Global Healthy Snack Market Size, Share and Industry Analysis Report Based on Type(Frozen and Refrigerated, Fruit, Nuts and Seeds, Bakery, Savory, Bars and Confectionery, Dairy, Others), By Packaging(Bag and Pouches, Boxes, Cans, Jars, Others), Based on Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 31463

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

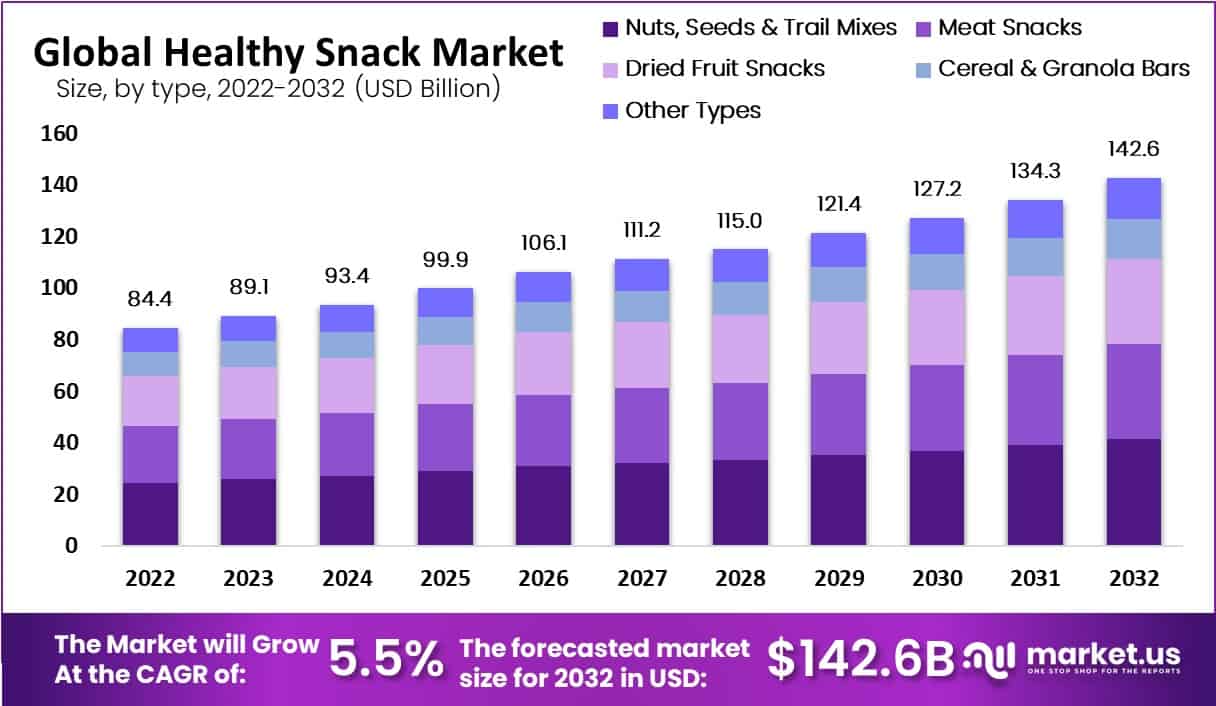

The global Healthy Snack Market size is expected to be worth around USD 142.6 billion by 2032, from USD 89.1 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

Snacks that are healthy are packed with protein and fiber and help you stay energetic all day. Hard-boiled eggs, seeds, whole grains, nuts, fruits, and vegetables, as well as low-fat dairy products, are all good snacks. Because snacks make up a large portion of your diet, they have a significant impact on your health.

Snacks that are healthy have a lot of advantages, like preventing weight gain, reducing the need for more food, strengthening the brain, and improving health. Healthy snacks are also a good way to get the vitamins, minerals, carbohydrates, fiber, and protein that your diet needs. Avoid overeating during meals by eating snacks before or after meals.

Snack sales and demand have abruptly declined. The panicked purchase of food supplies by customers during the early phases of the lockdown aided in the quick sale of ready-to-eat meals through retail distribution networks.

Grocery shop sales in 2020 increased by 25% on April 1st and by 99% in the middle of March, according to the U.S. Department of Agriculture. But later, the habit of purchasing goods from retail markets and preparing meals at home emerged as worries about the safety of processed foods and hygiene began to escalate. The snack sector is significantly impacted by the quick decline in the consumption of packaged and processed meals.

