Global Aviation MRO Market Size, Share Analysis Report By MRO Type (Line Maintenance, Engine Maintenance, Component Maintenance, Base Maintenance, Other MRO Types), By Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation), By Service Provider (OEMs (Original Equipment Manufacturers), Independent MRO Providers, Airlines Operator MRO), By Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: June 2025

- Report ID: 76252

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

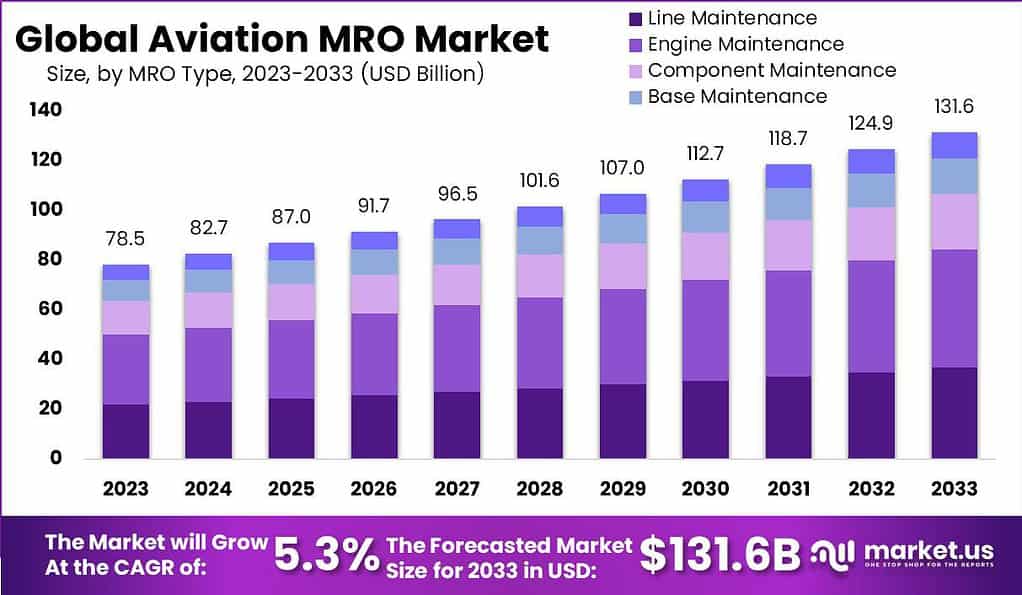

The global Aviation MRO Market is anticipated to be USD 131.6 billion by 2033. It is estimated to record a steady CAGR of 5.3% in the Forecast period 2023 to 2033. It is likely to total USD 78.5 billion in 2023.

The Aviation MRO market plays a crucial role in ensuring aircraft airworthiness, safety, and operational efficiency across commercial, military, and general aviation sectors. This market encompasses services such as engine maintenance, airframe repairs, component overhaul, and line maintenance.

As global air travel continues to recover and expand, the demand for high-performance and safety-compliant aircraft has made MRO services an indispensable part of the aviation value chain. The sector is experiencing transformation, driven by increasing fleet complexity, heightened safety regulations, and digitalization of maintenance operations.

A key driving force behind the growth of the aviation MRO market is the rapid expansion of global aircraft fleets, particularly in commercial aviation. Aging aircraft in both developed and developing regions require frequent inspections and part replacements.

Additionally, outsourcing of maintenance tasks by airlines seeking cost optimization and technical expertise has significantly accelerated demand for specialized third-party MRO providers. Rising air traffic and the need to ensure minimal downtime are further pushing airlines to invest in reliable, efficient MRO support.

The increasing number of daily commercial flights and growing passenger load factors are contributing to higher wear and tear across aircraft systems, engines, and avionics. This, in turn, increases the frequency of scheduled and unscheduled maintenance.

