Global Aircraft Micro Turbine Engines Market By Aircraft Type (Commercial Aircraft, Regional Jets, Single-aisle Aircraft, Military Aircraft, Drones, Fighter Jets, General Aviation, Light Aircraft and Helicopters), Engine Type (Single-shaft, Twin-shaft), By Application (Propulsion, Auxiliary Power Units (APUs)), Distribution Channel (OEM, Aftermarket), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2023

- Report ID: 73096

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

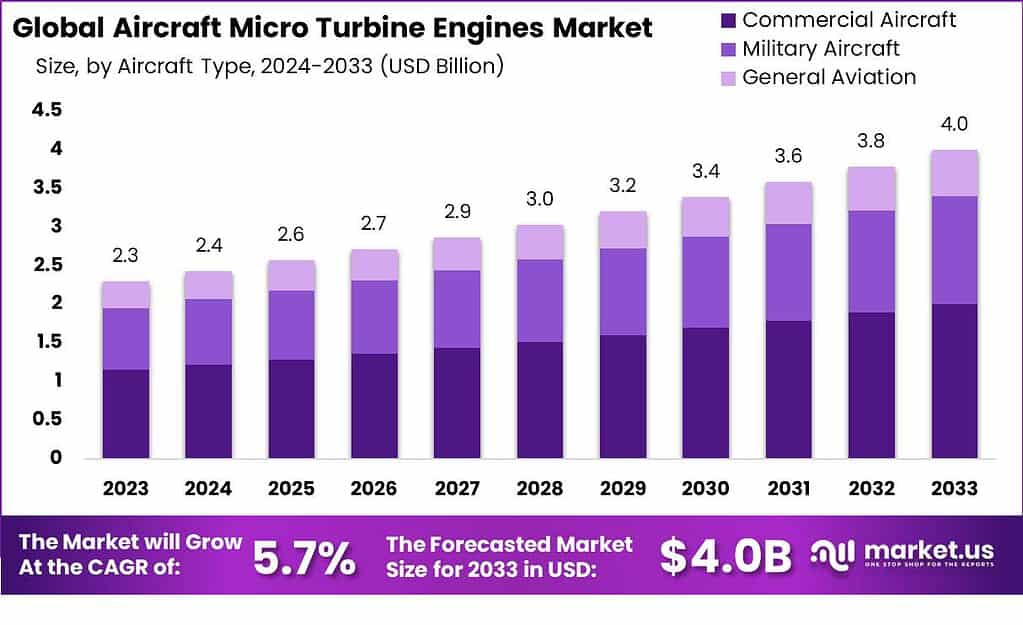

The Global Aircraft Micro Turbine Engines Market is estimated to be worth USD 2.3 billion in 2023 and projected to be valued at USD 4.0 billion in 2033. Between 2024 and 2033, the market is expected to register a growth rate of 5.7%.

Aircraft micro turbine engines are very small jet engines that provide power for small aircraft like drones and air taxis. These tiny jet engines are usually less than 100 pounds thrust and have a simple design with only one moving part – the rotor/compressor unit. The fuel, like kerosene, is injected into the combustion chamber where it mixes with compressed air and gets ignited. This combustion spins the turbine which powers the compressor. The exhaust gas from the turbine provides the engine thrust.

Note: Actual Numbers Might Vary In Final Report

These engines act like miniature turbines that generate the energy required to turn an aircraft’s propellers or fans, propelling its movement through the air. While smaller than engines found on larger planes, these little guys still pack a powerful punch and play an invaluable role in aviation.

The cogeneration option offered by these types of engines combines the usage of electricity and heat from an engine facilitating up to 85% in efficiency, with respect to point-of-power utilization, depending on heat process requirements. In addition, its low-cost energy dependency makes it a cheaper option for long-term use. Aircraft micro turbine engines are more efficient than reciprocating engines as they save space and facilitate lubricant oil & coolant-free operation.

Moreover, micro turbine engines offer different advantages, such as small moving parts, compact size, lightweight, low emissions, and greater efficiency levels. The global aircraft micro turbine engine market is experiencing considerable revenue growth, and is expected to significantly expand over the next few years.

