Global Small Satellites Market Size, Share Analysis Report By Type(Minisatellite, Microsatellite, Nanosatellite, Other Types), By Application (Earth Observation & Remote Sensing, Satellite Communication, Science & Exploration, Mapping & Navigation, Space Observation, Other Applications), By End-User (Commercial, Academic, Government & Military, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb. 2025

- Report ID: 110536

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

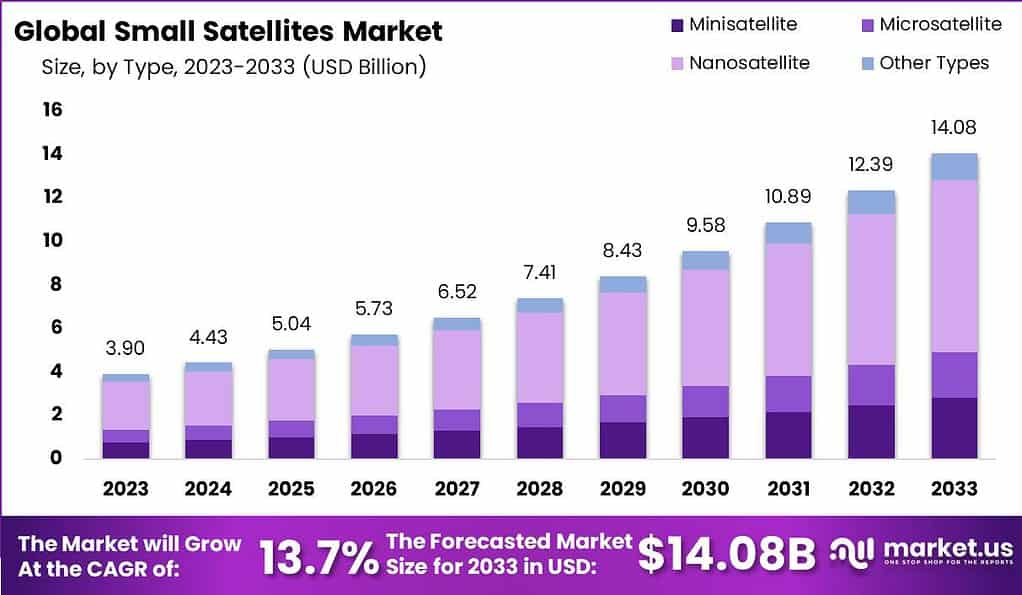

The Global Small Satellites Market size is expected to be worth around USD 14.08 Billion By 2033, from USD 4.43 billion in 2024, growing at a CAGR of 13.7% during the forecast period from 2024 to 2033.

Small satellites, often referred to as smallsats, are a category of spacecraft that are significantly smaller than conventional satellites. Typically weighing under 600 kilograms, these compact devices are designed for space research, communication, and Earth observation. The appeal of small satellites lies in their cost-effectiveness and shorter development cycles, enabling more frequent launches and accessible space exploration for countries and organizations with limited budgets.

The market for small satellites has witnessed substantial growth over recent years, driven by the increasing demand for high-resolution Earth imaging, seamless global communication, and cost-effective satellite solutions. Commercial sectors, governments, and educational institutions are major contributors to this expanding market. The ease of deployment and advancements in satellite miniaturization technology have further propelled the adoption of small satellites.

The demand for small satellites is escalating, particularly in sectors such as telecommunications, Earth observation, and scientific research. This surge is driven by the need for improved data connectivity and increased Earth monitoring capabilities that smallsats provide. The growing trend towards constellation deployment, where multiple satellites work in concert, has also amplified market demand.

There is significant potential for expansion in the small satellite market, especially in developing regions that are just beginning to tap into the benefits of satellite technology. Opportunities also exist in the development of more sophisticated payloads, improved ground station networks, and advanced data analytics services.

Technological progress in the realm of small satellites is rapid, with continual improvements in solar power efficiency, propulsion systems, and onboard computing capabilities. The integration of artificial intelligence and machine learning for autonomous operation of smallsats represents a frontier that is currently being explored, promising to enhance mission outcomes and satellite longevity.

Key Takeaways

- Small Satellites Market is poised to see significant growth With a projected CAGR (CAGR) in the range of 13.7% between 2024 to 2033. Its market size has been projected to grow to USD 14.08 billion by 2033.

- In 2023, the Nanosatellite segment emerged as a dominant force in the Small Satellites Market, securing an impressive market share of over 56%.