Moreover, fleet modernization programs by airlines, especially those involving narrow-body and fuel-efficient aircraft, are leading to demand for advanced MRO capabilities. The backlog in new aircraft deliveries is also compelling operators to extend the service life of older aircraft, further boosting maintenance needs.

Key Takeaways

- In 2023, Engine Maintenance emerged as the dominant MRO type, accounting for over 36.1% of the market, driven by the high cost, complexity, and frequency of engine overhauls.

- Line Maintenance and Component Maintenance also remained essential, supporting operational continuity and ensuring real-time aircraft reliability.

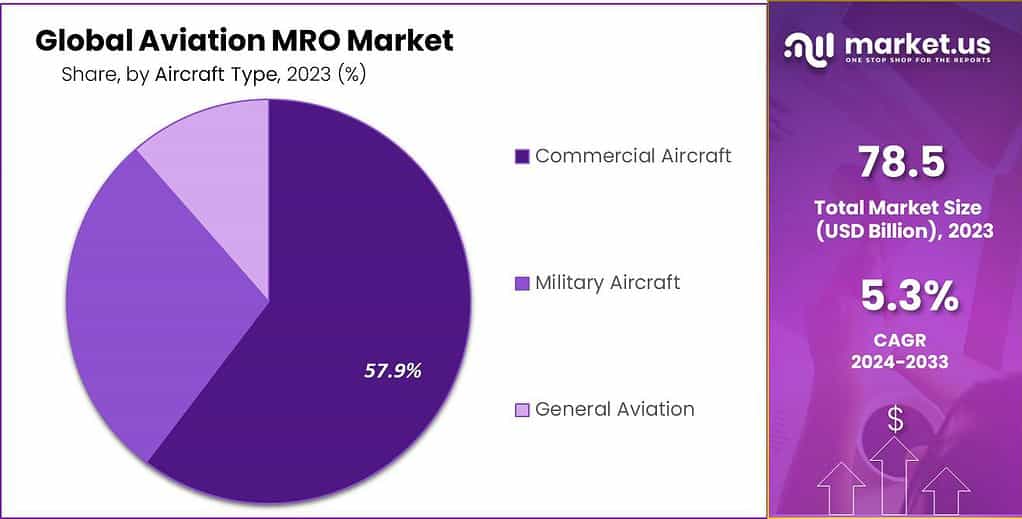

- Commercial Aircraft led the aviation MRO market by aircraft type, capturing more than 57.9% share in 2023, fueled by growing global air travel and fleet expansion.

- Military Aircraft and General Aviation also contributed significantly, reflecting diverse MRO demand across aviation segments.

- By service provider, Independent MRO Providers held the top position in 2023, commanding over 54.7% share, owing to cost advantages and specialized service offerings.

- OEM-affiliated MROs and Airline-operated MRO units continued to play vital roles, particularly in managing proprietary components and fleet-specific maintenance.

