Global Special Purpose Needles Market by Product (Fire Aspirating Needles, Biopsy Needles, Hypodermic Needles, Pen Needles, Suture Needles, Dental Needles, Blood Collection Needles, Others), By Delivery Mode (Sample Collection, Drug Delivery), By End User (Hospital Pharmacies, Private Clinics, Retail Pharmacies & Drug Stores, E-Commerce), and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: July 2024

- Report ID: 26850

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

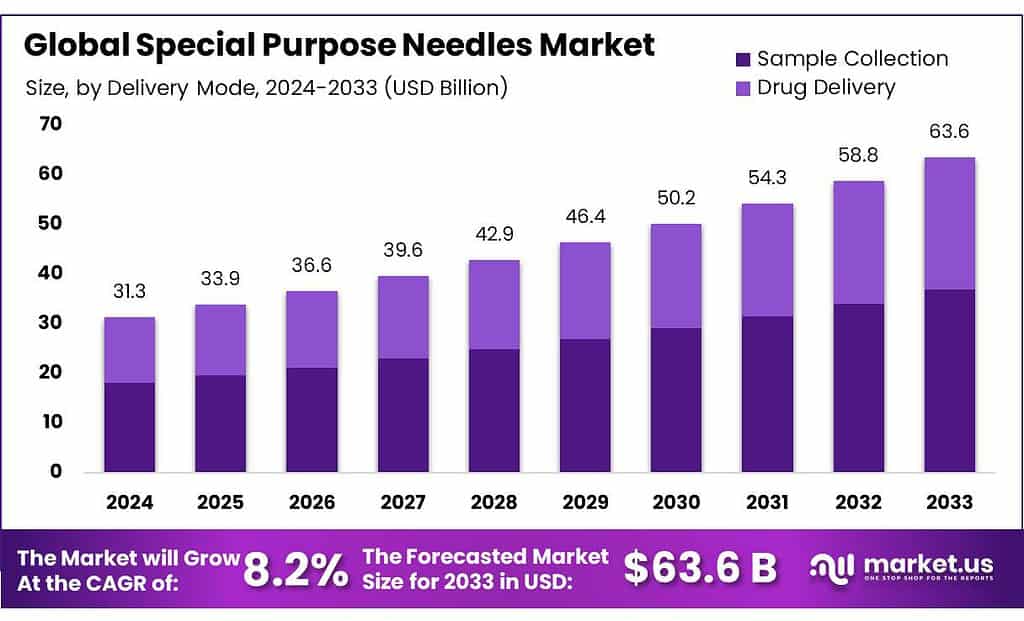

The global Special Purpose Needles size is expected to be worth around USD 63.6 billion by 2033, from USD 31.3 billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2023 to 2033.

The Special Purpose Needles Market is a vital segment within the healthcare industry, focusing on the production, distribution, and sale of specialized needles used for a variety of medical procedures, including biopsies, surgeries, and advanced drug delivery systems. This market is distinct from standard injection needles, catering specifically to complex medical tasks that require precision and specialized functionality.

Regulatory oversight is a significant aspect of this market, with stringent guidelines enforced by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations ensure that the needles are safe and effective for medical use. For example, the FDA mandates premarket notification and sometimes approval for these devices under the Medical Device Amendments of 1976, which can impact the cost and time to market for new products.

The international trade of special purpose needles is robust, highlighted by significant import and export activities. According to the United Nations Comtrade database, the U.S. imported approximately $1.5 billion worth of medical needles, including those for special purposes, in 2022. Germany, on the other hand, exported over $1 billion worth of medical needles during the same period, underscoring a strong global trade network that supports the distribution and availability of these specialized devices across markets.

Government initiatives also play a crucial role in supporting the demand for special purpose needles. For instance, India’s Ayushman Bharat program, which aims to establish 150,000 health and wellness centers nationwide, is expected to boost the demand for medical supplies, including special purpose needles. Such initiatives help expand healthcare access and infrastructure, which in turn drives the market for these specialized tools.

Investments in healthcare are pivotal for the continuous development and innovation within the Special Purpose Needles Market. In 2021, the U.S. government allocated over $160 billion to healthcare, with a portion of this funding dedicated to medical device innovation and safety. The private sector also contributes significantly, with venture capital investments in medical devices reaching $5.1 billion in 2021. These investments facilitate the advancement of new technologies and the improvement of existing products.