- In 2023, the Earth Observation & Remote Sensing segment asserted its dominance in the Small Satellites Market, holding a significant market share of over 45%.

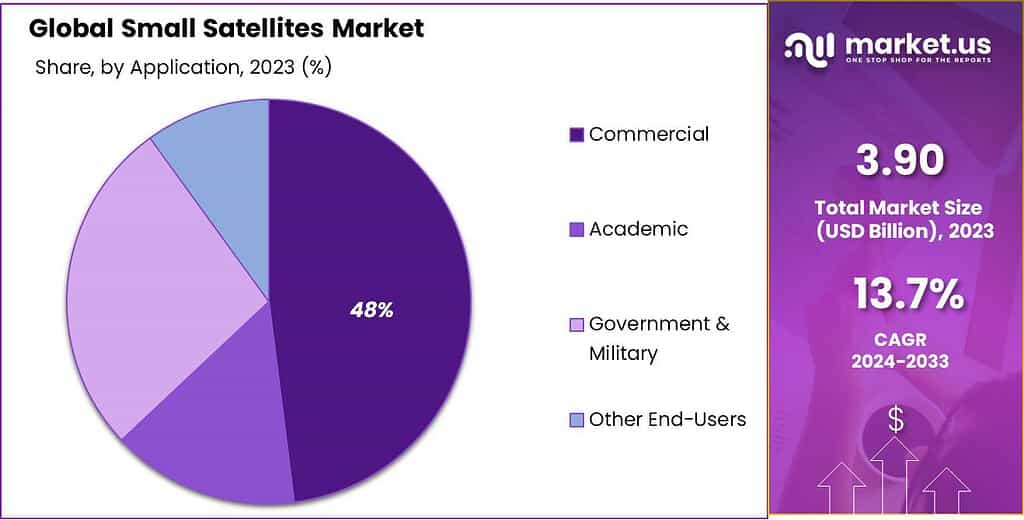

- In 2023, the Commercial segment took a commanding lead in the Small Satellites Market, securing a significant market share of over 48%.

Type Analysis

In 2023, the Nanosatellite segment emerged as a dominant force in the Small Satellites Market, securing an impressive market share of over 56%. This remarkable presence can be attributed to the growing demand for compact and cost-effective satellite solutions.

Nanosatellites, with their small size and weight, have become increasingly popular for various applications, including Earth observation, communication, and scientific research. Their affordability and rapid development cycles have made them a preferred choice for both government and commercial organizations. This segment’s strong performance reflects the industry’s recognition of the versatility and cost-efficiency offered by nanosatellites.

On the other hand, the Minisatellite segment also played a significant role in the market, offering larger payloads and capabilities compared to nanosatellites. In 2023, minisatellites held a substantial market share, particularly in missions requiring more extensive data collection or advanced technology payloads. These satellites are instrumental in remote sensing, navigation, and scientific missions, where their size allows for more comprehensive instrumentation and greater mission flexibility.

Microsatellites, falling between nanosatellites and minisatellites in terms of size and capability, captured their share of the market as well. Their versatility in handling a range of missions, from communication to scientific exploration, contributed to their market presence. Microsatellites offer a balanced compromise between cost-effectiveness and payload capacity.

Lastly, other satellite types, which include various specialized categories, also held their positions within the market. These may encompass picosatellites, femtosatellites, or even custom-built satellite solutions tailored to specific mission requirements. The diversity within the “Other Types” category reflects the market’s adaptability to unique mission needs and emerging technologies.

Application Insights

In 2023, the Earth Observation & Remote Sensing segment asserted its dominance in the Small Satellites Market, holding a significant market share of over 45%. This commanding presence is attributed to the critical role these small satellites play in monitoring and collecting data about our planet.

Earth observation and remote sensing satellites play a crucial role in diverse applications such as environmental monitoring, disaster management, agriculture, and urban planning. Their capacity to capture high-resolution imagery and collect valuable data for decision-making renders them indispensable in both the public and private sectors.

Simultaneously, the Satellite Communication segment has significantly contributed to the market by meeting the worldwide demand for connectivity. Small satellites in this category are utilized for broadband internet access, maritime and aviation communication, and remote areas connectivity. The convenience and cost-effectiveness of small satellite-based communication systems have driven their adoption.

Science & Exploration satellites, falling into the next segment, were responsible for conducting various scientific experiments and missions. These satellites facilitate research in space and planetary exploration, contributing to our understanding of the cosmos. In 2023, they carved out a significant share of the market, reflecting the continuous quest for knowledge beyond our planet.

