Global Isoamyl Market By Grade(Pharma Grade, Food Grade, Technical Grade), By End-use(Food and Beverage, Pharmaceutical, Cosmetic, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 78923

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

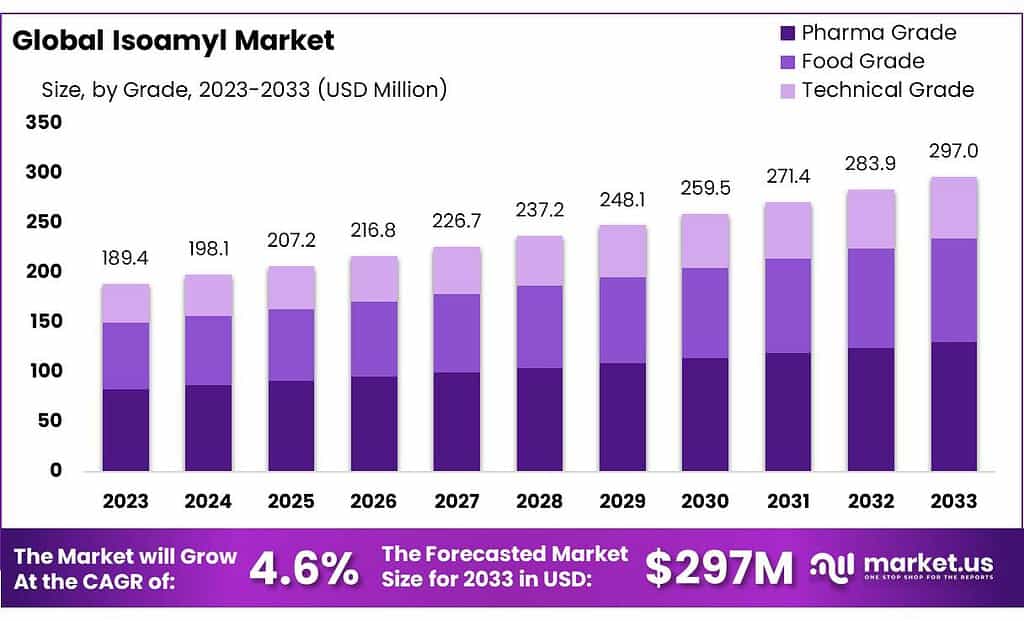

The global Isoamyl Market size is expected to be worth around USD 297.0 Million by 2033, from USD 189.4 Million in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

The Isoamyl Market refers to the global industry and commerce surrounding isoamyl compounds, which are organic substances primarily used as flavoring agents and in fragrance manufacturing. Isoamyl alcohol, one of the most common isoamyl compounds, is known for its application in the production of isoamyl acetate, a substance with a characteristic banana flavor used in food products and beverages.

Besides its role in flavoring, isoamyl compounds find utility in various industrial applications, including as solvents in the pharmaceutical and chemical sectors, and in the creation of cosmetics and personal care products due to their appealing scent and solvent properties.

The market for isoamyl compounds is driven by demand from the food and beverage industry, cosmetics and personal care industry, pharmaceuticals, and chemical manufacturing. Factors influencing the market include consumer preferences for natural and synthetic flavors and fragrances, technological advancements in extraction and synthesis methods, and regulatory standards governing the use of such chemicals in products.

Key stakeholders in the Isoamyl Market include chemical manufacturers, food and beverage companies, cosmetics and personal care product manufacturers, and end consumers. The market’s dynamics are shaped by trends in consumer behavior, regulatory changes, and advancements in chemical processing technologies. As the demand for flavored and scented products continues to grow, the Isoamyl Market is expected to expand, reflecting broader trends in global consumer goods industries.

Key Takeaways

- Market Growth: Isoamyl Market to reach USD 297.0 million by 2033, with a CAGR of 4.6% from USD 189.4 million in 2023.