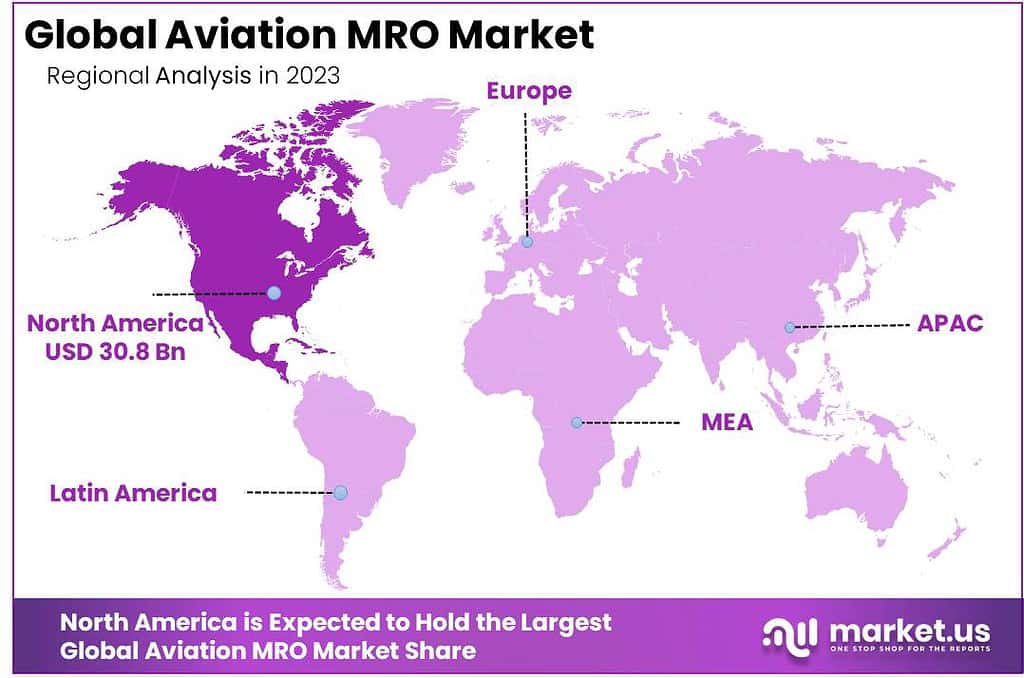

- North America maintained its leadership in the global Aviation MRO market with a market share exceeding 39.3% in 2023, supported by a mature aviation infrastructure and high aircraft utilization rates.

MRO Type Analysis

In 2023, the Engine Maintenance segment emerged as the frontrunner in the Aviation MRO market, commanding a formidable market share of over 36.1%. This robust performance can be attributed to the pivotal role engines play in ensuring aircraft safety and operational efficiency. Airlines are increasingly recognizing the significance of timely and thorough engine maintenance to enhance fuel efficiency and reduce operational costs. Furthermore, the growing global fleet of aircraft, coupled with stringent regulatory requirements, has propelled the demand for specialized engine maintenance services.

Line Maintenance, another crucial segment in the aviation MRO market, also exhibited a strong presence, accounting for a substantial share. In an era where safety and reliability are paramount, line maintenance activities ensure that aircraft remain in peak condition between flights, guaranteeing safe take-offs and landings. The need for rapid turnarounds and minimal disruption to flight schedules has fueled the demand for line maintenance services, with airlines emphasizing swift and efficient solutions.

Meanwhile, Component Maintenance services garnered significant attention within the aviation MRO landscape, with airlines recognizing the pivotal role of well-maintained components in overall aircraft safety and performance. The increasing complexity of modern aircraft components, such as avionics and control systems, has fueled the demand for specialized component maintenance services. This segment is poised for steady growth as airlines continue to prioritize the reliability of their aircraft systems.

Base Maintenance, encompassing comprehensive overhauls and refurbishments, maintained its significance in the aviation MRO market. Despite representing a smaller share compared to some other segments, base maintenance is indispensable for ensuring the long-term airworthiness of aircraft. Airlines often schedule base maintenance during planned downtime to conduct extensive inspections and repairs, ultimately extending the lifespan of their fleets.

Lastly, the market also witnessed the presence of other MRO types, encompassing various specialized services such as interior refurbishments, modifications, and cabin maintenance. This segment caters to the evolving demands of airlines seeking to enhance passenger experience and comply with changing regulations.

Aircraft Type Analysis

In 2023, the Commercial Aircraft segment asserted its dominance in the Aviation MRO market, securing an impressive market share of over 57.9%. This commanding position can be attributed to the sheer volume of commercial aircraft operating worldwide, driven by the increasing demand for air travel. As airlines strive to maintain rigorous safety standards and operational efficiency, the need for routine maintenance, repairs, and overhauls on commercial aircraft remains paramount. With the continuous expansion of airline fleets and the introduction of advanced technology in modern commercial aircraft, the demand for MRO services tailored to this segment is set to remain robust.

