Global Aircraft Seat Actuation Systems Market By Mechanism Type (Rotary and Linear), By Actuator Type (Electro-mechanical, Pneumatic, Hydraulic), By Passenger Class (Economy Class, Business and First-class), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2023

- Report ID: 53760

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

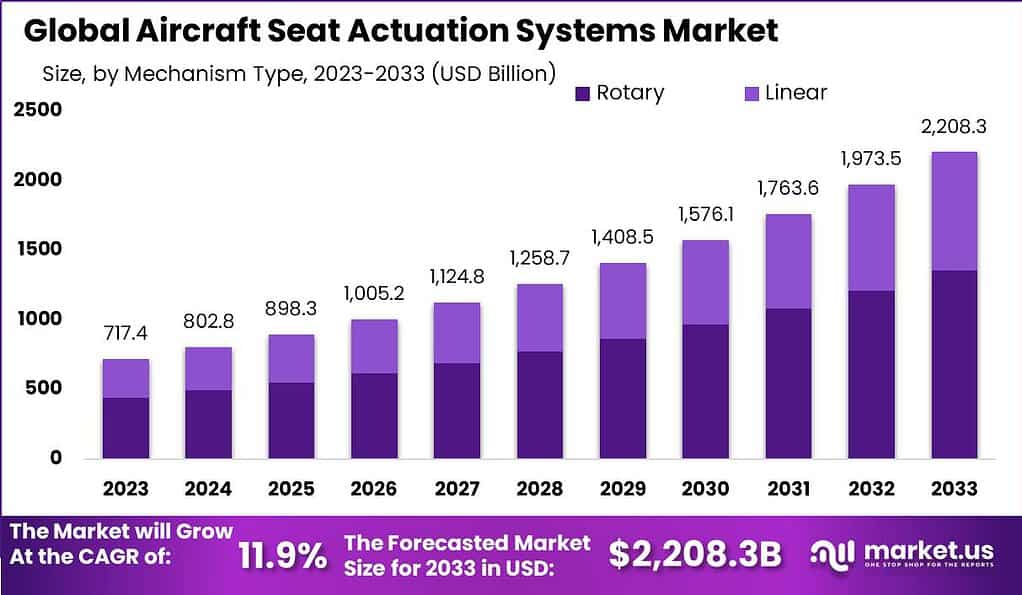

The global Aircraft Seat Actuation Systems Market is anticipated to be USD 2,208.3 billion by 2033. It is estimated to record a steady CAGR of 11.9% in the Forecast period 2023 to 2033. It is likely to total USD 717.4 billion in 2023.

Aircraft seat actuation systems are mechanisms that enable the movement and adjustment of seats in an aircraft cabin. These systems empower passengers or crew members to alter their seating positions for comfort, convenience, or safety during a flight. Comprising electric motors, gears, controls, and sensors, these actuation systems collaborate to enable seamless seat adjustments.

In simpler terms, aircraft seat actuation systems are the mechanisms responsible for moving and positioning seats inside an airplane. They permit passengers and crew to customize their seating arrangements for a more comfortable experience during a flight. These systems consist of diverse components working together to facilitate the desired seat movements.

Note: Actual Numbers Might Vary In Final Report

The aircraft seat actuation systems market encompasses the business and industry engaged in the design, production, and distribution of these seat actuation systems for aircraft. This sector includes companies specializing in the creation and supply of the essential components and systems that facilitate seat movement within airplanes.

Key Takeaways

- Market Size and Growth: The global Aircraft Seat Actuation Systems Market is projected to reach USD 2,208.3 billion by 2033 with an anticipated growth rate of 11.9%, estimated in 2023 as USD 717.4 billion.

- What Are Aircraft Seat Actuation Systems?: Aircraft seat actuation systems are mechanisms that allow for the movement and adjustment of seats in an aircraft cabin. These systems use electric motors, gears, controls, and sensors to enable seamless seat adjustments, enhancing passenger comfort.

- Mechanism Types: In 2023, rotary mechanisms dominate the market with a share of over 61.5%. They are known for their durability and efficiency in providing precise seat adjustments, making them a preferred choice for aircraft manufacturers.

