Global Printed Electronics Market By Material (Substrate, Inks), By Technology (Flexography, Ink-jet Printing, Gravure Printing, Screen Printing, Other Technologies), By Device(Sensors, Displays, Batteries, RFID, Lighting, Photovoltaic, Other Devices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 110469

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

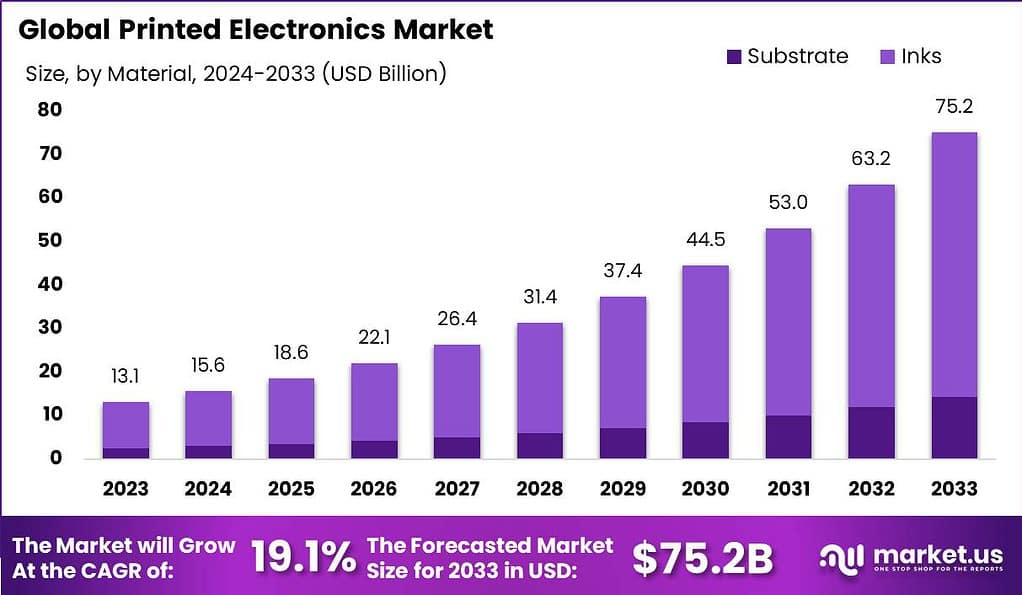

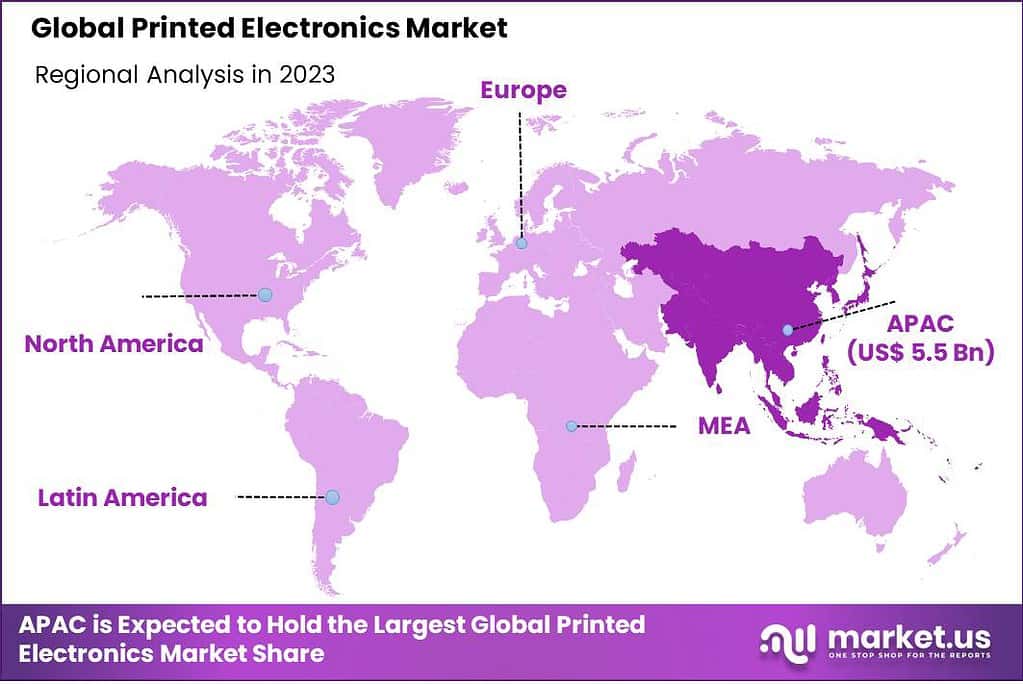

The Global Printed Electronics Market size is expected to be worth around USD 75.2 Billion By 2033, from USD 13.1 billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 42% share, holding USD 5.5 Billion revenue.

