Global Honey Market By Processing (Organic, Conventional), By Product Type (Alfalfa, Acacia, Wildflower, Buckwheat, Clover honey, Others), By Application (Food And Beverages, Personal Care, Pharmaceutical, Others), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 67254

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Honey Market Overview

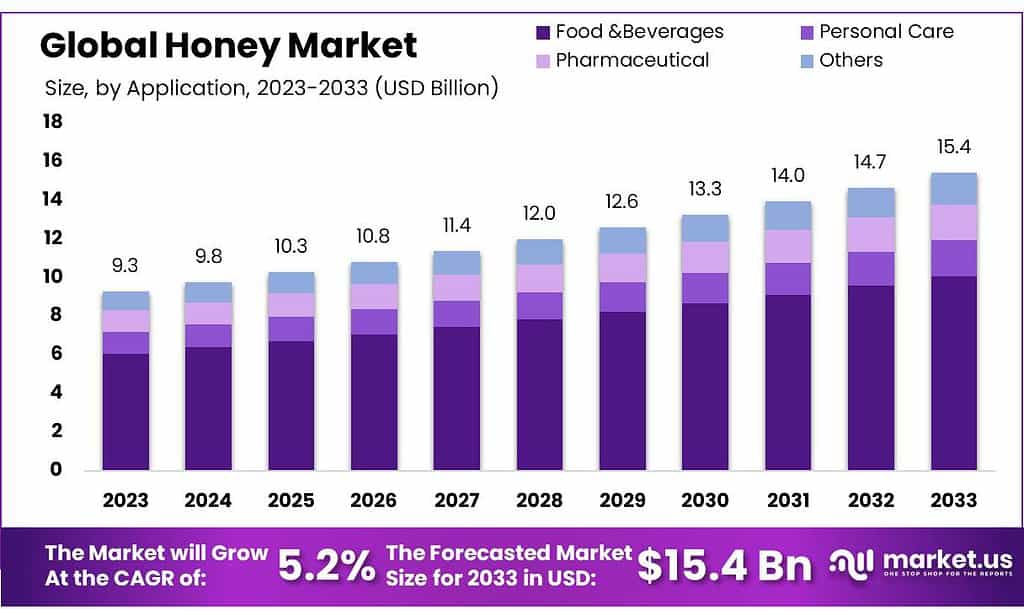

The global honey market size is expected to be worth around USD 15.4 billion by 2033, from USD 9.3 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

Honey is a rich source of vitamins, minerals, and antioxidants, making it an ideal sweetener choice for consumers. A prominent market driver is a high demand for nutritious products, as more people realize the benefits of honey and the importance of healthy living. Customers opt for natural and healthy food products such as honey instead of white sugar.

Even after the end of the pandemic customers have a demand for immunity-boosting products, which can add to the profits of the market.

Honey intake helps to reduce blood sugar levels in the human body and it reduces cholesterol and improves lipid metabolism in our body. The rise in diabetic patients and patients who are suffering from high obesity and cholesterol are constantly searching for a healthy, nutritious, and natural alternative to sugar, so instead of artificial sweetener products, consumer demands a source of honey.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: By 2033, it is anticipated that the global honey market will reach approximately USD 15.4 billion at an average compound annual growth rate (CAGR) rate of 5.2% from its value of USD 9.3 billion as reported in 2023.

