Global Frozen Pizza Market By Type (Non-vegetarian Frozen Pizza, and Vegetarian Frozen Pizza), By Crust Type (Thin Crust, Thick Crust, Stuffed , and Other Crust Types), By Toppings (Meat, Vegetables, Cheese, and Other Toppings) By Size (Regular, Large, and Extra-large) By Distribution Channel (Supermarkets/Hypermarkets , Convenience Stores , Specialty Stores, Online Retail , and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 13135

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

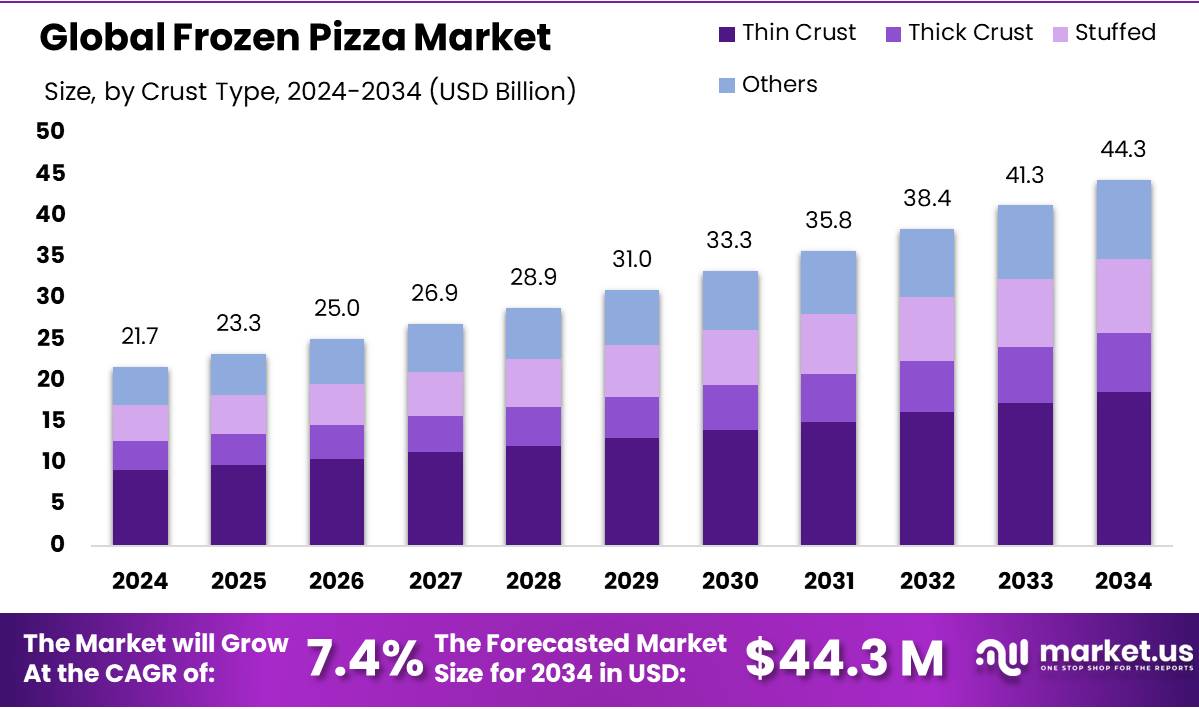

The Global Frozen Pizza Market size is expected to be worth around USD 44.3 Bn by 2034, from USD 21.7 Bn in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

Frozen pizza is a type of pizza that is pre-made and frozen for later consumption. It is typically made with a crust, sauce, cheese, and toppings, and is partially cooked before being frozen. Frozen pizzas can be found in a variety of flavors and styles, and are a popular convenience food option. Frozen pizza is a convenient and widely popular food product that combines the convenience of pre-prepared meals with the delicious flavors of traditional pizza.

There’s a growing demand for healthier alternatives, such as gluten-free and vegan frozen pizzas. These cater to specific dietary needs such as celiac disease, gluten intolerance, and plant-based diets. The market has seen a rise in offerings such as cauliflower crusts and vegan toppings, reflecting the shift towards more health-conscious eating habits.

