Global Platinum Group Metals Market Size, Share and Industry Analysis Report By Metal Type(Platinum, Palladium, Rhodium, Iridium, Ruthenium, Osmium), By Application(Jewelry, Medical Devices, Electronics, Auto Catalysts, Glass and Ceramics, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 104825

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

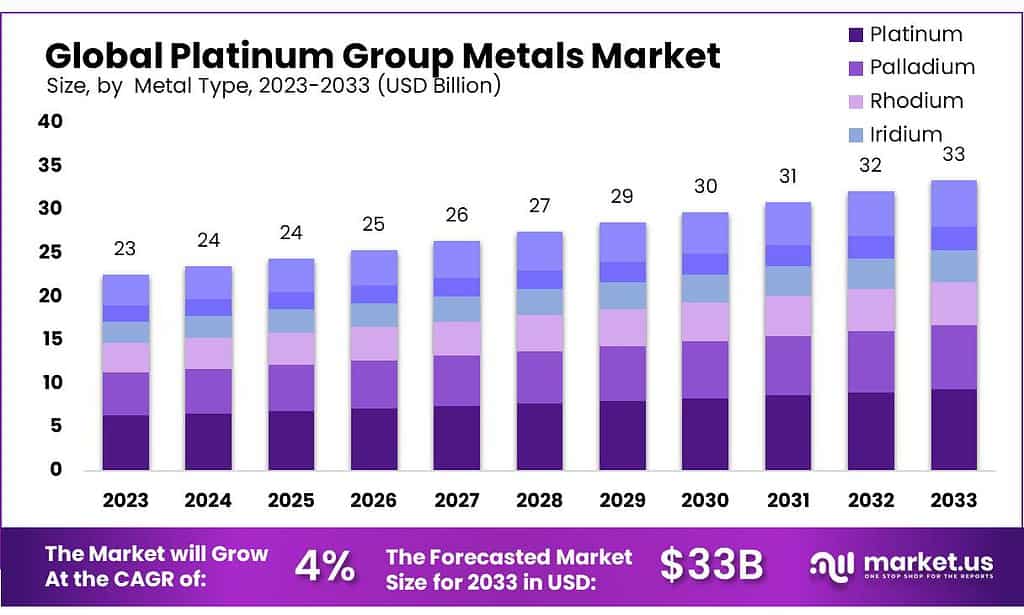

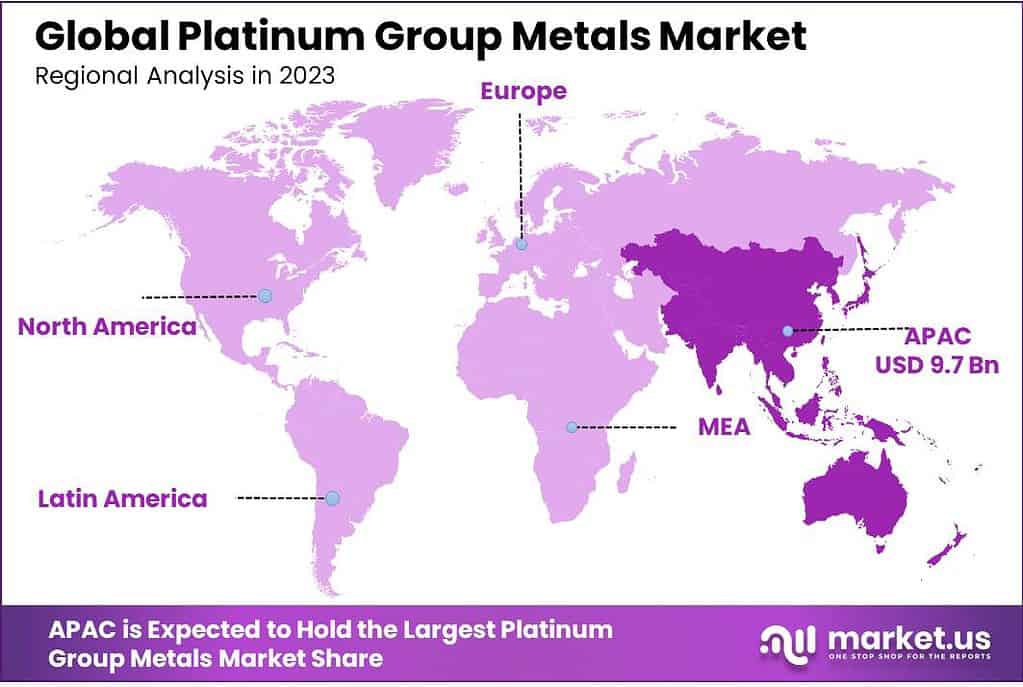

Platinum Group Metals Market size is expected to be worth around USD 33 Billion by 2033, from USD 23 Billion in 2023, growing at a CAGR of 4.0% during the forecast period from 2023 to 2033. Asia Pacific Driven by growing industrialization and widespread automotive and electronics manufacturing, particularly in China and India, Asia Pacific leads the PGM industry with a 43% share and a USD 9.7 billion valuation.

The Platinum Group Metals (PGMs) Market refers to the trading and industry associated with a group of six metallic elements platinum, palladium, rhodium, ruthenium, iridium, and osmium. These metals share similar physical and chemical properties, which make them valuable for various industrial applications, particularly in catalytic converters, jewelry manufacturing, electronics, and chemical processing.

The demand for the automotive catalyst market is anticipated to rise in response to increased investments and developments in the Indian automotive sector. India’s manufactured GDP is made up of automobiles, which provide 49 percent of the country’s GDP overall. After surpassing Japan in 2022 and placing fourth in the world for commercial vehicle manufacture in 2023, the Indian auto market was rated third globally.