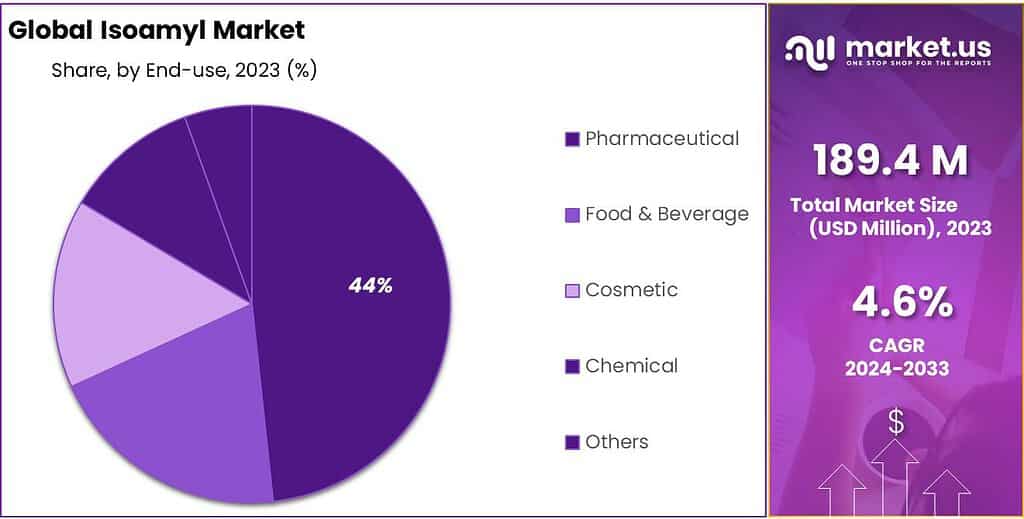

- End-use Dominance: Pharmaceuticals hold 47.3% market share in 2023, followed by food and beverage sectors.

- Grade Segmentation: Pharma-grade isoamyl products capture 45.3% market share in 2023.

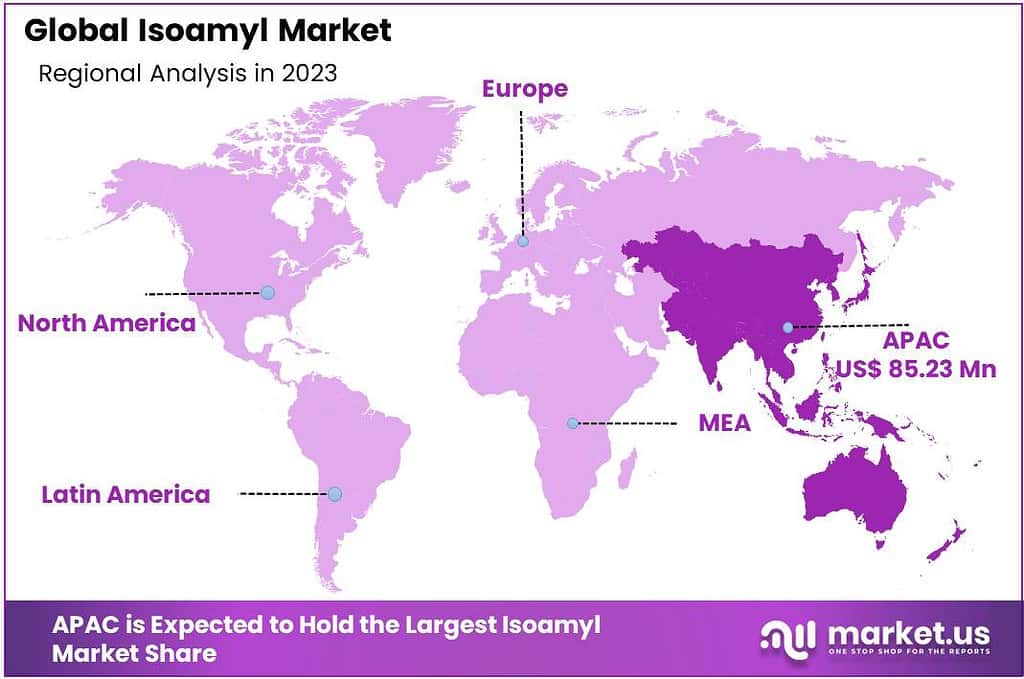

- Regional Analysis: Asia Pacific leads with 44.7% market share, followed by North America and Europe.

