Global Biostimulant Market Size, Share and Industry Analysis Report By Active Ingredients (Acid-based, Seaweed Extract, Microbial, Other Active Ingredients), By Crop Type (Row Crops and Cereals, Fruits and Vegetables, Turf and Ornamentals, Other Crop Type), By Application (Foliar Treatment, Soil Treatment, Seed Treatment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 47860

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

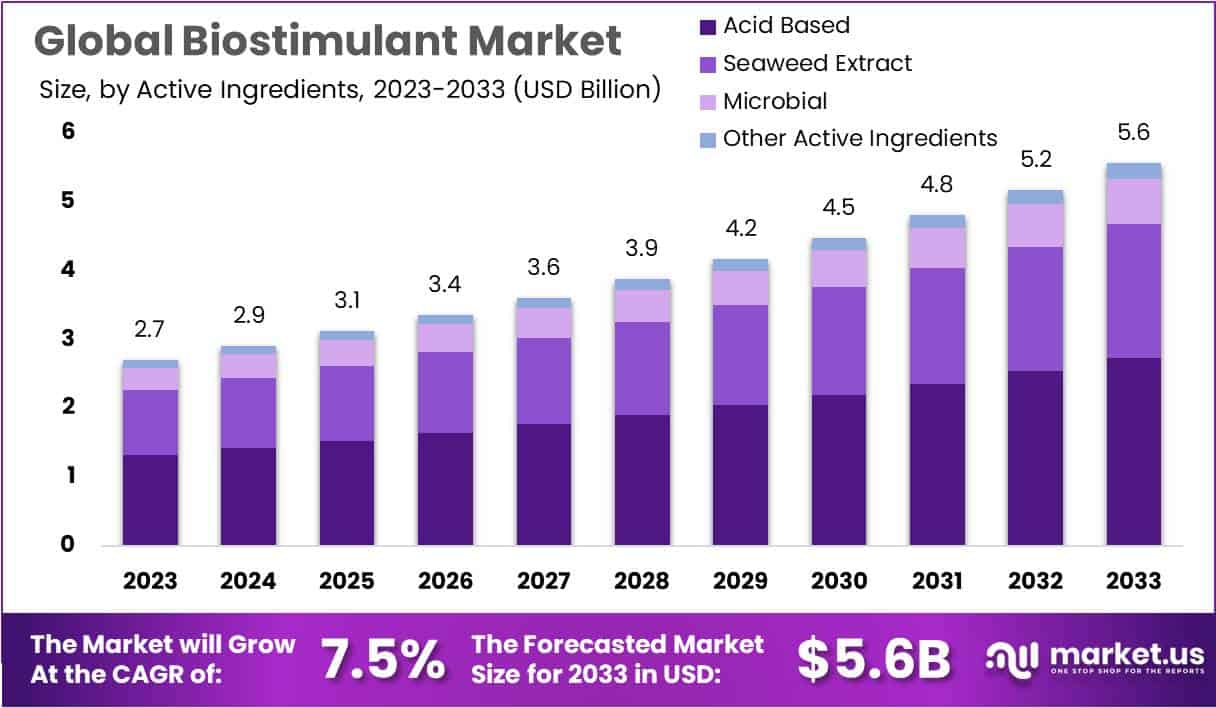

The Biostimulant Market Size is anticipated to reach approximately USD 5.6 billion by 2033, reflecting significant growth from its estimated value of USD 2.7 billion in 2023. This projected expansion signifies a (CAGR) of 7.5% throughout the forecast period spanning from 2024 to 2033. Europe led the market in 2023, with over 38.5% of total revenue, driven by the demand for organic foods.

A biostimulant is a substance or microorganism applied to plants or soils to improve nutrient uptake, efficiency, stress tolerance, and overall crop quality. Unlike conventional fertilizers, which primarily provide essential nutrients, biostimulants focus on enhancing plant health and performance. They encompass various compounds like humic acids, fulvic acids, seaweed extracts, amino acids, and beneficial microorganisms.

These components work synergistically to foster processes such as root development, nutrient absorption, stress resilience, and metabolic modulation. It’s crucial to understand that biostimulants complement rather than replace fertilizers, optimizing the plant’s capacity to absorb and utilize nutrients effectively. Their integration into modern agriculture aims to promote sustainability, minimize environmental impact, and boost crop productivity.

The biostimulant market has seen robust growth due to the global shift towards sustainable agriculture. Farmers increasingly appreciate the benefits of integrating biostimulants with traditional fertilizers, driven by stringent environmental regulations. Ongoing research and development efforts are yielding innovative formulations to enhance biostimulant efficacy, meeting the rising demand for eco-friendly solutions.