The International Organization of Motor Vehicle Manufacturers, or Organisation Internationale des Constructeurs d’Automobiles (OICA), reports that global sales of all automobiles in 2022 totaled 81.62 million, down from 82.75 million in 2021. The OICA reports that overall vehicle production in 2022 was 85.02 million, up from 80.21 million in 2021.

The World Trade Organization reports that in 2022, the US surpassed Japan to become the world’s second-largest exporter of automobiles. Of the top 10 exporters, China’s raised their exports by 30% the most. One noteworthy achievement in the manufacturing sector is that, in November 2023, China’s automobile product exports climbed in value by 7% year over year.

Key Takeaways

- Market Growth Projection: Platinum Group Metals market to reach USD 33 billion by 2033, with a 4.0% CAGR from 2023, reflecting steady expansion.

- Platinum Dominance: Platinum holds 31.3% market share in 2023, favored for automotive and jewelry applications.

- Palladium Significance: Palladium’s demand in catalytic converters drives market share, particularly in gasoline vehicles.

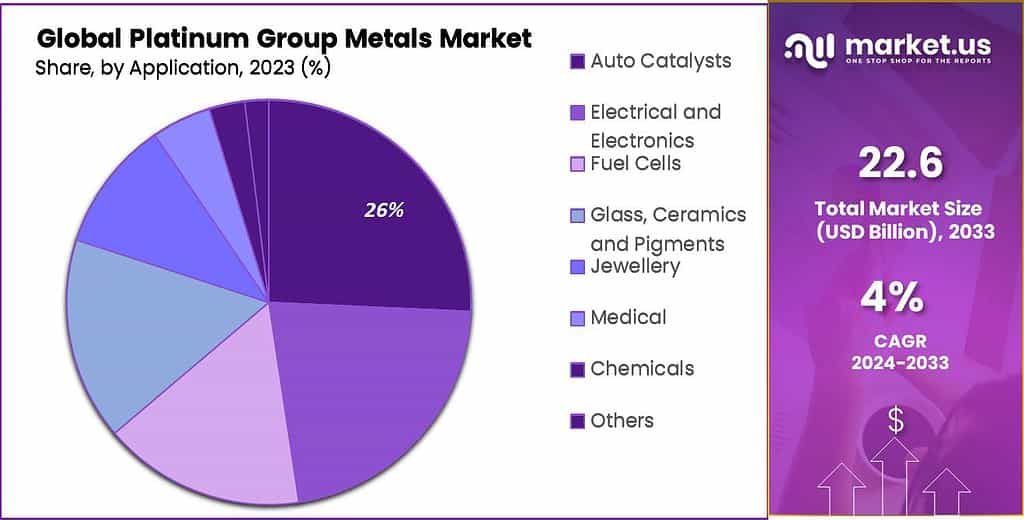

- Auto Catalysts Demand: Auto catalysts claim over 26.2% market share in 2023, crucial for emissions control.