By Grade

In 2023, Pharma Grade isoamyl products held a dominant market position, capturing more than a 45.3% share. This prominence is largely due to the stringent quality and purity requirements in the pharmaceutical industry, where isoamyl compounds are used as solvents and in the synthesis of various medicinal products. Their critical role in drug formulation and production underlines the demand for high-grade, reliable isoamyl compounds in pharmaceutical applications.

Following closely, Food Grade isoamyl compounds also command a significant portion of the market. These compounds, known for their flavoring properties, are widely used in the food and beverage industry to impart specific tastes and aromas to products. The demand in this segment reflects the growing consumer preference for enhanced flavor experiences in food and drinks, with isoamyl compounds playing a key role in meeting this need.

Technical-grade isoamyl products, while holding a smaller market share, are essential for various industrial applications beyond food and pharmaceuticals. These include uses in chemical synthesis, as solvents in paint and varnish production, and in the manufacture of personal care items. The versatility of technical-grade isoamyl compounds underpins their importance across a broad range of sectors.

Each grade caters to specific industry standards and consumer demands, with Pharma Grade leading due to the critical nature of pharmaceutical applications and the high standards required for products used in this sector. As industries continue to evolve and expand, the demand for isoamyl compounds across all grades is expected to grow, reflecting their wide-ranging utility and importance.

By End-use

In 2023, the Pharmaceutical sector held a dominant market position in the Isoamyl Market, capturing more than a 47.3% share. This leading status is largely attributed to the essential role of isoamyl compounds in pharmaceutical formulations, including their use as solvents and in the synthesis of active pharmaceutical ingredients (APIs). The demand in this segment underscores the critical nature of isoamyl compounds in developing and manufacturing a wide range of medicinal products, reflecting the healthcare industry’s stringent quality standards and growing need for reliable chemical substances.

Following closely, the Food & Beverage sector also occupies a significant portion of the market. Isoamyl compounds, particularly isoamyl acetate with its distinctive banana flavor, are popular flavoring agents used to enhance the taste profiles of various food and drink products. The segment’s substantial market share is indicative of the continuing consumer demand for flavored food and beverage options, driving the need for high-quality isoamyl compounds in culinary applications.

The Cosmetic sector represents another important application of isoamyl compounds, utilizing them for their fragrant properties and as solvents in the formulation of beauty and personal care products. The appeal of natural and pleasant-smelling cosmetics has bolstered the demand for isoamyl compounds in this industry, catering to consumers’ growing preference for products that combine aesthetic appeal with natural ingredients.

Chemical applications of isoamyl compounds, including their use as solvents and intermediates in chemical synthesis, account for a smaller but vital portion of the market. The versatility and effectiveness of isoamyl compounds in various industrial processes underscore their value across a range of chemical manufacturing activities.

With the Pharmaceutical sector leading due to its expansive use of isoamyl compounds in critical applications, the Isoamyl Market reflects a wide spectrum of end-use sectors, each relying on the unique properties of isoamyl compounds to meet specific industry needs. As technological advancements and consumer preferences continue to evolve, the demand for isoamyl compounds across all end-use sectors is expected to grow, further solidifying their importance in the global market.

Key Market Segments

By Grade

- Pharma Grade

- Food Grade

- Technical Grade

By End-use

- Food & Beverage

- Pharmaceutical

- Cosmetic

- Chemical

- Others

Drivers

Expanding Demand in the Flavor and Fragrance Industry: A Key Driver for the Isoamyl Market

A major driver propelling growth in the Isoamyl Market is the expanding demand within the flavor and fragrance industry. Isoamyl compounds, particularly isoamyl acetate, are celebrated for their distinct flavor and aroma profiles, reminiscent of ripe bananas and pears, making them indispensable in creating a wide array of food, beverage, and cosmetic products.

As global consumer preferences shift towards more natural and authentic sensory experiences, the demand for isoamyl compounds in crafting these experiences has surged.