Key Takeaways

- Market Growth Projection: The Aircraft Micro Turbine Engines Market is anticipated to reach USD 4.0 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 5.7%.

- Definition and Function: Aircraft micro turbine engines are compact jet engines used in small aircraft, including drones and air taxis. They are known for their simple design and efficient operation.

- Efficiency and Cogeneration: Micro turbine engines offer up to 85% efficiency when combined with electricity and heat generation. They are cost-effective and outperform reciprocating engines in terms of space utilization.

- Advantages: These engines are characterized by small moving parts, compact size, lightweight construction, low emissions, and high efficiency levels.

- Aircraft Type Analysis: Commercial Aircraft dominated the market in 2023 due to their extensive use of micro turbine engines for various purposes, including propulsion and auxiliary power units (APUs).

- Engine Type Analysis: Twin-shaft micro turbine engines held a dominant position in 2023, offering better fuel efficiency and power relative to size. Single-shaft engines are mechanically simpler and favored for smaller applications.

- Application Analysis: Propulsion accounted for over 70% of the market share in 2023, highlighting the crucial role of micro turbine engines in driving aircraft forward.

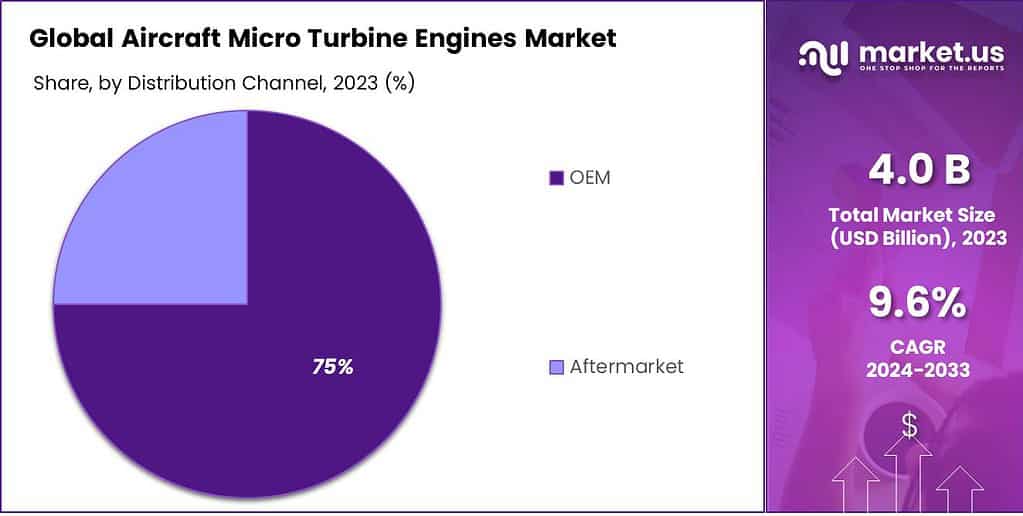

- Distribution Channels: OEMs (Original Equipment Manufacturers) secured over 75% of the market share in 2023, emphasizing their importance in the supply chain of micro turbine engines.

- Market Drivers: Increasing demand for efficient and compact propulsion systems, especially in unmanned aerial vehicles (UAVs) and military aircraft, is a prominent driver of market growth.

- Market Restraints: High manufacturing costs, supply chain disruptions, and competition from alternative propulsion technologies pose challenges to the Aircraft Micro Turbine Engines Market.

- Opportunities: Emerging technologies like urban air mobility and electric vertical takeoff and landing (eVTOL) vehicles present growth opportunities for micro turbine engines.

- Emerging Trends: Trends include 3D-printed engine components for cost reduction, advances in combustion technology for lower emissions, and increased collaboration among key players fostering innovation.

