Global Bamboos Market Size, Share, And Business Benefits By Type (Tropical, Herbaceous, Temperate), By Cultivation Method (Culms, Rhizomes, Seeds, Others), By Irrigation Method (Drip Irrigation, Flood Irrigation, Rainwater Irrigation), By End-Use (Furniture, Scaffolding, Engineered bamboo, Pulp and Paper, Charcoal and Activated Carbon, Handicrafts, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 38086

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

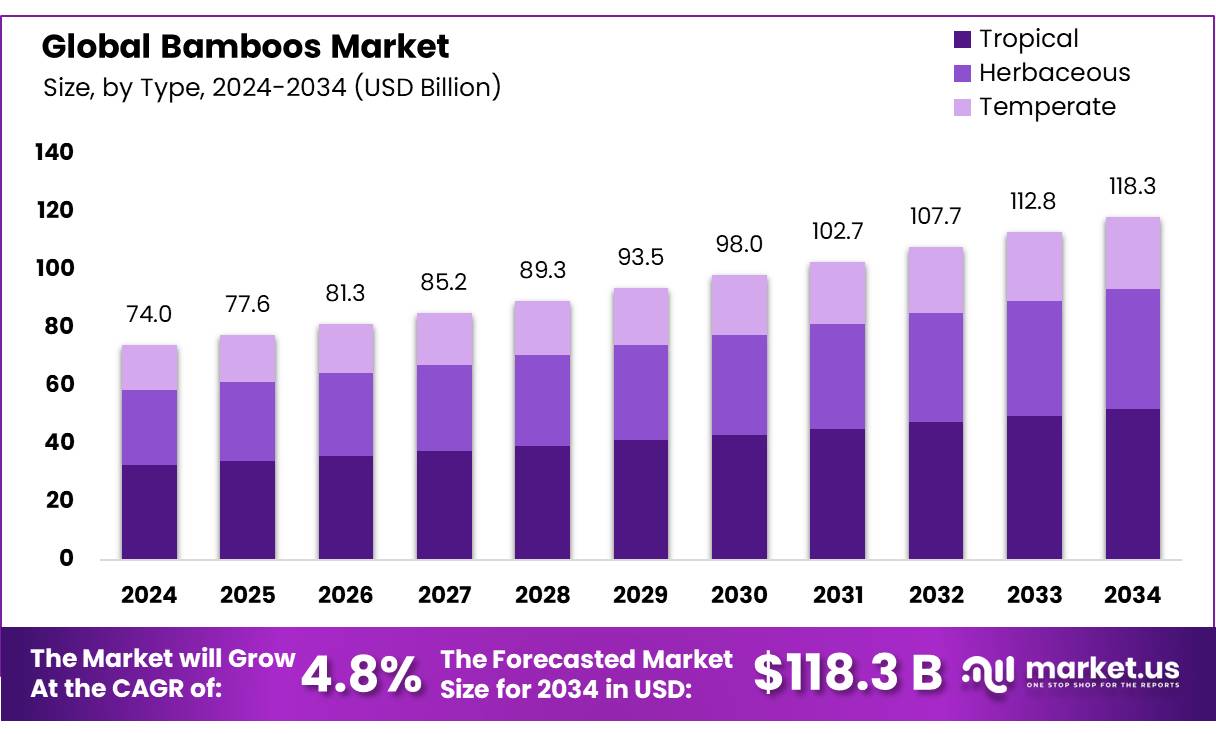

The Global Bamboos Market size is expected to be worth around USD 118.3 billion by 2034, from USD 74.0 billion in 2024, growing at a CAGR of 4.80% during the forecast period from 2025 to 2034.

The Bamboos Market is experiencing significant growth, driven by an increasing acknowledgment of its environmental and economic benefits. Bamboo, a highly renewable resource, offers substantial advantages due to its rapid growth rate, versatility in applications, and sustainability. This makes it an essential component in various industries ranging from construction and furniture to textiles and paper production.

Bamboos are a diverse group of woody, perennial, evergreen plants belonging to the grass family Poaceae. They have strong adaptability distributed widely from near the equator zone to the boreal zone with latitude ranges from 47° S to 50° 30′ N and altitudinal variation from sea level to 4300 m. Bamboo prefers a warm and humid climate and is distributed over the plain and hilly areas in the tropical and subtropical monsoon zone between the Tropic of Capricorn and the Tropic of Cancer.

The geographical distribution of bamboo is governed largely by the conditions of rainfall, temperature, altitude, and soil. Most of the bamboo requires a temperature from 80C to 360C and a minimum annual rainfall of 1000 mm, and high atmospheric humidity. Bamboos have a tree-like habit, a well-developed rhizome system, woody and hollow culms, branching patterns, petiolate leaves, and specialized sheathing organs.