The food and beverage sector, in particular, has seen a notable increase in the incorporation of isoamyl compounds to enhance the flavor profiles of products ranging from baked goods and candies to beverages and dairy products. This trend is driven by consumer desire for products that offer not only nutritional value but also enjoyment and novelty in consumption, pushing manufacturers to innovate in product development continually.

Similarly, in the cosmetics and personal care industry, there’s a growing emphasis on products that provide multi-sensory experiences. Isoamyl compounds are used to impart pleasant, natural fragrances to a variety of products, including perfumes, lotions, and soaps. This use aligns with the increasing consumer demand for beauty and personal care products that are not only effective but also provide an element of indulgence and wellbeing.

Moreover, the trend towards natural and organic products has further fueled the demand for isoamyl compounds. Consumers are increasingly skeptical of synthetic additives in their foods and cosmetics, leading to a preference for ingredients derived from natural sources. Isoamyl compounds, with their natural occurrence in fruits and plants, are perceived as a more desirable option, encouraging their broader application across industries.

The burgeoning aromatherapy and wellness market also presents a significant opportunity for the isoamyl market. Isoamyl compounds are utilized in aromatherapy products to create calming and uplifting environments, catering to the growing consumer interest in natural health and wellness solutions.

Restraints

Regulatory and Health Concerns: A Major Restraint in the Isoamyl Market

A significant restraint impacting the Isoamyl Market is the stringent regulatory environment and health concerns associated with the use of chemical compounds in consumable products. Isoamyl compounds, while widely used in the flavor, fragrance, and industrial sectors, are subject to rigorous scrutiny by health and safety regulatory bodies around the world.

Regulations such as the Food and Drug Administration (FDA) in the United States, the European Food Safety Authority (EFSA) in the European Union, and other national and international agencies set strict guidelines on the permissible levels of chemical additives in food, beverages, cosmetics, and pharmaceuticals. These regulations are designed to ensure consumer safety and prevent potential health risks that may arise from exposure to chemical substances.

Compliance with these regulatory standards involves extensive testing, documentation, and certification processes, which can be time-consuming and costly for manufacturers. The need to adhere to these regulations can slow down product development and innovation, particularly for new isoamyl-based products entering the market. Additionally, any changes or updates in regulatory standards require companies to quickly adapt their formulations and processes, further adding to the operational challenges.

Moreover, there is a growing consumer awareness and concern over the health implications of chemical additives in everyday products. Even when used within regulatory limits, certain isoamyl compounds may still raise health concerns among consumers, especially those prone to allergies or sensitivities. The increasing preference for all-natural and organic products has led some consumers to avoid products containing synthetic flavors or fragrances, including those derived from isoamyl compounds. This shift in consumer preferences poses a challenge for the isoamyl market, as it may limit the market potential for isoamyl-based additives in certain segments.

Opportunity

Sustainable Production and Eco-Friendly Applications: Expanding Horizons for the Isoamyl Market

A significant opportunity within the Isoamyl Market lies in the shift towards sustainable production methods and the development of eco-friendly applications. As environmental awareness and the demand for green chemistry solutions continue to rise, the industry is presented with the chance to innovate and reposition isoamyl compounds as essential components of a more sustainable and environmentally friendly market.

The increasing scrutiny over the environmental impact of chemical production processes has spurred interest in sustainable sourcing of raw materials and greener manufacturing techniques. For isoamyl compounds, this could involve optimizing production to minimize waste and energy consumption, as well as exploring bio-based sources for isoamyl derivatives. The use of biotechnological advances and renewable resources to produce isoamyl compounds can not only reduce the environmental footprint but also cater to the growing consumer preference for products derived from natural and sustainable sources.

Furthermore, the potential for isoamyl compounds in eco-friendly applications opens up new markets and opportunities for growth. Beyond their traditional roles in flavors, fragrances, and industrial solvents, isoamyl compounds could be utilized in the development of biodegradable plastics, organic pesticides, and green solvents. These applications not only align with global sustainability goals but also address the pressing need for alternatives to petroleum-based products and harmful chemicals.