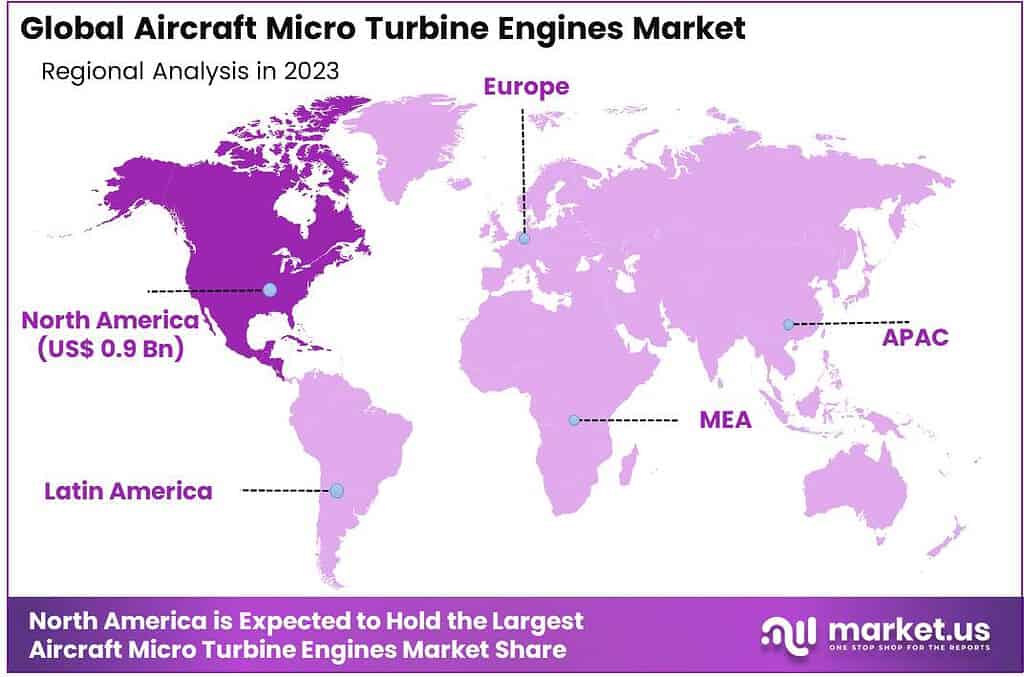

- Regional Analysis: North America and Europe lead the market in 2023, with North America benefiting from a robust aviation industry, while Europe focuses on reducing emissions and improving fuel efficiency.

- Key Players: Major companies such as Pratt & Whitney, Honeywell International Inc., and Rolls-Royce Holdings PLC play a pivotal role in shaping the market’s trajectory.

- Recent Developments: Notable developments include partnerships for more fuel-efficient airplanes and the introduction of powerful yet lightweight generators for drones.

Aircraft Type Analysis

In 2023, Commercial Aircraft emerged as the dominant segment in the Aircraft Micro Turbine Engines Market, securing a commanding market share of over 50%. This segment’s strong foothold can be attributed to the extensive use of micro turbine engines in commercial aviation due to their compact size and efficient performance. Commercial aircraft utilize micro turbine engines for various uses, including propulsion and auxiliary power units (APUs). Their small size, lightweight construction and reduced emissions make these micro engines the perfect fit for the rigorous requirements of aviation.

Regional Jets, another significant segment, also contributed substantially to the market. These aircraft are known for their versatility and are often used for short-haul flights. Micro turbine engines find applications in regional jets, enhancing their operational efficiency and performance.

Single-aisle Aircraft, a sub-category within the commercial aviation sector, also saw notable adoption of micro turbine engines. These aircraft are commonly used for medium-haul flights and benefit from the compact nature of these engines, which allows for efficient space utilization.

The Military Aircraft segment witnessed steady growth in 2023, driven by the need for advanced propulsion systems in military operations. Micro turbine engines offer advantages such as reliability and compact size, making them suitable for various military aircraft, including drones and fighter jets.

Speaking of drones, this segment experienced remarkable expansion as micro turbine engines became the preferred choice for Unmanned Aerial Vehicles (UAVs). These engines offer the necessary power-to-weight ratio and efficiency required for drone operations.

Fighter Jets, known for their high-performance requirements, also saw increased adoption of micro turbine engines, benefiting from their power output and compact design. These engines play a crucial role in enhancing the maneuverability and performance of fighter jets.

