Global Edible Insects Market By Insect Type (Beetles, Cricket, Caterpillar, Hymenoptera, Orthoptera, Tree Bugs, Others), By Type (Insect Powder, Insect Meal, Insect Bar, Insect Paste, Insect Oil, Others) By Application (Food & Beverages, Cosmetics, Health Supplements, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 24557

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

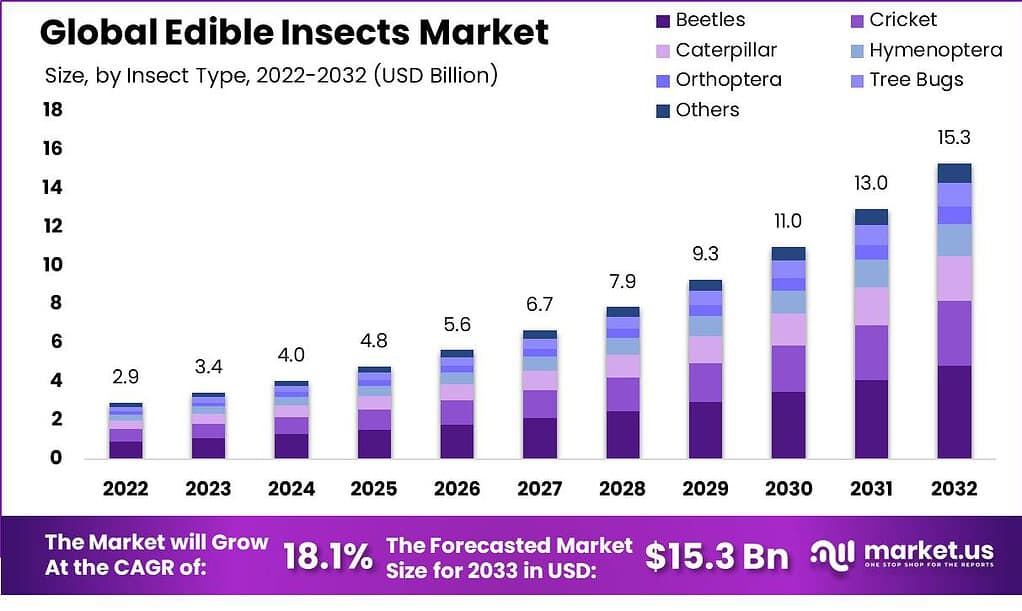

The Global Edible Insects Market is anticipated to be USD 15.3 billion by 2032. It is estimated to record a steady CAGR of 18.1% in the Forecast period 2022 to 2032. It is likely to total USD 3.4 billion in 2023.

Edible insects are insects consumed by humans to provide food. They’ve been a component of the traditional diets of various cultures across the globe for many centuries and continue to be eaten today. They are high in nutrients, protein as well as vitamins, minerals and healthy fats. This makes them a possible viable and healthy food option that is sustainable and nutritious.

Edible insects include a broad range of species, such as caterpillars, beetles, crickets, grasshoppers and mealworms as well as ants and beetles. They are available in a variety of forms, like whole insects, or ground into flours or powders, or as a component in processed food items.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Size: The Edible Insects Market is anticipated to reach USD 15.3 billion by 2032, with an estimated steady CAGR of 18.1%.

- Insect Types Analysis: Beetles held the dominant market position in 2023, capturing more than a 31.6% share due to their nutritional value and culinary versatility.

- Product Types Analysis: Insect Powder held a dominant market position in 2023, capturing more than a 40% share, used widely in various food products.