On the investment front, significant capital inflows are evident with major corporations like PepsiCo investing $3.3 billion in 2020 to innovate healthier product lines. Such private investments are instrumental in developing new products that align with evolving consumer preferences.

The rising popularity of healthy snacks. Factors driving this trend include growing health awareness linked to diet-related health issues such as obesity and diabetes, and the modern consumer’s need for convenience. These dynamics are prompting a shift towards healthier snacking options that contribute positively to overall health without compromising on taste or convenience.

Key Takeaways

- Market Projection: Expected to grow from USD 89.1 billion in 2023 to USD 142.6 billion by 2032, with a CAGR of 5.5%.

- Fruit, Nuts and Seeds held a dominant market position, capturing more than a 38.2% share.

- Bags and Pouches held a dominant market position, capturing more than a 41.8% share.

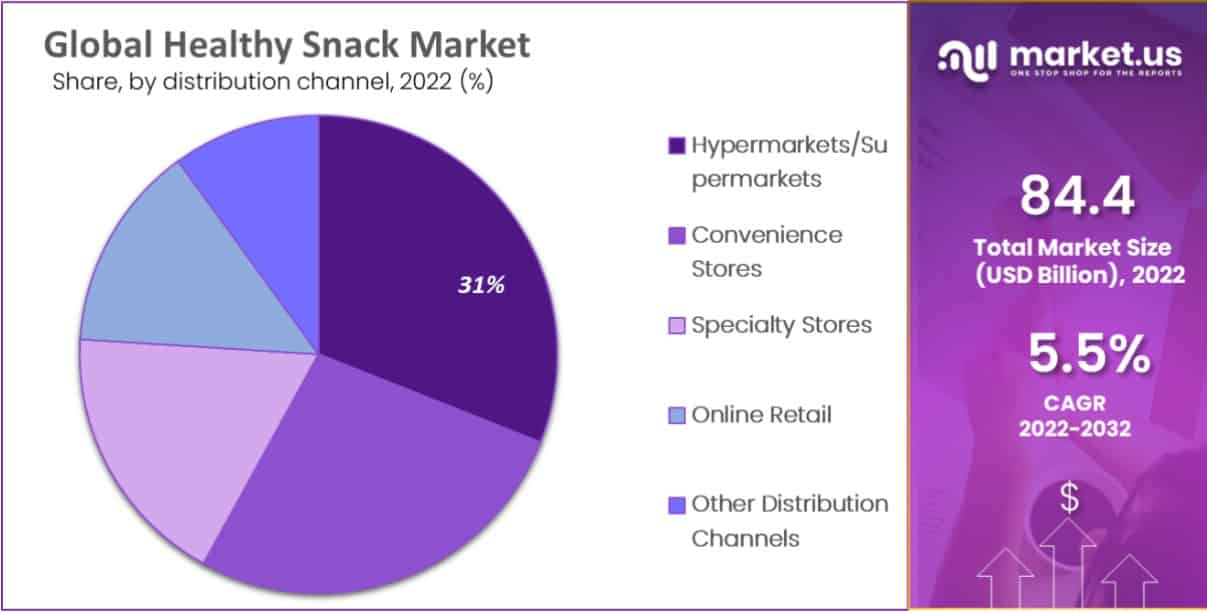

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 44.2% share.

