Global Micro-Irrigation Systems Market By Type (Drip Irrigation (Surface Drip Irrigation, Sub-surface Drip Irrigation, Online Drip, Others), Sprinkler Irrigation (Micro-sprinklers, Centre Pivot, Towable Pivot, Others), Bubbler Irrigation, Others), By Crop Type (Field Crops, Orchard And Vineyards, Plantation Crops, Fruits And Vegetables, Others), By Application (Open Field Agriculture, Protected Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 14148

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

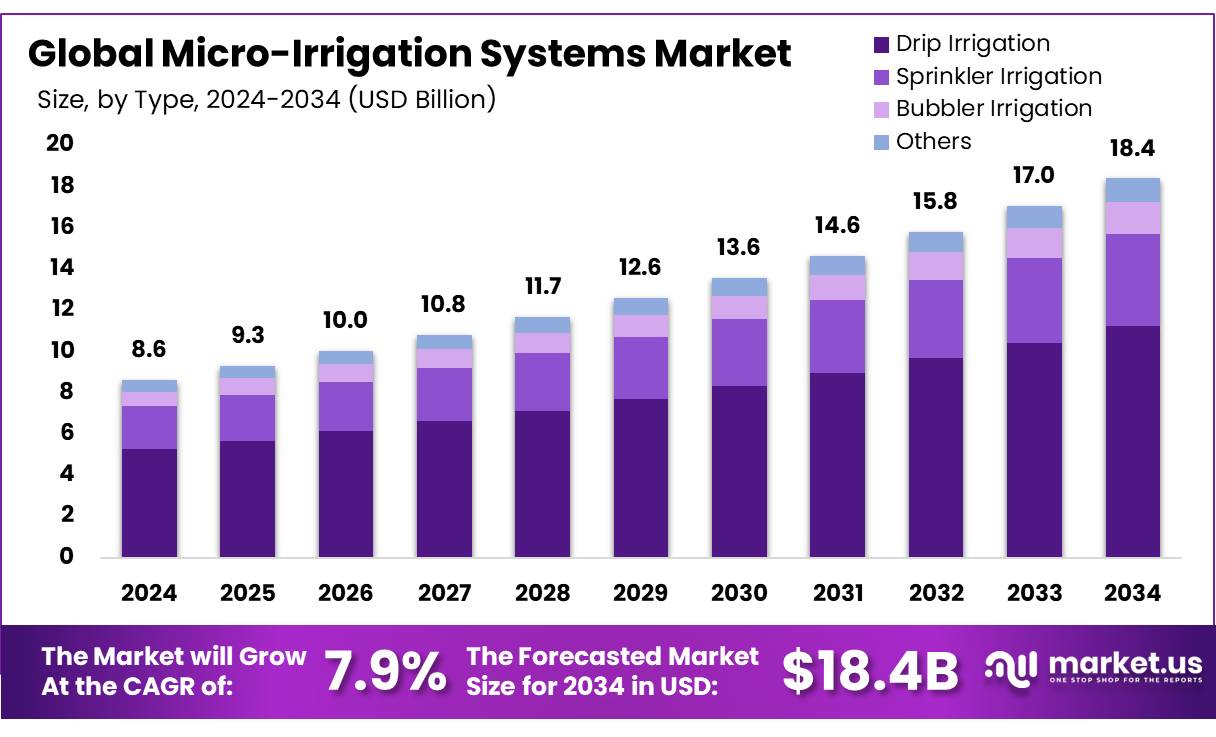

The Global Microirrigation Systems Market size is expected to be worth around USD 18.4 Billion by 2034, from USD 8.6 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Microirrigation systems, also known as drip or trickle irrigation, is a low-pressure irrigation method that delivers water directly to the root zone of plants in a precise, slow, and controlled manner.

These systems are different from traditional irrigation systems that cover large areas through overhead spraying or flooding, microirrigation systems market minimizes water loss due to evaporation, runoff, and deep percolation by applying water directly to the soil surface or subsurface through components such as drip lines, emitters, filters, control valves, and pressure regulators. This technology includes a variety of systems such as drip, sprinkler, mist, and fog irrigation, all designed to optimize water and nutrient use at the plant level.

With proven gains in water-use efficiency and crop productivity, supported by government incentives and technological innovation, micro-irrigation is becoming a key solution for climate-resilient farming. Microirrigation is gaining traction in urban agriculture, including rooftop and vertical farming, and is increasingly integrated with smart farming technologies like GPS-based precision irrigation and wireless sensor networks. These innovations allow for site-specific application of water and agrochemicals, improving both productivity and sustainability.