Military Aircraft, on the other hand, accounted for a substantial portion of the aviation MRO market. These specialized aircraft often operate in challenging environments and under demanding conditions, necessitating comprehensive maintenance and support services. With governments around the world prioritizing national defense, military aircraft maintenance remains a vital segment of the MRO industry. It ensures the readiness and effectiveness of military fleets, further bolstered by technological advancements and evolving security needs.

In the realm of General Aviation, this segment held its own in the aviation MRO landscape, catering to a diverse range of aircraft, including private jets, helicopters, and small turboprops. While its market share may be comparatively smaller than commercial and military counterparts, it remains a dynamic sector. General aviation encompasses a wide spectrum of aircraft owners, from private individuals to corporate entities, all seeking reliable MRO services to guarantee the safety and performance of their aircraft.

Note: Actual Numbers Might Vary In Final Report

Service Provider Analysis

In 2023, the Independent MRO Providers segment emerged as the dominant force in the Aviation MRO market, securing a substantial market share of over 54.7%. This impressive position underscores the growing preference among airlines and aircraft operators for third-party, independent MRO services. Independent MRO providers offer a competitive edge by providing specialized expertise, cost-effective solutions, and flexibility in servicing various aircraft types. Their ability to adapt to the evolving needs of the aviation industry, coupled with their reputation for quality service, has driven their ascendancy in the market.

Original Equipment Manufacturers (OEMs), while holding a significant presence, face intense competition from independent players. OEMs offer a unique advantage in terms of technical knowledge and access to proprietary data, making them a preferred choice for some airlines. However, the market dynamics are evolving, and OEMs are increasingly diversifying their service offerings to compete effectively with independent MRO providers.

Airlines Operator MRO, representing maintenance services conducted by the airlines themselves, also plays a substantial role, particularly among larger carriers with extensive fleets. These airlines choose to manage their maintenance operations in-house to maintain control over their aircraft’s upkeep. However, they often collaborate with independent MRO providers to complement their capabilities and optimize cost-efficiency.

Driving Factors

- Increasing Air Traffic: The continuous growth in global air passenger and cargo traffic is a significant driving factor for the Aviation MRO Market. The growing number of aircrafts in the skies has increased the need for repair, maintenance, and overhaul services. These are essential to ensure security and safety of operations in aircraft.

- Aging Aircraft Fleet: A large portion of the fleet of aircrafts worldwide is getting older, resulting in the need for more maintenance services.

- Advancements in Technology: Technological advancements in aviation, such as the integration of advanced materials, avionics, and more fuel-efficient engines, create opportunities for MRO providers. These advancements require specialized maintenance and upgrades, stimulating the market.

- Regulatory Compliance: Stringent aviation safety regulations and standards necessitate regular maintenance and compliance checks. Airlines must adhere to these regulations, propelling the need for MRO services to ensure they meet safety and operational requirements.

Restraining Factors

- High Capital Investment: Establishing and maintaining MRO facilities, in addition to purchasing cutting-edge equipment and technology requires a significant capital investment.

- Skilled Workforce Shortage: The industry faces a shortage of skilled technicians and engineers, which can hinder the capacity of MRO providers to meet increasing demand. This shortage often leads to higher labor costs and potential delays.

- Economic Volatility: The aviation MRO market is sensitive to economic fluctuations and airline profitability. Economic downturns can lead to budget cuts, impacting the demand for MRO services.

- Competition from OEMs: Original Equipment Manufacturers (OEMs) are expanding their MRO service offerings, intensifying competition in the market. This competition can make it challenging for independent MRO providers to maintain market share.

Growth Opportunities

- Digitalization and Predictive Maintenance: The adoption of digital technologies and predictive maintenance solutions can enhance operational efficiency and reduce downtime. Investing in these technologies presents a growth opportunity for MRO providers.

