Global IoT Device Management Market By Component (Solution, Services), By Solution (Data Management, Real-Time Streaming Analytics, Remote Monitoring, Security Solutions, Network Bandwidth Management), By Service (Professional Services, Managed Services), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use Industry (Retail, Transportation & Logistics, Manufacturing, Healthcare, Utilities, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 57371

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- U.S. tariffs on IoT device management

- Analyst Viewpoint

- Key Takeaways

- Component Analysis

- Solution analysis

- Service analysis

- Organization Size Analysis

- End-Use Industry Analysis

- Kеу Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

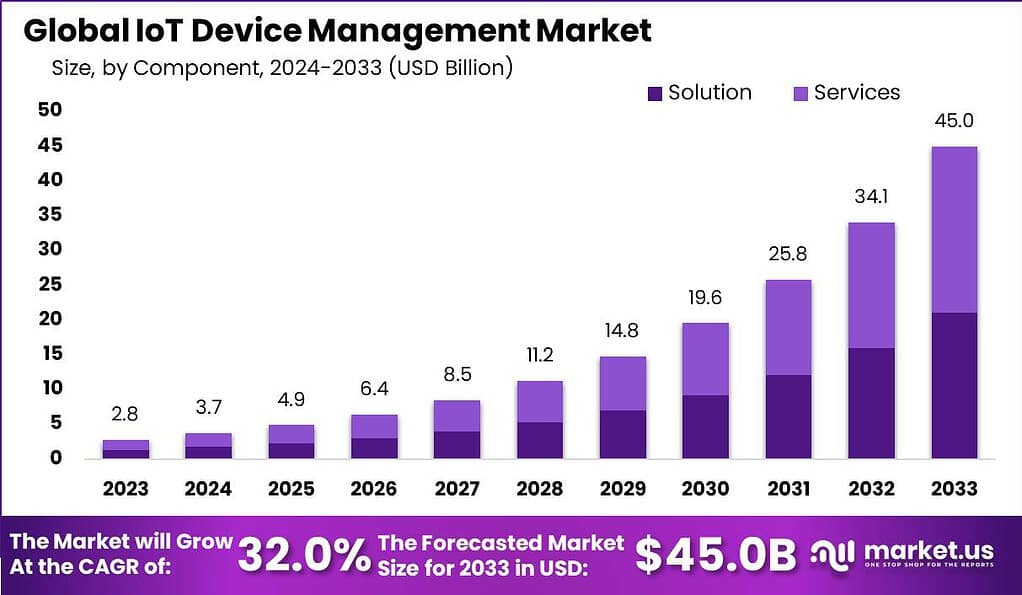

The Global IoT Device Management Market size is expected to be worth around USD 45 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 32.0% during the forecast period from 2024 to 2033.

IoT Device Management is a critical framework that enables organizations to securely register, monitor, organize, and remotely manage internet-connected devices at scale. This management is essential across various device types and operating systems, providing functionalities such as device provisioning, firmware updates, and security management. Effective IoT device management is pivotal for maintaining the health, connectivity, and security of devices throughout their lifecycle.

The primary drivers of the IoT Device Management market include the growing integration of smart devices in various industries and the need for advanced management capabilities to handle the increasing complexity and scale of IoT deployments. Organizations are leveraging IoT device management to achieve better operational efficiencies and reduce downtime through proactive management and maintenance of device infrastructures.

For instance, according to the Ericsson Mobility Report, cellular IoT connections are projected to account for 40% of all IoT connections by 2027, surpassing broadband IoT. This shift is primarily driven by widespread 4G connectivity, which enables low-latency and high-reliability communications essential for industrial and enterprise IoT deployments.

Demand for IoT device management solutions is bolstered by the critical need for comprehensive device lifecycle management, from initial deployment to end-of-life. Factors such as the escalating number of IoT devices, the complexity of operations, and the stringent requirements for security and compliance in sectors like healthcare and manufacturing contribute to this rising demand.

One of the notable market trends is the integration of AI and machine learning technologies, which enhance the capabilities of IoT device management platforms by enabling features like predictive maintenance and advanced analytics. These technologies are vital for the automation of complex processes and for making data-driven decisions.

Technologies facilitating IoT device management are evolving, with cloud-based solutions like SaaS becoming increasingly popular due to their scalability and flexibility. These technologies lower the barriers to entry for small and medium-sized enterprises and enable them to deploy IoT solutions without substantial upfront capital investments.