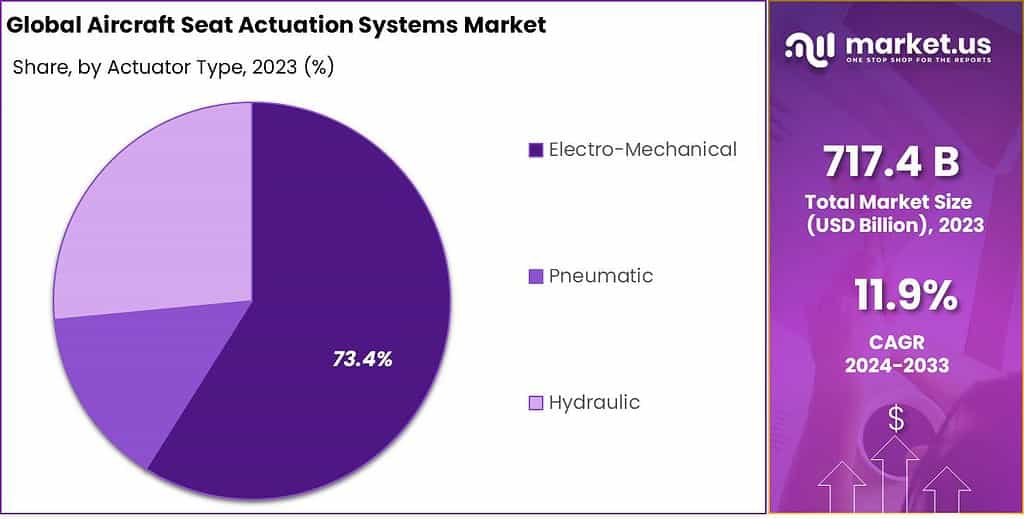

- Actuator Types: Electro-mechanical systems lead the market with over 73.4% share. They are preferred for their efficiency, precise control, and reduced environmental impact, aligning with the aviation industry’s focus on fuel efficiency and sustainability.

- Passenger Classes: Economy class dominates with a significant market share of 64.9%. Airlines focus on cost-effective and efficient seat actuation systems to cater to the high number of passengers in this class.

- Driving Factors: Passenger Comfort Enhancement: Airlines invest in advanced seat actuation systems to enhance passenger comfort during flights.

- Challenges: High Initial Costs: The installation of advanced seat actuation systems can be costly for airlines and manufacturers.

- Growth Opportunities: Integration of Artificial Intelligence (AI): Smart and adaptive seating solutions using AI are likely to be in high demand.

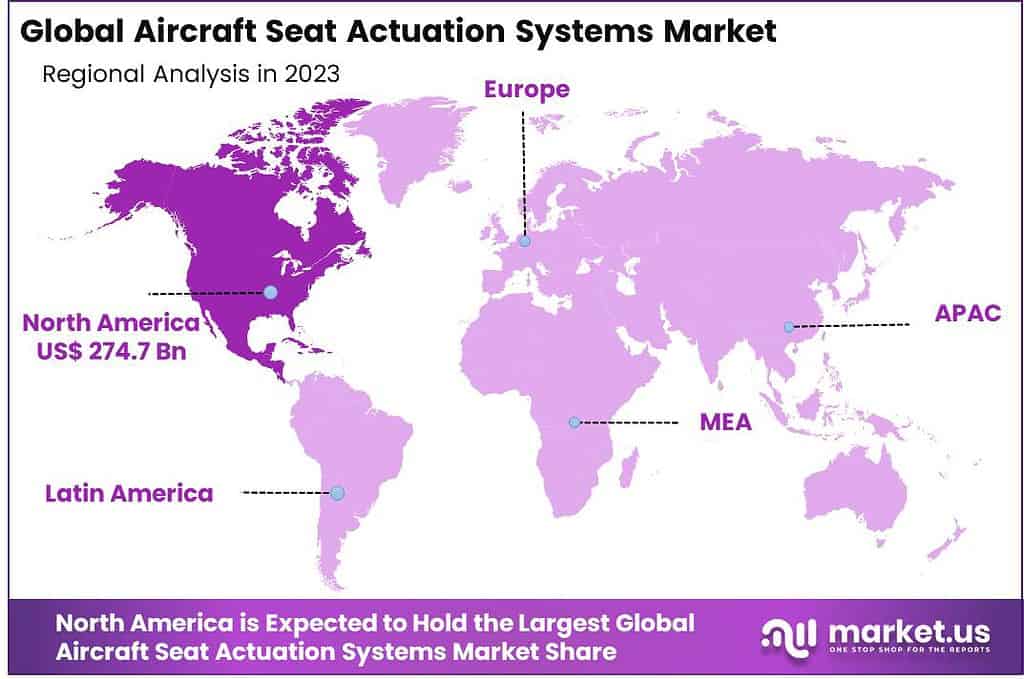

- Regional Analysis: North America: Dominates with a share of over 38.3%, driven by a robust aviation industry.