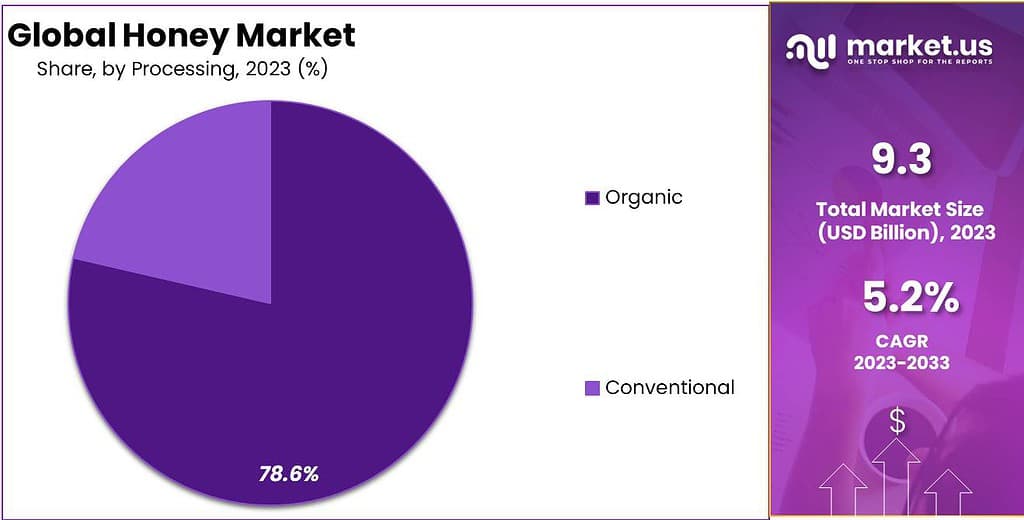

- Processing Analysis: Conventional honey held an estimated Honey market share of 786 percent as of 2023 due to its lower price and greater availability, while organic varieties are expected to experience compound annual compounded annual growth at 5.2% between 2023-2032 due to an increasing emphasis on healthier diets.

- Variety of Honey Types: There is an array of honey varieties, from Alfalfa and Buckwheat honey to Acacia honey, Wildflower honey, and Clover honey, designed to satisfy diverse consumer preferences. Buckwheat holds the largest market share due to its intense and flavorful characteristics;

- By Application: Honey can be found in food and beverage applications at 65.3% market share; its moisturizing and medicinal qualities also make it popularly utilized by cosmetic and pharmaceutical products.

- Distribution Channels: Hypermarkets and supermarkets captured 38.6% market share as of 2023, while online distribution channels are expected to experience rapid growth at 6.2% annually between 2023-2032 as shoppers increasingly turn toward digital shopping methods.

- Market Drivers: Honey is driven by consumer demand for healthier sweeteners, particularly due to its long shelf life and health advantages compared to regular sugar. As such, its market growth can be expected to remain robust.

- Market Challenges: Honey fraud has increased substantially, undermining quality and slowing market expansion. Meanwhile, alternative products like Stevia and Maple Syrup are quickly gaining ground posing competition to honey.