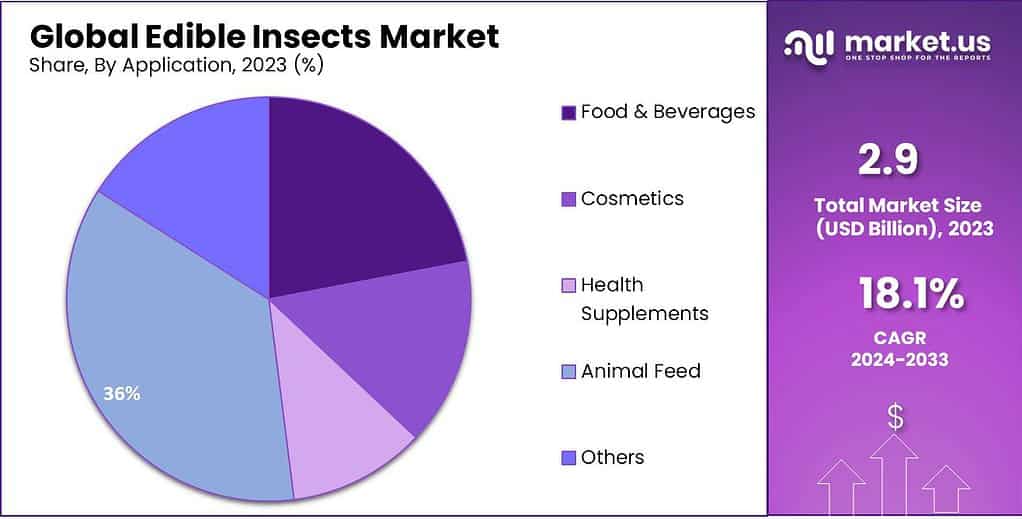

- Application Analysis: The Animal Feed segment held a dominant market position in 2023, driven by the demand for sustainable protein sources.

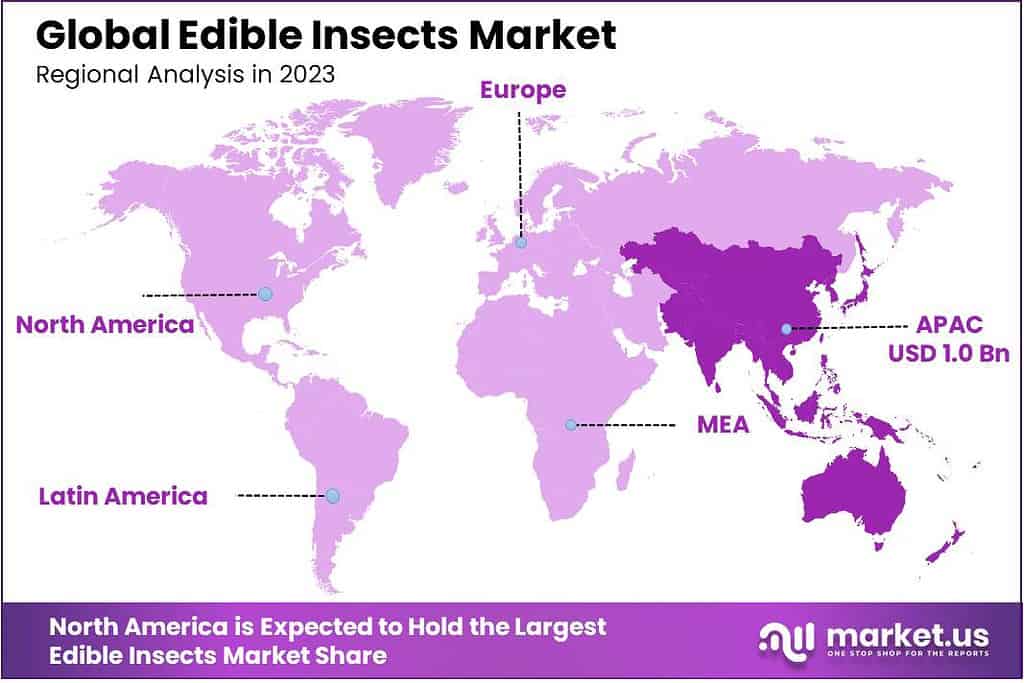

- Regional Analysis: In 2023, the Asia-Pacific (APAC) region had the highest market share, driven by cultural acceptance and consumption of insect products.

- Drivers: Drivers include nutritional awareness, health-conscious youth, environmental benefits, and global food shortages.

- Restraints: Restraints include cultural and psychological barriers, regulatory hurdles, and allergenic potential.

- Opportunities: Opportunities include expanding product range, B2B growth, and exploring emerging markets.

- Challenges: Challenges include scaling production, quality assurance, competition, market education, and price point.