Key Takeaways

- The global micro-irrigation systems market was valued at USD 8.6 billion in 2024.

- The global micro-irrigation systems market is projected to grow at a CAGR of 7.9 % and is estimated to reach USD 18.4 billion by 2034.

- Among types, drip irrigation accounted for the largest market share of 61.2%.

- Among crop types, field crops accounted for the majority of the market share at 46.4%.

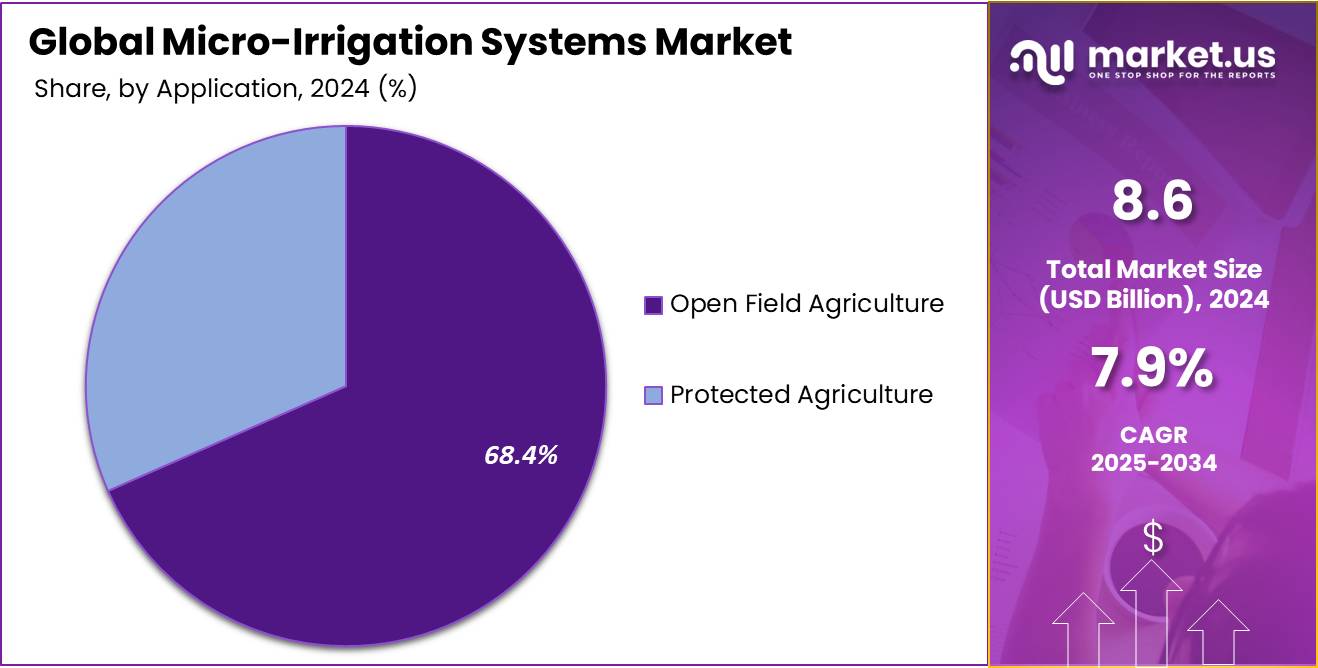

- By application, open-field agriculture accounted for the largest market share at 68.4%.

- North America is estimated as the largest market for Micro-Irrigation Systems with a share of 48.4% of the market share.

Product Type Analysis

The Drip Irrigation Segment Held A Significant Revenue Share Of 61.2%

The micro-rigation systems market is segmented based on type into drip irrigation, sprinkler irrigation, bubbler irrigation, and others. In 2024, the drip irrigation segment held a significant revenue share of 61.2%. This growth is largely attributed to its high water-use efficiency, making it ideal for regions facing water scarcity.

Drip systems deliver water and nutrients directly to the root zone, minimizing evaporation and runoff while maximizing plant uptake. The technology is especially effective for high-value crops like fruits, vegetables, and vineyards, where precision irrigation leads to better yields and quality. Additionally, increased government support and subsidies for water-saving technologies have further accelerated the adoption of drip irrigation systems worldwide.

Crop Type Analysis

The Predominance Of The Field Crops, Commanding A Substantial 46.4% Market Share

Based on crop type, the market is further divided into field crops, orchards & vineyards, plantation crops, fruits & vegetables, and others. The predominance of the field crops, commanding a substantial 46.4% market share in 2024. This dominance is driven by the large-scale cultivation of staple crops such as wheat, maize, rice, and pulses, particularly in developing regions with water scarcity challenges.

