Global Smart Farming Market By Offering (Hardware, Software, Service), By Agriculture Type (Precision Farming, Livestock Monitoring, Precision Aquaculture, Precision Forestry, Smart Greenhouse, Others), By Farm Size (Large Farms, Small Farms, Medium Farms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 29351

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

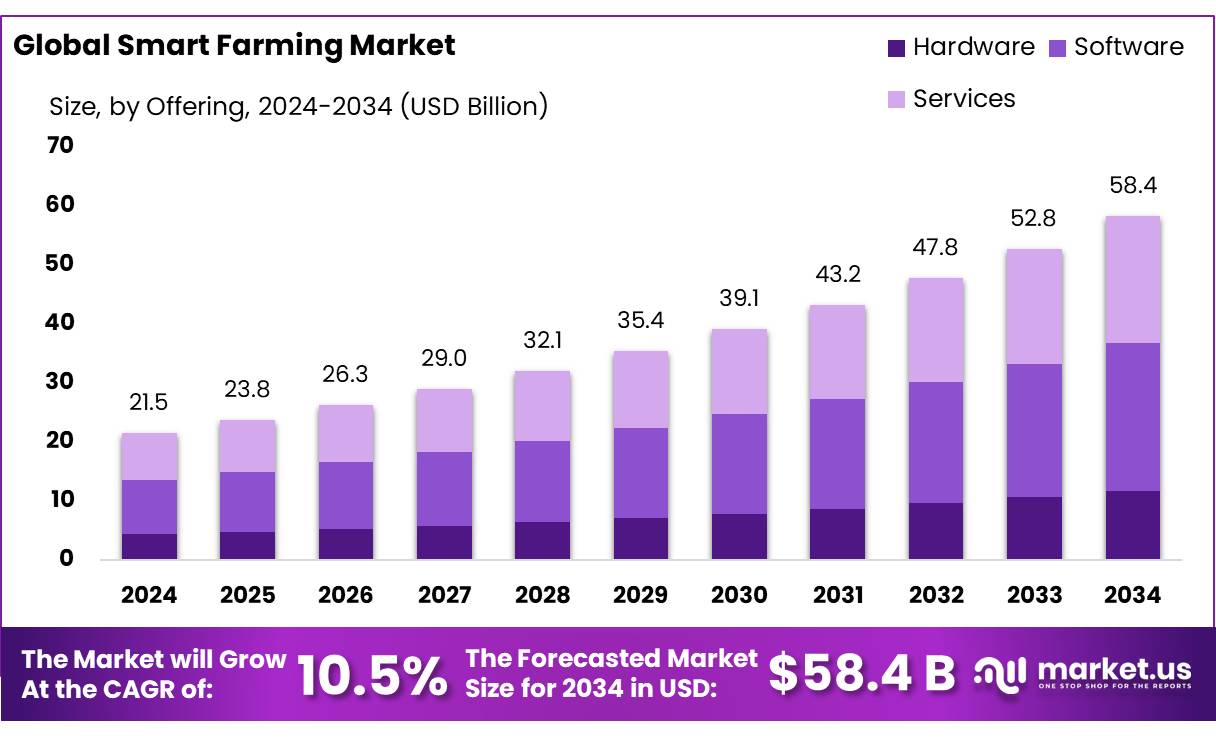

The Global Smart Farming Market size is expected to be worth around USD 58.4 Bn by 2034, from USD 21.5 Bn in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. Smart farming refers to the use of technology and data-driven solutions for improving efficiency, sustainability, and productivity in the agriculture industry.

Smart farming market, a rapidly advancing sector within modern agriculture, integrates information and communication technology into farm management. By employing IoT devices, sensors, GPS, and data analytics, smart farming enhances precision in farming practices, ultimately increasing efficiency, productivity, and profitability while reducing waste and environmental impact.

The demand for food production is expected to increase by nearly 70% according to the Food and Agriculture Organization (FAO). This surge necessitates more efficient agriculture practices, which smart farming technologies are uniquely positioned to deliver. Europe and North America currently lead in the adoption of smart farming technologies, due to strong governmental support and the presence of numerous technology providers. However, Asia-Pacific is emerging as a dynamic growth region, driven by increasing technological adoption and substantial agricultural output.

