Global Copper Fungicides Market By Type(Conventional Farming, Organic Farming), By Chemistry(Copper Oxychloride, Copper Hydroxide, Cuprous Oxide, Copper Sulfate, Others), By Formulation(Water-dispersible Granules (WG), Wettable Powder (WP), Soluble granules (SG), Others), By Application(Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: March 2024

- Report ID: 15982

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

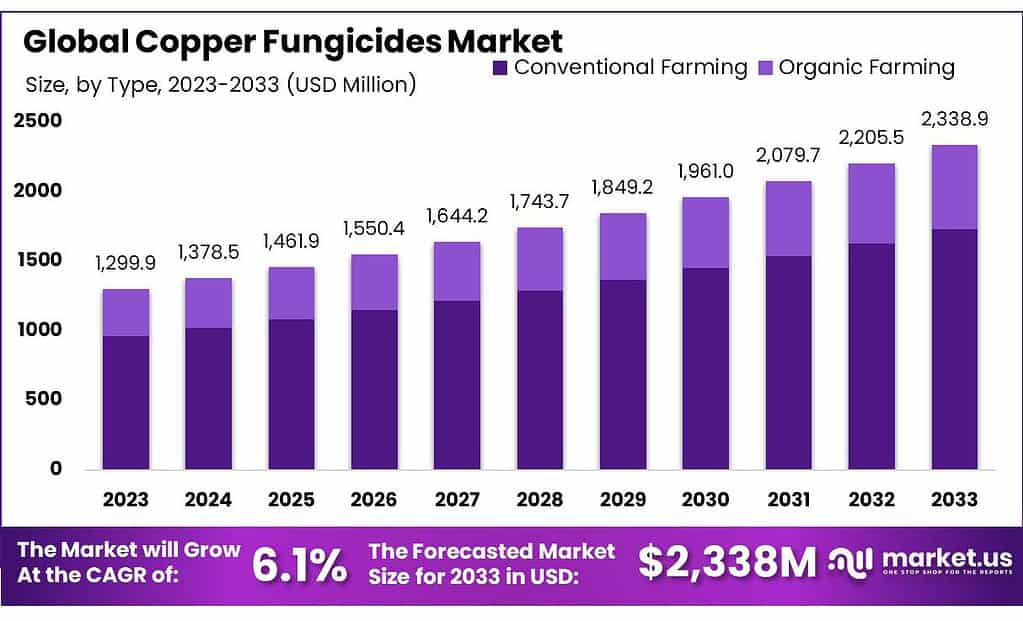

The global Copper Fungicides market size is expected to be worth around USD 2338.9 Million by 2033, from USD 1299.9 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The Copper Fungicides market refers to the sector involved in the production, distribution, and sale of fungicides containing copper compounds as their active ingredients. These fungicides are primarily used in agriculture and horticulture to control fungal diseases in crops, fruits, and vegetables. Copper fungicides work by preventing the growth and spread of fungal pathogens, thereby protecting plants from diseases such as mildew, blight, and rust.

The market encompasses various types of copper-based fungicides, formulations, and application methods designed to cater to the diverse needs of farmers and growers in safeguarding their crops from fungal infections. Additionally, factors such as regulatory policies, technological advancements, and the adoption of sustainable agricultural practices influence the dynamics of the Copper Fungicides market.

Key Takeaways

- Market Growth Projection: The Copper Fungicides market is forecasted to reach USD 2338.9 million by 2033, with a robust CAGR of 6.1%.

- Top Market Segments: Conventional farming dominates with 74.5% share, while Copper Oxychloride leads at 34.5% in 2024.