Governments across countries like India, China, and Brazil have introduced subsidy programs and irrigation mandates to encourage efficient water use in field crop production. The rising need to boost productivity while conserving resources in expansive agricultural lands has accelerated the adoption of drip and sprinkler irrigation systems in this segment.

Application Analysis

the Open Field Agriculture Segment Emerging As The Dominant Application, Holding 68.4% Of The Total Market Share.

By application, the market is categorized into open field agriculture, and protected agriculture. with the open field agriculture segment emerging as the dominant application, holding 68.4% of the total market share in 2024. This dominance is primarily due to the widespread adoption of micro-irrigation systems in large-scale farming of cereals, pulses, and oilseeds across vast rural landscapes.

Government subsidies, especially in countries with water-stressed environments, have played a crucial role in promoting micro-irrigation for open-field farming. Additionally, the growing need to improve irrigation efficiency and crop productivity in traditional agricultural regions has further fueled the segment’s expansion.

Key Market Segments

By Type

- Drip Irrigation

- Surface Drip Irrigation

- Sub-surface Drip Irrigation

- Online Drip

- Others

- Sprinkler Irrigation

- Micro-sprinklers

- Centre Pivot

- Towable Pivot

- Others

- Bubbler Irrigation

- Others

By Crop Type

- Field Crops

- Orchard & Vineyards

- Plantation Crops

- Fruits & Vegetables

- Others

By Application

- Open Field Agriculture

- Protected Agriculture

Drivers

Growing Emphasis On Agriculture Water Managements

The growing emphasis on agricultural water management is a key factor driving the expansion of the global micro irrigation systems market. Increasing water scarcity, climate change, and the urgent need for sustainable food production are raising the demand for efficient irrigation solutions. Water scarcity significantly impacts agricultural productivity, as insufficient water supply limits crop irrigation, leading to reduced yields, increased food insecurity, malnutrition, and broader socioeconomic challenges. To address these challenges, micro-irrigation systems such as drip and sprinkler irrigation offer a highly effective solution to reduce water consumption and improve irrigation efficiency compared to traditional surface irrigation.

- For instance, According to the UN FAO, agriculture is responsible for about 70% of global freshwater withdrawals and accounts for nearly 90% of total freshwater consumption worldwide.

- Additionally, The World Bank estimates that agricultural water demand will increase by an additional 15% by 2050 to meet the needs of the growing global population.

- For instance, According to the U.S. Environmental Protection Agency, microirrigation systems market use 20 to 50% less water than traditional spray sprinklers. This can save an average household over 25,000 gallons of water annually.

Additionally, microirrigation systems market not only conserves water by minimizing losses from evaporation, runoff, and deep percolation but also enhances crop productivity by 20% to 90%. Fertigation through drip systems delivers nutrients directly to plant roots, reducing fertilizer use and waste while improving soil health and crop yields.

Advances in GPS-based precision irrigation and wireless sensor networks allow for site-specific and precise application of water and agrochemicals, further optimizing resource use. As water management gains importance globally, these technologies are critical in driving market growth by supporting sustainable agricultural practices that address both water scarcity and food production challenges.

- The World Health Organization estimates that by 2050, 70% of the global population will reside in urban areas. This rapid urbanization, along with rising food demand and unsustainable farming practices, is accelerating farmland degradation, thereby driving the adoption of micro-irrigation as a key sustainable agricultural practice.

Furthermore, governments across water-scarce regions such as the Middle East, parts of Africa, and Southern Asia are increasingly implementing targeted policies and financial incentives to promote the adoption of micro-irrigation. Recognizing the importance of micro-irrigation to improve water-use efficiency, several governments have launched dedicated schemes aimed at encouraging the use of technologies such as drip and sprinkler irrigation. These initiatives are designed to support sustainable agriculture by reducing water consumption and enhancing productivity. By promoting modern irrigation practices, policymakers are positioning micro-irrigation as a long-term solution to both water scarcity and food security challenges.

- For instance, the World Bank’s support for the Tunisia Irrigated Agriculture Intensification Project reflects a strategic push toward water-efficient farming, promoting drip and micro-irrigation systems to address growing water scarcity in North Africa.

- In Morocco and Algeria, similar efforts are being led by the Global Water Partnership (GWP), which has focused on strengthening local capacity through targeted training programs in drip irrigation and integrated water management, supporting the region’s shift toward more sustainable agricultural practices.