- Russia is the world’s largest producer of palladium, accounting for approximately 40% of global production.

- South Africa and Russia together account for over 90% of the world’s rhodium production.

Metal Type Analysis

Palladium Accounted for The Largest Market Share Owing to Increasing Demand from The Automotive Sector Due to The Growing Vehicle Fleet Globally

In 2023, Platinum held a dominant market position, capturing more than a 31.3% share. Platinum is widely used in various industries, including automotive, jewelry, and chemical processing, due to its excellent corrosion resistance, catalytic properties, and aesthetic appeal.

Palladium also accounted for a significant share of the market, driven by its increasing demand in catalytic converters for gasoline-powered vehicles. Its ability to efficiently convert harmful emissions into less harmful substances makes it indispensable in the automotive industry.

Rhodium, known for its exceptional catalytic properties and resistance to corrosion, held importance in the market as well. It is primarily used in catalytic converters for diesel engines and in the production of high-performance alloys for various applications.

Iridium, although less commonly used compared to platinum and palladium, plays a vital role in specialty applications such as spark plugs, electrical contacts, and aerospace components due to its high melting point and corrosion resistance.

Ruthenium, valued for its hardness and ability to withstand high temperatures, is mainly utilized as a catalyst in the chemical industry and in the production of electronics, jewelry, and medical devices.

Osmium, the least abundant and most dense of the platinum group metals, is primarily used in the production of specialized alloys, electrical contacts, and fountain pen tips, owing to its hardness and corrosion resistance.

Application Analysis

The Increasing Global Demand for Automobiles Has Led to A Rise in The Production and Installation of Autocatalysts in Vehicles

In 2023, Auto Catalysts held a dominant market position, capturing more than a 26.2% share. Auto catalysts are crucial components in vehicles, utilizing platinum group metals to convert harmful pollutants from vehicle exhaust into less harmful emissions, contributing to cleaner air and environmental sustainability.

Electrical and Electronics accounted for a significant share of the market, driven by the increasing demand for electronic devices and components that utilize platinum group metals for their conductivity, durability, and corrosion resistance.

Fuel Cells also held importance in the market, with platinum group metals playing a vital role as catalysts in fuel cell technology, which is used to generate clean electricity through the electrochemical reaction of hydrogen and oxygen.

The glass, Ceramics, and Pigments segment utilized platinum group metals for their catalytic properties, aiding in the production of glass, ceramics, and pigments with enhanced properties such as strength, color, and durability.

Jewellery, a traditional application for platinum group metals, maintained its significance in the market, with platinum, palladium, and rhodium being prized for their beauty, rarity, and resistance to tarnish and corrosion.

The Medical sector also saw notable utilization of platinum group metals in various medical devices, implants, and treatments, benefiting from their biocompatibility, corrosion resistance, and antimicrobial properties.

The chemicals segment utilized platinum group metals as catalysts in various chemical processes, facilitating efficient and sustainable production of chemicals and pharmaceuticals.

Key Market Segments

By Metal Type

- Platinum

- Palladium

- Rhodium

- Iridium

- Ruthenium

- Osmium

By Application

- Jewelry

- Medical Devices

- Electronics

- Auto Catalysts

- Glass and Ceramics

- Other Applications

Drivers

Growth in the Automotive Industry, specifically in Electric Vehicles, is Anticipated to Bolster the Market.

Growing Demand in Automotive Applications: The most prominent driving factor for the platinum group metals (PGMs) market is the escalating demand for these metals in automotive catalytic converters. Catalytic converters are essential for reducing harmful emissions from vehicles, and the increasing global push towards stricter emission standards is amplifying the demand for PGMs, particularly palladium and platinum. This trend is expected to persist as the automotive industry continues to grow and evolve towards more environmentally friendly practices.

Technological Advancements and Diverse Applications: PGMs are also extensively utilized across various other industries, notably in electronics for manufacturing components like capacitors and resistors, which rely on the unique properties of these metals. The expansion of the electronics sector, therefore, presents a significant growth opportunity for the PGM market. Additionally, innovations in medical applications, such as cancer treatment drugs and medical devices, further drive the demand for these metals.