- Sustainable Aviation Practices: With the increasing focus on sustainability, MRO providers can explore opportunities in eco-friendly aircraft modifications, green aviation solutions, and sustainable materials, aligning with the industry’s evolving environmental goals.

- Emerging Markets: Emerging economies with expanding aviation sectors offer untapped opportunities for MRO providers. These regions often require infrastructure development and increased MRO capabilities to support their growing aviation industries.

- Partnerships and Alliances: Collaborations with airlines, OEMs, and other industry stakeholders can open doors to new business opportunities. Strategic partnerships can lead to shared resources, expanded service offerings, and increased market reach.

Challenges

- Global Supply Chain Disruptions: The aviation MRO market faces challenges related to global supply chain disruptions, affecting the timely availability of spare parts, components, and equipment required for maintenance.

- Rising Operating Costs: Escalating operating costs, including labor, energy, and compliance with regulatory changes, can erode profit margins for MRO providers.

- Cybersecurity Threats: As MRO processes become more digitally reliant, the industry faces cybersecurity threats. Protecting sensitive data and ensuring the integrity of aircraft systems is a pressing challenge.

- Environmental Regulations: Meeting increasingly stringent environmental regulations can be a challenge for MRO providers. Finding sustainable solutions and practices while remaining cost-effective is a complex task.

Key Market Trends

- Use of Augmented Reality (AR) and Virtual Reality (VR): MRO providers are adopting AR and VR technologies for training, remote assistance, and virtual inspections, improving efficiency and reducing downtime.

- Predictive Analytics: The use of data analytics and machine learning for predictive maintenance is a growing trend. This allows MRO providers to anticipate component failures and schedule maintenance proactively.

- Urban Air Mobility (UAM): The emergence of UAM vehicles is introducing new opportunities for MRO providers. These electric vertical takeoff and landing (eVTOL) aircraft require specialized maintenance services.

- Additive Manufacturing: 3D printing and additive manufacturing are increasingly used for creating aircraft components, reducing lead times and enabling customization in MRO processes.

Key Market Segments

MRO Type

- Line Maintenance

- Engine Maintenance

- Component Maintenance

- Base Maintenance

- Other MRO Types

Aircraft Type

- Commercial Aircraft

- Military Aircraft

- General Aviation

Service Provider

- OEMs (Original Equipment Manufacturers)

- Independent MRO Providers

- Airlines Operator MRO

Regional Analysis

In the year 2023, North America further solidified its dominant position within the Aviation MRO market, commanding an impressive market share exceeding 39.3%. This dominance of the region is due to a variety of factors, including the existence of a thriving aviation industry, a large number of military and commercial aircraft, as well as an intense focus on safety and compliance in aviation.

The demand for Aviation MRO in North America was valued at USD 30.8 billion in 2023 and is anticipated to grow significantly in the forecast period. Furthermore, North America benefits from a mature MRO ecosystem, comprising a mix of independent MRO providers, OEMs, and airline operator MRO facilities.

The region’s technological advancements and focus on innovation contribute to its leading role in the aviation MRO landscape, with a well-established customer base relying on high-quality maintenance services. Europe’s strategically placed position as a major hub for aviation along with a solid regulatory framework, guarantees a steady demand for repair and maintenance.

In the Asia-Pacific (APAC) area however is experiencing rapid growth thanks to the rapidly growing aviation industry in nations like China and India. APAC presents substantial growth opportunities due to its expanding commercial and military aviation fleets, making it an increasingly attractive market for MRO providers.

Latin America, Middle East, and Africa collectively contribute to the global aviation MRO market, albeit with varying dynamics. Latin America’s market is influenced by a mix of economic challenges and emerging opportunities, while the Middle East capitalizes on its strategic location and substantial investments in aviation infrastructure.

