Global Aquaculture Market Size, Share, Statistics Analysis Report By Environment (Marine Water, Fresh Water, Brackish Water), By Species (Aquatic Plants ( Seaweed, Microalgae), Aquatic Animals (Fish, Crustaceans, Mollusks, Others)), By End-use (Food Industry, Agriculture, Animal Feed, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025–2034

- Published date: Jan 2025

- Report ID: 21041

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global Aquaculture Market size is expected to be worth around USD 454.3 billion by 2034, from USD 268.5 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The global aquaculture market is a crucial segment of the food production industry, providing a sustainable solution to meet the rising global demand for seafood. It encompasses the breeding, rearing, and harvesting of aquatic organisms, including fish, crustaceans, mollusks, and seaweed. These activities take place in controlled environments such as freshwater, brackish water, and marine systems, ensuring efficient and regulated production.

With wild fish stocks increasingly threatened by overfishing and environmental degradation, aquaculture has emerged as a vital alternative to maintain a stable seafood supply. This industry plays a significant role in enhancing food security while also contributing to economic development by supporting employment, trade, and technological advancements in sustainable seafood production.

In recent years, aquaculture has significantly expanded its share of global seafood production, even surpassing capture fisheries in certain regions. Leading countries such as China, India, Vietnam, and Norway have emerged as dominant players in the industry, benefiting from technological advancements, government support, and favorable climatic conditions that drive production growth.

Beyond its role in food supply, aquaculture is a vital source of employment, supporting millions of livelihoods, particularly in developing economies. In 2022, aquaculture contributed to over 50% of the world’s seafood supply, a figure projected to increase steadily as investments in sustainable practices and innovative farming techniques continue to rise.

The growth of the global aquaculture market is driven by multiple factors, with the rising global population being a key contributor. As the world’s population is projected to reach 9.7 billion by 2050, the demand for protein-rich diets is expected to increase significantly. Seafood, known for its high nutritional value and health benefits, has gained popularity among health-conscious consumers. Additionally, the depletion of natural fish stocks has accelerated the adoption of aquaculture as a sustainable solution to meet the growing seafood demand.

Technological advancements have further propelled the industry, with innovations such as recirculating aquaculture systems (RAS), integrated multi-trophic aquaculture (IMTA), and genetically improved species enhancing productivity while reducing environmental impact. Favorable government policies, including subsidies, tax incentives, and initiatives promoting sustainable aquaculture practices, have also played a crucial role in supporting market growth and ensuring long-term industry viability.

Future growth opportunities for the aquaculture market are closely tied to the adoption of environmentally sustainable and technologically advanced practices. One key area of development is the shift toward alternative feed sources, such as insect-based and algae-based feeds, which aim to reduce dependence on wild-caught fishmeal and fish oil. This transition addresses ecological concerns while ensuring a more sustainable supply chain for aquaculture feed.

Another promising opportunity lies in the expansion of offshore aquaculture systems, supported by advanced engineering and monitoring technologies. These systems enable large-scale production while alleviating pressure on coastal ecosystems. Additionally, innovations in biotechnology, such as the genetic enhancement of aquatic species, offer further potential to improve yield, disease resistance, and growth rates, paving the way for a more efficient and resilient aquaculture industry.

The rising trend of aquaponics, which combines aquaculture with hydroponics, presents an integrated solution for food production by using fish waste as nutrients for plant cultivation. Additionally, growing demand for organic and premium seafood products creates a lucrative market for value-added aquaculture offerings. Emerging economies in Africa and Latin America, with their untapped water resources and favorable climatic conditions, present significant potential for expansion, provided there is sufficient investment in infrastructure and knowledge transfer.

Key Takeaways

- Aquaculture Market size is expected to be worth around USD 454.3 billion by 2034, from USD 268.5 billion in 2024, growing at a CAGR of 5.4%.

- Fresh Water held a dominant market position in the aquaculture market, capturing more than a 48.60% share.