Several key factors propel the adoption of smart farming solutions. Environmental concerns, such as water scarcity and the need for reduced use of chemical inputs, are pushing farms to optimize resource management. According to a report by the U.S. Environmental Protection Agency (EPA), precision agriculture can reduce water usage by up to 30% and enhance crop yields by 20%. This is significant considering agriculture accounts for approximately 70% of global freshwater use. Technological advancements such as autonomous tractors, drones, and AI-based crop management systems are becoming increasingly sophisticated, offering more precise and actionable insights to farmers.

Governments worldwide are recognizing the potential of smart farming to revolutionize agriculture. The European Union, under its Common Agricultural Policy (CAP), has allocated over EUR 4 billion for the integration of digital technologies in agriculture through 2027. This initiative aims to support farmers in deploying smart technology solutions that enhance productivity and sustainability. Similarly, the U.S. Department of Agriculture (USDA) invests in research and grants to foster the adoption of precision agriculture. In 2023, the USDA funded a $10 million project aimed at developing AI technologies to improve crop management practices.

Key Takeaways

- Smart Farming Market size is expected to be worth around USD 58.4 Bn by 2034, from USD 21.5 Bn in 2024, growing at a CAGR of 10.5%.

- Software solutions taking a leading role, securing more than a 42.7% share of the market.

- Precision Farming established itself as a cornerstone of the smart farming industry, holding a significant 34.8% market share.

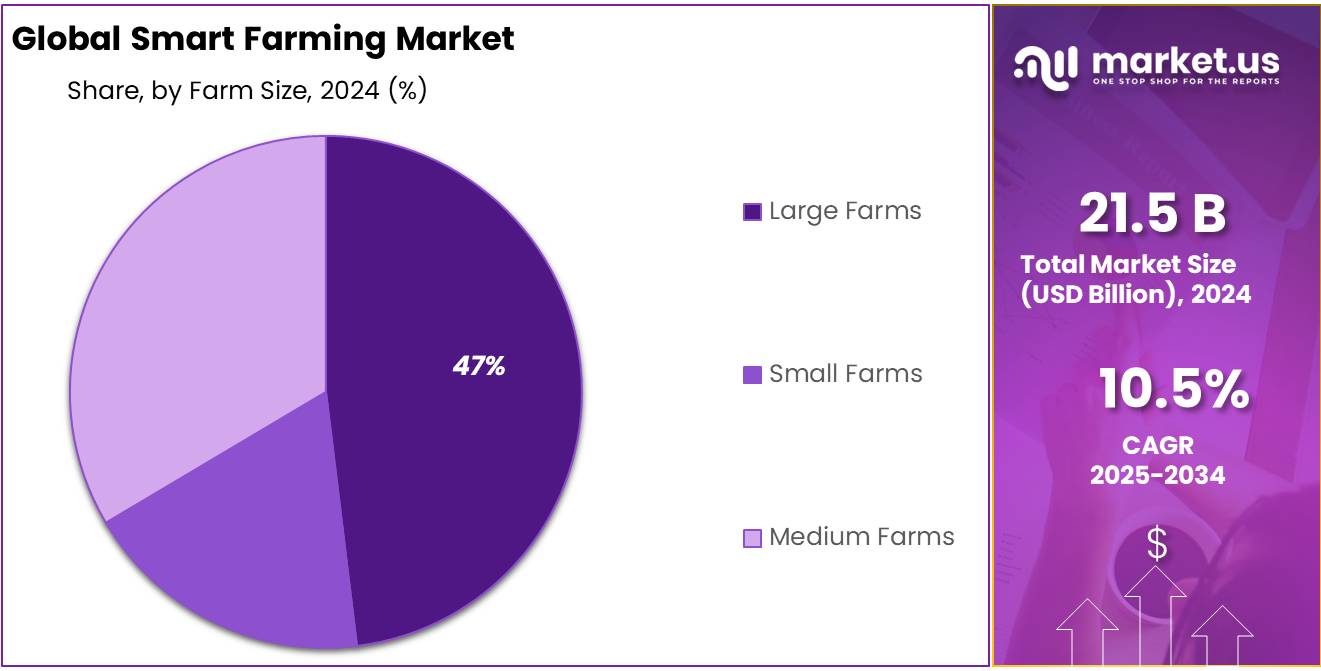

- Large farms solidified their leadership in the smart farming sector, capturing more than a 47.3% share of the market.

