intersection of skincare with self-care and wellness. More consumers are viewing skincare routines not just as a necessity, but as an essential part of their overall wellness regimen. This trend is particularly evident among younger generations, who are increasingly adopting holistic approaches to health and beauty.

As skincare becomes a form of self-care, people are investing in products and routines that promote not only skin health but also mental and emotional well-being. Skincare rituals are being seen as moments of relaxation and mindfulness, contributing to the broader wellness movement.

The shift towards wellness-oriented skincare has led to the proliferation of products that promise not only visible results but also enhanced sensory experiences, such as calming fragrances, luxurious textures, and soothing formulations. Additionally, consumers are increasingly incorporating wellness practices like facial massages, gua sha, and aromatherapy into their skincare routines to improve both physical appearance and mental relaxation.

As wellness trends continue to gain momentum, brands that align their offerings with the idea of skincare as a therapeutic, self-care activity are likely to resonate more with today’s health-conscious consumers. This trend supports market growth by broadening the appeal of skincare products beyond traditional beauty concerns to encompass overall well-being.

Consumer Preferences and Behavior

Natural and Organic Products

The growing trend toward wellness and natural ingredients has led to a rise in demand for organic and vegan skin care products. A 2023 consumer survey found that 65% of global consumers are actively seeking skin care products with natural ingredients.

Influence of Social Media and Influencers

Social media platforms such as Instagram, TikTok, and YouTube play a pivotal role in shaping consumer preferences. Beauty influencers and skin care experts drive product recommendations and trends, significantly impacting purchasing decisions.

Major Uses of Skin Care Products Market

- Anti-Aging Products: Anti-aging skin care products are a leading segment as consumers seek solutions to combat wrinkles, fine lines, and other visible signs of aging. The growing desire for youthful, healthy skin is propelling demand across various age groups, especially among older demographics and younger consumers who are more focused on prevention. The category remains a dominant force in the skin care market as new, effective ingredients continue to drive innovation.

- Moisturizers and Hydration Products: Moisturizers play a crucial role in daily skin care routines by providing hydration and skin protection. As skin hydration is fundamental to skin health, these products remain in constant demand across different age groups and geographic regions. Moisturizers are also increasingly formulated with added benefits such as anti-aging properties or specialized ingredients for sensitive or dry skin, further broadening their appeal.

- Acne Treatment Products: Acne treatment products, including cleansers, creams, and spot treatments, are particularly popular among teenagers and young adults. The rise in stress, hormonal changes, and environmental factors has contributed to a surge in demand. Advances in formulations targeting both prevention and treatment of acne have expanded this market, making these products a staple in many skin care regimens.

- Sunscreen and Sun Protection: Sunscreen products are essential for preventing skin damage caused by UV exposure, which can lead to premature aging and skin cancers. As public awareness of the risks associated with UV radiation increases, so does the demand for effective sun protection products. The market is also being influenced by a growing interest in sustainable and reef-safe sunscreen options, alongside a preference for broad-spectrum, high-SPF formulations.

- Skin Whitening and Brightening Products: Skin whitening and brightening products remain highly sought after, particularly in regions where fair skin is culturally preferred. These products often contain ingredients like vitamin C, niacinamide, and alpha-arbutin, designed to reduce dark spots and even out skin tone. Despite ongoing debates over safety and ethics, demand continues to grow as consumers seek effective solutions for pigmentation and radiance.

- Natural and Organic Skin Care Products: The natural and organic skin care market has experienced significant growth as consumers increasingly turn to products that are free from synthetic chemicals and environmentally friendly. Ingredients such as aloe vera, tea tree oil, and plant-based oils are highly favored in these products, with a focus on sustainability and transparency in sourcing. This trend is reflective of broader consumer preferences for clean beauty and eco-consciousness.

- Exfoliating Products: Exfoliating products, such as scrubs, chemical exfoliants, and exfoliating masks, help to remove dead skin cells and promote smoother, brighter skin. The rising popularity of at-home skin care routines and multi-step regimens has driven demand for effective exfoliators. As consumers seek products that offer both immediate and long-term benefits, exfoliants are becoming a key component of both basic and advanced skin care routines.

Regional Analysis

North America Dominates the Skin Care Products Market with a 31.7% Share in 2023

The global skin care products market is witnessing robust growth across various regions, driven by evolving consumer preferences, rising awareness about personal grooming, and advancements in skincare technology. Among the regions, North America holds the largest market share, accounting for 31.7% of the total market in 2023, with a market value of USD 43.0 billion.

This dominance is primarily attributed to the region’s strong demand for high-quality, innovative skin care products, driven by a growing health-conscious population and increasing disposable income. The United States, in particular, remains the key contributor, where both premium and mass-market skin care products are experiencing significant growth, propelled by rising consumer interest in organic and natural formulations.

In Europe, the skin care market is characterized by a strong inclination towards premium and luxury brands, especially in countries like France, Italy, and the UK. The market is fueled by consumers’ increasing focus on anti-aging products and sustainable, eco-friendly solutions.

The region’s demand is also bolstered by a heightened awareness of skin health, which has prompted the introduction of clinically tested and dermatologically approved products. Europe’s market growth is more gradual compared to North America but remains strong, with emerging trends like personalized skincare solutions and the rise of clean beauty gaining significant traction.

In Asia Pacific, the skin care products market is expanding at a rapid pace, driven by the region’s large population base and rising disposable incomes, particularly in countries like China, Japan, and South Korea. South Korea, a global hub for skincare innovation, continues to influence trends in the region and worldwide, contributing to the strong demand for products focused on skin hydration, brightening, and anti-aging.