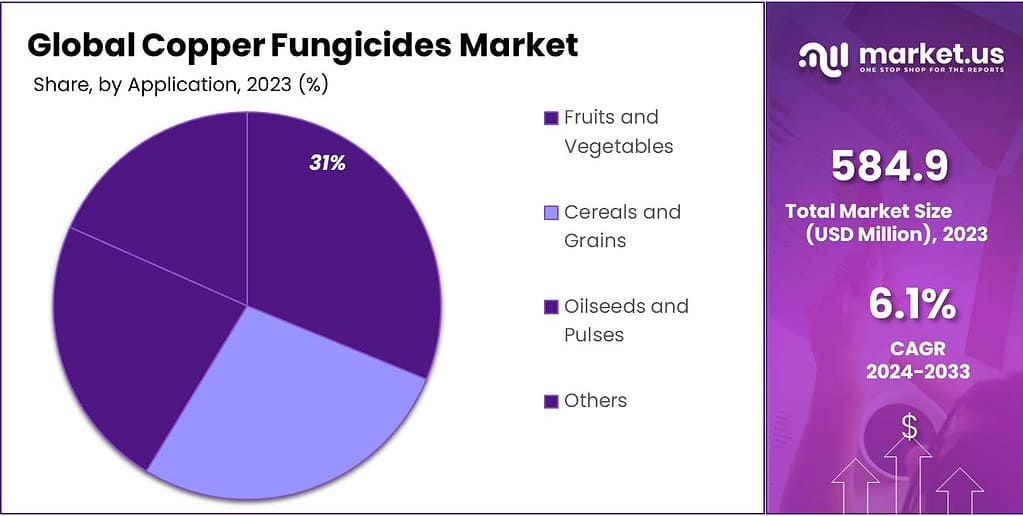

- Primary Application Focus: Fruits and vegetables hold over 45.6% market share in 2024.

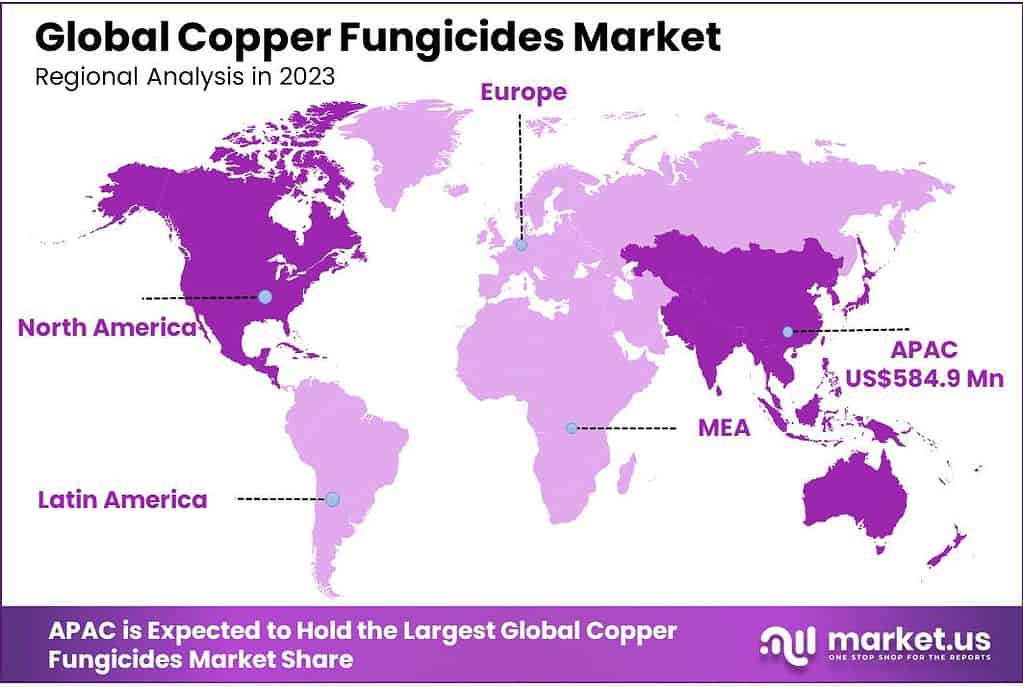

- Regional Dominance: Asia Pacific leads, capturing 45% of the market share in 2023, driven by urbanization and industrialization.

