Global Kid’s Food and Beverages Market By Product Type (Cereals, Snacks, Beverages, Ready-to-Eat Meals, Dairy and Dairy Alternatives, Bakery And Confectionery), By Category (Organic and Conventional), By End-User (Infants And Toddler, Children, and Adolescents) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 67539

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

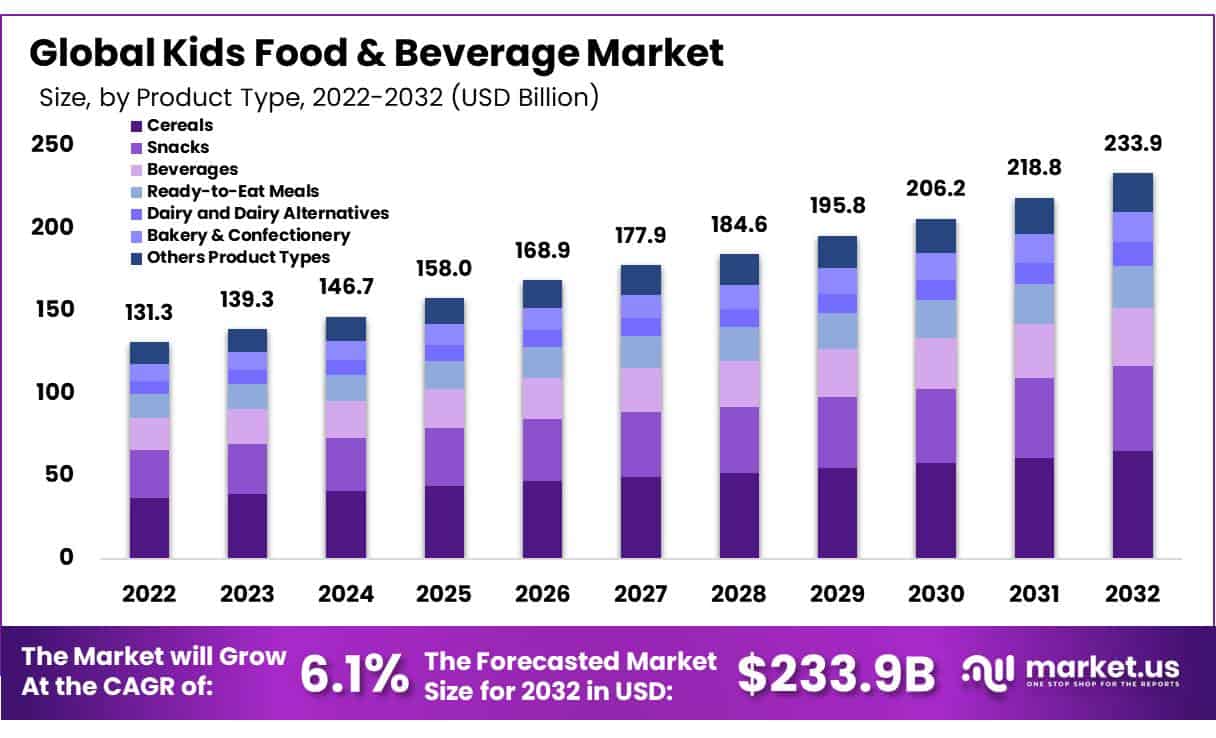

In 2022, the Global Kid’s Food and Beverages Market was valued at USD 131.3 billion and is expected to reach around USD 233.9 Billion by 2032. From 2023 and 2032, this market is estimated to register a CAGR of 6.1%.

Kids’ Food and Beverages (KF&Bs) are food products specifically created and designed for consumption by children. These products are often designed considering the nutritional needs, portion sizes, flavors, and packaging that appeals to children and, by extension, their parents or guardians.

They encompass various items, from everyday meals and snacks to specialty products. Often, these foods are fortified with essential vitamins and minerals to support the growing needs of children. Several companies provide their products in colorful, attractive, and sometimes interactive packaging, which makes the product appealing to end-users and boosts its market.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth: The global kids’ food and beverages market has experienced steady expansion due to growing awareness around child nutrition as well as changing diet preferences, with an anticipated annual growth of CAGR 6.1% from 2023-2032.