- Key Market Players: Top key players in the Edible Insects Market include Beta Hatch Inc., Deli Bugs Ltd., InnovaFeed, and others.

Insect Type Analysis

In 2023, the Beetles segment held a dominant market position in the Edible Insects Market, capturing more than a 31.6% share. Beetles are one of the most widely consumed insect types due to their availability, nutritional value, and versatility in culinary applications. They are rich in protein, vitamins, and minerals, making them an attractive choice for consumers seeking a sustainable protein source. The Beetle segment is expected to maintain its leading position during the forecast period as awareness and acceptance of edible insects continue to grow.

The Cricket segment is also a significant contributor to the Edible Insects Market, accounting for a substantial market share. Crickets are widely recognized for their high protein content, balanced amino acid profile, and eco-friendly farming practices. These factors have propelled the demand for cricket-based products, including whole crickets, cricket flour, and cricket protein bars. The Cricket segment is expected to exhibit substantial growth, driven by increasing consumer acceptance and the incorporation of cricket-based ingredients in various food products.

Caterpillars represent another notable segment in the Edible Insects Market. They are widely consumed throughout the world and are well-known for their nutritional value as well as distinctive flavors. High in protein, healthy fats, and micronutrients caterpillars can be a good source of nutrition. The Caterpillar segment is anticipated to witness steady growth due to the cultural significance of caterpillar consumption in certain regions and the increasing interest in exploring diverse food options.

The Hymenoptera segment, which includes insects such as bees and wasps, is also gaining traction in the Edible Insects Market. Bees, particularly bee larvae and pupae, are consumed in certain cultures and are valued for their nutritional content, including proteins, fatty acids, and antioxidants. The Hymenoptera segment is projected to experience moderate growth, driven by the expanding awareness of their nutritional benefits and the development of innovative bee-based food products.

Orthoptera, which includes locusts and grasshoppers, is growing as a promising sector of the Edible Insects Market. Grasshoppers and the locusts are abundant in protein, fiber and other essential nutrients, which makes them a viable alternative to livestock. It is expected that the Orthoptera segment is predicted to grow significantly driven by the growing popularity of insect-based snacks powders, protein bars.

Tree Bugs and Other insect types, such as ants and silkworms, also contribute to the Edible Insects Market. These segments offer unique flavors and textures, appealing to adventurous consumers seeking novel culinary experiences. While currently holding a smaller market share, these segments are anticipated to witness moderate growth as awareness and acceptance of edible insects expand.

Product Analysis

In 2023, the Powder segment held a dominant market position in the Edible Insects Market, capturing more than a 40% share. Insect powders are widely utilized as a versatile ingredient in various food products, including bakery goods, snacks, and protein supplements. The powdered form offers convenience and ease of incorporation into recipes, making it a popular choice among manufacturers. Insect powders are rich in protein, fiber, and essential nutrients, contributing to their growing demand as a sustainable and nutritious food ingredient.

The Insect Meal segment is another significant contributor to the Edible Insects Market, accounting for a substantial market share. Insect meal is made by crushing whole insects into an extremely fine, meal-like consistency. It is used extensively in aquaculture, animal feed and pet food applications. Insect meal is a renewable protein source with low environmental impact, which makes it an appealing alternative for the animal nutrition industry. The Insect Meal segment is expected to witness steady growth, driven by the increasing demand for alternative protein sources in animal feed formulations.

Insect Bars have gained popularity among health-conscious consumers as a convenient and nutritious snack option. These bars are made by incorporating insect-based ingredients, such as cricket flour or mealworms, into a bar format. Insect bars offer a sustainable protein source, along with other essential nutrients, and cater to the growing demand for on-the-go, healthy snack alternatives. The Insect Bar segment is projected to experience significant growth, supported by the increasing consumer inclination toward sustainable and functional food products.

Insect Paste, derived from processed and pureed edible insects, is utilized in the production of sauces, spreads, and condiments. Insect pastes provide a unique flavor profile and nutritional benefits, enhancing the taste and nutritional value of various culinary creations. The Insect Paste segment is anticipated to witness moderate growth, driven by the expanding applications of insect-based condiments and the growing consumer interest in exploring novel taste experiences.

