Global Seed Treatment Market By Type (Chemical, Biological), By Crop Type [Oilseeds (Soybean, Cotton, Canola, Sunflower, Others), Cereals and Grains (Corn, Wheat, Rice, Sorghum, Barley, Others), Fruits and Vegetables ( Solanaceae, Cucurbits, Brassicas, Leafy vegetables, Root and bulb vegetables, Others), Other Crop Types], By Function [Seed Protection(Insecticides, Fungicides, Others), Seed Enhancement ( Bioinsectisides, Biofungicides, Others)], By Application (Coating, Dressing, Pelleting), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Oct 2024

- Report ID: 36728

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

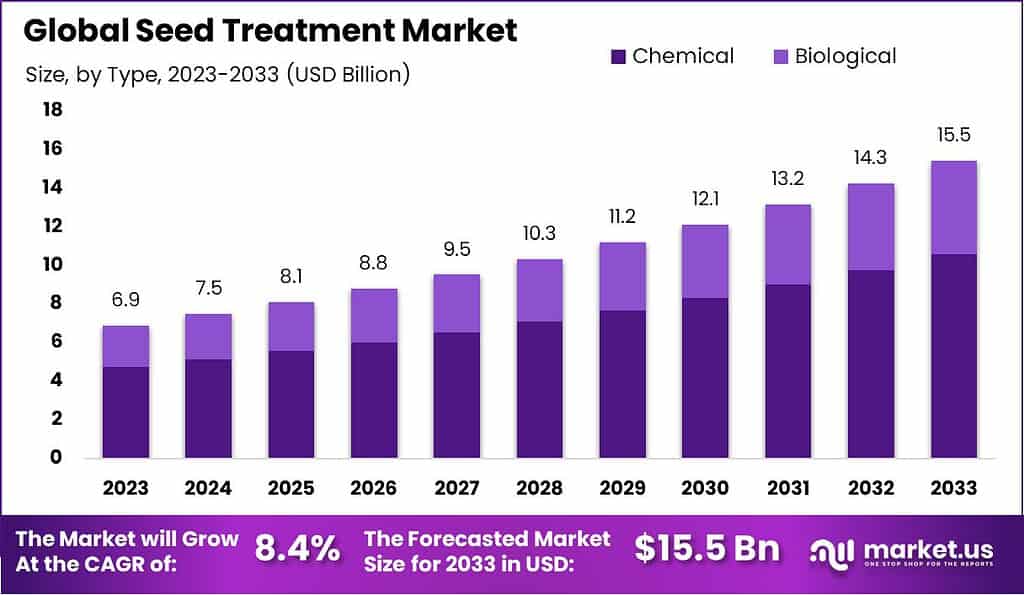

The Global Seed Treatment Market size is expected to be worth around USD 15.5 Billion by 2033, from USD 6.9 Billion in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

The seed treatment market is crucial for enhancing agricultural productivity by applying biological or chemical agents to seeds before planting. This process not only protects seeds from pests and diseases but also promotes healthier growth, contributing significantly to higher crop yields and more sustainable farming methods.

The market offers various products like fungicides, insecticides, and increasingly popular bio-based options, tailored to meet specific agricultural needs. These advancements enhance overall crop efficiency and productivity, addressing the dual challenges of rising global food demand and decreasing arable land. As the world’s population continues to grow, there is a pressing need to optimize crop yields from the available land, a key factor driving the demand for effective seed treatments.

Moreover, the environmental advantages of seed treatments, such as reduced use of field chemicals and lower emissions, contribute to their popularity. These benefits align with global shifts towards more sustainable agricultural practices, supported by government regulations. Regulatory frameworks, including Maximum Residue Limits (MRLs), which govern the permissible levels of pesticide residues in food, also significantly influence market dynamics.

Prominent market players like Bayer AG, Syngenta AG, and BASF SE are at the forefront of developing biologically derived seed treatments, reflecting the industry’s move towards sustainability. These companies are pivotal in driving innovation and adoption of safer, more effective seed treatment solutions worldwide. The combination of regulatory support and technological advancements is expected to sustain the market’s expansion, ensuring it remains a vital component of global agricultural practices.

Key Takeaways

- The Global Seed Treatment Market size is expected to be worth around USD 15.5 Billion by 2033, from USD 6.9 Billion in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

- The Chemical segment dominated the Seed Treatment Market with a 68.6% share.

- Cereals & Grains dominated the Seed Treatment Market with a 41.3% share.

- Seed Protection dominated the Seed Treatment Market with a 38.7% share.

