Global Standalone 5G Network Market Size, Share, Trends Analysis Report By Component (Solutions (5G Radio Access Network (RAN), 5G Core Network, Others (Backhaul and Fronthaul, Switches, Routers))), Services), By Spectrum Type (Sub-6 GHz, mmWave), By Network Type (Public, Private), By Industry Vertical (Manufacturing, Automotive and Transportation, Enterprise/Corporate, Energy & Utilities, Healthcare/Hospitals, Smart Cities, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 107219

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

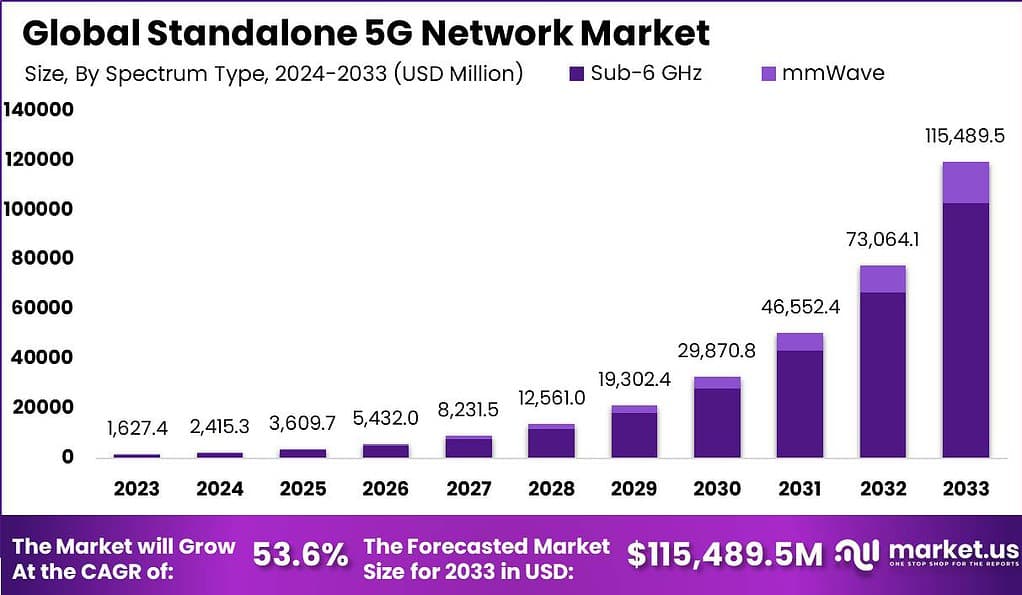

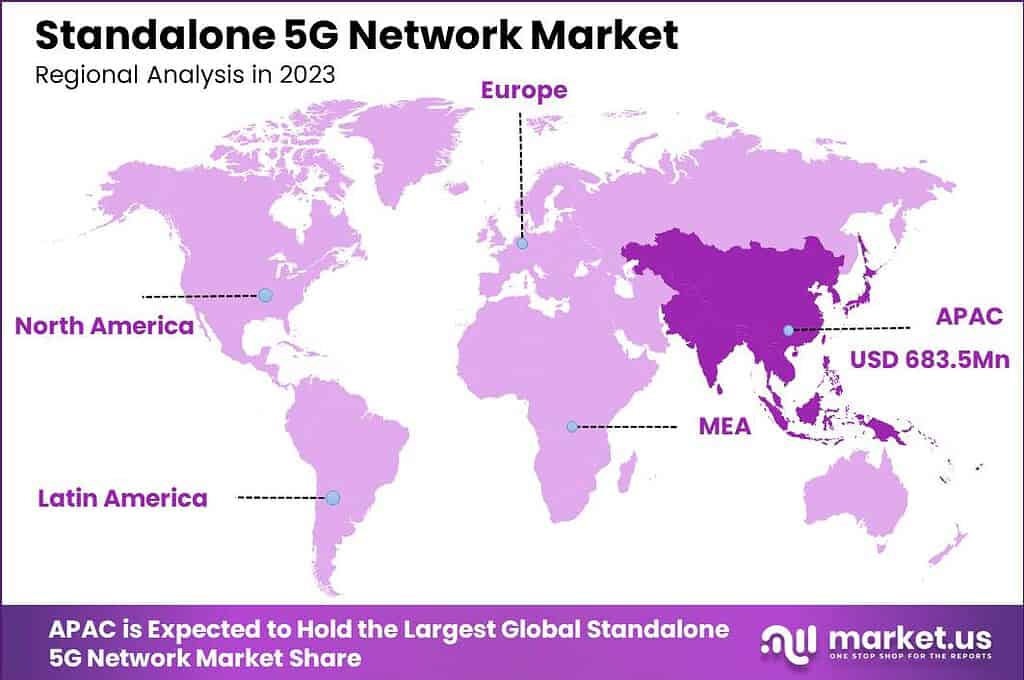

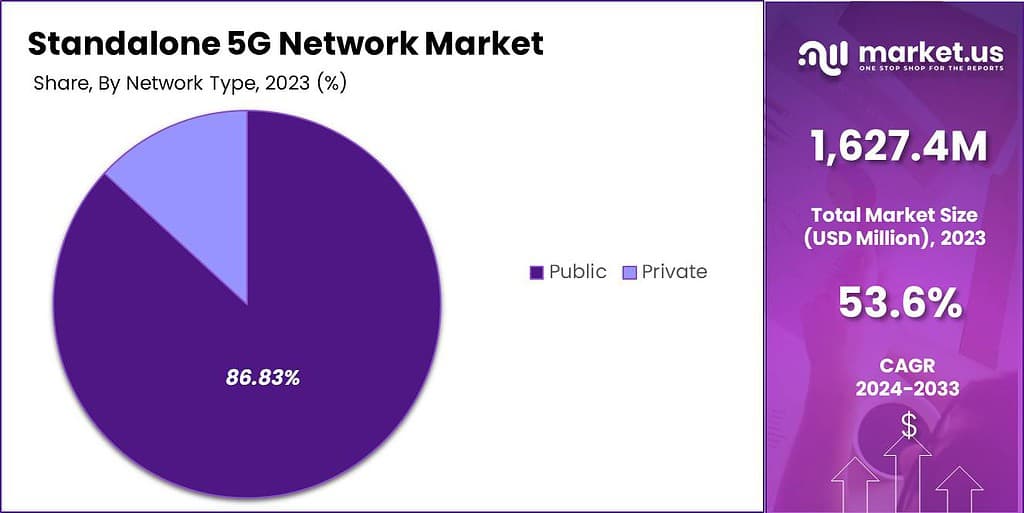

The Global Standalone 5G Network Market size is expected to be worth around USD 115,489.5 Million By 2033, from USD 1,627.4 Million in 2023, growing at a CAGR of 53.6% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 42% share, holding USD 683.5 Million revenue.

A Standalone 5G Network (5G SA) refers to a fully independent 5G network that operates without relying on existing 4G LTE infrastructure. This network architecture employs a dedicated 5G core that manages all traffic and data, distinguishing it from Non-Standalone (NSA) networks that combine 5G technologies with a 4G core. The standalone version delivers a complete 5G experience, characterized by significantly faster data speeds, ultra-low latency, and improved network efficiency.

The Standalone 5G Network market is expanding as more mobile operators adopt this technology to leverage its full capabilities. The market’s growth is driven by the demand for higher data speeds and more reliable network connections that are critical for emerging technologies like autonomous vehicles, industrial automation, and massive IoT deployments. This transition is fueled by the need for more efficient networks capable of supporting new business models and services that require high reliability and low latency.

For instance, According to GSMA, by the end of 2022, global 5G connections hit an impressive 1 billion, and they are expected to rise to 1.5 billion by 2023 and further to 2 billion by 2025. This surge makes 5G the fastest rollout ever for a new generation of mobile tech, easily outpacing the adoption rates of both 3G and 4G. The demand for faster connectivity and a growing ecosystem of 5G devices are key drivers behind this accelerated adoption.

Key growth factors for the Standalone 5G Network market include the ongoing global push for digital transformation across various sectors including manufacturing, automotive, and public safety. The need for networks that can support extensive machine-to-machine communication and real-time data transmission without delays is propelling the adoption of 5G SA. Moreover, governments and private entities are heavily investing in 5G infrastructure to boost economic growth and improve public services, thereby increasing market demand.

Standalone 5G networks open up attractive opportunities in areas such as smart cities, telemedicine, and advanced AR/VR applications. These networks enable technologies that require immediate data processing capabilities and support innovations like network slicing, where operators can partition a single physical network into multiple virtual networks optimized for specific applications.

Additionally, the integration of edge computing with 5G SA reduces latency further, enhancing the performance of real-time applications. These capabilities make standalone 5G a foundational technology for the future of digital communication, promising significant advancements in how industries operate and deliver services.

