Global Animal Feed Enzymes Market By Form(Dry, Liquid), By Source(Microorganisms, Plants, Animals), By Product(Carbohydrases, Phytases, Proteases, Other Products), By Application(Poultry, Ruminants, Swine, Aquatic Animals, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 15936

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

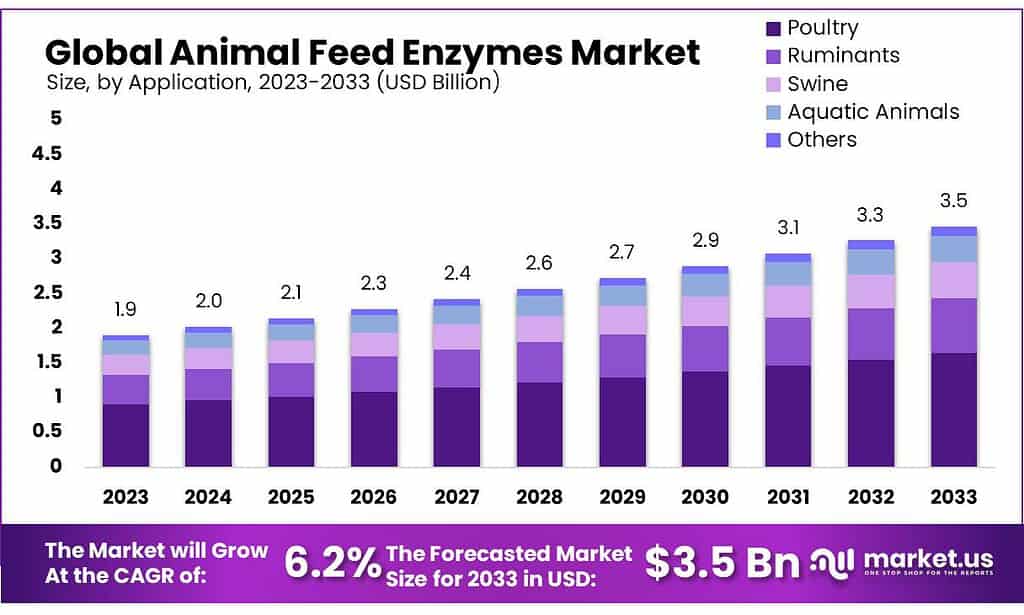

The Animal Feed Enzymes Market size is expected to be worth around USD 3.5 billion by 2033, from USD 1.9 Bn in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

Enzymes act as initiators and catalysts to improve various chemical or biochemical reactions. These products are used in multiple animal food processing as additives.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The Animal Feed Enzymes Market is expected to reach around USD 3.5 billion by 2033, marking a significant increase from USD 1.9 billion in 2023, with a growth rate of CAGR 6.2% annually.

- Enzyme Impact: Enzymes play a crucial role in animal nutrition by improving digestion and absorption of nutrients. For instance, phytase aids in phosphorus digestion, reducing waste and environmental impact.

- Product Impact: Carbohydrase enzymes aid in nutrient absorption, promoting healthy growth in animals. Proteases, the fastest-growing segment, assist in protein digestion, notably in the poultry and pig sectors.

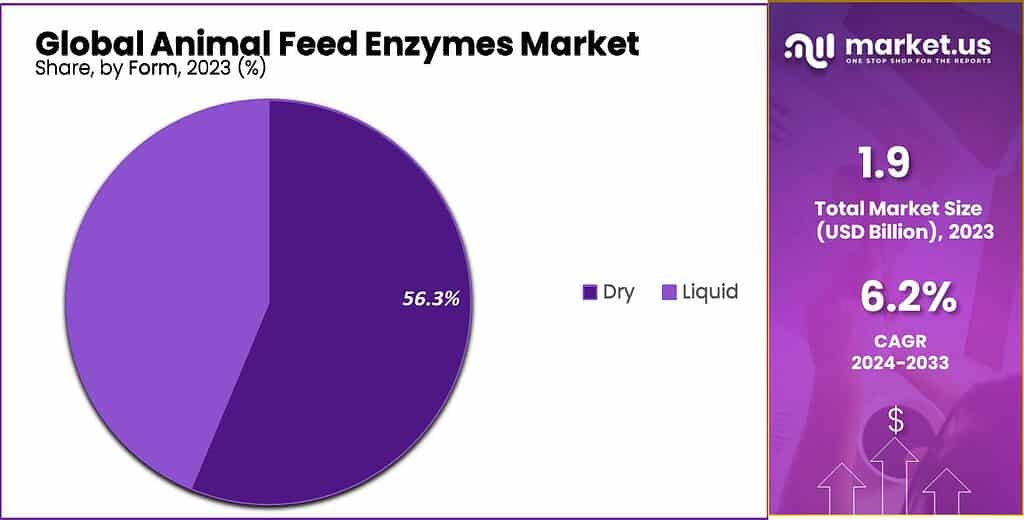

- Form Preferences: Dry enzymes dominate the market due to stability, longer shelf life, and ease of handling. These traits align with the cost-effectiveness sought by feed manufacturers, capturing over 56.3% market share in 2023.

