Global Data Analytics in PPA Management Market Statistics Analysis Report By Component (Software (Analytics Platforms, Predictive Analytics Tools, Real-time Monitoring and Dashboards, Others), Services (Consulting Services, Managed Services, Custom Analytics and Integration Services)), By Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Others), By Application (Energy Forecasting and Demand Prediction, Performance Monitoring and Optimization, Risk Management and Mitigation, Cost Optimization and Financial Analysis, Others), By End User (Energy Producers, Energy Buyers, Energy Traders, Energy Consultants), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139193

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Size and Growth

- Component Analysis

- Type Analysis

- Application Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

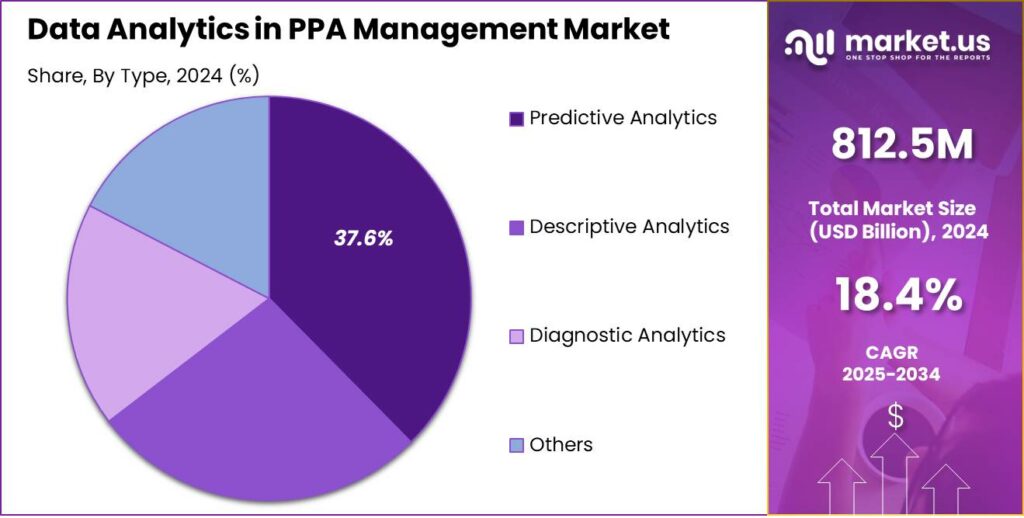

The Global Data Analytics in PPA Management Market size is expected to be worth around USD 4,398.9 Million By 2034, from USD 812.5 Million in 2024, growing at a CAGR of 18.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the market with over 32.8% share, generating USD 266.5 million in revenue.

Data analytics in Power Purchase Agreement (PPA) management involves the systematic computational analysis of data related to PPAs. This practice is crucial for optimizing energy sales, managing financial risks, and ensuring compliance with contractual obligations. By analyzing trends and patterns within the PPA data, stakeholders can make informed decisions about energy pricing, demand forecasting, and contract negotiations.

The market for Data Analytics in PPA Management is experiencing robust growth due to the increasing reliance on renewable energy sources and the complex nature of energy trading and risk management. Companies are investing in advanced data analytics tools to enhance their decision-making capabilities, allowing them to predict and mitigate risks more effectively.

The integration of AI and machine learning technologies is also playing a pivotal role in transforming data into actionable insights, leading to more accurate and efficient management of PPAs. This technological evolution is driving the adoption of sophisticated analytics in managing and optimizing PPAs across the energy sector.

Technological advancements are central to the evolution of data analytics in PPA management. The use of AI for predictive maintenance and the deployment of IoT devices for real-time data collection are notable examples. These technologies enable more precise forecasting of energy production and demand, which is critical for effective PPA management.

The popularity of data analytics in PPA management is increasing as organizations recognize its ability to improve efficiency and reduce costs. As the shift to renewable energy continues, companies are leveraging analytics to track performance, forecast energy needs, and optimize contracts. Advances in AI and machine learning further fuel this growth by offering deeper insights into market trends, enabling more informed decision-making.