- Coating dominated the seed treatment market with over 39% share, enhancing crop yield and sustainability.

- North America dominates the seed treatment market with a 34.6% share, valued at USD 2.4 billion.

By Type Analysis

In 2023, The Chemical segment dominated the Seed Treatment Market with a 68.6% share.

In 2023, Chemical held a dominant market position in the By Type segment of the Seed Treatment Market, capturing more than a 68.6% share. This segment comprises two primary categories: Chemical and Biological treatments. The substantial market share of the Chemical category is primarily driven by its efficacy in protecting crops from pests and diseases, coupled with the established trust and reliability perceived by agricultural professionals. These treatments are known for their direct action and longer-lasting effects on treated seeds, which contribute significantly to their widespread adoption.

On the other hand, the Biological segment, although smaller, is experiencing robust growth. This rise can be attributed to the increasing awareness of environmental issues and the push for sustainable agricultural practices. Biological treatments, which include the use of natural organisms and substances, appeal to the growing segment of consumers and farmers interested in organic and non-GMO produce.

By Crop Type Analysis

In 2023, Cereals & Grains dominated the Seed Treatment Market with a 41.3% share.

In 2023, The Seed Treatment Market was characterized by its diversification across various crop types, with Cereals & Grains, Oilseeds, and Fruits & Vegetables being the primary segments. Cereals & Grains held a dominant market position in the By Crop Type segment, capturing more than 41.3% of the market share. This segment’s robust performance can be attributed to the increasing demand for high-yield crops due to the growing global population and escalating food security concerns.

Oilseeds followed, driven by the rising need for oil-rich diets and the growing biodiesel market, which rely heavily on treated seeds to ensure crop protection and yield enhancement. The emphasis on sustainable agricultural practices and the reduction of chemical usage in farming have further bolstered the adoption of seed treatment solutions in this segment.

Lastly, the Fruits & Vegetables segment has seen a notable uptake in seed treatments, spurred by the expanding health-conscious consumer base demanding more pesticide-free produce. This segment benefits from advancements in biotechnological methods and organic treatments that align with the global shift towards safer and more sustainable farming practices.

By Function Analysis

In 2023, Seed Protection dominated the Seed Treatment Market with a 38.7% share.

In 2023, Seed Protection held a dominant market position in the By Function segment of the Seed Treatment Market, capturing more than a 38.7% share. This segment encompasses strategies aimed at safeguarding seeds from pathogens and pests during the critical stages of germination and early growth. The emphasis on seed protection underscores the increasing reliance on agricultural biotechnologies that enhance crop yield and resilience.

Additionally, Seed Enhancement, which focuses on improving the physiological properties of seeds, including germination rates and stress tolerance, also plays a pivotal role in the market. This segment leverages advanced treatment formulations to bolster seed performance under varied environmental conditions, thereby supporting robust agricultural outputs.

By Application Analysis

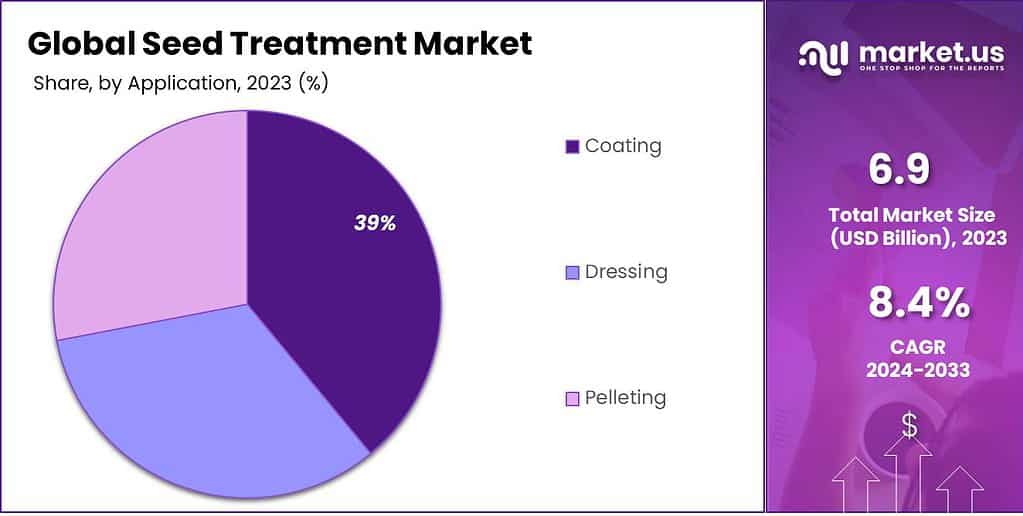

In 2023, Coating dominated the seed treatment market with over 39% share, enhancing crop yield and sustainability.

