Global Industrial Internet Of Things (IIoT) Market By Component (Solution, Services and Platform), By End-Use Industry (Manufacturing, Energy & Power, Transportation & Logistics, Mining, Oil & Gas, Healthcare and Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 56479

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

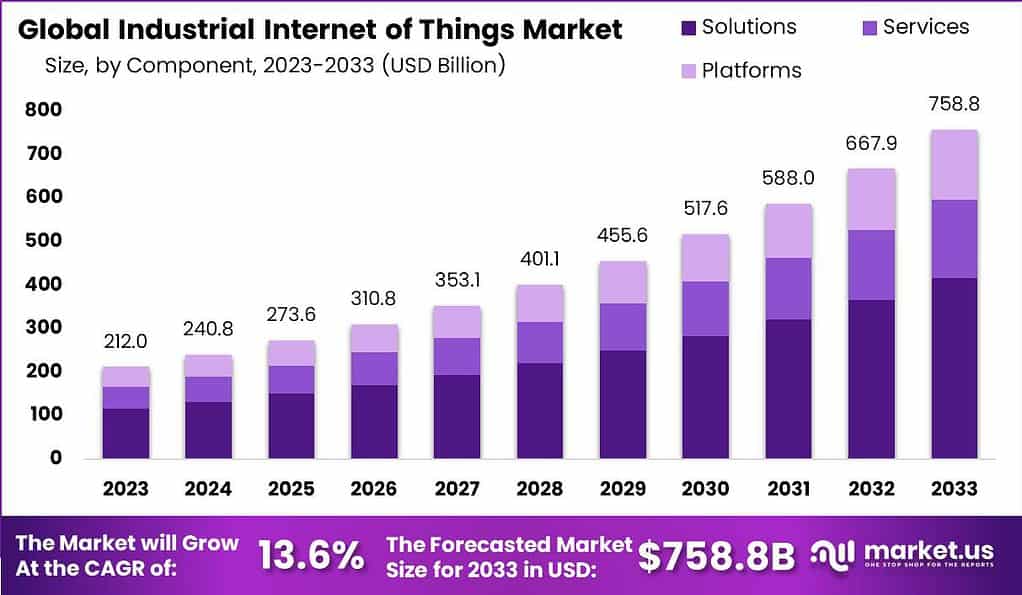

The Global Industrial Internet Of Things (IIoT) Market size is expected to be worth around USD 758.8 billion by 2033 from USD 212.0 billion in 2023, growing at a CAGR of 13.6% during the forecast period from 2024 to 2033.

The Industrial Internet of Things (IIoT) refers to the application of internet connectivity and smart sensors to industrial equipment and machines. It enables advanced data collection, monitoring, analytics and more automation in manufacturing environments. IIoT connects industrial assets to a network, allowing them to communicate and share insights across platforms. This creates operational efficiencies, improves productivity and helps address issues proactively.

IIoT makes use of advanced technologies like cloud computing, big data analytics, machine learning and artificial intelligence, to facilitate seamless data connectivity as well as data transfer between systems and devices. It allows industrial enterprises to manage, monitor and optimize their processes remotely, which results in reductions in costs, enhanced efficiency and performance, as well as improved overall competitiveness.

Note: Actual Numbers Might Vary In The Final Report

The Industrial Internet of Things (IIoT) Market pertains to the industry that delivers solutions, platforms, and services supporting the implementation and use of IIoT technologies in various industrial sectors. This market encompasses a diverse array of hardware, software, and service providers, addressing the specific requirements of industrial automation, manufacturing, energy, transportation, and related fields.

The growth of the IIoT Market is fueled by the escalating demand for automation, connectivity, and data-driven insights in the industrial sector. Organizations are keen on harnessing IIoT technologies to optimize their operations, enhance asset utilization, minimize downtime, and improve overall operational efficiency. The market provides a range of solutions, including industrial sensors, connectivity solutions, edge computing devices, data analytics platforms, and cybersecurity solutions tailored to industrial environments.

Key Takeaways

- Market Size and Growth: The IIoT market is projected to reach approximately USD 758.8 billion by 2033 from its 2023 valuation of USD 212.0 billion, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

- Definition of IIoT: IIoT stands for Industrial Internet of Things, which involves the application of internet connectivity and smart sensors to industrial equipment and machines. This technology enables advanced data collection, monitoring, analytics, and automation in manufacturing environments.

- Technological Advancements: IIoT leverages advanced technologies such as cloud computing, big data analytics, machine learning, and artificial intelligence to facilitate seamless data connectivity and transfer between industrial systems and devices.