Bamboos are found as natural flora in many parts of the world, from sea level to the snowy mountains, in tropical, subtropical, and mild temperate climates, with 1678 species classified into 123 genera. They are found in abundance in Asia’s southern and southeastern borders, from India to China and Japan to Korea. Bamboos are found in Africa, Australia, and Madagascar, among other places. In the Western hemisphere, bamboos extend from the eastern United States to Chile and Argentina. South America is also rich in bamboo.

Key Takeaways

- The global Bamboos Market is projected to grow from USD 74.0 billion in 2024 to USD 118.3 billion by 2034, at a 4.80% CAGR.

- Tropical bamboo leads with over 44.3% market share due to its versatility and sustainability.

- The culm’s method holds a 43.3% market share for its sustainability and efficient regrowth.

- Drip irrigation dominates with a 48.4% share for water efficiency and precise nutrient delivery.

- Bamboo furniture accounts for 29.2% of end-use demand, favored for its strength and eco-friendliness.

- APAC leads with 56.2% market share (USD 41.5 billion), driven by high production and government support.

By Type

The Tropical bamboo segment held a dominant position in the market, capturing more than a 44.3% share. This significant market share is indicative of the high demand for tropical bamboo, primarily driven by its versatility and sustainability. Tropical bamboos, known for their rapid growth and robustness, are extensively used in various applications, including construction, furniture, and textile industries.

The preference for tropical bamboo can be attributed to its exceptional strength and flexibility, which makes it a preferred material in regions with high humidity and rainfall. Additionally, its natural resistance to pests and diseases reduces the need for chemical treatments, making it a more eco-friendly option compared to other materials.

The market for tropical bamboo is expected to maintain its lead, thanks to growing environmental awareness and the increasing adoption of sustainable building materials. Furthermore, advancements in cultivation techniques and processing technologies are likely to enhance the quality and durability of tropical bamboo, fueling its demand across both developed and developing nations.

By Cultivation Method

The Culms cultivation method held a dominant market position, capturing more than a 43.3% share of the bamboo market. This method, which involves harvesting mature bamboo stalks or culms without damaging the root system, has gained prominence due to its sustainability and efficiency.

The popularity of culms cultivation is also bolstered by its cost-effectiveness and the high quality of bamboo produced, which is essential for various applications such as construction, handicrafts, and furniture making. As sustainable practices continue to rise in importance across industries.

The continued focus on eco-friendly practices and the expanding applications of bamboo are expected to drive further adoption of the culms cultivation method. This trend is anticipated to strengthen the method’s market share as more consumers and businesses prioritize green materials and sustainable agricultural practices.

By Irrigation Method

Drip Irrigation held a dominant market position in the bamboo cultivation sector, capturing more than a 48.4% share. This high adoption rate is driven by its efficiency in water conservation, precise nutrient delivery, and suitability for bamboo’s growth requirements.

The trend is expected to strengthen, with drip irrigation projected to grow further as sustainable farming practices gain traction. Governments and agricultural bodies in key bamboo-producing regions are promoting drip systems through subsidies, boosting their adoption.

Compared to flood or sprinkler irrigation, drip systems significantly enhance bamboo yield and quality, making them the preferred choice. As water scarcity concerns rise globally, drip irrigation in bamboo farming will likely expand, reinforcing its market leadership in the coming years.

