Global Potato Starch Market By Type (Modified, Native), By Nature (Conventional, Organic), By End-use (Food And Beverage, Dairy Products, Bakery And Confectionery, Snacks And Processed Foods, Infant Formula, Others, Pharmaceutical, Paper And Packaging, Chemical, Cosmetics And Personal Care, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 22882

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

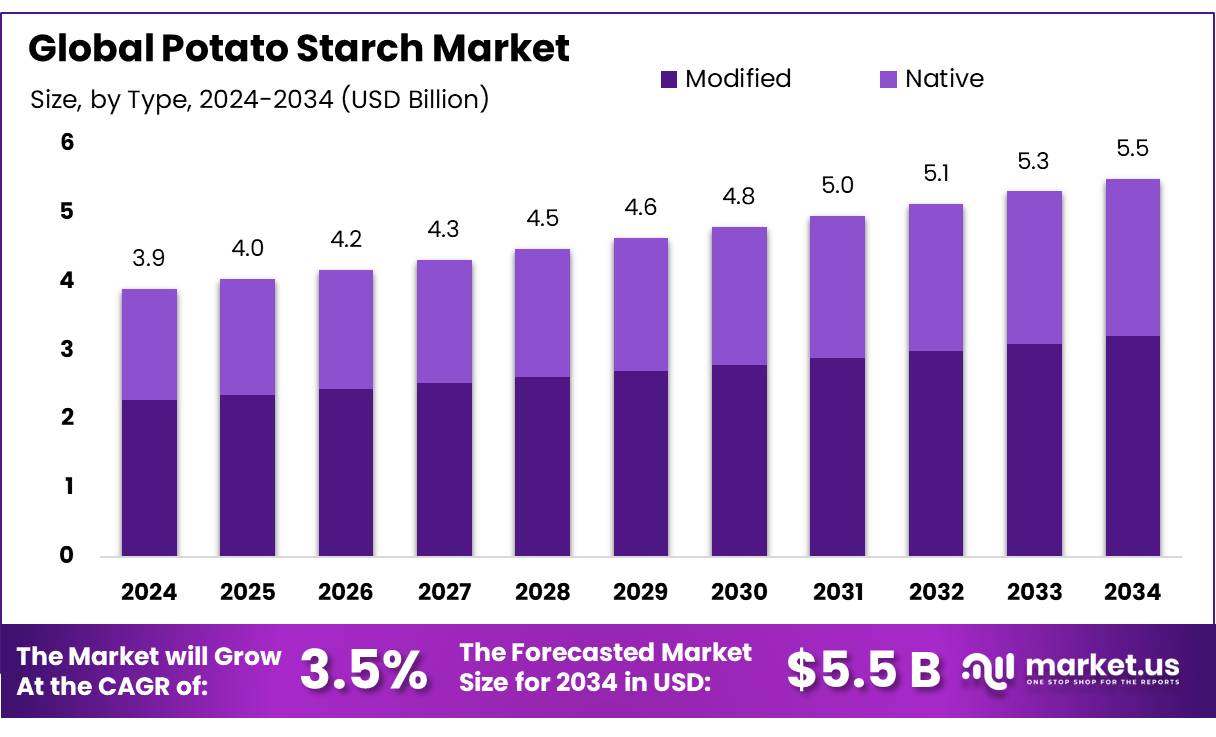

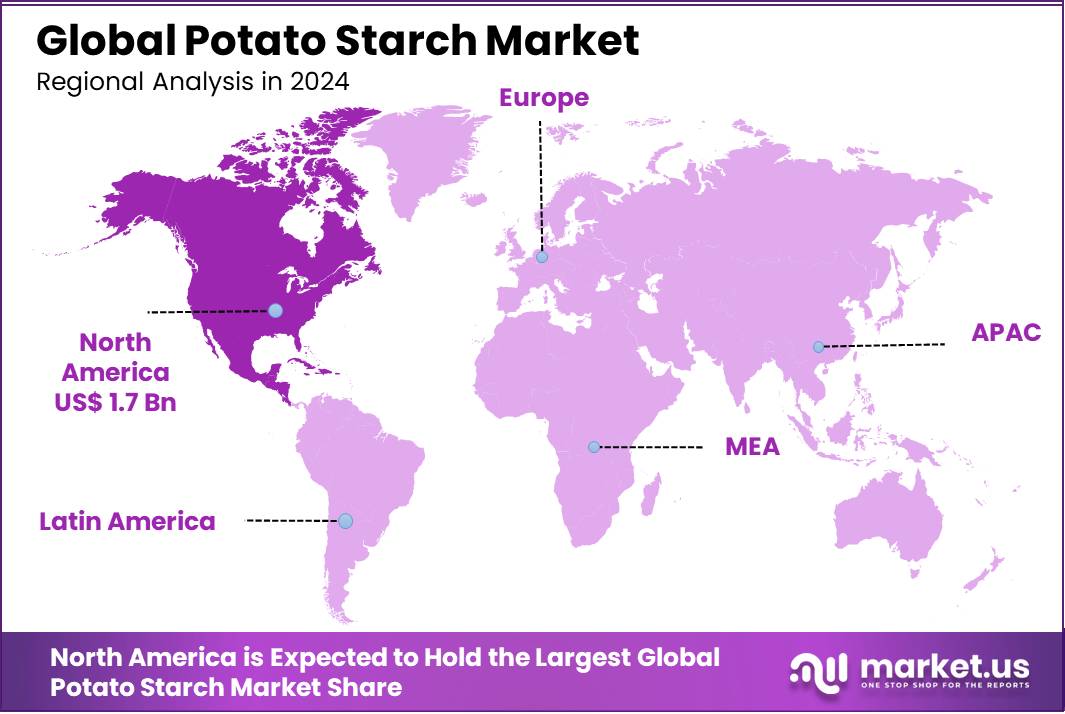

The Global Potato Starch Market is expected to be worth around USD 5.5 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034. Strong demand for packaged food boosted North America emerged as a leading region in the global potato starch market, holding approximately 45.8% of the total market share, equating to around USD 1.7 billion.

Potato starch concentrates are refined products extracted from potatoes, valued for their thickening, binding, and moisture-retaining properties. Widely used in food, paper, textile, and biodegradable packaging industries, they are prized for being natural and gluten-free. The process involves washing, crushing, and refining potatoes to produce a high-purity starch slurry, which is then dried into powder. These concentrates offer functional benefits such as clarity, freeze-thaw stability, and strong adhesion, making them versatile in processed foods, pharmaceuticals, and industrial applications.

Potato starch forms an essential sub-segment within this larger market, supported by growing consumer demand for clean-label ingredients. Of the 375 million tonnes of potatoes produced globally in 2022, China and India together contributed over 151 million tonnes—approximately 40% of total production—highlighting the substantial raw material base for starch processing. In Europe, France’s starch quota system caps annual production at around 265,354 tonnes, reflecting a mature and regulated market.

Several governments have employed subsidy schemes to support potato starch centrifuge capacity. For instance, various EU policies have regulated starch quotas and supported modern production units, while India’s “Operation Greens” initiative allocated INR 500 crore (approximately USD 60 million) from 2018–19 onward to stabilize and develop the value chains for tomato, onion, and potato, including processing infrastructure for starch and concentrates.

Innovative applications such as biodegradable packaging and bioplastics create promising avenues for potato starch concentrates. Waste potato starch from food processing is estimated at 1.4 million tonnes annually from 360 million tonnes of potatoes globally—indicating a significant substrate source for bio-based materials

Key Takeaways

- Potato Starch Market is expected to be worth around USD 5.5 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 3.5%.

- Modified held a dominant market position, capturing more than a 58.3% share in the global potato starch market.

- Conventional held a dominant market position, capturing more than an 89.9% share in the global potato starch market.