- The particle size of copper fungicides can range from 1 to 10 microns for effective coverage and adhesion to plant surfaces.

- Copper fungicides can have a maximum copper content of up to 60% by weight in certain formulations

- Copper fungicides can have a rain fastness period of 2 to 6 hours, depending on the formulation and environmental conditions.

By Type

In 2024, Conventional Farming dominated the Copper Fungicides market, securing over 74.5% of the market share. Conventional farming refers to the traditional agricultural practices that rely on synthetic pesticides and fertilizers to maximize crop yields. Copper fungicides are widely utilized in conventional farming systems due to their effectiveness in controlling fungal diseases and improving crop productivity.

These fungicides play a crucial role in protecting crops from various fungal pathogens, such as mildew, blight, and rust, thereby ensuring higher yields and quality produce for conventional farming operations. Despite the growing interest in organic farming practices, the demand for copper fungicides remains strong in conventional farming due to their proven efficacy and widespread acceptance among farmers.

By Chemistry

In 2024, Copper Oxychloride emerged as the leading segment in the Copper Fungicides market, commanding a significant share of over 34.5%. Copper Oxychloride is a widely used copper-based fungicide known for its effectiveness in controlling fungal diseases in various crops.

It acts by inhibiting fungal spore germination and growth, thereby protecting plants from infections caused by pathogens such as mildew, blight, and leaf spots. The popularity of Copper Oxychloride stems from its broad spectrum of activity, long-lasting protection, and relatively low cost compared to other copper-based fungicides.

Farmers and growers prefer Copper Oxychloride for its proven efficacy and ease of application, making it a preferred choice in the agriculture sector for disease management. Despite the availability of alternative copper-based fungicides like Copper Hydroxide, Cuprous Oxide, and Copper Sulfate, Copper Oxychloride maintains its dominance in the market due to its widespread acceptance and reliability in crop protection.

By Formulation

In 2024, Water-dispersible Granules (WG) emerged as the leading segment in the Copper Fungicides market, capturing over 45.6% of the market share. Water-dispersible granules are a popular formulation of copper fungicides due to their ease of use and effectiveness in controlling fungal diseases in crops.

These granules dissolve quickly in water, forming a suspension that can be easily sprayed onto plants, ensuring uniform coverage and distribution of the fungicide. Farmers prefer water-dispersible granules for their convenience and versatility in application methods, making them suitable for both foliar spraying and soil drenching.

Additionally, water-dispersible granules offer improved stability and storage compared to other formulations like wettable powder and soluble granules, enhancing their shelf life and reducing the risk of product degradation. Despite the availability of alternative formulations, water-dispersible granules maintain their dominance in the Copper Fungicides market due to their reliable performance and ease of handling, contributing to their widespread adoption in agricultural practices.

By Application

In 2024, Fruits and Vegetables emerged as the leading segment in the Copper Fungicides market, capturing more than a 45.6% share. Copper fungicides play a crucial role in protecting fruits and vegetables from fungal diseases such as mildew, blight, and fruit rot, which can significantly reduce crop yields and quality.

Fruits and vegetables are highly susceptible to fungal infections due to their moisture content and exposure to environmental factors conducive to fungal growth. Therefore, farmers rely on copper fungicides to prevent and manage these diseases, ensuring healthy crop development and marketable produce.

Additionally, the increasing demand for organic fruits and vegetables has driven the adoption of copper fungicides in organic farming practices, as they are approved for use in organic agriculture and offer effective disease control without synthetic chemicals.

Despite the availability of alternative disease management strategies, such as cultural practices and biological control methods, the use of copper fungicides remains widespread in the fruits and vegetables segment due to their proven efficacy and reliability in safeguarding crops from fungal pathogens.