Furthermore, the market dynamics are influenced by corporate activities such as innovations, acquisitions, and partnerships. In 2021, Becton, Dickinson and Company (BD), a leading company in this market, acquired Tepha, Inc., a firm specializing in resorbable polymer technology. This move is intended to enhance BD’s surgical device offerings. Additionally, Medtronic introduced its Extended Infusion Set in 2020 in select European markets, which doubles the wear time of insulin pump infusion sets, showcasing ongoing innovation in the sector.

Key Takeaways

- The special purpose needles market is expected to grow from USD 31.3 billion in 2023 to USD 63.6 billion by 2033, at a CAGR of 8.2%.

- In 2023, Fine Aspirating Needles hold an 18.5% market share, crucial for extracting fluid samples in diagnostics.

- Drug Delivery commands a 58.4% market share in 2023, emphasizing the importance of needles in medication administration.

- Hospital Pharmacies lead distribution channels with a 44.5% share in 2023, ensuring immediate availability for medical procedures.

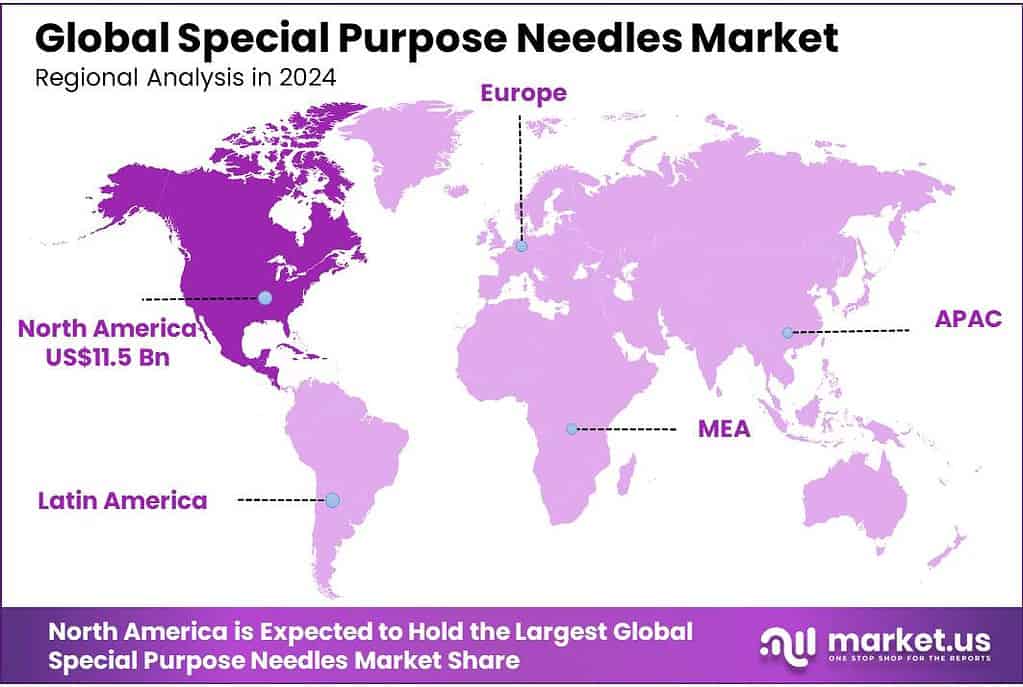

- North America dominates the market with a 37% share, valued at USD 11.5 billion in 2023, driven by advanced healthcare infrastructure.

By Product Type

In 2023, Fine Aspirating Needles held a dominant market position, capturing more than an 18.5% share. These needles are primarily used for extracting fluid samples from the body, proving essential in diagnostic procedures.

Biopsy Needles also represent a significant segment, designed for collecting tissue samples from muscles, bones, and other internal organs for cancer diagnosis and other medical tests. Their precision and effectiveness in minimally invasive procedures enhance their demand.

Hypodermic Needles, known for their widespread use in drug delivery, continue to be indispensable in medical settings. These needles are crucial for injections and withdrawing fluids, supporting a broad range of therapeutic applications.

Pen Needles, used with injection pens for delivering insulin and other medications, have seen an increase in usage due to the growing prevalence of diabetes. Their convenience and ease of use drive their popularity among patients requiring regular injections.

Suture Needles, essential for wound closure, are vital in surgeries and emergency care. Their design variations cater to different tissue types, making them critical in surgical procedures. IV Catheter Needles are crucial for intravenous treatments, including medication delivery and fluid replacement. Their role in critical care and long-term treatments underlines their importance in hospitals and clinics.