The food and beverage industry, a major end-user of isoamyl compounds, is increasingly seeking natural and organic ingredients to meet consumer demands for cleaner labels and healthier products. By focusing on the natural and potentially organic certification of isoamyl compounds, producers can tap into this lucrative market segment, offering a compelling value proposition to manufacturers aiming to differentiate their products.

Additionally, the growing interest in natural cosmetics and personal care products provides another avenue for the application of isoamyl compounds. The development of natural fragrances and flavorings for use in these products can further enhance their appeal to health-conscious consumers, driving demand in a market increasingly focused on wellness and natural ingredients.

Furthermore, the potential environmental impact of synthesizing and disposing of chemical compounds, including isoamyl derivatives, prompts environmental and sustainability concerns. The industry faces pressure to develop eco-friendly and sustainable production methods that minimize the environmental footprint of chemical manufacturing processes.

Trends

The Rising Demand for Natural Ingredients in the Isoamyl Market

A significant trend shaping the Isoamyl Market is the escalating consumer demand for natural ingredients across various industries, including food and beverages, pharmaceuticals, and cosmetics. This trend stems from a growing awareness among consumers about the health and environmental impacts of synthetic chemicals and a corresponding increase in preference for products that are perceived as more natural and safer. Isoamyl compounds, particularly those derived from natural sources, stand to benefit significantly from this shift in consumer preferences.

In the food and beverage sector, natural isoamyl compounds are increasingly favored for their ability to impart unique flavors and aromas without the use of synthetic additives. This demand aligns with the broader consumer trend toward clean eating and transparency in food sourcing, driving food manufacturers to seek out natural flavoring agents that can meet these consumer expectations. As a result, there’s a growing emphasis on the development and marketing of natural isoamyl-based flavorings to cater to the health-conscious consumer.

Similarly, in the pharmaceutical and cosmetic industries, there’s a heightened demand for products formulated with natural ingredients, driven by consumer concerns over potential side effects and environmental impact of synthetic substances. Natural isoamyl compounds are being explored for their therapeutic properties and their use as natural solvents and fragrances, providing a greener alternative to traditional chemical ingredients. This shift is encouraging companies in these sectors to invest in research and development of naturally derived isoamyl products, opening up new applications and markets.

Moreover, sustainability concerns are influencing the supply chain, with an increasing number of companies seeking to source isoamyl compounds from sustainable and ethical production practices. This includes interest in organic farming methods, fair trade sourcing, and minimizing the carbon footprint of production and distribution processes. The emphasis on sustainability not only responds to consumer demand but also aligns with global efforts to reduce environmental impact and promote ethical business practices.

The trend toward natural ingredients is driving innovation in the Isoamyl Market, prompting companies to explore novel sources of isoamyl compounds, improve extraction and purification processes, and develop new products that can meet the stringent criteria of being natural, sustainable, and ethically produced. As this trend continues to evolve, it presents both challenges and opportunities for market players, necessitating a strategic focus on sustainability, quality, and transparency to capitalize on the growing consumer demand for natural products.

Geopolitical Impact Analysis

Geopolitical tensions have disrupted supply chain activities in the global isoamyl market, impacting various sectors such as pharmaceuticals, fragrances, and chemical manufacturing. The isoamyl market, a crucial component in these industries, is increasingly susceptible to geopolitical complexities, which influence supply chains, regulatory landscapes, energy costs, and investment patterns. These factors collectively shape market trends, demand dynamics, and strategic decisions made by stakeholders within this sector.

The primary impact of geopolitical tensions is observed within the isoamyl supply chain. The market relies on a global network of suppliers for raw materials and ingredients. Geopolitical conflicts or trade disputes can disrupt these supply chains, resulting in shortages of essential raw materials, increased expenses, and prolonged production timelines. For example, trade tariffs arising from geopolitical tensions can raise the costs of imported materials, squeezing profit margins for isoamyl manufacturers and prompting a reassessment of procurement strategies.