- Key Players: Major companies in the market include Bühler Motor GmbH, ITT Inc., Moog Inc., Safran S.A., Collins Aerospace, Astronics Corporation, and others.

By Mechanism Type

In 2023, the Aircraft Seat Actuation Systems market exhibited a noteworthy dichotomy in its Mechanism Type segments. The Rotary segment emerged as the dominant player, securing a substantial market share of over 61.5%. This significant share can be attributed to the widespread use of rotary mechanisms in aircraft seat actuation systems, known for their durability and efficiency in providing precise adjustments to passenger seats. The reliability and ease of maintenance associated with rotary mechanisms have made them a preferred choice for many aircraft manufacturers and operators, further solidifying their market dominance.

On the other hand, the Linear segment, while not as extensive in its market presence, still held its ground with a meaningful share. Linear mechanisms are valued for their ability to offer smooth and controlled seat adjustments, enhancing passenger comfort during flights. In 2023, the Linear segment accounted for the remaining market share, reflecting the continued demand for this type of mechanism, particularly in aircraft cabins where passenger experience is a priority.

By Actuator Type

As of 2023, the Aircraft Seat Actuation Systems market exhibits a distinct segmentation based on actuator types, primarily comprising Electro-Mechanical, Pneumatic, and Hydraulic systems. Notably, the Electro-Mechanical segment emerged as the dominant force, securing a commanding market position by capturing over 73.4% share. This segment’s ascendancy can be attributed to the growing preference for electrically powered actuation systems, driven by their efficiency, precise control, and reduced environmental impact compared to traditional hydraulic or pneumatic alternatives.

The Electro-Mechanical segment’s robust growth is further propelled by the aviation industry’s increasing focus on fuel efficiency and environmental sustainability. Airlines and aircraft manufacturers are keenly adopting electro-mechanical actuation systems due to their lighter weight, which contributes to overall fuel savings and reduces the ecological footprint of air travel. Moreover, advancements in electric motor technology, sensor integration, and control mechanisms have bolstered the reliability and performance of Electro-Mechanical seat actuation systems, garnering trust and preference among key stakeholders.

In contrast, the Pneumatic and Hydraulic segments exhibit a noteworthy presence in the market, albeit facing certain challenges in the wake of the Electro-Mechanical dominance. Pneumatic actuation systems, leveraging air pressure for seat adjustments, have found application in specific aircraft models. However, their market share is somewhat constrained due to concerns regarding system complexity, maintenance costs, and potential environmental impact.

Similarly, Hydraulic actuation systems, long-established in the aviation industry, showcase a resilient presence, particularly in larger aircraft where high force and power are essential. Despite this, the Hydraulic segment faces headwinds as airlines seek to enhance fuel efficiency and comply with stringent environmental regulations. The demand for more sustainable alternatives, such as Electro-Mechanical systems, continues to pose challenges to the growth trajectory of Hydraulic actuation systems.

Note: Actual Numbers Might Vary In Final Report

Looking ahead, market analysts anticipate further advancements and innovations in Electro-Mechanical seat actuation systems, emphasizing increased integration with smart cabin technologies and automation features. These developments are poised to amplify the segment’s market share, accentuating its dominance in the foreseeable future. However, the Pneumatic and Hydraulic segments are not to be discounted, as ongoing research and development efforts aim to address their limitations and enhance their compatibility with evolving aviation industry requirements.

By Passenger Class

As of 2023, the Aircraft Seat Actuation Systems market is strategically segmented by passenger class, featuring key distinctions in Economy Class, Business Class, and First-Class segments. Notably, in the current market landscape, the Economy Class segment has asserted its dominance by securing a substantial market position, capturing an impressive 64.9% share. This commanding presence can be attributed to the sheer volume of passengers traveling in economy class across various airlines, emphasizing the significance of cost-effectiveness and efficiency in seat actuation systems.