Adoption rates for data analytics in PPA management are increasing as companies recognize the value of data-driven insights in optimizing energy contracts. The demand for these analytical solutions is particularly high among enterprises looking to improve their energy efficiency and manage financial risks associated with renewable energy sources.

The sector presents significant investment opportunities, particularly in developing tools that can enhance the predictive accuracy of energy production and demand forecasts. Investments are also flowing into the creation of more user-friendly analytics platforms that can integrate with existing systems and provide real-time insights.

Key Takeaways

- The Global Data Analytics in PPA Management Market size is projected to reach USD 4,398.9 Million by 2034, growing from USD 812.5 Million in 2024, with a CAGR of 18.40% during the forecast period from 2025 to 2034.

- In 2024, the Software segment held a dominant market position, capturing more than 73.5% of the share in the Data Analytics in PPA Management market.

- The Predictive Analytics segment dominated in 2024, capturing over 37.6% of the market share.

- The Energy Forecasting and Demand Prediction segment was the leader in 2024, capturing more than 29.3% of the Data Analytics in Power Purchase Agreement (PPA) Management market.

- In 2024, Energy Producers captured the largest share, holding over 32.4% of the Data Analytics in Power Purchase Agreement (PPA) Management market.

- North America was the dominant region in 2024, accounting for more than 32.8% of the global market share, translating into a revenue of USD 266.5 million.

- The U.S. Data Analytics in PPA Management Market, valued at USD 223.9 million in 2024, is expected to grow at a CAGR of 18.40%.

U.S. Market Size and Growth

The U.S. market for Data Analytics in Power Purchase Agreement (PPA) management is projected to reach a valuation of $223.9 million in 2024. This growth is expected to continue robustly, with the market forecasted to expand at (CAGR) of 18.40%.

The growing adoption of data analytics in the renewable energy sector, especially for managing and optimizing PPAs, is fueling significant growth. As organizations and energy providers use advanced analytics to improve contract management, monitor performance, and forecast energy consumption, the demand for innovative solutions in this area is expected to continue rising.

The integration of data analytics tools allows stakeholders in PPA management to make more informed decisions, mitigate risks, and enhance operational efficiencies. With the growing complexity of PPAs, which involve long-term contracts between energy producers and buyers, the need for precision in tracking and managing these agreements is crucial.

In 2024, North America held a dominant position in the Data Analytics in Power Purchase Agreement (PPA) Management market, capturing more than 32.8% of the global market share, which translated into a revenue of USD 266.5 million.

This leadership is driven by several key factors, including advanced renewable energy infrastructure and high adoption of data analytics tools in the energy sector. North America, especially the United States, is seeing rapid growth in renewable energy, supported by strong government incentives, regulatory frameworks, and a robust energy trading ecosystem.

The presence of leading technology companies and analytics providers in North America further strengthens its dominance in this market. These companies are constantly innovating and developing advanced analytics tools tailored for PPA management, improving contract visibility, risk mitigation, and long-term energy planning.

The shift toward cleaner energy and decarbonization initiatives in North America has also fueled this market segment’s growth. With significant investments in solar and wind power, companies involved in PPAs require more advanced analytics to manage complex contracts, forecast energy output, and track consumption patterns.

Component Analysis

In 2024, the Software segment held a dominant market position in the Data Analytics in PPA Management market, capturing more than a 73.5% share. The primary driver for this dominance is the increasing reliance on software solutions to streamline PPA management.

These platforms help organizations analyze data in real time, predict energy production, monitor contract performance, and manage risks. The growing demand for efficient, automated processes is driving businesses to widely adopt these software solutions to reduce errors and improve operational efficiency.

The rise of advanced analytics platforms, such as predictive analytics tools, is also contributing to the software segment’s leadership. These tools help energy companies forecast future energy generation and optimize power procurement strategies, leading to significant cost savings and better-informed decision-making.

Predictive capabilities allow for proactive management of PPA agreements, helping companies avoid penalties or financial losses due to non-compliance with contract terms. As energy markets become more complex, predictive analytics tools are essential for managing the volatility associated with renewable energy sources like wind and solar power.

