Global Pet Food Market By Product Type (Dry Food, Wet Food and Snacks/Treats), By Pet Type (Dog and Cat), By Source(Animal, Plant), By Distribution Channel(Supermarkets/ Hypermarkets, Convenience Stores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 21390

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

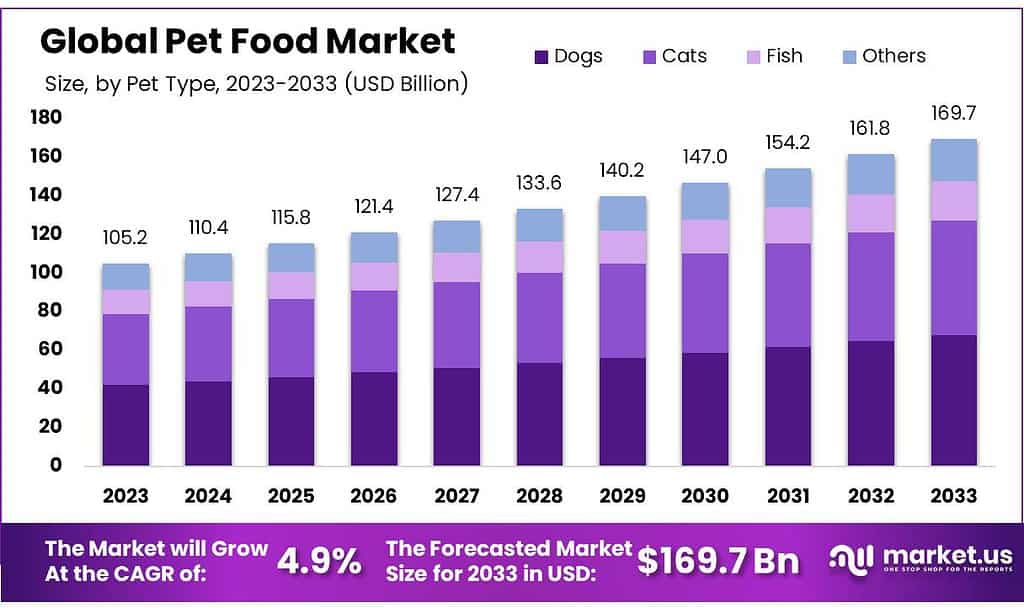

The global Pet Food market size is expected to be worth around USD 169.7 Billion by 2033, from USD 105.2 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

Pet food markets can be broadly defined as economic systems and industries focused on producing, distributing, and selling food products made specifically to satisfy the nutritional needs, taste preferences, and health requirements of domesticated animals such as dogs, cats, birds, and other domesticated species.

They come in all forms including dry pet food products (poultry feed), canned pet food as well as many others tailored specifically towards meeting different breed’s specific requirements.

The pet food market is driven by factors like pet ownership trends, humanization of pets, advances in pet nutrition science, and shifting consumer tastes for various forms of food available for their pets – from dry kibble to wet/canned food; semi-moist treats; specialty diets tailored specifically for life stages/health conditions of pets.

Pet food markets operate worldwide and involve numerous stakeholders such as manufacturers, distributors, retailers and pet owners – each endeavoring to ensure companion animals’ health, well-being and welfare.

Key Takeaways

- By 2033, the global pet food market is expected to reach USD 169.7 billion, growing from USD 105.2 billion in 2023 with a CAGR of 4.9%.