U.S. tariffs on IoT device management

The impact of U.S. tariffs on IoT device management in 2025 is significant, with several critical points to consider:

- Increased Costs: Tariffs have led to increased costs for critical IoT components like semiconductors, sensors, and 5G equipment, which are vital for smart city ecosystems. This has resulted in budget overruns for many U.S. smart city projects, with some experiencing up to a 72% increase in costs.

- Supply Chain Delays: The dependence on Chinese-made components has caused delays in supply chains. For instance, tariffs have led to prolonged procurement times for essential IoT devices, affecting project timelines and contractual obligations.

- Competitive Disadvantages: U.S. companies face heightened competition from European and Asian firms that are not subject to similar tariffs. This has made it challenging for U.S. firms to win bids in the global smart city market, as their pricing is often higher due to tariff costs.

- Strategic Shifts: In response to these challenges, companies are adjusting their strategies. This includes forming localized manufacturing partnerships to reduce tariff liabilities and dependency on foreign components. For example, a Phoenix-based startup reduced its tariff costs by 37% through domestic production initiatives.

- Investment and Innovation: Despite these hurdles, tariffs are also driving innovation within the IoT industry. Companies are increasingly investing in R&D to develop tariff-resilient technologies and exploring new manufacturing and supply chain strategies to mitigate the impacts of tariffs.

Analyst Viewpoint

In the competitive landscape of IoT device management, Microsoft holds the largest market share at 24.5%, fueled by a substantial investment of $10 billion specifically allocated to enhance its Azure IoT platform in 2023. Following closely behind is Amazon Web Services (AWS) with a 22.3% market share, supported by a $5 billion investment dedicated to advancing its AWS IoT services during the same period.

PTC, securing a 12.2% market share, allocated $200 million toward the development and improvement of its ThingWorx platform, focusing primarily on industrial applications. Google Cloud Platform (GCP) captures a 10.8% market share, having invested $1 billion in its Cloud IoT Core platform to strengthen its competitive position.

Lastly, IBM maintains an 8.6% market share, having also invested $1 billion into its Watson IoT platform, emphasizing the integration of cognitive computing into IoT solutions. These investments underscore the fierce competition among industry leaders, each vying for market dominance through substantial funding aimed at innovation and technological advancement in the IoT device management sector.

The IoT Device Management sector presents numerous investment opportunities, especially in developing cloud-based management solutions and services tailored for specific industries like healthcare and manufacturing. These investments are geared towards solutions that can offer enhanced analytics, improved security features, and better integration with existing enterprise systems.

The regulatory environment for IoT is becoming increasingly stringent, with more focus on data security and privacy. Compliance with these regulations is a major consideration for IoT device management solutions, prompting continuous updates and adherence to the latest security protocols.

Key Takeaways

- The IoT device management market is anticipated to witness substantial growth, reaching a projected value of USD 45 billion by 2033, with a remarkable CAGR of 32.0% during the forecast period from 2024 to 2033.

- Microsoft leads the market with a 24.5% share, followed by Amazon Web Services (AWS) at 22.3%, PTC at 12.2%, Google Cloud Platform (GCP) at 10.8%, and IBM at 8.6%. These companies have made significant investments in advancing their IoT platforms, highlighting fierce competition in the industry.

- In 2023, the solution segment dominated the market, capturing over 46.9% share. Within solutions, Data Management held a dominant position with a 25.5% share, emphasizing the importance of collecting, storing, analyzing, and extracting insights from vast IoT data.

- Professional Services held the largest market share at 68.1% in 2023, reflecting the complexity associated with IoT device management and the need for specialized expertise in implementation, customization, integration, and ongoing support.

- The manufacturing sector emerged as the dominant force in the IoT Device Management market in 2023, securing over 33.7% market share. This underscores the sector’s focus on digital transformation and the integration of IoT technologies to optimize production processes and enhance operational efficiency.