- Market Drivers: The growth of the IIoT market is driven by the increasing demand for automation, connectivity, and data-driven insights in various industrial sectors. It helps optimize operations, enhance asset utilization, minimize downtime, and improve overall operational efficiency.

- Component Analysis: In 2023, the Solutions segment held the dominant market position in the IIoT market, accounting for more than 54.8% share. Services and Platforms also play crucial roles in the IIoT ecosystem.

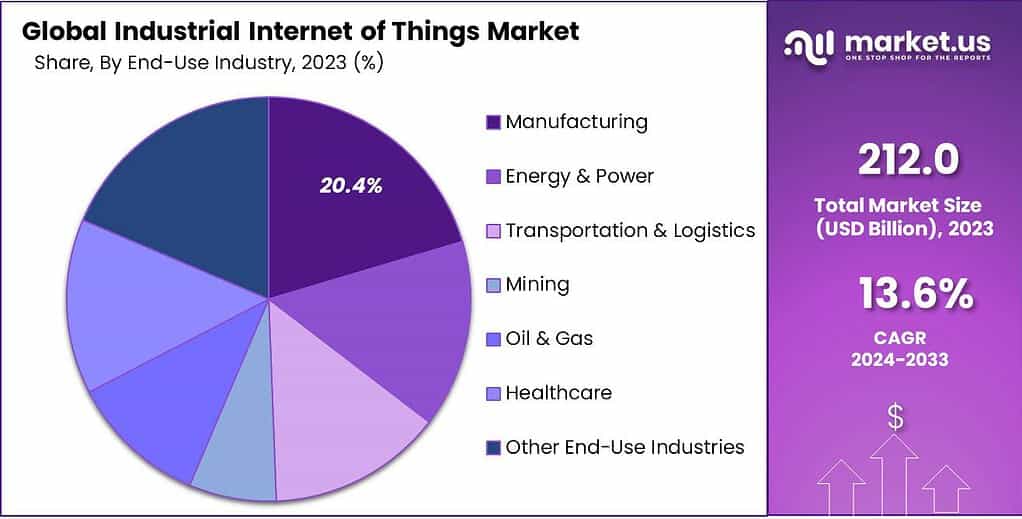

- End-Use Industries: Manufacturing is the leading end-use industry for IIoT, followed by Energy & Power, Transportation & Logistics, Mining, Oil & Gas, Healthcare, and Other End-Use Industries. IIoT is revolutionizing these sectors by improving efficiency and productivity.

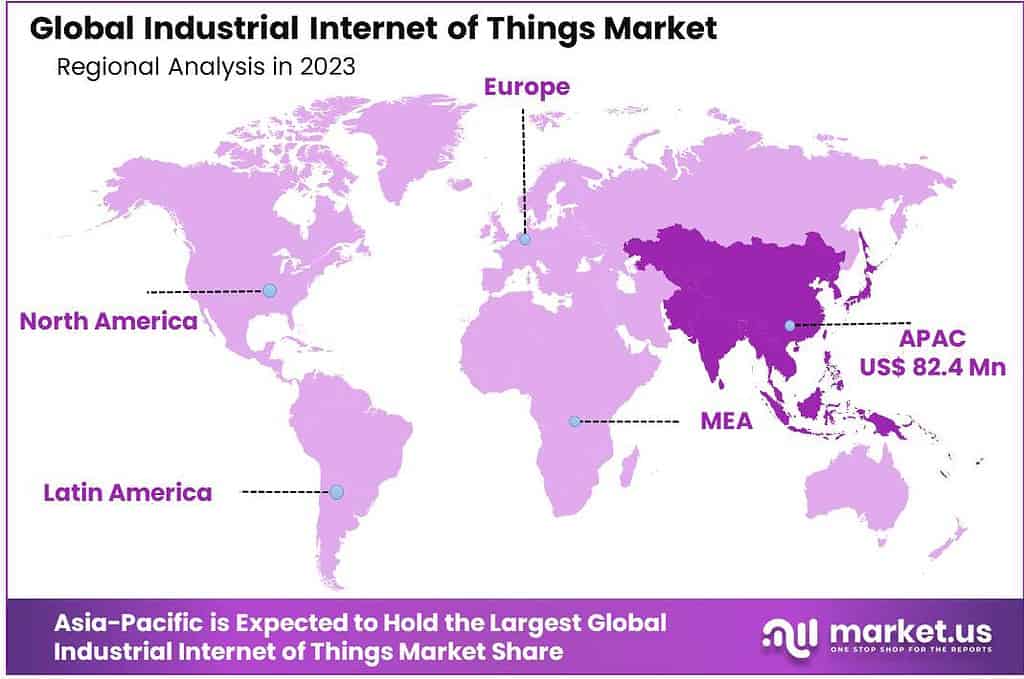

- Regional Analysis: In 2023, Asia-Pacific (APAC) led the IIoT market with over 38.9% market share, driven by its thriving manufacturing sector and rapid industrialization. North America and Europe also held significant market positions.