- Aquatic Animals held a dominant market position in the aquaculture market, capturing more than an 81.30% share.

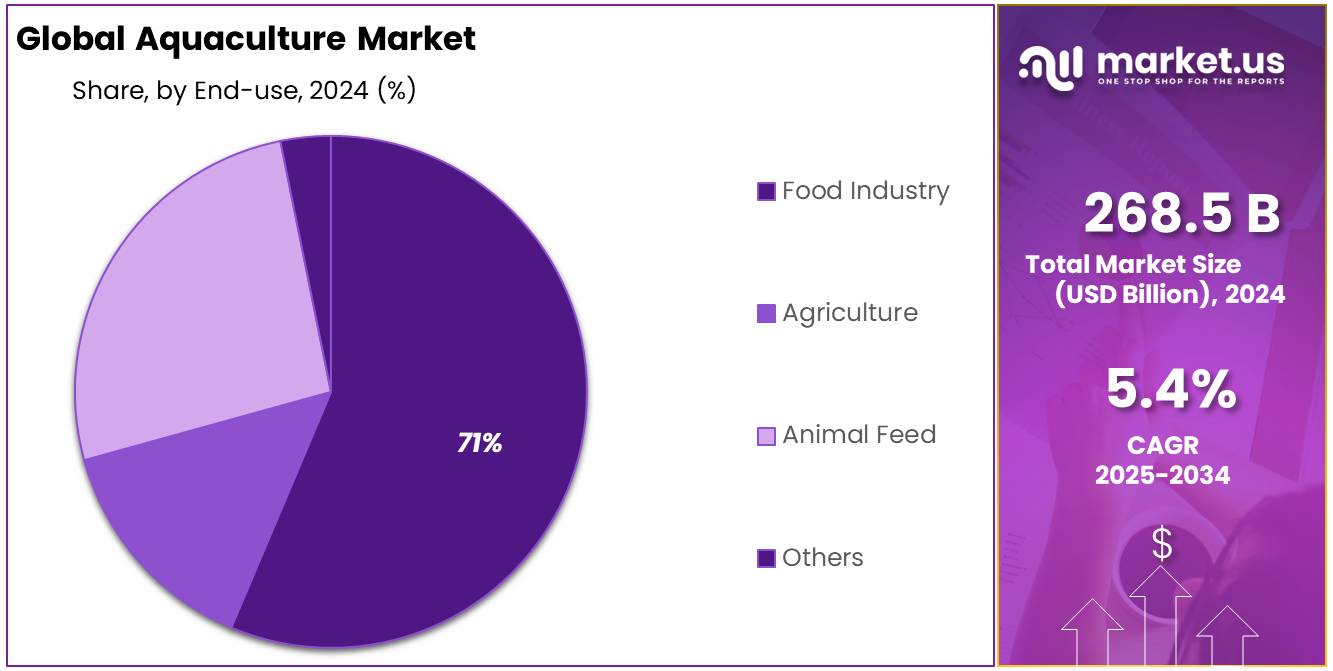

- Food Industry held a dominant market position in the aquaculture sector, capturing more than a 71.20% share.