- Overview: The kids’ food and beverage market comprises an expansive variety of products designed specifically to meet nutritional requirements as well as taste preferences for kids of various age groups.

- Product Type: Dairy products and alternatives held the greatest share in 2022 of the kids’ food and beverages market at 38%.

- Category Analysis: Conventional products are cost-effective and readily accessible, which makes them the go-to segment in the global kids’ food and beverages market.

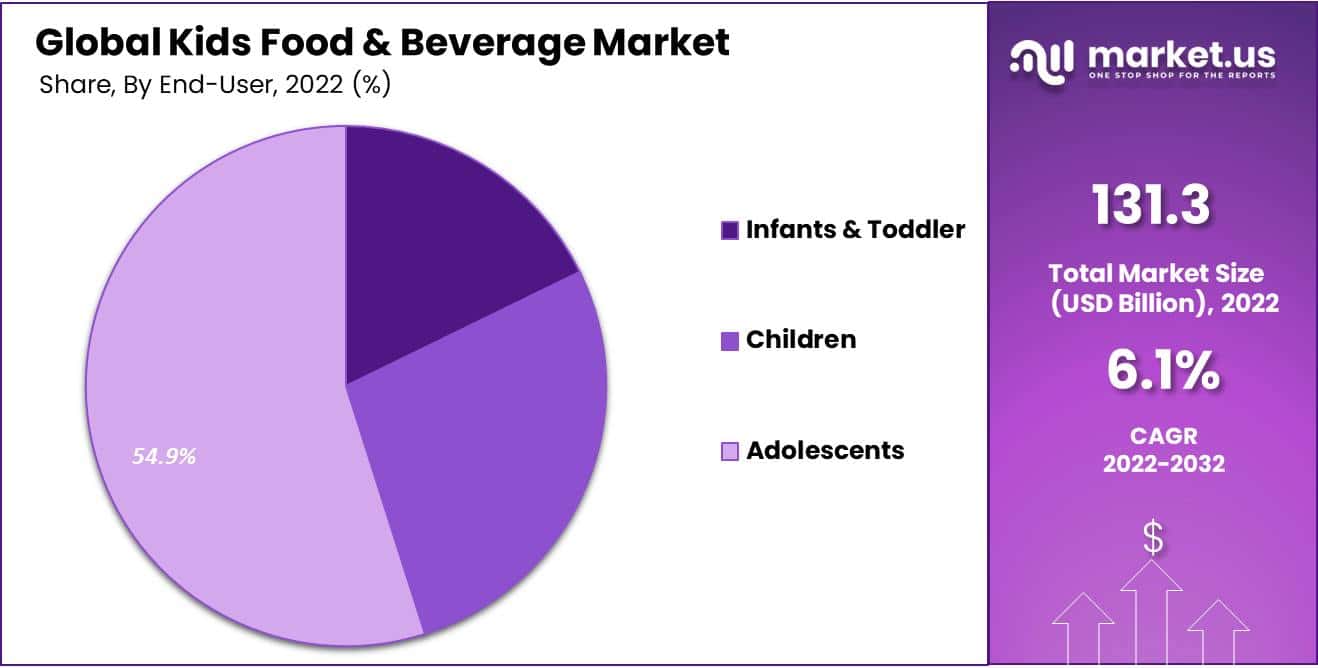

- End Users: Infants, toddlers, children, and adolescents represent different age groups in this market; among these age categories, adolescents accounted for 54.9% market share as of 2022.

- Drivers: Increased awareness and concern about children’s nutrition as well as rising concerns about childhood obesity contributes to market expansion. Furthermore, digital platforms providing access to child nutrition information are likely to influence purchasing decisions as well.

- Restraints: Obstacles to success include concerns related to sugar content, allergens, and additives in children’s products as well as fulfilling regulatory requirements and maintaining product safety requirements can present formidable obstacles in this market.