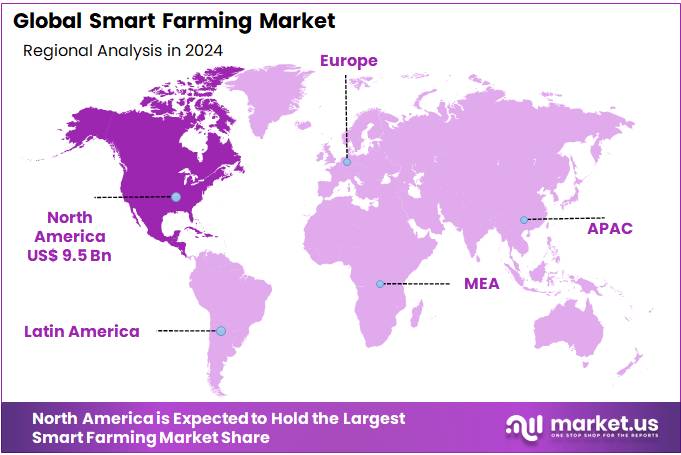

- North America stands out as a dominant force, commanding a significant 44.2% market share, which translates to approximately USD 9.5 billion.

Analyst Viewpoint

From an investment perspective, smart farming represents a burgeoning frontier with substantial growth prospects underpinned by technological advancements and increasing global food demand. The sector, expected to reach a market size of USD 13.5 billion by 2023 according to U.S. government sources, offers compelling opportunities for stakeholders. This growth trajectory is largely driven by the escalating need for efficiency and sustainability in agriculture to support a projected global population of 9.7 billion by 2050. Investors are particularly attracted to the integration of AI, IoT, and robotics in farming, which promise significant enhancements in crop yield and resource management.

However, investment in smart farming is not without risks. Technological complexity and the significant capital required for initial setup can be daunting. There is also the ongoing challenge of interoperability between different technologies and platforms, which can hinder the seamless integration necessary for optimal operations. Furthermore, the regulatory environment remains stringent, as governments worldwide impose tight regulations on data handling, usage, and privacy. These regulations can impact the deployment and scalability of technology solutions in agriculture, necessitating careful navigation by investors.

By Offering Analysis

Software Dominates Smart Farming with 42.7% Market Share

In 2024, the Smart Farming market saw software solutions taking a leading role, securing more than a 42.7% share of the market. This segment’s prominence is largely attributed to its critical function in integrating various smart farming technologies. Software in smart farming acts as the backbone that enables seamless communication between devices and provides farmers with invaluable data analytics and control capabilities. These software platforms are essential for optimizing tasks such as data management, crop management, and farm operation monitoring, making them indispensable for modern agricultural practices. As farms continue to embrace digital transformation, the reliance on sophisticated software solutions is expected to grow, further solidifying their dominant position in the smart farming landscape.

By Agriculture Type Analysis

Precision Farming Leads with 34.8% of Smart Farming Market

In 2024, Precision Farming established itself as a cornerstone of the smart farming industry, holding a significant 34.8% market share. This agricultural approach leverages advanced technologies such as GPS, IoT sensors, and data analytics to enhance crop yield and efficiency, thereby addressing the growing demands for sustainable agricultural practices.

Precision farming’s dominant market position reflects its effectiveness in optimizing resource use, reducing waste, and increasing productivity on farms. As global focus intensifies on maximizing agricultural outputs while minimizing environmental impacts, the role of precision farming is expected to become increasingly vital, driving continuous innovation and adoption in the sector.