Type Analysis

In 2024, the Predictive Analytics segment held a dominant market position, capturing more than a 37.6% share. This dominance stems from the growing need to forecast energy demand, price fluctuations, and contract performance in the PPA management market.

The ability to predict future trends, such as energy price shifts or demand spikes, has made predictive analytics an essential tool for companies aiming to optimize their PPA contracts. This helps organizations reduce risks associated with energy procurement, enabling them to negotiate better terms and adjust strategies accordingly.

Moreover, as renewable energy sources gain momentum, the need for forecasting technologies has skyrocketed. Predictive analytics can estimate future production levels from renewable assets, which often fluctuate depending on weather conditions, thereby allowing businesses to plan for energy needs more effectively.

Advancements in AI and machine learning have enhanced predictive models’ accuracy, making them crucial for PPA management. These technologies enable real-time data analysis and adaptive learning, ensuring more precise predictions. As a result, the predictive analytics segment is expected to drive significant market growth in the coming years.

Application Analysis

In 2024, the Energy Forecasting and Demand Prediction segment dominated the Data Analytics in Power Purchase Agreement (PPA) Management market, capturing more than 29.3% of the market share. This dominance can be attributed to the growing importance of accurate energy forecasting in managing long-term PPAs.

Energy producers and buyers require accurate predictions of demand and supply to align agreements with future consumption and pricing. With the energy market becoming more volatile due to factors like weather, regulations, and technology, precise forecasting and demand prediction tools have become essential.

Advanced data analytics tools allow stakeholders to analyze historical consumption patterns, weather data, and market trends to generate reliable forecasts. This capability is crucial for optimizing energy production and consumption under PPAs, ensuring that both energy providers and buyers meet their contractual obligations without incurring unnecessary costs.

Furthermore, the ability to accurately predict energy demand and supply helps energy companies mitigate risks associated with power shortages or surpluses. By leveraging predictive analytics, firms can make informed decisions about energy procurement, pricing strategies, and contract negotiations.

End User Analysis

In 2024, the Energy Producers segment held a dominant position in the Data Analytics in Power Purchase Agreement (PPA) Management market, capturing over 32.4% of the market share. This dominance is due to the growing need for energy producers to use advanced data analytics to optimize PPA contracts, forecast generation, and minimize operational risks.

As demand for clean energy rises, producers are using data-driven solutions to improve efficiency, predict energy production, and ensure sustainability. Analytics help identify optimal production levels and match them with favorable PPA terms, enhancing their ability to secure profitable contracts.

Energy producers also benefit from using data analytics to refine their asset management strategies. By analyzing historical production data, weather patterns, and market demand fluctuations, they can forecast future production trends with greater accuracy, ensuring that their PPAs are aligned with market needs.

Furthermore, data analytics supports energy producers in optimizing their operations and improving energy efficiency. By integrating real-time data from various sources, such as power plants, smart meters, and weather stations, producers can better understand the factors that affect their energy output.

Key Market Segments

By Component

- Software

- Analytics Platforms

- Predictive Analytics Tools

- Real-time Monitoring and Dashboards

- Others

- Services

- Consulting Services

- Managed Services

- Custom Analytics and Integration Services

By Type

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Others

By Application

- Energy Forecasting and Demand Prediction

- Performance Monitoring and Optimization

- Risk Management and Mitigation

- Cost Optimization and Financial Analysis

- Others

By End User

- Energy Producers

- Energy Buyers

- Energy Traders

- Energy Consultants

Driver

Enhanced Decision-Making through Data Insights

The integration of data analytics in Power Purchase Agreement (PPA) management significantly enhances decision-making. By leveraging real-time data and advanced analytics, stakeholders gain deeper insights into market trends, energy consumption patterns, and pricing fluctuations. This enables better forecasting and more accurate predictions regarding energy supply and demand, allowing companies to make informed decisions.

Analytics can identify inefficiencies in energy procurement strategies, optimize contract terms, and suggest improvements in PPA structures to achieve more favorable pricing or performance clauses. Additionally, the ability to continuously track and analyze operational performance ensures that PPAs remain aligned with the dynamic market landscape.