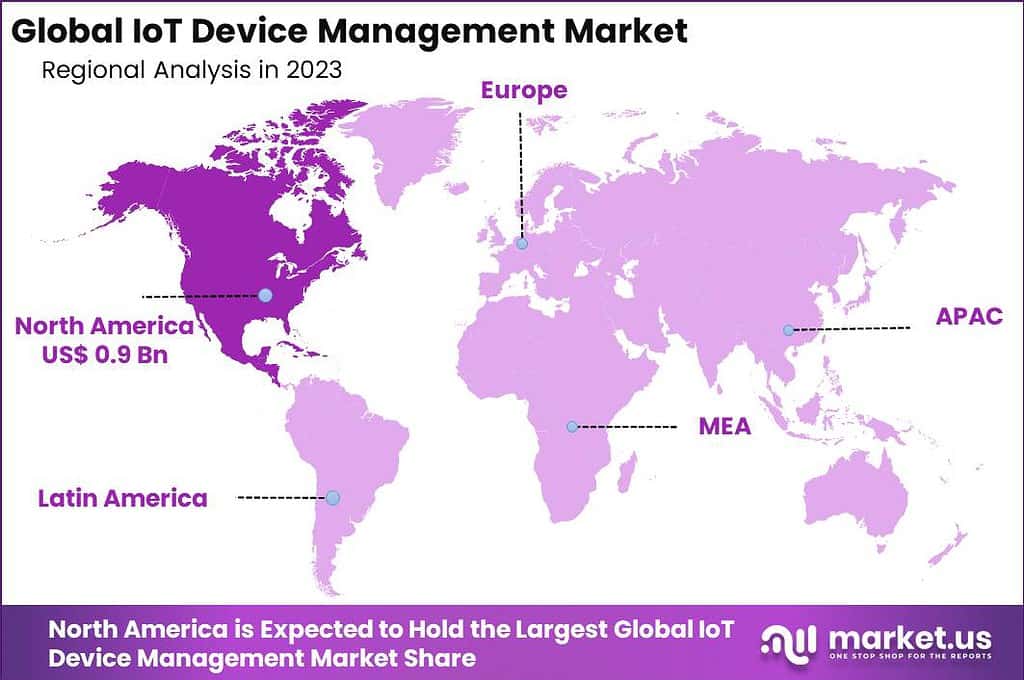

- North America led the market in 2023, capturing over 34.3% share. The region’s mature IoT infrastructure, presence of major technology players, favorable regulatory environment, and strong emphasis on digital transformation initiatives contribute to its dominance in the market.

Component Analysis

In 2023, the solution segment held a dominant market position in the IoT device management market, capturing more than a 46.9% share.

The solution segment encompasses various software and hardware solutions designed to manage and monitor IoT devices throughout their lifecycle. These solutions provide organizations with the necessary tools and functionalities to effectively control, secure, and optimize their IoT deployments. With the rapid proliferation of IoT devices across industries, the demand for comprehensive and scalable solutions has surged, leading to the dominance of the solution segment.

One of the primary reasons for the solution segment’s leadership is the increasing complexity of managing large-scale IoT deployments. IoT device management solutions offer features such as device provisioning, configuration management, remote monitoring, and firmware updates.

These capabilities enable organizations to efficiently manage a diverse range of IoT devices, streamline operations, and ensure optimal performance. As a result, organizations are investing in solution-based offerings to simplify and automate their IoT device management processes.

Furthermore, the solution segment addresses critical security concerns associated with IoT devices. IoT devices are often vulnerable to cyber-attacks, making security management a top priority for organizations. IoT device management solutions provide robust security features such as authentication, encryption, and access control mechanisms.

These features help organizations safeguard their IoT ecosystems, protect sensitive data, and mitigate potential security risks. The emphasis on security has driven the adoption of solution-based offerings to ensure comprehensive protection across IoT device networks.

Solution analysis

In 2023, the Data Management segment held a dominant market position in the IoT device management market, capturing more than a 25.5% share.

The Data Management segment encompasses solutions that focus on collecting, storing, analyzing, and extracting insights from the vast amount of data generated by IoT devices. As IoT deployments continue to grow in scale and complexity, the volume of data generated by these devices has increased exponentially. The Data Management solutions offer organizations the ability to handle this data efficiently and derive actionable insights from it.

One of the primary reasons for the Data Management segment’s leadership is the critical role of data in driving decision-making and optimizing IoT operations. IoT devices generate a wealth of data that can provide valuable insights into various aspects of an organization’s operations, including performance, maintenance, and customer behavior.

Data Management solutions enable organizations to collect and aggregate data from disparate sources, cleanse and transform it, and store it in a structured manner. This structured data can then be analyzed to gain valuable insights that can drive operational efficiencies, improve predictive maintenance, and enhance overall business performance.

Furthermore, the Data Management segment addresses the challenge of data integration and interoperability in IoT environments. IoT devices often operate on different protocols and generate data in various formats. Data Management solutions provide the necessary capabilities to integrate data from different sources, normalize it, and make it accessible for analysis. This interoperability ensures that organizations can effectively leverage the data generated by their IoT devices and derive meaningful insights.