By Farm Size Analysis

Large Farms Command a Leading 47.3% Share in Smart Farming Market

In 2024, large farms solidified their leadership in the smart farming sector, capturing more than a 47.3% share of the market. This dominance is primarily due to the scale at which these operations can implement advanced smart farming technologies, including automation, AI, and IoT systems. Large farms have the infrastructure and capital to invest in sophisticated systems that enhance productivity and efficiency, making smart farming technologies particularly attractive.

The substantial market share held by large farms reflects their ability to leverage these innovations to optimize agricultural output and resource management, setting a benchmark for efficiency in the broader agricultural industry. As technology continues to evolve and become more integrated into agricultural practices, large farms are likely to continue driving forward the adoption of smart farming solutions.

Key Market Segments

By Offering

- Hardware

- Precision Farming Hardware

- Automation & Control Systems

- Sensing & Monitoring Devices

- Water Sensors

- Climate Sensors

- Others

- Livestock Monitoring Hardware

- Sensors

- Transmitters & Mounting Equipment

- GPS

- Others

- Precision Forestry Hardware

- Harvesters & Forwarders

- UAVs/Drones

- GPS

- Cameras

- Sensors & RFID Tags

- Others

- Precision Aquaculture Hardware

- Monitoring devices

- Camera systems

- Control systems

- Others

- Smart Greenhouse Hardware

- HVAC Systems

- LED Grow Lights

- Irrigation Systems

- Material Handling Equipment

- Valves & Pumps

- Control Systems

- Sensors & Cameras

- Others

- Precision Farming Hardware

- Software

- Web Based

- Cloud Based

- Service

- System Integration and Consulting

- Support and Maintenance

- Connectivity Services

- Managed Services

- Professional Services

- Others

By Agriculture Type

- Precision Farming

- Livestock Monitoring

- Precision Aquaculture

- Precision Forestry

- Smart Greenhouse

- Others

By Farm Size

- Large Farms

- Small Farms

- Medium Farms

Driving Factors

Rising Global Demand for Sustainable Agriculture Drives Smart Farming Adoption

One of the primary driving factors for the smart farming market is the escalating global demand for sustainable agricultural practices. As the world population continues to grow—expected to reach nearly 10 billion by 2050—the pressure on agricultural systems to produce more food without exacerbating environmental degradation has become intense. According to the United Nations Food and Agriculture Organization (FAO), agriculture must become more productive and sustainable to successfully feed the growing population while mitigating its environmental impact.

Governments around the world are responding to this need by promoting smart farming technologies through various initiatives. For example, the European Union has significantly funded research and development in precision agriculture, a key component of smart farming, to enhance crop yields and reduce waste and chemical use. The EU’s commitment to sustainable agriculture is evident in their Common Agricultural Policy (CAP) which supports farmers in transitioning to more sustainable practices, including the adoption of smart technologies.

These technologies, which include advanced sensors, GPS, and data analytics systems, allow farmers to monitor field conditions precisely, optimizing water usage, pesticide application, and planting strategies. This not only leads to higher yields but also minimizes the environmental footprint of farming operations. For instance, precision irrigation systems can reduce water usage by up to 30%, according to studies cited by the U.S. Environmental Protection Agency.

The push towards sustainable farming driven by consumer demand for environmentally friendly products further accelerates the adoption of smart farming technologies. Consumers are increasingly aware of the environmental impacts of their food choices and are demanding more sustainably produced goods, thereby influencing farming practices globally.

Restraining Factors

High Initial Investment Costs Curb Smart Farming Adoption

A significant restraining factor in the expansion of the smart farming market is the high initial investment required for technology deployment. Implementing advanced agricultural technologies such as precision farming systems, IoT devices, and data analytics platforms necessitates substantial capital investment, which can be prohibitive for small to medium-sized farms. According to a report by the U.S. Department of Agriculture (USDA), the average cost for a farm to adopt digital agricultural technology can range anywhere from $15,000 to $25,000, depending on the scale and the technologies implemented.

These costs include not only the purchase of hardware and software but also the installation and maintenance of complex systems that require specialized skills. Many farmers, especially in developing regions, lack access to the necessary financing to cover these costs, making it difficult for them to take advantage of smart farming benefits. Moreover, there is often a significant knowledge gap that needs to be bridged with training and support, adding to the overall expenses.