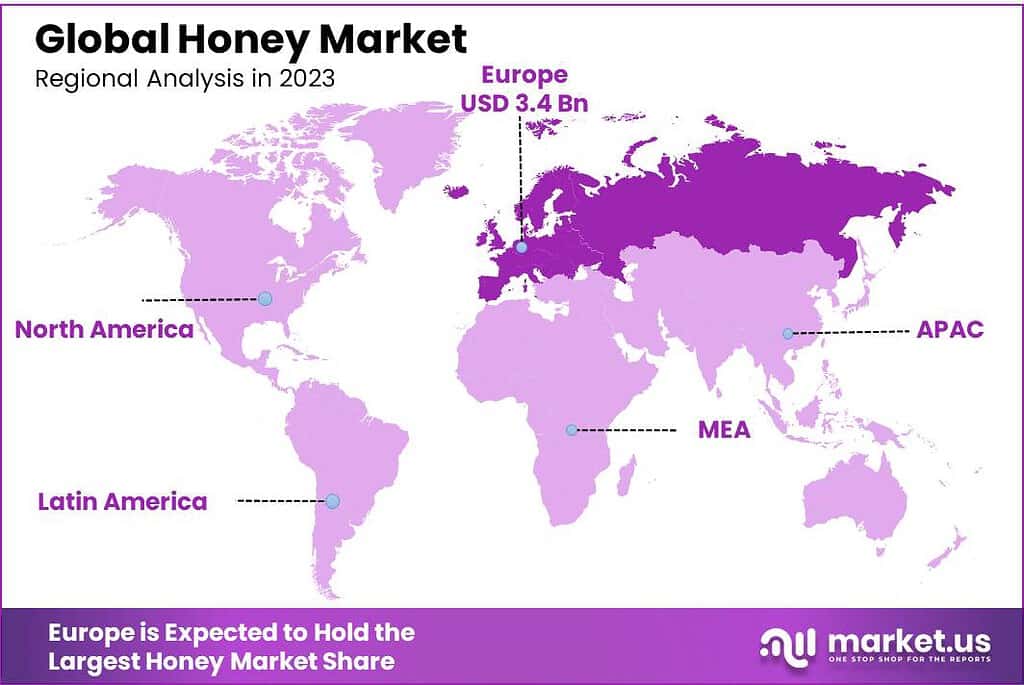

- Regional Analysis: Europe held the largest share in 2023 of revenue at 36.7% and Asia Pacific is forecasted to experience the highest compound annual compounding growth between 2023-2032, while key players dominate regional markets.

- Key Market Players: Major players in the honey market include Amul, Dabur, Capilano Honey Co. Ltd, and New Zealand Honey Co.; they each employ various initiatives in order to remain competitive in this highly specialized arena.

Processing Analysis

The competitive landscape with the Processing segment had the honey market revenue share, exceeding 78.6% in 2023. It is expected that it will continue to lead the market over the forecast period due to its lower price and wider availability compared to the organic honey market.

The conventional segment will continue to grow as new flavors and exotic add-ons are introduced. Organics are expected to grow at 5.2% annually between 2023-2032, due to the rising trend in eating healthier among millennials.

The substitution of plant-based natural sweeteners will accelerate the market growth rate with natural honey sweeteners in the future.

The availability of products and its ability to impart Key players in the market have huge market opportunities to grow because of the rising population and shift to honey sweeteners.

The extensive supply of contaminated products in the local and global markets has resulted in unprofitable for high-quality and pure product producers.

*Actual Numbers Might Vary In The Final Report

By Product Type

Alfalfa honey gained popularity because of its light color and mild taste. People who preferred a subtle and delicate flavor in their honey found Alfalfa honey appealing.

Buckwheat Honey held a dominant market position in 2023, capturing over 32.4% of the market share. Its dark color and strong, molasses-like taste appealed to those looking for a more intense and flavorful honey option.

Acacia honey stood out for its unique floral flavor. It became increasingly popular as consumers appreciated its gentle and fragrant taste, making it a sought-after choice in the market.

Wildflower honey, derived from a mix of nectar sources, offered a more robust and complex flavor profile. This segment attracted consumers who desired a diverse and rich honey experience.Clover honey, one of the most common types, gained popularity for its mild and sweet flavor. This segment remained a popular choice among consumers who preferred a classic and familiar honey taste.

Lastly, the “Other” segment included various types of honey not specifically mentioned. This segment catered to niche preferences and offered a wide range of unique flavors and characteristics.

Overall, in 2023, the honey market showcased a diverse array of product types, each with its own distinct appeal. Buckwheat honey emerged as the market leader, indicating a growing demand for intense and flavorful honey options.

By Application

Food and beverages, held a dominant market position, capturing over 65.3% of the market share. This segment’s popularity stemmed from the widespread use of honey as a natural sweetener and flavor enhancer in various food and beverage products.

The Personal Care segment also played a significant role in the honey market. Honey’s natural moisturizing and nourishing properties make it a sought-after ingredient in skincare and haircare products. Consumers value honey for its potential benefits in enhancing skin and hair health.

In the Pharmaceutical segment, honey found applications in various medicinal products. Its antimicrobial and soothing properties made it a valuable ingredient in cough syrups, wound dressings, and other healthcare formulations.