By End-Use

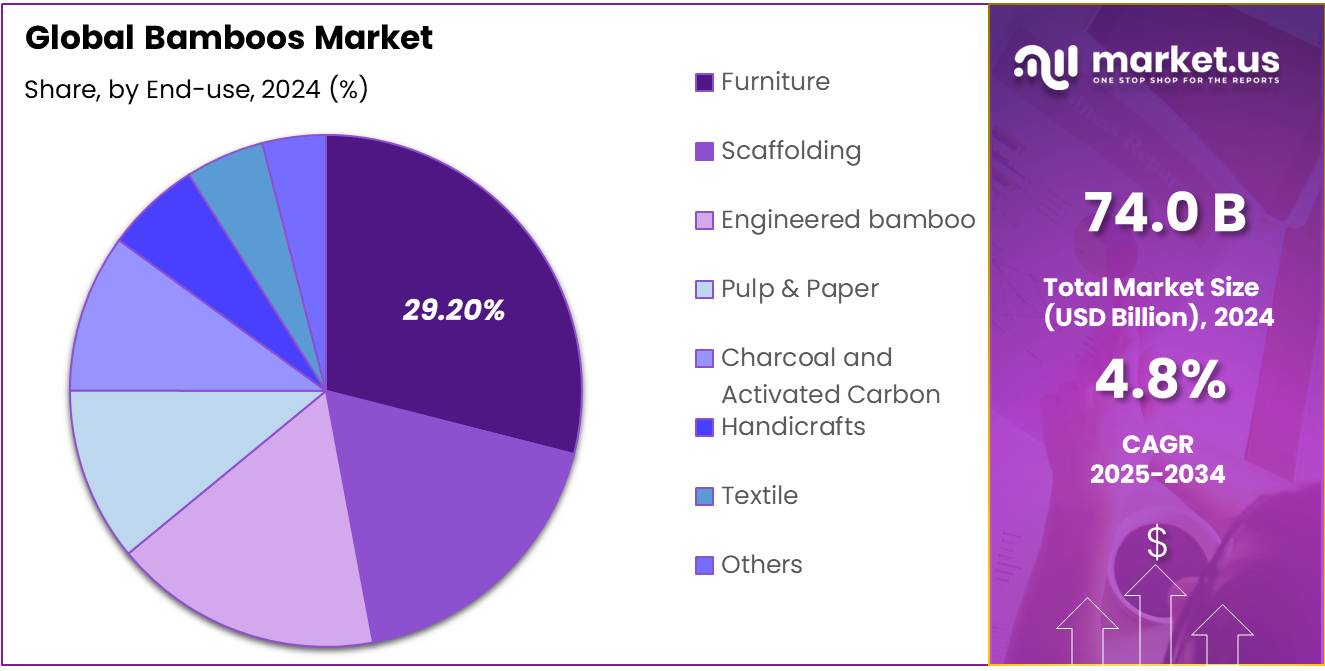

The Furniture segment dominated the bamboo market, holding more than a 29.2% share of total end-use demand. Bamboo’s strength, sustainability, and aesthetic appeal make it a top choice for modern furniture, from flooring to outdoor decor. Consumers and manufacturers alike prefer it over traditional wood due to its fast regrowth and eco-friendly properties.

The furniture industry is expected to keep driving bamboo consumption, especially as more brands switch to sustainable materials. Homeowners and businesses are increasingly opting for bamboo-based furniture as regulations on deforestation tighten. Affordable pricing compared to hardwoods and innovations in bamboo processing, like laminated and engineered bamboo, are also boosting its popularity.

Key Market Segments

By Type

- Tropical

- Herbaceous

- Temperate

By Cultivation Method

- Culms

- Rhizomes

- Seeds

- Others

By Irrigation Method

- Drip Irrigation

- Flood Irrigation

- Rainwater Irrigation

By End-Use

- Furniture

- Scaffolding

- Engineered bamboo

-

- Flooring

- Panels

- Beams

- Others

- Pulp and Paper

- Charcoal and Activated Carbon

- Handicrafts

- Textile

- Others

Drivers

Rising Demand for Sustainable Packaging Boosts Bamboo Market

One of the biggest drivers for the global bamboo market is the shift toward eco-friendly packaging. With plastic pollution becoming a major environmental crisis, industries and governments are pushing for biodegradable alternatives, and bamboo is emerging as a leading solution.

The European Union’s Single-Use Plastics Directive has accelerated bamboo adoption, with countries like Germany and France investing in local bamboo production for packaging. In Asia, India’s Ministry of Environment has promoted bamboo as part of its Plastic Waste Management Rules, supporting startups that develop bamboo-based food containers.

The only sector driving demand is Amazon, and other e-commerce giants are increasingly using bamboo-based cushioning and wraps to replace plastic bubble wrap. With global plastic packaging waste, bamboo’s role as a renewable, compostable alternative will only grow.

Restraints

Limited Supply Chain Infrastructure Hinders Bamboo Industry Growth

One of bamboo’s biggest challenges isn’t about the plant itself but what happens after harvest – the lack of reliable processing and distribution networks. While bamboo grows abundantly in tropical regions, turning those fast-growing stalks into consistent, high-quality materials for global markets remains a logistical nightmare.

The numbers reveal a stark reality. Harvested bamboo reaches industrial processing facilities in most producing countries. The rest either decay before transport or get used for low-value applications. This supply chain bottleneck explains why major retailers like Walmart get their sustainable packaging materials from bamboo, despite strong consumer demand.

The infrastructure deficit creates a frustrating paradox – while bamboo grows abundantly in over 50 countries, consistent industrial supply remains concentrated in just a few regions. Until more producing nations develop complete value chains from farm to factory, bamboo’s potential as a mass-market sustainable material will remain limited by these behind-the-scenes logistical challenges.