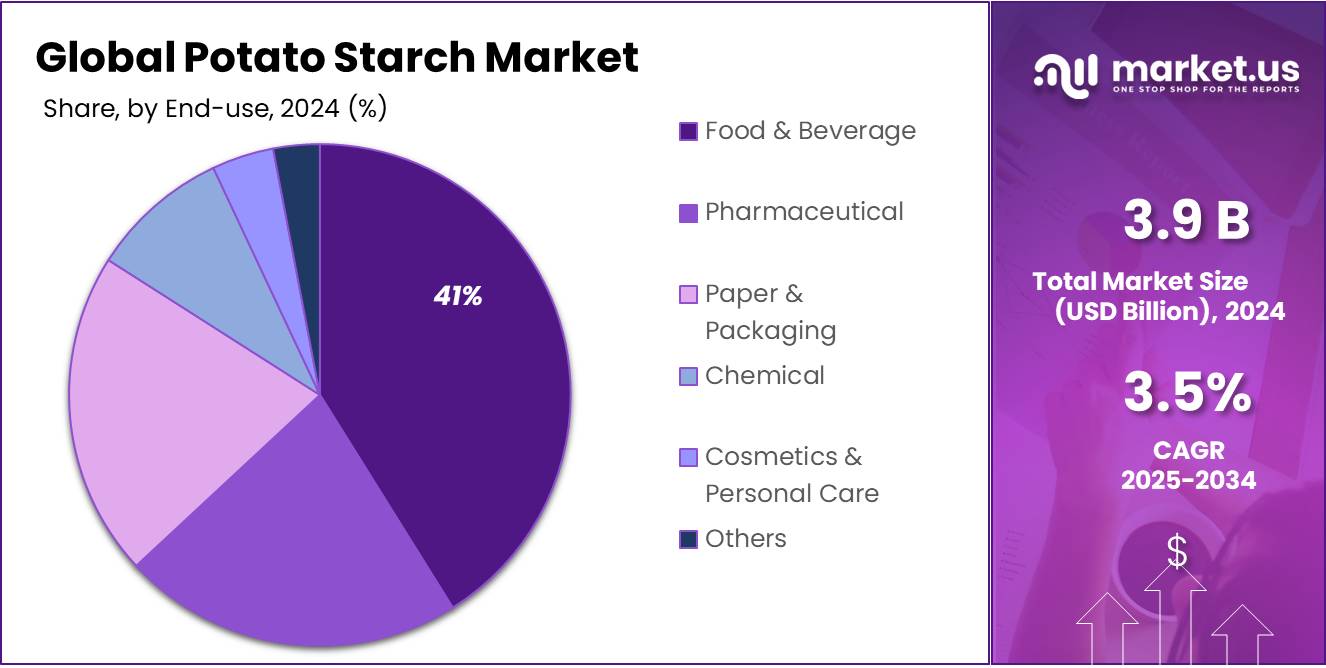

- Food & Beverage held a dominant market position, capturing more than a 41.2% share in the global potato starch market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 38.1% share in the global potato starch market.

- North America emerged as a leading region in the global potato starch market, holding approximately 45.8% of the total market share, equating to around USD 1.7 billion

By Type Analysis

Modified starch dominates with 58.3% share in 2024 due to its high stability and wide industrial usage.

In 2024, Modified held a dominant market position, capturing more than a 58.3% share in the global potato starch market by type. This strong performance is mainly due to its superior functional properties such as enhanced thickening, improved freeze-thaw stability, and better shelf-life. Modified potato starch is widely used in processed foods, sauces, dairy products, and ready-to-eat meals, where consistency and heat resistance are crucial. Its popularity extends beyond food, serving important roles in paper manufacturing, textiles, and pharmaceuticals. Looking into 2025, demand for modified starch is expected to stay strong as industries continue to prioritize cost-effective, adaptable, and high-performance ingredients.

By Nature Analysis

Conventional starch dominates with 89.9% share in 2024 due to its cost-efficiency and wide commercial acceptance.

In 2024, Conventional held a dominant market position, capturing more than an 89.9% share in the global potato starch market by nature. This overwhelming preference is driven by its affordability, high availability, and broad applicability across various industries, including food, paper, textiles, and adhesives. Conventional potato starch continues to be the first choice for manufacturers looking for consistent performance at scale, especially in regions where organic certification is still emerging. In 2025, this segment is expected to maintain its lead, supported by strong industrial demand and well-established supply chains.

By End-User Analysis

Food & Beverage dominates with 41.2% share in 2024 due to high usage in processed and ready-to-eat products.

In 2024, Food & Beverage held a dominant market position, capturing more than a 41.2% share in the global potato starch market by end-use. This leadership is driven by the ingredient’s widespread use in sauces, soups, bakery fillings, dairy items, and meat products, where it serves as a thickener, stabilizer, and moisture-retention agent. The demand for convenience foods and clean-label ingredients continues to push manufacturers toward using potato starch for its natural origin and neutral flavor. In 2025, this trend is expected to grow steadily as consumer interest in processed, gluten-free, and plant-based foods remains strong across global markets.

By Distribution Channel Analysis

Hypermarkets/Supermarkets lead with 38.1% share in 2024 due to their broad reach and high consumer footfall.

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 38.1% share in the global potato starch market by distribution channel. These retail outlets have remained a preferred choice for consumers due to the convenience of one-stop shopping, consistent product availability, and promotional offers. In many urban and semi-urban areas, supermarkets provide an accessible platform for both bulk and small-scale purchases of potato starch, catering to household needs as well as small food businesses. Going into 2025, this channel is expected to maintain strong performance, supported by increasing retail infrastructure and rising packaged food consumption.