Overall, in 2023, the Food & Beverages segment dominated the honey market, driven by the widespread use of honey as a natural sweetener and flavoring agent. The Personal Care and Pharmaceutical segments also played significant roles, capitalizing on honey’s beneficial properties.

Distribution Channel Analysis

The largest revenue share was captured by hypermarkets & supermarkets, at over 38.6% in 2023. Increased penetration by independent retailers like Costco and Walmart is increasing product visibility and attracting a greater consumer base.

These consumers prefer to inspect the product before they buy, which is increasing sales through this channel. Online distribution channels are expected to grow at 6.2% between 2023 and 2032. The shift in consumer purchasing patterns and significant lifestyle changes are driving consumers to switch from offline channels to online.

Online platforms are a great way to grow the segment. They offer convenience, better product visibility, and home delivery. Most consumers use virtual shops to navigate the vast array of products on offer and to find the return and exchange options that they need if they aren’t satisfied with the products. These stores offer greater accountability and superior customer service.

Кеу Маrkеt Ѕеgmеntѕ

By Processing

- Conventional

- Organic

By Product Type

- Alfalfa

- Acacia

- Wildflower

- Buckwheat

- Clover honey

- Others

By Application

- Food &Beverages

- Personal Care

- Pharmaceutical

- Others

By Distribution Channel

- Convenience Stores

- Online

- Hypermarkets & Supermarkets

- Others

Driver

Healthier Sweeteners Growth.

Honey has quickly become one of the preferred natural sweeteners due to its beneficial health properties. Consumers who prioritize healthy living often switch out regular sugar for something healthier like honey for various health-related issues that come from its consumption, including obesity, diabetes, and heart disease.

Honey not only sweetens but also provides antioxidants, germ-fighting abilities as well as essential vitamins and minerals making it a top pick; plus its freshness remains for an extended period without much cost involved – increasing consumer interest further!

Restraint

Measures have been implemented.

Honey Fraud Recently, there has been an upsurge in honey fraud. This compromises its quality and slows market expansion; according to U.S. Pharmacopeia’s Food Fraud Database, honey is now one of the three most frequently adulterated food items, after milk and olive oil.

Adulteration also affects the profits of good, pure honey makers while other alternatives like Stevia or Maple Syrup gain in popularity and create additional competition with honey producers.

Opportunity

Expanding Honey’s Application in Different Fields

Honey has become an invaluable ingredient across various industries due to its nutritional benefits, being used as an ideal replacement for sugar or artificial sweeteners in making food and drinks, healthcare treatments such as cough syrups containing honey as an antidote for congestion issues; people seeking natural solutions for skin ailments have increased demand further while big businesses have developed beauty and cosmetic products with honey in them in order to attract customers.

Challenge

Sustainability of Large-Scale Beekeeping

Commercial honey production presents some serious environmental concerns. Global bee populations have decreased as people use land more intensively; as commercial beekeeping grows to meet rising honey demand, bee populations may expand beyond natural levels, potentially pollinating fewer plants than they should and ultimately weakening world food supplies.

Commercial beekeeping could even result in bee colonies disbanding which would further harm our world environment in the future – this presents yet another environmental challenge to face head-on!

Regional Analysis

Europe held the largest share of revenue at 36.7% or more in 2023. It is expected that it will continue to lead the market over the forecast period. A rapidly improving economy as a result of rising disposable income, urbanization, and changing lifestyles will drive product demand in each region and increase market growth over the next few years.

European demand for honey within the Food and Beverage sector reached a valuation of USD 3.4 billion in 2023, with expectations of substantial growth in the forecast period.

Asia Pacific is predicted to experience the greatest CAGR between 2023-2032. Market growth is being driven by consumers’ increased desire for healthy and delicious food habits.

Asia Pacific’s market is driven by well-established companies and the growing millennial population. Jedwards International, Inc., Koru Natural, and Pacific Resources International dominate the market. A rise in the consumption of honey and an increase in honey production are the main factors that will favor regional market growth.