Jewelry and Investment Demand: In regions like Asia-Pacific, particularly China and India, there’s a growing consumption of jewelry that incorporates PGMs, especially platinum. This demand is not just limited to aesthetic appeal but also investment purposes, where PGMs are valued for their rarity and intrinsic value.

Restraints

High Production and Maintenance Costs

One of the significant restraint factors affecting the platinum group metals (PGMs) market is the high costs associated with their production. Extracting and refining these metals require complex and energy-intensive processes, which substantially increase the overall production costs.

These high costs are further exacerbated by the deep mining operations needed to access PGM ore bodies, which are often located in geopolitically unstable regions. The expense involved in maintaining and operating these mines, coupled with stringent environmental regulations, contributes to the high overheads for PGM producers

Impact on Market Growth: The elevated costs not only impact the profitability of mining companies but also influence the end-product pricing, making PGM-containing products more expensive in the consumer market. This can reduce market demand, particularly in price-sensitive sectors, and may encourage the search for cheaper alternatives or substitutes. Additionally, the volatile prices of PGMs on global markets add an extra layer of financial uncertainty, further complicating investment and production strategies.

Technological and Economic Challenges: Moreover, the need for continuous technological advancements to improve yield and efficiency in PGM extraction and processing places additional financial burdens on companies. The capital-intensive nature of these technological investments, combined with the high risk associated with PGM mining operations, poses significant economic challenges that can restrain market growth.

Opportunity

Expansion in the Automotive and Chemical Industries

A significant opportunity for the platinum group metals (PGMs) market is the increasing demand for these metals in automotive applications, particularly in catalytic converters. These devices, which are crucial for reducing vehicle emissions, heavily rely on PGMs like platinum, palladium, and rhodium to effectively neutralize harmful gases.

With global automotive production on the rise and stricter emission regulations being enforced worldwide, the demand for PGMs is expected to remain robust. The automotive sector’s shift towards more sustainable practices, including the development of hybrid and hydrogen fuel cell vehicles, further underscores the growing need for these metals.

Advancements in Chemical Manufacturing: Another promising avenue for PGMs is their critical role in the chemical industry, especially as catalysts in processes such as hydrogenation and oxidation. The unique properties of metals like rhodium make them indispensable for producing key chemicals, which sees them poised for increased demand in this sector. Investments in new technologies and the expansion of production capacities in chemical manufacturing are set to drive the PGM market. For instance, significant investments in expanding recycling capacities in Europe underline the strategic moves being made to bolster the supply chain for PGMs, ensuring their availability for various industrial applications.

Technological Innovations and Regional Market Growth: Technological advancements in PGM recovery and processing are pivotal in defining market opportunities. New plants and enhanced capacities, particularly in Europe, are set to increase the efficiency of PGM production, reducing chemical use and enhancing process efficiencies. This not only supports the sustainability goals of the industry but also helps in meeting the rising demand more effectively.

Asia-Pacific Market Expansion: The Asia-Pacific region, led by China and India, represents a fast-growing market for PGMs, driven by its expanding automotive sector and rapid industrialization. Initiatives like the development of new technology centers in China focused on PGMs highlight the region’s commitment to leveraging these metals for various applications, including electronics and clean energy technologies.

Trends

Growing Demand for Catalytic Converters: A significant trend in the platinum group metals (PGMs) market is the sustained demand for these metals in the production of catalytic converters for the automotive industry. This trend is fueled by the ongoing need to meet stringent global emission standards, which catalytic converters help achieve by reducing harmful emissions from vehicles. Platinum, palladium, and rhodium, used in these converters, are essential due to their effectiveness in emission control. The demand in this segment is expected to remain robust as global automotive production continues to grow.

Expansion in the Electronics Sector: Another key trend is the increasing use of PGMs in the electronics industry, where these metals are employed in various components such as capacitors and circuit boards. This trend is driven by the properties of PGMs that make them ideal for use in electronic devices due to their excellent conductive and resistant characteristics against corrosion and high temperatures. The growth in consumer electronics adoption globally, particularly in smartphones and computers, is expected to further drive the demand for PGMs.