Printed electronics refers to the application of printing techniques to create electrical devices on various substrates. This field leverages traditional printing processes like screen printing, inkjet, and flexography to deposit electronic materials. The result is the production of lightweight, flexible electronic components that can be used across a range of applications, including sensors, displays, and photovoltaics.

The Printed Electronics Market is witnessing substantial growth due to its transformative potential in several industries. As of recent years, this market has grown significantly, driven by the increasing demand for lightweight, flexible, and low-cost electronics. Sectors such as automotive, consumer electronics, healthcare, and retail are major adopters, fueling the market’s expansion.

The rapid advancements in materials and printing technologies have further broadened the scope of printed electronics, enabling innovative applications that were once limited by traditional manufacturing methods. The market landscape is characterized by collaborations, partnerships, and innovation efforts among industry players to capitalize on emerging opportunities.

Several factors are propelling the printed electronics market. The adaptability of printing technologies allows for the cost-effective mass production of electronics, which is crucial in consumer electronics and automotive applications. Furthermore, the growing trend towards IoT and the increasing need for flexible and lightweight electronics are significant drivers of this market’s growth.

Market demand is significantly influenced by the expanding applications of printed electronics in sectors like healthcare for creating wearable sensors and in automotive for producing flexible displays and lighting systems. The opportunity to integrate printed electronics into smart packaging and photovoltaics also presents a considerable growth avenue, especially with the increasing focus on sustainability and energy efficiency.

The market is witnessing continuous technological advancements such as enhancements in ink formulations and printing processes that improve the functionality and durability of printed components. Innovations are particularly noted in the development of more efficient and scalable printing techniques, which are crucial for keeping up with the growing demand for high-quality printed electronics.

Key Takeaways

- Market Size and Growth: Global Printed Electronics Market is expected to grow significantly to reach a projected USD 75.2 billion in 2033. This will be accompanied by an astounding CAGR that is 19.1%.

- Material Analysis: In 2023, the Inks segment held over 81% of the market share. This dominance is attributed to the critical role of inks in achieving desired electrical conductivity and functionality in printed electronic devices. Advances in conductive and functional inks have expanded applications.

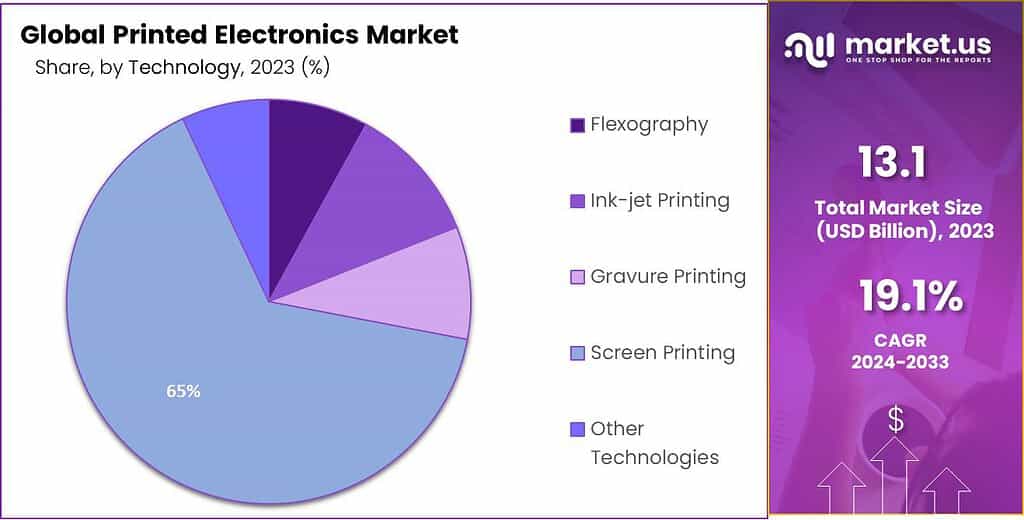

- Technology Insights: In 2023, the Screen Printing segment emerged as a dominant force in the Printed Electronics market, capturing more than an impressive 65% share.

