Global Gesture Recognition in Consumer Electronics Market By Technology (Touch-based Gesture Recognition, Touchless Gesture Recognition), By Type (Hand Gestures, Facial Expressions, Body Movements, Finger Gestures), By Application (Gaming Devices, Smartphones, Smart Televisions, Wearable Devices, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 72206

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

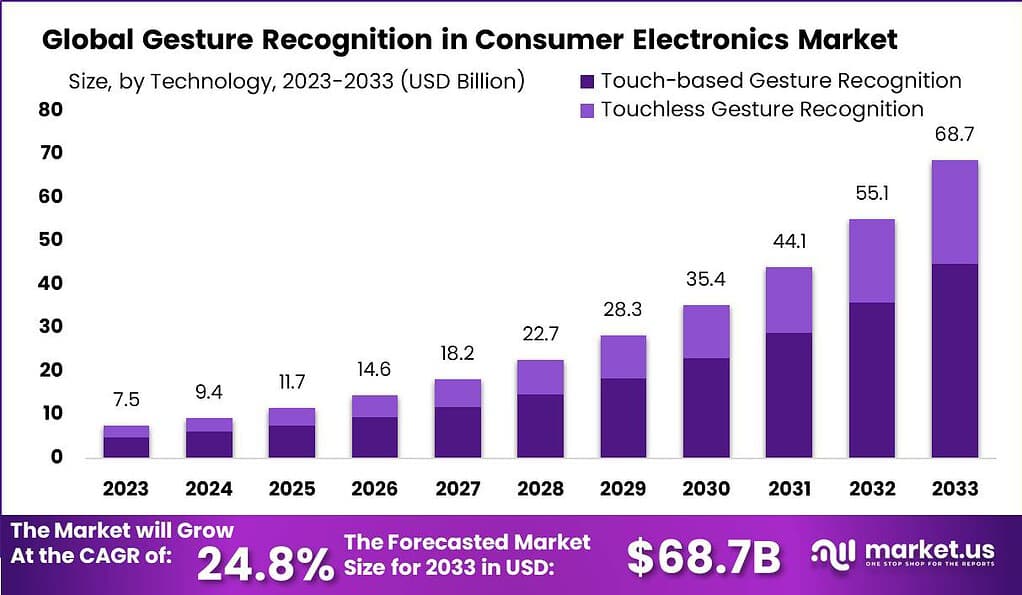

The Global Gesture Recognition in Consumer Electronics Market size is expected to be worth around USD 68.7 Billion by 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 24.8% during the forecast period from 2024 to 2033.

Gesture recognition technology has emerged as a significant development in the field of consumer electronics. This technology enables devices to interpret and respond to human gestures, allowing users to interact with their devices in a more intuitive and natural way.

The gesture recognition market in consumer electronics is propelled by the growing consumer demand for seamless and effortless interaction with devices. Gesture-based interfaces offer a more engaging and immersive user experience compared to traditional input methods like keyboards or touchscreens. Moreover, the integration of gesture recognition technology enhances accessibility for individuals with disabilities, allowing them to interact with devices more effectively.

In this market, various consumer electronic devices, such as smartphones, tablets, gaming consoles, and smart TVs, are incorporating gesture recognition capabilities. These devices use sensors, cameras, and advanced algorithms to detect and interpret hand and body movements, enabling users to control and navigate their devices through gestures. For example, users can swipe, pinch, or rotate their fingers to navigate through menus, zoom in or out, scroll through content, or play games.

The adoption of gesture recognition in gaming consoles and virtual reality (VR) headsets is expected to experience significant growth, with a projected increase of 40% compared to 2023. This growth can be attributed to the desire for more immersive and intuitive gaming experiences, where users can control the game through natural hand and body movements.

In the smartphone market, it is estimated that by 2023, over 70% of smartphones will be equipped with gesture recognition capabilities. This integration of gesture recognition technology aims to provide users with more intuitive user interfaces and enhanced accessibility, allowing them to perform actions such as scrolling, navigating, and controlling applications through simple hand gestures.