Implantation Needles, used in procedures like placing contraceptive implants, play a critical role in long-term treatment strategies. Their specialized designs ensure minimal discomfort and high precision. Dental Needles are designed for anesthesia delivery during dental procedures. Their specific requirements for length and gauge make them a vital tool for dentists.

Ophthalmic Needles, used in surgeries and treatments involving the eye, are tailored for extreme precision, which is mandatory in the delicate ocular area. Finally, Blood Collection Needles remain essential for diagnostic tests and blood donations. Their efficiency and safety features, like retractable designs, enhance patient comfort and practitioner ease of use.

By Delivery Mode

In 2023, Drug Delivery held a dominant market position, capturing more than a 58.4% share. This segment involves the use of special-purpose needles for administering medications directly into the body’s tissues. These needles are crucial in treatments ranging from insulin administration for diabetes to chemotherapy for cancer. Their importance is amplified by the ongoing demand for effective and direct drug administration methods, particularly in chronic disease management.

On the other hand, the Sample Collection segment also plays a vital role in the healthcare industry. These needles are used to collect blood, tissue, or other samples for medical testing and diagnosis. Despite having a smaller market share compared to Drug Delivery, Sample Collection is essential for detecting and monitoring various health conditions. The demand for these needles is driven by the global need for accurate diagnostic procedures and the growing emphasis on preventive medicine.

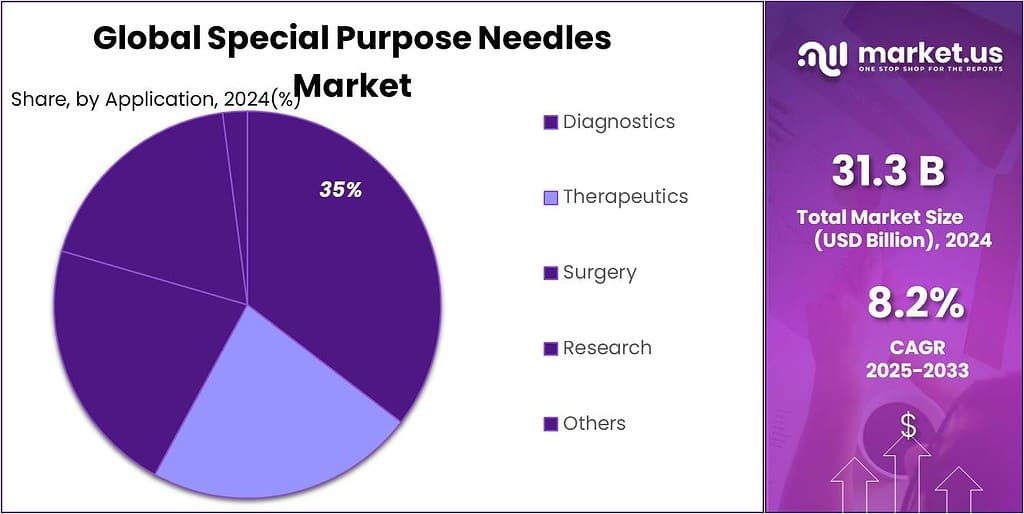

By Application

In 2023, Diagnostics held a dominant market position, capturing more than a 34.5% share. This segment encompasses the use of special purpose needles for various diagnostic procedures, such as drawing blood or sampling tissue, which are essential for identifying diseases and monitoring health conditions. The demand in this segment is driven by the global increase in health awareness and the need for early disease detection.

Therapeutics follows closely, utilizing special purpose needles for the administration of medications and treatments directly to patients. This application is critical in chronic disease management and in scenarios requiring precise medication dosages, such as in the treatment of diabetes with insulin.

Surgery is another significant application area for special purpose needles. These needles are vital for numerous surgical procedures, including suturing and other invasive interventions. Their design and precision directly impact the effectiveness and safety of surgical practices.

The Research segment also utilizes special purpose needles extensively, particularly in the fields of medical and pharmaceutical research. These needles are used in experimental procedures and the administration of treatments in controlled environments, helping to advance medical knowledge and develop new therapies.

By Distribution Channel

In 2023, Hospital Pharmacies held a dominant market position, capturing more than a 44.5% share. This segment leads due to the direct integration of hospital pharmacies within healthcare facilities, ensuring immediate availability of special purpose needles for various treatments and procedures. Their central role in hospitals supports efficient healthcare delivery, particularly in emergency and critical care situations.