Africa, with its growing aviation industry, seeks to bridge the gap between supply and demand for MRO services. While each region faces unique challenges, such as economic volatility and regulatory complexities, they collectively shape the global aviation MRO market’s evolving landscape, characterized by regional nuances and growth potentials.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

A Key Player Analysis of the Aviation MRO Market refers to an in-depth profiling and evaluation of the leading MRO companies across metrics like annual revenues, MRO capabilities, geographical presence, key customers served, recent M&A activity, and innovative services offered. Identifying the major players allows sizing up and ranking the MRO vendors who are driving the most growth and transformation in this market. It enables understanding which firms lead various segments like engine MRO, components MRO, digital & predictive MRO solutions etc. Comparing the growth strategies and financial performance of the top vendors also provides crucial insights into the future direction and competitiveness of the global aviation MRO market.

Top Player’s Company Profiles

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc.

- Lufthansa Technik AG

- Raytheon Technologies Corporation

- ST Engineering Aerospace

- The Boeing Company

- GE Aerospace

- Emirates Engineering

- Hong Kong Aircraft Engineering Company Limited

- SIA Engineering Company Limited

- MTU Aero Engines AG

- Other Key Players

Recent Developments

- In 2023, Boeing and Airbus announce major MRO investments, focusing on digital solutions, automation, and new capabilities like in-house engine overhaul.

- In 2023, GE Aviation – Engine manufacturer with a growing MRO network, focusing on engine overhaul and maintenance.

- In 2023, HAECO Group – Hong Kong-based MRO provider with a strong presence in Asia, specializing in narrowbody aircraft.

Report Scope

Report Features Description Market Value (2023) US$ 78.5 Bn Forecast Revenue (2033) US$ 131.6 Bn CAGR (2023-2033) 5.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By MRO Type (Line Maintenance, Engine Maintenance, Component Maintenance, Base Maintenance, Other MRO Types), By Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation), By Service Provider (OEMs (Original Equipment Manufacturers), Independent MRO Providers, Airlines Operator MRO) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AAR Corp., Airbus SE, Delta Airlines, Inc., Lufthansa Technik AG, Raytheon Technologies Corporation, ST Engineering Aerospace, The Boeing Company, GE Aerospace, Emirates Engineering, Hong Kong Aircraft Engineering Company Limited, SIA Engineering Company Limited, MTU Aero Engines AG, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What does Aviation MRO stand for?Aviation MRO stands for Aviation Maintenance, Repair, and Overhaul. It refers to the activities involved in maintaining, repairing, and servicing aircraft to ensure their safety, airworthiness, and operational efficiency.

What tasks are included in Aviation MRO?Aviation MRO encompasses a wide range of tasks, including routine inspections, scheduled maintenance, component repairs, and system overhauls.

How big is Aviation MRO Market?The global Aviation MRO Market is anticipated to be USD 131.6 billion by 2033. It is estimated to record a steady CAGR of 5.3% in the Forecast period 2023 to 2033. It is likely to total USD 82.7 billion in 2024.

What is the market trend for Aircraft MRO?The market trend for Aircraft MRO is generally positive, driven by factors such as the increasing global fleet of aircraft, advancements in technology, and the growing demand for maintenance services to ensure the safety and efficiency of aviation operations.

What is MRO in the aviation industry?MRO in the aviation industry refers to Maintenance, Repair, and Overhaul. It encompasses a wide range of activities and services aimed at maintaining, repairing, and overhauling aircraft to ensure their continued airworthiness and safe operation.

What is the future of the MRO industry?The future of the MRO industry looks promising, driven by technological advancements, the adoption of innovative solutions, and the continuous growth of the global aviation sector. The industry is likely to see increased demand for specialized MRO services and a focus on efficiency and sustainability.

-

-

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc.

- Lufthansa Technik AG

- Raytheon Technologies Corporation

- ST Engineering Aerospace

- The Boeing Company

- GE Aerospace

- Emirates Engineering

- Hong Kong Aircraft Engineering Company Limited

- SIA Engineering Company Limited

- MTU Aero Engines AG

- Other Key Players