Global Almond Milk Market By Product Type(Plain, Flavored), By Type(Organic, Conventional), By Application(Beverages, Frozen Desserts, Personal Care, Other Applications), By Distribution Channel(Hypermarkets & Supermarkets, Convenience Stores, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 37214

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

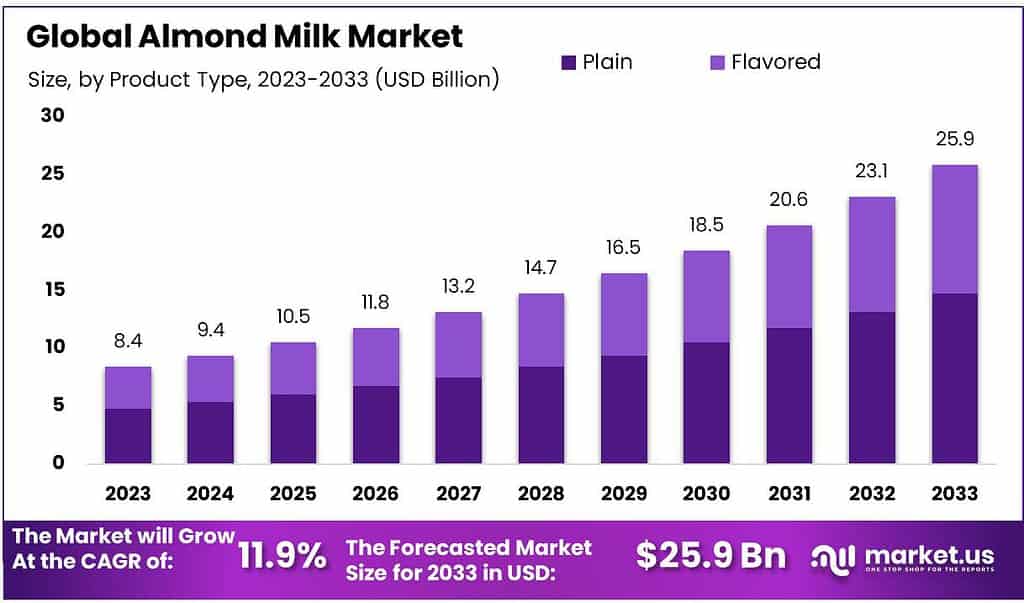

The global Almond milk market size is expected to be worth around USD 25.9 billion by 2033, from USD 8.4 billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2023 to 2033.

Almond milk can be substituted for dairy products with plant-based ingredients and is rich in vitamin E and omega-3 oils. Over the estimated period, the market will be driven by increasing health consciousness and an increased preference for plant-based dairy products.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Projection: By 2033, the almond milk market is estimated to reach approximately USD 25.9 billion, growing from USD 8.4 billion in 2023 at a CAGR of 11.9%.

- Plain vs. Flavored: In 2023, plain almond milk dominated the market share (over 65%) due to its purity and suitability for diagnostics. Flavored variants cater to niche preferences and are growing, focusing on enhancing taste and patient comfort.