Looking at home appliances, the use of gesture recognition is anticipated to rise by 35% year-over-year in 2024. Home appliances like smart ovens and refrigerators are being equipped with gesture recognition capabilities to offer users a touchless and convenient way to control and interact with these devices. For example, users can wave their hand to open or close the oven or make hand gestures to adjust temperature settings on a refrigerator.

Key Takeaways

- The Gesture Recognition in Consumer Electronics Market is anticipated to reach a significant milestone, estimated at USD 68.7 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of 24.8%.

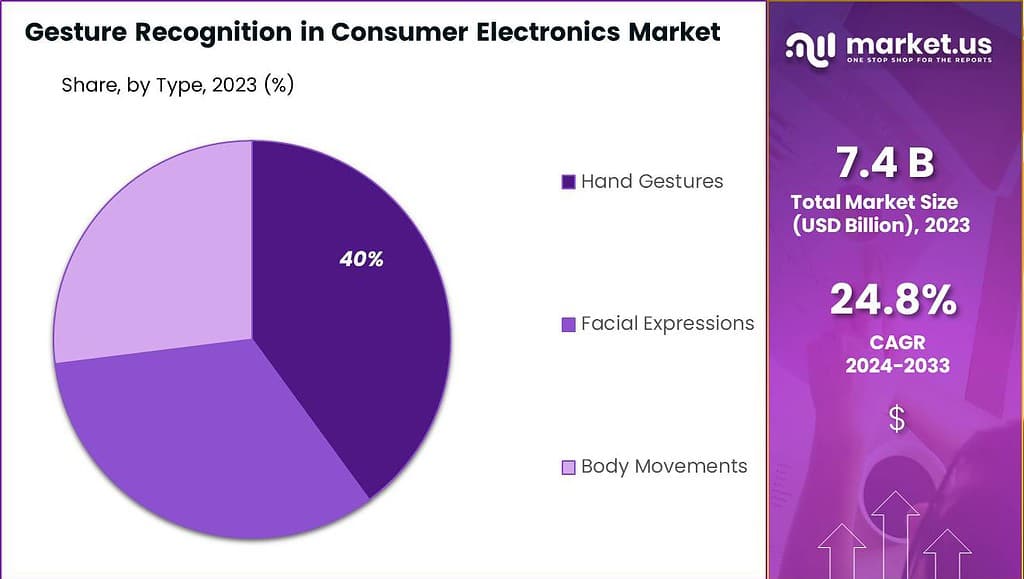

- In 2023, the Touchless Gesture Recognition segment commanded over 65% of the market share, fueled by its innovative and hygienic approach to device interaction.

- Hand gestures accounted for over 40% of the market share in 2023, owing to their widespread application and intuitive user interaction across devices like smartphones and gaming consoles.

- Smartphones Segment Commands a Significant Share With a share exceeding 35% in 2023, smartphones emerged as the dominant application segment, driven by the increasing demand for intuitive device interaction and enhanced user interfaces.

- By 2023, it is estimated that over 65% of automotive infotainment systems will seamlessly incorporate gesture recognition functionalities. This integration is poised to redefine in-car user experiences, offering drivers safer and more convenient control options while minimizing distractions on the road.

- In 2024, the adoption of gesture recognition within wearable devices, including smartwatches and fitness trackers, is projected to grow by 30% compared to the previous year. This surge reflects a growing consumer appetite for wearable technology that seamlessly integrates intuitive gesture-based interactions into daily activities, enhancing user convenience and engagement.

- By the year 2023, it is expected that over 75% of smart home systems will offer support for gesture recognition technology. This advancement enables users to effortlessly control connected devices such as lighting, thermostats, and security systems, heralding a new era of hands-free convenience and seamless home automation.

Technology Analysis

In 2023, the Touchless Gesture Recognition segment held a dominant market position in the Gesture Recognition in Consumer Electronics market, capturing more than a 65% share. This leading segment’s substantial market share can be attributed to its innovative technology, which allows users to control devices through gestures without physical contact.

The growing demand for hygienic and contactless interfaces, particularly in the wake of global health concerns, has significantly propelled the adoption of touchless gesture recognition technologies. Moreover, advancements in sensors and AI have improved the accuracy and responsiveness of touchless systems, making them more appealing to both manufacturers and consumers.