- Device Analysis: Displays accounted for more than 38% of the market share, primarily driven by demand in consumer electronics, automotive dashboards, and signage. Printed electronic displays offer flexibility, lightweight design, and cost-effectiveness.

- Driving Factors: Continuous innovation in printed electronics, including flexible and organic materials, has expanded their applications, improving durability and efficiency.

- Restraining Factors: Printed electronics may not match the performance of traditional silicon-based electronics in high-end applications, limiting their adoption in certain industries.

- Growth Opportunities: Printed electronics offer opportunities in healthcare, including wearable medical devices and smart healthcare monitoring systems.

- Challenges: Establishing industry standards and ensuring consistent quality control in printed electronics manufacturing remains a challenge.

Material Analysis

In 2023, the Printed Electronics market exhibited notable trends and dynamics within its key segments. Beginning with the Inks segment, it asserted its dominance by capturing more than an impressive 81% share of the market. This prominence in the market can be attributed to the critical role of inks in the manufacturing of printed electronic devices. The formulation and composition of inks play a pivotal role in achieving desired electrical conductivity and functionality.

Moreover, advancements in ink technologies, such as conductive and functional inks, have been pivotal in expanding the applications of printed electronics across various industries. These inks enable the creation of flexible and lightweight electronic components, contributing to the market’s growth.

Moving on to the Substrate segment, it also played a significant role in the Printed Electronics market. Substrates provide the physical foundation for printed electronic circuits and components. In 2023, this segment held a substantial market share, offering a variety of substrate materials tailored to specific applications. The choice of substrate material impacts factors like flexibility, durability, and performance in different environmental conditions. As printed electronics continue to find applications in areas like wearables and IoT devices, the substrate segment is expected to witness continued innovation and growth.

Technology Insights

In 2023, the Screen Printing segment emerged as a dominant force in the Printed Electronics market, capturing more than an impressive 65% share. This technology’s prominence can be attributed to its versatility and suitability for various applications within the printed electronics industry. Screen printing allows for precise deposition of conductive and functional inks on a wide range of substrates, making it a preferred choice for manufacturing electronic components like RFID tags, sensors, and displays.

Additionally, screen printing offers cost-effective and scalable production capabilities, aligning with the market’s growing demand for affordable and efficient printed electronic solutions. As the market continues to expand, screen printing is expected to maintain its significant market share due to its adaptability and proven track record.

In 2023, the Flexography segment in the Printed Electronics market played a vital role, offering unique advantages and capturing a substantial market share. Flexographic printing is known for its ability to provide high-quality, high-speed printing on flexible substrates, making it ideal for applications like printed sensors and flexible displays.

The segment’s market share reflects the growing demand for printed electronics in sectors such as packaging and healthcare, where flexible and conformable electronic components are crucial. The ability of flexography to produce intricate designs and patterns with precision has contributed to its market prominence. With continued advancements in flexible materials and ink formulations, the flexography segment is poised for further growth.

In 2023, the Ink-jet Printing segment demonstrated its significance in the Printed Electronics market, securing a notable market share. This technology’s appeal lies in its ability to provide precise and non-contact deposition of inks, making it suitable for applications requiring fine details and miniaturization. Ink-jet printing is widely used for printing electronic circuits and OLED displays, thanks to its high resolution and adaptability to various substrates.

The segment’s market share reflects the demand for high-quality printed electronics in industries like consumer electronics and automotive. As the need for customization and rapid prototyping grows, ink-jet printing is expected to maintain its market position and evolve with technological advancements.

Gravure Printing also played a role in the Printed Electronics market in 2023, contributing to the diversity of printing technologies available. While holding a smaller market share, gravure printing excels in producing high-quality images and patterns with consistent ink coverage. It finds applications in printed electronics, particularly for decorative and packaging purposes. The segment’s market share represents its niche within the industry, catering to specific requirements for aesthetics and brand representation. Gravure printing is likely to continue serving these specialized needs, albeit with a limited share compared to other technologies.