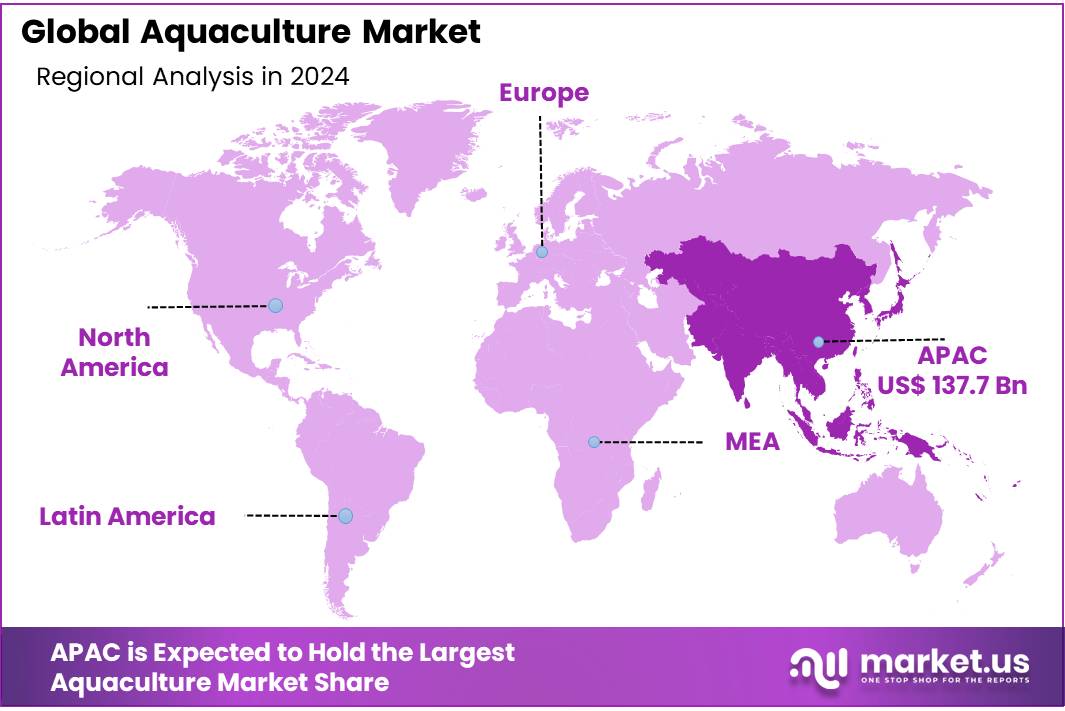

- Asia Pacific region is poised to emerge as a leading market for aquaculture, capturing the largest market share of 51.30%. It is anticipated to reach a value of 137.7 Bn

By Environment

In 2024, Fresh Water held a dominant market position in the aquaculture market, capturing more than a 48.60% share. This segment benefits greatly from the widespread availability of inland water bodies and the relatively low cost of setup and maintenance compared to marine and brackish water environments. Freshwater aquaculture is primarily driven by the farming of species such as carp, trout, and tilapia, which are highly adaptable to pond and lake systems. The growing demand for these fish, fueled by their nutritional value and affordability, continues to support the expansion of freshwater aquaculture practices.

Marine Water aquaculture, also known as mariculture, accounted for a significant portion of the market in 2024. This segment involves the cultivation of marine organisms in their natural habitats, including oceans and seas, under controlled conditions. Key species such as salmon, shrimp, and oysters are commonly farmed in marine waters. The segment benefits from the high market value of its produce, which often garners premium pricing. Innovations in offshore aquaculture technology and sustainable practices are set to boost the growth of this segment as demand for seafood increases globally.

Brackish Water aquaculture forms a unique and essential part of the industry, blending freshwater and marine aquaculture techniques to farm species that thrive in mixed water conditions. This segment specializes in species like barramundi and certain types of bass, which require specific salinity levels for optimal growth. The adaptability of brackish water systems allows for diverse farming practices and can be particularly effective in coastal areas where water salinity can be controlled. As of 2024, this segment is gaining traction due to its efficient use of transitional water zones and the rising popularity of its fish varieties among health-conscious consumers.

By Species

In 2024, Aquatic Animals held a dominant market position in the aquaculture market, capturing more than an 81.30% share. This segment’s strength is largely due to the high consumer demand for protein-rich diets that include diverse fish species, crustaceans like shrimp and crabs, and mollusks such as oysters and mussels. Aquatic animals are primarily cultivated for their nutritional value and economic benefits, which contribute significantly to the global food supply chain. Advancements in breeding technologies, disease control, and aqua farming techniques have further bolstered the productivity and sustainability of this sector, making it a robust area of growth within the aquaculture industry.