The push for organic products and strategic industry collaborations further propel market expansion. This dynamic sector responds to consumer preferences, emphasizing sustainability and navigating regulatory changes while contributing to a more environmentally conscious approach in agriculture.

Key Takeaways

- The global Biostimulant Market size was valued at USD 2.7 billion in 2023.

- The market is expected to grow at a CAGR of 7.5% between 2024 and 2033.

- By 2033, the Biostimulant Market size is projected to reach around USD 5.6 billion, up from USD 2.7 billion in 2023.

- Acid-based active ingredients accounted for over 49% of total revenue in 2023.

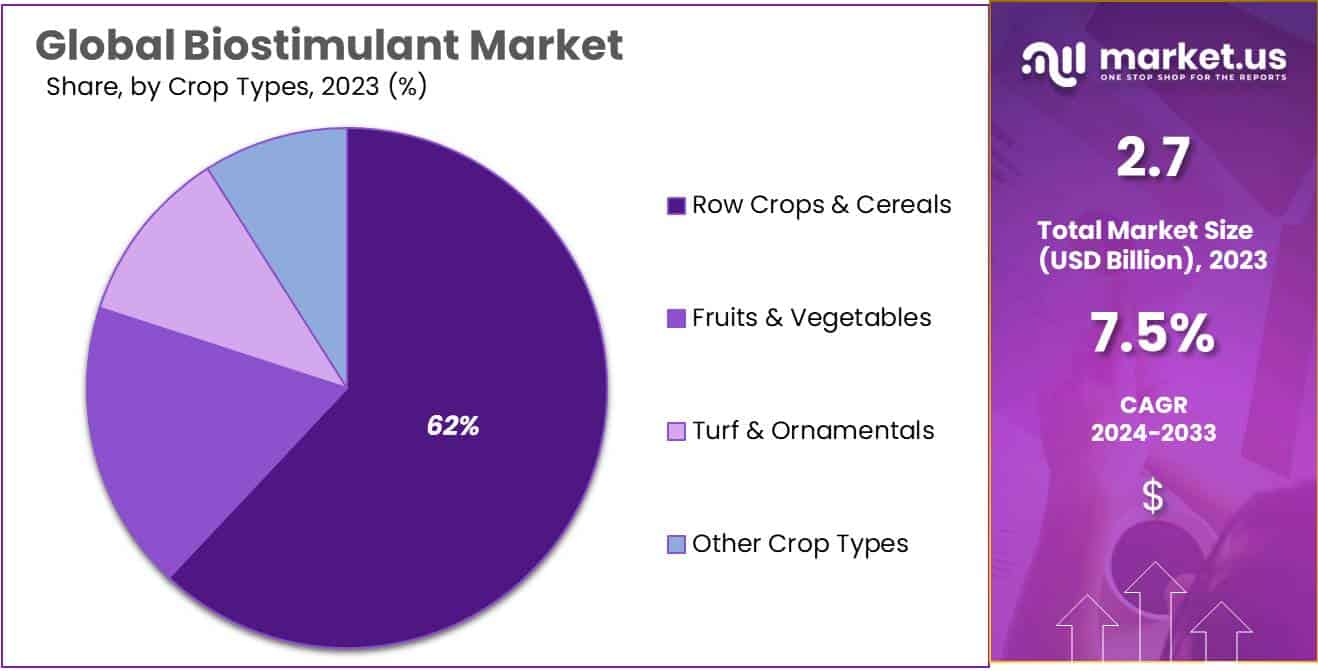

- Row crops and cereals were the dominant crop type in 2023, with over 62% market share.

- Europe led the market in 2023, with over 38.5% of total revenue, driven by the demand for organic foods.

Active Ingredients Analysis

Globally, the acid-based active ingredients segment was dominant and accounted for over 49% of total revenue in 2023. These ingredients are highly sought after due to their potency enhancement properties and sustainability. They are also economically viable. They are also economically feasible. amino acids like fulvic acid and humic acid are key instigators for plant hormones that stimulate metabolic processes and improve seed germination.

Seaweed extracts are biostimulants because they present plant growth hormones such as auxins and cytokines. The most widely used seaweed extracts are brown, green, and red algae. The growth rate of microbial biostimulants is expected to be moderate over the predicted time. These include using microorganisms or a combination of microorganisms to stimulate plant growth. Bacteria, yeasts, and fungi commonly use microbial biostimulants. They aid the plant in coping with stress and rise its nutritional absorption.