General Aviation, which includes a wide range of private and recreational aircraft, found value in micro turbine engines due to their efficiency and reliability. Light Aircraft within this segment, in particular, benefitted from these engines, as they are well-suited for smaller aircraft types. Helicopters, with their diverse applications, also witnessed growth in the usage of micro turbine engines. These engines provide the necessary power for helicopters while maintaining a compact footprint.

Engine Type Analysis

In 2023, twin-shaft micro turbine engines held a dominant position in the market, capturing more than a 55% share. Twin-shaft designs have two separate shafts connecting the turbine and compressor sections. This allows for independent optimization of the compressor and turbine. Twin-shaft engines provide better fuel efficiency and can produce more power relative to size. Major manufacturers like Honeywell, Rolls-Royce, and Collins Aerospace offer popular twin-shaft micro turbine models for small UAVs. The configuration also works well for hybrid-electric aircraft. Continued innovation in twin-shaft technology will help this segment maintain its leading market share over the forecast period.

Single-shaft micro turbine engines accounted for the remaining market share in 2023. These have a single rotating shaft linking the compressor and turbine. While not as fuel-efficient as twin-shaft, single-shaft engines are mechanically simpler and more rugged. Their compact shape and simplicity also allows very small engine designs. Single-shaft micro turbines work well for nano or very small drones where minimum size and weight are critical. Cost-sensitive consumer and commercial UAV applications also favor single-shaft designs. Ongoing focus on shrinking engine size and improving durability will position single-shaft models for continued adoption in the high-volume consumer drone segment.

Application Analysis

In 2023, the Aircraft Micro Turbine Engines Market exhibited a clear leader in the application segment, with Propulsion taking the dominant market position by capturing over 70% of the share. This commanding presence of Propulsion in the market is a testament to the crucial role that micro turbine engines play in driving the forward movement of aircraft. These engines are a primary source of thrust and power for aircraft, ensuring their ability to take off, climb, and cruise efficiently.

Auxiliary Power Units (APUs), while essential, held a smaller share in the market compared to Propulsion. APUs serve as secondary power sources that provide electricity and pneumatic power to various aircraft systems, including lighting, air conditioning, and avionics, especially when the main engines are not running. While their share may be smaller, APUs are integral for maintaining aircraft functionality when on the ground and during specific in-flight phases.

Distribution Channel Analysis

In the year 2023, the Aircraft Micro Turbine Engines Market clearly showcased a dominant player in the Distribution Channel segment, with OEM (Original Equipment Manufacturer) securing a commanding market position, holding over 75% of the share. This significant share underlines the importance of OEMs in the supply chain of micro turbine engines for aircraft.

OEMs are the primary source for micro turbine engines, providing them as integral components in the initial manufacturing of aircraft. OEMs take great pride in producing micro turbine engines that meet all of the stringent aviation specifications for safety, performance, and regulatory compliance. Aircraft manufacturers rely heavily on OEMs to deliver top-quality micro turbine engines that can seamlessly integrate with their aircraft designs.

On the other hand, the Aftermarket segment played a valuable but smaller role in the market compared to OEM. The Aftermarket involves the sale of replacement parts, maintenance, and repair services for micro turbine engines once the aircraft is in operation. It caters to the ongoing maintenance needs of aircraft operators, ensuring that micro turbine engines continue to operate efficiently throughout their service life.

Note: Actual Numbers Might Vary In Final Report

Drivers

In the Aircraft Micro Turbine Engines Market, one of the prominent drivers is the increasing demand for more efficient and compact propulsion systems. These engines are popular due to their ability to deliver higher power-to-weight ratios, improving aircraft performance while increasing fuel efficiency. Their growing use in unmanned aerial vehicles (UAVs) and military aircraft has further propelled market expansion, while stringent air quality regulations have motivated manufacturers to develop engines with lower emissions levels further expanding market growth.

Restraints

High manufacturing costs pose a significant restraint in the Aircraft Micro Turbine Engines Market. The intricate engineering and quality control required to meet aviation standards can result in elevated production expenses. Additionally, the limited availability of certain materials and components can lead to supply chain disruptions, affecting market growth. The niche nature of these engines also limits economies of scale, contributing to higher costs.