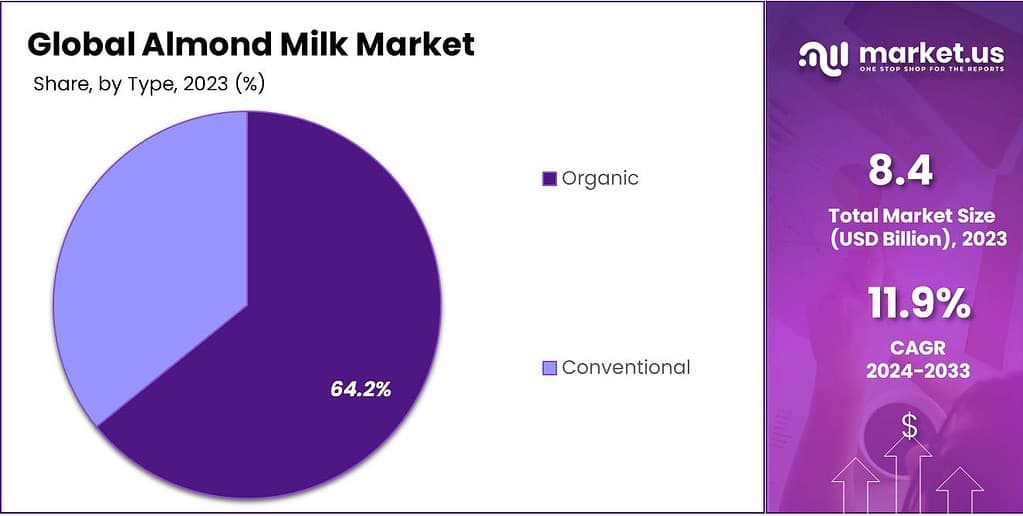

- Organic vs. Conventional: Organic options, relying on natural biomarkers, are preferred for their safety and precision. Conventional methods, though smaller in share, persist in specific scenarios due to established protocols.

- Beverages, Frozen Desserts, Personal Care: Almond milk finds wide application in beverages, especially in regions with lactose-intolerant populations. Additionally, its use in personal care products is expected to grow at a CAGR of 9.9%.

- Hypermarkets/Supermarkets: Dominated sales in 2023, followed by a rise in online retail due to platforms like Big Basket offering almond milk beverages.

- Market Drivers: Health Benefits and Veganism Increased adoption driven by health advantages (reducing inflammation, cholesterol) and rising veganism globally.

- Challenges: Almond Price Volatility and Awareness Gap Challenges include fluctuating almond prices due to supply issues and lack of awareness in certain regions hindering market growth.

- Opportunities: Veganism and Changing Preferences Opportunities arise from the increasing adoption of vegan lifestyles and evolving consumer preferences for plant-based alternatives.

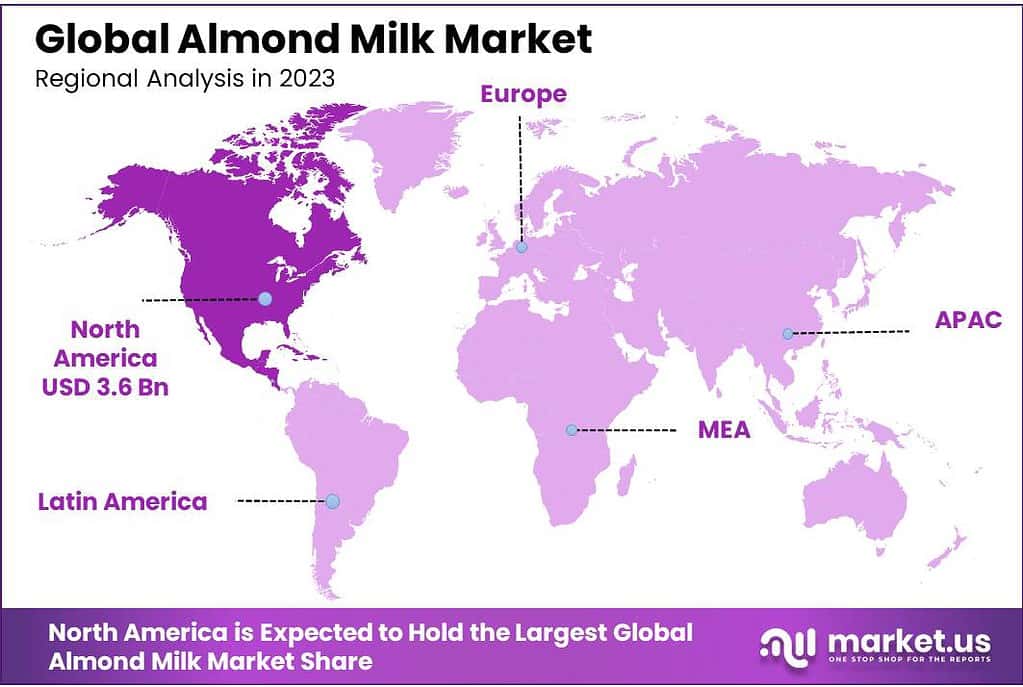

- Asia Pacific Dominance: APAC held the largest market share due to increased beverage demand and rising consumption of almond milk in personal care products.