According to the Global Mobile Suppliers Association (GSA)’s July 2023 summary report, there’s significant investment in public 5G Standalone (SA) networks. Globally, 115 operators across 52 countries are progressing through various stages, including trials, planned deployments, and active rollouts. This group forms 21.4% of the total 535 operators that are active in 5G-related activities such as securing licenses and deploying networks.

Out of these operators, 36 have either launched or are in the process of deploying public 5G SA networks, some on a trial basis. Additionally, 24 operators are currently involved in public network deployments or trials. Meanwhile, 31 operators have plans laid out for future 5G SA deployments.

The growth of the 5G SA ecosystem is also evident in the number of devices ready for this technology. By July 2023, the market saw an impressive rise to over 1,750 announced devices compatible with 5G SA, highlighting a robust increase from the previous years. This expansion points to the growing industry recognition of the benefits offered by 5G SA, such as reduced latency and better support for multiple devices, illustrating a strong market momentum

Key Takeaways

- The Standalone 5G Network Market is projected to reach USD 115,489.5 million by 2033, starting from USD 1,627.4 million in 2023, showcasing a robust CAGR of 53.6% over the forecast period (2024–2033).

- Asia-Pacific (APAC) emerged as the leading region in 2023, capturing over 42% market share, equivalent to USD 683.5 million in revenue. This dominance is driven by APAC’s early 5G deployments and large-scale investments in network infrastructure.

- Within this market, the Solutions segment dominated with an 81.23% share in 2023. This preference reflects a growing demand for tailored 5G solutions that align with the digital needs of various industries.

- The Sub-6 GHz segment took the lead in the spectrum category, accounting for 86.11% of the market share in 2023. This high share emphasizes the broad adoption of Sub-6 GHz frequencies for balanced coverage and speed across both urban and rural areas.

- The Public segment also stood out, holding an 86.83% market share in 2023. This reflects the widespread rollout of standalone 5G networks by public carriers and government-backed initiatives aimed at enhancing connectivity.

- By industry, Manufacturing dominated in 2023 with a 23.52% market share. This is fueled by the sector’s focus on integrating 5G for smart manufacturing, automation, and improved supply chain efficiency.

APAC Standalone 5G Network Market Size

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the Standalone 5G Network Market, capturing more than a 42% share, with revenues amounting to USD 683.5 million. This leadership can largely be attributed to the rapid industrialization and digitalization across major APAC economies, especially in countries like China, South Korea, and Japan.

These nations have made significant investments in 5G technology, driven by governmental support and initiatives aimed at enhancing their technological infrastructure to support advanced applications such as smart cities, industrial automation, and digital healthcare. Moreover, the high population density in the region offers a vast consumer base for 5G services, which are increasingly demanded for enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine type communications.

The region’s telecom operators are aggressively expanding their 5G services, which is further propelled by the growing proliferation of 5G-enabled smartphones and devices among consumers. This consumer market dynamic fosters an environment ripe for rapid adoption and expansion of 5G networks. Additionally, APAC benefits from a competitive landscape where local technology firms and telecom operators are deeply involved in the development and testing of new 5G technologies.

This competition not only drives innovation but also reduces costs, making 5G solutions more accessible and encouraging faster rollout across the region. The presence of major global players in semiconductor and telecommunications manufacturing within APAC also supports the deployment and expansion of standalone 5G networks by ensuring the availability of necessary hardware and expertise.

The market share of standalone 5G networks in North America stands at 5.8%. This reflects a growing interest in leveraging advanced network capabilities to enhance connectivity and support various tech-driven sectors like telecommunications and IoT.

Europe shows a strong adoption rate, holding 33.2% of the standalone 5G network market. This significant percentage indicates robust investments and deployment of 5G infrastructures aimed at improving network performance and supporting the digital transformation initiatives across the continent.

The market penetration of standalone 5G networks in Latin America is currently at 5.6%. Additionally, the overall contribution to the 5G network space is 13.3%, suggesting a steady but growing interest in modernizing network capabilities to boost connectivity and technological upgrades in the region.

Component Analysis

In 2023, the Solutions segment within the Standalone 5G Network Market held a dominant position, capturing more than an 81.23% share. This segment’s leadership is attributed to its crucial role in enabling the core functionalities of 5G networks.