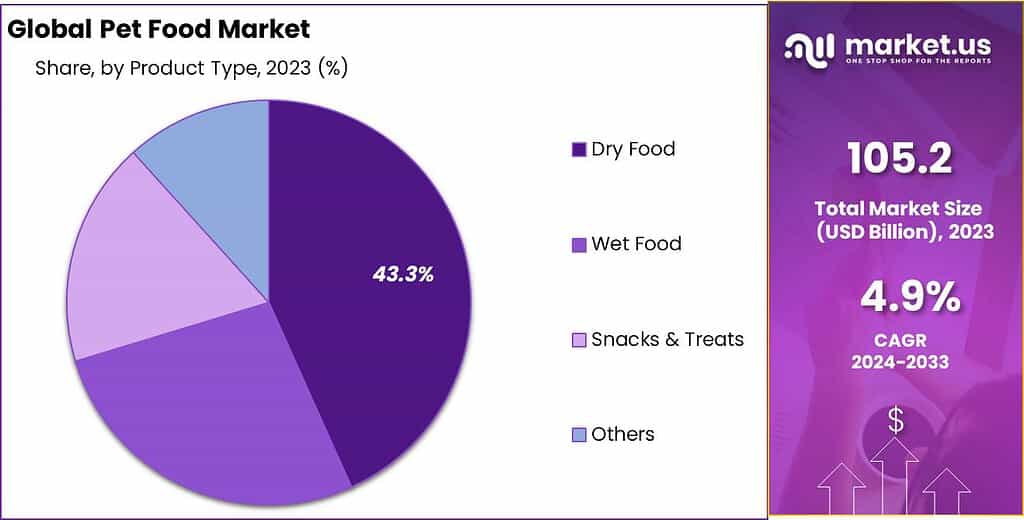

- Dry food, accounting for 43.3% of the market in 2023, is popular for its benefits like maintaining healthy teeth in dogs.

- Dogs made up 40% of the pet food market revenue in 2023, with rising consumer focus on dog health and care.

- Animal-source products dominate the pet food market, while plant-based options cater to specific dietary needs.

- In 2023, supermarkets/hypermarkets were the leading distribution channel, holding 42.8% of the pet food market share.

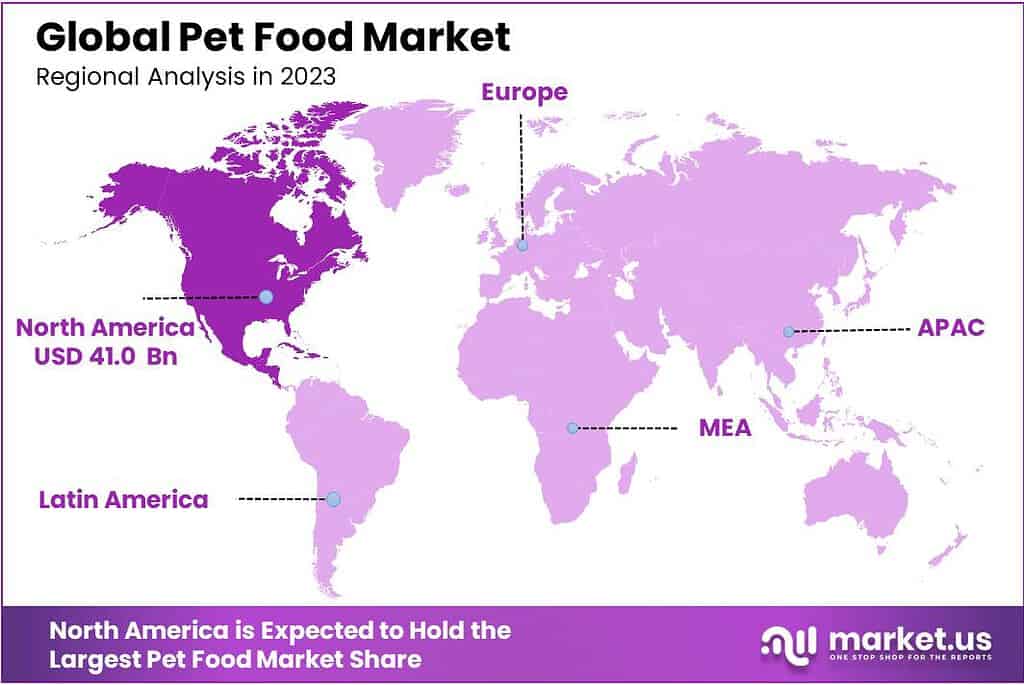

- North America led the regional market in 2023 with 39.3% of global revenues, driven by trends in pet humanization.

Product Type Analysis

Dry food made up 43.3% of the total market’s largest share for 2023. It’s useful for maintaining healthy teeth in dogs and reducing plaque buildup. This product provides the necessary crunch and chewing for animals’ overall health. Dry food doesn’t need to be frozen as canned food for pets.

