Global Precision Farming Market By Offering (Services, Hardware, and Software), By Application (Yield Monitoring, Inventory Management, Crop Scouting, Farm labor Management, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 12401

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

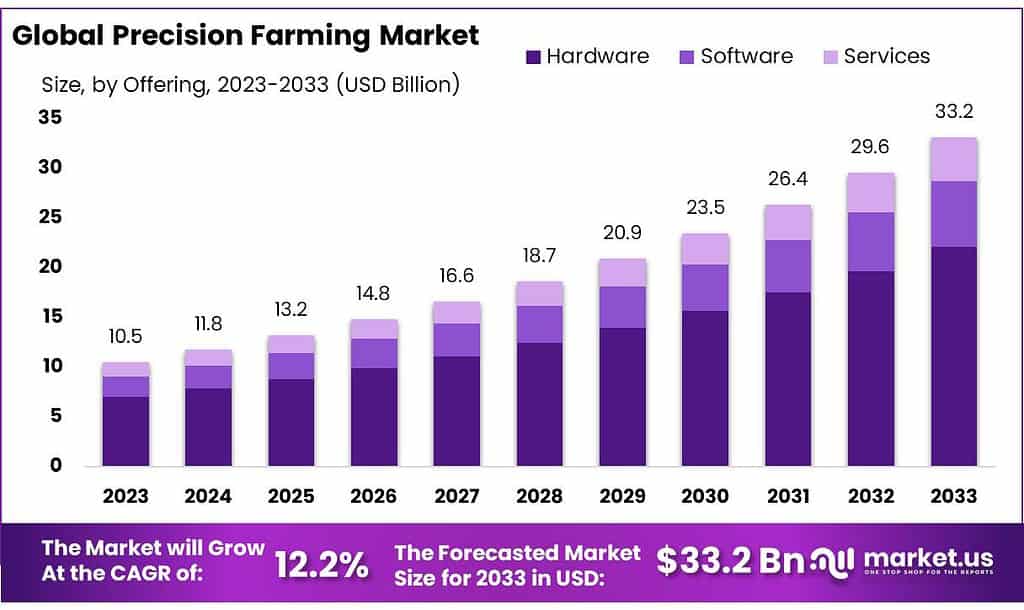

The global precision farming market size is expected to be worth around USD 33.2 billion by 2033, from USD 10.5 billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2023 to 2033.

The burgeoning use of advanced analytical tools by farmers and the Internet of Things (IoT), has contributed to the rise of precision agriculture. Advanced analytics is a component of data science. It uses multiple tools and methods that forecast data to ensure that crops and soil are well-nourished. This helps farmers plan their actions.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The precision farming market is projected to witness substantial growth, with an expected worth of approximately USD 33.2 billion by 2033, showing a significant increase from USD 10.5 billion in 2023. The projected Compound Annual Growth Rate (CAGR) stands at 12.2%.

- Technological Advancements: Advanced analytics, IoT, and the use of sophisticated tools like sensors, drones, and GPS systems are pivotal in driving the growth of precision agriculture. These technologies aid in data collection, enabling farmers to make informed decisions about crops and soil health.

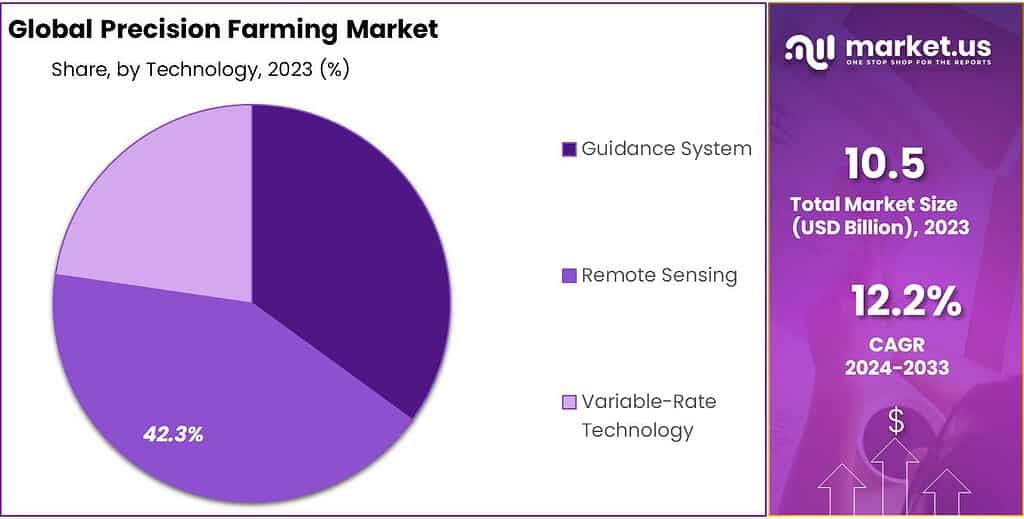

- Segment Dominance: In 2023, hardware emerged as the leading segment in the precision farming market, particularly automation and control systems, sensing, and drones, accounting for over 66.6% of the market share. Among technologies, Remote Sensing held a dominant position, securing over 42.3% of the market share.