The Economy Class segment’s market leadership is underscored by airlines’ continuous efforts to optimize seating arrangements for larger passenger capacities while ensuring a balance between comfort and economic considerations. Manufacturers and suppliers catering to this segment have focused on developing reliable and cost-efficient seat actuation systems that meet the rigorous demands of high-frequency and high-capacity air travel. The numerical data supporting the Economy Class’s substantial market share highlights the pivotal role played by this segment in shaping the overall dynamics of the Aircraft Seat Actuation Systems market.

In contrast, the Business Class and First-Class segments, although holding notable shares, operate within distinct market dynamics. The Business Class, known for its emphasis on premium amenities and enhanced passenger experience, commands attention for its specific seat actuation requirements. The demand for sophisticated and customizable seating configurations in Business Class drives innovations in actuation systems, catering to passengers seeking a higher level of comfort and personalization during their journeys.

Similarly, the First-Class segment, synonymous with luxury and exclusivity, presents a unique set of challenges and opportunities for seat actuation systems. While the market share for First-Class may be comparatively smaller, it holds significance due to the intricate and premium nature of the seat adjustment mechanisms required. Airlines and manufacturers targeting this elite segment prioritize cutting-edge technologies, premium materials, and advanced features to meet the discerning expectations of First-Class passengers.

Looking ahead, the Aircraft Seat Actuation Systems market is poised for ongoing evolution, with a focus on enhancing the passenger experience across all classes. As airlines seek to differentiate their offerings and cater to diverse traveler preferences, the market is likely to witness continued innovation in seat actuation systems tailored to the unique requirements of Economy, Business, and First-Class passengers. The numerical insights from 2023 underscore the current market dynamics, providing valuable insights into the strategic positioning of each passenger class within the broader context of the Aircraft Seat Actuation Systems industry.

Driving Factors

- Passenger Comfort Enhancement: A significant driving factor for the Aircraft Seat Actuation Systems market is the relentless pursuit of enhancing passenger comfort. Airlines are investing in advanced seat actuation systems to provide ergonomic designs, adjustable features, and personalized seating options, ultimately elevating the overall in-flight experience.

- Fuel Efficiency Demands: The increasing emphasis on fuel efficiency in the aviation industry is driving the adoption of lightweight and energy-efficient seat actuation systems. Manufacturers are developing innovative solutions that contribute to aircraft weight reduction, leading to fuel savings and environmental sustainability, in alignment with global aviation regulations.

- Rising Air Travel Trends: With the continuous growth in global air travel, there is a heightened demand for modern and efficient seat actuation systems to accommodate increasing passenger numbers. This surge in air travel, especially in emerging markets, propels the market as airlines invest in upgrading their fleets with state-of-the-art seating arrangements.

- Advancements in Smart Cabin Technologies: The integration of smart cabin technologies is a key driver shaping the Aircraft Seat Actuation Systems market. Systems that enable connectivity, entertainment, and personalized controls contribute to the overall appeal of an airline’s offering, driving the demand for more sophisticated and technologically advanced seat actuation solutions.

Restraining Factors

- High Initial Costs: One of the significant challenges hindering the market growth is the high initial costs associated with installing advanced seat actuation systems. Airlines and aircraft manufacturers face budget constraints, especially during economic downturns, impacting their ability to invest in cutting-edge technologies for seat adjustments.

- Stringent Certification Standards: The stringent certification standards imposed by aviation regulatory bodies add complexity and time to the development and approval process for new seat actuation systems. Adhering to these standards poses challenges for manufacturers, potentially delaying the introduction of innovative products to the market.

- Maintenance and Service Costs: The ongoing maintenance and service costs associated with seat actuation systems can be a restraining factor. Airlines and operators are cautious about the long-term costs of maintaining complex systems, influencing their decisions regarding the adoption of certain seat actuation technologies.

- Limited Retrofitting Options: Retrofitting existing aircraft with advanced seat actuation systems can be challenging due to space constraints and compatibility issues. This limitation poses a challenge for airlines looking to upgrade their fleets with the latest seat adjustment technologies without significant modifications.