Insect Oil is gaining traction in the Edible Insects Market due to its potential health benefits and culinary versatility. Insect oil, derived from insects such as crickets or mealworms, is rich in omega-3 fatty acids, vitamins, and antioxidants. It is utilized in cooking, as a nutritional supplement, and in the cosmetics industry. The Insect Oil segment is expected to witness steady growth, driven by the increasing awareness of the nutritional properties of insect oils and their potential applications in various industries.

Other product types, including whole insects, snacks, and innovative insect-based food formulations, contribute to the Edible Insects Market. These segments offer diverse options for consumers seeking unique culinary experiences and sustainable protein sources. While currently holding a smaller market share, these segments are anticipated to witness growth as consumer awareness and acceptance of edible insects continue to expand.

Application Analysis

In 2023, the Animal Feed segment held a dominant market position in the Edible Insects Market, capturing more than a 36% share. Edible insects are increasingly recognized as a valuable ingredient in animal feed formulations due to their nutritional composition and sustainability. Insects, such as mealworms and black soldier fly larvae, offer a rich source of protein, healthy fats, and essential nutrients, making them a suitable alternative to traditional feed ingredients. The Animal Feed segment is driven by the growing demand for sustainable and high-quality protein sources in the livestock and aquaculture industries, as well as the need to address the challenges of feed production and environmental impact.

The Food & Beverages segment is another significant contributor to the Edible Insects Market, accounting for a substantial market share. Insects are incorporated into various food products, including snacks, bakery goods, pasta, and protein bars, to enhance nutrition, texture, and flavor. Edible insects offer a sustainable protein source and cater to the rising consumer demand for alternative and eco-friendly food options. The Food & Beverages segment is expected to experience continuous growth, driven by the increasing consumer acceptance and exploration of insect-based culinary innovations.

In the Cosmetics industry, edible insects are utilized for their beneficial properties in skincare and beauty products. Insect-derived ingredients, such as cricket powder or mealworm oil, are rich in antioxidants, vitamins, and essential fatty acids, offering potential benefits for skin health and rejuvenation. The Cosmetics segment is projected to witness steady growth, fueled by the rising demand for natural and sustainable ingredients in personal care products.

Health Supplements incorporating edible insects are gaining traction among consumers seeking functional and nutritious dietary supplements. Insect-based supplements, such as capsules or protein powders, provide a concentrated source of essential nutrients, including amino acids, vitamins, and minerals. The Health Supplements segment is anticipated to witness significant growth, driven by the increasing awareness of the nutritional benefits of edible insects and the growing interest in alternative protein sources for dietary supplementation.

The Edible Insects Market also finds application in Other sectors, including agriculture, pharmaceuticals, and biotechnology. In agriculture, insects are utilized for pest control and as pollinators, contributing to sustainable farming practices. In the pharmaceutical and biotech industries, insect-derived compounds are investigated for their potential medicinal and industrial applications. While currently holding a smaller market share, these segments offer diverse opportunities for the utilization of edible insects in various fields.

Drivers

The growth of the Edible Insects Market can be attributed to several key drivers:

- Nutritional Awareness: More people are learning about the health benefits of eating insects. Insects are packed with protein and can be a great alternative source of both protein and amino acids.

- Health-Conscious Youth: Young people, who are more open to experimenting with their diets and exploring new food sources, are driving the market forward. Their growing interest in health and wellness is making them curious about insect-based foods.

- Environmental Benefits: Eating insects is eco-friendly. It can reduce greenhouse gas emissions, a big issue with traditional livestock and poultry farming. This environmental angle is appealing to those who want to make sustainable food choices.

- Global Food Shortages: With food scarcity becoming a more pressing issue globally, high-quality alternatives like insect protein are gaining traction. This is pushing the edible insects market to grow.

Restraints

Despite the promising growth, the Edible Insects Market faces certain restraints:

- Cultural and Psychological Barriers: In many Western countries, there is a stigma associated with consuming insects. Overcoming this psychological barrier and changing consumer attitudes can be a slow and challenging process.

- Regulatory Hurdles: The regulatory framework for edible insects varies from country to country. Achieving standardized regulations can be a cumbersome process and may slow down market growth.