Restraint

High Initial Investment in Technology and Expertise

Despite its benefits, the adoption of data analytics in PPA management requires significant upfront investment in both technology and expertise.For smaller energy companies or utility providers, implementing data analytics can be costly, with expenses for advanced software, data integration, and hiring skilled analysts to interpret and act on the data.

The technical complexity of deploying such systems may be daunting for organizations with limited resources, potentially slowing the overall adoption rate of analytics in the sector. Moreover, existing systems may need significant upgrades or integration, adding to the costs. As a result, many companies hesitate to pursue digital transformation, despite the long-term benefits of data analytics potentially outweighing these initial financial and technical challenges.

Opportunity

Unlocking Renewable Energy Integration

One major opportunity presented by data analytics in PPA management is the seamless integration of renewable energy sources. Analytics tools can forecast fluctuations in renewable energy generation, such as solar and wind, which is highly variable. By using predictive analytics, energy buyers and sellers can better anticipate when renewable energy sources will be available or scarce, leading to more accurate and reliable PPA agreements.

Furthermore, data analytics can help in designing contracts that maximize the integration of renewables, ensuring that both buyers and suppliers can optimize costs and meet sustainability targets. As more businesses are under pressure to reduce carbon footprints, the role of data analytics in enabling renewable energy integration could help pave the way for more flexible, sustainable, and cost-effective PPAs, contributing to a greener energy future.

Challenge

Data Privacy and Security Risks

A significant challenge in utilizing data analytics for PPA management is ensuring the privacy and security of sensitive data. The vast amounts of data generated, especially when dealing with power consumption patterns, contract terms, and pricing, are highly valuable but also vulnerable to cyberattacks. With growing concerns over data breaches, energy companies must invest heavily in cybersecurity measures to protect client and operational data.

Additionally, sharing data across various entities involved in PPA negotiations such as suppliers, buyers, and third-party vendors raises questions about data ownership and governance. If not managed properly, these risks can erode trust in data-driven solutions, hindering the adoption of analytics in the sector. Companies must tackle security and privacy concerns to fully leverage the potential of data analytics while minimizing associated risks.

Emerging Trends

One emerging trend is the integration of predictive analytics to forecast energy demand and pricing patterns. By analyzing historical data, energy producers and buyers can better anticipate market fluctuations and optimize their contracts.

Another key trend is the use of machine learning algorithms to automate certain processes in PPA management. Additionally, these algorithms can optimize contract terms based on past performance data, leading to more favorable agreements for both parties.

Moreover, blockchain technology is being explored as a way to enhance transparency and security in PPA contracts. The ability to create immutable, time-stamped records of transactions could help prevent disputes and ensure that both parties are adhering to the terms of the agreement.

Business Benefits

- Improved Decision Making: Data analytics helps organizations make smarter choices by providing insights into energy consumption patterns, pricing trends, and contract performance. With clear data, managers can assess risks and opportunities better.

- Cost Optimization: By analyzing historical and real-time data, businesses can identify ways to reduce energy costs. It allows companies to compare various energy contracts and find the most cost-effective options.

- Enhanced Risk Management: Analytics helps in predicting potential risks like market volatility or regulatory changes. This gives companies a proactive approach to managing their PPAs, reducing unexpected financial impacts.

- Better Compliance and Reporting: Data analysis helps companies stay on top of compliance requirements by automatically tracking key metrics, ensuring they meet regulatory standards and report accurately.

- Optimized Contract Performance: By monitoring real-time data and trends, companies can optimize contract terms, renegotiate deals if necessary, and ensure they are meeting the best performance levels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Enel X S.r.l. stands out in the market as a leader in providing innovative energy management solutions, especially in the field of PPAs. With its advanced data analytics capabilities, Enel X helps companies better understand their energy usage and streamline their procurement processes.

Siemens Energy, Inc. is another top player that has made significant strides in integrating data analytics with PPA management. Their expertise in the energy sector, combined with advanced analytics tools, allows for real-time energy monitoring and optimization.