Touchless Gesture Recognition technology has gained prominence for its convenience and the enhanced user experience it offers. It supports a wide range of applications, from smart home devices to automotive infotainment systems, driving its integration into an increasing number of consumer electronics. The technology’s ability to interpret human gestures with high precision, without the need for direct touch, positions it as a key player in the market’s future growth.

Additionally, the segment’s expansion is supported by consumer preferences shifting towards more intuitive and interactive user interfaces. With significant investments in R&D, the sector is witnessing continuous innovation, leading to the development of more sophisticated and reliable gesture recognition solutions.

Type Analysis

In 2023, the Hand Gestures segment held a dominant market position in the Gesture Recognition in Consumer Electronics market, capturing more than a 40% share. This segment’s leadership is largely due to its widespread application and the intuitive interaction it offers across various devices, such as smartphones, tablets, and gaming consoles.

Hand gestures are a natural form of communication for humans, making this technology highly accessible and easy to adopt for a broad range of consumers. Furthermore, the advancements in sensor technology and machine learning algorithms have significantly enhanced the accuracy and efficiency of hand gesture recognition systems, contributing to their increased adoption in consumer electronics.

The popularity of hand gestures as a mode of interaction in consumer electronics is underscored by their ability to provide a seamless and immersive user experience. This technology allows users to control devices with simple movements, reducing the need for physical contact and making interactions more engaging.

The versatility of hand gesture recognition, enabling applications from volume control to game navigation, has made it an essential feature in next-generation consumer electronics. Additionally, as the technology continues to evolve, it is becoming more sophisticated, with the ability to recognize a wider array of gestures, further solidifying its market dominance.

Application Analysis

In 2023, the Smartphones segment secured a commanding presence in the Gesture Recognition in Consumer Electronics market, capturing more than a 35% share. This leadership position is primarily due to the ubiquitous use of smartphones worldwide and the continuous evolution of gesture recognition technologies that have enhanced the user interface.

The convenience of gesture controls in smartphones, allowing users to interact with their devices in a more intuitive and seamless manner, has significantly contributed to the segment’s dominance. Whether it’s swiping, tapping, or pinching, gesture recognition has made smartphone usage more efficient and engaging, fostering its adoption across a broad demographic.

The proliferation of advanced technologies, such as AI and machine learning, has further elevated the sophistication of gesture recognition capabilities in smartphones. This advancement not only improves the accuracy and responsiveness of gesture controls but also paves the way for innovative applications, enhancing user experiences and device interactivity.

The integration of gesture recognition in smartphones caters to the growing consumer demand for convenience and speed, enabling tasks to be performed more quickly and effectively without the need for physical contact. This trend is reflective of a broader shift towards touchless interfaces in consumer electronics, driven by hygiene considerations and the enhanced functionality these interfaces offer.

Key Market Segments

By Technology

- Touch-based Gesture Recognition

- Touchless Gesture Recognition

By Type

- Hand Gestures

- Facial Expressions

- Body Movements

- Finger Gestures

By Application

- Gaming Devices

- Smartphones

- Smart Televisions

- Wearable Devices

- Others

Driver

Advancements in Sensor Technologies

The relentless advancements in sensor technologies represent a primary driver for the Gesture Recognition in Consumer Electronics market. Innovations in 3D sensing, infrared, ultrasonic, and camera technologies have significantly enhanced the accuracy, responsiveness, and reliability of gesture recognition systems. These technological advancements have enabled more sophisticated and nuanced recognition of gestures, even in complex environments.

As sensors become more capable of capturing subtle movements, the potential applications for gesture recognition in consumer electronics expand, ranging from immersive gaming experiences to intuitive smart home controls. The integration of advanced sensors not only improves user experience but also broadens the market for gesture recognition technologies, driving growth across various consumer electronics segments.

Restraint

High Implementation Costs

One of the main restraints facing the Gesture Recognition in Consumer Electronics market is the high implementation costs associated with the technology. Developing and integrating sophisticated gesture recognition systems requires substantial investment in research and development, advanced sensors, and software algorithms.