- Allergenic Potential: Some individuals may be allergic to specific insect proteins, posing a risk that needs careful consideration in product development.

Opportunities

The market for edible insects presents several exciting opportunities:

- Expanding Product Range: As consumer acceptance grows, there is an opportunity to diversify product offerings. This includes exploring various insect species and developing innovative insect-based recipes.

- B2B Growth: Edible insects can become a significant component of the business-to-business (B2B) supply chain. They are used in animal feed, pet food, and fertilizer production, offering a lucrative avenue for market growth.

- Emerging Markets: Exploring untapped markets in Asia, Africa, and Latin America, where insect consumption is more culturally accepted, can lead to substantial growth opportunities.

Challenges

The Edible Insects Market is not without its challenges:

- Scaling Production: Meeting the growing demand for edible insects while maintaining quality and sustainability requires significant advancements in insect farming techniques.

- Quality Assurance: Ensuring the safety and quality of insect-based products is crucial. This includes addressing concerns related to pesticide residues and contamination during production.

- Competition: The market is becoming more competitive, with numerous startups entering the space. Established players need to innovate and maintain product quality to stay ahead.

- Market Education: Educating consumers about the nutritional and environmental benefits of edible insects remains a challenge. Effective marketing and awareness campaigns are essential.

- Price Point: Keeping prices competitive with traditional protein sources is vital for market adoption, which can be challenging given the initial high production costs.

Key Market Segments

By Insect Type

- Beetles

- Cricket

- Caterpillar

- Hymenoptera

- Orthoptera

- Tree Bugs

- Others

Product Type

- Insect Powder

- Insect Meal

- Insect Bar

- Insect Paste

- Insect Oil

- Others

Application

- Food & Beverages

- Cosmetics

- Health Supplements

- Animal Feed

- Others

Regional Analysis

In 2023, it was reported that the Asia-Pacific (APAC) area had the highest share of the market for edible insects, with more than 32.6% of the world market share. The demand for Edible Insects in APAC was valued at USD 1.0 billion in 2023 and is anticipated to grow significantly in the forecast period. This is due to the long-standing acceptance of culture as well as the consumption and use of insect products in countries such as Thailand, China, and Vietnam. The market in APAC benefits from both a robust consumer base and significant production capabilities. Rapid urbanization and rising income levels in this region have further fueled the demand for processed and packaged insect-based foods.

Moving to North America, the market is experiencing steady growth, primarily driven by increasing health and environmental consciousness among consumers. In the United States and Canada, there’s a growing trend of incorporating insects into diets as a sustainable protein source. The region’s market is further bolstered by innovative startups and considerable investment in insect farming technologies. However, consumer reluctance and stringent food regulations sometimes pose challenges to market growth.

In Europe, the edible insects market is evolving rapidly, thanks to heightened awareness about sustainability and environmental impacts of traditional livestock farming. Countries like the Netherlands and Belgium are leading this charge, benefiting from relatively relaxed regulations and increasing public acceptance. The European market is also supported by strong research and development, particularly in processing technologies for insect-based foods, which is vital for expanding consumer appeal.

Latin America’s market, while still developing, shows potential due to traditional consumption patterns in countries like Mexico and Brazil. However, expanding the market beyond these traditional uses requires increased public awareness and educational efforts to introduce processed insect-based foods as viable dietary options.

The African market, with its history of entomophagy, provides a cultural foundation for the consumption of edible insects. Nevertheless, the market here is largely informal and faces challenges in standardization and developing export capabilities. The opportunity lies in formalizing the sector, which could enhance quality control and open up new markets.

Lastly, the Middle East region represents a nascent market with minimal current consumption of edible insects, largely due to cultural and dietary preferences. However, growing interest in sustainable food sources and food security issues could potentially drive market growth in the future.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The edible insects market is a rapidly evolving space, with several key players contributing to its growth and diversification. These companies range from startups innovating in insect farming methods to established food companies expanding their product lines to include insect-based foods.

Top Key Players

- Beta Hatch Inc.

- Deli Bugs Ltd.

- InnovaFeed

- AgriProtein Technologies

- Protix B.V

- Ynsect SAS

- ReeseFiner Foods Inc.