- For instance, the Great Man-Made River (GMR) project, initiated by the governments of Libya and Egypt, is one of the world’s largest irrigation efforts, supporting agricultural water supply with micro-irrigation technologies playing a central role in improving water efficiency.

- The Indian government has also provided support for micro-irrigation by implementing the Centrally Sponsored Scheme (CSS), which offers subsidies and technical assistance to farmers to encourage the widespread adoption of efficient irrigation technologies.

Restraints

High Maintenance Demand in Sandy and Silty Soil Condition.

The high maintenance demand associated with sandy and silty soils remains one of the key factors restraining the growth of the global micro irrigation systems market. In sandy soils rapid water infiltration and poor moisture retention, water applied through microirrigation systems market tends to drain quickly beyond the root zone. This rise needs more frequent, shorter irrigation cycles to maintain optimal soil moisture, placing greater operational pressure on pumps, emitters, and valves.

Over time, this increases system wear, raises maintenance requirements, and demands consistent monitoring to ensure performance reliability further limiting the adoption of micro-irrigation systems in sandy soil regions. Furthermore, Silty soils, while offering better water-holding capacity than sandy soils, bring their own set of challenges. These soils are vulnerable to surface crusting and uneven water distribution, particularly if irrigation is not precisely managed.

The fine texture of silt increases the likelihood of emitter clogging, necessitating frequent maintenance of filters and drip components. Effective use of microirrigation systems market in these soils often requires careful scheduling, regular system flushing, and the use of advanced automation to maintain efficiency. However, these added complexities and ongoing costs can limit adoption, especially among smallholder farmers, ultimately slowing the wider growth of micro-irrigation systems in regions with these soil types.

- For instance, in Florida, large-scale citrus groves are typically planted on sandy soils with low water-holding capacity, causing water from micro-irrigation systems to drain quickly below the root zone. To manage this, growers are required to irrigate more frequently with shorter cycles and use closely spaced drippers to keep moisture near the roots which increases system maintenance and operational demands.

Opportunity

Expansion of Vertical And Rooftop Farming In Urban Spaces Using Micro-Irrigation

The expansion of vertical and rooftop farming in urban areas is emerging as a significant growth opportunity for the global micro irrigation systems market. As urban populations rise and space for conventional agriculture becomes increasingly limited, innovative farming solutions such as vertical and rooftop farming are gaining momentum. Growers around the world’s vertical and rooftops integrated with micro-irrigation systems, particularly drip and sprinkler technologies these urban agriculture models offer an efficient solution for producing food locally while conserving water, reducing transportation-related emissions, and enhancing urban sustainability.

Furthermore, microirrigation systems market plays a critical role in these systems by delivering water directly to plant roots, minimizing evaporation and runoff, and ensuring precise nutrient management. In many urban farms that use hydroponics or soilless substrates, micro-irrigation supports closed-loop systems that recycle water and reduce usage by up to 90–95% compared to traditional farming. Additionally, rooftop farms utilizing these technologies contribute to improved stormwater management and better urban water conservation. As more cities adopt sustainable food production strategies, the demand for micro-irrigation systems tailored to urban and small-scale applications is expected to rise, creating a new avenue for market expansion.

Trends

Construction of Micro-Irrigation System With Renewable Energy Sources.

The integration of renewable energy sources particularly solar power with microirrigation systems is shaping a significant trend in the global microirrigation systems market. By combining the water-saving efficiency of drip and sprinkler irrigation with the environmental and economic benefits of solar energy, this approach offers a highly sustainable solution for modern agriculture. Solar-powered micro-irrigation systems enable farmers to reduce dependence on fossil fuels, lower operational costs, and minimize greenhouse gas emissions, aligning with global efforts toward climate-resilient farming practices. This trend is especially relevant in off-grid or energy-insecure regions, where unreliable electricity access hampers agricultural productivity.

Solar-driven pumps provide consistent and autonomous irrigation, enhancing crop yields while reducing input costs associated with diesel or kerosene fuels. Furthermore, by expanding the area of arable land under irrigation, these systems contribute to improved food security and rural income generation. The added vegetative cover also supports soil conservation, addressing land degradation. As governments and development agencies continue to promote renewable energy in agriculture, the adoption of solar-powered micro-irrigation systems is expected to accelerate, driving forward both market growth and environmental sustainability.