Crop Type Analysis

With the largest market share of over 62%, the row crops and cereals segment was dominant in 2023. This segment includes crops like cotton, soybean, millet, and barley. These crops provide companies with growth opportunities and can be grown over vast agricultural land areas. It increases the size and harvest of the seeds as well as the rate of cell division.

The key biostimulants in cereals and row crops are amino acids, Polyamines (IAA), and Indole-3-acetic Acid. It can overcome different barriers that prevent cell division and development. multinationals and agricultural experts are increasingly using the demand for the biostimulant industry to cultivate cereals and row crops.

The demand for organic cereals like oats or millet is expected to boost the segment’s growth. The market is expected to see tremendous growth opportunities due to increasing acceptance and recognition of sustainable and ecological organic farming to meet rising food demand. Due to increased turf and ornamental usage worldwide, Turf and Ornamental were the second-largest segments in 2023.

Application Analysis

In 2023, Foliar treatment segment held a dominant market position, capturing more than a 80% share. This Foliar treatment has many benefits, including increased cellular activity and faster absorption of nutrients. Foliar treatment involves directly applying biostimulants to plant leaves to aid the rapid absorption of nutrients. The epidermis, stomata, and other surface elements of the leaves facilitate absorption. To facilitate easy application and absorption, biostimulants are often in liquid form for foliar treatment. Seed treatment is cost-effective and efficient. It requires less labor than other methods.

The industry is also driven by an increasing population, rising demand for organic products, and encouragement from the government to use biostimulants. Biostimulants are used in soil treatment to increase fertility and productivity. The four main soil treatment methods are physical, chemical, biological, and mechanical. A decrease in chemical use in agriculture will increase soil treatment product usage. Acid-based and microbial biostimulants are the most commonly used biostimulants in soil treatment.

Key Market Segments

Active Ingredients

- Acid-based

- Seaweed Extract

- Microbial

- Other Active Ingredients

Crop Type

- Row Crops & Cereals

- Fruits & Vegetables

- Turf and Ornamentals

- Other Crop Type

Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

Drivers

Regulatory Support and Government Initiatives: One of the primary drivers of the biostimulant market is the increasing regulatory support and government initiatives promoting sustainable agricultural practices. In Europe, the European Commission has set ambitious targets for organic farming, aiming for 25% of agricultural land to be organic by 2030.

This focus on sustainable practices significantly boosts the biostimulant market, as these products are integral to organic farming. For instance, Germany has implemented legal frameworks for ‘Plant Strengtheners,’ which include biostimulants, to promote eco-friendly farming methods. Similarly, the USDA in the United States has launched initiatives like the Organic Transition Initiative, allocating substantial funds to support organic farming and the adoption of biostimulants.

Increasing Awareness of Sustainable Agriculture: The biostimulant market is also driven by a growing awareness of the need for sustainable agriculture. Biostimulants are seen as a key component in climate-smart agricultural strategies. They are used to enhance plant resilience and reduce the dependency on chemical inputs, thereby contributing to lower CO2 emissions and promoting a healthier environmental ecosystem. This shift towards eco-friendly farming practices is evident across various regions, including North America and Asia-Pacific, where there is an increasing acceptance of biostimulants among conventional farmers.

Innovation and Research & Development (R&D): Ongoing R&D activities are crucial in driving the adoption and effectiveness of biostimulants. Innovations in product development, particularly those that offer novel and low-rate application products that maximize crop health and yield with minimal quantities, are propelling market growth. Companies are investing heavily in biotechnology to develop new biostimulant formulations that address specific agricultural needs, thereby enhancing the attractiveness of biostimulants in the market.

Market Adoption Across Application Segments: The application of biostimulants in various agricultural practices such as foliar treatment, seed treatment, and soil treatment significantly contributes to their market growth. Foliar applications, which involve applying biostimulants directly to plant leaves, dominate the market due to their efficiency in enhancing nutrient absorption and improving plant health rapidly. Moreover, the adoption of biostimulants in high-value crops like fruits and vegetables is increasing due to their benefits in improving yield, quality, and shelf-life, further driving market growth.

Restraints

Navigating Research Costs, Farmer Awareness, Regulatory Processes, and Fertilizer Competition

One of the most significant restraining factors for the growth of the biostimulant market is the complex regulatory landscape across different regions. The approval process for biostimulants can be lengthy and involves stringent scrutiny from government bodies to ensure the quality and safety of these products. This rigorous regulatory framework often results in delays in the introduction of new biostimulants to the market, affecting the pace at which new and innovative products can reach farmers.

