Global Environmental, Social and Governance (ESG) Consulting Market Size, Share, Statistics Analysis Report By Type (Strategy & Planning, Testing, Auditing & Verification, Technical Support, Sustainability Marketing, Others), By Application (Building & Construction, Agriculture, Food & Beverage, Oil & Gas, Mining, Chemicals, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov. 2025

- Report ID: 140988

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

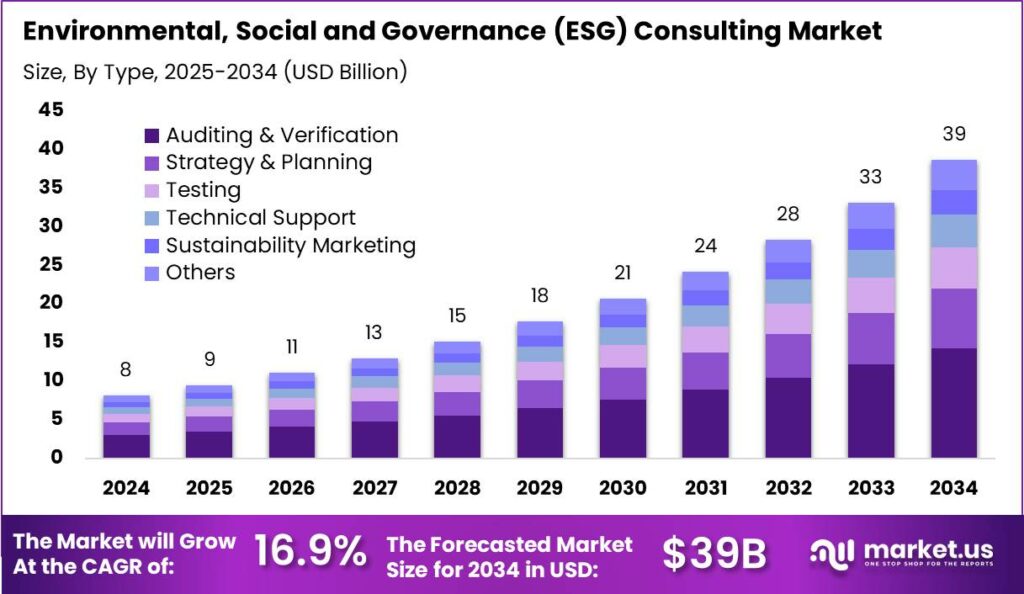

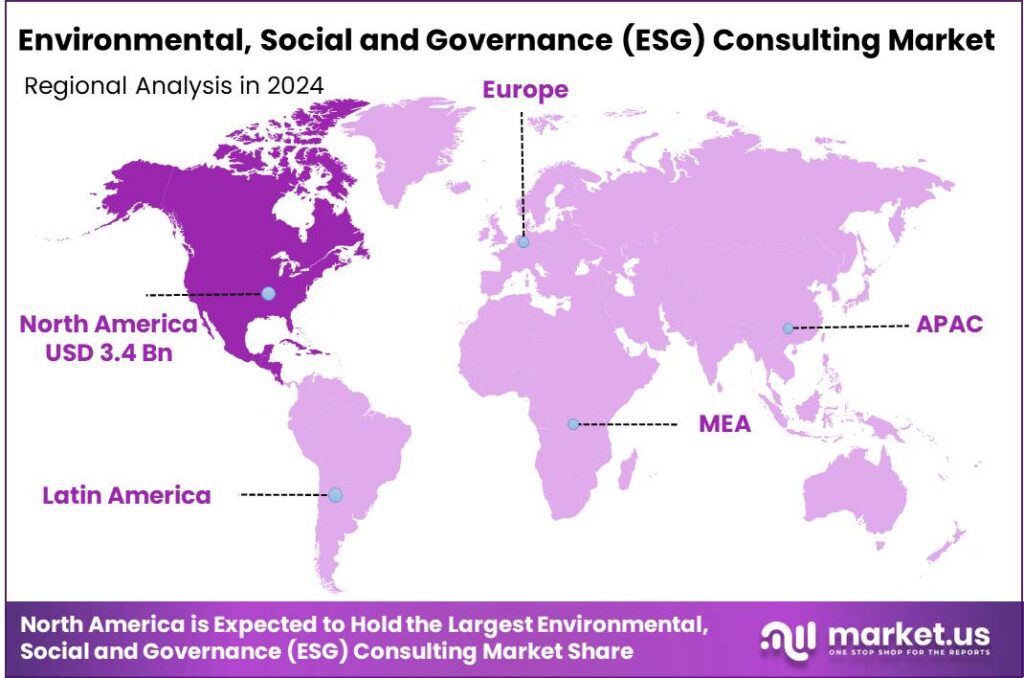

The Global Environmental, Social and Governance (ESG) Consulting Market size is expected to be worth around USD 39 Billion By 2034, from USD 8.12 Billion in 2024, growing at a CAGR of 16.90% during the forecast period from 2025 to 2034. North America held a leading market position in the ESG consulting market in 2024, capturing more than 42.15% of the total market share, with a revenue of USD 3.4 billion.

The Environmental, Social and Governance (ESG) Consulting market is rapidly evolving as companies increasingly recognize the importance of integrating sustainability and ethical governance into their core operations. Businesses seek expert guidance to align with rising global standards and meet demands from regulators, investors, and customers. This market is driven by growing regulations around ESG transparency and reporting, pushing firms to adopt clear, measurable ESG strategies.

A dominant factor fueling demand is the strengthening of regulations worldwide, such as in North America where disclosure requirements have intensified significantly. Companies face mounting pressure to provide verified ESG data, prompting a need for auditing and verification services. In 2024, this segment accounted for over one-third of the market, reflecting how critical independent validation has become to stakeholder confidence.