- Tiny Farms

- Aspire Food Group

- HaoCheng Mealworm Inc.

- Global Bugs Asia CO., Ltd

- Enviro Flight

- Hargol Foodtech

- Kreca V.O.F.LLC

- Armstrong Cricket Farm Georgia

- Entomo Farms

- EntoCube Ltd.

- Protifarm Holdings Nv

Recent Developments

- In September 2022, major South Korean snack and ice cream manufacturer Lotte Confectionery signed an agreement with Aspire Food Group, a leading Canadian edible insect agriculture and food technology company, to cooperate on alternative protein and insect food products. The memorandum of understanding brings together Lotte’s expertise in snack-making with Aspire’s advanced capabilities in sustainable insect rearing.

- The edible insect market saw further expansion in September 2022 as French firm InnovaFeed raised $250 million backed by agriculture giants ADM and Cargill. The funding will support InnovaFeed’s plans to construct a large-scale production facility focused on black soldier fly rearing in Decatur, Illinois. The facility aims to boost capacity to meet rising demand for insect ingredients.

- In April 2022, ValuSect, a European consortium of insect producers, provided €460,000 ($496,600) in business development services to 18 edible insect startups across North-West Europe. The selected companies will receive expert help to progress their innovative ideas and products in the insect food space. The initiative aims to improve insect rearing techniques and increase consumer acceptance in European markets through these startups.

Report Scope

Report Features Description Market Value (2023) US$ 3.4 Bn Forecast Revenue (2032) US$ 15.3 Bn CAGR (2023-2032) 18.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Insect Type (Beetles, Cricket, Caterpillar, Hymenoptera, Orthoptera, Tree Bugs, Others), By Type (Insect Powder, Insect Meal, Insect Bar, Insect Paste, Insect Oil, Others) By Application (Food & Beverages, Cosmetics, Health Supplements, Animal Feed, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Beta Hatch Inc., Deli Bugs Ltd., InnovaFeed, AgriProtein Technologies, Protix B.V, Ynsect SAS, ReeseFiner Foods Inc., Tiny Farms, Aspire Food Group, HaoCheng Mealworm Inc., Global Bugs Asia CO., Ltd, Enviro Flight, Hargol Foodtech, Kreca V.O.F.LLC, Armstrong Cricket Farm Georgia, Entomo Farms, EntoCube Ltd., Protifarm Holdings Nv Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are edible insects?Edible insects are insects that are safe and suitable for human consumption. They are rich in protein, vitamins, and minerals, making them a nutritious alternative to traditional sources of animal protein.

Why are edible insects gaining popularity?Edible insects are gaining popularity due to their sustainability and low environmental impact. They require less land, water, and feed compared to conventional livestock, making them an eco-friendly choice for food production.

How big is Edible Insects Market?The Global Edible Insects Market is anticipated to be USD 15.3 billion by 2032. It is estimated to record a steady CAGR of 18.1% in the Forecast period 2022 to 2032. It is likely to total USD 3.4 billion in 2023.

Which insects are commonly consumed?Commonly consumed edible insects include crickets, mealworms, grasshoppers, ants, and more. These insects are utilized in various culinary applications, from snacks to gourmet dishes.

Are there any challenges to the acceptance of edible insects?While acceptance is growing, challenges include overcoming cultural hesitations and the need for widespread education about the culinary and nutritional benefits of consuming edible insects.

What is the future outlook for the edible insects market?The edible insects market is expected to continue growing as awareness increases and more sustainable food practices gain prominence. Culinary innovations and a focus on environmental sustainability contribute to the positive outlook for the market.

-

-

- Beta Hatch Inc.

- Deli Bugs Ltd.

- InnovaFeed

- AgriProtein Technologies

- Protix B.V

- Ynsect SAS

- ReeseFiner Foods Inc.

- Tiny Farms

- Aspire Food Group

- HaoCheng Mealworm Inc.

- Global Bugs Asia CO., Ltd

- Enviro Flight

- Hargol Foodtech

- Kreca V.O.F.LLC

- Armstrong Cricket Farm Georgia

- Entomo Farms

- EntoCube Ltd.

- Protifarm Holdings Nv