Key Market Segments

By Type

- Conventional Farming

- Organic Farming

By Chemistry

- Copper Oxychloride

- Copper Hydroxide

- Cuprous Oxide

- Copper Sulfate

- Others

By Formulation

- Water-dispersible Granules (WG)

- Wettable Powder (WP)

- Soluble granules (SG)

- Others

By Application

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds and Pulses

- Others

Driving Factors

Increasing Incidence of Fungal Diseases in Crops Driving Demand for Copper Fungicides

The escalating incidence of fungal diseases in crops stands as a major driver propelling the growth of the Copper Fungicides market. Fungal pathogens pose significant threats to agricultural productivity by causing devastating diseases such as mildew, blight, and rust in various crops including fruits, vegetables, cereals, and oilseeds.

These diseases can lead to substantial yield losses, reduced crop quality, and economic hardships for farmers. Copper fungicides offer effective solutions for disease management by inhibiting the growth and spread of fungal pathogens, thereby safeguarding crops and ensuring optimal yields.

The prevalence of fungal diseases is exacerbated by factors such as changes in climate patterns, increased global trade facilitating the spread of pathogens, and intensive agricultural practices that create favorable conditions for disease development.

As a result, farmers are increasingly turning to copper fungicides to protect their crops and mitigate the risks associated with fungal infections. Copper fungicides provide broad-spectrum protection against a wide range of fungal pathogens, making them indispensable tools in integrated disease management strategies.

Furthermore, the rising demand for food security and sustainable agriculture further drives the adoption of copper fungicides. With the world’s population projected to reach 9 billion by 2050, ensuring food security becomes paramount. Copper fungicides enable farmers to maintain healthy crop growth and productivity, contributing to global food security initiatives.

Additionally, copper fungicides are compatible with integrated pest management (IPM) and organic farming practices, aligning with the growing consumer preference for sustainably produced food.

Moreover, advancements in formulation technologies and product innovations enhance the efficacy and applicability of copper fungicides, further fueling market growth. Manufacturers are developing novel formulations with improved stability, enhanced coverage, and reduced environmental impact, expanding the usability of copper fungicides across diverse agricultural settings.

Restraining Factors

Environmental Concerns and Regulatory Restrictions Limiting Copper Fungicides Market Growth

One major restraining factor impeding the growth of the Copper Fungicides market is the growing environmental concerns and regulatory restrictions surrounding the use of copper-based pesticides. Copper fungicides, while effective in controlling fungal diseases, can pose environmental risks and health hazards if misused or over-applied.

Copper accumulates in soil over time, leading to soil contamination and potential toxicity to soil microorganisms, plants, and aquatic ecosystems. Moreover, excessive copper residues in agricultural runoff can contaminate water bodies, posing risks to aquatic life and human health.

In response to these environmental concerns, regulatory agencies worldwide are imposing stricter regulations on the use of copper fungicides in agriculture. Limits on maximum residue levels (MRLs) in food commodities and water quality standards are being enforced to mitigate the environmental impact of copper-based pesticides.

Additionally, restrictions on the application rates, frequency of use, and pre-harvest intervals are being imposed to minimize copper residues in crops and reduce the risk of human exposure.

Furthermore, there is growing public scrutiny and consumer awareness regarding the potential health risks associated with copper fungicides. Concerns about pesticide residues in food and their impact on human health have led to increased demand for organic and pesticide-free produce. Consumers are seeking alternatives to conventional farming practices, driving the adoption of organic farming methods and biopesticides.

Moreover, the development of resistance in fungal pathogens poses a significant challenge to the efficacy of copper fungicides. Continuous and indiscriminate use of copper-based pesticides can lead to the emergence of resistant strains of fungal pathogens, rendering copper fungicides ineffective in disease management.

As a result, farmers may need to resort to alternative disease control measures, such as chemical rotations, cultural practices, and biological control agents, which could limit the demand for copper fungicides.

Additionally, the high cost associated with copper fungicides and the availability of cheaper alternatives pose economic challenges for farmers, especially small-scale growers with limited financial resources. As a result, some farmers may opt for alternative disease management strategies or forego fungicide applications altogether, affecting market demand for copper fungicides.