Private Clinics also form a significant part of the distribution network for special purpose needles. These facilities rely on a steady supply of needles for diagnostics, therapeutics, and routine medical care, catering primarily to outpatient services and specialized medical treatments.

Retail Pharmacies and Drug Stores serve as accessible points for obtaining medical supplies, including special purpose needles, especially for patients managing chronic conditions at home, such as diabetes. Their widespread presence enhances patient access to necessary medical tools in residential areas.

E-Commerce has seen substantial growth as a distribution channel for medical products like special purpose needles. The convenience of online ordering and the expansion of digital platforms have facilitated the broader distribution of these needles, particularly in regions with limited physical pharmacy access.

Key Market Segments

By Product Type

- Fine Aspirating Needles

- Biopsy Needles

- Hypodermic Needles

- Pen Needles

- Suture Needles.

- IV Catheter Needles

- Implantation Needles

- Dental Needles

- Ophthalmic Needles

- Blood Collection Needles

By Delivery Mode

- Sample Collection

- Drug Delivery

By Application

- Diagnostics

- Therapeutics

- Surgery

- Research

- Others

By Distribution Channel

- Hospital Pharmacies

- Private Clinics

- Retail Pharmacies and Drug Stores

- E-Commerce

- Others

Drivers

Rising Incidence of Chronic Diseases and Related Medical Procedures

One of the primary drivers of the Special Purpose Needles market is the increasing prevalence of chronic diseases, which necessitates a wide range of medical procedures involving special purpose needles. Chronic conditions such as diabetes, cardiovascular diseases, and cancers require ongoing management, which often includes regular diagnostic tests and treatments that use these needles.

Diabetes and Insulin Administration: The global surge in diabetes has significantly driven the demand for pen needles used in insulin administration. As of 2021, approximately 537 million adults (20-79 years) are living with diabetes, with the number expected to rise to 643 million by 2030 according to the International Diabetes Federation. This increase directly correlates with heightened demand for pen needles, enhancing market growth.

Cancer Diagnoses and Biopsies: The rise in cancer prevalence has led to an increased use of biopsy needles. Biopsy procedures are essential for diagnosing cancer, and the precision and effectiveness of biopsy needles are crucial in these procedures. The World Health Organization reports that cancer is a leading cause of death worldwide, accounting for nearly 10 million deaths in 2020. This statistic underlines the critical demand for effective biopsy needles in oncology.

Aging Population: An aging global population is another significant driver. Older adults typically require more medical interventions, involving various types of special purpose needles for treatments and diagnostics. The United Nations estimates that the number of persons aged 60 years or over is projected to double by 2050, which will likely increase the demand for medical procedures involving special purpose needles.

These factors combine to create a robust demand for special purpose needles across various applications in healthcare, from chronic disease management to emergency medicine and elective surgeries. The consistent rise in healthcare spending worldwide further supports market opportunities, as healthcare systems expand and modernize to accommodate the growing needs of the global population.

Restraints

Increasing Development of Needle-Free Injection Technology

A significant restraint affecting the growth of the Special Purpose Needles market is the rapid advancement and adoption of needle-free injection technology. This technology offers a range of benefits over traditional needle-based systems, primarily by eliminating the need for skin puncture, which can reduce the risk of needlestick injuries and improve patient comfort.

Needle-Free Technology Adoption: Needle-free technology is gaining traction due to its advantages in safety and patient compliance, particularly in vaccinations and insulin delivery. The development of jet injectors and other needle-free devices that can deliver drugs effectively through the skin without a needle is a growing trend.

Market Impact: This shift towards needle-free solutions is poised to disrupt the demand for conventional special purpose needles. With increasing healthcare provider and patient preference for less invasive treatment methods, the demand for traditional needles may decline, particularly in settings where needle-free alternatives are viable and readily available.

Regulatory and Health Campaigns: The push from health organizations and governments towards safer medical practices further encourages the use of needle-free systems. These bodies often support innovations that promise reduced transmission risks of diseases and lower overall healthcare costs through improved safety profiles.

The rise of needle-free technology represents a paradigm shift in drug delivery and diagnostic procedures, posing a challenge to the special purpose needles market. Despite the challenge, needles are still required for numerous medical applications, ensuring continued, albeit possibly reduced, market relevance.