Geopolitical shifts often lead to regulatory changes that reverberate throughout the isoamyl market. Emerging trade agreements, sanctions, and environmental policies can alter market dynamics, influencing business operations and competition globally. Sanctions imposed on specific regions may hinder market access, compelling companies to seek alternative markets or suppliers. Conversely, new trade agreements can unlock fresh market opportunities, providing growth avenues for isoamyl producers looking to broaden their market presence.

Regional Analysis

As of 2023, the Asia Pacific region has solidified its position as the most lucrative market for isoamyl compounds, boasting a dominant 44.7% market share. This remarkable growth is primarily fueled by the increasing application of isoamyl compounds in industries such as food and beverage, pharmaceuticals, and cosmetics within key countries including China, India, Korea, Thailand, Malaysia, and Vietnam. The region’s market expansion is supported by rising disposable incomes and an expanding consumer demographic keen on exploring high-quality and innovative flavor and fragrance solutions.

In North America, a robust culture surrounding food innovation and personal care, along with a vibrant industrial landscape, significantly propels the demand for isoamyl products. The region’s emphasis on research and development in flavors, fragrances, and chemical applications, combined with a growing preference for natural and sustainable ingredients, firmly establishes North America as a critical market for isoamyl compounds.

Europe is also set to witness notable growth in the Isoamyl Market. This surge is propelled by the demand for natural flavoring agents and fragrances, alongside stringent regulatory standards for food safety and environmental sustainability. European consumers’ increasing pursuit of products that offer both quality and eco-friendliness is driving the adoption of isoamyl compounds across various applications, from culinary arts to cosmetics, making Europe a key player in the global market landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Isoamyl Market is a dynamic and evolving space, with several key players driving innovation and growth across the globe. These companies are at the forefront of producing isoamyl compounds, catering to diverse industries such as food and beverage, pharmaceuticals, cosmetics, and chemical manufacturing. Here’s an analysis of some notable companies shaping the Isoamyl Market:

Market Key Players

- BASF SE

- OMV Aktiengesellschaft (Petrom)

- Thermo Fisher Scientific, Inc.

- DuPont de Nemours, Inc.

- Merck KGaA

- International Flavors & Fragrances Inc.

- WILD Flavors, Inc.

- OQ Chemicals GmbH

- Seqens

- Nimble Technologies Pvt. Ltd.

Recent Development

In 2023 BASF SE, company maintained its position as a leading supplier of isoamyl products, catering to various industries such as pharmaceuticals, fragrances, and chemical manufacturing.

In 2023 DuPont de Nemours, Inc., company showcased its expertise as a leading provider of isoamyl products, serving diverse industries such as pharmaceuticals, fragrances, and chemical manufacturing. DuPont de Nemours, Inc. prioritized innovation and sustainability, investing in research and development initiatives aimed at improving product quality and efficiency.

Report Scope

Report Features Description Market Value (2023) USD 189.4 Mn Forecast Revenue (2033) USD 297.0 Mn CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Pharma Grade, Food Grade, Technical Grade), By End-use(Food and Beverage, Pharmaceutical, Cosmetic, Chemical, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, OMV Aktiengesellschaft (Petrom), Thermo Fisher Scientific, Inc., DuPont de Nemours, Inc., Merck KGaA, International Flavors & Fragrances Inc., WILD Flavors, Inc., OQ Chemicals GmbH, Seqens, Nimble Technologies Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Isoamyl Market?BASF SE, OMV Aktiengesellschaft (Petrom), Thermo Fisher Scientific, Inc., DuPont de Nemours, Inc., Merck KGaA, International Flavors & Fragrances Inc., WILD Flavors, Inc., OQ Chemicals GmbH, Seqens, Nimble Technologies Pvt. Ltd.

What CAGR is projected for the Isoamyl Market?The Isoamyl Market is expected to grow at 4.6% CAGR (2023-2033).

-

-

- BASF SE

- OMV Aktiengesellschaft (Petrom)

- Thermo Fisher Scientific, Inc.

- DuPont de Nemours, Inc.

- Merck KGaA

- International Flavors & Fragrances Inc.

- WILD Flavors, Inc.

- OQ Chemicals GmbH

- Seqens

- Nimble Technologies Pvt. Ltd.