Government initiatives have been crucial in mitigating some of these challenges by providing subsidies and financial incentives for technology adoption. For example, the European Union, under its Horizon Europe program, has allocated funds specifically for research and innovation in agriculture, aiming to reduce the economic burden on farmers transitioning to smart farming technologies (European Commission, 2024). These initiatives are essential for enabling broader access to smart farming solutions.

Despite these efforts, the upfront cost remains a daunting barrier for many, hindering the widespread adoption of smart farming practices. This is particularly true in less economically developed countries, where such resources are even scarcer. The disparity in technology access between large and small-scale farmers exacerbates the divide, potentially leading to increased economic inequality within the agricultural sector.

Growing Opportunities

Emerging Markets Present Expansive Growth Opportunities for Smart Farming

A major growth opportunity for the smart farming market lies in its expansion into emerging markets. As these regions experience rapid economic growth, urbanization, and increased technological adoption, the potential for integrating smart farming solutions becomes more pronounced. According to the Food and Agriculture Organization (FAO), there is a significant gap in agricultural productivity between developed and developing countries, with the latter often achieving only 40-50% of the agricultural output of developed nations.

Governments in these emerging markets are increasingly aware of the benefits that smart farming can bring, particularly in terms of increasing productivity and sustainability. For example, the Indian government has launched several initiatives under its ‘Digital India’ campaign to encourage the use of ICT in agriculture. This includes substantial investments in rural internet connectivity and training programs for farmers on the use of smart technology in agricultural practices.

These initiatives are crucial as they not only provide the necessary technological infrastructure but also help in educating the farming community about the potential benefits of smart farming. With better knowledge and resources, farmers in these regions can improve crop yields, manage resources more efficiently, and ultimately increase their income levels.

Moreover, the increasing penetration of smartphones and internet services in these areas offers a robust platform for the deployment of smart farming apps and management systems. These technologies can provide farmers with real-time data on weather conditions, soil health, and crop prices in the market, enabling better decision-making and increased profitability.

Latest Trends

Integration of AI and Machine Learning: Revolutionizing Smart Farming

One of the most transformative trends in the smart farming market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These innovations are redefining the agricultural landscape by enhancing decision-making processes and operational efficiencies. According to a statement by the U.S. Department of Agriculture (USDA), AI in agriculture is set to increase the industry’s economic output significantly, with an emphasis on improving crop yield predictions, soil health monitoring, and pest management.

AI and ML applications in smart farming range from predictive analytics that forecast weather impacts on crop yields to algorithms that optimize planting schedules and irrigation systems. For example, AI-driven systems can analyze data from satellite images and sensors to detect early signs of disease or stress in crops, allowing farmers to take preemptive actions that can save entire harvests. Additionally, machine learning models are being used to analyze historical agricultural data, enabling farmers to understand crop performance trends and improve their agricultural practices over time.

Government bodies worldwide are supporting these advancements through funding and research initiatives. The European Commission, for instance, has underlined AI’s role in agriculture within its Horizon Europe program, committing substantial funds to develop new technologies that can make farming more efficient and sustainable.

Regional Analysis

In the smart farming landscape, North America stands out as a dominant force, commanding a significant 44.2% market share, which translates to approximately USD 9.5 billion. This substantial market presence is underpinned by a combination of advanced technological infrastructure, robust governmental support, and a strong presence of leading agricultural technology companies.

The region’s dominance is further bolstered by comprehensive investments in research and development, enabling the rapid deployment of innovative technologies such as precision agriculture, IoT-based monitoring systems, and AI-driven predictive analytics. These technologies are integrated across various farming operations to enhance productivity, efficiency, and sustainability.

Government initiatives in North America, particularly in the United States and Canada, play a critical role in fostering the growth of smart farming. Policies aimed at promoting digital agriculture include grants and subsidies that encourage farmers to adopt smart technologies. For instance, the USDA invests in smart farming by funding projects that aim to improve agricultural data integration and decision-making processes, reflecting a clear commitment to enhancing the sector’s technological uptake.