- Key Players: Prominent players in the IIoT market include ABB Ltd., Siemens AG, IBM Corporation, Intel Corporation, Schneider Electric SE, and many others. These players are focusing on innovation and collaboration to strengthen their market presence.

- Growth Opportunities: The IIoT market presents opportunities for advancements in technology, smart city initiatives, predictive maintenance solutions, and growth in the healthcare sector. These factors contribute to the market’s positive outlook.

- Challenges: Challenges associated with implementing IIoT solutions include a skill gap in managing IIoT systems, data privacy and regulatory complexities, interoperability issues, and ensuring device reliability in harsh industrial environments.

Industrial Internet of Things (IIoT) Market Trends

According to research from Microsoft, 87% of decision-makers in the manufacturing industry express a preference for adoption. Key use cases include industrial automation, quality and compliance, production planning and scheduling, supply chain and logistics, as well as plant safety and security.

For example, as revealed in a survey conducted by Ubisense, a tracker specializing in the precise tracking of the location, movement, and interactions of objects, the 2023 manufacturing landscape presents a clear picture. The survey indicates that 62% of manufacturers have integrated IoT technologies into their manufacturing or assembly processes. This notable surge in adoption underscores a growing recognition of IoT’s substantial potential to streamline operations and enhance productivity.

Furthermore, a study conducted by Capgemini indicates that industrial manufacturing ranks second in average implementation percentage of high-potential use cases among industries, trailing only behind the telecom sector, with a rate of 33%. This focus is primarily directed towards production asset maintenance, manufacturing intelligence, and optimization of product quality.

Component Analysis

In 2023, the Solutions segment held a dominant market position in the Industrial Internet of Things (IIoT) Market, capturing more than a 54.8% share. This segment includes critical elements like industrial sensors, smart meters, and automation systems that are fundamental to the IIoT infrastructure. The prominence of the Solutions segment is primarily due to the increasing need for operational efficiency, predictive maintenance, and optimized resource utilization in industries.

Manufacturers and industrial operators are investing heavily in IIoT solutions to enhance productivity, reduce downtime, and gain deeper insights into their operations. The integration of advanced analytics and machine learning with these solutions is further driving their adoption, providing industries with the tools to make data-driven decisions and improve their overall performance.

The Services segment also plays a crucial role in the IIoT market. As the deployment of IIoT solutions grows, the demand for services such as installation, maintenance, and consulting is also increasing. These services are essential for ensuring the proper implementation and functioning of IIoT systems. They help organizations navigate the complexities of digital transformation, ensuring that the technologies are aligned with business objectives and are delivering the expected value. The Services segment is particularly important for companies that lack the in-house expertise to manage IIoT solutions, making it a critical component of the market.

Lastly, the Platform segment is an integral part of the IIoT market, providing the necessary framework for connecting and managing devices and data. These platforms offer tools for data collection, processing, visualization, and analysis, enabling businesses to extract valuable insights from their IIoT deployments. As the number of connected devices continues to grow, and the need for interoperability and security becomes more critical, the importance of robust IIoT platforms is becoming increasingly apparent. This segment is expected to see significant growth as companies look for scalable, secure, and efficient ways to manage their expanding networks of IIoT devices.

End-Use Analysis

In 2023, the Manufacturing segment held a dominant market position in the Industrial Internet of Things (IIoT) market, capturing more than a 20.4% share. This substantial share is primarily due to the increasing adoption of smart sensors, robotics, and big data analytics in manufacturing processes to improve efficiency, reduce downtime, and predict maintenance needs. The integration of IIoT in manufacturing, often referred to as Smart Manufacturing or Industry 4.0, is revolutionizing production lines, leading to more flexible and responsive operations.

Following closely is the Energy & Power sector, leveraging IIoT for advanced monitoring and management of energy distribution networks. With a significant focus on sustainable and efficient energy use, IIoT technologies are critical in optimizing power generation, distribution, and consumption, enhancing grid stability and operational efficiency.