These costs can be prohibitive for manufacturers, particularly small and medium-sized enterprises, limiting the adoption of gesture recognition technologies across the broader market. Additionally, the expense of integrating these systems can also increase the final retail price of consumer electronics, potentially deterring price-sensitive consumers. This cost barrier not only affects the penetration rate of gesture recognition technologies but also restricts innovation and competition within the market.

Opportunity

Integration in Smart Home Devices

The integration of gesture recognition technologies in smart home devices presents a significant opportunity for growth in the consumer electronics market. As smart homes become more prevalent, there is a growing demand for more intuitive and convenient ways to interact with home automation systems.

Gesture recognition offers a hands-free, seamless method of controlling smart home devices, such as lighting, entertainment systems, and security features. This technology enhances the user experience by making interactions more natural and efficient, driving consumer interest and adoption.

The expansion of the smart home devices market, coupled with the increasing demand for innovative user interfaces, provides a fertile ground for the adoption and growth of gesture recognition technologies, positioning it as a key area for development and investment.

Challenge

User Acceptance and Reliability Concerns

Despite the advancements in gesture recognition technology, user acceptance and reliability concerns pose significant challenges. Users may be hesitant to adopt gesture-based interfaces due to unfamiliarity or skepticism about their effectiveness and ease of use. Additionally, the performance of gesture recognition systems can vary in different environments, particularly in conditions with poor lighting or where there are obstructions.

Ensuring consistent reliability and overcoming user skepticism are critical challenges that manufacturers and developers must address. Building trust in the technology’s accuracy and creating user-friendly interfaces are essential steps toward wider acceptance and integration of gesture recognition in consumer electronics.

Growth Factors

- Rising Demand for Contactless Interfaces: The global health crisis has accelerated the demand for contactless technologies, making gesture recognition more appealing for health and hygiene reasons.

- Growth in AR and VR: The expansion of augmented reality (AR) and virtual reality (VR) applications in gaming and education increases the need for intuitive interaction methods, including gesture recognition.

- Expansion of IoT and Smart Devices: The proliferation of IoT devices and smart technologies in homes and industries creates more opportunities for gesture recognition integration.

- Consumer Demand for Enhanced UX: The push for more immersive and interactive user experiences in electronics propels the development and adoption of gesture recognition technologies.

Emerging Trends

- AI and Machine Learning Integration: Leveraging AI and machine learning algorithms to improve gesture recognition accuracy and create more personalized user interactions.

- Multi-Modal Interaction Systems: The development of systems that combine gesture, voice, and facial recognition for a comprehensive and intuitive user interface.

- Wearable Gesture Control Devices: The emergence of wearable technologies that use gesture recognition to control other devices, enhancing mobility and convenience.

- Gesture Recognition in Automotive: The use of gesture recognition in automotive applications, such as controlling infotainment systems and enhancing driver safety features, is becoming increasingly popular.