The high level of moisture in this product makes sure that pets are hydrated. They also provide benefits to the bladder. The high cost of this product, particularly canned meat-based protein canned food may limit its appeal to consumers, which could hinder the segment’s growth over the forecast period.

Pet snacks are preferred because they provide a better way for pets to eat more nutritious and higher quality based on ingredient type. Treats can be used as a key trend of products to encourage good behavior. Snacks often consist of baked availability of products such as roasted grains, biscuits, dried fruits, and vegetables.

*Actual Numbers Might Vary In The Final Report

Pet Type

In 2023 alone, the dog segment made up 40% of global revenue. Increased consumer awareness regarding pet care has led to a greater emphasis on dog weight and overall pet health. Demand customers are increasingly choosing among multiple quality food options and heavily relying upon the brand of each product.

The key companies continue to focus on the premium food products market and increase their overall profit margin.

The growing trend of owning multiple cats is driving product demand, particularly in North America. Cats are less trained than dogs and can spend more time on their own. It is cheaper to owe cats than it is to a dog.

Innovative products for birds and fish as well as reptiles make up the second application segment. These animal categories will see lower product demand than those for dogs and cats. As compared with dogs and cats, this segment will have low product demand due to their short lives and slow food consumption.

By Source

Animal Source: The animal source segment in the pet food market predominantly comprises products derived from animal proteins and fats. These ingredients are sourced from various animals, including poultry, beef, lamb, fish, and other meat sources.

Plant Source: The plant source segment includes pet food products primarily formulated with ingredients derived from plants, grains, and vegetables. This segment caters to the dietary needs of pets with specific health conditions, dietary restrictions, or those following vegetarian or vegan diets.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 42.8% share in the pet food market. These large retail spaces offer a wide variety of pet food brands and products, providing consumers with a convenient one-stop shopping experience.

The aisle dedicated to pet care in supermarkets and hypermarkets is often well-stocked, showcasing different formulations, flavors, and brands to cater to diverse pet preferences.

Online Retailers emerged as a robust player in the pet food market, securing a substantial market share. With the ease of browsing, ordering, and doorstep delivery, pet owners increasingly turn to online platforms for the convenience and time-saving benefits they offer.

The rise of e-commerce has facilitated access to a broader range of specialty and niche pet food products, meeting the specific needs of different pets and their owners.

Convenience Stores, while holding a smaller market share, play a significant role in the pet food distribution landscape. These stores offer a quick and accessible option for pet owners to grab essentials. With a focus on convenience, these outlets often stock popular and widely consumed pet food products, ensuring accessibility for consumers with immediate needs.

Key Market Segments

By Product Type

- Dry Food

- Wet Food

- Snacks/Treats

By Pet Type

- Dog

- Cat

- Fish

- Others

By Source

- Animal

- Plant

By Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience Stores

- Online Retailers

- Others

Driving Factors

Rising Pet Ownership across Developing Economies to Aid Growth

More people getting pets worldwide, especially in developing areas, is a big reason the market is growing. Cities growing and folks treating pets like family mean more demand for healthy pet food, making the market grow faster.

As people make more money, they’re spending it on better food for their pets. It’s not just about healthy and organic pet food; it’s also about having options at different prices. This is a big deal for the global market, reaching people with different budgets.

Increasing Innovation by Pet Food Manufacturers to Positively Influence the Market

Big companies around the world are making lots of different pet foods for all kinds of animals and ages. They’re doing this to make the global market bigger. Lately, companies like General Mills, Nestle, and Mars Inc. started selling fancy pet foods to get people’s attention and meet the needs of growing pets.

Restraining Factors

Stringent Regulations Associated with Pet Food to Obstruct Market Growth

Pet food is super-regulated, especially in Western countries. They check everything from making the food to selling it. This strictness can slow down the market’s growth. Also, in some developing places, not many people like or can afford expensive pet food, which makes it tough for the market to grow.

So, in developed countries, they watch pet food closely at every step. This makes it hard for the market to grow fast. And in some developing countries, people don’t really go for expensive pet food, which is another thing holding back the market’s growth.

Opportunity

Diverse Products Catering to Pet Needs

Pet food manufacturers are innovating with a variety of products to meet the needs of different animals and age groups. This presents an opportunity for market growth, providing diverse options for pet owners.