Opportunity

Expanding Adoption of Integrated Pest Management Presents Growth Opportunities for Copper Fungicides Market

One major opportunity for the Copper Fungicides market lies in the expanding adoption of Integrated Pest Management (IPM) practices by farmers worldwide. IPM is a holistic approach to pest and disease management that aims to minimize reliance on synthetic pesticides while maximizing the use of environmentally friendly and sustainable pest control methods. Copper fungicides play a crucial role in IPM programs as they provide effective disease control while being relatively safer for the environment and human health compared to many synthetic chemicals.

The growing awareness among farmers about the environmental and health risks associated with conventional pesticide use is driving the shift towards IPM strategies. By integrating cultural practices, biological control agents, and resistant crop varieties with judicious use of copper fungicides, farmers can effectively manage fungal diseases while reducing their reliance on synthetic pesticides. This presents a significant opportunity for the Copper Fungicides market to cater to the evolving needs of environmentally conscious growers seeking sustainable disease management solutions.

Moreover, the increasing demand for organic and sustainably produced food is bolstering the adoption of copper fungicides in organic farming systems. Copper-based pesticides are approved for use in organic agriculture by many certification bodies worldwide, making them an essential tool for organic growers to manage fungal diseases while adhering to organic standards. As the organic food market continues to grow globally, driven by consumer preferences for healthy and environmentally friendly products, the demand for copper fungicides in organic farming is expected to rise, presenting lucrative opportunities for market players.

Furthermore, advancements in formulation technologies and product innovation offer opportunities for market expansion. Manufacturers are investing in research and development to develop more efficacious and environmentally friendly formulations of copper fungicides. This includes the development of micronized and nano-formulations that improve the efficacy and bioavailability of copper while reducing environmental impact and application rates. Additionally, the introduction of bio-based adjuvants and surfactants enhances the performance of copper fungicides, further driving their adoption in modern agriculture.

The expansion of agriculture into new regions and the increasing cultivation of high-value crops such as fruits, vegetables, and specialty crops also present growth opportunities for the Copper Fungicides market. As farmers seek to protect their crops from fungal diseases in diverse climatic conditions and production systems, the demand for effective and reliable disease control solutions, including copper fungicides, is expected to rise.

Trending Factors

Increasing Emphasis on Sustainable Agriculture Driving Demand for Copper Fungicides

One major trending factor influencing the Copper Fungicides market is the increasing emphasis on sustainable agriculture practices worldwide. As concerns about environmental sustainability, food safety, and human health continue to rise, there is a growing preference among growers for sustainable crop protection solutions that minimize environmental impact while ensuring effective disease control.

Copper fungicides have emerged as a key tool in sustainable agriculture due to their proven efficacy against a wide range of fungal diseases and their relatively low environmental footprint compared to synthetic pesticides.

Governments, regulatory bodies, and agricultural organizations are implementing policies and initiatives to promote sustainable agriculture practices, driving the adoption of copper fungicides. For example, many countries have implemented regulations to restrict the use of certain synthetic pesticides with high environmental and health risks, leading growers to seek alternative solutions such as copper fungicides.

Additionally, certification programs for sustainable agriculture, such as organic certification, often permit the use of copper fungicides, further boosting their demand among organic growers.

Another trending factor is the increasing prevalence of fungal diseases in agriculture, driven by factors such as climate change, globalization of trade, and intensive agricultural practices. Fungal pathogens pose significant threats to crop yields and quality, leading growers to prioritize disease management strategies.

Copper fungicides offer broad-spectrum protection against a wide range of fungal pathogens, making them indispensable tools for disease control in various crops, including fruits, vegetables, cereals, and ornamentals.

Furthermore, advancements in copper fungicide formulations and application technologies are driving market growth and adoption. Manufacturers are investing in research and development to enhance the efficacy, safety, and sustainability of copper fungicides. Innovations such as micronized and nano-formulations improve the dispersion and bioavailability of copper, leading to better disease control with lower application rates.