Opportunity

One of the major growth factors for the bamboo market is the rising demand for bamboo-based food products, especially bamboo shoots. These shoots are widely consumed in Asian countries and are gaining popularity in other parts of the world due to their nutritional value and low-calorie content.

Bamboo shoots are rich in dietary fiber, potassium, and antioxidants, making them a healthy option for people looking to improve gut health and reduce cholesterol. With consumers shifting toward plant-based and low-fat diets, bamboo shoots have emerged as a popular ingredient in both traditional and modern cuisines.

Governments in Asia are also encouraging bamboo cultivation to meet rising food demand and reduce dependence on conventional crops. India’s National Bamboo Mission, for instance, promotes bamboo farming across more than 1.05 million hectares, offering subsidies to farmers and supporting food processing units that utilize bamboo shoots. This initiative not only boosts rural incomes but also ensures year-round crop availability.

Trends

Bamboo in Sustainable Food Packaging

An emerging factor contributing to the growth of the bamboo industry is its increasing use in sustainable food packaging. As the global community intensifies efforts to reduce plastic waste, bamboo has emerged as a viable alternative due to its rapid growth and biodegradability. Bamboo’s natural properties make it an excellent material for creating durable and eco-friendly packaging solutions.

Government initiatives further support this trend. The partnership between FAO and the International Bamboo and Rattan Organization aims to scale up the use of bamboo in sustainable development, emphasizing its role in reducing rural poverty and promoting green industries. Such collaborations underscore the commitment to integrating bamboo into eco-friendly practices.

Regional Analysis

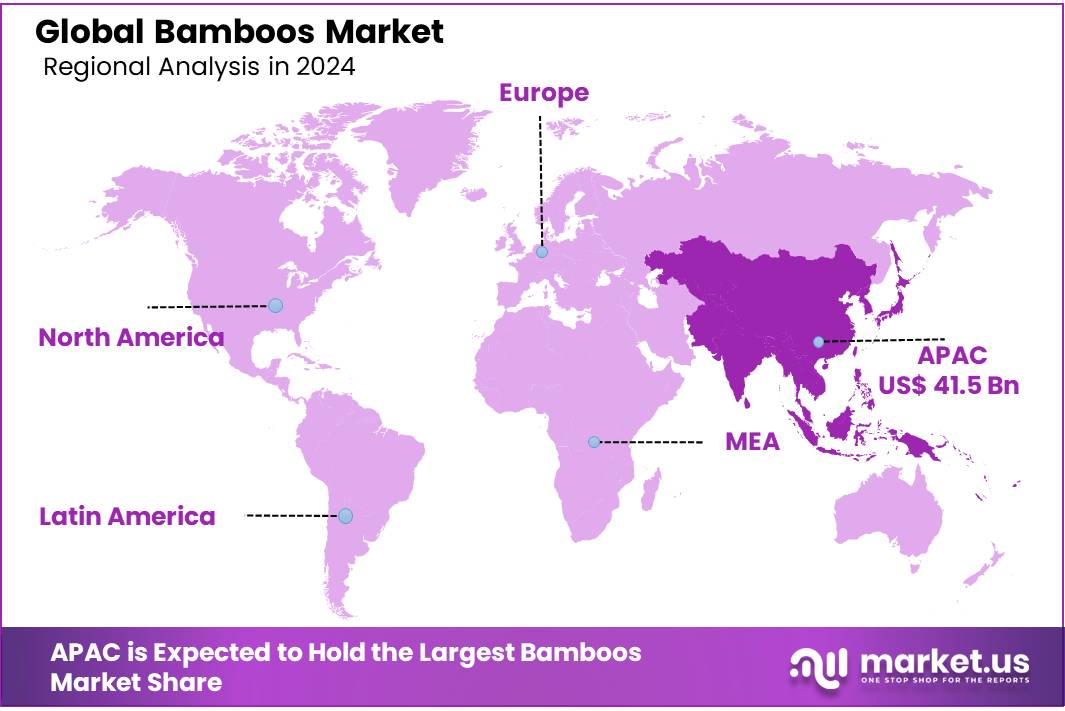

Asia-Pacific (APAC) Dominates the Global Bamboo Market with 56.2% Share, Valued at USD 41.5 Billion

The Asia-Pacific (APAC) region is the undisputed leader in the global bamboo market, holding a dominant share of 56.2% and a market value of USD 41.5 billion. This supremacy is driven by high production, extensive commercial applications, and strong government support for sustainable alternatives to timber and plastic.