- Market Leaders: Companies like The Coca-Cola Company, Nestlé, Danone, and others drive market growth through innovative product launches and strategic developments.

By Product Type

In 2023, the Almond Milk market was led by the Plain segment, claiming more than a 65% share of the market. This straightforward, unflavored almond milk resonated strongly with consumers, emphasizing simplicity and core almond milk characteristics.

Preferred for its purity and versatility, Plain Almond Milk emerged as a staple choice, particularly in various culinary applications and as a dairy milk substitute. Its dominance indicates a robust preference for the unadulterated almond milk experience among consumers, showcasing the enduring popularity of the classic and unflavored variety.

In contrast, the Flavored segment, while constituting a smaller market share, caters to specific tastes by offering a variety of enhanced options. These flavored almond milk aim to provide diverse taste experiences, attracting consumers who seek a more nuanced and indulgent flavor profile. Despite its smaller portion of the market, the Flavored segment reflects an evolving trend where consumers explore almond milk beyond its traditional form, emphasizing taste diversity and enjoyment.

The Almond Milk market is poised for continued growth, with the Plain segment expected to maintain its dominance, driven by the enduring appeal of its unembellished, natural characteristics. The Flavored segment, though smaller, is likely to see increased traction as consumers increasingly seek unique and indulgent almond milk choices.

By Type

In 2023, the Almond Milk market saw Organic almond milk dominating with over a 64.2% market share. This segment, known for its natural and pure composition, strongly resonated with health-conscious consumers seeking clean-label options.

The appeal of Organic Almond Milk lies in its authenticity, devoid of synthetic additives, aligning with the rising demand for wholesome and natural products. This widespread preference indicates a growing consumer inclination towards a healthier and more genuine almond milk experience.

On the flip side, the Conventional segment, while holding a smaller market share, remains notable in the industry. These almond milk products adhere to traditional processing methods and may incorporate synthetic additives for flavoring and preservation. Despite not overshadowing the Organic counterpart, the Conventional segment caters to consumers who prioritize familiarity and conventional taste profiles.

Looking forward, the Almond Milk market is poised for continued growth, propelled by the sustained popularity of Organic almond milk and the evolving preferences of consumers seeking both natural and traditional almond milk options.

*Actual Numbers Might Vary In The Final Report

Application Analysis

Almond milk is a popular product in APAC, particularly in China and India. This will likely lead to a favorable growth estimate for the product. The product’s wide application in the beverage and food industries has led to a high requirement from Japan and China.

The growing APAC vegan population is responsible for the growth in beverage applications. According to a National Institutes of Health report, the majority of lactose-intolerant people are from Eastern Asia. This gives almond milk producers more opportunities to reach these regions

Because of its unique anti-aging properties and a high percentage of vitamin C, vitamin E, and zinc in the product’s formulation, the personal care segment is expected to grow at a CAGR (of 9.9%) over the forecast period.

This and creams body sop products have been used in skin repair lotions, for example, manufactures a range of body butter, shampoos, conditioners, and other products for its customers around the world. This is in response to the growing need for almond milk.

The market also has applications for cream liquor, chocolates, and bakery. Almond milk is often used by milk chocolate producers to make nut and fruit chocolates. Tobler One, a Swiss brand of chocolate, uses almond milk to make its products.

Distribution Channel Analysis

In 2023, Hypermarkets/Supermarkets took the lead in the Almond Milk market distribution channels, securing over 40.6% of the market share. This dominant position reflects consumers’ preferences for these retail giants, offering a wide variety of almond milk options and allowing hands-on product experiences.

Shoppers benefit from the convenience and diverse product selections provided by Hypermarkets/Supermarkets, driving significant market presence. Conversely, Convenience Stores, while constituting a smaller share, cater to on-the-go consumers seeking quick purchases.