Service analysis

In 2023, the Professional Services segment held a dominant market position in the IoT device management market, capturing more than a 68.1% share. This segment’s leadership can be attributed to several key factors that emphasize its importance in supporting organizations in their IoT device management initiatives.

The Professional Services segment encompasses a range of services provided by vendors and consultants to assist organizations in the implementation, customization, integration, and ongoing support of IoT device management solutions. These services are designed to address the unique requirements and challenges faced by organizations in managing their IoT deployments effectively.

One of the primary reasons for the Professional Services segment’s leadership is the complexity associated with IoT device management. Implementing and managing IoT devices across an organization’s infrastructure requires specialized knowledge and expertise. Professional Services providers offer consulting and implementation services to help organizations design and deploy IoT device management solutions tailored to their specific needs. They guide organizations in selecting the right tools, defining workflows, and integrating the solution with existing systems, ensuring a smooth and successful implementation.

Furthermore, the Professional Services segment addresses the need for ongoing support and maintenance of IoT device management solutions. IoT environments are dynamic and require continuous monitoring, updates, and optimization to ensure smooth operations. Professional Services providers offer post-implementation support, including troubleshooting, training, and system updates. Their expertise helps organizations address any challenges that arise, optimize system performance, and stay up to date with the latest advancements in IoT device management.

Organization Size Analysis

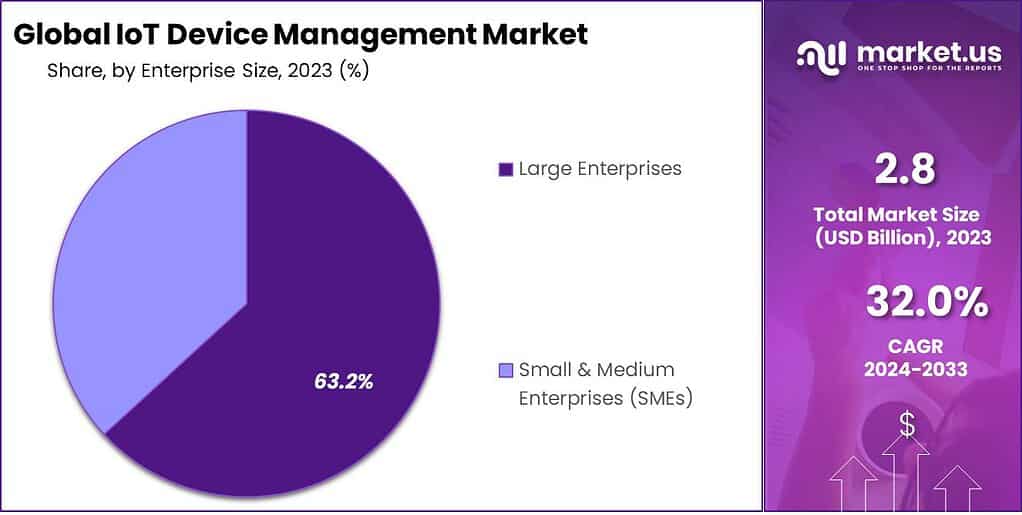

In 2023, the Large Enterprises segment asserted its dominance within the IoT Device Management market, securing over 63.2% of the market share.

This substantial share can be attributed to several factors. Firstly, large enterprises often possess extensive resources, both financial and technological, allowing them to invest significantly in IoT infrastructure and management systems. Consequently, they are more inclined to adopt comprehensive IoT device management solutions to streamline operations and enhance efficiency across various business functions.

Moreover, the scale of operations in large enterprises typically involves a vast network of interconnected devices, spanning multiple locations and diverse functionalities. As a result, the need for robust device management becomes paramount to ensure seamless integration, monitoring, and maintenance of these interconnected systems.

Additionally, large enterprises are often early adopters of advanced technologies, recognizing the strategic importance of IoT in driving innovation and gaining a competitive edge in the market. This proclivity towards innovation and technology adoption further reinforces their leadership in embracing sophisticated IoT device management solutions.

End-Use Industry Analysis

In 2023, the Manufacturing segment emerged as the dominant force in the IoT Device Management market, securing over 33.7% of the market share.

The manufacturing industry has been at the forefront of digital transformation, leveraging IoT technologies to optimize production processes, enhance operational efficiency, and improve overall productivity. With the advent of Industry 4.0, manufacturers are increasingly embracing smart factory initiatives, integrating IoT-enabled devices and sensors across their production lines to enable real-time monitoring, predictive maintenance, and process automation.