- Application Significance: Sugarcane, as an application, holds over 70.3% of the market share in 2023 due to its vital role in providing beneficial enzymes for animal feed.

- Drivers: Increasing awareness among livestock farmers about feed utilization, meeting consumer demand for high-quality animal products, and the emphasis on sustainable agriculture are key drivers for market growth.

- Restraints: Stringent regulations, high production costs, limited awareness, and challenges in maintaining enzyme stability are major hurdles inhibiting widespread adoption.

- Opportunities: Enzymes align with rising demands for sustainable farming practices. Advancements in production technology, tailored nutrition, and growing global demands for animal protein create opportunities for market expansion.

- Challenges: Regulatory complexities, production costs, limited awareness, maintaining effectiveness under various conditions, and the need for ongoing R&D pose challenges to market growth.

Product Analysis

Phytase was the top enzyme on the animal feed market in 2023. This amazing enzyme helps animals digest phosphorus better, leading to healthier animals that produce less waste with excessive levels of phosphorus in their waste products – as well as fewer environmental issues linked to excessive amounts of phosphorus being expelled into the environment from waste by animals.

Carbohydrase enzymes help break down food for animals to more easily absorb essential vitamins and nutrients, improving their digestive systems to ensure growth while staying healthy. Carbohydrase enzymes play an integral part in helping them grow healthily and remain fit throughout life.

These products also help increase consistency in fodder, which can, in turn, improve livestock production. Proteases are expected to be the fastest-growing segment in the global industry. They are predicted to provide lucrative opportunities for the sector over the forecast period. These protein-digesting molecules are becoming more important in poultry, pigs, and other sectors.

Form Analysis

In the Animal Feed Enzymes Market, the dominance of the “Dry” form was evident in 2023, securing more than a 56.3% market share. This form of enzyme is favored for its practical advantages in the manufacturing process.

Dry enzymes exhibit greater stability, enabling longer shelf life, and prove to be more manageable during storage and transportation. These characteristics align with the efficiency and cost-effectiveness sought by feed manufacturers, contributing significantly to their preference in the market.

There are two types of commercial formulations for feed enzymes: liquid and dry. The dominant revenue share for the entire industry was in the dry formulation in 2021.

These products are more popular than liquid-based additives due to their ease of handling, high thermal stability, and enhanced enzyme activity. There are both powdered and pellet forms of dry formulations available on the global market. This category is expected to be used in significant numbers in poultry and ruminant feeds over the coming years.

Note: Actual Numbers Might Vary In The Final Report

Application Analysis

In 2023, Sugarcane emerged as a leading application in the Animal Feed Enzymes Market, capturing a dominant market position with more than a 70.3% share. Sugarcane stands as an indispensable resource when it comes to animal feed enzymes, serving an indispensable purpose by providing beneficial enzymes.

It is believed that enzyme consumption by pigs and ruminants can be increased at a rapid rate. Incorporating these additives in the processing of pig or ruminant foodstuffs is crucial for improving animal health, digestibility, and maximum utilization of nutrients, as well as minimizing the environmental footprint.

Key Market Segments

By Form

- Dry

- Liquid

By Source

- Microorganisms

- Plants

- Animals

By Product

- Carbohydrases

- Phytases

- Proteases

- Other Products

By Application

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Drivers

Animal feed enzymes market growth is propelled by multiple driving forces. One prominent one is an increasing awareness among livestock farmers about the significance of proper feed utilization to increase animal health and productivity, including effective utilization of enzymes within diets which aid with digestion of complex nutrients for greater absorption, improved feed efficiency, and subsequently enhanced animal growth.

As demand for high-quality animal products such as meat, dairy, and eggs increases, advanced feed solutions such as animal feed enzymes become even more essential in meeting consumer expectations for more nutritious food choices. Animal feed enzymes play an integral part in optimizing nutrient absorption to produce higher-grade animal products that fulfill consumer preferences for healthier and tastier eating choices.

As more emphasis is placed on sustainable agriculture practices and environmentally friendly farming techniques, enzymes have become an integral component of animal feed. Enzymes help mitigate environmental impact by optimizing nutrient utilization for efficient waste production from animal excretions. These drivers drive the expansion of the animal feed enzymes market, meeting evolving livestock industry needs while catering to consumer preferences and environmental considerations.