Aquatic Plants, including seaweeds and microalgae, form another critical segment of the aquaculture market. While this segment does not match the massive scale of aquatic animals, it is gaining momentum due to the rising awareness of its health benefits and its applications in pharmaceuticals, cosmetics, and biofuel production. Seaweed and microalgae are particularly noted for their ability to absorb nutrients and carbon dioxide, offering environmental benefits alongside commercial opportunities. As of 2024, innovative harvesting techniques and biotechnological advancements are driving the expansion of this segment, catering to an increasingly environmentally conscious and health-focused global market.

By End-User

In 2024, the Food Industry held a dominant market position in the aquaculture sector, capturing more than a 71.20% share. This segment’s prominence is underpinned by the increasing global demand for seafood, driven by its recognition as a healthy source of protein. Aquaculture products such as fish, shrimp, and mollusks are staples in diets worldwide, contributing significantly to nutritional security and culinary diversity. The food industry’s reliance on aquaculture is also motivated by the sustainability it offers compared to traditional fishing methods, which are often subject to overfishing and environmental concerns.

The Agriculture segment utilizes aquaculture in aquaponics systems, where fish farming coexists with plant cultivation, creating a symbiotic environment. Although smaller in scale compared to the food industry, this segment is growing as it promotes water conservation and organic crop production without the need for chemical fertilizers, appealing to eco-conscious consumers and farmers.

Animal Feed is another vital segment within aquaculture, where by-products from processed fish are used to make high-quality feed for poultry, swine, and other livestock. This segment leverages the nutritional value of fishmeal and fish oil, which are excellent sources of protein and omega-3 fatty acids, essential for the healthy growth of farm animals.

Key Market Segments

By Environment

- Marine Water

- Fresh Water

- Brackish Water

By Species

- Aquatic Plants

- Seaweed

- Microalgae

- Aquatic Animals

- Fish

- Crustaceans

- Mollusks

- Others

By End-use

- Food Industry

- Agriculture

- Animal Feed

- Others

Driving Factors

Rising Demand for Sustainable Protein Sources Drives Growth of Aquaculture Market

The Aquaculture Market is experiencing significant growth driven by the rising demand for sustainable protein sources worldwide. As global population continues to expand and incomes rise, there is a corresponding increase in demand for protein-rich foods.

However, traditional protein sources such as beef, pork, and poultry are associated with environmental concerns, including deforestation, greenhouse gas emissions, and water pollution. In contrast, aquaculture offers a more sustainable alternative by efficiently converting feed into edible protein, with lower environmental impact compared to land-based animal farming.

One of the major drivers behind the growth of the aquaculture market is the increasing recognition of seafood as a healthy and nutritious protein source. Fish and shellfish are rich in essential nutrients such as omega-3 fatty acids, vitamins, and minerals, making them an integral part of a balanced diet. Health-conscious consumers are increasingly turning to seafood as a healthier protein option compared to red meat, contributing to the growing demand for aquaculture products.

Furthermore, aquaculture addresses key sustainability challenges facing the global food system. Unlike terrestrial livestock farming, aquaculture requires less land, water, and feed input to produce the same amount of protein, making it more resource-efficient and environmentally friendly.

Additionally, aquaculture operations can be tailored to minimize environmental impact through practices such as recirculating aquaculture systems, integrated multi-trophic aquaculture, and sustainable feed sourcing.

The Aquaculture Market is experiencing significant growth driven by the rising demand for sustainable protein sources worldwide. As global population continues to expand and incomes rise, there is a corresponding increase in demand for protein-rich foods. However, traditional protein sources such as beef, pork, and poultry are associated with environmental concerns, including deforestation, greenhouse gas emissions, and water pollution. In contrast, aquaculture offers a more sustainable alternative by efficiently converting feed into edible protein, with lower environmental impact compared to land-based animal farming.

