Global Satellite IoT Market By Service Type (Sat-Iot Backhaul Services, Direct To Satellite Services), Frequency Band (L-Band, Ku- And Ka-Band, S-Band, Others (X-Band And C-Band)), End-Use (Agriculture, Oil & Gas, Automotive, Transportation & Logistics, Energy & Utilities, Healthcare, Military & Defense, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 110576

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

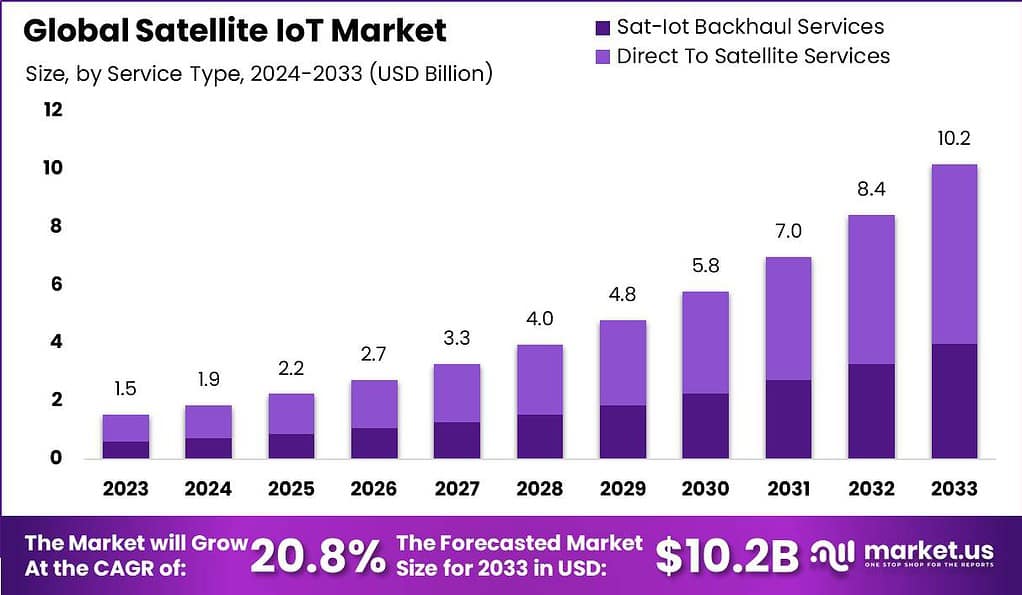

The global Satellite IoT Market is anticipated to be USD 10.2 billion by 2033. It is estimated to record a steady CAGR of 20.8% in the Forecast period 2024 to 2033. It is likely to total USD 1.9 billion in 2024.

Satellite IoT (Internet of Things) is the term used to describe making use of satellite communications networks to provide connection and exchange of data for IoT devices that are located in rural, remote, or inaccessible locations. It is about the integration of satellite technology with IoT infrastructure to offer global coverage and connectivity to many different applications, such as environmental monitoring, asset tracking and logistics, agriculture as well as maritime and logistics services.

The satellite IoT market has gained significant traction due to several factors. Firstly, traditional terrestrial networks have limitations when it comes to providing connectivity in remote or isolated regions. Satellite IoT fills this connectivity gap by offering ubiquitous coverage, ensuring that IoT devices can transmit and receive data regardless of their location, whether on land, sea, or in the air. This enables businesses and organizations to expand their IoT deployments to areas where terrestrial networks are unavailable or impractical.

Note: Actual Numbers Might Vary In Final Report

Secondly, satellite IoT provides a reliable and resilient communication solution. Satellite networks are less susceptible to regional outages, natural disasters, or infrastructure limitations that can affect terrestrial networks. This makes satellite IoT an ideal option for applications which require continuous connectivity and instant data transmission in vital sectors like transportation, energy and emergency services.

Satellite IoT market has significant opportunities for growth. As the amount of IoT devices grows exponentially, the need of global coverage and connectivity will rise. Satellite IoT allows companies to expand its IoT installations beyond the urban area, and gain access to new industries and markets that were previously not served. It allows for real-time monitoring data collection and analysis at remote locations, helping to improve efficiency in operations, savings and more informed making.

Key Takeaways

- Market Growth Projection: Satellite IoT industry is poised to grow significantly with a predicted value of USD 10.2 billion by 2033. The growth rate is expected to be stable with an average CAGR in the range of 20.8%.