Growth Opportunities

- Emerging Markets Expansion: The expansion of air travel in emerging markets presents a substantial growth opportunity for the Aircraft Seat Actuation Systems market. As more people gain access to air travel, there is an increasing demand for modern and comfortable seating solutions, driving market growth in these regions.

- Integration of Artificial Intelligence (AI): The integration of Artificial Intelligence (AI) in seat actuation systems opens up new growth avenues. Smart and adaptive seating solutions that use AI to learn passenger preferences and adjust accordingly are likely to be in high demand, providing opportunities for innovation and market expansion.

- Collaboration with Aircraft Interior Designers: Collaborations between seat actuation system manufacturers and aircraft interior designers offer growth opportunities. Joint efforts in designing aesthetically pleasing and functionally advanced seating arrangements can be a compelling value proposition for airlines seeking unique cabin experiences.

- Focus on Sustainable Materials: The growing emphasis on sustainability creates opportunities for the market to explore seat actuation systems using eco-friendly materials. Manufacturers can capitalize on the demand for environmentally conscious solutions, aligning with the aviation industry’s broader commitment to reducing its ecological footprint.

Challenges

- Complex Regulatory Landscape: Navigating the complex and evolving regulatory landscape, encompassing safety and certification standards, poses a persistent challenge for seat actuation system manufacturers. Adherence to these regulations is critical and requires ongoing efforts to stay compliant.

- Global Economic Uncertainties: Economic uncertainties, such as recessions and financial downturns, pose challenges for the Aircraft Seat Actuation Systems market. Airlines may delay or reconsider investments in new seating technologies during periods of economic instability, affecting market growth.

- Limited Innovation Funding: Limited funding for research and development in the aviation sector can be a challenge. Manufacturers may face constraints in innovating and introducing next-generation seat actuation systems, limiting the pace of technological advancements.

- Supply Chain Disruptions: The susceptibility of the aviation supply chain to disruptions, such as geopolitical tensions and global events, poses challenges for timely production and delivery of seat actuation systems. Managing supply chain risks is crucial for ensuring uninterrupted market operations.

Key Market Trend

- Personalization and Customization: A key trend shaping the market is the increasing focus on personalization and customization of seat configurations. Airlines are adopting seat actuation systems that allow passengers to personalize their in-flight experience, offering a range of adjustable features for individual comfort.

- Incorporation of Biometric Technologies: The integration of biometric technologies into seat actuation systems is gaining traction as a notable market trend. Biometrics enhance security and streamline passenger experience by enabling seamless and secure seat adjustments based on individual passenger profiles.

- Modular and Scalable Solutions: The trend towards modular and scalable seat actuation solutions is emerging. Manufacturers are developing systems that can be easily integrated into various aircraft models, providing flexibility for both airlines and aircraft manufacturers in adapting to different cabin configurations.

- Focus on Health and Wellness Features: An increasingly prominent trend is the integration of health and wellness features in seat actuation systems. This includes ergonomic designs, posture support, and features promoting passenger well-being, aligning with the growing emphasis on holistic passenger comfort in the aviation industry.

Key Market Segments

By Mechanism Type

- Rotary

- Linear

By Actuator Type

- Electro-mechanical

- Pneumatic

- Hydraulic

By Passenger Class

- Economy class

- Business class

- First class

Regional Analysis

In 2023, the Aircraft Seat Actuation Systems market displayed distinctive regional dynamics, with North America emerging as the dominant force, capturing an impressive market share of over 38.3%. This significant share can be attributed to the robust aviation industry in the region, marked by a high volume of air travel, modernization initiatives by airlines, and the presence of major aircraft manufacturers.

The demand for Aircraft Seat Actuation Systems in North America was valued at USD 274.7 billion in 2023 and is anticipated to grow significantly in the forecast period. North American airlines have been keen on enhancing passenger experience, leading to a consistent demand for advanced seat actuation systems that offer comfort and customization options.

Europe also played a substantial role in the market, holding a noteworthy share. European airlines and aircraft manufacturers have been at the forefront of incorporating innovative seat actuation systems to maintain competitiveness and meet stringent regulatory requirements. This region’s commitment to sustainability and passenger comfort has driven the adoption of cutting-edge technologies in seat actuation systems.