- Application Significance: Yield Monitoring stood out as the primary application in 2023, capturing over 48.7% of the market share. It involves tracking and analyzing crop output throughout the growing season, providing crucial insights for farmers to enhance productivity.

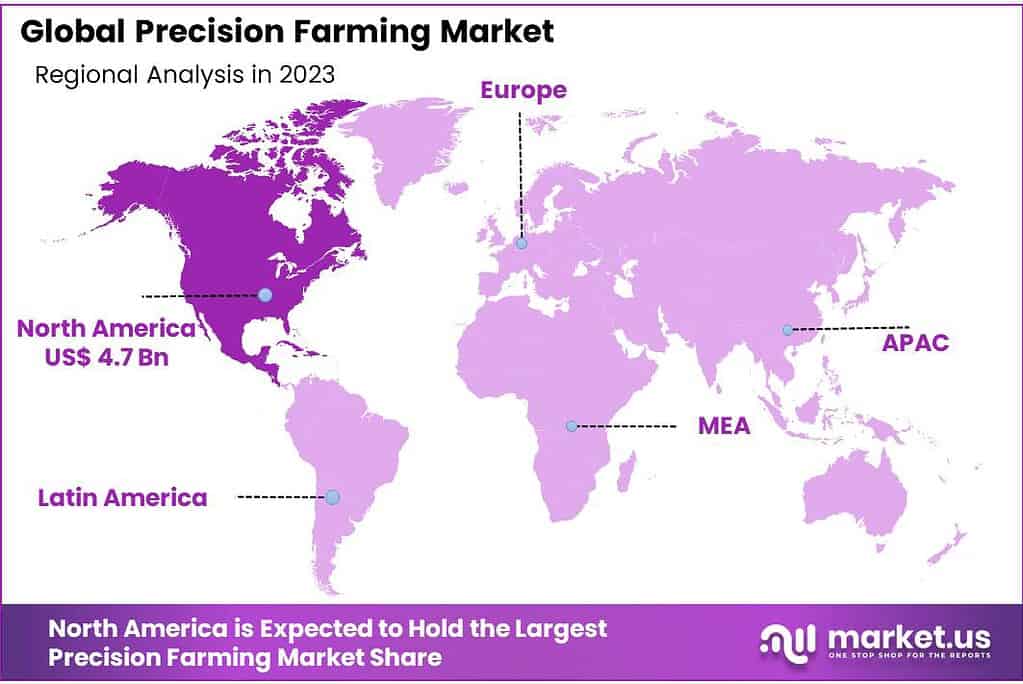

- Regional Influence: North America led the market in 2023 with a 45.5% revenue share, owing to early technology adoption, government support, and developed infrastructure. Meanwhile, the Asia Pacific region is projected to witness significant growth, driven by initiatives in countries like India, Nigeria, and Sri Lanka, aiming to increase productivity through modern agricultural technologies.

- Key Players and Innovations: Major market players like Deere & Company, Trimble Inc., AGCO Corporation, and others are actively involved in strategic acquisitions and technological advancements to cater to the growing demands of precision farming.

- Challenges & Opportunities: Challenges include ensuring data security and bridging the technological gap in rural areas, where internet connectivity might hinder the adoption of advanced farming techniques. However, opportunities lie in the utilization of digital tools, specialized software, and sustainable farming practices to increase yield, support the environment, and gain profitability.

Offering Type Analysis

In 2023, Hardware took the lead in the precision farming market, owning over 66.6% of the market share. This includes physical tools like sensors, drones, and GPS systems that help gather data on crops and soil conditions.

The hardware segment is further divided into automation and controls, sensing and antennas, and access points. Automation and control systems, sensing, and drones are all key components in helping farmers.

GIS guidance systems, for example, are very useful to growers because they can see the agricultural workflow and the surrounding environment. VRT technology allows farmers to identify areas where they need more pesticides and seeds, and then distribute them equally throughout the field.

The software segment is split based on web and cloud-based precision agriculture. Cloud computing eliminates high maintenance costs and high operating costs by focusing on shared networks and servers. Accordingly, the software market is forecast to experience a CAGR exceeding 15.9% in the forecast period. Predictive analytics software guides farmers on crop rotation, soil management, and optimal planting times.

By Technology

In 2023, Remote Sensing emerged as the frontrunner in the precision farming market, securing over 42.3% of the market share. This technology involves using drones or satellites to gather data on crop health, soil moisture, and other vital factors from a distance, aiding farmers in making informed decisions.