- Growth Opportunities: The Satellite IoT market offers significant growth opportunities as the number of IoT devices continues to grow. It allows companies to expand their IoT installations beyond urban areas, access new industries, and collect real-time data for better decision-making.

- Service Types: Direct To Satellite Services is a pivotal segment, commanding over 61% of the market share in 2023. This segment offers a direct and seamless communication channel between IoT devices and satellites, particularly beneficial in remote regions.

- Frequency Bands: Ku- And Ka-Band frequencies emerged as leaders, capturing over 43% of the market share in 2023. These bands offer a balance between data transfer speed and signal coverage, making them suitable for various IoT applications.

- End-Use Sectors: The Military & Defense sector established a dominant presence in 2023, with a market share exceeding 21%. Satellite IoT plays a crucial role in secure, real-time communication for mission-critical operations in this sector.

- Driving Factors: Factors driving the growth of Satellite IoT include the increasing demand for global connectivity, rapid growth of the IoT ecosystem, security and reliability of satellite communication, and technological advancements.

- Challenges: Challenges include cost constraints, limited bandwidth, regulatory hurdles, and competition from alternative technologies like 5G and LPWAN.

- Growth Trends: Key trends in the market include the integration of edge computing, the use of hybrid networks combining Satellite IoT and terrestrial networks, and a growing focus on eco-friendly satellite technologies.

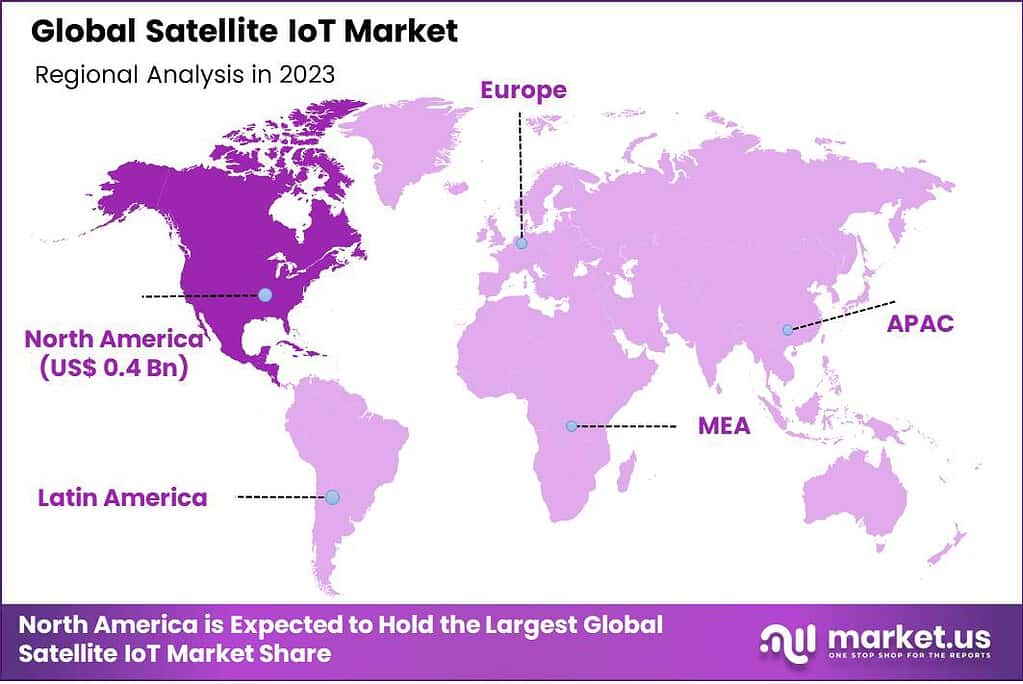

- Regional Dominance: North America led the Satellite IoT market in 2023, securing a dominant position with a market share exceeding 32%. This was driven by a robust IoT ecosystem, technological prowess, and regulatory support.

- Prominent Players: Key players in the Satellite IoT market include ORBCOMM Inc., Iridium Communication, Globalstar, Inmarsat Global Limited, and many others.

Service Type Analysis

In 2023, the Satellite IoT market witnessed a pivotal moment with the Direct To Satellite Services segment firmly establishing its dominance, commanding an impressive market share exceeding 61%. This commanding position can be attributed to several key factors, primarily driven by the ever-expanding applications and capabilities of Direct To Satellite Services in the context of the Internet of Things (IoT).