Apart from the aforementioned segments, the Printed Electronics market also encompasses various other printing technologies, each with its unique capabilities and applications. These include technologies like offset printing and intaglio printing, which cater to specific niche markets. While they may hold smaller market shares, these technologies play essential roles in addressing specialized requirements within the printed electronics industry, such as security printing and certain types of displays. The market’s diversity in printing technologies underscores its adaptability to a wide range of applications and customer needs.

Note: Actual Numbers Might Vary In Final Report

Device Analysis

In 2023, the Printed Electronics market witnessed significant developments and market dynamics across various device segments. Displays segment, it has solidified its dominance by securing more than 38% of the market share, making it the leading segment in the market. This prominent position can be attributed to the continually growing demand for printed electronic displays in various applications such as consumer electronics, automotive dashboards, and signage..

Printed electronic displays offer advantages like flexibility, lightweight design, and cost-effectiveness, driving their widespread adoption. Furthermore, technological advancements have enhanced the quality and performance of printed displays, making them a preferred choice for many industries.

Moving on to the Sensors segment, it played a pivotal role in the Printed Electronics market by offering innovative solutions for various industries. In 2023, the Sensors segment witnessed substantial growth, driven by the rising need for sensors in applications such as healthcare, environmental monitoring, and industrial automation. Printed electronic sensors, known for their flexibility and low-cost manufacturing, have gained popularity. They are instrumental in collecting data and enabling smart and connected systems, making them a key contributor to the market’s expansion.

Additionally, the Batteries segment emerged as a crucial player in the Printed Electronics market. These printed batteries, known for their compact size and flexibility, found applications in various wearable devices and Internet of Things (IoT) applications. The RFID segment also demonstrated notable growth, offering cost-effective and efficient solutions for tracking and identification in logistics, retail, and supply chain management.

Driving Factors

- Technological Advancements: Continuous advancements in printed electronics technology, including the development of flexible and organic materials, have expanded the potential applications of printed electronics. These innovations improve the durability, performance, and efficiency of printed electronic devices.

- Rising Demand for IoT Devices: The rising embrace of Internet of Things (IoT) devices in diverse industries like healthcare, automotive, and consumer electronics is fueling the demand for printed electronics. Printed sensors and components are integral to IoT devices, fostering market growth.

- Environmental Sustainability: Printed electronics offer eco-friendly and sustainable manufacturing processes compared to traditional electronics. This aligns with the growing environmental consciousness among consumers and industries, leading to a preference for printed electronic solutions.

- Cost-Efficiency: Printed electronics enable cost-effective manufacturing processes, making them attractive to industries seeking cost-efficient solutions. Reduced material waste and lower production costs contribute to their widespread adoption in various applications.

Restraining Factors

- Limited Performance in High-End Applications: Printed electronics may not match the performance of traditional silicon-based electronics in high-end applications, limiting their adoption in certain industries like aerospace and high-performance computing.

- Complex Manufacturing Processes: While printed electronics offer cost savings, the manufacturing processes can be complex and require specialized equipment. This complexity can deter some manufacturers from transitioning to printed electronic solutions.

- Quality and Reliability Concerns: Ensuring consistent quality and reliability in printed electronic devices can be challenging. Variability in printing processes and materials may raise concerns among end-users, especially in critical applications.

- Competition from Conventional Electronics: Established conventional electronic technologies pose competition to printed electronics. Convincing industries to switch to printed solutions requires addressing their concerns about reliability, performance, and compatibility.

Growth Opportunities

- Healthcare Applications: Printed electronics offer growth opportunities in healthcare, including wearable medical devices and smart healthcare monitoring systems. The demand for non-invasive, flexible, and disposable healthcare devices is driving innovation in this sector.

- Automotive Industry: Printed electronics find applications in automotive displays, sensors, and lighting. With the automotive industry’s shift towards electric vehicles and advanced driver-assistance systems (ADAS), the demand for printed electronic components is expected to surge.

- Smart Packaging: The integration of printed electronics in packaging for tracking, authentication, and interactive features creates growth opportunities in the consumer goods and retail sectors. Smart packaging enhances consumer engagement and product safety.

- Energy Harvesting: Printed electronics enable energy harvesting solutions, such as printed solar cells and piezoelectric devices. These technologies have the potential to power IoT devices and remote sensors, opening new markets in energy-efficient applications.