The complexity is compounded by the lack of harmonization in regulations across countries, which creates an uneven playing field and uncertainty for producers and consumers alike. For example, what qualifies as a biostimulant in one country might not in another, leading to confusion and hindrance in market expansion.

Opportunities

The Emerging Landscape of Biostimulants in Developing Economies and Sustainable Agriculture

Expanding Use in High-Value Crop Production: A significant growth opportunity for the biostimulant market lies in its expanding use in high-value crop production, particularly within the fruits and vegetables segment. The demand for biostimulants in this sector is being driven by the rising consumer preference for sustainably grown produce and the global increase in health consciousness which emphasizes the consumption of organic food. Biostimulants are critical in enhancing crop resilience, improving yield and quality, and extending shelf life, making them increasingly vital in the cultivation of fruits and vegetables.

The use of biostimulants is also supported by their ability to improve plant vigor and productivity through enhanced nutrient uptake, pest resistance, and stress tolerance. As global dietary patterns shift towards more fruit and vegetable consumption, the role of biostimulants in agriculture is expected to become more pronounced, with projections indicating substantial market growth.

Moreover, the increasing adoption of advanced agricultural practices such as precision farming and protected agriculture (like greenhouse production) further bolsters the demand for biostimulants. These methods require precise and efficient nutrient management solutions that biostimulants can provide, making them integral to modern farming operations aiming for high efficiency and sustainability

Trends

Emerging Trends in Biostimulant Adoption and Agricultural Innovation

A significant trend in the biostimulant market is the expanded use of these products in specialty and high-value crops, such as fruits, vegetables, nuts, and ornamental plants. This trend is driven by the benefits biostimulants offer in enhancing crop yield, quality, and shelf-life. As the demand for organic and sustainably grown produce continues to rise, biostimulants are increasingly seen as a vital component in achieving these agricultural goals. They improve nutrient uptake, stress tolerance, and overall crop health, which are critical factors in high-value crop production.

Moreover, this trend is supported by the growing awareness among farmers and producers about the environmental and economic benefits of using biostimulants. This includes reduced dependency on chemical fertilizers, enhancement of soil health, and increased plant resilience to environmental stresses. The adoption of biostimulants is particularly notable in regions with intensive agricultural practices and where there is significant pressure to shift towards more sustainable farming methods.