Geopolitical Impact Analysis

Geopolitical Uncertainty Disrupts Microirrigation System Supply Chains

Geopolitical instability has a substantial impact on the supply chain of micro-irrigation systems, impacting raw material sourcing, manufacturing cross-border logistics, and market accessibility. Many critical components of microirrigation systems such as plastic polymers, filtration units, sensors, valves, and emitters are sourced or manufactured in different regions of the world. Different trade and wars between countries impact the availability and price of these materials.

Furthermore, Trade tensions, tariffs, and sanctions between major economies including U.S.-China, EU-Russia, or India-Pakistan and Israel -Iran can disrupt the supply flow of microirrigation products and raw materials, leading to price volatility and component shortages. Such as import restrictions or export bans on plastics, electronics, or agricultural machinery parts can delay production timelines and increase operational costs for manufacturers and distributors.

- In April 2025, the U.S. government imposed a 10% universal import tariff on nearly all products, with a second round of reciprocal tariffs (up to 50%) targeting imports from 57 countries. These tariffs are affecting microirrigation manufacturing, raw material sourcing, and equipment imports.

Additionally, conflicts or political instability in key transit regions such as the Red Sea, Suez Canal, or major port hubs can interrupt shipping routes and logistics, causing delays and uncertainty in delivery schedules. Such disruptions may particularly affect developing regions dependent on imported micro-irrigation technologies and limit the timely implementation of irrigation projects.

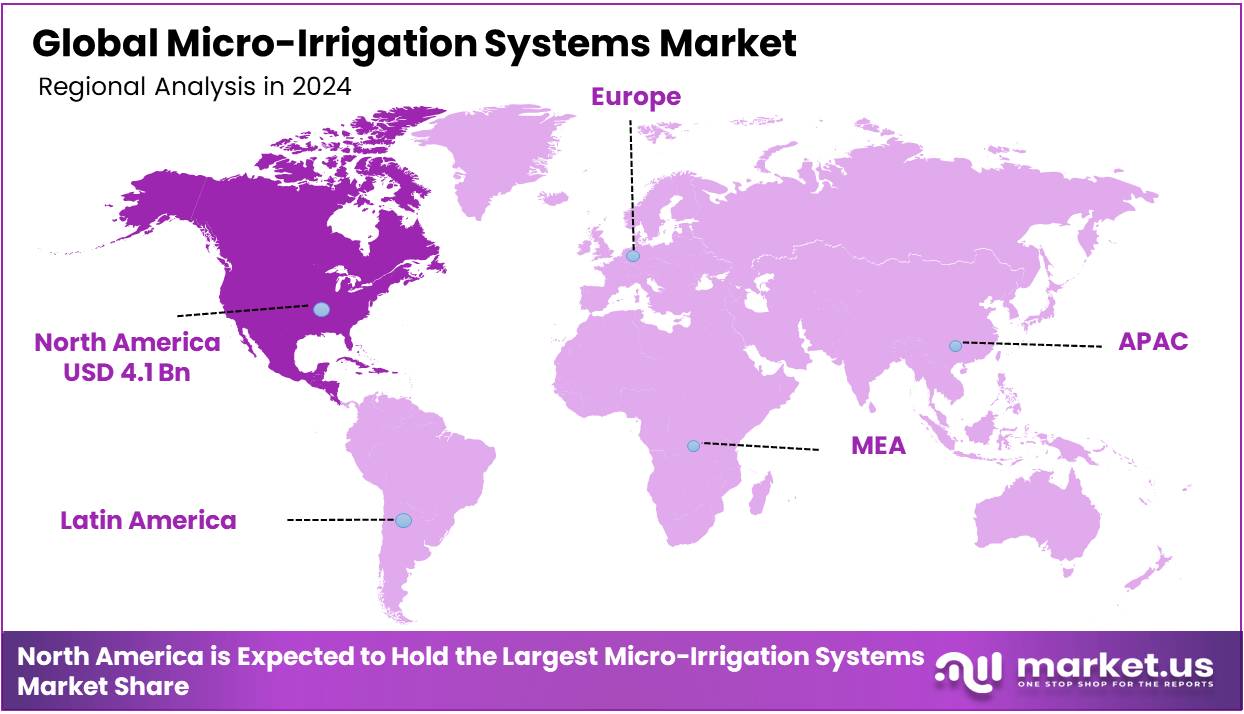

Regional Analysis

North America Held the Largest Share of the Global Micro-Irrigation Systems Market

In 2024, North America dominated the global micro-irrigation systems market, accounting for 48.4% of the total market share, Driven by a combination of technological innovation, increasing water scarcity concerns, and strong policy support for sustainable agriculture. The region has been quick to adopt advanced irrigation solutions, with farmers and agribusinesses recognizing the long-term benefits of micro-irrigation in enhancing water-use efficiency and improving crop yields.