The Solutions segment includes essential components such as the 5G Radio Access Network (RAN), 5G Core Network, and other infrastructure elements like backhaul and fronthaul, switches, and routers. These components are foundational to deploying standalone 5G networks that do not rely on existing 4G infrastructure.

The 5G RAN is pivotal in ensuring wide coverage and efficient data transmission across the network. It allows for higher data rates and capacity, which are fundamental to meeting the demands of increased traffic and the burgeoning number of IoT devices. Similarly, the 5G Core Network is integral to managing network traffic and routing, providing the necessary agility and flexibility that define 5G technology.

This core network supports advanced features like network slicing, which enables the creation of multiple virtual networks within a single physical network, catering to varied service requirements. Furthermore, the inclusion of other components like backhaul, fronthaul, switches, and routers underlines the importance of robust and reliable connectivity infrastructure.

These components help in efficiently managing the data traffic between the cell sites and the core network, which is vital for maintaining the performance of the 5G network under high demand. The need for high-speed and reliable connectivity solutions is ever-increasing in industries such as autonomous driving, smart cities, and telemedicine, thus driving the demand for these advanced network solutions.

The prominence of the Solutions segment is also bolstered by continuous technological advancements and the integration of AI and machine learning technologies, which enhance the capability of 5G networks to handle complex operations and decision-making processes in real-time.

This makes the Solutions segment not only critical but also a strategic driver of growth in the standalone 5G network market. As the deployment of 5G networks expands globally, the demand for these sophisticated and high-performing network components is expected to rise, further reinforcing the leading position of the Solutions segment in the market.

Spectrum Type Analysis

In 2023, the Sub-6 GHz segment of the Standalone 5G Network Market held a dominant market position, capturing more than an 86.11% share. This leadership is primarily due to its wider coverage and compatibility across existing mobile infrastructure, which makes it a foundational element in the global rollout of 5G networks.

Sub-6 GHz frequencies are crucial for operators looking to offer 5G capabilities over large geographic areas, as they travel farther and penetrate buildings better than higher frequency bands. This characteristic is particularly advantageous in rural and suburban areas where wide coverage is necessary.

Moreover, the Sub-6 GHz spectrum is instrumental in providing a balanced combination of coverage, speed, and latency. While it does not match the peak speeds that millimeter wave (mmWave) frequencies can offer, it significantly enhances the capacity and consistency of service compared to earlier generations. This makes it ideal for a broad range of applications, from enhanced mobile broadband to industrial IoT and smart cities, where reliability and widespread coverage are more critical than ultra-high speeds.

The predominance of the Sub-6 GHz segment is also supported by the existing regulatory and spectrum allocation frameworks in many regions, which have facilitated quicker and more cost-effective deployment compared to mmWave. The equipment and devices supporting Sub-6 GHz are more mature, leading to faster adoption among service providers and users.

As 5G networks expand, the demand for Sub-6 GHz solutions continues to grow, driven by the need for robust mobile broadband services and the burgeoning development of connected devices. Overall, the Sub-6 GHz segment’s leadership in the Standalone 5G Network Market is a testament to its role as a versatile and practical solution for delivering next-generation 5G services across diverse environments and applications.

Network Type Analysis

In 2023, the Public segment of the Standalone 5G Network Market held a dominant market position, capturing more than an 86.83% share. This leadership stems primarily from the extensive investment in public 5G infrastructures by governments and telecommunications companies worldwide, aimed at enhancing national and regional connectivity.

Public 5G networks are crucial for implementing wide-area coverage that benefits the general population, supporting everything from mobile broadband to critical communication services in urban and rural areas. Additionally, the public segment benefits significantly from regulatory support, which often includes spectrum allocation and funding initiatives designed to accelerate the deployment of 5G technology.

These networks are essential for driving the digital economy, supporting sectors such as education, healthcare, and public safety by providing high-speed, reliable connectivity. As these sectors increasingly rely on advanced technological solutions, the demand for robust public 5G networks continues to grow.

The scalability of public 5G networks also contributes to their dominant position. They are designed to handle massive numbers of simultaneous connections without degradation in service, crucial for the support of IoT applications and the burgeoning number of 5G-enabled devices. This capability is vital in urban environments where the density of users and devices per square kilometer is high, ensuring that the network infrastructure can meet demand now and in the future.

Overall, the predominance of the Public segment in the Standalone 5G Network Market is driven by its foundational role in national infrastructure, significant government and commercial backing, and its ability to meet wide-scale consumer and business needs effectively. This makes the public network type not just prevalent but also critical for the broader adoption and success of 5G technology globally.