Challenge

Competitive Pressure and Premium Offerings

Intense competition among key players like General Mills, Nestle, and Mars Inc. in offering premium products poses a challenge. While it drives innovation, it also increases the need for companies to stand out in a crowded market.

Regional Analysis

North America led the market and held 39.3% of global revenues in 2023. The rise in consumer awareness and the increasing humanization of animals are two major factors that drive regional demand for pet foods.

In 2023, the demand for pet food in North America’s Food and Beverage sector hit USD 41.0 billion, and there’s a strong anticipation of significant growth in the upcoming period.

Market rapid growth is also expected to be supported by the growing trend among millennials to adopt pets. According to the American Pet Products Association (APPA), approximately 38% own cats in the United States, with an average of two cats per home.

Europe is expected to experience a 4.5% increase in revenue over the forecast time. According to the European Pet Food Industry Federation FEDIAF (European Pet Food Industry Federation), more than 80 million households in Europe own at most one pet. Cat food products dominate the market in this region due to the high level of cat ownership.

Asia Pacific, dominated by China Japan, India, and South Korea, emerged in 2018 as one of the major global markets. The increased demand for premium dog nutrition can be explained by the steady pet food market growth of these markets. According to the Alltech Global Feed Survey (April 2023), pet food production in Asia Pacific increased up to 3%.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of the Middle East & Africa

Key Players Analysis

Major Pet food manufacturers’ market players are heavily inclined toward expansion, mergers & acquisitions, and new product developments. Product differentiation is still an important factor in increasing sales.

Market Key Players

- Mars Petcare Inc.

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- J.M. Smucker

- Blue Buffalo

- Diamond Pet Foods

- WellPet

- Ainsworth Pet Nutrition

- Merrick Pet Care

- Big Heart Pet Brands

- Deuerer

- Central Garden Pet Company

- Other Key Players

Key Industry Development

In July 2021, Nestlé Purina PetCare Co. put $182 million into making its pet care products factory in Virginia, US bigger. They’re planning to finish the expansion by late 2023, adding 138,000 square feet to make more Tidy Cat litter products.

Mars Inc. did something in June 2021 too. They started selling wet cat food in India under their Whiskas brand. You can get it in pet shops, grocery stores, and online.

Also in June 2021, Hill’s Pet Nutrition opened a big 25,000 square feet center in the US. This place helps them create cool products just for small and mini dogs.

Report Scope

Report Features Description Market Value (2022) USD 105.2 Bn Forecast Revenue (2032) US$ 169.7 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type (Dry Food, Wet Food and Snacks/Treats), By Pet Type (Dog,Cat, Fish, Others), By Source(Animal, Plant), By Distribution Channel(Supermarkets/ Hypermarkets, Convenience Stores, Online Retailers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Mars Petcare Inc., Nestlé Purina PetCare, Hill’s Pet Nutrition, J.M. Smucker, Blue Buffalo, Diamond Pet Foods, WellPet, Ainsworth Pet Nutrition, Merrick Pet Care, Big Heart Pet Brands, Deuerer, Central Garden Pet Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

How much is the Pet Food Market worth?Pet Food market size is expected to be worth around USD 169.7 Billion by 2033, from USD 105.2 Billion in 2023.

What is the CAGR of Pet Food Market?The global Pet Food Market is growing at a CAGR of 4.9% during the forecast period 2022 to 2033.Who are the major players operating in the Pet Food Market?Mars Petcare Inc., Nestlé Purina PetCare, Hill's Pet Nutrition, J.M. Smucker, Blue Buffalo, Diamond Pet Foods, WellPet, Ainsworth Pet Nutrition, Merrick Pet Care, Big Heart Pet Brands, Deuerer, Central Garden Pet Company, Other Key Players

-

-

- Mars Petcare Inc.

- Nestlé Purina PetCare

- Hill's Pet Nutrition

- J.M. Smucker

- Blue Buffalo

- Diamond Pet Foods

- WellPet

- Ainsworth Pet Nutrition

- Merrick Pet Care

- Big Heart Pet Brands

- Deuerer

- Central Garden Pet Company

- Other Key Players