Restraints

Numerous factors present challenges and restraints to the growth of animal feed enzymes market. One significant impediment is its stringent regulatory framework surrounding approval and use. Compliance with ever-evolving global regulations necessitates extensive testing and validation processes; adding complexity and time delays during product development as well as market entry.

Cost is another constraint on enzyme production and formulation. The expenses incurred while researching, developing and manufacturing enzymes for animal feed may be substantial; high production costs might hamper their widespread adoption, particularly among smaller livestock farmers who may find them too economically burdensome.

Limitations in public understanding and awareness regarding animal feed enzymes present a challenge, so education and awareness initiatives must inform farmers of the advantages and effective utilization of these enzymes to boost animal nutrition and performance.

As enzymes are sensitive to environmental conditions and may deteriorate over time, compromising their effectiveness, it remains a significant challenge in the industry. Ensuring stable storage and distribution remains an arduous task. Overall, these restrictions impede animal feed enzyme adoption and expansion, necessitating efforts to overcome regulatory hurdles, lower production costs, increase awareness, and strengthen enzyme stability in feed formulations.

Opportunities

Animal feed enzymes offer numerous opportunities for expansion and advancement in agriculture. One such opportunity lies with the rising demand for sustainable and eco-friendly practices in animal husbandry; enzymes offer a sustainable solution by improving nutrient utilization in feed while simultaneously reducing wastage and environmental impacts – thus aligning themselves with rising sustainability goals in agriculture.

Technological advancements and innovations in enzyme production provide opportunities to increase enzyme efficiency, stability and cost-effectiveness. Furthermore, ongoing research and development efforts in enzyme formulations and delivery mechanisms pave the way for enhanced enzyme performance as well as better integration into animal diets.

Precision livestock farming and tailored nutrition present an immense opportunity for animal feed enzymes. Tailored solutions designed specifically to individual animal requirements may increase efficiency while simultaneously optimizing performance – opening doors for these specialized enzyme products. With an ever-increasing global population and its rising demand for animal protein, dairy, and aquaculture products driving efficient animal production methods.

Enzymes play an integral part in optimizing nutrient uptake, feed conversion rates, animal growth enhancement, as well as meeting rising global demands for high-quality animal products. With increasing awareness among consumers and livestock producers about animal welfare and health issues, enzymes have an opportunity to play an instrumental role in supporting better animal nutrition and digestion for improved animal well-being.

Challenges

The animal feed enzymes market faces several challenges that impact its growth and adoption. One significant challenge is the stringent regulatory landscape governing enzyme usage in animal feed. Regulatory approvals and compliance requirements vary across regions and countries, posing hurdles for enzyme manufacturers to meet diverse regulatory standards and ensure product safety and efficacy. Another challenge lies in the cost associated with enzyme production and incorporation into animal feed. Enzymes often involve intricate production processes, leading to higher manufacturing costs.

Additionally, ensuring the stability and effectiveness of enzymes throughout the feed processing and storage stages adds complexity and cost to their utilization. Limited awareness among livestock producers regarding the benefits and applications of feed enzymes remains a significant challenge, requiring education and convincing efforts to promote widespread adoption. Enzyme supplementation remains beneficial, impacting animal performance as well as profitability – for widespread adoption, it must remain on everyone’s minds!

Enzyme stability and effectiveness present manufacturers with unique challenges when used with different feed formulations, environmental conditions, or processing techniques. Ensuring effective enzyme functionality under various feed compositions and handling procedures remains a daily struggle for them.

Finally, research and development to optimize enzyme formulations for various animal species and production systems presents further obstacles. Generating enzymes that effectively address nutritional requirements as well as digestive requirements across categories requires continued investment in research and product innovation.