Opportunity

Expansion into Emerging Markets

One of the most significant growth opportunities for the Special Purpose Needles market lies in the expansion into emerging markets. These regions are experiencing rapid healthcare sector growth due to rising economic levels, increased healthcare spending, and government initiatives aimed at improving medical infrastructure.

Rising Healthcare Expenditure: Countries like China and India are witnessing substantial increases in healthcare expenditure, which is forecasted to continue. This surge is partly due to governmental efforts to enhance healthcare systems and increase accessibility to advanced medical treatments, creating a fertile environment for the adoption of specialized medical devices, including special purpose needles.

Increased Chronic Disease Prevalence: The global burden of chronic diseases is rising, with significant impacts in emerging markets. The need for regular, effective management of conditions such as diabetes, which often requires the use of specific needles for insulin administration, is expected to drive the demand for these products.

Government Initiatives and Health Reforms: Many governments in emerging markets are implementing health reforms and initiatives that encourage the adoption of advanced medical technologies. These policies are designed to improve the quality of care and increase the safety of medical procedures, both of which underpin the demand for high-quality special purpose needles.

Technological Innovations in Needle Manufacturing

Advancements in needle technology, such as the development of safety needles designed to prevent needlestick injuries and the production of more efficient and less painful needle designs, represent another major growth avenue. These innovations cater to increasing safety standards and the growing demand for more patient-friendly medical solutions.

Safety Needles: Innovations in safety needles, which automatically retract after use, are becoming increasingly popular as they help reduce the incidence of needlestick injuries among healthcare workers. This technological advancement not only improves safety but also complies with stringent regulations mandating the use of safety-engineered medical devices.

Biopsy Needles: The rising incidence of cancer globally is driving demand for biopsy needles, used for diagnosing cancer. Innovations in this segment include needles that provide more accurate samples with minimal patient discomfort.

Strategic Partnerships and Mergers

Engaging in strategic partnerships and mergers with local firms in high-growth markets can also provide significant opportunities. These collaborations can help companies enhance their market reach, share technical know-how, and align with regional market demands more effectively.

Local Partnerships: Collaborating with local players can help international companies navigate regulatory landscapes more smoothly and tailor products to meet specific regional needs, which is particularly crucial in markets with unique healthcare challenges and requirements.

Trends

Rise in Use of Safety Needles and Smart Needles

One of the most significant trends in the Special Purpose Needles market is the increasing adoption of safety needles and the development of smart needles. This trend is driven by the growing emphasis on reducing needlestick injuries and enhancing the precision of diagnostic and therapeutic procedures.

Safety Needles: Safety needles, designed to prevent needlestick injuries, are becoming increasingly prevalent in healthcare settings. These needles typically feature mechanisms that either retract, cover, or blunt the needle after use, significantly reducing the risk of accidental injury. This safety feature is becoming a standard due to stringent regulatory guidelines aimed at protecting healthcare workers from potential infections transmitted through needle injuries.

Smart Needles: The development of smart needles represents a breakthrough in medical technology. These needles are equipped with sensors that can aid in more precise placements, making them particularly valuable in procedures like biopsies or injections into delicate areas of the body. Smart needles enhance the accuracy of the procedures, reduce complications, and improve patient outcomes.

The shift towards these advanced needle technologies is not only enhancing patient and healthcare provider safety but also aligning with global health policies promoting safer medical practices. The integration of these technologies into the special purpose needles market is expected to drive substantial growth, offering enhanced solutions for medical procedures that traditional needles cannot provide.

These innovations in needle technology highlight the industry’s focus on improving safety standards and procedural accuracy, promising significant impacts on healthcare delivery and market growth.

Regional Analysis

The global Special Purpose Needles Market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America leads the market, commanding a substantial 37% share, valued at USD 11.5 billion. The dominance of North America can be attributed to the advanced healthcare infrastructure, high healthcare expenditure, and the increasing prevalence of chronic diseases necessitating specialized needles. The United States, with its robust medical device industry and favorable reimbursement policies, is the major contributor to this region’s market share.

Europe follows closely, driven by the presence of key market players, technological advancements, and a significant geriatric population requiring specialized medical care. Countries such as Germany, France, and the United Kingdom are at the forefront due to their strong healthcare systems and ongoing research and development activities in medical technologies.