Industry Vertical Analysis

In 2023, the Manufacturing segment held a dominant market position in the Standalone 5G Network Market, capturing more than a 23.52% share. This leading role is primarily due to the critical nature of digital transformation initiatives across the manufacturing industry, which rely heavily on the capabilities provided by 5G technology.

Standalone 5G networks enable manufacturers to implement advanced digital solutions such as real-time monitoring, automation, and AI-driven analytics, which significantly enhance operational efficiency and productivity. Moreover, the adoption of 5G in manufacturing facilitates the deployment of Industrial Internet of Things (IIoT) technologies, which are essential for creating smart factories.

These technologies help in optimizing production processes and improving supply chain management, making the manufacturing sector one of the most significant beneficiaries of 5G’s ultra-reliable and low-latency communications. As factories continue to evolve into fully integrated and automated environments, the demand for dependable and fast network infrastructure becomes increasingly crucial.

Additionally, 5G networks support the application of augmented reality (AR) and virtual reality (VR) in manufacturing operations for tasks such as equipment maintenance, training, and product development. These applications require massive data bandwidth and extremely low latency to function effectively, which are hallmarks of standalone 5G networks.

The ability to process and analyze data at unprecedented speeds allows manufacturers to gain insights faster, predict maintenance issues before they occur, and customize production processes in real-time. Overall, the Manufacturing segment’s dominance in the Standalone 5G Network Market is driven by its rapid technological advancements and the essential need for connectivity solutions that can support the high demands of modern manufacturing environments.

Key Market Sements

By Component

- Solutions

- 5G Radio Access Network (RAN)

- 5G Core Network

- Others (Backhaul and Fronthaul, Switches, Routers)

- Services

By Spectrum Type

- Sub-6 GHz

- mmWave

By Network Type

- Public

- Private

By Industry Vertical

- Manufacturing

- Automotive and Transportation

- Enterprise/Corporate

- Energy & Utilities

- Healthcare/Hospitals

- Smart Cities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Driver

Enhanced User Experience and Technological Capabilities

One of the primary drivers of the Standalone 5G Network Market is the significant enhancement in user experience and the technological capabilities it enables. Standalone 5G networks operate independently from the existing 4G infrastructure, which allows for lower latency and greater coverage.

This fundamental improvement is crucial for applications requiring real-time responsiveness such as autonomous driving, immersive virtual reality, and industrial automation. The deployment of Standalone 5G promises to revolutionize these sectors by providing faster, more reliable connectivity and supporting a wide range of new applications and services that were not possible with earlier technology generations.

Restraint

High Deployment Costs

The expansion of Standalone 5G networks faces a significant restraint due to the high costs associated with deploying new network infrastructures. Building out a Standalone 5G network requires substantial investment in new technologies and infrastructure, such as small cells for dense network coverage and upgraded backhaul capabilities to handle increased data loads. The financial burden is compounded by the need for extensive testing and optimization to ensure network reliability and performance, making the initial setup and operational scaling costly.

Opportunity

Expanding Enterprise Applications

Standalone 5G networks present vast opportunities, especially in enterprise applications across various industries. The technology’s ability to handle massive data transfer speeds and its low latency supports critical applications like smart manufacturing and logistics, where real-time data processing and analysis are essential. Furthermore, as businesses increasingly rely on cloud computing and IoT devices, Standalone 5G networks will be pivotal in managing these elements efficiently, offering businesses new ways to operate and innovate.

Challenge

Integration with Existing Technologies

A notable challenge in the Standalone 5G Network Market is the complexity of network management and the integration of new technologies with existing infrastructures. As 5G networks require significant modifications to traditional network architectures, integrating these advanced networks with current systems poses technical and management challenges.

This includes ensuring compatibility between old and new technologies, maintaining network security, and providing consistent quality of service across different environments. These factors require sophisticated skill sets and substantial resources, posing a barrier to smooth and widespread adoption of standalone 5G networks.

Growth Factors

The growth of the Standalone 5G Network Market is primarily driven by the continuous expansion of IoT and the increasing automation in industries such as automotive, manufacturing, and healthcare. As these sectors increasingly adopt connected devices that require robust and efficient networks, standalone 5G networks are set to become indispensable.

These networks provide the necessary infrastructure to support massive IoT deployments with enhanced capabilities like network slicing, which allows for the creation of customized environments tailored to specific needs of connectivity and security.