Guidance Systems are also significant, providing accurate navigation for farming equipment like tractors and harvesters. These systems ensure precise and efficient operations in the field, reducing overlaps and optimizing resource usage.

Variable-Rate Technology (VRT) allows farmers to customize the application of inputs like fertilizers and pesticides based on specific areas’ needs within a field. This targeted approach maximizes yields while minimizing waste.

Each technology – Remote Sensing, Guidance Systems, and variable rate Technology – plays a pivotal role in modernizing agriculture, empowering farmers to adopt more efficient and sustainable practices.

Note: Actual Numbers Might Vary In the Final Report

Application Analysis

In 2023, Yield Monitoring stood out in the precision farming market, grabbing over 48.7% of the market share. This application involves tracking and analyzing crop output throughout the growing season, providing farmers with valuable insights into their productivity.

It helps farmers make decisions about their farms. On-farm yield monitors and off-farm monitoring are further sub-categories of this segment. On-farm monitoring allows farmers access to real-time data during harvest, and can also create a historical spatial dataset.

This segment is expected to be the largest in the precision farming market because it provides equitable landlord negotiations and documentation of environmental compliance.

The segment of irrigation management will see significant growth during the projection period. Smart irrigation is the application of multiple technologies such as rain sensors, weather controllers, sensor controllers, and water meters to determine the correct amount of irrigation water. These benefits will drive the adoption and use of irrigation drones.

Weather forecasters are able to forecast accurately by using sensors. Machine learning techniques and advanced data analysis services have also helped to increase the accuracy and reliability of forecasts, which has accelerated the market’s growth.

Key Market Segments

By Offering Type

- Services

- Maintenance & Support

- System Integration & Consulting

- Managed Services

- Assisted Professional Services

- Hardware

- Automation & Control Systems

- Application Control Devices

- Drones

- Guidance System

- Remote Sensing

- Other Automation & Control Systems

- Software

- Web-based

- Cloud-based

By Technology

- Guidance System

- Remote Sensing

- Variable-Rate Technology

By Application

- Yield Monitoring

- On-farm

- Off-farm

- Inventory Management

- Crop Scouting

- Farm labor Management

- Other Applications

Drivers

Implementing high-tech sensors, GPS tracking devices and data tools into farm machines has become a standard in modern agriculture. Farmers are taking to fitting these innovative gadgets onto tractors, drones, and harvesters in order to make operations run more smoothly – this mash-up improves data collection while making work faster and facilitating smart decisions.

Modern farms use sophisticated machines with smart sensors that monitor soil, crops, and weather in real-time. GPS helps them move precisely along exact paths for planting, spraying, and harvesting; thus covering more ground without spending too much time going back over old spots.

Variable Rate Technology (VRT) allows farmers to utilize variable fertilizer usage based on what each area of their field requires, saving resources while improving crops.

One advantage is that these machines can operate without direct human control, reducing work for farmers and the costs associated with hiring helpers.

Farmers who utilize intelligent software are better able to make decisions regarding watering, feeding, and pest management on their land – yielding greater harvest while being more environmentally friendly.

Drones play an invaluable role in this process! Drones help identify problems such as sick crops or insects quickly so that farmers can address these problems swiftly.

All these smart measures help farmers do their jobs more effectively, producing more food without harming the environment.

Restraints

Rural areas where farming is an integral component can sometimes experience poor internet connection speeds or reliability, making it challenging for farmers to use all the modern tech they’d like for precise farming decisions – without reliable internet, sensors and drones cannot send data in real-time to make smart farming decisions.

Attaining accurate analyses requires an excellent internet connection, while without good infrastructure farmers cannot take advantage of modern farming methods which require ongoing communication and sharing of information.

That means farmers in these rural areas might miss out on using technology to conserve resources and produce higher-yield crops. To address this, we need to ensure these rural spots have adequate internet and infrastructure, enabling farmers there to take advantage of advanced farming methods and maximize crop production more efficiently.

Opportunities

Digital tools and specialized software for agriculture are becoming ever more essential to their work. This software gathers data from sensors, drones, and satellites before compiling it all in one convenient place so farmers can make fast decisions based on current conditions in their fields.

These tools help farmers keep an eye on all activities happening on their farm, from crops and machines to resources being utilized more effectively, when water or fertilizers need to be used, and testing out new ways of growing crops; all to increase food yield while working smarter.

Precision farming is also good for the environment. People want food that does not harm nature too severely; precision farming helps by using just enough water and fertilizers – this means less wasteful chemicals in the environment and better overall results for people concerned with sustainability. Precision farming meets this desire perfectly!

By practicing sustainable farming practices, farmers can also sell their products more profitably in markets that prioritize eco-friendly goods. Doing it this way gives farmers a distinct edge in the farming world and could make all of them stand out and do well in business.

By employing these high-tech farming methods, farmers not only increase production but also support nature – creating an ideal win-win scenario!