In 2023, The seed treatment market witnessed significant contributions from three primary segments: coating, dressing, and pelleting. Coating held a dominant market position in the ‘By Application’ segment, capturing more than 39% of the market share. This method involves the application of a protective layer on seeds, enhancing their resistance to pests and diseases while improving the overall germination process. Coating not only optimizes the agricultural yield but also supports sustainable farming practices by reducing the need for bulk agrochemical applications.

Dressing, the second key segment, typically involves the treatment of seeds with a fine powder or liquid fungicide and sometimes insecticide, right before planting. This process is aimed at protecting seeds from soil-borne pathogens and pests, promoting a healthier start for crops.

Lastly, pelleting transforms seeds into uniform, rounded shapes, enhancing their handling characteristics and planting accuracy. This method often incorporates nutrients and growth-promoting substances to support early plant development. Each technique plays a crucial role in modern agriculture, contributing to enhanced crop reliability and yield efficiency.

Key Market Segments

By Type

- Chemical

- Biological

By Crop Type

- Oilseeds

- Soybean

- Cotton

- Canola

- Sunflower

- Others

- Cereals & Grains

- Corn

- Wheat

- Rice

- Sorghum

- Barley

- Others

- Fruits & Vegetables

- Solanaceae

- Cucurbits

- Brassicas

- Leafy vegetables

- Root & bulb vegetables

- Others

- Other Crop Types

By Function

- Seed Protection

- Insecticides

- Fungicides

- Others

- Seed Enhancement

- Bioinsectisides

- Biofungicides

- Others

By Application

- Coating

- Dressing

- Pelleting

Driving Factors

Rising Demand for High-Quality Seeds

The escalating demand for high-quality seeds significantly propels the growth of the seed treatment market. High-quality seeds are a cornerstone for achieving high yields, disease resistance, and stress tolerance in crops, which is critical in meeting the global demand for food production.

This surge in demand encourages farmers and agricultural firms to invest in treated seeds that promise enhanced germination rates and vigor. The treatment of seeds with fungicides, insecticides, and other protective chemicals ensures robust seedling development, thereby optimizing the agricultural output.

Technological Advancements

Technological advancements play a pivotal role in shaping the seed treatment market. Innovations such as microencapsulation techniques, advanced biostimulants, and precision coating technologies enhance the effectiveness and efficiency of seed treatments.

These technologies ensure precise application rates, improve adhesion of active ingredients, and extend the protection period against pests and diseases. Such enhancements not only increase the seed survival rate during the germination phase but also promote healthier crop development.

Sustainable Agriculture Practices

Sustainable agriculture practices significantly influence the growth of the seed treatment market. There is a growing shift towards minimizing the environmental impact of farming, which underscores the importance of seed treatments. By using treatments, farmers can reduce the overall chemical load on fields, as these treatments are targeted and require lower quantities of chemicals as compared to traditional spraying methods.

This approach aligns with sustainable farming protocols that seek to conserve biodiversity, reduce pollution, and maintain ecological balance. As the global emphasis on environmental sustainability intensifies, the demand for advanced seed treatment solutions that support these goals is expected to rise.

Food Security Concerns

Food security concerns, driven by a burgeoning global population and climatic uncertainties, directly boost the seed treatment market. As regions face challenges like unpredictable weather patterns and increasing pest pressures, the reliability on treated seeds becomes paramount. These treatments offer early protection to seeds and young plants, pivotal in ensuring crop resilience and yield stability.

Ensuring food security involves not only increasing food production but also enhancing the quality and reliability of crop yields, for which seed treatments are critical. This growing need to stabilize agricultural outputs amidst challenging conditions is a key driver for the market’s expansion.

Adoption of Genetically Modified (GM) Seeds

The adoption of genetically modified (GM) seeds is another crucial factor fueling the seed treatment market. GM seeds, engineered for higher crop productivity and resistance to pests and diseases, frequently require specific treatments to maximize their genetic potential. These treatments protect the seeds from soil-borne diseases and pests, enhancing the overall effectiveness of the GM traits.

As more nations embrace genetically modified crops as a solution to meet food demand and agricultural efficiency, the corresponding need for compatible seed treatments escalates. This adoption not only supports the growth of the seed treatment market but also complements the broader trends towards agricultural biotechnology and innovation.