Key Market Segments

By Type

- Modified

- Native

By Nature

- Conventional

- Organic

By End-use

- Food & Beverage

- Dairy Products

- Bakery & Confectionery

- Snacks & Processed Foods

- Infant Formula

- Others

- Pharmaceutical

- Paper & Packaging

- Chemical

- Cosmetics & Personal Care

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online retail

- Others

Driving Factors

Rising Demand for Clean Label and Functional Ingredients

In recent years, consumers have shown a strong preference for natural and clean-label ingredients, significantly boosting demand for potato starch. According to the FAO, global diets are shifting away from fresh tubers toward processed foods—such as convenience meals and snacks—that rely on potato starch for its thickening and stabilizing properties.

This trend is reinforced by the sheer size of the global processed food market, which is projected to exceed USD 4.2 trillion in 2024, according to the U.S. Department of Agriculture. As manufacturers strive to offer clean-label products, they increasingly select potato starch for its natural origin, gluten-free status, and lack of additives.

Governments and food safety authorities have also played a key role by supporting clean-label initiatives. For example, the European Union’s Farm to Fork strategy includes measures encouraging manufacturers to replace synthetic additives with “natural” alternatives—positioning potato starch as a preferred ingredient. Similarly, in the U.S., the FDA’s endorsement of potato starch as a safe food additive has reinforced its acceptance in the clean-label movement.

With processed food sales remaining strong—U.S. exports reached USD 38.8 billion in 2024—food manufacturers are motivated to meet consumer demand for transparency and ingredient purity. Potato starch, being neutral in flavor and functional with high viscosity, fits well in sauces, soups, bakery fillings, and gluten‑free formulations.

Restraining Factors

Health Risks from High Glycemic Index Pose a Major Restraint

Potato starch is known to have a very high glycemic index (GI)—around 91—meaning it triggers a rapid increase in blood sugar levels shortly after eating. This sharp glucose spike can be particularly concerning for people with insulin resistance, pre-diabetes, or type 2 diabetes.

According to a meta-analysis spanning nearly 4 million person-years, consuming two to four servings of potatoes per week was linked with a 7% higher risk of developing type 2 diabetes, while seven or more servings weekly raised risk by 33% compared with eating less than one serving weekly . These numbers highlight growing public unease about potato starch and similar high-GI starches in food.

Such health concerns have shaped dietary recommendations from leading health organizations. The American Diabetes Association emphasizes careful portion control of high-GI foods such as potatoes, and encourages pairing them with protein, fiber, or fats to reduce their blood sugar impact. Diabetes UK and NICE also caution that starchy vegetables like potatoes can cause blood sugar surges when consumed too rapidly or in large quantities.

As consumers become more aware of the link between dietary GI and chronic conditions, they are considering swaps for lower-GI alternatives such as whole grains or resistant starch preparations. Even though cooled or resistant potato starch can slow digestion, the overall perception of potato starch as a high-GI product dampens its appeal in health-conscious markets.

Growth Opportunity

Potato Starch in Biodegradable Packaging

The global push towards sustainability has opened a significant growth avenue for the potato starch market—biodegradable packaging. Potato starch, a natural polymer, is increasingly being utilized to create eco-friendly alternatives to traditional plastic wraps and packaging materials. This shift is driven by the need to reduce plastic waste and the environmental impact associated with petroleum-based products.

One notable example is Great Wrap, an Australian company that has developed a compostable cling wrap made from potato waste. Collaborating with Monash University’s chemical engineering team, they transformed potato starch into a biopolymer that decomposes within 180 days, unlike conventional plastic wrap that persists in the environment for centuries. This innovation not only addresses plastic pollution but also offers a cost-effective solution by utilizing abundant potato waste, which would otherwise contribute to methane emissions if left to rot.

In India, where agriculture plays a pivotal role in the economy, leveraging potato starch for biodegradable packaging presents a dual opportunity. It can address the growing environmental concerns associated with plastic waste while also providing farmers with an additional revenue stream through the sale of potato waste. This approach aligns with the government’s initiatives promoting sustainable agriculture and waste management practices.

Latest Trends

Rise of High-Performance Potato Starch in Sustainable Packaging

Potato starch is increasingly gaining attention as a key ingredient in sustainable packaging solutions. This trend is driven by the growing consumer demand for eco-friendly products and the need to reduce plastic waste. Potato starch, being biodegradable and derived from renewable resources, offers a viable alternative to traditional petroleum-based plastics.