Direct To Satellite Services, as a crucial subset of Satellite IoT services, offers a direct and seamless communication channel between IoT devices and satellites, eliminating the need for terrestrial infrastructure. This presents a compelling advantage, particularly in remote or inaccessible regions, where traditional connectivity solutions are often impractical. Furthermore, the increased demand for real-time data transmission, which is essential in mission-critical applications like asset tracking, environmental monitoring, and emergency response systems, has significantly boosted the prominence of Direct To Satellite Services.

Moreover, the cost-effectiveness and scalability of Direct To Satellite Services have not gone unnoticed by businesses across various sectors. The ability to connect and manage a vast number of IoT devices cost-efficiently has contributed to its market leadership. This is particularly pertinent in industries such as agriculture, transportation, and logistics, where precise tracking and monitoring are paramount for optimizing operations and ensuring regulatory compliance.

It is imperative to note that this market segment’s ascendancy is also bolstered by the ongoing advancements in satellite technology, resulting in enhanced coverage, data transmission speeds, and overall reliability. The availability of Low Earth Orbit (LEO) satellite constellations has further improved the feasibility and efficiency of Direct To Satellite Services.

Frequency Band Analysis

In 2023, the Satellite IoT market experienced a notable shift in dynamics, with the Ku- And Ka-Band segment emerging as the undisputed leader, securing a substantial market share exceeding 43%. This remarkable achievement can be attributed to several key factors, underlining the critical role that these frequency bands play in the Satellite IoT ecosystem.

The dominance of the Ku- And Ka-Band segment is primarily driven by its unique characteristics that cater to the evolving demands of IoT applications. These frequency bands offer a harmonious balance between data transfer speed and signal coverage, making them particularly well-suited for a wide range of use cases.

The Ku-Band with its higher rate of data transfer is ideal to be used in applications that need fast and effective communications, such as real-time asset tracking and telemetry. On the other hand the Ka-Band excels in the delivery of high-speed data to smaller and more efficient IoT devices which is essential in applications like environmental monitoring and smart agriculture.

Furthermore, the growing adoption of satellite-based IoT solutions in industries like transportation, agriculture, and energy has significantly bolstered the prominence of Ku- And Ka-Band frequencies. These bands enable reliable and consistent connectivity in remote and geographically challenging locations, ensuring uninterrupted data transmission even in the most demanding environments.

It’s noteworthy that while other frequency bands like L-Band, S-Band, X-Band, and C-Band continue to play essential roles in specific applications, the agility and adaptability offered by the Ku- And Ka-Band frequencies have propelled them to the forefront of the Satellite IoT market. Their ability to meet the diverse connectivity needs of IoT devices, coupled with ongoing advancements in satellite technology, positions them as the go-to choice for businesses and industries looking to harness the full potential of IoT-driven insights.

Note: Actual Numbers Might Vary In Final Report

End-Use Analysis

In 2023, a pivotal landscape emerged in the Satellite IoT market, with the Military & Defense segment establishing a commanding presence, seizing an impressive market share exceeding 21%. This remarkable feat can be attributed to several pivotal factors that underscore the critical role of Satellite IoT in addressing the unique needs and challenges of the military and defense sector.

The dominance of the Military & Defense segment is primarily a result of the sector’s stringent requirements for secure, reliable, and real-time communication. Satellite IoT solutions offer the ideal platform for ensuring seamless connectivity in mission-critical operations, remote deployments, and hostile environments. The ability to transmit vital data, including situational awareness, troop movements, and surveillance information, with high levels of security and redundancy, positions Satellite IoT as an indispensable asset for military and defense applications.

Furthermore, the continued global geopolitical uncertainties and the need for rapid response capabilities have driven increased investment in Satellite IoT solutions by defense agencies worldwide. These solutions enable effective command and control, asset tracking, and intelligence gathering, contributing significantly to enhanced operational efficiency and national security.

It is worth noting that while other end-use sectors such as agriculture, transportation, and healthcare continue to leverage Satellite IoT for their unique applications, the Military & Defense segment’s dominance is underpinned by its unwavering commitment to ensuring the safety and security of nations. The numerical data affirming this segment’s substantial market share underscores its pivotal role in the Satellite IoT landscape, making it an integral part of the market’s growth trajectory.

Driving Factors

- Global Connectivity Demand: The increasing need for global connectivity, especially in remote and underserved areas, is a significant driver. Satellite IoT provides a reliable solution to connect devices where traditional networks are unavailable.

- IoT Proliferation: The rapid growth of the Internet of Things (IoT) ecosystem is a driving force. As more devices become IoT-enabled, the demand for Satellite IoT services to facilitate their connectivity and data transmission grows.