One of the major drivers behind the growth of the aquaculture market is the increasing recognition of seafood as a healthy and nutritious protein source. Fish and shellfish are rich in essential nutrients such as omega-3 fatty acids, vitamins, and minerals, making them an integral part of a balanced diet. Health-conscious consumers are increasingly turning to seafood as a healthier protein option compared to red meat, contributing to the growing demand for aquaculture products.

Furthermore, aquaculture addresses key sustainability challenges facing the global food system. Unlike terrestrial livestock farming, aquaculture requires less land, water, and feed input to produce the same amount of protein, making it more resource-efficient and environmentally friendly.

Additionally, aquaculture operations can be tailored to minimize environmental impact through practices such as recirculating aquaculture systems, integrated multi-trophic aquaculture, and sustainable feed sourcing.

Restraining Factors

Environmental Concerns and Sustainability Challenges Impede Growth of Aquaculture Market

While the Aquaculture Market shows immense potential for meeting global food demands sustainably, it faces significant restraining factors, primarily revolving around environmental concerns and sustainability challenges. These factors hinder the industry’s growth and pose obstacles to achieving long-term viability and profitability.

One major restraining factor for the aquaculture market is environmental degradation and habitat destruction associated with intensive aquaculture operations. Aquaculture facilities, especially large-scale operations, can generate significant environmental impacts, including pollution of water bodies, disruption of natural ecosystems, and loss of biodiversity.

Effluent discharge, excess nutrients, and chemical inputs from aquaculture farms can degrade water quality, harm aquatic organisms, and degrade surrounding ecosystems, leading to long-term environmental damage and ecosystem instability.

Furthermore, the spread of diseases and pathogens in aquaculture facilities poses a significant risk to both farmed and wild aquatic populations. High stocking densities, limited genetic diversity, and poor biosecurity measures in aquaculture operations create favorable conditions for disease outbreaks, which can result in significant economic losses and environmental damage.

Diseases such as viral infections, bacterial infections, and parasitic infestations can spread rapidly within aquaculture facilities and may also impact wild fish populations through transmission via waterways.

Another restraining factor for the aquaculture market is the unsustainable use of resources, particularly in feed production and fishmeal sourcing. Aquaculture relies heavily on fishmeal and fish oil derived from wild-caught fish, which places additional pressure on already depleted marine resources and contributes to overfishing and ecosystem depletion.

Additionally, the inefficient conversion of feed into edible protein in some aquaculture systems further exacerbates resource depletion and environmental degradation, undermining the industry’s sustainability credentials.

Moreover, regulatory challenges and governance issues present significant barriers to the sustainable growth of the aquaculture market. Inadequate regulations, weak enforcement mechanisms, and governance gaps in aquaculture management can lead to overexploitation of natural resources, environmental degradation, and social conflicts. Lack of transparency, corruption, and regulatory inconsistencies further undermine investor confidence and hinder industry development.

Growing Opportunities

Expanding Market for Value-Added Aquaculture Products Presents Growing Opportunities

One major growing opportunity for the Aquaculture Market lies in the expansion of the market for value-added aquaculture products. As consumer preferences evolve and demand for premium seafood products increases, there is a growing opportunity for aquaculture producers to capitalize on this trend by diversifying their product offerings and focusing on value-added products with higher profit margins.

One significant opportunity within the value-added segment is the production of specialty or niche seafood products. Consumers are increasingly seeking unique and high-quality seafood products that offer distinctive flavors, textures, and culinary experiences.

Aquaculture producers can cater to this demand by specializing in the cultivation of premium species or producing specialty products such as organic, sustainably sourced, or artisanal seafood. By targeting niche markets and offering differentiated products, aquaculture producers can command higher prices and capture a larger share of the market.

Additionally, there is a growing opportunity for aquaculture producers to capitalize on the rising demand for sustainably sourced and responsibly produced seafood. As consumers become more environmentally conscious and socially aware, there is increasing demand for seafood products that are produced using sustainable aquaculture practices, minimize environmental impact, and adhere to ethical labor standards.