Advancements in Recycling Technologies: The PGM market is also witnessing a trend towards improved recycling technologies, which are becoming increasingly important due to the high cost and limited supply of these metals. Advances in recycling not only support sustainability efforts but also help in stabilizing supply chains for PGMs, making these processes a critical component of the industry’s future growth strategies.

Regional Analysis

Asia-Pacific Holds Region Accounted Significant Share of the Global Platinum Group Metals Market

Asia Pacific: Dominating the PGM market with a 43% share and a valuation of USD 9.7 billion, Asia Pacific leads due to rapid industrialization and extensive automotive and electronics manufacturing, especially in China and India. This region’s substantial market share is propelled by increasing vehicle production and stringent environmental regulations, which elevate the demand for catalytic converters using platinum and palladium.

North America: In North America, the market is driven by advanced emission control technologies and a robust automotive industry, particularly in the United States and Canada. Stringent environmental regulations, such as the EPA’s Tier 3 standards, have significantly boosted the demand for PGMs in automotive catalytic converters. Additionally, the region sees growth in the electronics sector, where PGMs are used in various high-tech applications.

Europe: Europe maintains a strong PGM market presence due to its rigorous environmental policies and a substantial automotive manufacturing base. Countries like Germany, the United Kingdom, and France lead in using PGMs to meet strict emission standards. Moreover, the region is witnessing growth in the recycling of PGMs, supporting sustainability in metal usage.

Middle East & Africa: Although smaller in comparison, the market in the Middle East and Africa is gradually expanding. This growth is driven by the development of the automotive sector and industrial applications. South Africa, in particular, plays a crucial role due to its significant PGM mining activities, providing a substantial portion of the global supply.

Latin America: This region shows potential for growth in the PGM market, primarily through the automotive and electronics sectors in countries like Brazil and Mexico. Increased environmental regulations and the expansion of manufacturing capacities are expected to drive the demand for PGMs in the future.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain The Dominance Of Industry Leaders

Key players in this market are operating several strategies through partnerships, investments in expanding their product portfolio, mergers, and acquisitions, etc. Recycling becomes crucial due to the limited availability and higher cost of PGMs. Manufacturers often recover PGMs from spent catalytic converters, electronics, and other applications to ensure a steady supply.

Moreover, innovation in extraction, refining, and application processes is pivotal. Manufacturers can maintain their competitive edge by improving extraction efficiency or developing new applications.

Market Key Players

With the presence of several key players across the globe, the platinum group metals market is fragmented. New key players are subject to intense competition from leading market players, particularly those with strong brand recognition and high distribution networks.

As evident, the majority of these key players are based in or have significant operations in South Africa owing to its rich PGM deposits in the country. Companies have gained various expansion strategies, partnerships, and development in new research technologies to stay on top of the market.

- African Rainbow Minerals

- ANGLO AMERICAN PLATINUM LIMITED

- Glencore

- Implats Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Northam Platinum Limited

- Platinum Group Metals Ltd

- Royal Bafokeng Platinum

- Sibanye-Stillwater

- Vale

Recent Development

African Rainbow Minerals (ARM): In 2023, ARM continued its focus on operational excellence and sustainability initiatives across its PGMs portfolio, implementing advanced technologies to enhance production efficiency and reduce environmental impact.

Report Scope

Report Features Description Market Value (2023) USD 23 Bn Forecast Revenue (2033) USD 33 Bn CAGR (2023-2033) 4.0% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Metal Type(Platinum, Palladium, Rhodium, Iridium, Ruthenium, Osmium), By Application(Jewelry, Medical Devices, Electronics, Auto Catalysts, Glass and Ceramics, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape African Rainbow Minerals, ANGLO AMERICAN PLATINUM LIMITED, Glencore, Implats Platinum Limited, Johnson Matthey, Norilsk Nickel, Northam Platinum Holdings Limited, Northam Platinum Limited, Platinum Group Metals Ltd, Royal Bafokeng Platinum, Sibanye-Stillwater, Vale Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Platinum Group Metals MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Platinum Group Metals MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- African Rainbow Minerals

- ANGLO AMERICAN PLATINUM LIMITED

- Glencore

- Implats Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Northam Platinum Limited

- Platinum Group Metals Ltd

- Royal Bafokeng Platinum

- Sibanye-Stillwater

- Vale