Schneider Electric SE is well-known for its innovative approach to energy management and automation, and it brings this expertise to PPA management through the power of data analytics. By using predictive analytics, Schneider Electric offers solutions that allow companies to optimize energy procurement strategies, forecast future consumption, and manage energy risks effectively.

Top Key Players in the Market

- Enel X S.r.l.

- Siemens Energy, Inc.

- Schneider Electric SE

- GE Digital LLC

- GridEdge Solutions Ltd.

- Trilliant Inc.

- EnergyHub, Inc.

- Itron, Inc.

- Uptake Technologies, Inc.

- ABB Group

- Other Major Players

Top Opportunities Awaiting for Players

- Optimizing Contract Performance & Risk Management: Data analytics enables real-time monitoring of PPA performance, helping producers and buyers track energy production, consumption, and costs. By analyzing historical data, companies can better forecast risks like price volatility, system failures, and supply disruptions.This predictive capability enables stakeholders to act proactively and mitigate financial risks, leading to more stable and reliable agreements.

- Market Expansion and Innovation: Data analytics can uncover emerging market opportunities and consumer preferences, enabling companies to tailor their offerings and explore new business models. This adaptability is crucial for staying ahead in a rapidly evolving energy landscape.

- Enhancing Renewable Energy Integration: Data analytics offers the opportunity to optimize the integration of renewable sources like wind and solar into the grid. By analyzing factors such as weather patterns, energy production efficiency, and grid performance, analytics can predict how renewable sources will contribute to the energy mix, helping to balance supply and demand.

- Efficiency in Energy Trading: Energy trading plays a crucial role in PPA management, particularly for large corporations and utilities. Analytics tools help simplify this process by offering insights into market trends, price fluctuations, and supply-demand gaps. This helps players make more informed and timely decisions in the energy markets, potentially increasing profitability through smarter trade strategies.

- Automating PPA Reporting & Compliance: By automating reporting processes, companies can streamline the tracking of energy consumption, financial transactions, and environmental impact metrics. This reduces administrative overhead, ensuring timely and accurate reports while also improving transparency with regulatory bodies and other stakeholders.

Recent Developments

- In May 2024, LevelTen Energy has revolutionized Power Purchase Agreement (PPA) negotiations by integrating advanced AI tools. These innovative solutions streamline contract processes, providing predictive analytics and valuable market insights that empower decision-making. By leveraging AI, LevelTen simplifies complex negotiations, enhancing efficiency and accuracy.

- In August 2024, Meta has partnered with NextEra Energy to develop a 600 MW wind farm in Iowa, a project set to power Meta’s data centers while also bolstering the state’s renewable energy infrastructure. This collaboration not only advances Meta’s sustainability goals but also contributes to the growth of green energy, fostering long-term environmental benefits.

Report Scope

Report Features Description Market Value (2024) USD 812.5 Mn Forecast Revenue (2034) USD 4,398.9 Mn CAGR (2025-2034) 18.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software (Analytics Platforms, Predictive Analytics Tools, Real-time Monitoring and Dashboards, Others), Services (Consulting Services, Managed Services, Custom Analytics and Integration Services), By Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Others), By Application (Energy Forecasting and Demand Prediction, Performance Monitoring and Optimization, Risk Management and Mitigation, Cost Optimization and Financial Analysis, Others), By End User (Energy Producers, Energy Buyers, Energy Traders, Energy Consultants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Enel X S.r.l., Siemens Energy, Inc., Schneider Electric SE, GE Digital LLC, GridEdge Solutions Ltd., Trilliant Inc., EnergyHub, Inc., Itron, Inc., Uptake Technologies, Inc., ABB Group, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Analytics in PPA Management MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Data Analytics in PPA Management MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Enel X S.r.l.

- Siemens Energy, Inc.

- Schneider Electric SE

- GE Digital LLC

- GridEdge Solutions Ltd.

- Trilliant Inc.

- EnergyHub, Inc.

- Itron, Inc.

- Uptake Technologies, Inc.

- ABB Group

- Other Major Players