The Transportation & Logistics industry is also making strides with IIoT, using it to streamline operations, enhance supply chain visibility, and improve the safety and maintenance of vehicles and infrastructure. Real-time data from sensors helps in making informed decisions, reducing costs, and improving service delivery.

In the realm of Mining, IIoT is a game-changer, providing solutions for remote monitoring of hazardous environments, predictive maintenance of equipment, and optimization of operations. The technology ensures safer working conditions and more efficient resource extraction.

The Oil & Gas sector relies heavily on IIoT for real-time monitoring of operations, predictive maintenance, and safety management. With the industry’s complex and often remote operations, IIoT technologies offer significant improvements in operational reliability and cost reductions.

Healthcare is another significant segment embracing IIoT, with applications ranging from remote patient monitoring to the management of medical assets and supply chains. The technology enhances patient care, reduces costs, and improves the overall efficiency of healthcare services.

Other End-Use Industries, including agriculture, retail, and smart cities, are also incorporating IIoT solutions to transform their operations and services. These industries benefit from improved data collection, enhanced decision-making, and increased automation and efficiency.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Increased Efficiency and Productivity: IIoT integrates advanced technologies like machine learning and big data analytics, driving significant improvements in operational efficiency and productivity across industries.

- Demand for Automation: The growing demand for automation in manufacturing, logistics, and other sectors is propelling the adoption of IIoT solutions to streamline processes and reduce human error.

- Energy Management: In sectors like energy & power, IIoT technologies are critical for optimizing energy distribution and consumption, leading to reduced operational costs and enhanced sustainability.

- Enhanced Decision Making: IIoT provides real-time data and insights, enabling businesses to make informed decisions quickly, predict maintenance needs, and respond proactively to changing market conditions.

Restraining Factors

- Security Concerns: The increased connectivity and data sharing raise significant concerns regarding data security and vulnerability to cyber-attacks, potentially hindering adoption.

- High Initial Investment: Implementing IIoT solutions often requires substantial upfront investment in technology and infrastructure, which can be a deterrent for smaller businesses.

- Complexity in Integration: Integrating IIoT with existing systems can be complex and challenging, requiring skilled personnel and potentially disrupting current operations.

- Lack of Standardization: The absence of universal standards for interoperability and data sharing across different IIoT platforms and devices can limit integration and efficiency.

Growth Opportunities

- Advancements in Technology: Continuous innovation in areas like AI, machine learning, and edge computing presents significant opportunities for enhancing IIoT capabilities and applications.

- Smart City Initiatives: Increasing investments in smart city projects around the world offer vast opportunities for IIoT in areas like traffic management, waste management, and energy optimization.

- Predictive Maintenance: There’s growing demand for predictive maintenance solutions across industries, which IIoT can address by providing real-time monitoring and data analysis.

- Healthcare Sector Growth: The expanding use of IIoT in healthcare for remote monitoring, asset tracking, and patient care offers significant growth potential.

Challenges

- Skill Gap: There is a notable shortage of skilled professionals who can develop, implement, and manage IIoT solutions, which can slow down adoption and innovation.

- Data Privacy and Regulations: Navigating the complex landscape of data privacy laws and regulations can be a challenge, especially for global operations.

- Interoperability Issues: The lack of standardized protocols and technologies can lead to interoperability issues, making it difficult for different IIoT systems to communicate and work together effectively.

- Reliability in Harsh Environments: Ensuring the reliability and durability of IIoT devices in harsh industrial environments like mining and oil & gas can be challenging.

Kеу Маrkеt Ѕеgmеntѕ

By Component

- Solutions

- Services

- Platforms

By End-Use

- Manufacturing

- Energy & Power

- Transportation & Logistics

- Mining

- Oil & Gas

- Healthcare

- Other End-Use Industries

Regional Analysis

In 2023, the Industrial Internet of Things (IIoT) Market witnessed a dominant market position held by Asia-Pacific (APAC), capturing more than a 38.9% share. The region’s strong market position can be attributed to its thriving manufacturing sector, rapid industrialization, and increasing adoption of advanced technologies. Countries like China, Japan, and South Korea have been at the forefront of implementing IIoT solutions in various industries, including manufacturing, automotive, and energy. APAC’s large consumer base, coupled with government initiatives promoting industrial automation, has driven the demand for IIoT technologies in the region.

Following APAC, North America held a significant market share in the IIoT Market. The region’s well-established industrial base, technological advancements, and early adoption of IIoT solutions have contributed to its strong market presence. The United States is a key market within North America, with industries such as manufacturing, oil and gas, and healthcare driving the adoption of IIoT technologies. The region’s focus on digitization, data analytics, and industrial automation has further propelled the growth of the IIoT Market.