Furthermore, the complex and interconnected nature of modern manufacturing operations necessitates robust device management solutions to ensure seamless integration and coordination among various equipment, machinery, and systems. IoT device management platforms play a pivotal role in facilitating communication, data exchange, and interoperability across disparate devices, thereby enabling manufacturers to streamline operations and achieve greater agility and responsiveness.

Moreover, the manufacturing sector faces stringent regulatory requirements and quality standards, mandating precise monitoring and control of production processes. IoT device management solutions offer advanced analytics capabilities, empowering manufacturers to collect, analyze, and leverage real-time data insights for proactive decision-making and continuous improvement initiatives.

Additionally, the growing emphasis on supply chain resilience and sustainability is driving manufacturers to adopt IoT technologies for enhanced visibility, traceability, and environmental monitoring throughout the value chain. By leveraging IoT device management solutions, manufacturers can optimize resource utilization, minimize waste, and mitigate risks, thereby strengthening their competitive position in the market.

Kеу Market Segments

By Component

- Solution

- Service

By Solution

- Real-Time Streaming Analytics

- Security Solutions

- Data Management

- Remote Monitoring

- Network Bandwidth Management

By Services

- Professional Services

- Managed Services

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry

- Retail Industry

- Healthcare

- Transportation & Logistics

- Utilities

- Manufacturing

- Others

Driver

One driver for the IoT device management market is the increasing adoption of IoT devices across industries. With the proliferation of IoT devices, organizations are seeking effective solutions to manage and monitor their IoT deployments. IoT devices offer numerous benefits such as improved operational efficiency, cost savings, and enhanced customer experiences.

However, managing a large number of devices and handling the data they generate can be complex. This drives the demand for IoT device management solutions that provide functionalities such as device provisioning, configuration management, and real-time monitoring.

The increasing adoption of IoT devices across industries acts as a strong driver for the growth of the IoT device management market, as organizations recognize the need for comprehensive solutions to effectively manage their IoT ecosystems.

Restraint

One restraint for the IoT device management market is the challenge of ensuring data security and privacy. IoT devices generate vast amounts of data, often including sensitive information. Protecting this data from unauthorized access, breaches, and cyber-attacks is a significant concern for organizations.

Data security and privacy regulations, such as the General Data Protection Regulation (GDPR), impose strict requirements on organizations to safeguard personal data. Ensuring data security and privacy in IoT environments requires robust security measures, such as encryption, access controls, and secure data transmission protocols.

Organizations must invest in secure IoT device management solutions and implement best practices to address these challenges effectively. The need for stringent data security measures can act as a restraint for organizations hesitant to adopt IoT device management solutions due to concerns about data breaches and compliance with data protection regulations.

Opportunity

One significant opportunity in the IoT device management market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML have the potential to revolutionize IoT device management by providing advanced analytics, predictive maintenance capabilities, and automated decision-making. These technologies can enable organizations to extract valuable insights from IoT data, optimize device performance, and detect anomalies and potential issues in real-time.

By leveraging AI and ML, organizations can achieve proactive device management, reduce downtime, and improve operational efficiency. The integration of AI and ML technologies into IoT device management solutions presents an opportunity for vendors to offer more intelligent and automated solutions, catering to the evolving needs of organizations seeking to maximize the benefits of their IoT deployments.

Challenge

One significant challenge in the IoT device management market is interoperability and standardization. IoT devices often operate on different protocols and communication standards, making it challenging to manage and integrate diverse devices within an IoT ecosystem. Lack of interoperability can hinder seamless communication and data exchange between devices and systems, limiting the effectiveness of IoT device management solutions.

Additionally, the absence of widely adopted standards for device management poses challenges in implementing cohesive and scalable solutions. Addressing interoperability and standardization challenges requires industry collaboration, the development of common protocols, and efforts to establish interoperable frameworks. Overcoming this challenge is crucial for organizations to achieve seamless integration and management of IoT devices, enabling the full potential of IoT technology to be realized.

Regional Analysis

In 2023, North America held a dominant market position in the IoT Device Management sector, capturing over 34.3% of the market share. This significant share reflects the region’s robust ecosystem for IoT adoption and innovation. The demand for IoT Device Management in North America was valued at US$ 0.9 billion in 2023 and is anticipated to grow significantly in the forecast period.