Restraining Factors

Stringent Regulatory Requirements: A Barrier to Market Entry and Innovation

Stringent regulatory requirements have a dual impact on the growth of the Seed Treatment Market. These regulations often mandate rigorous testing and compliance measures before products can reach the market. While this ensures safety and efficacy, it also extends the time and increases the costs associated with product development. Such barriers can deter new entrants and stifle innovation among established players.

However, they also serve as a quality control mechanism that can enhance consumer trust in seed treatment products. When regulatory hurdles are perceived as excessively burdensome, they can significantly restrict market growth by limiting the introduction of new and potentially more effective treatments.

Resistance Development: Threatening Long-term Efficacy and Market Viability

The development of resistance to seed treatments, particularly chemical agents, poses a serious threat to the long-term efficacy and viability of these solutions. As pests and diseases evolve to withstand conventional treatments, the effectiveness of existing products diminishes, leading to reduced demand and a potential decline in market growth.

This factor necessitates continuous research and development efforts to introduce new products that can overcome resistance, driving up costs for manufacturers and potentially slowing the rate of market expansion.

Competition from Biological Solutions: Shaping Market Dynamics

The rise of biological solutions as alternatives to chemical seed treatments is reshaping market dynamics. These eco-friendly options appeal to the growing consumer preference for sustainable agricultural practices and are supported by less stringent regulations compared to their chemical counterparts.

The competition from biological solutions encourages innovation in the chemical seed treatment sector but also divides the market, potentially slowing growth in the chemical segment while simultaneously boosting the biological segment.

Varying Government Regulations: A Complex Global Landscape

The impact of varying government regulations across different countries creates a complex landscape for the Seed Treatment Market. Divergent policies and approval processes can fragment the market and complicate the efforts of companies to launch standardized products globally. This factor can slow market growth by increasing operational complexities and compliance costs for companies looking to expand into new regions.

Financial Hurdles for New Entrants: Consolidating Market Power

Financial hurdles for new entrants, such as high initial investment costs in research, development, and regulatory compliance, contribute to the consolidation of market power among established companies. This consolidation can limit market competition and innovation, potentially stifling growth.

On the other hand, these financial barriers also ensure that only the most capable and committed players enter the market, which can lead to the development of highly effective and innovative solutions. However, the overall effect tends to favor larger, established companies, possibly leading to a slower pace of innovation and growth in the seed treatment market.

Growth Opportunities

Growth of Biological Seed Treatments

The seed treatment market is witnessing a significant shift towards biological solutions. This trend is driven by the increasing global emphasis on sustainable agriculture practices. Biological seed treatments, which include the use of natural organisms and bio-derivatives, are projected to experience robust growth. These treatments are not only seen as environmentally friendly but are also effective in enhancing seed performance and yield outcomes.

Customization of Treatments

Customization of seed treatments is emerging as a key market differentiator. The ability to tailor treatments to specific crop needs and local soil conditions allows for enhanced crop productivity and resilience. This customization extends from choosing the right biological agents to adjusting chemical doses, thereby optimizing the growth environment for seeds. This trend is expected to gain momentum as technological advancements in seed treatment applications continue.

Integration with Digital Agriculture

Digital technologies are revolutionizing the seed treatment market by integrating data-driven insights into the treatment process. Precision agriculture tools can now predict the optimal treatment mixes and application times, enhancing seed survival rates and growth efficiency. The integration of digital tools is facilitating a more efficient and effective approach to seed treatment, making it a cornerstone of modern agricultural practices.

Rising Demand for High-Quality Seeds

There is a growing demand for high-quality seeds across the global market, driven by the need to ensure food security and crop consistency in varying climatic conditions. High-quality treated seeds offer improved germination rates and are more resistant to pests and diseases, which are critical factors in achieving higher agricultural output.

Focus on Sustainable Practices

Sustainable practices in seed treatment are gaining traction, reflecting the broader agricultural sector’s shift towards sustainability. This includes reducing chemical use by incorporating more biological treatments and adopting practices that minimize environmental impact. The focus on sustainability not only meets regulatory requirements but also aligns with consumer preferences for environmentally responsible farming practices.

Latest Trends

Sustainable Formulations

The Seed Treatment Market is increasingly embracing sustainable formulations. These eco-friendly treatments are gaining traction due to heightened regulatory scrutiny and a growing consumer preference for sustainable agricultural practices. The development and adoption of such formulations are expected to reduce environmental impact and enhance soil health, propelling market growth.