- Security and Reliability: Satellite IoT is known for its secure and reliable communication. This is critical for applications such as military, defense, and critical infrastructure, which require uninterrupted and secure data transfer.

- Technological Advancements: Advances in satellite technology, including the deployment of Low Earth Orbit (LEO) satellite constellations, have improved data transfer speeds and reduced latency, making Satellite IoT more appealing for real-time applications.

Restraining Factors

- Cost Constraints: One of the primary challenges is the cost associated with Satellite IoT services. High upfront infrastructure costs and subscription fees can deter some potential users, particularly in cost-sensitive industries.

- Limited Bandwidth: Satellite bandwidth is finite, and as more devices are connected, congestion can occur, leading to potential limitations in data transfer speeds and increased latency.

- Regulatory Hurdles: Compliance with various regulatory requirements and licensing for satellite communication can be complex and time-consuming, creating barriers to entry and expansion.

- Competition from Alternative Technologies: Emerging terrestrial IoT technologies like 5G and LPWAN (Low Power Wide Area Network) are competing with Satellite IoT, offering lower latency and potentially lower costs for certain applications.

Growth Opportunities

- Emerging Markets: Expanding into emerging markets with limited terrestrial infrastructure presents a significant growth opportunity for Satellite IoT providers, especially in regions with growing industrialization and urbanization.

- Precision Agriculture: The agriculture sector offers substantial growth potential for Satellite IoT, as farmers increasingly adopt IoT solutions for precision agriculture, including remote monitoring and automated farming practices.

- Disaster Management: Satellite IoT plays a crucial role in disaster management and response. There’s an opportunity to expand services for emergency communication and rapid response in disaster-stricken areas.

- Environmental Monitoring: With the growing concern for climate change and environmental conservation, Satellite IoT can find opportunities in applications like monitoring weather patterns, wildlife tracking, and ecosystem preservation.

Challenges

- Latency: Satellite communication inherently introduces latency due to the time it takes for signals to travel to and from space. Reducing latency remains a challenge for real-time applications.

- Spectrum Allocation: The allocation of suitable frequency bands for Satellite IoT can be competitive, and obtaining the necessary spectrum can be a challenge in some regions.

- Interference: Interference from terrestrial sources or other satellites can disrupt communication and is an ongoing challenge for maintaining reliable connectivity.

- Scalability: As the number of IoT devices continues to grow, scaling Satellite IoT networks to accommodate the increased demand while maintaining performance and reliability is a complex task.

Key Market Trends

- Edge Computing Integration: Integration of edge computing with Satellite IoT for real-time data processing and decision-making at the device level is becoming a prominent trend.

- Hybrid Networks: Combining Satellite IoT with terrestrial networks to create hybrid solutions is gaining traction, offering the benefits of both technologies.

- Green Satellite Initiatives: Growing awareness of environmental sustainability has led to the development of eco-friendly satellite technologies and a trend towards “green” satellites in the Satellite IoT market.

- Enhanced Security: With the increasing importance of cybersecurity, the implementation of advanced encryption and security protocols within Satellite IoT networks is a prevailing trend to protect data integrity.

Key Market Segments

Service Type

- Sat-Iot Backhaul Services

- Direct To Satellite Services

Frequency Band

- L-Band

- Ku- And Ka-Band

- S-Band

- Others (X-Band And C-Band)

End-Use

- Agriculture

- Oil & Gas

- Automotive

- Transportation & Logistics

- Energy & Utilities

- Healthcare

- Military & Defense

- Other End-Uses

Regional Analysis

In 2023, North America emerged as a frontrunner in the Satellite IoT market, firmly securing a dominant market position by capturing a substantial share exceeding 32%. Several key factors contributed to this regional supremacy, making North America a key player in the global Satellite IoT landscape. The demand for Satellite IoT in North America reached USD 0.4 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

First and foremost, North America’s dominance can be attributed to its robust and highly developed IoT ecosystem. The region boasts a vast array of industries, including agriculture, energy, healthcare, and transportation, all of which have embraced Satellite IoT for its reliability and comprehensive coverage, particularly in remote areas where terrestrial networks may be limited.

Furthermore, North America’s technological prowess and significant investments in satellite infrastructure have propelled it to the forefront of Satellite IoT adoption. The presence of established satellite service providers and innovative startups has fostered an environment conducive to the rapid expansion of IoT applications.

In addition, the regulatory framework in North America has been conducive to Satellite IoT growth, with clear guidelines and spectrum allocation for satellite communication. This regulatory stability has encouraged businesses and industries to invest confidently in Satellite IoT solutions.