In Europe, the adoption of starch-based packaging is particularly prominent. The European Union’s stringent regulations on single-use plastics and its Circular Economy Action Plan have created a favorable environment for the development and use of biodegradable materials. Countries like Germany and the Netherlands are leading the way in implementing these sustainable packaging solutions .

In India, where agriculture plays a crucial role in the economy, leveraging potato starch for biodegradable packaging presents a dual opportunity. It can address the growing environmental concerns associated with plastic waste while also providing farmers with an additional revenue stream through the sale of potato waste. This approach aligns with the government’s initiatives promoting sustainable agriculture and waste management practices.

Regional Analysis

North America commands 45.8% of the potato starch market, valued at USD 1.7 billion in 2024

In 2024, North America emerged as a leading region in the global potato starch market, holding approximately 45.8% of the total market share, equating to around USD 1.7 billion in value. This commanding position is underpinned by the region’s strong demand for clean-label and functional starches in food processing, driven by the rise of convenience and gluten-free products.

The United States, which produces approximately 433,000 tonnes, accounted for around 83% of regional output in 2024, with Canada contributing 90,000 tonnes—together shaping robust processing and manufacturing pipelines. Meanwhile, imports surged to 175,000 tonnes, up 14% year-over-year, indicating strong domestic consumption and industrial need.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Royal Avebe reported revenues of €781 million in the 2023–2024 financial year, processing around 3 million tonnes of potatoes via facilities in the Netherlands, Germany, and Sweden, supported by about 1,254 employees. The cooperative’s per-tonne performance score was €118.62, underlining efficient margins amid a challenging macroeconomic environment. Avebe continues to invest in processing innovation and farmer partnerships, enhancing payouts and sustainability while broadening its clean-label and functional starch portfolio.

In 2024, Roquette Frères achieved a turnover of €4.495 billion, though down roughly 10% from 2023, with an 11.8% EBITDA margin and €529 million in EBITDA. The French-based firm operates over 30 sites globally, including 18 production locations. With leadership in native, modified starch, and plant protein products, Roquette invests in diversification—launching tapioca-based texturers—and maintains financial discipline and margins despite price volatility.

Cargill remains a major player in potato starch through its SimPure and native starch lines. While official 2024 revenue figures specific to potato starch were not disclosed, Cargill has significantly invested—USD 22.5 million—in enhancing Danish potato starch capacity and clean-label product offerings. Its starch portfolio spans native, functional native, and modified lines, supporting diverse end-use needs from baking and adhesives through food-texture solutions.

Market Key Players

- Avebe U.A.

- Roquette Frères

- Cargill, Incorporated

- Ingredion Incorporated

- AGRANA Beteiligungs-AG

- Tereos

- Tate & Lyle

- Südstärke GmbH

- KMC

- Pepees S.A.

- AKV Langholt AmbA

- Novidon

- Vimal PPCE

- Lyckeby Culinar

- PPZ Trzemeszno Sp. z o.o.

Recent Development

In 2023–2024 year, Avebe U.A., a leading potato starch cooperative, achieved a performance indicator of €118.62 per tonne of starch potatoes—equivalent to around USD 128.57/tonne—reflecting healthier margins despite macroeconomic pressures.

In the 2024–25, Tereos Group—operating in sugar, starch, and sweeteners—reported €5.93 billion in total revenues (a 17% drop from €7.14 billion in 2023/24) with €801 million EBITDA (down 29%) and €405 million recurring EBIT.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Bn Forecast Revenue (2034) USD 5.5 Bn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Modified, Native), By Nature (Conventional, Organic), By End-use (Food And Beverage, Dairy Products, Bakery And Confectionery, Snacks And Processed Foods, Infant Formula, Others, Pharmaceutical, Paper And Packaging, Chemical, Cosmetics And Personal Care, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online retail, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Avebe U.A., Roquette Frères, Cargill, Incorporated, Ingredion Incorporated, AGRANA Beteiligungs-AG, Tereos, Tate & Lyle, Südstärke GmbH, KMC, Pepees S.A., AKV Langholt AmbA, Novidon, Vimal PPCE, Lyckeby Culinar, PPZ Trzemeszno Sp. z o.o. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avebe U.A.

- Roquette Frères

- Cargill, Incorporated

- Ingredion Incorporated

- AGRANA Beteiligungs-AG

- Tereos

- Tate & Lyle

- Südstärke GmbH

- KMC

- Pepees S.A.

- AKV Langholt AmbA

- Novidon

- Vimal PPCE

- Lyckeby Culinar

- PPZ Trzemeszno Sp. z o.o.