Challenges

- Standardization and Quality Control: Establishing industry standards and ensuring consistent quality control in printed electronics manufacturing remains a challenge. Inconsistent quality can hinder market acceptance.

- Limited Material Choices: Printed electronics rely on specific materials, and the availability of suitable materials may be limited. Developing new materials with desired properties is crucial for expanding applications.

- Data Security: In IoT and smart device applications, data security is a significant concern. Protecting sensitive data from potential breaches and ensuring the security of printed electronic systems pose challenges.

- Education and Awareness: Educating industries and consumers about the benefits and capabilities of printed electronics is essential for market growth. Increasing awareness and understanding can overcome resistance to adopting new technology.

Key Market Trends

- Flexible and Wearable Electronics: The trend towards flexible and wearable electronics continues to grow. Printed electronics are ideal for creating lightweight and flexible devices, aligning with the demand for comfortable and portable technology.

- Integration with IoT: Printed electronics are increasingly integrated into IoT ecosystems, enabling sensor networks and smart devices. This trend drives innovation in printed sensors, RFID tags, and communication modules.

- Innovations in Energy Storage: Advancements in printed energy storage solutions, such as printed batteries and supercapacitors, are gaining attention. These innovations cater to the need for compact and efficient power sources in electronic devices.

- Collaboration and Partnerships: Companies in the printed electronics market are forming strategic collaborations and partnerships to combine expertise and develop comprehensive solutions. This trend fosters innovation and market expansion.

Key Market Segments

Material

- Substrate

- Inks

Technology

- Flexography

- Ink-jet Printing

- Gravure Printing

- Screen Printing

- Other Technologies

Device

- Sensors

- Displays

- Batteries

- RFID

- Lighting

- Photovoltaic

- Other Devices

Regional Analysis

In 2023, Asia-Pacific held a dominant market position, capturing more than a 42% share of the global Printed Electronics market. This region’s robust presence can be attributed to several factors. Asia-Pacific is a major hub for manufacturing electronics including countries like China, Japan, and South Korea leading the industry.

The demand for Printed Electronics in Asia-Pacific reached USD 5.5 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. The region’s emphasis on technological innovation, paired with significant investment into research and development has led to the widespread adoption of printed electronics in a variety of applications.

In addition there is the Asia-Pacific market is benefiting from the growing market for IoT, consumer electronic gadgets as well as smart packaging. This means that Asia-Pacific is expected to maintain its position as the leader within market share in Printed Electronics market, driving both innovation and production.

North America also played a significant role in the Printed Electronics market in 2023. North America is characterized by a thriving ecosystem of startups and established companies specializing in printed electronics technologies. The region’s emphasis on research and development, particularly in sectors like healthcare, automotive, and aerospace, has driven the adoption of printed electronic solutions.

Additionally, North America’s commitment to sustainability and environmental concerns has encouraged the use of eco-friendly printed electronic materials and processes. The region is poised to maintain its substantial market share by leveraging its technological expertise and industry collaborations.

In 2023, Europe demonstrated a noteworthy market share in the Printed Electronics industry, holding a position of influence in the global market. Europe is known for its emphasis on innovation and sustainability, aligning well with the principles of printed electronics. Countries like Germany, the UK, and France have been at the forefront of adopting printed electronics in sectors such as automotive displays and smart packaging.

Moreover, Europe’s strong focus on environmental regulations and energy efficiency has led to the development of energy-efficient printed electronic solutions. As a result, Europe is expected to maintain its market presence and contribute to the industry’s growth.

In 2023, Latin America held a smaller yet promising share of the Printed Electronics market. The region’s growing interest in technology and digital innovation, particularly in countries like Brazil and Mexico, has fueled the adoption of printed electronics. Latin America’s market share reflects a younger demographic’s increasing interest in technology-related hobbies and innovation.

Although facing challenges related to the cost of importing technology, Latin America’s potential for growth in the Printed Electronics market is significant, driven by a population eager to explore innovative solutions.

MEA exhibited signs of emerging interest in the Printed Electronics market in 2023, albeit with a relatively smaller market share. The region’s focus on educational advancement and skill development in the IT sector, along with investments in technology infrastructure, indicates growth potential.