Key Takeaways

- The global frozen pizza market will be valued at USD 21.7 billion in 2024.

- The global frozen pizza market is projected to reach USD 44.3 billion by 2034.

- Among crust types, thin-crust type frozen pizza accounted for the majority of the market share with 42.1%.

- Among types, non-vegetarian frozen pizza accounted for the largest market share of 61.6%.

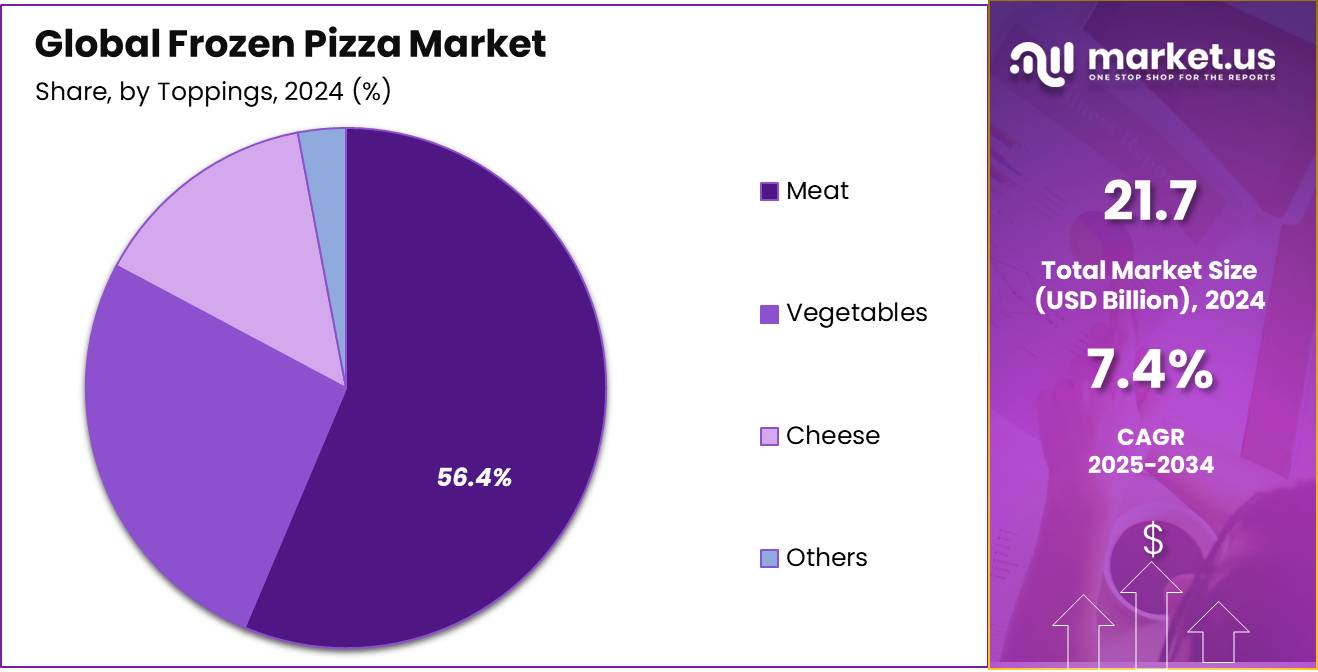

- Based on toppings, meat-based toppings are expected to account for the largest market share in 2024 with 56.4%.

- Among frozen pizza sizes, the large-sized frozen pizza is more popular among consumers, and thus, it holds a 53.3% revenue share.

- Based on the distribution channel, the supermarkets/hypermarkets segment is anticipated to account market share of 53.5%.

- 2 out of every 3 households in America eat frozen pizza regularly.

Regulatory Frameworks

Region/Country Regulatory Body/ Regulation Description United States Food and Drug Administration (FDA) Food Safety Modernization Act (FSMA)

The FDA regulates various aspects of food production, including frozen pizzas. The FDA has specific requirements for labeling, including ingredient lists, nutrition facts, and allergen declarations. The FSMA mandates preventive controls and hazard analysis to ensure the safety of frozen food products, including those in the frozen pizza category. Europe European Food Safety Authority (EFSA) Regulation (EU) No 1169/2011 on the provision of food information to consumers, which includes detailed requirements for food labeling. Crust Type Analysis

Owing to Their Crisp Texture, Thin Crust Frozen Pizzas Are Preferred Over Other Crust Types

The market is segregated into thin crust, thick crust, stuffed, and others based on a crust type. Among these, the thin crust type frozen pizza is more popular and thus accounted for the majority of the market share of 42.1% in 2024. Thin-crust pizzas generally contain fewer calories and less dough than their thick or stuffed counterparts.