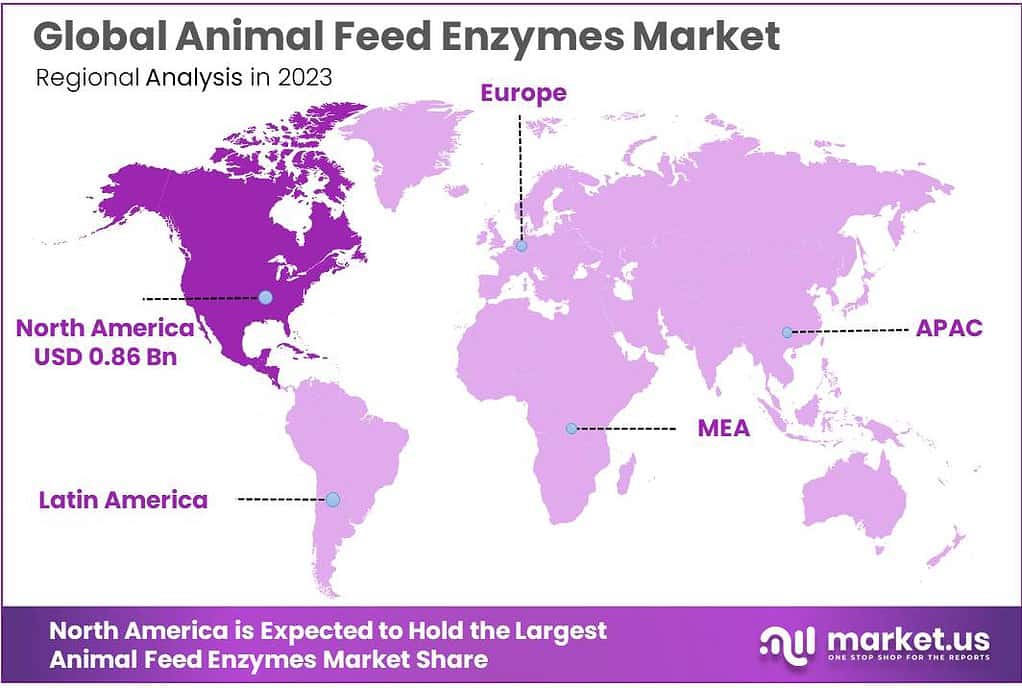

Regional Analysis

North America held the highest revenue share at over 45.1% in 2023. Closely followed by North America and the Asia Pacific. Russia and Spain will likely see substantial industry growth over the coming years. Germany and Spain are currently the top two producers of livestock in Europe.

Growth is supported by a strong end-user industry and a well-channeled distribution system. Due to increased livestock production and increasing pork consumption, countries in the eastern half of Europe (including Russia) are likely to experience the most rapid growth.

The Asia Pacific industry will experience the fastest growth because of key socio-economic variables such as rising meat consumption in India, China, and other Southeast Asian countries. A growing awareness of livestock diseases has resulted in the acceptance of safe animal nutrition practices. This will likely play a significant role in driving the demand for animal feed additives within the region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Novozymes is one of the major industry players. Companies are focused on increasing their market presence through various growth strategies like research & development and new product launches. They also expand production capacity, joint ventures, and acquisitions, as well as joint ventures. To cater to India’s livestock fodder industry, BASF SE introduced Natuphos E (a new enzyme) in January 2021.

Market Key Players

- Cargill, Incorporated

- BASF SE

- DuPont

- Bluestar Adisseo Co., Ltd.

- Koninklijke DSM NV

- Kemin Industries, Inc.

- Archer Daniel Midland Co.

- DSM Nutritional Products AG

- Elanco Animal Health Inc.

- Danisco Animal Nutrition

- Kerry Group PLC

- Biovet S.A.

- Novus International, Inc.

- Solvay SA

- Ajinomoto Co. Inc.

Recent Developments

In January 2022, Hiphorius is a new generation of phytase introduced by the DSM-Novozymes alliance. It is a comprehensive phytase solution created to assist poultry producers in achieving lucrative and sustainable protein output.

Report Scope

Report Features Description Market Value (2023) US$ 1.9 Bn Forecast Revenue (2033) US$ 3.5 Bn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Dry, Liquid), By Source(Microorganisms, Plants, Animals), By Product(Carbohydrases, Phytases, Proteases, Other Products), By Application(Poultry, Ruminants, Swine, Aquatic Animals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Cargill, Incorporated, BASF SE , DuPont , Bluestar Adisseo Co., Ltd., Koninklijke DSM NV , Kemin Industries, Inc., Archer Daniel Midland Co., DSM Nutritional Products AG, Elanco Animal Health Inc., Danisco Animal Nutrition, Kerry Group PLC, Biovet S.A., Novus International, Inc., Solvay SA, Ajinomoto Co. Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are animal feed enzymes, and what role do they play in animal nutrition?Animal feed enzymes are additives used in animal diets to enhance digestion and nutrient absorption. They help break down complex feed components, making nutrients more accessible for animals, leading to improved digestion and overall health.

What factors drive the growth of the animal feed enzymes market?Factors include increased demand for meat products, a focus on improving animal health and performance, advancements in feed technology, and a growing understanding of the benefits of enzyme supplementation in animal diets.

What innovations or trends are expected to shape the animal feed enzymes market in the future?Trends include the development of enzyme blends targeting multiple feed components, advancements in enzyme stability and delivery systems, and increasing focus on non-GMO or organic enzyme alternatives.

-

-

- Novozymes A/S

- DuPont de Nemours, Inc.

- AB Enzymes GmbH

- Koninklijke DSM N.V.

- BASF SE

- Kemin Industries

- The Soufflet Group

- Youtell Bio Chemical Inc.

- Other Key Players