Key Regions and Countries

- North America

- The United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Honey market Analysis is fragmented. The market is dominated by a few large key companies and a few medium players. To be competitive in the market, key strategic initiatives are being taken by industry players such as product launches.

Amul launched a brand new product in September 2023. It was developed by the Gujarat Cooperative Milk Marketing Federation Ltd. Along with the National Bee Board. The government now promotes beekeeping among small-scale farmers with this initiative.

Dabur is one of the largest Ayurvedic companies in India. Dabur India Ltd.’s entry into syrups and spreads was announced in July 2023 with the launch of ‘Dabur Honey Tasties. It is available in Strawberry or Chocolate. Conscious Food launched a raw, unprocessed Himalayan multiflora bee honey in May 2023. Conscious Food is a pioneer in Indian organic food products.

Маrkеt Кеу Рlауеrѕ

- Beyond the Hive

- Barkman Honey LLC

- Dabur India Ltd.

- Capilano Honey Ltd.

- New Zealand Honey Co.

- Streamland Biological Technology Ltd.

- Oha Honey LP

- Billy Bee Honey Products

- Comvita Ltd.

- Gold Honey Inc.

- Honey Limited

- Dutch Gold Honey Inc.

- Comvita Food Ltd.

- Comvita China Ltd.

- Other Key Players

Recent Development

January 2022: Sweet Harvest Foods Inc., one of the leading manufacturers of honey and other natural sweeteners, acquired Nature Nate’s Honey Co. Nature Nate’s offers 100% pure, raw & unfiltered honey to consumers through retail shops across the nation.

January 2022: Tayima Foods announced the launch of its latest product, I’M HONEY, which is 100% raw and organic honey. The product has high medicinal value and comes in some unique flavors. The launch was in line with the digital India program, where the product was made available through no-contact retail kiosks and on Amazon.

Report Scope

Report Features Description Market Value (2023) USD 9.3 Billion Forecast Revenue (2033) USD 15.4 Billion CAGR (2023-2032) 5.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Processing (Organic, Conventional), By Product Type (Alfalfa, Acacia, Wildflower, Buckwheat, Clover honey, Others), By Application (Food And Beverages, Personal Care, Pharmaceutical, Others), By Distribution Channel (Hypermarkets and supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Beyond the Hive, Barkman Honey LLC, Dabur India Ltd., Capilano Honey Ltd., New Zealand Honey Co., Streamland Biological Technology Ltd., Oha Honey LP, Billy Bee Honey Products, Comvita Ltd., Gold Honey Inc., Honey Limited, Dutch Gold Honey Inc., Comvita Food Ltd., Comvita China Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the honey market?The global honey market size is expected to be worth around USD 15.4 billion by 2033, from USD 9.3 billion in 2023, during the forecast period from 2023 to 2033.

What is the projected CAGR at which the Honey market is expected to grow at?The Honey market is expected to grow at a CAGR of 5.3% (2023-2033).List the key industry players of the Honey market?Beyond the Hive, Barkman Honey LLC, Dabur India Ltd., Capilano Honey Ltd., New Zealand Honey Co., Streamland Biological Technology Ltd., Oha Honey LP, Billy Bee Honey Products, Comvita Ltd., Gold Honey Inc., Honey Limited, Dutch Gold Honey Inc., Comvita Food Ltd., Comvita China Ltd., Other Key Players

-

-

- Beyond the Hive

- Barkman Honey LLC

- Dabur India Ltd.

- Capilano Honey Ltd.

- New Zealand Honey Co.

- Streamland Biological Technology Ltd.

- Oha Honey LP

- Billy Bee Honey Products

- Comvita Ltd.

- Gold Honey Inc.

- Honey Limited

- Dutch Gold Honey Inc.

- Comvita Food Ltd.

- Comvita China Ltd.

- Other Key Players