Lastly, the region’s commitment to national security and defense has led to substantial investments in satellite-based communication systems, further boosting the prominence of Satellite IoT. This sector’s focus on secure, real-time data transmission aligns seamlessly with the capabilities offered by Satellite IoT services.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The satellite IoT market has attracted several key players who are actively involved in providing satellite connectivity solutions for IoT devices. These companies bring expertise in satellite communication, IoT infrastructure, and data management to deliver comprehensive solutions for global connectivity

Top Key Players

- ORBCOMM Inc.

- Iridium Communication

- Globalstar

- Inmarsat Global Limited

- Astrocast

- Airbus S.A.S

- Intelsat Corporation

- Thales Group

- Swarm Technologies (Space X)

- Eutelsat Communication SA

- Alen Space

- OQ Technology

- Swarm Technologies

- Northrop Grumman

- Thuraya Telecommunication

- Verizon Communications

- Virgin Galactic

- Vodafone Group plc.

- Other Key Players

Recent Developments

- In January 2023, Iridium and Qualcomm joined forces to enable satellite messaging on smartphones. The collaboration’s objective is to integrate satellite services into various smartphone brands initially, with the potential for future expansion to other consumer devices.

- In December 2022, Globalstar announced a commercial partnership with Wiagro, an Agtech startup based in Argentina. Globalstar is supplying Wiagro with 2,500 ST100 satellite modem transmitters for its Smart Silobag. This technology facilitates remote monitoring of grain conditions stored in silo bags.

- In February 2022, Astrocast SA introduced its commercially available, cost-effective, bidirectional Satellite Internet of Things (SatIoT) service. This service allows global connectivity for IoT devices beyond terrestrial networks at a comparable cost.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2033) US$ 10.2 Bn CAGR (2024-2033) 20.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Sat-Iot Backhaul Services, Direct To Satellite Services), Frequency Band (L-Band, Ku- And Ka-Band, S-Band, Others (X-Band And C-Band)), End-Use (Agriculture, Oil & Gas, Automotive, Transportation & Logistics, Energy & Utilities, Healthcare, Military & Defense, Other End-Uses) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ORBCOMM Inc., Iridium Communication, Globalstar, Inmarsat Global Limited, Astrocast, Airbus S.A.S, Intelsat Corporation, Thales Group, Swarm Technologies (Space X), Eutelsat Communication SA, Alen Space, OQ Technology, Swarm Technologies, Northrop Grumman, Thuraya Telecommunication, Verizon Communications, Virgin Galactic, Vodafone Group plc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Satellite IoT (Internet of Things)?Satellite IoT, or Satellite Internet of Things, refers to the utilization of satellite communication networks to enable connectivity and data exchange for IoT devices, especially in remote or inaccessible areas.

How big is Satellite IoT Market?The global Satellite IoT Market is anticipated to be USD 10.2 billion by 2033. It is estimated to record a steady CAGR of 20.8% in the Forecast period 2024 to 2033. It is likely to total USD 1.9 billion in 2024.

What are the key applications of Satellite IoT?Satellite IoT finds applications in various sectors, including asset tracking, environmental monitoring, agriculture, logistics, maritime services, and more.

Which companies are prominent players in the Satellite IoT Market?Key players in the Satellite IoT Market include ORBCOMM Inc., Iridium Communication, Globalstar, Inmarsat Global Limited, Astrocast, Airbus S.A.S, Intelsat Corporation, Thales Group, Swarm Technologies (Space X), Eutelsat Communication SA, Alen Space, OQ Technology, Swarm Technologies, Northrop Grumman, Thuraya Telecommunication, Verizon Communications, Virgin Galactic, Vodafone Group plc., Other Key Players contributing to the development and expansion of satellite-based IoT services.

What benefits does Satellite IoT offer for businesses?Satellite IoT provides businesses with extended connectivity, enabling them to monitor and manage devices and assets in remote locations, improving operational efficiency and expanding the reach of IoT applications.

-

-

- ORBCOMM Inc.

- Iridium Communication

- Globalstar

- Inmarsat Global Limited

- Astrocast

- Airbus S.A.S

- Intelsat Corporation

- Thales Group

- Swarm Technologies (Space X)

- Eutelsat Communication SA

- Alen Space

- OQ Technology

- Swarm Technologies

- Northrop Grumman

- Thuraya Telecommunication

- Verizon Communications

- Virgin Galactic

- Vodafone Group plc.

- Other Key Players