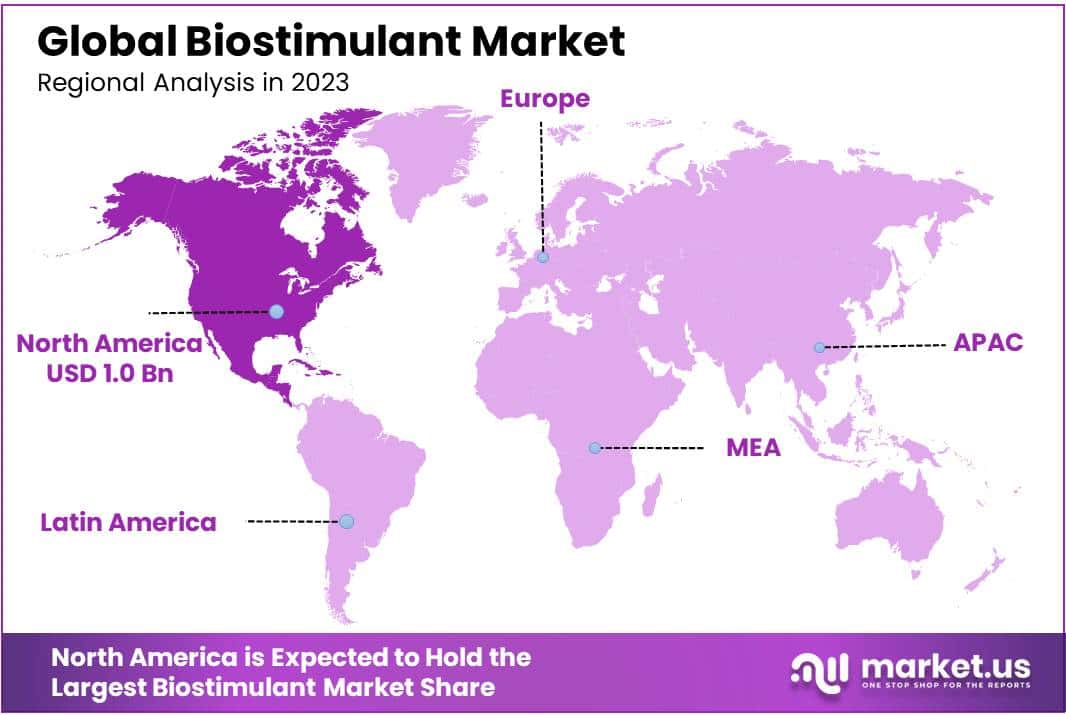

Regional Analysis

In 2023, Europe held a dominant market position, capturing more than a 38.5% share and holds USD 1.0 Bn market value for the year. The large share is attributed to the high adoption of biostimulants among farmers and growers in the region. Countries like Spain, Italy, France and Germany are the key markets, driven by favorable government policies, rising awareness of sustainable agriculture practices, and increasing need to improve crop quality and yields.

North America closely tracks Europe in market influence, securing more than moderate market share. Key players in the U.S. and Canada are driving advancements in research and product innovations, supported by regulatory backing and subsidies for biostimulant adoption. The Asia Pacific is anticipated to experience the highest growth rate in the foreseeable future. Factors such as rapid population growth, diminishing arable land, initiatives to enhance agricultural productivity, and government funding in significant countries like China and India are expected to drive regional growth.

Latin America and Middle East & Africa currently hold modest market shares, but offer promising growth opportunities. Expanding populations, need for food security and focus on agricultural development is creating conducive conditions. As more players turn focus on these untapped markets, substantial growth can be achieved through appropriate positioning and pricing strategies suited for the regions. Overall, the global biostimulant market remains in the growth stage and has bright prospects across both developed and developing regional markets over the forecast period.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The competition in this market is highly dependent on the crop type, active ingredient type, grade of products, number of sellers/manufacturers, and geographical location. Key companies engage in continuous R&D, mergers and acquisitions, capacity expansion, and other strategies to gain a competitive landscape in this market. Manufacturers focus on increasing their product portfolios through strategic joint ventures and high R&D investments.

Major players have made substantial investments in innovation in recent years to meet the growing demand for agricultural products globally. They also help companies develop new sustainable products and increase their profit margins. Isagro Group purchased Phoenix Del in 2020 to expand its product range of copper-based fungicides. This acquisition promoted technological advancement and revolutionized products under the “BioSolutions” segment.

The following are some of the most prominent market players in the global biostimulant market: Isagro Group, BASF SE, Biolchim SpA, Sapec Agro S.A., Platform Specialty Products Corp., Novozymes A/S, Adama ltd, Valagro SpA, Italpollina SAP, biostat India limited Other Key Players.

Market Key Players

- Bayer AG

- Isagro Group

- BASF SE

- Biolchim S.P.A.

- Novozymes A/S

- Valagro SpA

- Koppert B.V.

- Biostadt India Limited

- Marrrone Bio Innovations

- Syngenta AG

Recent Developments

- In August 2023, Lallemand, known for its expertise in yeast and bacteria fermentation, successfully acquired Biotalys, a company specializing in innovative biostimulants and biocontrol solutions. This strategic move, valued at $1.1 billion, is set to bolster Lallemand’s standing in the biostimulant market, presenting a promising avenue for future growth.

- In June 2023, Novozymes, a prominent figure in bioinnovation, introduced ProTera, a groundbreaking biostimulant demonstrating the potential to enhance crop yields by up to 15%. ProTera, a natural product, achieves this by optimizing the plant’s nutrient absorption and water utilization.

- In May 2023, witnessed a significant collaboration between BASF, a global chemical leader, and Corteva Agriscience, renowned in the field of agriculture. Together, they forged a strategic alliance with the goal of developing cutting-edge biostimulants. This collaboration harnesses BASF’s prowess in chemistry and Corteva’s agricultural expertise to create products aimed at helping farmers enhance both crop yields and quality.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Bn Forecast Revenue (2033) USD 5.6 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Active Ingredients (Acid-based, Seaweed Extract, Microbial, Other Active Ingredients), By Crop Type (Row Crops & Cereals, Fruits & Vegetables, Turf and Ornamentals, Other Crop Type), By Application (Foliar Treatment, Soil Treatment, Seed Treatment) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bayer AG, Isagro Group, BASF SE, Biolchim S.P.A., Novozymes A/S, Valagro SpA, Koppert B.V., Biostadt India Limited, Marrrone Bio Innovations, Syngenta AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer AG

- Isagro Group

- BASF SE

- Biolchim S.P.A.

- Novozymes A/S

- Valagro SpA

- Koppert B.V.

- Biostadt India Limited

- Marrrone Bio Innovations

- Syngenta AG