As health and wellness trends continue to influence consumer choices, many opt for thin crust options as a way to enjoy pizza while consuming fewer calories and less bread. Several consumers prefer the crispy texture of a thin-crust pizza, especially when baked or reheated. The thin base can provide a satisfying crunch that contrasts well with the soft cheese and toppings.

Global Frozen Pizza Market, By Crust Type, 2020-2024 (USD Mn)

Crust Type 2020 2021 2022 2023 2024 Thin Crust 7,065.00 7,503.75 7,996.76 8,545.03 9,168.12 Thick Crust 2,876.87 3,029.28 3,190.87 3,358.17 3,542.03 Stuffed 3,448.86 3,645.41 3,866.26 4,111.53 4,390.24 Others 3,752.08 3,946.95 4,166.11 4,409.32 4,685.90 Crust Type 7,065.00 7,503.75 7,996.76 8,545.03 9,168.12 Type Analysis

Non-Vegetarian Frozen Pizza Accounted for The Largest Market Share Owing to Their Higher Popularity

The global frozen pizza market is segmented based on type into non-vegetarian frozen pizza and vegetarian frozen pizza. Among both, non-vegetarian frozen pizza holds the majority of the revenue share of 61.6% in 2024. Non-vegetarian pizzas, often topped with various meats such as pepperoni, sausage, and chicken, are popular in many cultures and are seen as the traditional or standard option in various regions. This popularity drives higher sales volumes.

In various Western countries, where frozen pizza consumption is high, meat-inclusive diets are prevalent. These dietary habits influence the demand for non-vegetarian frozen pizzas. There’s a wide variety of non-vegetarian frozen pizzas available, featuring different types of meats and combinations, appealing to a broad range of tastes.

Global Frozen Pizza Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Non-Veg 10,655.87 11,247.99 11,904.29 12,621.58 13,431.14 Veg 6,486.93 6,877.40 7,315.72 7,802.47 8,355.15 Toppings Analysis

The Demand for Meat Based Toppings is Boosting Due to the Availability of Variety of Options

The market is further divided into meat, vegetables, cheese, and others based on toppings. Among these, meat toppings accounted for the largest market share in 2024, with 56.4%. Meat toppings such as pepperoni, sausage, and ham are traditional favorites. They are often associated with a richer flavor and greater satisfaction, appealing to a broad consumer base that enjoys hearty and savory tastes.

The range of meat toppings available is extensive, from common options such as chicken and beef to more gourmet choices such as prosciutto or chorizo. This variety allows consumers to choose from a wide array of flavors and textures, catering to diverse palates. Meat toppings are often perceived as more premium compared to other options. Consumers might associate meat with higher value, making them more willing to pay a premium for meat-topped frozen pizzas.

Global Frozen Pizza Market, By Toppings, 2020-2024 (USD Mn)

Toppings 2020 2021 2022 2023 2024 Meat 9,656.39 10,215.78 10,836.08 11,514.95 12,280.80 Vegetables 4,412.80 4,693.13 5,008.17 5,358.69 5,757.11 Cheese 2,525.04 2,645.12 2,780.45 2,930.67 3,101.80 Others 548.57 571.36 595.31 619.73 646.59 Toppings 9,656.39 10,215.78 10,836.08 11,514.95 12,280.80 Size Analysis

Larger Frozen Pizzas Can Accommodate More or A Variety of Toppings, Catering to Diverse Taste References Within a Group; hence, They Are Anticipated to Hold the Majority of Revenue Share.

Based on size global frozen pizza market is segmented into regular, large, and extra-large. Among these, large-size frozen pizza is more popular and holds the majority of the market share at 53.3%. Larger pizzas offer more space for a variety of toppings, allowing for greater diversity in flavours and ingredients in a single pizza.