Emerging Trends

Emerging trends in the Standalone 5G Network Market include the adoption of network slicing, which allows for the creation of multiple virtual networks within a single physical network. This capability is critical for supporting diverse applications with varying performance requirements within the same infrastructure.

Additionally, the push towards integrating artificial intelligence and machine learning in network management is gaining traction. These technologies are expected to improve network efficiency and automation, offering service providers new ways to manage and optimize their networks dynamically.

Key Players Analysis

The market players in the SA 5G space are actively focused on developing new products and upgrading their existing portfolios. This proactive approach to innovation helps them stay competitive in a rapidly evolving market. By expanding their offerings, these companies not only meet the growing demand but also strengthen their position in the 5G landscape.

For instance, in January 2023, Telefonaktiebolaget LM Ericsson partnered with Spark, New Zealand’s prominent telecommunications and digital service provider, along with Red Hat, a leader in open-source enterprise solutions. Together, they successfully completed an SA 5G trial in New Zealand. This collaboration highlights the value of shared expertise and is a promising step towards expanding SA 5G implementation in the region

T-Mobile USA, Inc. has been a major player in the U.S. 5G market, focusing on expanding its 5G Standalone (SA) capabilities. T-Mobile was among the first to launch 5G SA nationwide, allowing it to offer improved speeds and latency across the country. This positions T-Mobile as a leader in leveraging Standalone 5G to provide advanced mobile experiences and support emerging applications like augmented reality (AR) and the Internet of Things (IoT).

Nokia Corporation has established itself as a leading 5G SA vendor by offering cutting-edge solutions like 5G RAN and core network technology. The company collaborates with telecom operators globally, providing end-to-end 5G solutions that emphasize speed, security, and reliability. Nokia’s emphasis on network slicing and 5G for enterprises positions it well in various industries, from manufacturing to healthcare.

Vodafone Limited focus on 5G SA technology across Europe and Asia highlights its commitment to bringing ultra-fast connectivity to urban and rural areas. Vodafone has made substantial investments in its infrastructure to support standalone 5G, which has enabled the company to enhance mobile broadband experiences for consumers and explore industrial use cases such as remote monitoring and smart logistics.

Top Key Players in the Market

- T-Mobile USA, Inc.

- Nokia Corporation

- Vodafone Limited

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- Samsung Electronics. Co. Ltd.

- AT&T, Inc.

- Singtel

- Rogers Communications Canada Inc.

Recent Developments

- Nokia Corporation, in collaboration with T-Mobile and Qualcomm, achieved a global first in February 2023 by deploying 5-component carrier (5CC) aggregation on T-Mobile’s 5G standalone network. The trial demonstrated 4.2 Gbps peak speeds, using Nokia’s AirScale base station and Qualcomm’s Snapdragon X75 Modem-RF system, marking a step toward higher data rates and improved 5G network coverage for carrier.

- T-Mobile USA Inc. partnered with Nokia and Qualcomm to achieve a significant milestone in March 2023, aggregating four channels of mid-band spectrum on its standalone 5G network. This enabled T-Mobile to reach uplink speeds above 3.3 Gbps using Samsung Galaxy S23 devices. This move supports faster speeds and reduced latency, laying the groundwork for seamless 5G applications such as gaming and VoNR (Voice over New Radio) in cities across the U.S.

Report Scope

Report Features Description Market Value (2023) USD 1,627.4 Mn Forecast Revenue (2033) USD 115,489.5 Mn CAGR (2024-2033) 53.6% Base Year for Estimation 2023 Historic Period 2021-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions (5G Radio Access Network (RAN), 5G Core Network, Others (Backhaul and Fronthaul, Switches, Routers))), Services), By Spectrum Type (Sub-6 GHz, mmWave), By Network Type (Public, Private), By Industry Vertical (Manufacturing, Automotive and Transportation, Enterprise/Corporate, Energy & Utilities, Healthcare/Hospitals, Smart Cities, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa (South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape T-Mobile USA Inc., Nokia Corporation, Vodafone Limited, Huawei Technologies Co., Ltd., Verizon Communications Inc., Samsung Electronics. Co. Ltd., AT&T Inc., Singtel, Rogers Communications Canada Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Standalone 5G Network MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Standalone 5G Network MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- T-Mobile USA, Inc.

- Nokia Corporation

- Vodafone Limited

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- Samsung Electronics. Co. Ltd.

- AT&T, Inc.

- Singtel

- Rogers Communications Canada Inc.