The increasing preference for natural and herbal ingredients is another prominent trend in the Asia Pacific market. This region is expected to maintain a high growth rate, with key drivers being the growing middle-class population, increasing urbanization, and a rising awareness of skincare regimes among younger consumers.

The Middle East & Africa region is experiencing a more niche but steady growth in the skin care products market. This growth is mainly driven by the increasing demand for luxury skin care products and the growing interest in dermatological skin care treatments.

The region’s strong cultural focus on beauty and personal care, coupled with a high concentration of wealth in countries like the UAE and Saudi Arabia, supports premium product consumption. Furthermore, there is a growing interest in products designed for specific skin concerns, such as sun protection and hyperpigmentation, influenced by the region’s hot and arid climate.

In Latin America, the skin care market is witnessing gradual growth, with a rising demand for both local and international brands. Brazil, the largest economy in the region, continues to drive market expansion, where consumers are increasingly seeking skincare solutions that address environmental factors, such as UV exposure and pollution.

The growing middle class in countries like Mexico, Argentina, and Colombia is further contributing to market expansion. Latin American consumers are becoming more aware of the benefits of skincare routines, and the preference for products with natural ingredients is growing steadily.

According to Scottmax, North Asia dominates the global beauty market, representing a significant 35% share, with China leading the region’s growth. North America accounts for 26%, followed by Europe at 22%, showcasing robust demand across these key markets.

Notably, 40% of facial skincare users have increased their usage of products such as cleansers, moisturizers, exfoliators, and scrubs, reflecting a growing emphasis on daily skincare routines. On average, women use five skincare products daily, underlining the multi-step approach driving product innovation. Additionally, 38% of U.S. consumers regularly utilize cleanser products, highlighting strong penetration within this high-demand category.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global skin care products market continues to be dominated by several key players who leverage strong brand recognition, expansive product portfolios, and significant global distribution networks to maintain competitive advantage.

L’Oréal S.A., with its extensive range of high-performance skin care products, remains a market leader, combining cutting-edge research and development with a deep understanding of consumer needs. The company’s strong presence in both premium and mass-market segments allows it to capture diverse consumer demographics across regions.

Beiersdorf AG, through its renowned Nivea brand, remains a major force in the market, offering high-quality, affordable skin care solutions. The company’s focus on sustainability and consumer-centric innovation positions it well to appeal to environmentally-conscious consumers. Similarly, Shiseido Co., Ltd. stands out with its premium offerings and strong emphasis on science-backed, age-defying skin care, particularly in the Asia-Pacific region.

Procter & Gamble (P&G) and Unilever both benefit from their vast consumer goods portfolios and a focus on mass-market accessibility. P&G’s Olay brand continues to grow, particularly in the anti-aging segment, while Unilever’s Dove remains a dominant player in the natural and sensitive skin care categories.

Johnson & Johnson, Inc., with its broad portfolio that includes brands like Neutrogena, continues to capture market share through dermatologist-recommended products. Avon Products, Inc. and Coty Inc. focus on leveraging their direct-selling channels and beauty expertise to engage with a diverse customer base.

Meanwhile, Colgate-Palmolive Company and Revlon have seen steady growth, capitalizing on their strong brand equity and established relationships with consumers in both skincare and personal care segments. Together, these players represent a dynamic and competitive landscape, driving innovation and adapting to the increasing demand for sustainable, efficacy-driven skin care products.

Top Key Players in the Market

- L’Oréal S.A.

- Beiersdorf AG

- Shiseido Co., Ltd.

- Procter & Gamble (P&G)

- Unilever

- Johnson & Johnson, Inc.

- Avon Products, Inc.

- Coty Inc.

- Colgate-Palmolive Company

- Revlon

Recent Developments

- In 2024, The Estée Lauder Companies Inc. (NYSE: EL) completed its acquisition of DECIEM Beauty Group Inc., a Canadian-based, multi-brand beauty company. ELC had first invested in DECIEM in 2017, increasing its stake to majority ownership in 2021. On May 31, 2024, ELC purchased the remaining shares for approximately $860 million, bringing the total investment to around $1.7 billion.

- In 2023, Shiseido Company, Limited announced the acquisition of DDG Skincare Holdings LLC, a dermatologist-led, science-based skincare company. This agreement, finalized on December 22, 2023, enhances Shiseido’s portfolio in the prestige skincare segment in the U.S. market.

- In July 2023, L’Oréal shared its future vision for dermatology at the World Congress of Dermatology in Singapore. The company unveiled new research and innovations aimed at advancing skin health, highlighting its commitment to leadership in dermatological science.

- In March 2024, Dow and Procter & Gamble announced a joint development agreement for a new recycling technology. The partnership aims to convert hard-to-recycle plastic packaging into high-quality recycled polyethylene with a reduced environmental impact.

Report Scope

Report Features Description Market Value (2023) USD 135.7 Bn Forecast Revenue (2033) USD 198.9 Bn CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Gender (Male, Female), By Product (Face Creams and Moisturizers, Cleansers and Face Wash, Sunscreen, Body Creams and Moisturizers, Shaving Lotions and Creams, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmacy and drugstore, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oréal S.A, Beiersdorf AG, Shiseido Co., Ltd, Procter & Gamble (P&G), Unilever, Johnson & Johnson, Inc, Avon Products, Inc, Coty Inc, Colgate-Palmolive Company, Revlon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L’Oréal S.A.

- Beiersdorf AG

- Shiseido Co., Ltd.

- Procter & Gamble (P&G)

- Unilever

- Johnson & Johnson, Inc.

- Avon Products, Inc.

- Coty Inc.

- Colgate-Palmolive Company

- Revlon