With a young, tech-savvy population, MEA has the opportunity to contribute to the global Printed Electronics market’s expansion. Overcoming challenges related to technology costs and availability will be crucial for realizing this potential.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key Players Analysis involves identifying and evaluating the most important players or businesses who play a major role in a certain market or industry. This analysis aids in understanding the market dynamics, and strategies used by the key players to get an edge. By studying the strengths and weaknesses, as well as the opportunities and threats from these competitors, companies can make informed choices and devise successful strategies to compete on the market.

Top Key Players

- Samsung Electronics Co. Ltd.

- LG Display Co. Ltd.

- Molex LLC

- Agfa-Gevaert Group

- Palo Alto Research Center Incorporated (PARC)

- DuPont de Nemours Inc.

- Nissha Co. Ltd.

- BASF

- NovaCentrix

- E Ink Holdings Inc.

- Other Key Players

Recent Developments

- In July 2024, IDS and APES joined forces to enhance 3D printed electronics through innovative NanoJet and aerosol technologies. This partnership focuses on optimizing the pathway from design to production, improving alignment of manufacturing processes with design capabilities to boost the efficiency and adoption of printed electronics.

- FLEXOO GmbH emerged as a new independent entity from InnovationLab in February 2024, after acquiring Heidelberg Printed Electronics GmbH. Focusing on mass production of printed electronics, FLEXOO aims to lead in the industry, leveraging its advanced technology showcased at the LOPEC trade fair.

- Fuji Corporation and J.A.M.E.S. GmbH announced their collaboration in May 2023 to advance additive manufacturing for electronics. Their initiative centers around Fuji’s FPM-Trinity 3D printer, which integrates multiple manufacturing processes into one machine, enhancing the production efficiency of 3D printed electronics.

Report Scope

Report Features Description Market Value (2023) US$ 13.1 Bn Forecast Revenue (2033) US$ 75.2 Bn CAGR (2024-2033) 19.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Substrate, Inks), By Technology (Flexography, Ink-jet Printing, Gravure Printing, Screen Printing, Other Technologies), By Device(Sensors, Displays, Batteries, RFID, Lighting, Photovoltaic, Other Devices) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Samsung Electronics Co. Ltd., LG Display Co. Ltd., Molex LLC, Agfa-Gevaert Group, Palo Alto Research Center Incorporated (PARC), DuPont de Nemours Inc., Nissha Co. Ltd., BASF, NovaCentrix, E Ink Holdings Inc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is printed electronics?Printed electronics involves the use of printing technologies to create electronic devices on various substrates, such as paper or plastic. It enables the production of flexible and lightweight electronic components.

How big is Printed Electronics Industry?The Global Printed Electronics Market size was projected to be USD 13.1 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 15.6 billion. During the forecast period, the global market for printed electronics is expected to garner a 19.1% CAGR and reach a size of USD 75.2 billion by 2033.

What is the process of printed electronics?The process of printed electronics involves using printing technologies, such as inkjet or screen printing, to deposit conductive materials like inks or pastes onto flexible substrates. These substrates can be materials like paper, plastic, or even fabric. The printed patterns form electronic components like transistors, sensors, or conductive traces, enabling the creation of flexible and lightweight electronic devices.

Which country has largest print market?China, the United States, and Japan are among the countries with significant printing industries.

What is in high demand in electronics?Products in high demand in the electronics industry include smartphones, tablets, laptops, smart TVs, wearables, and components like semiconductors and memory devices. Emerging technologies such as electric vehicles and the Internet of Things (IoT) also contribute to demand.

Who are the top key players in Printed Electronics Market?Some of key players are include Samsung Electronics Co. Ltd., LG Display Co. Ltd., Molex LLC, Agfa-Gevaert Group, Palo Alto Research Center Incorporated (PARC), DuPont de Nemours Inc., Nissha Co. Ltd., BASF, NovaCentrix, E Ink Holdings Inc., Other Key Players

Printed Electronics MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Printed Electronics MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co. Ltd.

- LG Display Co. Ltd.

- Molex LLC

- Agfa-Gevaert Group

- Palo Alto Research Center Incorporated (PARC)

- DuPont de Nemours Inc.

- Nissha Co. Ltd.

- BASF

- NovaCentrix

- E Ink Holdings Inc.

- Other Key Players