The Online channel, though smaller in market share, is gaining momentum, offering the ease of doorstep deliveries and expanding the accessibility of almond milk to a broader consumer base. Looking ahead, the market anticipates sustained growth, with Hypermarkets/Supermarkets maintaining their dominance, while Online channels continue to gain significance in meeting evolving consumer preferences.

Key Market Segment

By Product Type

- Plain

- Flavored

By Type

- Organic

- Conventional

By Application

- Beverages

- Frozen Desserts

- Personal Care

- Other Applications

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

Drivers

The global almond milk market has experienced exponential revenue growth for various reasons. One key driver has been the rising prevalence of lactose intolerance and hypercholesterolemia among individuals, as this condition impairs digestion of dairy products like cheese and yogurt resulting in people looking for alternatives such as almond milk as dairy alternatives.

Almond milk’s composition – comprised of polyunsaturated fatty acids known to reduce inflammation and cholesterol levels – makes it appealing to individuals suffering from hypercholesterolemia, making adoption and market expansion inevitable. This health advantage has contributed to its widespread consumption.

Increased adoption of veganism globally has driven increased interest in plant-based dairy alternatives such as almond milk – particularly in regions with limited animal milk availability. This rising trend of the vegan diet has resulted in more almond consumption as an animal milk alternative.

The versatility of almond milk has also significantly contributed to market expansion. It serves as a crucial ingredient in the frozen desserts market finds wide application in various beverage productions, and is utilized in items within the personal care and organic cosmetics industries. This multi-functionality has been a key driver in propelling the market’s revenue growth.

Health-conscious consumer behaviors have further fueled the demand for organic almond milk. Consumers increasingly prefer organic variants produced without additives or thickeners, albeit at a higher cost compared to non-organic options.

Additionally, consumer preferences for flavored almond milk, aiming for a blend of taste, nutrition, and lactose-free attributes, are expected to boost demand during the forecast period. This consumer inclination towards flavorful and nutritious options is anticipated to drive market growth shortly.

Restraints

One big issue is the increasing cost of almonds. Prices have gone up for different reasons. For example, in Afghanistan, a major almond exporter, fighting between groups like the Taliban and Afghan forces made the supply of almonds drop in 2021. This drop in supply caused a big increase in almond prices, affecting importers, manufacturers, and consumers who had to pay more.

Also, in California, where most almonds come from, there was less rain and higher temperatures in 2021. This bad weather made the almond crops smaller, affecting the global supply and pushing prices up. If these kinds of situations continue or happen again, it could hurt the almond milk market’s revenue.

Another challenge is that in some developing countries, not many people know about the benefits of almond milk. People there mostly prefer cow milk or milk from other animals. This lack of knowledge about almond milk’s advantages might slow down its growth in those places.

Additionally, most people worldwide still prefer cow or other animal milk. This preference might hold back the almond milk market’s growth in the future, making it hard for it to expand financially.

Opportunities

Due to the increasing global adoption of veganism, almond milk markets present significant opportunities. More people are turning vegan for animal welfare reasons and this trend has given a boost to almond milk as an eco-friendly and healthier dairy alternative.

Veganism has gained prominence, particularly among residents in developed nations and urban areas of developing nations. People in these locations tend to embrace a vegan lifestyle more readily than in previous decades, creating opportunities for market expansion through plant-based alternatives like almond milk.

Challenges

Almond Price Swings: Almond prices can change a lot because of things like bad weather or tensions in places that grow almonds. This affects how much it costs to make almond milk and how much people pay for it.

Not Enough Awareness in Some Places: Some countries don’t know much about almond milk. They still prefer milk from animals. This makes it hard for almond milk to become popular in those areas.

Competition and Tastes: Even though almond milk is liked by many, there are other plant-based milks like soy or oat milk that people also enjoy. Lots of folks still love cow’s milk too, which makes it tough for almond milk to grow.

Environment Concerns: People worry about how much water almonds need to grow. In places with less water, growing almonds might not be a good idea. This worry can change how people see almond milk’s benefits for the environment.