Chemical vs. Biological Treatments

There is a noticeable shift in the seed treatment sector from chemical to biological treatments, reflecting a broader industry trend towards biologics. Biological treatments are perceived as safer and more sustainable compared to their chemical counterparts. This trend is driven by the need for solutions that offer effective pest and disease management without the ecological footprint associated with chemical treatments.

Seed Coating Techniques

Innovation in seed coating techniques is a significant trend shaping the seed treatment market. These advancements are focused on improving adhesion properties and the precision of active ingredient delivery. Enhanced seed coating technologies not only increase the efficacy of treatments but also contribute to higher crop yields, meeting the dual demands of efficiency and sustainability.

Integration with Digital Agriculture

Digital agriculture technologies are increasingly integrated with seed treatment solutions, offering precise application techniques and real-time data analytics. This integration supports the optimization of treatment protocols and improves planting strategies, ultimately enhancing crop outcomes and operational efficiencies.

Focus on Crop Protection

The emphasis on crop protection continues to be a pivotal trend in the seed treatment market. With the growing global population and the resultant rise in food demand, protecting crops from pests and diseases is more crucial than ever. Advanced seed treatment solutions are central to these protective strategies, ensuring crop resilience and contributing to food security on a global scale.

Regional Analysis

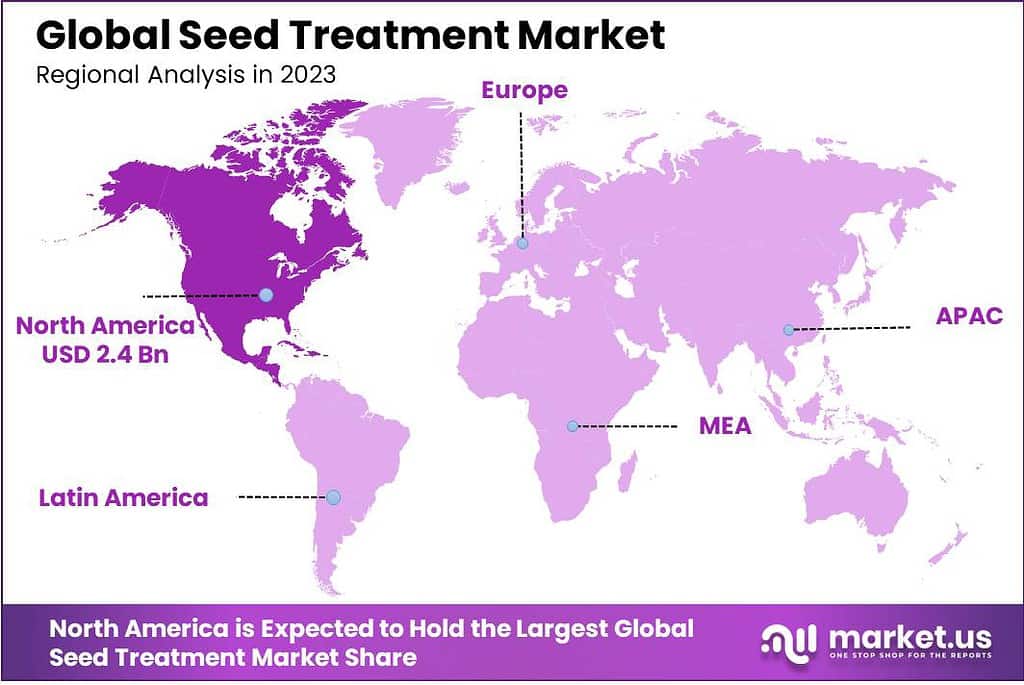

North America dominates the seed treatment market with a 34.6% share, valued at USD 2.4 billion.

The seed treatment market exhibits significant variations across global regions, reflecting the diverse agricultural practices and crop preferences.

North America remains the dominating region, holding a 34.6% market share, valued at USD 2.4 billion. This prominence is driven by advanced agricultural technologies and a high adoption rate of genetically modified crops, which necessitate sophisticated seed treatment solutions to enhance yield and protect against pests and diseases.

Europe follows, characterized by stringent regulations regarding environmental safety and a strong emphasis on sustainable farming practices. The European market is increasingly favoring biological seed treatments, which align with the EU’s green growth strategies and the demand for reducing chemical inputs in agriculture.

Asia Pacific is identified as a rapidly growing segment within the seed treatment market. Factors such as large agrarian economies like India and China, increasing awareness of the benefits of seed treatment, and government initiatives aimed at enhancing crop yields fuel this growth. The region is expected to witness significant advancements in biotechnological research, driving adoption rates.