This variety caters to different taste preferences within a household or group, making it a versatile option. Purchasing a large frozen pizza is convenient as it reduces the frequency of cooking or buying meals, fitting well into the busy lifestyles of modern consumers. It also means fewer packaging materials and storage requirements compared to multiple smaller pizzas.

Global Frozen Pizza Market, By Size, 2020-2024 (USD Mn)

Size 2020 2021 2022 2023 2024 Large 9,018.64 9,564.52 10,173.12 10,843.80 11,602.95 Regular 6,658.31 7,014.48 7,414.99 7,859.58 8,365.10 Extra-large 1,465.85 1,546.38 1,631.90 1,720.66 1,818.25 Distribution Channel Analysis

Supermarkets/Hypermarkets Accounted for The Largest Revenue Share In The Frozen Pizza Market Primarily Due To Wide Product Assortment and Availability.

The market is segregated into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others. Among these, supermarkets/hypermarkets are estimated to account for the majority of revenue share of 53.5%. by 2024. Supermarkets and hypermarkets typically offer a wide range of frozen pizza brands and varieties, from premium to budget options.

Consumers appreciate the ability to choose from an extensive selection under one roof. Due to their size, supermarkets and hypermarkets can often offer more competitive prices compared to smaller retail formats. They benefit from economies of scale and can negotiate better terms with suppliers. These retailers frequently run promotions, discounts, and loyalty programs that attract consumers looking for value deals on frozen pizzas and other products.

Global Frozen Pizza Market, By Distribution Channel, 2020-2024 (USD Mn)

Distribution Channel 2020 2021 2022 2023 2024 Supermarkets/Hypermarkets 8,916.31 9,474.63 10,111.17 10,830.50 11,653.76 Convenience Stores 3,982.27 4,201.51 4,434.40 4,676.20 4,942.10 Specialty Stores 1,221.94 1,285.73 1,353.35 1,423.33 1,500.26 Online Retail 2,507.99 2,629.75 2,766.90 2,919.14 3,092.49 Others 514.28 533.77 554.18 574.88 597.69 Key Market Segments

By Type

- Non-vegetarian Frozen Pizza

- Vegetarian Frozen Pizza

By Crust Type

- Thin Crust

- Thick Crust

- Stuffed

- Other Crust Types

By Toppings

- Meat

- Vegetables

- Cheese

- Other Toppings

By Size

- Regular

- Large

- Extra-large

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Demand for Convenience and Time-saving Meal Options Driving the Global Frozen Pizza Market Growth

In today’s fast-paced world, people are leading increasingly hectic lives. Balancing work, family, and other commitments leaves limited time and energy for preparing elaborate meals. This is where the convenience of frozen pizza becomes apparent. With frozen pizza, consumers can have a hot and delicious meal on the table in a matter of minutes, sparing them the need to plan and cook a meal from scratch. One of the standout features of frozen pizza is the minimal preparation required.

Unlike making pizza dough and preparing toppings, frozen pizzas come ready-made with crust, sauce, cheese, and toppings. All consumers need to do is preheat the oven and pop the pizza in, reducing the hands-on cooking time to a minimum. This is especially appealing to those who may lack culinary skills or the time to engage in extensive meal preparation. One of the primary drivers of the increasing popularity of frozen pizza is its unmatched convenience. Among busy individuals, such as women aged 35 to 44 and singles, frozen pizza has a large demand because it offers a quick and hassle-free meal option. For instance:

- S. households led by women aged 35 to 44 purchased frozen pizza approximately 8.3 times annually in 2019, indicating a consistent demand for this convenient meal option among this demographic.

Availability of Variety of Flavors and Customization Options Driving the Market Growth

Availability of variety in flavor profiles is a significant factor driving the frozen pizza market growth. Manufacturers in the market recognize that consumers have diverse taste preferences, and they respond by offering an extensive array of flavors. These options can range from classic choices such as pepperoni and supreme to more adventurous combinations such as Mediterranean vegetables or chicken. This breadth of choices means that there is something for everyone, whether consumers prefer traditional flavors or exploring new and exciting tastes.