Supply Chain Issues: Problems in getting almonds from where they grow to where they’re made into milk can cause shortages or higher prices for almond milk.

To overcome these challenges, we need to tell more people about the good things about almond milk, create different types of plant-based milk, find ways to grow almonds more sustainably, and make sure almonds reach the milk factories without problems.

Regional Analysis

Asia Pacific held the largest market share with 42.03%. Between 2023-2032, the Asia Pacific market value will grow by 14.04%. Global beverage demand is forecast to increase over the forecast period. This is due in part to the increased popularity of Raw and Danone Silk brands and the advancement of dairy substitute technology.

Blue Diamond Growers has been providing high-quality almond milk for customers all around the world through the Hain Celestial Group. With their recent product launches, Raw & Sofit has increased almond milk consumption in APAC. This region is also in high demand for personal care products, such as moisturizers, conditioners, hand creams, and hair sprays.

The U.S. frozen dessert market is one sector that has been driving the market growth. In 2018, this sector represented 26.8% of the U.S. This is due to an increase per capita income and changes in eating patterns across the various MEA nations. The market is expected to increase over the forecast period. Almond milk has become a common part of consumers’ daily lives due to growing environmental concerns.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Danone is a company that uses almond milk to make drinks such as flavored milkshakes. Confectionery producers can use almond milk for almond-flavored baked goods, such as cakes, cookies, or cookies. These products are very popular. Baileys used the product to launch Almande Irish cream liqueur for vegans during the holiday season.

Market Key Players

- The Coca-Cola Company

- Nestlé SA

- Danone SA

- Campbell Soup Company

- Elmhurst 1925

- Malk Organics LLC

- SunOpta Inc.

- The Hain Celestial Group Inc.

- Califia Farms LLC

- Blue Diamond Growers

- Ecotone

- Daiya Foods Inc.

- Earth’s Own Food Company Inc.

Recent Development

- In November 2022, Hain Celestial Releases Plan for Leadership Succession.

- In November 2022, Oat milk sales surpassed almond milk for the first time, according to SunOpta.

- In October 2022, Pacific Avenue Capital will procure the business of SunOpta’s sunflower and roasted snacks as part of a strategic sale.

- In July 2022, SUNOPTA manufacturing facilities in Alexandria achieved zero waste to landfill.

- In April 2022, New Sunopta Headquarters And Innovation Center was Announced.

Report Scope

Report Features Description Market Value (2023) USD 8.4 Billion Forecast Revenue (2033) USD 25.9 Billion CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Plain, Flavored), By Type(Organic, Conventional), By Application(Beverages, Frozen Desserts, Personal Care, Other Applications), By Distribution Channel(Hypermarkets & Supermarkets, Convenience Stores, Online) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape The Coca-Cola Company, Nestlé SA, Danone SA, Campbell Soup Company, Elmhurst 1925, Malk Organics LLC, SunOpta Inc., The Hain Celestial Group Inc., Califia Farms LLC, Blue Diamond Growers, Ecotone, Daiya Foods Inc., Earth’s Own Food Company Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is almond milk?Almond milk is a plant-based beverage made by blending almonds with water and often includes additional ingredients like sweeteners, flavors, and thickeners.

What are the reasons for the popularity of almond milk?Almond milk is popular due to its dairy-free nature, suitability for lactose-intolerant individuals, lower calorie content compared to dairy milk, and potential health benefits attributed to almonds, such as being a source of vitamins and minerals.

How is almond milk made?Almond milk is produced by soaking almonds in water, blending them, and then straining the mixture to separate the liquid (the milk) from the almond solids.

-

-

- The Coca-Cola Company

- Nestlé SA

- Danone SA

- Campbell Soup Company

- Elmhurst 1925

- Malk Organics LLC

- SunOpta Inc.

- The Hain Celestial Group Inc.

- Califia Farms LLC

- Blue Diamond Growers

- Ecotone

- Daiya Foods Inc.

- Earth's Own Food Company Inc.