Challenges

A big challenge in high-tech farming is keeping data safe and private. All the info collected from sensors, drones, and satellites is important but also needs protection. It could include stuff like how well crops are growing, soil details, and even personal farmer info.

To make this work, farmers and tech folks need to make sure this data doesn’t get into the wrong hands. They have to keep it safe from hackers and other people who shouldn’t see it. This builds trust between farmers and the tech guys, making it easier to share data and use cool farming tech.

To keep data safe, they use strong codes to lock it up, keep it in safe places, and control who gets to see it. Being clear about how the data will be used and following rules about it also helps farmers feel better about sharing.

By making sure data stays private and secure, the farming industry can build trust. This means farmers can use all the cool tech without worrying about their private info getting out there.

Regional Analysis

North America had a 45.5% revenue share, the largest in 2023. This region is an early adopter and benefactor of technology. High revenue has been achieved by factors like increased support from the government for the adoption of modern agricultural technologies as well as the developed infrastructure.

To increase awareness among farmers, the National Institute of Food and Agriculture conducts geospatial and sensor programs. NIFA works in partnership with Land Grand universities to help farmers develop robust sensors, software, and instrumentation that can be used for modeling, observing, and analyzing a variety of complex biological materials.

The Asia Pacific is expected to see significant growth in the forecasted duration. This region is projected to experience an increase in its GDP by more than 16.1% between 2023 and 2032. In order to increase productivity, there are many government initiatives in countries like India, Nigeria, and Sri Lanka.

China and Israel reached a trade deal in September 2017 that was worth US$ 300 million to allow the export of eco-friendly Israeli technology. A solid administrative framework also allows farmers to learn the correct use and maintenance of precision farming equipment.

Note: Actual Numbers Might Vary In the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Major players in this market include AgJunction Inc., Ag Leader Technology Inc. (U.S.), CropMetrics LLC (U.S.), and AGCO Corporation, among others. The growing demands of precision farming are making conventional farming methods unsuitable. It is no surprise that major players are involved in strategic acquisitions and technological innovations.

Key Market Players

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- AgJunction LLC

- Raven Industries, Inc.

- AG Leader Technology

- Teejet Technologies

- Topcon

- Taranis

- AgEagle Aerial Systems Inc

- ec2ce

- Descartes Labs, Inc.

- Granular Inc.

- Hexagon AB

- Climate LLC

Recent Development

In July 2023, Deere & Company acquired Smart Apply, Inc. (US), a precision spraying equipment company. The acquisition aims to strengthen the emphasis on high-value crop customers and dealers, while also broadening the range of solutions available to assist growers in tackling their primary concerns regarding labor, input costs, and regulatory compliance.

In April 2023, AGCO Corporation revealed its partnership with Bosch BASF Smart Farming to introduce and market Smart Spraying technology on Fendt Rogator sprayers. Furthermore, both companies will collaborate to develop additional innovative features.

In August 2022, Trimble Inc. and CLAAS entered a strategic alliance to develop an advanced precision farming system for CLAAS tractors collaboratively, combines, and forage harvesters. The precision farming system comprises the cutting-edge CLAAS CEMIS 1200 smart display, GPS PILOT steering system, and the SAT 900 GNSS receiver. Within this system, the CEMIS display leverages Trimble’s latest embedded modular software architecture, facilitating precise positioning, steering, and seamless connectivity to control and monitor implements in the field using ISOBUS technology.

In August 2022, Trimble Inc. entered into a definitive agreement to acquire Bilberry, a privately held French technology company known for its expertise in selective spraying systems for sustainable agriculture. Bilberry is at the forefront of using artificial intelligence (AI) technology to identify various weed species in real time across a wide range of crops. This strategic acquisition will enhance Trimble’s crop protection portfolio by incorporating green-on-green selective spraying capabilities and will further bolster their efforts in developing autonomous agricultural solutions.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Billion Forecast Revenue (2033) USD 33.2 Billion CAGR (2023-2032) 12.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering Type(Services, Hardware, Software), By Technology(Guidance System, Remote Sensing, Variable-Rate Technology), By Application(Yield Monitoring, Inventory Management, Crop Scouting, Farm labor Management, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Deere & Company, Trimble Inc., AGCO Corporation, AgJunction LLC, Raven Industries, Inc., AG Leader Technology, Teejet Technologies, Topcon, Taranis, AgEagle Aerial Systems Inc, ec2ce, Descartes Labs, Inc., Granular Inc., Hexagon AB, Climate LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- AgJunction LLC

- Raven Industries, Inc.

- AG Leader Technology

- Teejet Technologies

- Topcon

- Taranis

- AgEagle Aerial Systems Inc

- ec2ce

- Descartes Labs, Inc.

- Granular Inc.

- Hexagon AB

- Climate LLC