This diversity in flavor profiles keeps consumers engaged and eager to try different pizzas, contributing significantly to the market’s growth. Customization is a significant aspect of the frozen pizza market. Many brands in the market provide consumers with the opportunity to create their own unique pizza experiences. This often takes the form of build-your-own pizza kits, which include various crusts, sauces, and an assortment of toppings. Such customization empowers consumers to tailor their pizzas to their specific tastes and dietary needs. It adds a layer of personalization to the dining experience, allowing individuals to craft a pizza that suits their cravings perfectly. This level of flexibility enhances the attractiveness of frozen pizzas as a convenient and customizable meal option.

Restraints

Intense Competition from Fresh Pizza Hinder the Market Growth

Fresh pizza is often perceived as superior in quality and taste compared to frozen pizza. It is prepared with fresh ingredients, including locally sourced produce, premium cheeses, and a variety of toppings. The dough is usually made from scratch, resulting in a fresher, more authentic flavor. In contrast, frozen pizza is pre-cooked, frozen, and reheated by consumers, which can affect its taste and texture.

The perception of better quality can lead consumers to choose fresh pizza over frozen options, which can restrain the market growth for frozen pizzas. Fresh Pizza offers a high level of customization. Customers can choose their preferred crust type, sauce, cheese, and toppings, allowing for a personalized dining experience. This level of customization is difficult to replicate with frozen pizzas, which come in pre-set varieties.

Consumers who value customization are more likely to opt for fresh pizza. Fresh pizza dining often includes the experience of eating out or ordering in, which can be social and enjoyable. It is a common choice for gatherings, parties, and family dinners. Frozen pizza lacks this dining experience and is often seen as a more solitary or utilitarian meal option. These factors, along with the restraints affecting the market, contribute to the challenges in the frozen pizza industry’s growth and consumer preference.

Opportunity

Growing Demand for Premium and Gourmet Options

The evolving consumer palate and increased willingness to experiment with diverse flavors and ingredients present a significant opportunity for the frozen pizza market. There is a growing demand for premium and gourmet frozen pizzas that offer an elevated eating experience comparable to restaurant quality. The trend of premiumization involves upgrading the quality, ingredients, and overall value proposition of frozen pizzas. This includes using specialty cheeses, hand-tossed crusts, exotic meats and vegetables, and unique flavor combinations.

By positioning these products as premium, companies can attract a segment of consumers willing to pay more for a superior product. Moreover. advancements in freezing and preservation technology have enabled manufacturers to produce higher-quality frozen pizzas that retain taste, texture, and nutritional value. These technological improvements make it possible to offer gourmet-quality pizzas in a frozen format, meeting consumer demands for convenience without compromising on quality.

Trends

Rise of Plant-Based and Health-Conscious Offerings

A major trend in the frozen pizza market is the rise of plant-based and health-conscious offerings. This trend is driven by the increasing number of consumers adopting vegetarian, vegan, and flexitarian diets, as well as the general shift towards healthier eating habits. In addition to plant-based options, there is also a growing demand for frozen pizzas that cater to various health considerations. This includes gluten-free crusts, low-carb options, and pizzas made with whole, unprocessed ingredients.

These health-conscious offerings are designed to appeal to consumers who are mindful of their dietary choices but still seek the convenience and comfort of frozen pizza. Brands are also repositioning their products to highlight the health and ethical benefits of their plant-based and health-conscious offerings. This involves clear labeling, health claims, and marketing campaigns that align with the values and lifestyles of their target consumers.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Disrupted the Supply Chain Activities Which May Hinder the Growth of the Frozen Pizza Market

Changes in trade policies, including the imposition of tariffs on imported goods or raw materials, can significantly affect the frozen pizza market. For instance, tariffs on cheese, meat, or wheat imported from certain countries can increase production costs for manufacturers, affecting pricing and potentially reducing competitiveness in international markets. Geopolitical tensions or conflicts can disrupt supply chains, affecting the availability of key ingredients for frozen pizza, such as cheese, meats, vegetables, and wheat.