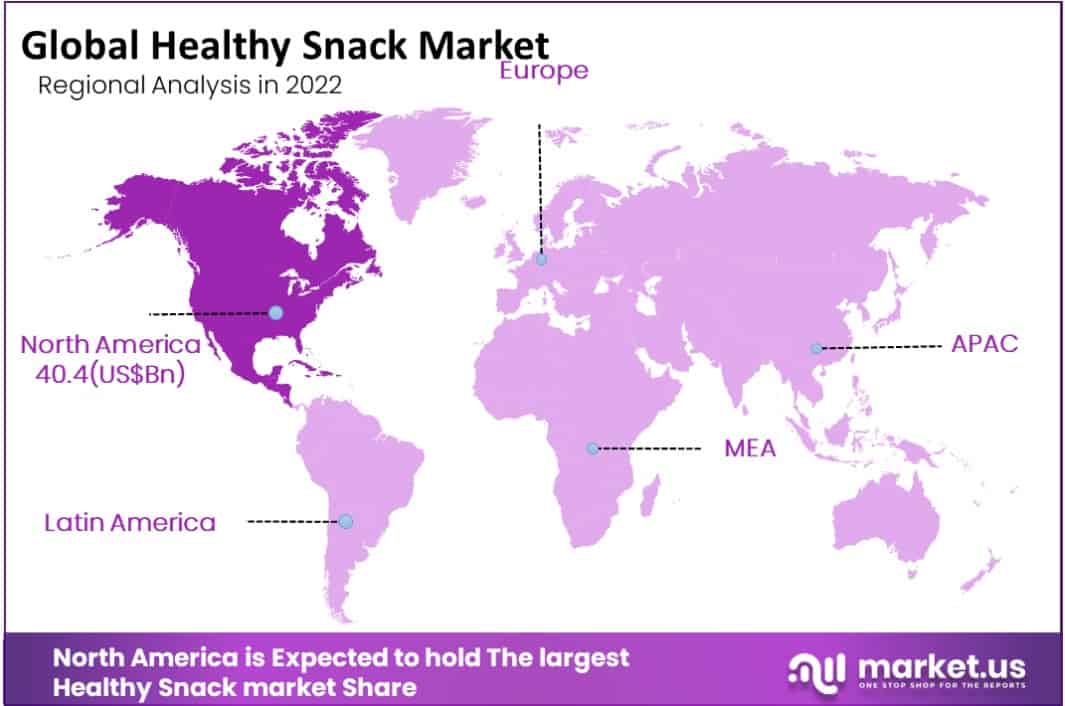

- North America is the leading region in the healthy snack market, commanding a 38.9% share.

Type Analysis

Fruit, Nuts and Seeds Hold a Major Market Share Attributed to their High-protein Content & Easy Consumption

In 2023, Fruit, Nuts and Seeds held a dominant market position, capturing more than a 38.2% share of the healthy snacks market. This segment benefits from the consumer’s preference for natural and minimally processed foods. Fruits and nuts are not only convenient but also packed with essential nutrients, making them a top choice for health-conscious buyers.

The Frozen & Refrigerated segment also plays a crucial role in the market. These products offer convenience while maintaining the nutritional integrity of snacks. Innovations in freezing and refrigeration technology have improved the quality and appeal of these snacks, making them a practical option for busy consumers seeking healthful choices.

Bakery products, encompassing items like whole-grain breads, muffins, and other baked goods, are increasingly being sought after for their comfort food aspect while still aligning with health standards. Manufacturers are incorporating healthier ingredients and reducing harmful fats and sugars to cater to health-focused individuals.

Savory snacks, which include items like vegetable chips, whole-grain crackers, and air-popped popcorn, provide a tasty alternative to traditional high-calorie, high-salt snacks. The demand in this category is driven by consumers desiring flavorful yet healthy options.

Bars and Confectionery have witnessed substantial growth due to their portability and convenience. Protein bars, granola bars, and low-sugar confections are particularly popular among people who lead active lifestyles or need quick meal replacements.

The Dairy segment includes yogurt, cheese snacks, and other dairy-based products known for their protein and calcium content. With an increase in the availability of low-fat and fortified dairy options, this segment is appealing to both health enthusiasts and general consumers looking for nutritious snack options.

By Packaging

In 2023, Bags and Pouches held a dominant market position, capturing more than a 41.8% share of the healthy snacks packaging market. This popularity stems from their convenience, lightweight nature, and the ability to preserve freshness. Bags and pouches are favored for their portability and ease of use, making them ideal for on-the-go consumption.

Boxes are another significant packaging type in the healthy snacks market. They are primarily used for cereals, bars, and baked goods, providing sturdy protection and easy stacking for storage. Boxes also offer excellent opportunities for branding, with ample space for attractive designs and nutritional information, appealing to health-conscious consumers.

Cans are used less frequently but remain relevant for packaging nuts, seeds, and some fruit snacks. They are valued for their long shelf life and ability to protect contents from air and light, preserving the nutritional quality of the snacks inside.

Jars, typically glass or high-quality plastic, are used for premium or artisanal snack products. They are popular in the packaging of high-value nuts, gourmet spreads, and organic or specialty items. Jars are reusable and recyclable, aligning with the environmental consciousness of many health snack consumers.

Distribution Channel Analysis

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 44.2% share of the healthy snacks market distribution channels. These large retail spaces are favored for their wide range of products and the convenience of one-stop shopping, allowing consumers to access a diverse selection of healthy snacks alongside their regular grocery purchases.