The rise in eco-conscious consumer behavior and demand for sustainable materials has further accelerated bamboo consumption across APAC, especially in segments like flooring, furniture, packaging, and textiles. Countries like Vietnam and the Philippines are also emerging as competitive bamboo exporters, benefiting from lower production costs and strategic global linkages.

In Japan and South Korea, high-end architectural and lifestyle products made from bamboo are gaining traction, adding to the premium market value. The APAC region also benefits from favorable agro-climatic conditions and a skilled labor base, enabling cost-effective production and large-scale manufacturing. APAC is expected to retain its leading position in the bamboo market over the forecast period.

The growing popularity of bamboo-based textiles in the region, propelled by eco-conscious consumers and fashion brands, has opened new revenue streams. Overall, the APAC region’s blend of natural resources, industrial infrastructure, policy support, and cultural affinity has made it the epicenter of global bamboo production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- MOSO International B.V. is a leading global bamboo solutions provider known for high-performance products in flooring, decking, and panels. The company’s innovative technologies focus on sustainability, CO₂ neutrality, and durability, making it a preferred brand across Europe and North America.

- Bamboo Australia is a prominent player in the APAC bamboo industry, offering a wide range of bamboo products, including poles, plants, and landscaping materials. Located in Queensland, the company is known for promoting sustainable bamboo cultivation and biodiversity.

- Bamboo Village Company Limited is an established manufacturer and exporter of handmade bamboo and rattan products. The company focuses on eco-friendly homeware, kitchenware, and decorative goods, catering primarily to markets in Europe and North America.

- Shanghai Tenbro Bamboo Textile specializes in the development and production of bamboo fiber textiles. As one of China’s leading bamboo yarn and fabric suppliers, the company serves the apparel, home textile, and hygiene industries. It is known for its environmentally friendly production processes and high-quality bamboo viscose fabrics.

Top Key Players in the Market

- MOSO International B.V.

- Bamboo Australia

- Bamboo Village Company Limited

- Shanghai Tenbro Bamboo Textile Co., Ltd

- Simply Bamboo PTY LTD

- Xiamen HBD Industry & Trade Co., Ltd

- Dasso Group

- Smith & Fong Limited

- ANJI TIANZHEN BAMBOO FLOORING CO. LTD

- Fujian HeQiChang Bamboo Product Co., Ltd.

- BambroTex Inc.

- Cali Bamboo LLC

- Oceans Republic

- EcoPlanet Bamboo

- Kerala State Bamboo Corporation Ltd (KSBC)

- Other Key Players

Recent Developments

- In 2025, MOSO International B.V., a Netherlands-based leader in innovative and sustainable bamboo products, announced the launch of two new high-performance bamboo solutions. These products emphasize sustainable design and innovation, aligning with the company’s commitment to eco-friendly materials.

- In 2025, Bamboo Australia, based in Queensland, expanded its nursery operations to meet the growing demand for bamboo plants in landscaping and construction. The addition of new bamboo species to their catalog, aimed at both commercial and residential markets.

Report Scope

Report Features Description Market Value (2024) USD 74.0 Billion Forecast Revenue (2034) USD 118.3 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tropical, Herbaceous, Temperate), By Cultivation Method (Culms, Rhizomes, Seeds, Others), By Irrigation Method (Drip Irrigation, Flood Irrigation, Rainwater Irrigation), By End-Use (Furniture, Scaffolding, Engineered bamboo, Pulp and Paper, Charcoal and Activated Carbon, Handicrafts, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape MOSO International B.V., Bamboo Australia, Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd, Simply Bamboo PTY LTD, Xiamen HBD Industry & Trade Co., Ltd, Dasso Group, Smith and Fong Limited, ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Fujian HeQiChang Bamboo Product Co., Ltd., BambroTex Inc., Cali Bamboo LLC, Oceans Republic, EcoPlanet Bamboo, Kerala State Bamboo Corporation Ltd (KSBC) Customization Scope Customization for segments at, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- MOSO International B.V.

- Bamboo Australia

- Bamboo Village Company Limited

- Shanghai Tenbro Bamboo Textile Co., Ltd

- Simply Bamboo PTY LTD

- Xiamen HBD Industry & Trade Co., Ltd

- Dasso Group

- Smith & Fong Limited

- ANJI TIANZHEN BAMBOO FLOORING CO. LTD

- Fujian HeQiChang Bamboo Product Co., Ltd.

- BambroTex Inc.

- Cali Bamboo LLC

- Oceans Republic

- EcoPlanet Bamboo

- Kerala State Bamboo Corporation Ltd (KSBC)