Disruptions can lead to increased costs and shortages, impacting production and distribution. Geopolitical events often lead to fluctuations in currency exchange rates. For companies operating in multiple countries, this can have a significant impact on profits, costs, and pricing strategies. A weaker currency can make imports more expensive, while a stronger currency can make exports less competitive.

Geopolitical shifts can lead to changes in regulations affecting food safety, labeling, and quality standards. Companies must adapt to these changes, which can involve additional costs for compliance and modifications to product formulations or packaging. Global and regional efforts to combat climate change can lead to stricter environmental regulations affecting the frozen pizza market, such as requirements for sustainable packaging or emissions reductions.

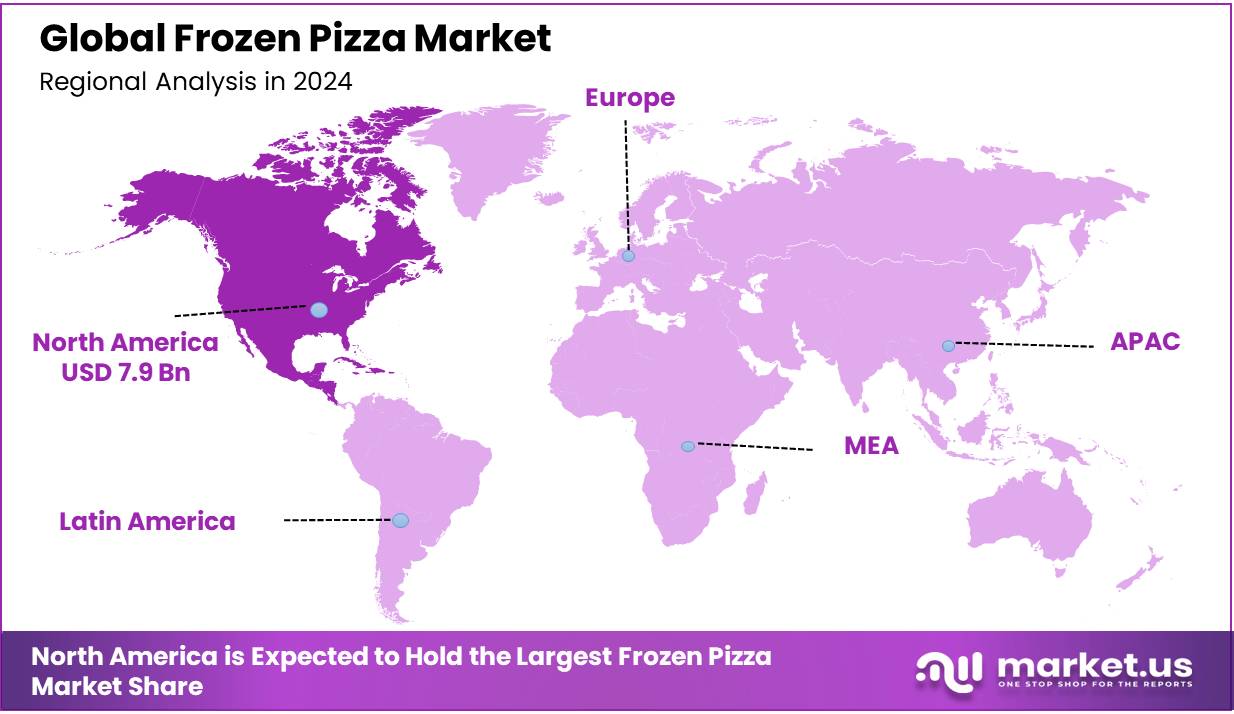

Regional Analysis

North America is Estimated to be the Most Lucrative Market in the Global Frozen Pizza Market.

North America holds the largest market share, with 39.1% in frozen pizza in 2024. North America, particularly the United States, holding the largest market share in the frozen pizza industry can be attributed to various factors that contribute to its dominant position. Frozen pizza is immensely popular in North America, especially in the United States. It is a staple of American cuisine, with a significant portion of the population consuming it regularly. The fast-paced lifestyle of many North American consumers drives the demand for convenient meal solutions.