Meanwhile, the Asia-Pacific (APAC) region demonstrated rapid growth potential, securing a some share. The surge in the aviation sector in nations such as China and India, accompanied by a growing middle-class demographic, has resulted in a notable upswing in air travel. This trend, in turn, is fueling a heightened demand for contemporary seat actuation systems within this region.

Meanwhile, Latin America, the Middle East, and Africa jointly contributed to the remaining portion of the market share. While these regions had a relatively smaller market presence, they showed promise for future growth, primarily driven by expanding aviation markets and an increasing focus on passenger experience and comfort.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Industry competition has been intensified by the presence of multiple market players. A lack of product differentiation is a major reason why few market players can capture substantial market share, despite the high level of competition. There are also many actuator types and mechanisms that offer significant opportunities to industry vendors.

Маrkеt Kеу Рlауеrѕ

- Bühler Motor GmbH

- ITT Inc.

- Moog Inc.

- Safran S.A.

- Collins Aerospace

- Astronics Corporation

- Rollon Group

- Crane Aerospace & Electronics, Inc.

- NOOK Industries, Inc.

- Almec EAS Ltd.

- Sitec Aerospace GmbH

- Other Key Players

Recent Developments

- Recaro Aircraft Seating secured a contract in September 2021 to furnish Qatar Airways’s upcoming A321neo fleet with the innovative CL3810 economy class seat. Commencing at the end of 2022, Recaro will embark on the installation of the new CL3810 seats across 20 A321neo aircraft.

- In a noteworthy development from August 2021, Geven and PriestmanGoode jointly introduced Elemento, a cutting-edge aircraft seat featuring a patented wave system and PED Holders to enhance passenger comfort. This advancement was a result of a collaborative partnership agreement inked by the two companies in February 2021.

Report Scope

Report Features Description Market Value (2023) US$ 717.4 Bn Forecast Revenue (2033) US$ 2,208.3 Bn CAGR (2023-2033) 11.9% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Mechanism Type (Rotary and Linear), By Actuator Type (Electro-mechanical, Pneumatic, Hydraulic), By Passenger Class (Economy Class, Business and First-class) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Bühler Motor GmbH, ITT Inc., Moog Inc., Safran S.A., Collins Aerospace, Astronics Corporation, Rollon Group, Crane Aerospace & Electronics, Inc., NOOK Industries, Inc., Almec EAS Ltd., Sitec Aerospace GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an Aircraft Seat Actuation System?An Aircraft Seat Actuation System is a mechanism designed to facilitate the movement and adjustment of seats within an aircraft cabin. It allows passengers and crew members to modify the position of their seats for comfort, convenience, or safety during a flight. These systems typically consist of electric motors, gears, controls, and sensors working together to enable seat movement.

Why is the Aircraft Seat Actuation Systems Market Significant?The Aircraft Seat Actuation Systems market is significant due to its direct impact on passenger comfort, airline efficiency, and overall aviation experience. As air travel continues to grow globally, there is an increasing demand for advanced seat adjustment technologies that enhance the in-flight experience, contributing to the market's importance.

How big is Aircraft Seat Actuation Systems Market?The global Aircraft Seat Actuation Systems Market is anticipated to be USD 2,208.3 billion by 2033. It is estimated to record a steady CAGR of 11.9% in the Forecast period 2023 to 2033. It is likely to total USD 717.4 billion in 2023.

What are the Key Driving Factors for the Aircraft Seat Actuation Systems Market?The key driving factors include the emphasis on passenger comfort enhancement, the demand for fuel-efficient solutions, the rising trend in air travel, and advancements in smart cabin technologies. These factors collectively contribute to the growth and adoption of advanced seat actuation systems in the aviation industry.

What Challenges Does the Aircraft Seat Actuation Systems Market Face?Challenges in the market include high initial costs, stringent certification standards, maintenance and service costs, and limitations in retrofitting options. These challenges impact the adoption and development of seat actuation systems in the aviation sector.

Aircraft Seat Actuation Systems MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Aircraft Seat Actuation Systems MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Bühler Motor GmbH

- ITT Inc.

- Moog Inc.

- Safran S.A.

- Collins Aerospace

- Astronics Corporation

- Rollon Group

- Crane Aerospace & Electronics, Inc.

- NOOK Industries, Inc.

- Almec EAS Ltd.

- Sitec Aerospace GmbH

- Other Key Players