Convenience Stores also play a crucial role in the distribution of healthy snacks. Due to their widespread presence and extended operating hours, they offer easy access to quick snack options for consumers on the move. This channel is particularly popular among busy professionals and commuters who seek nutritious snacks without deviating from their daily routes.

Specialty Stores, which focus on health foods and dietary specific products, cater to a niche market. These stores attract health-conscious consumers looking for organic, gluten-free, or vegan snack options that may not be available in mainstream retail outlets.

Online Retail has seen significant growth in the distribution of healthy snacks. The convenience of home delivery and the ability to easily compare prices and product reviews have propelled the popularity of this channel. Consumers appreciate the breadth of options available online, from exotic superfoods to locally-sourced organic snacks.

Other Distribution Channels include vending machines in schools, offices, and hospitals, as well as direct sales from producers at farmers’ markets and through subscription snack boxes. These channels offer unique points of access to healthy snacks, catering to specific consumer needs and environments.

Key Market Segments

Based on Type

- Frozen & Refrigerated

- Fruit, Nuts and Seeds

- Bakery

- Savory

- Bars and Confectionery

- Dairy

- Others

By Packaging

- Bag & Pouches

- Boxes

- Cans

- Jars

- Others

Based on Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Other Distribution Channels

Drivers

Increasing Demand for Functional/Healthy Foods to Fuel Demand for Healthy Snack Products

The growing demand for functional foods in the global market is driving the growth of the global market. Functional foods are used to improve overall health and lower the risk of developing certain lifestyle-related chronic conditions. Consumers are continuing to look for healthier options in the food aisles. Functional ingredients, such as proteins, micronutrients, and fiber, have been adopted by mainstream retailers.

The growth of the market for healthy snacks is driven by the increasing promotion of such functional foods for weight management, improving digestive health, and lowering the risk of obesity, diabetes, and cardiovascular diseases.

Rising Popularity of Convenience Foods & On-the-go Snacking to Support Developments

The growth of the healthy snacks market can be attributed in large part to the rising popularity of ready-to-eat, convenience, and on-the-go snacking options. In a busy schedule, on-the-go healthy snacks market products provide quick nutrition and a feeling of fullness.

Due to their portion control, snacks are also viewed as an essential component of a healthy diet by consumers. During a hectic workday, these portable and convenient packs provide a small boost of energy. By offering a variety of healthy snacks that meet the growing demand for nutrition on the go, the healthy eating trend is contributing to the development of the snack industry.

Restraints

Technological & Processing-Related Challenges to Impede Market Growth

The difficulties manufacturers face during the processing of healthy snacks hinder the market. Customers’ primary considerations when making a purchase include the snack’s texture and crispness. The final product’s texture is impacted by the moisture retention and binding capacity of the ingredients when fats and sugar are reduced or eliminated, and whole grains are added. In a similar vein, the fruit and vegetable snacks market presents challenges in terms of shelf stability and preservation.

Clean-label snack products, such as additive-free or preservative-free snacks, may face challenges without ingredients that can support emulsification and stabilization and creamy texture. These challenges will be addressed by processors through ongoing innovations and technological advances.

Opportunity

Healthy Snack Options are One of the Most Widely Consumed Food Groups.

Customers are more responsible, so healthy snacks may be an alternative to certain meals. The essence of snacks is changing as empowered customers seek snacks that are healthy, nutritious, and affordable to fuel their busy lifestyles.

Eating is on the rise as people are more mobile and want to eat. In healthier snacks, premiumization drives innovation and variety. The restriction is that you can’t use unusual ingredients or fiery flavors to please people from all over the world.

This encourages growth in the provincial business sector. Comfort is also driving ready-to-eat snack sales online. One of the most sought-after categories of food that can be purchased online is healthy snack options.

Trends

Emerging Trend of On-the-go Nutrition to Propel Innovation in Snacking Industry

There is a rise in the demand for snacks due to the increasing number of people who are entering the workforce. Because snacks offer instant satisfaction and relief from stress, they are a great choice. This market for healthy snacks is driven by the growing healthy snack trend to avoid certain chronic diseases and maintain health & well-being through mindful consumption.

As working adults and millennials look for snacks to combat nutrient deficiencies, the on-the-go nutrition trend is quickly gaining popularity.