Challenges

One of the primary challenges facing the market today is competition from alternative propulsion technologies such as electric and hybrid systems. These offer environmental benefits and are being increasingly explored within aviation. Adapting to changing regulatory frameworks and ensuring safety certifications also pose challenges for micro turbine engine manufacturers.

Opportunities

The market presents opportunities in the form of expanding applications beyond aircraft propulsion. Micro turbine engines can find use in various emerging technologies, including urban air mobility and electric vertical takeoff and landing (eVTOL) vehicles. Moreover, the global trend toward sustainability and the use of biofuels presents opportunities for micro turbine engines as they can efficiently utilize a variety of fuels.

Emerging Trends

Emerging trends in the Aircraft Micro Turbine Engines Market include 3D-printed engine components that reduce manufacturing costs while increasing design flexibility. Furthermore, advances in combustion technology that decrease emissions while increasing efficiency are making strides forward. Furthermore, the industry is witnessing increased collaboration and partnerships among key players, fostering innovation and market growth.

Key Market Segmentation

Aircraft Type

- Commercial Aircraft

- Regional Jets

- Single-aisle Aircraft

- Military Aircraft

- Drones

- Fighter Jets

- General Aviation

- Light Aircraft

- Helicopters

Engine Type

- Single-shaft

- Twin-shaft

Application

- Propulsion

- Auxiliary Power Units (APUs)

Distribution Channel

- OEM

- Aftermarket

Regional Analysis

In 2023, North America established a commanding presence in the Aircraft Micro Turbine Engines Market, securing over 40% of the market share. This region’s ascendancy can be attributed to several factors. Firstly, North America boasts a robust aviation industry, with a significant number of aircraft operators and manufacturers. This translates into a consistent demand for micro turbine engines, driven by both replacement needs and the integration of advanced technologies.

Furthermore, stringent environmental regulations and the growing awareness of sustainable aviation solutions have spurred the adoption of micro turbine engines in North America. Key players in the region, such as Pratt & Whitney and Honeywell International Inc., have been instrumental in driving this trend with their eco-friendly engine offerings.

In contrast, Europe held a noteworthy position in the market, accounting for a substantial share. The European aviation sector has a strong focus on reducing emissions and improving fuel efficiency, which aligns seamlessly with the advantages offered by micro turbine engines. Consequently, the region has witnessed a steady uptake of these engines, particularly in smaller aircraft and regional aviation.

The Asia-Pacific (APAC) region, while still evolving, displayed considerable growth potential. Factors like rising air travel demand, expansion of the commercial aviation sector, and government initiatives to modernize aviation infrastructure have contributed to the increasing adoption of micro turbine engines in APAC. Notably, the segment catering to business and general aviation in this region has witnessed substantial growth, with the demand for fuel-efficient and reliable engines.

Latin America, on the other hand, represented a niche yet promising market segment. The region’s diverse geography and varying transportation needs have led to a demand for versatile micro turbine engines, especially in remote and off-grid areas. These engines have found applications in aircraft for missions such as medical evacuations, resource exploration, and surveillance, contributing to a modest but steady market share.

In the Middle East & Africa, micro turbine engines have gradually gained traction, primarily driven by a growing interest in aviation infrastructure development and defense applications. While this region held a relatively smaller share in the market, it showcased potential for expansion in the near future.

Note: Actual Numbers Might Vary In Final Report

In conclusion, the Aircraft Micro Turbine Engines Market exhibited varying dynamics across different regions in 2023, with North America and Europe leading the way. However, it is essential to acknowledge the growth potential in APAC, Latin America, and the Middle East & Africa, as these regions adapt to the evolving landscape of aviation technology and sustainability.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the realm of the Aircraft Micro Turbine Engines Market, a meticulous analysis of key players reveals a landscape shaped by technological innovation and strategic collaborations. Leading entities such as Pratt & Whitney, Honeywell International Inc., and Rolls-Royce Holdings plc have consistently demonstrated their prowess in this domain. Their commitment to research and development, coupled with a robust global presence, positions them as formidable contenders.