Furthermore, the integration of renewable energy, particularly solar power, with micro-irrigation systems is emerging as a significant trend across the region. This approach not only addresses high energy costs and environmental concerns but also supports irrigation in off-grid or remote farming areas, particularly in parts of the western United States and rural Mexico.

- According to the U.S. Geological Survey, in 2015, irrigation withdrawals in the United States were estimated at 118,000 million gallons per day, covering approximately 63.5 million acres of farmland. Of this, only about 5.49 million acres less than 10% were irrigated using drip or micro-irrigation systems, highlighting significant potential for wider adoption of efficient irrigation technologies across the country.

Collaborations such as the exclusive distribution agreement between Rivulis and Dragon-Line in the U.S., Canada, and Mexico reflect a growing interest in modernizing traditional pivot systems with mobile drip irrigation technologies. These innovations are helping transform large-scale commercial farms as well as smaller operations by reducing water consumption, improving fertilizer efficiency, and lowering carbon footprints. With increased government incentives for renewable energy use in agriculture and a growing emphasis on sustainable food production, North America is expected to remain a key market for micro-irrigation system expansion in the coming years.

- The World Bank and Inter-American Development Bank provide funding in Colombia and Mexico to accelerate the transition from traditional irrigation methods to advanced micro-irrigation systems.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Global Microirrigation Market Driving Growth Through Continuous Innovation, Global Expansion, And Strategic Partnerships.

The global micro-irrigation systems market is led by key players such as Jain Irrigation Systems, Netafim, Rivulis Irrigation, Rain Bird Corporation, and The Toro Company. These companies dominate the market through technological innovation, global distribution networks, and strategic mergers—such as the Rivulis-Jain Irrigation international merger. Their focus on sustainable irrigation solutions and smart technologies has strengthened their presence across both emerging and developed markets. Together, they play a pivotal role in advancing water-efficient agriculture globally.

The Major Players in the Industry

- Jain Irrigation Systems Ltd.

- Nelson Irrigation

- Netafim Limited

- Lindsay Corporation

- Rivulis

- The Toro Company

- Rain Bird Corporation

- Finolex Plasson

- Mahindra EPC Irrigation Limited

- T-L Irrigation Co.

- Hunter Industries

- Chinadrip Irrigation Equipment Co., Ltd.

- Antelco

- Microjet

- Kothari Group

- Other Key Players

Recent Development

- In February 2025- Mahindra EPC Irrigation secured a ₹11.79 crore order to supply micro-irrigation systems for a 2,359-hectare community project, marking a key development in its growth strategy.

- In September 2023- Rivulis and Dragon-Line entered into an exclusive distribution agreement covering the U.S., Mexico, and Canada to launch a new Mobile Drip Irrigation System, enabling the conversion of center pivots from sprinklers to efficient drip systems. This collaboration reflects Rivulis’ innovation strategy and aims to improve water use efficiency and crop yields across North America.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Bn Forecast Revenue (2034) USD 18.4 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Drip Irrigation (Surface Drip Irrigation, Sub-surface Drip Irrigation, Online Drip, Others), Sprinkler Irrigation (Micro-sprinklers, Centre Pivot, Towable Pivot, Others), Bubbler Irrigation, Others), By Crop Type (Field Crops, Orchard & Vineyards, Plantation Crops, Fruits & Vegetables, Others), By Application (Open Field Agriculture, Protected Agriculture) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Jain Irrigation Systems Ltd., Nelson Irrigation, Netafim Limited, Lindsay Corporation, Rivulis, The Toro Company, Rain Bird Corporation, Finolex Plasson, Mahindra EPC Irrigation Limited, T-L Irrigation Co., Hunter Industries, Chinadrip Irrigation Equipment Co., Ltd., Antelco, Microjet, Kothari Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Microirrigation Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Microirrigation Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Jain Irrigation Systems Ltd.

- Nelson Irrigation

- Netafim Limited

- Lindsay Corporation

- Rivulis

- The Toro Company

- Rain Bird Corporation

- Finolex Plasson

- Mahindra EPC Irrigation Limited

- T-L Irrigation Co.

- Hunter Industries

- Chinadrip Irrigation Equipment Co., Ltd.

- Antelco

- Microjet

- Kothari Group

- Other Key Players