Additionally, the development of adjuvants and surfactants that enhance the performance of copper fungicides further contributes to their effectiveness in disease management.

The trend towards precision agriculture and digital farming is also influencing the Copper Fungicides market. Growers are increasingly adopting precision agriculture technologies such as sensors, drones, and satellite imagery to optimize crop management practices, including pesticide application. By utilizing these technologies, growers can target copper fungicide applications more precisely, reducing wastage and environmental impact while maximizing disease control efficacy.

Regional Analysis

APAC Emerges as the Dominant Region in the Global Copper Fungicides Market

Asia Pacific (APAC) stands out as the most lucrative region in the global Copper Fungicides market. With a commanding 45% share of the market in 2023, APAC leads the way in the adoption of Copper Fungicides for agricultural purposes. This dominance is attributed to several key factors driving demand within the region.

One significant factor is the rapid pace of urbanization and industrialization across APAC countries such as China, Japan, and South Korea. As these nations experience substantial economic growth and urban expansion, the demand for high-quality agricultural produce rises in tandem, leading to increased usage of Copper Fungicides to protect crops from fungal diseases.

Moreover, the widespread adoption of electric vehicles (EVs) in APAC nations contributes to the growing demand for Copper Fungicides. With the automotive industry transitioning towards electric mobility to reduce carbon emissions, the need for efficient and sustainable agricultural practices intensifies, further propelling the use of Copper Fungicides.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Copper Fungicides market is characterized by the presence of several key players contributing to its growth and development. These companies play a vital role in shaping the competitive landscape of the Copper Fungicides market through their extensive product portfolios, strategic initiatives, and innovative approaches.

Market Key Players

- ADAMA

- Albaugh, LLC

- Bayer AG

- Aktiengesellschaft

- Certis USA LLC

- Cinkarna Celje dd

- Corteva

- Cosaco

- Isagro S.p.A.

- MAT Holdings S.L.

- Nordox AS

- Nufarm

- Quimetal

- UPL Limited

- Zhejiang Hisun Group Co. Ltd. And Mitsui & Co.Ltd

Report Scope

Report Features Description Market Value (2023) USD 1299.9 Mn Forecast Revenue (2033) USD 2338.9 Mn CAGR (2023-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Conventional Farming, Organic Farming), By Chemistry(Copper Oxychloride, Copper Hydroxide, Cuprous Oxide, Copper Sulfate, Others), By Formulation(Water-dispersible Granules (WG), Wettable Powder (WP), Soluble granules (SG), Others), By Application(Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ADAMA, Albaugh, LLC, Bayer AG, Aktiengesellschaft, Certis USA LLC, Cinkarna Celje dd, Corteva, Cosaco, Isagro S.p.A., MAT Holdings S.L., Nordox AS, Nufarm, Quimetal, UPL Limited, Zhejiang Hisun Group Co. Ltd. And Mitsui & Co.Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Copper Fungicides market?Copper Fungicides market size is expected to be worth around USD 2338.9 Million by 2033, from USD 1299.9 Million in 2023

What is the CAGR for the Copper Fungicides Market?The Copper Fungicides Market expected to grow at a CAGR of 6.1% during 2023-2033.Who are the key players in the Copper Fungicides Market?ADAMA, Albaugh, LLC, Bayer AG, Aktiengesellschaft, Certis USA LLC, Cinkarna Celje dd, Corteva, Cosaco, Isagro S.p.A., MAT Holdings S.L., Nordox AS, Nufarm, Quimetal, UPL Limited, Zhejiang Hisun Group Co. Ltd. And Mitsui & Co.Ltd

-

-

- ADAMA

- Albaugh, LLC

- Bayer AG

- Aktiengesellschaft

- Certis USA LLC

- Cinkarna Celje dd

- Corteva

- Cosaco

- Isagro S.p.A.

- MAT Holdings S.L.

- Nordox AS

- Nufarm

- Quimetal

- UPL Limited

- Zhejiang Hisun Group Co. Ltd. And Mitsui & Co.Ltd