One key factor contributing to North America’s leadership is its mature IoT infrastructure, which facilitates widespread deployment of connected devices across various industries. This infrastructure enables seamless integration and management of IoT ecosystems, driving demand for sophisticated device management solutions.

Moreover, the presence of major technology players and IoT solution providers in North America further accelerates market growth. These companies leverage their expertise and resources to develop cutting-edge IoT device management platforms, catering to the diverse needs of businesses across sectors.

Additionally, North America’s favorable regulatory environment and strong emphasis on digital transformation initiatives propel the adoption of IoT technologies. Organizations in the region invest significantly in research and development, driving innovation in IoT device management solutions and fueling market expansion.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The IoT Device Management market features several prominent players driving innovation and shaping the industry landscape. These key players encompass a diverse range of companies, including technology giants, software developers, and solution providers, each contributing unique expertise and capabilities to the market.

One such key player is Microsoft Corporation, renowned for its Azure IoT platform, which offers comprehensive device management capabilities, including device provisioning, monitoring, and security. Microsoft’s extensive cloud infrastructure and commitment to IoT innovation position it as a formidable player in the market.

Top Market Leaders

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Robert Bosch GmbH

- Advantech Co., Ltd.

- Amazon Web Services, Inc.

- Aeris Communications, Inc.

- PTC Inc.

- Cisco Systems, Inc.

- Smith Micro Software, Inc.

- Sierra Wireless, Inc.

- Telit Communications PLC

- Other Key Players

Recent Developments

- In February 2024, Oracle launched its Enterprise Communications Platform, built on Oracle Cloud Infrastructure, to reshape enterprise communication. By merging IoT, messaging, and video into a unified system, the platform allows real-time data sharing across connected devices.

- In March 2023, Aeris Communication strengthened its foothold in the IoT space by acquiring Ericsson’s IoT Accelerator and Connected Vehicle Cloud units. This move was made to expand Aeris’ service capabilities in both IoT and connected mobility, helping the company offer more advanced connectivity solutions while extending its reach in the global IoT ecosystem.

Report Scope

Report Features Description Market Value (2023) US$ 2.8 Bn Forecast Revenue (2033) US$ 45.0 Bn CAGR (2024-2033) 32.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Solution (Data Management, Real-Time Streaming Analytics, Remote Monitoring, Security Solutions, Network Bandwidth Management), By Service (Professional Services, Managed Services), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs), By End-Use Industry (Retail, Transportation & Logistics, Manufacturing, Healthcare, Utilities, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, Microsoft Corporation, Robert Bosch GmbH, Advantech Co. Ltd., Amazon Web Services Inc., Aeris Communications Inc., PTC Inc., Cisco Systems Inc., Smith Micro Software Inc., Sierra Wireless Inc., Telit Communications PLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is IoT device management?IoT device management involves overseeing the lifecycle of connected devices, including provisioning, monitoring, updating firmware, and troubleshooting, to ensure optimal performance and security.

How big is IoT Device Management Industry?The Global IoT Device Management Market size is expected to be worth around USD 45 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 32.0% during the forecast period from 2024 to 2033.

Which service analysis segment accounted for the largest IoT device management market share?In 2023, the Professional Services segment held a dominant market position in the IoT device management market, capturing more than a 68.1% share.

Who are the key players in the IoT device management market?Some key players operating in the IoT device management market include IBM Corporation, Oracle Corporation, Microsoft Corporation, Robert Bosch GmbH, Advantech Co. Ltd., Amazon Web Services Inc., Aeris Communications Inc., PTC Inc., Cisco Systems Inc., Smith Micro Software Inc., Sierra Wireless Inc., Telit Communications PLC, Other Key Players

What are the key drivers fueling the growth of the IoT device management market?Factors such as the proliferation of IoT devices across industries, the need for efficient device monitoring and maintenance, and the rising demand for secure connectivity are driving the growth of the IoT device management market.

What are the primary challenges facing the IoT device management market?Challenges include ensuring interoperability among diverse devices, managing large-scale deployments efficiently, addressing security concerns, and dealing with the complexity of heterogeneous IoT ecosystems.

IoT Device Management MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

IoT Device Management MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Robert Bosch GmbH

- Advantech Co., Ltd.

- Amazon Web Services, Inc.

- Aeris Communications, Inc.

- PTC Inc.

- Cisco Systems, Inc.

- Smith Micro Software, Inc.

- Sierra Wireless, Inc.

- Telit Communications PLC

- Other Key Players