Mapping & Navigation satellites, meanwhile, catered to applications such as GPS services and geospatial mapping. Their precision and reliability are crucial in industries like logistics, transportation, and agriculture. Small satellites in this segment held their ground in the competitive market landscape.

Space Observation satellites, focusing on monitoring celestial bodies and phenomena, also secured their position. These satellites contribute to astronomical research, helping astronomers and scientists gather valuable data about the universe.

Lastly, the “Other Applications” category encompassed a variety of specialized satellite missions, including technology demonstrations, education, and innovative experiments. This segment highlighted the adaptability of small satellites to a wide range of niche applications, fostering innovation and exploration.

End-User Analysis

In 2023, the Commercial segment took a commanding lead in the Small Satellites Market, securing a significant market share of over 48%. This dominant position highlights the growing involvement of commercial entities in satellite operations and services.

Commercial end-users utilize small satellites for a wide range of applications, including telecommunications, Earth observation, and providing services like global internet coverage. Their ability to offer cost-effective solutions and rapid deployment has made small satellites an attractive choice for commercial ventures seeking to enter the space industry and provide innovative services to a global audience.

Simultaneously, the Government & Military segment also played a substantial role in the market, reflecting the interest of government agencies and military organizations in leveraging small satellites for various missions. These missions encompass national security, surveillance, border monitoring, and communication in remote areas. Government and military end-users prioritize small satellites for their versatility and ability to support critical operations.

Academic institutions, falling into the next segment, continued to contribute significantly to the market. They utilize small satellites for educational purposes, research projects, and technology demonstrations. These missions provide valuable hands-on experience for students and foster innovation within the academic community.

Lastly, the “Other End-Users” category covered a spectrum of niche applications, including non-profit organizations, space agencies, and specialized research endeavors. This segment illustrated the adaptability of small satellites to cater to a diverse range of end-user needs, driving exploration, and innovation across various sectors.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Cost Efficiency: Small satellites offer cost-effective solutions for various applications, making them accessible to a wider range of industries and organizations. Their smaller size and weight reduce launch costs and overall mission expenses.

- Rapid Development: The shorter development cycles of small satellites allow for quicker deployment and response to changing market needs. This agility is particularly advantageous for commercial ventures and emerging technologies.

- Versatility: Small satellites cater to a broad spectrum of applications, from Earth observation to communication and scientific research. Their adaptability makes them suitable for diverse end-user requirements.

- Global Connectivity: Small satellite constellations, such as those for internet coverage, enable global connectivity in remote and underserved regions, addressing the demand for seamless communication and data access.

Restraining Factors

- Limited Payload Capacity: Small satellites have limitations in terms of payload capacity, which can hinder their suitability for missions requiring larger and more complex instruments or components.

- Competition from Larger Satellites: Small satellites face competition from traditional, larger satellites in certain applications, where size and capabilities are crucial, such as deep-space exploration or high-resolution imaging.

- Regulatory Challenges: Evolving regulations and licensing requirements for satellite operations can pose challenges for small satellite operators, potentially delaying deployments and increasing compliance costs.

- Reliability Concerns: Some stakeholders may have concerns about the reliability and longevity of small satellites compared to larger, more established satellite systems, impacting their adoption in critical missions.

Growth Opportunities

- Emerging Markets: Small satellites open doors to emerging markets and new business opportunities, including space tourism, lunar exploration, and asteroid mining, as technology advances expand mission possibilities.

- IoT and Connectivity: The growing demand for Internet of Things (IoT) applications and global connectivity presents substantial growth opportunities for small satellite constellations, offering seamless data transmission worldwide.

- Environmental Monitoring: Small satellites are well-suited for environmental monitoring, contributing to climate change research, weather forecasting, and disaster management, which are areas of increasing importance.

- Educational Initiatives: Collaborative educational initiatives involving small satellite projects in schools and universities encourage innovation and skill development, fostering a new generation of space professionals.

Challenges

- Space Debris Management: The increase in small satellite numbers raises apprehensions regarding space debris, underscoring the importance of implementing effective debris management strategies for long-term orbital sustainability.

- Security Risks: Small satellites face susceptibility to cyber threats and physical attacks, emphasizing the need for robust security measures to safeguard mission-critical data and assets.

- Regulatory Compliance: Adhering to evolving international and national space regulations requires constant vigilance and can be a challenge for small satellite operators.

- Funding and Investment: Securing funding for small satellite projects, especially for startups and academic institutions, can be challenging, as investors often perceive space endeavors as high-risk ventures.