Aquaculture producers that adopt sustainable production methods, such as recirculating aquaculture systems, organic certification, and fair labor practices, can differentiate their products in the market and attract environmentally conscious consumers willing to pay a premium for sustainably sourced seafood.

Furthermore, technological advancements and innovations in aquaculture production present growing opportunities for market expansion. Advances in aquaculture technology, such as automation, artificial intelligence, and remote monitoring systems, enable producers to improve efficiency, productivity, and profitability of aquaculture operations.

These technologies allow for better control over environmental conditions, optimized feeding regimes, and early detection of health issues, resulting in higher yields, lower production costs, and improved product quality. Aquaculture producers that invest in innovative technologies and adopt data-driven approaches to production management can gain a competitive edge in the market and capitalize on growing demand for technologically advanced aquaculture products.

Latest Trends

Emerging Trends Shaping the Future of Aquaculture Market

The Aquaculture Market is witnessing significant transformations driven by emerging trends that are reshaping the industry landscape and driving innovation across various segments. These latest trends reflect evolving consumer preferences, technological advancements, and sustainability imperatives, shaping the future trajectory of the aquaculture industry.

One major trend in the aquaculture market is the increasing adoption of recirculating aquaculture systems (RAS) and land-based aquaculture facilities. RAS technology allows for the intensive cultivation of aquatic organisms in closed-loop systems, where water is continuously recycled and treated to maintain optimal water quality and environmental conditions.

This trend addresses key sustainability challenges associated with traditional aquaculture methods, such as water pollution, disease outbreaks, and habitat degradation, by minimizing environmental impact, conserving water resources, and improving production efficiency.

Another emerging trend is the growing popularity of land-based marine aquaculture facilities, also known as offshore aquaculture or marine recirculating aquaculture systems (MRAS). These facilities are located on land but utilize seawater for fish production, offering advantages such as reduced environmental footprint, improved biosecurity, and enhanced control over production parameters.

Land-based marine aquaculture is particularly well-suited for high-value marine species like salmon, seabass, and seabream, which require specific environmental conditions for optimal growth and health.

Additionally, there is a rising trend towards the integration of aquaculture with other sectors such as agriculture, energy, and wastewater treatment, through concepts such as aquaponics, integrated multi-trophic aquaculture (IMTA), and co-location of aquaculture facilities with renewable energy installations. These integrated systems harness synergies between different production processes, optimize resource utilization, and minimize waste generation, leading to greater economic efficiency, environmental sustainability, and overall system resilience.

Moreover, there is growing consumer demand for sustainably sourced and traceable seafood products, driven by increased awareness of environmental and social issues associated with aquaculture and fisheries. As a result, aquaculture producers are increasingly adopting certification schemes, eco-labeling programs, and traceability systems to assure consumers of the sustainability and quality of their products. These initiatives help differentiate products in the market, build consumer trust, and meet regulatory requirements, while also driving industry-wide improvements in environmental performance and social responsibility.

Regional Analysis

The Asia Pacific region is poised to emerge as a leading market for aquaculture, capturing the largest market share of 51.30%. It is anticipated to reach a value of 137.7 Bn during the forecast period. This substantial growth is primarily attributed to the escalating demand for seafood products and sustainable aquaculture solutions across key sectors such as commercial fisheries, aquaponics, and integrated aquaculture systems in residential areas.

Countries like China, India, and Southeast Asian nations including Korea, Thailand, Malaysia, and Vietnam are pivotal to the expansion of the aquaculture market in the region. These countries are witnessing a surge in investments in aquaculture infrastructure and initiatives aimed at promoting sustainable aquaculture practices and enhancing food security.

In North America, economic development, coupled with the increasing adoption of aquaculture technologies and the rising demand for seafood products, is expected to drive significant growth in the aquaculture market. The region’s focus on sustainable aquaculture practices and the conservation of marine resources further contribute to market expansion.