Technology is a growing enabler in this market, with data analytics, artificial intelligence, and blockchain solutions helping companies track and report on ESG metrics accurately. Consultants guide organizations to adopt these advanced tools to enhance data quality, improve regulatory compliance, and achieve greater sustainability insight. This trend toward digital ESG management reflects a broader shift toward integrating sustainability deeply into daily operations.

Emerging opportunities lie in the increasing appetite for green investments, where investors clearly prefer companies demonstrating strong ESG performance. Consultants aid businesses in attracting these investments by embedding sustainability into corporate strategies and reporting in ways that resonate with socially conscious capital markets. This alignment is expected to bolster demand for advisory services as green finance grows rapidly worldwide.

Key Takeaways

- The Global Environmental, Social, and Governance (ESG) Consulting Market is expected to reach USD 39 Billion by 2034, up from USD 8.12 Billion in 2024, growing at a CAGR of 16.90% from 2025 to 2034.

- In 2024, the Auditing & Verification segment held a dominant market position, capturing more than 36.8% of the overall ESG consulting market.

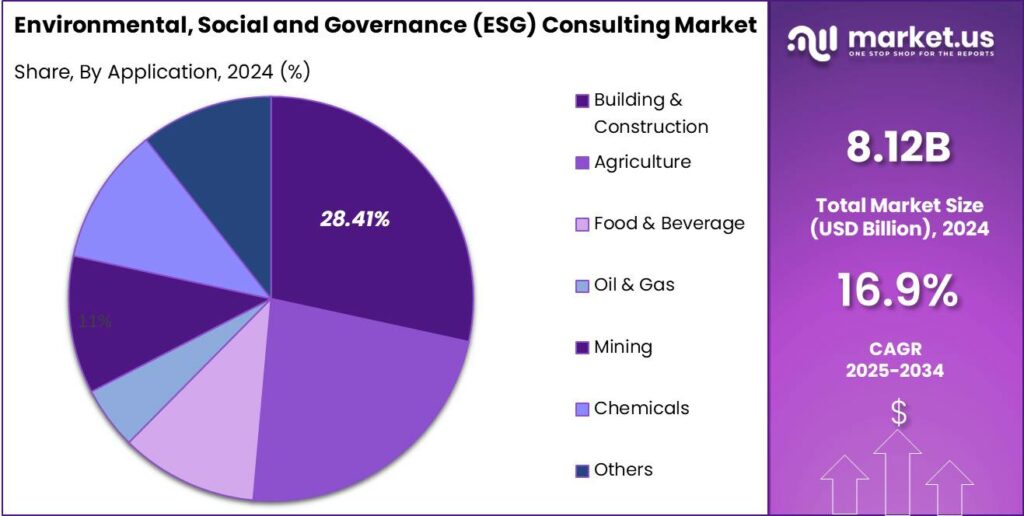

- In 2024, the Building & Construction segment also held a dominant position, accounting for over 28.41% of the total ESG consulting market.