Furthermore, these players have adeptly harnessed the evolving trend toward natural and sustainable aviation solutions, ensuring that their offerings align with environmental considerations. In the coming years, the aircraft micro turbine engines market is anticipated to witness a steady trajectory, and the endeavors of these key players will undoubtedly play a pivotal role in shaping its course.

Biggest Key players

- Rolls-Royce Holdings PLC

- General Electric (GE) Aviation

- Honeywell International Inc.

- Pratt & Whitney (Raytheon Technologies)

- Safran SA

- Williams International

- Capstone Turbine Corporation

- Kratos Defense & Security Solutions

- AeroVironment Inc.

- Teledyne Technologies

- Bladon Jets

- UAV Turbines Inc.

- Other Key Players

Recent Development

- In July 2022, Ricardo, an aerospace company, made an agreement with Pratt & Whitney Canada. Ricardo will help Pratt & Whitney Canada create new technology for airplanes in the future. They want to make planes that use less fuel and produce less pollution. They want these planes to be 30% better at using fuel and make 30% less carbon dioxide compared to the engines used in small regional planes today.

- Also in July 2022, Fusionflight, a company that makes drones, introduced a small generator that makes electricity. It’s very powerful, with 8 kilowatts of electricity, but it’s also very light, weighing less than one-tenth of a similar gasoline generator. This generator can work using diesel or jet fuel, mixed with a special type of oil.

Report Scope

Report Features Description Market Value (2023) US$ 2.3 Bn Forecast Revenue (2033) US$ 4.0 Bn CAGR (2023-2032) 5.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Aircraft Type (Commercial Aircraft, Regional Jets, Single-aisle Aircraft, Military Aircraft, Drones, Fighter Jets, General Aviation, Light Aircraft and Helicopters), Engine Type (Single-shaft, Twin-shaft), By Application (Propulsion, Auxiliary Power Units (APUs)), Distribution Channel (OEM, Aftermarket) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Rolls-Royce Holdings PLC, General Electric (GE) Aviation, Honeywell International Inc., Pratt & Whitney (Raytheon Technologies), Safran SA, Williams International, Capstone Turbine Corporation, Kratos Defense & Security Solutions, AeroVironment Inc., Teledyne Technologies, Bladon Jets, UAV Turbines Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are aircraft micro turbine engines, and what role do they play in aviation?Aircraft micro turbine engines are compact, high-powered engines used in smaller aircraft, helicopters, and drones. They provide the necessary thrust for propulsion, enabling these aircraft to fly and perform various missions.

How big is Aircraft Micro Turbine Engines Market?The Global Aircraft Micro Turbine Engines Market is estimated to be worth USD 2.3 billion in 2023 and projected to be valued at USD 4.0 billion in 2033. Between 2024 and 2033, the market is expected to register a growth rate of 5.7%.

How do micro turbine engines differ from larger jet engines used in commercial airliners?Micro turbine engines are smaller and lighter, designed for smaller aircraft. They have a higher power-to-weight ratio and are more fuel-efficient, making them suitable for light aviation and unmanned aerial vehicles (UAVs).

What is the smallest turbine aircraft engine?The smallest turbine aircraft engines are often found in microjets or very light jets (VLJs). One example is the Williams International FJ33 engine, which is among the smallest turbofan engines used in aviation.

How much does a microturbine cost?- The cost of a microturbine can vary significantly depending on factors such as brand, model, and specifications. On average, microturbines can range from tens of thousands to several hundred thousand dollars.

What are the four types of aircraft turbine engines?The four main types of aircraft turbine engines are:

- Turbojet Engines

- Turboprop Engines

- Turbofan Engines

- Turboshaft Engines

Aircraft Micro Turbine Engines MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Aircraft Micro Turbine Engines MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Rolls-Royce Holdings PLC

- General Electric (GE) Aviation

- Honeywell International Inc.

- Pratt & Whitney (Raytheon Technologies)

- Safran SA

- Williams International

- Capstone Turbine Corporation

- Kratos Defense & Security Solutions

- AeroVironment Inc.

- Teledyne Technologies

- Bladon Jets

- UAV Turbines Inc.

- Other Key Players