Latin America is also a key player, with Brazil and Argentina leading in the adoption of seed treatments due to their vast soybean and corn cultivation. The focus in this region is on combating the high pest and fungal disease prevalence, making it a robust market for both chemical and biological seed treatments.

Middle East & Africa presents a smaller, yet growing market segment. The increase in commercial farming activities and the need for high-quality agricultural output are stimulating the demand for treated seeds. Countries such as South Africa and Egypt are spearheading this growth, with an emphasis on improving crop resilience against the challenging climatic conditions prevalent in the region.

These regional dynamics highlight the diverse strategies and growth opportunities within the global seed treatment market, underscoring the need for tailored approaches to meet specific regional demands and regulatory environments.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the global seed treatment market, key players such as Syngenta International AG, Bayer Crop Science AG, BASF SE, and Corteva Agriscience continue to dominate the sector driving innovation and market expansion through advanced biotechnological and chemical solutions. These leading corporations are instrumental in developing seed treatments that enhance crop yield, resist pests and diseases, and provide stress tolerance, responding effectively to the growing demands for agricultural productivity and sustainability.

Syngenta International AG and Bayer Crop Science AG remain at the forefront, leveraging extensive research and development capabilities to introduce novel seed treatment products that address both conventional and specific niche market needs. Their global reach and strategic partnerships facilitate deep market penetration and customer engagement across diverse agricultural landscapes.

BASF SE and Corteva Agriscience are not far behind, focusing on eco-friendly and sustainable solutions. Their products are designed to minimize environmental impact, reflecting the industry’s shift towards sustainable agricultural practices. These companies invest heavily in bio-based seed treatments, which are gaining traction due to their lower ecological footprint and alignment with global regulatory standards.

Emerging players such as Croda International PLC and Evologic Technologies are carving out significant positions by specializing in biostimulants and microbial treatments that support plant health and soil vitality. Their innovative approaches are critical in a market that increasingly values sustainability alongside efficacy.

The inclusion of companies like Amulix, which focuses on developing biodegradable coatings for seeds, highlights a growing segment within the market that supports the reduction of plastic use in agriculture, resonating with global environmental sustainability goals.

Overall, the competitive landscape in the seed treatment market is characterized by a blend of innovation, sustainability, and global reach, with these key players driving both market growth and technological advancements in seed treatment solutions.

Top Key Players

- Syngenta International AG

- Bayer Crop Science AG

- BASF SE

- Corteva Agriscience

- Croda International PLC

- KWS

- Evologic Technologies

- Borregaard

- Amulix

- ADAMA Ltd.

- Bioworks Inc.

- Certis Europe

Recent Development

- In August 2022, BASF partnered with Poncho Votivo at the Field of Dreams Movie Site in the U.S. This collaboration focuses on delivering broad spectrum insect control and strong nematode protection, aiming to produce higher yields through improved seed treatments.

- Syngenta’s New Product Launch – VICTRATO: In May 2022, Syngenta launched a new seed treatment product named VICTRATO, which targets nematode and soil-borne fungal diseases. This product is designed to enhance the quality and yield of several crops including soybeans, corn, cereals, cotton, and rice.

Report Scope

Report Features Description Market Value (2023) US$ 6.9 Bn Forecast Revenue (2032) US$ 15.5 Bn CAGR (2023-2032) 8.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Chemical, Biological), By Crop Type [Oilseeds (Soybean, Cotton, Canola, Sunflower, Others), Cereals & Grains (Corn, Wheat, Rice, Sorghum, Barley, Others), Fruits & Vegetables ( Solanaceae, Cucurbits, Brassicas, Leafy vegetables, Root & bulb vegetables, Others), Other Crop Types], By Function [Seed Protection(Insecticides, Fungicides, Others), Seed Enhancement ( Bioinsectisides, Biofungicides, Others)], By Application (Coating, Dressing, Pelleting) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Syngenta International AG, Bayer CropScience AG, BASF SE, Corteva Agriscience, Croda International PLC, KWS, Evologic Technologies, Borregaard, Amulix , ADAMA Ltd., Bioworks Inc., Certis Europe Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Syngenta International AG

- Bayer Crop Science AG

- BASF SE

- Corteva Agriscience

- Croda International PLC

- KWS

- Evologic Technologies

- Borregaard

- Amulix

- ADAMA Ltd.

- Bioworks Inc.

- Certis Europe