- North America held a leading market position in the ESG consulting market in 2024, capturing more than 42.15% of the total market share, with a revenue of USD 3.4 billion.

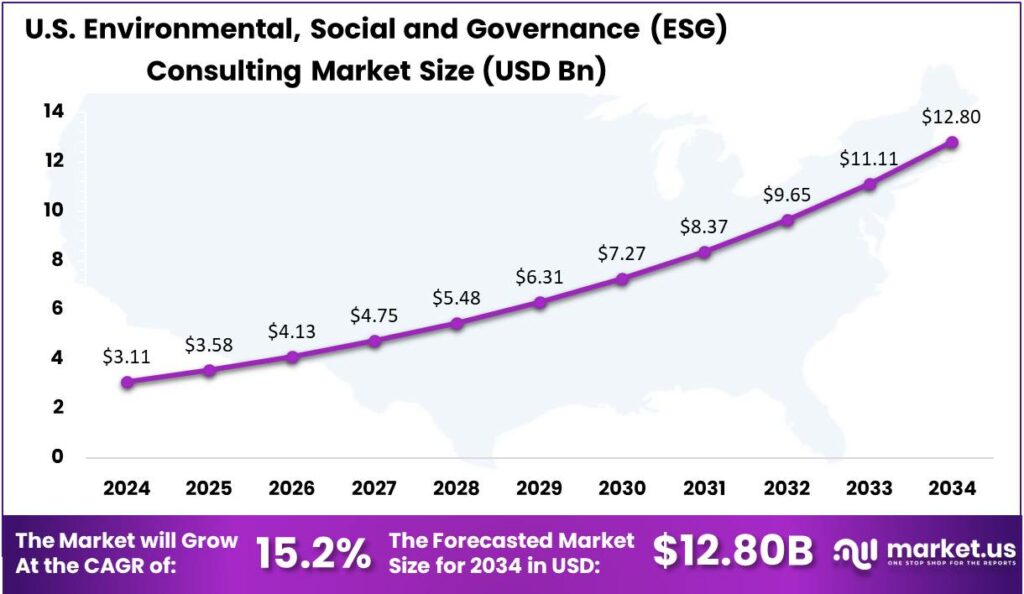

- The U.S. ESG consulting market is projected to reach a valuation of USD 3.11 billion by 2024, growing at a CAGR of 15.2%.

U.S. Market Size

The U.S. Environmental, Social, and Governance (ESG) consulting market is projected to reach a valuation of $3.11 billion by 2024, growing at a compound annual growth rate (CAGR) of 15.2%. The market for ESG consulting is growing as businesses seek guidance on integrating ESG principles. Firms offer expertise in navigating regulations, enhancing social responsibility, and improving governance to stay competitive and meet stakeholder expectations.

Rising pressure from investors, regulators, and consumers for companies to adopt sustainable and ethical practices has been a key driver. Stakeholders are increasingly emphasizing responsible governance, environmental stewardship, and social impact. Additionally, stricter U.S. regulations now require greater transparency in corporate ESG performance.

As organizations aim to meet new mandates, demand for specialized ESG consulting is set to grow, with firms seeking help on risk management, reporting, and strategy implementation for long-term sustainability. The growing understanding that strong ESG strategies can boost financial performance is driving businesses to prioritize these areas, further fueling market expansion.

In 2024, North America held a dominant market position in the Environmental, Social, and Governance (ESG) consulting market, capturing more than 42.15% of the total market share, with a revenue of USD 3.4 billion. This region’s leadership can be attributed to a combination of regulatory pressure, growing corporate awareness, and an active investment environment that emphasizes sustainable practices.

U.S. companies have led the way in adopting ESG practices, integrating ESG frameworks to meet national and global sustainability standards. Meanwhile, North American investors are placing greater emphasis on ESG factors, urging companies to showcase strong governance, environmental stewardship, and social responsibility.

The regulatory landscape in North America, driven by the SEC’s focus on transparency and sustainability, is fueling demand for ESG consulting. With states and municipalities enacting their own regulations, businesses seek expert guidance to navigate complex compliance requirements, driving growth and evolution in ESG advisory services and contributing to North America’s significant share of the global market.

Another contributing factor is the robust presence of multinational corporations headquartered in North America. North American companies are adopting ESG initiatives to mitigate risks and capitalize on sustainability opportunities. They recognize that effective ESG strategies can improve long-term financial performance, risk management, and enhance reputations with consumers and investors.