Frozen pizzas offer a quick, easy, and often cost-effective option for meals, fitting well with the busy lifestyle of many individuals and families. North America has a highly developed retail sector, including supermarkets, hypermarkets, and convenience stores, where frozen pizzas are readily available. This accessibility boosts sales and makes it easy for consumers to purchase these products. While frozen pizza is often considered a convenience food, there’s also a growing segment of health-conscious consumers in North America. Manufacturers have responded by offering healthier options, including pizzas with organic ingredients, vegetable toppings, low-carb crusts, and plant-based cheeses.

Global Frozen Pizza Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 6,043.39 6,448.24 6,899.27 7,396.62 7,958.92 Europe 5,437.49 5,747.92 6,093.68 6,473.92 6,904.07 Asia Pacific 3,983.56 4,176.95 4,392.39 4,628.67 4,896.26 Middle East & Africa 733.93 764.56 798.72 836.11 878.55 Latin America 944.42 987.73 1,035.94 1,088.73 1,148.49 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies. Maintain the Dominance of Industry Leaders

The frozen pizza market, in various sectors in the food industry, is experiencing dynamic changes and growth, driven by evolving consumer preferences, technological advancements, and innovative marketing strategies. Companies are offering healthier alternatives with organic ingredients, gluten-free crusts, and plant-based toppings to cater to health-conscious consumers.

The key players in the global frozen pizza market are employing a combination of strategies focused on product innovation, technological advancements, strategic marketing, and sustainability. By adapting to changing consumer preferences and leveraging new technologies, these companies are not only maintaining but also strengthening their positions in the competitive market landscape.

Market Key Players

The frozen pizza market features a mix of well-established brands and emerging players. Dominance in this market is often achieved through brand recognition, product quality, distribution networks, and marketing strategies. Major key players such as, Dr. August Oetker AG, Conagra Brands, Bellisio Foods, Inc., Freiberger Lebensmittel GmbH, Newman’s Own, Nestlé S.A., etc. continuously innovates with new flavors, crust types, and specialty offerings. These companies dominate the market through a blend of quality products, strong brand presence, effective marketing, and widespread distribution. They keep a close watch on consumer trends and are quick to adapt, ensuring they meet the changing needs and preferences of customers worldwide.

The following are some of the major players in the industry

- August Oetker AG

- Conagra Brands

- Bellisio Foods, Inc.

- Freiberger Lebensmittel GmbH

- Newman’s Own

- Nestlé S.A.

- Simply Good Foods Co.

- Monte Pizza International B.V.

- McCain Foods Limited

- Other Manufacturers

Recent Development

- In April 2024, Nestlé and private equity firm PAI Partners have agreed to set up a joint venture for Nestlé’s frozen pizza business in Europe. The joint venture will create a dedicated player in a competitive and dynamic category, with the business being headquartered in Germany and led by a strong and experienced management team. The joint venture will operate two manufacturing facilities, in Nonnweiler, Germany, and Benevento, Italy.

- In May 2024, Nestlé’s DiGiorno frozen pizza brand has introduced two new varieties to its lineup: Loaded Ultra-Thin and Detroit Style.

- In June 2022, Healthy Choice a Conagra Brands, Inc. brand launched three new pizzas named turkey pepperoni flatbread pizza, chicken sausage supreme pizza, and BBQ seasoned chicken flatbread pizza.

Report Scope

Report Features Description Market Value (2024) USD 21.7 Bn Forecast Revenue (2034) USD 44.3 Bn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Non-vegetarian Frozen Pizza, and Vegetarian Frozen Pizza), By Crust Type (Thin Crust, Thick Crust, Stuffed , and Other Crust Types), By Toppings (Meat, Vegetables, Cheese, and Other Toppings) By Size (Regular, Large, and Extra-large) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Dr. August Oetker AG, Conagra Brands, Bellisio Foods, Inc., Freiberger Lebensmittel GmbH, Newman’s Own, Nestlé S.A. , Simply Good Foods Co., Monte Pizza International B.V., McCain Foods Limited, LLC, and Other Manufacturers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bellisio Foods Inc.

- Nestle SA

- One Planet Pizza

- McCain Foods Ltd.

- Daiya Foods Inc.

- California Pizza Kitchen Inc.

- Oetker GmbH

- Other Key Players