- Opportunity: Children represent an immense market potential when it comes to innovative, healthier products designed specifically to their preferences and nutritional value. Brands that can effectively communicate the nutritional benefits and safety aspects of their offerings will most likely achieve market success.

- Trends: Trends in kids’ food and beverages include an increasing desire for organic and natural products with lower sugar and salt contents, eco-friendly packaging materials, as well as an increased focus on sustainability and ethical ingredient sourcing.

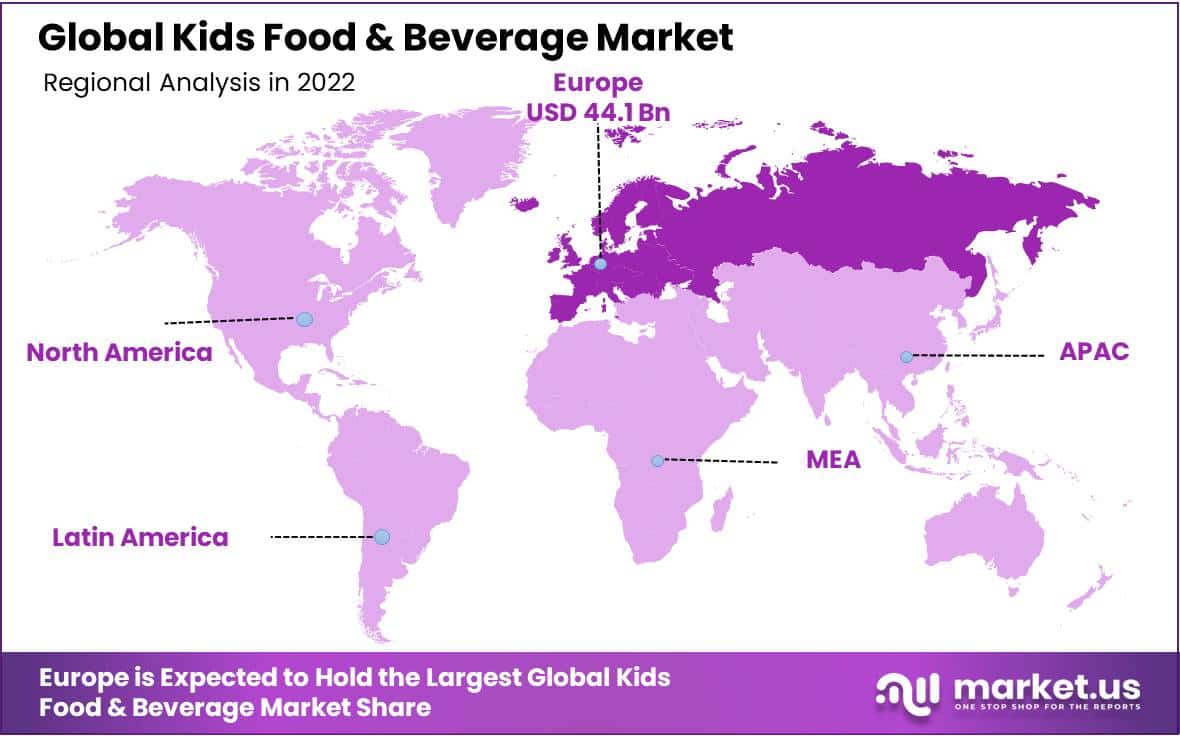

- Europe: Europe held the largest share (33.6% in 2022) due to an abundance of natural and organic products available for purchase.

- Key Players: The market features both established players and new entrants; key players aim to provide products through innovation, marketing, partnerships, or healthcare professionals as a solution for parent/child nutritional needs. Collaborations between healthcare professionals and pediatric nutritionists may also prove fruitful strategies for meeting such demands.