Analysts’ Viewpoint

The demand for ESG consulting is high among corporations, investment firms, and small to medium enterprises aiming to enhance their sustainability practices. The sector offers substantial investment opportunities as businesses seek to innovate in carbon reduction, energy efficiency, and equitable workforce development. However, risks such as greenwashing – where claims of environmental stewardship are misleading – pose significant challenges, necessitating rigorous and transparent ESG reporting standards to maintain credibility.

Advancements in technology play a critical role in ESG consulting, particularly through data analytics and artificial intelligence. These technologies enable more accurate tracking and reporting of ESG metrics, helping companies to identify inefficiencies, manage risks, and seize opportunities in real-time. Innovative tools are also being developed to facilitate effective ESG audits and to integrate sustainability into daily business operations.

The regulatory landscape for ESG is becoming increasingly complex and stringent worldwide. Recent developments include the implementation of frameworks by the International Sustainability Standards Board (ISSB) and enhancements in climate-related financial disclosures. These regulations compel companies to adopt comprehensive ESG measures and ensure that their reporting methods are robust, accurate, and compliant with new global standards

Type Analysis

In 2024, the Auditing & Verification segment held a dominant market position, capturing more than a 36.8% share of the overall Environmental, Social, and Governance (ESG) consulting market. This share is driven by growing regulatory pressure for transparency and compliance in ESG reporting, with governments enforcing strict disclosure guidelines.

One of the primary reasons for the dominance of the Auditing & Verification segment is the growing scrutiny by investors and stakeholders. Financial institutions and investors are demanding more granular and verified ESG data to make informed investment decisions. This trend is particularly evident in the rise of green finance and sustainable investment products, where the credibility of ESG disclosures is paramount.

The global push for corporate accountability is driving demand for auditing and verification services. With increased pressure on companies to prove their ESG claims, independent audits are crucial for ensuring accuracy and minimizing reputational risks, making the Auditing & Verification segment the market leader.

The complexity of ESG metrics and evolving international standards has heightened the importance of auditing and verification services. As ESG frameworks and reporting standards change, companies rely on these services to stay compliant, making the Auditing & Verification segment essential and solidifying its leadership in the ESG consulting market.

Application Analysis

In 2024, the Building & Construction segment held a dominant market position, capturing more than 28.41% of the overall ESG consulting market. The reason for this dominance can be attributed to the increasing emphasis on sustainability in the construction sector.

With growing global concerns about carbon emissions and the environmental impact of buildings, the demand for ESG consulting in this space has surged. Construction companies are focusing on reducing their carbon footprints, implementing green building practices, and adhering to environmental regulations, all of which require expert guidance from ESG consultants.

The building and construction industry faces growing scrutiny for its environmental impact, leading to stricter regulations on materials, energy efficiency, and waste management. As a result, businesses seek ESG consulting to comply with evolving standards and improve sustainability, with certifications like LEED becoming crucial in construction projects.

Investor interest is boosting the Building & Construction segment, as real estate developers and construction firms must demonstrate ESG commitment to attract investment. ESG-focused investors demand transparency in energy use, waste reduction, and community impact, driving the need for consulting services to meet regulations and appeal to socially conscious investors.

Key Market Segments

By Type

- Strategy & Planning

- Testing

- Auditing & Verification

- Technical Support

- Sustainability Marketing

- Others

By Application

- Building & Construction

- Agriculture

- Food & Beverage

- Oil & Gas

- Mining

- Chemicals

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Regulatory Pressure on ESG Compliance

As environmental, social, and governance (ESG) concerns continue to gain global prominence, regulatory frameworks surrounding ESG disclosures are becoming more stringent. Governments worldwide are mandating greater transparency in ESG practices. In Europe, regulations like the EU Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR) require companies to disclose their sustainability efforts and impacts.

The growing regulatory landscape is driving demand for ESG consulting services as companies seek guidance to ensure compliance, mitigate legal risks, and maintain stakeholder trust. ESG consultants assist organizations in navigating these complex and evolving regulations, helping them structure their ESG reporting frameworks and adopt best practices to align with local and international requirements. The regulatory environment is expected to continue evolving, providing a sustained demand for ESG consulting expertise.