Europe is also projected to experience substantial growth in the aquaculture market, fueled by stringent regulations promoting sustainable aquaculture practices and environmental conservation. The increasing consumer demand for high-quality seafood products and the adoption of innovative aquaculture technologies contribute to the growing market presence in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global aquaculture market is highly competitive, with several key players driving industry growth through innovation, strategic expansions, and sustainable practices. Leading companies such as Mowi ASA, SalMar, Leroy Seafood Group, and Bakkafrost Scotland are at the forefront of salmon farming, leveraging advanced aquaculture techniques to enhance productivity and maintain high-quality seafood supply. Cermaq Group AS, Grieg Seafood, and Cooke Aquaculture Inc. are also major contributors, focusing on large-scale production and sustainable practices to meet the rising global demand for seafood.

Beyond salmon farming, companies like Blue Ridge Aquaculture, Inc., Eastern Fish Company, and Huon Aquaculture Group Pty Ltd. have established strong market positions by specializing in various fish species and sustainable aquaculture technologies.

Asmak, Nireus Aquaculture S.A, and Promarisco play significant roles in expanding the industry’s reach, particularly in shrimp and marine fish farming. Additionally, Thai Union Group Plc and Leroy Seafood Group ASA contribute to the global supply chain through integrated seafood processing and distribution. With increasing investments in innovation and sustainable solutions, these players, along with other emerging market participants, continue to shape the future of the aquaculture industry.

Market Key Players

- Mowi ASA

- SalMar

- Leroy Seafood Group

- Bakkafrost Scotland

- Cermaq Group AS

- Grieg Seafood

- Cooke Aquaculture Inc.

- Blue Ridge Aquaculture , Inc.

- Eastern Fish Company

- Huon Aquaculture Group Pty Ltd.

- asmak

- Nireus Aquaculture S.A

- Promarisco

- Thai Union Group Plc

- Leroy Seafood Group ASA

- Other Key Players

Recent Development

In 2024 Mowi ASA, a leading global seafood company, achieved record-high operating revenues of €1.44 billion in the third quarter of 2024, with an operational profit of €173 million.

In 2024, SalMar ASA reported an operational EBIT of NOK 1,041 million, with a harvest volume of 60,300 tonnes, equating to an EBIT per kilogram of NOK 17.3.

In 2024, Lerøy Seafood Group ASA reported a total harvest of 171,200 tonnes of salmon and trout, up from 159,600 tonnes in 2023.

In 2024, Bakkafrost Scotland harvested 27,900 tonnes of salmon, an increase from 24,040 tonnes in 2023.

Report Scope

Report Features Description Market Value (2024) USD 268.5 Bn Forecast Revenue (2034) USD 454.3 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Environment (Marine Water, Fresh Water, Brackish Water), By Species (Aquatic Plants, Seaweed, Microalgae, Aquatic Animals, Fish, Crustaceans, Mollusks, Others), By End-use (Food Industry, Agriculture, Animal Feed, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Mowi ASA, SalMar, Leroy Seafood Group, Bakkafrost Scotland, Cermaq Group AS, Grieg Seafood, Cooke Aquaculture Inc., Blue Ridge Aquaculture , Inc. , Eastern Fish Company, Huon Aquaculture Group Pty Ltd., asmak, Nireus Aquaculture S.A, Promarisco, Thai Union Group Plc, Leroy Seafood Group ASA, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mowi ASA

- SalMar

- Leroy Seafood Group

- Bakkafrost Scotland

- Cermaq Group AS

- Grieg Seafood

- Cooke Aquaculture Inc.

- Blue Ridge Aquaculture , Inc.

- Eastern Fish Company

- Huon Aquaculture Group Pty Ltd.

- asmak

- Nireus Aquaculture S.A

- Promarisco

- Thai Union Group Plc

- Leroy Seafood Group ASA

- Other Key Players