Key Market Trends

- Increased CubeSat Adoption: CubeSats, a specific category of small satellites, are witnessing significant adoption due to their standardized form factor and affordability, enabling educational and research missions.

- Satellite Constellations: The deployment of satellite constellations for various purposes, such as global internet coverage and Earth observation, is a prominent trend, with companies launching numerous small satellites to create comprehensive networks.

- Lunar and Planetary Exploration: Small satellites are increasingly involved in lunar and planetary exploration missions, with nanosatellites and microsatellites contributing to scientific research beyond Earth’s orbit.

- Commercial Dominance: Commercial entities are taking a leading role in the small satellite market, leveraging their resources and innovative business models to drive market growth and competition.

Key Market Segments

Type

- Minisatellite

- Microsatellite

- Nanosatellite

- Other Types

Application

- Earth Observation & Remote Sensing

- Satellite Communication

- Science & Exploration

- Mapping & Navigation

- Space Observation

- Other Applications

End-User

- Commercial

- Academic

- Government & Military

- Other End-Users

Regional Analysis

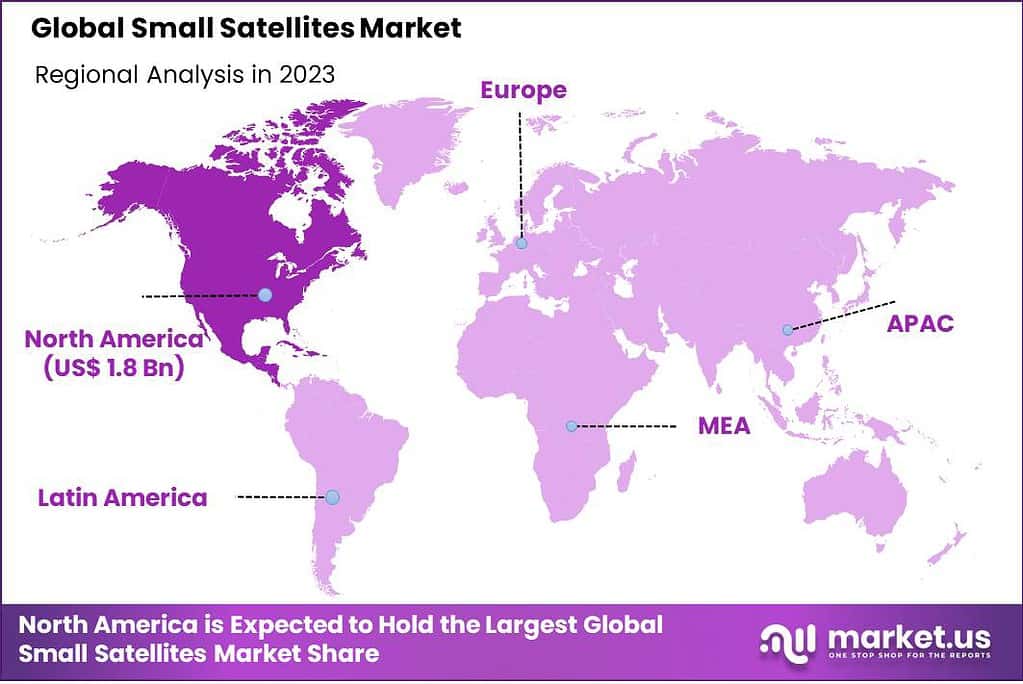

In 2023, North America secured a prominent position in the Small Satellites Market, holding over 47% of the market share. This dominance is attributed to the presence of key aerospace and technology companies, substantial government investments in space exploration, and a thriving private space sector. The United States, in particular, has emerged as a hub for small satellite innovation, witnessing numerous startups and established companies launching small satellite missions for various applications. Regulatory support and a mature space infrastructure further bolstered the growth of the small satellite industry in North America.

Europe also played a major part within this Small Satellites Market in 2023 and contributed to a substantial market share. Countries like Germany, France, the UK and Italy invested substantial amounts in the development of small satellites in support of research development, development, and commercial deployments. In the end, the European Space Agency (ESA) actively assisted small satellite missions for earth observation, research and telecoms.

The Asia-Pacific (APAC) region demonstrated a growing presence in the Small Satellites Market in 2023, marked by noteworthy developments. Led by countries like China, Japan, and India, APAC actively pursued space exploration and advancements in satellite technology. China, in particular, launched a significant number of small satellites for purposes such as Earth observation and global connectivity. The region’s emphasis on emerging technologies and the rapid expansion of the commercial space sector contributed to the increased adoption of small satellites.