Restraint

Lack of Standardization in ESG Reporting

One of the significant barriers hindering the effective implementation of Environmental, Social, and Governance (ESG) practices is the lack of uniformity in ESG reporting standards. ESG metrics are still largely unregulated across industries and regions, with companies using a wide variety of reporting frameworks. This absence of standardized guidelines can lead to inconsistent data reporting, making it difficult for investors, regulators, and other stakeholders to compare or assess ESG performance across companies.

Furthermore, companies may find it challenging to interpret which standards align best with their operations, and as a result, their ESG reporting may either overstate or understate their actual performance, affecting credibility. Without a universally accepted ESG reporting framework, businesses may face difficulties in fully realizing the potential benefits of ESG practices, thus limiting the effectiveness of their sustainability initiatives.

Opportunity

Growing Demand for Green Investments

The increasing preference for sustainable and socially responsible investment is creating substantial opportunities in the ESG consulting sector. As investors become more focused on ESG factors when making decisions, there is a heightened demand for consulting services that can guide companies in structuring their business models and strategies to attract green investments. ESG-driven investments, particularly in sectors such as renewable energy, clean technologies, and sustainable agriculture, are gaining momentum.

Growing shift reflects the awareness that aligning investments with ESG criteria is not only a moral imperative but also a sound financial strategy, as companies with strong ESG performance are increasingly seen as lower risk and higher potential in the long term. ESG consultants are positioned to help businesses integrate sustainable practices into their operations, positioning them to capture capital from the expanding green investment pool.

Challenge

Complexity in Measuring ESG Impact

One of the key challenges in ESG consulting lies in the complexity of accurately measuring the impact of sustainability practices. ESG metrics are inherently qualitative and can vary significantly depending on the industry, region, and specific business objectives. ESG performance is challenging to measure due to its intangible, long-term factors.

Similarly, social factors like employee wellbeing or community relations can be influenced by numerous variables, making quantification complex. This challenge is compounded by the absence of universally accepted benchmarks, leading to discrepancies in how organizations report and track their ESG performance. Consequently, ESG consultants must develop sophisticated, customized methodologies to assess impact and communicate results effectively.

Emerging Trends

One emerging trend is the integration of ESG factors into core business strategies. Companies are shifting from seeing ESG as a regulatory requirement to integrating it into their long-term growth and resilience strategies. This change is driven by pressure from stakeholders, such as consumers, governments, and investors, who demand more responsible corporate behavior.

Another key trend in ESG consulting is the rise of data-driven approaches. Firms are leveraging advanced technologies, such as artificial intelligence (AI) and machine learning, to assess and monitor ESG performance more accurately. These tools allow businesses to identify risks, opportunities, and improvements more efficiently.

Additionally, the focus on climate change has led to a greater emphasis on “net-zero” strategies. Companies are seeking guidance on reducing carbon emissions, optimizing energy use, and implementing sustainable practices. ESG consultants play a crucial role in developing actionable, measurable plans to help businesses stay competitive and relevant in a rapidly evolving market.

In 2023, green bond issuance globally exceeded $500 billion, and it is projected to reach $1 trillion by 2025, according to the Climate Bonds Initiative. This surge in sustainable finance presents an opportunity for consulting firms to support the growing demand for expert advice on green finance instruments.

Business Benefits

One of the most significant advantages is the positive impact on a company’s reputation. As consumers and investors become more socially conscious, businesses that demonstrate commitment to sustainability and ethical practices tend to enjoy stronger brand loyalty and greater customer trust.

Moreover, companies adopting ESG practices are often better positioned to attract and retain top talent. Employees today are increasingly seeking workplaces that align with their personal values, particularly those related to environmental sustainability and social responsibility.

Additionally, companies with strong ESG frameworks are often better positioned to secure investment. Institutional investors increasingly prioritize ESG performance when evaluating potential investments, seeking companies that demonstrate long-term value creation through sustainable and ethical practices.

In 2023, ESG-related assets surpassed $40 trillion globally, a 30% increase from the previous year, as reported by the Global Sustainable Investment Alliance (GSIA). This sharp rise demonstrates the growing interest and reliance on ESG factors by investors, creating a substantial demand for advisory and consultancy services.

Key Player Analysis

The growing demand for ESG solutions has created a competitive market, with leading consulting firms offering specialized expertise.

- Deloitte is one of the top global players in the ESG consulting market, offering a wide range of services that span environmental, social, and governance sectors. Known for its deep industry knowledge and large-scale solutions, Deloitte helps clients integrate ESG strategies into their business models.