Driving Factors

Increasing Product Innovation in Kid’s Food Is Expected to Propel the Global Kid’s Food and Beverages Market

Due to these challenges, demand has skyrocketed for food and beverage products that provide nutritious profiles tailored specifically for children. Furthermore, innovations like plant-based alternatives will likely boost demand further for innovative products.

Numerous companies are developing kid-friendly plant-based alternatives like almond milk, soy-based snacks, and plant-based meat. Furthermore, in response to increasing concerns over sugar intake and its negative impacts, brands are providing reduced or sugar-free versions of children’s snacks and beverages, helping drive demand further. This trend should continue into 2018.

Restraining Factors

Rising Health Concerns Regarding Kid’s Obesity Level May Hinder the Market Growth.

The rising rates of childhood obesity are a global concern. Parents, healthcare providers, and governments are increasingly cautious about the types of food and beverages children consume, leading to a demand for healthier options.

In addition, health concerns have led to stricter regulations around food and beverages for children. For instance, several countries have guidelines or laws that limit the amount of sugar, salt, and unhealthy fats in kid’s products. Some places have even banned the sale of certain high-sugar drinks and snacks in schools.

Moreover, supermarkets and online retailers are increasingly offering their own cheaper, private-label alternatives, which can trouble the market share of established brands. Factors such as this are anticipated to hinder the market’s growth.

Geopolitical Impact Analysis

Geopolitical events have an enormous influence on the global kid’s food and beverages market. From supply chains to consumer preferences and regulatory systems, geopolitical forces have an effect that extends far beyond national borders. Trade disputes among nations can result in tariffs or import/export restrictions being placed upon specific food or beverage items affecting cost and availability across markets globally.

Trade tensions between the U.S. and China could escalate further and have serious repercussions for global supply chains of ingredients and finished products, altering costs and availability; Middle Eastern conflicts have already had an effect on oil prices which will ultimately influence transporting costs as a result of their disruption of shipping networks.

Political unrest in developing nations could interrupt agricultural products supply lines; nationalist sentiment could encourage consumers to purchase local brands at the expense of international ones; thus affecting market shares of international ones directly or indirectly. With regard to the kid’s food and beverages market worldwide, geopolitics continues to fluctuate causing both direct and indirect effects upon it.

Market Scope

By Product Type Analysis

The Dairy and Dairy Alternatives Segment Held the Largest Market Share in 2022, Owing to Their Essential Nutrient Contents Leading to its Higher Consumption.

Based on product type, the kid’s food and beverages market is segmented into cereals, snacks, beverages, ready-to-eat meals, dairy and dairy alternatives, bakery & confectionery, and other product types.

Among these, dairy and dairy alternatives were the most dominant segment in the global kid’s food and beverages market, with a market share of 38% in 2022. The dominance is attributed to their essential nutrient contents, which leads to their higher consumption.

Dairy products contain essential nutrients like calcium, protein, and vitamins which play an essential role in child development and growth. With more and more people opting for plant-based diets like veganism or vegetarianism leading to more plant-based alternatives like almond, oat, and soy milk becoming available – which should further drive market expansion.

By Catagory Analysis

The Conventional Products are Cost Effective And Easily Available, Making Them More Dominant Segment in the Global Kid’s Food and Beverages Market

By category, the market can be further subdivided into organic and conventional. Of these categories, conventional food and beverages held the greatest market share in 2022 due to their cost-efficiency and convenience of availability.

Conventional products tend to be less costly and accessible for more consumers, being widely available and with longer shelf lives at stores ranging from supermarket chains to local specialty shops.

Conventional products often contain preservatives to increase shelf life, making them more suitable for retailers and consumers.

By End-User

The Adolescents Segment Dominated the Global Market In 2022 Owing to Their Self Purchasing Power

Based on end-users, the market is further segmented into Infants & and toddlers, Children, and Adolescents. Among these, the Adolescents segment accounted for 54.9% of the total market share in 2022.

Adolescents tend to consume snacks, energy drinks, and quick foods which represent significant categories in the kid’s food and beverages market. At the same time, adolescents have become increasingly health conscious in recent years and seek products that meet their dietary requirements such as low-sugar, organic, or protein-rich options.