Moreover, North American farmers are highly receptive to adopting new technologies, driven by the need to address challenges such as labor shortages, the rising cost of traditional farming inputs, and the pressures of producing more food sustainably amid climate change. The high level of technology penetration in terms of broadband connectivity and mobile device usage among rural populations provides a strong foundation for the continued expansion of smart farming solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ag Leader Technology is at the forefront of precision farming, offering a wide range of innovative agricultural solutions. Founded in 1992, the company specializes in products that enhance planting, spraying, and harvesting operations. Ag Leader is renowned for its high-quality precision farming tools that assist farmers in optimizing yield and reducing waste, making it a key player in driving agricultural efficiency and productivity.

AGCO Corporation is a global leader in the design, manufacture, and distribution of agricultural equipment. With a strong presence in the smart farming market, AGCO provides advanced equipment and technology solutions that support efficient farming practices. The company’s commitment to integrating smart technology into their machinery allows them to offer cutting-edge solutions that improve the effectiveness and sustainability of modern agriculture.

AgJunction Inc. specializes in precision agriculture by developing integrated solutions that facilitate automation and management across farming operations. The company’s technology is pivotal in helping farmers reduce operational costs and increase productivity by delivering precise control over agricultural machinery, thus optimizing field-level management.

Market Key Players

- Ag Leader Technology

- AGCO Corporation

- AgJunction Inc.

- AgEagle Aerial Systems Inc.

- Autonomous Solutions Inc.

- Argus Control Systems Ltd.

- BouMatic Robotic B.V.

- CropMetrics LLC.

- CLAAS KGaA mbH

- CropZilla Software Inc.

- Deere & Company

- DICKEY-john Corporation

- com

- DeLaval Inc.

- Farmers Edge Inc.

- Grownetics Inc.

- Granular Inc.

- Gamaya Inc.

- GEA Group Aktiengesellschaft

- Raven Industries Inc.

- Trimble Inc.

- Topcon Positioning Systems Inc.

- Other Key Players

Recent Developments

- In 2024, Ag Leader continues to lead with new solutions that integrate seamlessly with existing agricultural systems, helping to simplify operations and improve yield outcomes. Their approach not only supports better farming practices but also contributes to more sustainable agricultural ecosystems by optimizing resource use and reducing waste.

- In 2024, Ag Leader has continued to evolve, integrating cutting-edge technology that supports real-time decision-making and farm management. Their products are pivotal in enabling farmers to implement more precise farming techniques, which are crucial for optimizing resource use and enhancing the sustainability of farming operations.

Report Scope

Report Features Description Market Value (2024) USD 21.5 Bn Forecast Revenue (2034) USD 58.4 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2024-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Service), By Agriculture Type (Precision Farming, Livestock Monitoring, Precision Aquaculture, Precision Forestry, Smart Greenhouse, Others), By Farm Size (Large Farms, Small Farms, Medium Farms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ag Leader Technology, AGCO Corporation, AgJunction Inc., AgEagle Aerial Systems Inc., Autonomous Solutions Inc., Argus Control Systems Ltd., BouMatic Robotic B.V., CropMetrics LLC., CLAAS KGaA mbH, CropZilla Software Inc., Deere & Company, DICKEY-john Corporation, DroneDeploy.com, DeLaval Inc., Farmers Edge Inc., Grownetics Inc., Granular Inc., Gamaya Inc., GEA Group Aktiengesellschaft, Raven Industries Inc., Trimble Inc., Topcon Positioning Systems Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ag Leader Technology

- AGCO Corporation

- AgJunction Inc.

- AgEagle Aerial Systems Inc.

- Autonomous Solutions Inc.

- Argus Control Systems Ltd.

- BouMatic Robotic B.V.

- CropMetrics LLC.

- CLAAS KGaA mbH

- CropZilla Software Inc.

- Deere & Company

- DICKEY-john Corporation

- com

- DeLaval Inc.

- Farmers Edge Inc.

- Grownetics Inc.

- Granular Inc.

- Gamaya Inc.

- GEA Group Aktiengesellschaft

- Raven Industries Inc.

- Trimble Inc.

- Topcon Positioning Systems Inc.

- Other Key Players