Regional Analysis

In 2023, North America is the leading region in the healthy snack market, commanding a 38.9% share. The U.S.’s strong demand for healthy snacks dominates the local market. In this location, snack consumption was already high, but since the COVID-19 epidemic, the rate of intake of nutritious snacks has increased dramatically. Currently, more and more people are becoming health-conscious and looking for wholesome snacks.

Europe is still the second largest market, and the growing popularity of on-the-go nutrition trends and the growing awareness of the beneficial health effects of functional foods are contributing to their enormous potential.

The demand for healthy snacks in the regional market is being driven by a positive attitude toward preventative measures, an increase in the number of older people, a busier daily schedule, an increase in mental stress, and an increasing prevalence of health conditions linked to lifestyle choices. The market for innovative granola bars and portfolios continues to expand in Europe thanks to the growing investments made by major corporations.

Due to the rising demand for “better-for-you” products that encourage healthy well-being, the market in Asia-Pacific is anticipated to expand at a significant CAGR. It is anticipated that the expansion of the market in the region will be fueled by the rising disposable income that enables consumers to indulge in healthful activities. Due to low product penetration in underdeveloped markets, the Middle East and Africa, and South American markets will have lower healthy snack market share.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the healthy snacks market, PepsiCo Inc. holds a significant position with its portfolio of well-known brands like Quaker and Bare Snacks. PepsiCo has made considerable investments in developing healthier product lines, aligning with the increasing demand for nutritious and convenient snack options. Similarly, Nestlé S.A. continues to expand its presence through products focused on nutrition, health, and wellness. Nestlé’s focus on organic and plant-based snacks has allowed it to capture a growing segment of health-conscious consumers globally.

Other key players include Unilever PLC and Tyson Foods Inc., both of which have diversified into the healthy snacks market through acquisitions and product innovations. Kellogg Company has a strong foothold with its well-established brands like Special K and Kashi, targeting health-focused consumers seeking nutritious on-the-go options.

B & G Foods Inc. and Mondelēz International are also active in this space, with Mondelēz leveraging its global reach to promote brands like BelVita and Good Thins. Smaller players such as Harvest Almond Snacks and Happytizers Pvt Ltd are also making waves by focusing on niche segments like plant-based and allergen-free snacks, further expanding the market’s diversity.

These key players, along with other emerging companies, continue to shape the competitive landscape of the healthy snacks market through strategic product innovations, acquisitions, and global expansions. The market is seeing a blend of both large multinational corporations and smaller, more specialized firms driving growth and catering to the varied preferences of health-conscious consumers worldwide.

Market Key Players

- PepsiCo Inc.

- Nestle S.A.

- Unilever PLC

- Tyson Foods Inc.

- Kellogg Company

- B & G Foods Inc.

- Mondelēz International

- Harvest Almond Snacks

- Happytizers Pvt Ltd

- Other Key Players

Recent Developments

- December 2022: Agthia, a food and beverage company based in the United Arab Emirates, announced that it had acquired a 60% stake in Abu Auf, an Egypt-based company that makes healthy snacks and coffee products. Tanmiya Capital owns the remaining 10%, and the founders of Abu Auf retained a 30% stake.

- In August 2022, Mondelez International Inc., an American food- and beverage company, announced that it had completed its acquisition of Clif Bar & Company. Clif Bar & Company is a top provider of energy bars with organic ingredients in America. The acquisition increased Mondel’z International’s snack business value to over US$ 1 Billion.

Report Scope

Report Features Description Market Value (2022) US$ 84.4 Bn Forecast Revenue (2032) US$ 142.6 Bn CAGR (2023-2032) 5.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Type(Frozen and Refrigerated, Fruit, Nuts and Seeds, Bakery, Savory, Bars and Confectionery, Dairy, Others), By Packaging(Bag and Pouches, Boxes, Cans, Jars, Others), Based on Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PepsiCo Inc., Nestle S.A., Unilever PLC, Tyson Foods Inc., Kellogg Company, B & G Foods Inc., Mondelēz International, Harvest Almond Snacks, Happytizers Pvt Ltd, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PepsiCo Inc.

- Nestle S.A.

- Unilever PLC

- Tyson Foods Inc.

- Kellogg Company

- B & G Foods Inc.

- Mondelēz International

- Harvest Almond Snacks

- Happytizers Pvt Ltd

- Other Key Players