Adolescents typically possess greater autonomy to make purchasing decisions themselves than infants or younger children do, which can further drive sales growth.

By Distribution Channel

Based on distribution channels, the market is further segmented into supermarkets/hypermarkets, convenience stores, online platforms, and other distribution channels. Among these, supermarkets/hypermarkets have accounted for the largest market share, with 36.7%.

Supermarkets and hypermarkets offer a wide range of products, from different brands to various types of foods and beverages, all under one roof. This variety attracts a broad customer base. These outlets often carry well-known brands that consumers are familiar with, enhancing trust and reliability.

Furthermore, Due to their large scale, supermarkets and hypermarkets can offer competitive prices, including discounts and promotions, which can be a significant draw for consumers.

Key Market Segments

Based on Product Type

- Cereals

- Snacks

- Beverages

- Ready-to-Eat Meals

- Dairy and Dairy Alternatives

- Bakery & Confectionery

- Others Product Types

Based on Category

- Organic

- Conventional

Based on End-User

- Infants & Toddler

- Children

- Adolescents

Based on the Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Store

- Online Platforms

- Other Distribution Channels

Growth Opportunities

Rising Demand for Nutrit-Rich Options

With increasing awareness surrounding childhood obesity and proper nutrition, there has been an upsurge in demand for nutritious children’s food and beverages with lower sugar, artificial additives, and healthier ingredient profiles. Companies specializing in this space will likely experience substantial growth opportunities.

Parents have become more vigilant in monitoring what goes into their children’s food supply, with organic and natural products free from synthetic pesticides, hormones, or genetically modified organisms (GMOs). This presents an exceptional growth opportunity.

Offering diverse flavors and incorporating elements from various ethnic cuisines can appeal to culturally diverse families and introduce children to different taste experiences.

Latest Trends

Rising Consumer Awareness and Government Support for Sustainability

Numerous trends are projected to shape the market over the coming years, chief among them nutritional fortification – as end users seek out healthier food alternatives, fortified products offering essential vitamins, minerals, and fiber are becoming more prevalent.

Organic options have grown increasingly popular as parents search for foods free from synthetic pesticides and fertilizers, with products featuring minimal ingredients without artificial additives gaining in popularity and manufacturers adding clean labels on packaging to increase sales of such items.

Regional Analysis

Europe is the Dominant Region in the Global Kid’s Food and Beverages Market

Europe held the majority of market shares among other regions in 2022 with 33.6 % market share, due to Europeans’ preference for natural and organic products; reflecting parents’ increasing search for foods without additives, artificial colors, or preservatives in them for their children’s meals.

Europe is widely revered for its strict food regulations and nutritional requirements, which has led to products aligning with health and nutrition recommendations being increasingly preferred among European consumers. Organic and natural products tend to be popular choices with minimally processed options without artificial additives being preferred over more processed ones. Culinary traditions across Europe also influence what types of children’s food and beverages can be purchased there.

North America, including both the US and Canada, features an expansive and well-established kid’s food and beverage market, which has seen increasing emphasis placed on developing healthier eating habits in children in response to childhood obesity concerns.

North American markets offer an assortment of organic and allergen-free options with strong branding efforts in marketing and branding, while Asia-Pacific nations including China, Japan India Australia are experiencing rapid urbanization along with shifting dietary practices and urban sprawl.

Attributed to rapid market expansion in this region and global trends such as health consciousness, sustainability, and convenience which influence all regions alike.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the market, including Campbell Soup Company, Conagra Brands, Inc., The Kraft Heinz Company, Nestlé S.A., and Mondelez International, Inc., are actively involved in research and development of low sugar content products and sustainable packaging solutions which are gaining more profit in the target market.

Moreover, the competitive landscape is evolving and dynamic. For instance, Nestlé focuses on innovation and product diversification, offering a wide range of products from infant formula to cereals and snacks. They also invest in fortifying their products with essential nutrients.