Europe also maintained a substantial market share in the IIoT Market. The region’s mature industrial landscape, emphasis on energy efficiency, and government initiatives promoting Industry 4.0 have fostered the adoption of IIoT technologies. Countries like Germany, France, and the United Kingdom have been early adopters of IIoT solutions, particularly in manufacturing, automotive, and logistics sectors. The presence of well-established industrial players and the push for digital transformation have contributed to the growth of the IIoT Market in Europe.

Latin America, the Middle East, and Africa (LAMEA) held a comparatively smaller market share in the IIoT Market. However, these regions are witnessing a gradual increase in the adoption of IIoT technologies. Latin America, in particular, is experiencing growth in industries such as manufacturing, agriculture, and mining, where IIoT solutions can bring significant operational efficiencies. The Middle East and Africa region is also exploring IIoT applications in sectors like oil and gas, utilities, and transportation.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The players in the Industrial Internet of Things (IIoT) market are emphasizing inorganic growth strategies, including strategic collaborations and merger and acquisition activities with technology partners. This approach is aimed at enhancing their offerings and expanding their market reach.

Key players in the Industrial Internet of Things (IIoT) market, such as General Electric Corporation, Intel Corporation, Emerson Electric, Accenture PLC, and Huawei Technology Co., Ltd., are striving to innovate within the IIoT sector. Their goal is to bring a similar or higher level of expertise to the service segment, ultimately strengthening their presence in the market.

Top Key Рlауеrѕ

- ABB Ltd.

- Siemens AG

- IBM Corporation

- Intel Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- Honeywell International Inc.

- General Electric Co.

- NEC Corporation

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- PTC Inc.

- Other Key Players

Recent Developments

- In February 2023, Cisco, a multinational digital communications technology conglomerate corporation, expanded its suite of cloud tools by introducing new products. These additions aim to enhance visibility and control over networks, specifically focusing on industrial Internet of Things (IIoT) applications.

- Also in February 2023, KORE, a global provider of Internet of Things (IoT) solutions and worldwide IoT Connectivity-as-a-Service (IoT CaaS), is preparing to launch MODGo at the Mobile World Congress in Barcelona. MODGo is an innovative software offering a cohesive digital strategy for IoT asset management.

Report Scope

Report Features Description Market Value (2023) USD 212 Bn Forecast Revenue (2032) USD 758.8 Bn CAGR (2023-2032) 13.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services and Platform), By End-Use Industry (Manufacturing, Energy & Power, Transportation & Logistics, Mining, Oil & Gas, Healthcare and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Siemens AG, IBM Corporation, Intel Corporation, Schneider Electric SE, Rockwell Automation, Inc., Honeywell International Inc., General Electric Co., NEC Corporation, Cisco Systems, Inc., Amazon Web Services, Inc., PTC Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Industrial Internet of Things (IIoT)?The Industrial Internet of Things (IIoT) refers to the integration of Internet of Things (IoT) technologies in industrial sectors, enabling the connectivity and communication of devices, machines, and systems to enhance efficiency, productivity, and data-driven decision-making.

How big is the Industrial Internet Of Things Market?The Global Industrial Internet Of Things (IIoT) Market size is expected to be worth around USD 758.8 billion by 2033 from USD 212.0 billion in 2023, growing at a CAGR of 13.6% during the forecast period from 2024 to 2033.

What is the current Industrial Internet Of Things Market size?In 2024, the Industrial Internet Of Things Market size is expected to reach USD 240.8 billion.

Who are the key players in Industrial Internet Of Things Market?General Electric Company, Oracle Corporation, SAP SE, Honeywell International Inc. and IBM Corporation are the major companies operating in the Industrial Internet Of Things Market.

Which is the fastest growing region in Industrial Internet Of Things Market?Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2033).

What challenges are associated with implementing IIoT solutions?Challenges may include cybersecurity concerns, interoperability issues, data privacy considerations, and the need for standardization in communication protocols.

What trends are shaping the future of the IIoT market?Trends include the adoption of 5G for improved connectivity, edge computing for real-time processing, and the integration of AI and machine learning for advanced analytics in industrial settings.

Industrial Internet Of Things (IIoT) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Industrial Internet Of Things (IIoT) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- IBM Corporation

- Intel Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- Honeywell International Inc.

- General Electric Co.

- NEC Corporation

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- PTC Inc.

- Other Key Players