The Asia Pacific region is experiencing rapid growth, supported by increasing healthcare investments, improving medical infrastructure, and a rising awareness about advanced medical treatments. China and India are the primary growth engines, owing to their large populations and expanding healthcare sectors. The growing incidence of diabetes and other chronic conditions in these countries further propels the demand for special purpose needles.

The Middle East & Africa region is gradually gaining momentum, primarily due to the improving healthcare facilities and increasing government initiatives to enhance medical services. The United Arab Emirates and Saudi Arabia are notable markets within this region, focusing on healthcare modernization.

Latin America, with countries like Brazil and Mexico, is also contributing to market growth. Economic improvements and the development of healthcare infrastructure are key factors driving the demand for special purpose needles in this region. Collectively, these regions illustrate the diverse and dynamic nature of the global special purpose needles market, with North America firmly established as the leading region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Special Purpose Needles Market is highly competitive, featuring key players such as B. Braun Melsungen AG, Becton, Dickinson and Company, Boston Scientific Corporation, Cardinal Health, Inc., and Cook Group Incorporated. These companies leverage their extensive experience and innovation capabilities to maintain significant market shares. B. Braun Melsungen AG is known for its comprehensive product portfolio and commitment to innovation, which has strengthened its market position.

Similarly, Becton, Dickinson and Company excels through its broad range of needle products and strong global presence, ensuring a robust market footprint. Boston Scientific Corporation continues to advance in this space with its cutting-edge medical technologies and strategic acquisitions that expand its product offerings and market reach.

Other notable players include EXELINT International, Co, Medline Industries, Inc., Medtronic Plc, and Nipro Medical Corporation, each contributing to the market through diverse and specialized needle products that cater to various medical needs. Retractable Technologies, Inc. and SERAG-WIESSNER GmbH & Co. KG focus on safety and innovation, driving the development of needles designed to minimize needlestick injuries and enhance patient safety.

Smith’s Medical Inc., Stryker Corporation, Terumo Group, and The Smith Group Inc. also play pivotal roles, leveraging their extensive research and development capabilities to introduce advanced needle technologies. The competitive landscape is characterized by ongoing innovation, strategic partnerships, and a commitment to addressing evolving medical requirements, ensuring sustained growth and advancement within the special purpose needles market.

Market Key Players

- B. Braun Melsungen AG.

- Becton

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group Incorporated

- Dickinson and Company

- EXELINT International, Co

- Medline Industries, Inc.

- Medtronic Plc

- Nipro Medical Corporation

- Retractable Technologies, Inc.

- SERAG-WIESSNER GmbH & Co. KG

- Smith’s Medical Inc.

- Stryker Corporation

- Terumo Group

- The Smith Group Inc.

Recent Development

In 2023 B. Braun Melsungen AG, the company saw a 5% increase in needle sales compared to the previous quarter, driven by higher adoption rates in hospital pharmacies.

By March 2023 Becton, the company reported a 5.7% organic revenue growth, attributing success to their diverse product portfolio and strategic initiatives.

Report Scope

Report Features Description Market Value (2023) US$ 31.3 Bn Forecast Revenue (2033) US$ 63.6 Bn CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Fine Aspirating Needles, Biopsy Needles, Hypodermic Needles, Pen Needles, Suture Needles., IV Catheter Needles, Implantation Needles, Dental Needles, Ophthalmic Needles, Blood Collection Needles), By Delivery Mode(Sample Collection, Drug Delivery), By Application(Diagnostics, Therapeutics, Surgery, Research, Others), By Distribution Channel(Hospital Pharmacies, Private Clinics, Retail Pharmacies and Drug Stores, E-Commerce, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape B. Braun Melsungen AG., Becton, Boston Scientific Corporation, Cardinal Health, Inc., Cook Group Incorporated, Dickinson and Company, EXELINT International, Co, Medline Industries, Inc., Medtronic Plc, Nipro Medical Corporation, Retractable Technologies, Inc., SERAG-WIESSNER GmbH & Co. KG, Smith’s Medical Inc., Stryker Corporation, Terumo Group, The Smith Group Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Special Purpose Needles MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Special Purpose Needles MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- B. Braun Melsungen AG.

- Becton

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group Incorporated

- Dickinson and Company

- EXELINT International, Co

- Medline Industries, Inc.

- Medtronic Plc

- Nipro Medical Corporation

- Retractable Technologies, Inc.

- SERAG-WIESSNER GmbH & Co. KG

- Smith's Medical Inc.

- Stryker Corporation

- Terumo Group

- The Smith Group Inc.