- Boston Consulting Group (BCG) is another leader in the ESG consulting space. The company leverages its extensive knowledge of business strategy and innovation to help organizations develop sustainable practices. BCG focuses on building sustainable business models that prioritize environmental impact, inclusivity, and ethical governance.

- PA Knowledge Limited, a global consulting firm, specializes in delivering tailored ESG solutions across various industries. PA’s expertise lies in integrating ESG factors into businesses’ core strategies while addressing both regulatory compliance and sustainability goals. They are well-regarded for their hands-on approach to delivering practical solutions that balance economic, environmental, and social needs.

Top Key Players in the Market

- Deloitte

- Boston Consulting Group

- PA Knowledge Limited

- Accenture

- TATA Consultancy Services Limited

- DSS Sustainable Solutions Switzerland SA

- McKinsey & Company

- Ernst & Young

- KPMG

- Bain & Company, Inc.

- Other Major Players

Top Opportunities Awaiting for Players

The Environmental, Social and Governance (ESG) consulting market presents numerous opportunities for growth and innovation.

- Rising Demand for Regulatory Compliance: ESG consultants are well-positioned to assist firms in adhering to new regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate-related disclosures. This growing need for compliance guidance opens significant opportunities for consultancy firms to expand their services, particularly in Europe and North America.

- Integration of ESG into Corporate Strategy: Many businesses are increasingly integrating ESG factors into their long-term strategies. Companies are seeking advisory services to embed sustainability into their core business operations, from supply chain management to product development. ESG consultants can help organizations create actionable, measurable goals and align them with financial performance, ensuring long-term viability and growth. This represents a high-demand area as companies strive to balance profitability with social responsibility.

- ESG Technology and Data Analytics: The adoption of technology in ESG tracking is becoming a critical area. As businesses collect more data on sustainability efforts, ESG consultants who can leverage AI and data analytics to offer detailed reporting and performance assessments will be in high demand. Tools that measure carbon footprints, energy usage, and diversity metrics are evolving quickly. Consultants who can guide businesses in integrating these technologies and creating actionable insights will benefit from an emerging market segment.

- Focus on Supply Chain Sustainability: The sustainability of supply chains has become a priority for businesses, as stakeholders demand greater transparency and accountability. Consulting firms that specialize in supply chain ESG strategies such as identifying responsible sourcing, reducing carbon emissions, and enhancing labor standards will see significant growth.

- Growing Need for ESG Reporting and Communication: Firms offering services in ESG reporting, communication, and branding will continue to thrive, especially as businesses face pressure to publish sustainability reports in line with global standards. Consultants who can assist with creating robust ESG communication strategies will help companies enhance their credibility and attract a broader base of investors and customers.

Recent Developments

- In January 2024, Sphera Solutions acquired SupplyShift, a developer of supply chain data management software. This acquisition expands Sphera’s supply chain offerings with enhanced supplier mapping and traceability capabilities.

- In April 2024, EY acquired Denkstatt, an Austrian sustainability consulting firm. This move enhances EY’s capabilities in providing comprehensive sustainability consulting services, including CSRD and EU taxonomy consulting, sustainability assessments, and climate strategies.

- In November 2024, SLR Consulting acquired RGC, expanding its sustainability consulting capabilities globally.

Report Scope

Report Features Description Market Value (2024) USD 8.12 Bn Forecast Revenue (2034) USD 39 Bn CAGR (2025-2034) 16.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Strategy & Planning, Testing, Auditing & Verification, Technical Support, Sustainability Marketing, Others), By Application (Building & Construction, Agriculture, Food & Beverage, Oil & Gas, Mining, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Deloitte, Boston Consulting Group, PA Knowledge Limited, Accenture, TATA Consultancy Services Limited, DSS Sustainable Solutions Switzerland SA, McKinsey & Company, Ernst & Young, KPMG, Bain & Company, Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Environmental, Social and Governance (ESG) Consulting MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Environmental, Social and Governance (ESG) Consulting MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deloitte

- Boston Consulting Group

- PA Knowledge Limited

- Accenture

- TATA Consultancy Services Limited

- DSS Sustainable Solutions Switzerland SA

- McKinsey & Company

- Ernst & Young

- KPMG

- Bain & Company, Inc.

- Other Major Players