Their notable products include Gerber, NIDO, Cerelac, etc. While Danone emphasizes health and wellness, aiming to provide nutritious options rich in probiotics, vitamins, and minerals. They also focus on sustainability and ethical sourcing. These companies have a global wide geographic reach, with a strong presence in developed and emerging markets.

Market Key Players

- Atkins Nutritionals, Inc.

- Britvic plc

- Brothers International Food Holdings, LLC

- Campbell Soup Company

- Conagra Brands, Inc.

- The Kraft Heinz Company

- Nestlé S.A.

- Danone S.A.

- Mondelez International, Inc.

- General Mills, Inc.

- The Kellogg Company

- PepsiCo, Inc.

- Frito-Lay, Inc.

- Mars, Incorporated

- Other Key Players

Recent Developments

- August 2022: Mondelez International acquired Clif Bar & Company, a U.S. Leader in fast-growing energy bars. The company is a manufacturer of nutritious energy bars using organic ingredients. As a result of the acquisition, Mondelez International’s global snack bar business was expanded to be worth more than $1 billion.

- October 2022: Danone and independent animation studio ZAG partnered to bring healthy food and beverages to kids across Portugal and Spain. The three products of Danone featured superheroes from the flagship property of ZAG, Miraculous.

Report Scope

Report Features Description Market Value (2022) USD 131.3 Bn Forecast Revenue (2032) USD 233.9 Bn CAGR (2023-2032) 10.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cereals, Snacks, Beverages, Ready-to-Eat Meals, Dairy and Dairy Alternatives, Bakery and confectionery, and Other Product Types), By Category (Organic and Conventional), By End-User (Infants and toddlers, Children, and Adolescents) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Platforms, and Other Distribution Channels) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Atkins Nutritionals, Inc., Britvic plc, Brothers International Food Holdings, LLC, Campbell Soup Company, Conagra Brands, Inc., The Kraft Heinz Company, Nestlé S.A., Danone S.A, Mondelez International, Inc., General Mills, Inc., The Kellogg Company, PepsiCo, Inc., Frito-Lay, Inc., Mars, Incorporated, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the nutritional considerations for kids’ food and beverages market?Nutritional considerations for children's products often focus on providing essential vitamins and minerals, appropriate portion sizes, lower sugar and sodium content, and the inclusion of wholesome ingredients to support growth and development.

How big is the Kid’s Food and Beverages Market?Kid’s Food and Beverages Market was valued at USD 131.3 billion and is expected to reach around USD 233.9 Billion by 2032. Between 2023 and 2032.

What is the Kid’s Food and Beverages Market growth?The global Kid’s Food and Beverages Market is expected to grow at a compound annual growth rate of 6.1%.Who are the key companies/players in the Kid’s Food and Beverages Market ?Some of the key players in the Kid’s Food and Beverages Market Atkins Nutritionals, Inc., Britvic plc, Brothers International Food Holdings, LLC, Campbell Soup Company, Conagra Brands, Inc., The Kraft Heinz Company, Nestlé S.A., Danone S.A., Mondelez International, Inc., General Mills, Inc., The Kellogg Company, PepsiCo, Inc., Frito-Lay, Inc., Mars, Incorporated, Other Key Players ,

How is the kids’ food and beverages market regulated for safety and labeling?Government agencies, such as the FDA in the United States, regulate labeling and safety standards for children's food and beverages. These regulations address aspects like ingredient disclosure, allergen labeling, and nutritional information to ensure consumer safety and informed choices.

Kids Food and Beverages MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Kids Food and Beverages MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Atkins Nutritionals, Inc.

- Britvic plc

- Brothers International Food Holdings, LLC

- Campbell Soup Company

- Conagra Brands, Inc.

- The Kraft Heinz Company

- Nestlé S.A.

- Danone S.A.

- Mondelez International, Inc.

- General Mills, Inc.

- The Kellogg Company

- PepsiCo, Inc.

- Frito-Lay, Inc.

- Mars, Incorporated

- Other Key Players