Latin America showcased a promising market share in the Small Satellites Market in 2023. Countries like Brazil and Mexico displayed a growing interest in space technology and satellite deployments. Latin America’s potential for growth in the small satellite market is driven by the enthusiasm of a younger demographic to explore innovative solutions and the region’s increasing emphasis on technology-related initiatives. While facing challenges related to technology costs and availability, Latin America is poised to contribute to the global expansion of the Small Satellites Market.

The Middle East and Africa (MEA) exhibited signs of emerging interest in the Small Satellites Market in 2023, albeit with a relatively smaller market share. The region’s focus on educational advancement, skill development in the IT sector, and investments in technology infrastructure indicate growth potential. With a young, tech-savvy population, MEA has the opportunity to contribute to the global expansion of the Small Satellites Market, overcoming challenges related to technology costs and availability will be crucial for realizing this potential.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Small Satellites Market key players analysis entails the identification and evaluation of the pivotal players or businesses that significantly influence a particular market or industry. This analysis is instrumental in comprehending market dynamics and deciphering the strategies employed by these key players to gain a competitive advantage. By scrutinizing the strengths and weaknesses, as well as the opportunities and threats posed by these competitors, companies can make informed decisions and formulate successful strategies to compete effectively in the market.

Top Key Players

- Airbus S.A.S.

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Planet Labs Inc.

- Sierra Nevada Corporation

- Thales Group

- Aerospace Corporation

- The Boeing Company

- Other Key Players

Recent Developments

- June 2022: Falcon 9 successfully launched Globalstar FM15 into low-Earth orbit from Space Launch Complex 40 (SLC-40) at Cape Canaveral Space Force Station in Florida.

- May 2022: As part of the Transporter-5 mission, another five satellites—namely ICEYE-X17, -X18, -X19, -X20, and -X24—were successfully launched.

- April 2022: Swarm Technologies launched 12 ‘picosatellites’ during the Transporter 4 mission, aimed at establishing a low-data-rate communications network.

Report Scope

Report Features Description Market Value (2023) US$ 3.90 Bn Forecast Revenue (2033) US$ 14.08 Bn CAGR (2024-2033) 13.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Minisatellite, Microsatellite, Nanosatellite, Other Types), By Application (Earth Observation & Remote Sensing, Satellite Communication, Science & Exploration, Mapping & Navigation, Space Observation, Other Applications), By End-User (Commercial, Academic, Government & Military, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Airbus S.A.S., GomSpace, L3Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Planet Labs Inc., Sierra Nevada Corporation, Thales Group, Aerospace Corporation, The Boeing Company, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are small satellites?Small satellites, also known as smallsats or nanosatellites, are miniature satellites that have smaller physical dimensions and lower mass compared to traditional larger satellites. They typically weigh less than 500 kilograms (1,100 pounds) and can be as small as a shoebox or smaller.

What is driving the growth of the small satellites market?The small satellites market is driven by advancements in miniaturization, cost reduction, and increased accessibility to space. The development of smaller and more affordable satellite components, as well as the availability of launch opportunities, has made it easier for organizations to design, manufacture, and deploy small satellite systems.

How big is Small Satellites Market?The Global Small Satellites Market size was projected to be USD 3.90 billion in 2023, and by the end of 2024, it is expected to reach a valuation of USD 4.43 billion. During the forecast period, the global small satellites industry is forecasted to exhibit a 13.7% Compound Annual Growth Rate (CAGR), reaching a substantial size of USD 14.08 billion by 2033.

What applications are driving the demand for small satellites?The demand for small satellites is driven by diverse applications, including Earth observation, telecommunications, scientific research, technology demonstration, and global connectivity. Their compact size and versatility make them suitable for a wide range of purposes.

What challenges does the Small Satellites Market face?Common challenges in the Small Satellites Market include limited payload capacity, constrained power systems, and potential communication issues due to their smaller size. Overcoming these challenges is essential for the continued growth and effectiveness of small satellite missions.

What future trends can be anticipated in the Small Satellites Market?Anticipated future trends include the continued miniaturization of satellite components, increased collaboration between public and private sectors, advancements in propulsion technologies, and the emergence of new applications, further diversifying the Small Satellites Market.

-

-

- Airbus S.A.S.

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Planet Labs Inc.

- Sierra Nevada Corporation

- Thales Group

- Aerospace Corporation

- The Boeing Company

- Other Key Players