Regional Analysis

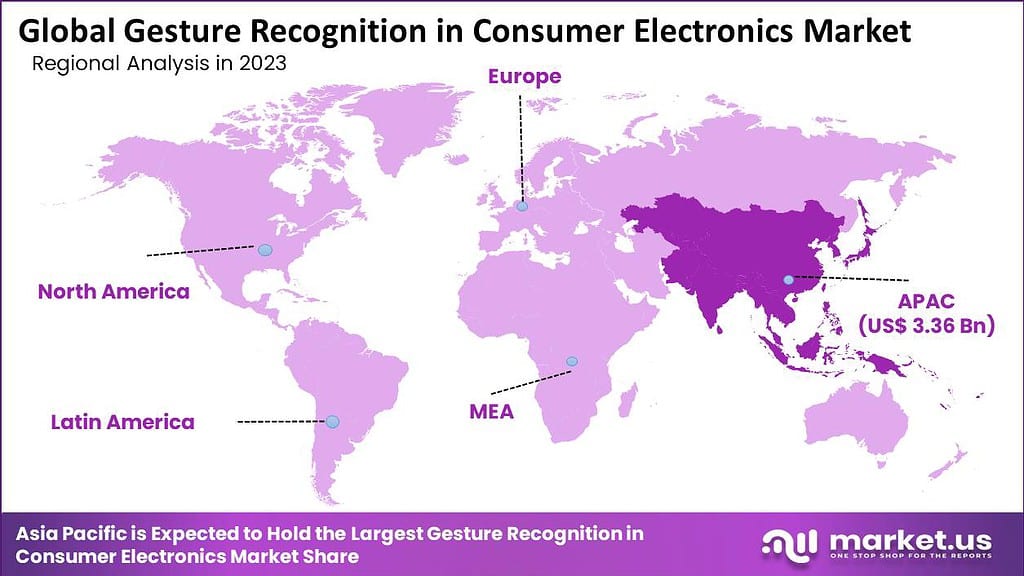

In 2023, Asia-Pacific emerged as the frontrunner in the gesture recognition market within the consumer electronics sector, securing a dominant position with over a 45% share. The demand for Gesture Recognition in Consumer Electronics in Asia-Pacific was valued at USD 3.36 billion in 2023 and is anticipated to grow significantly in the forecast period.

This substantial market share can be attributed to several pivotal factors that underscore the region’s pioneering role. Firstly, the presence of major consumer electronics manufacturers in countries such as China, South Korea, and Japan has significantly contributed to the development and adoption of gesture recognition technologies.

These countries are renowned for their robust electronics manufacturing capabilities and for being the home to global giants like Samsung, Sony, and Xiaomi, which have been instrumental in integrating gesture recognition features into their products.

Moreover, the Asia-Pacific region’s rapid technological advancement, combined with a high consumer adoption rate of smart and interactive devices, has fueled the demand for gesture recognition solutions. The region’s vast population and growing middle class have also played a crucial role in this surge, leading to an increase in disposable incomes and a willingness to invest in the latest consumer electronics.

Furthermore, government initiatives across the region aimed at promoting digitalization and smart city projects have bolstered the integration of advanced technologies, including gesture recognition, in various applications.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the gesture recognition market for consumer electronics, several key players have emerged, each contributing to the advancement and adoption of gesture recognition technology. These key players are actively involved in research and development, product innovation, and strategic partnerships to gain a competitive edge in the market.

Top Market Leaders

- Microsoft

- Samsung Electronics

- Intel

- Sony

- Texas Instruments

- Softkinetic

- Apple Inc.

- Cipia

- NXP Semiconductors

- Cognitec Systems

- OmniVision Technologies Inc.

- Other key players

Recent Developments

- Microsoft: In March 2023, Microsoft revealed a better version of its Kinect sensor, which is a tool that can see and understand people’s movements. This new version is really good at recognizing gestures, which means it can understand the way you move your hands and body. Microsoft made this to make playing games and using other electronic devices more fun and easy, as you can now do things like jump or wave your hand to control the game or device.

- Samsung Electronics: In June 2023, Samsung brought out a new set of smart TVs that come with an upgraded way to recognize gestures. These TVs let you do things like turn the volume up or down, switch channels, or scroll through menus just by moving your hands. This makes watching TV a lot more interactive and fun because you don’t always have to find the remote to control your TV.

- Intel: In September 2023, a big company known for making computer parts, joined hands with a top group that studies AI (artificial intelligence) to create a new way to keep laptops and tablets safe. They are working on a system that lets you unlock your device with special hand movements. This means that in the future, you might be able to open your laptop or tablet just by doing a unique gesture, making your device more secure and personal to you.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Bn Forecast Revenue (2033) USD 68.7 Bn CAGR (2024-2033) 24.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Touch-based Gesture Recognition, Touchless Gesture Recognition), By Type (Hand Gestures, Facial Expressions, Body Movements, Finger Gestures), By Application (Gaming Devices, Smartphones, Smart Televisions, Wearable Devices, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft, Samsung Electronics, Intel, Sony, Texas Instruments, Softkinetic, Apple Inc., Cipia, NXP Semiconductors, Cognitec Systems, OmniVision Technologies Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Gesture Recognition in Consumer Electronics?Gesture recognition in consumer electronics refers to the technology that enables devices to interpret human gestures as commands or inputs. These gestures can include hand movements, body gestures, or facial expressions.

What are the applications of Gesture Recognition in Consumer Electronics?Gesture recognition technology is used in various consumer electronics devices such as smartphones, tablets, gaming consoles, smart TVs, and wearable devices. Applications include controlling media playback, navigating user interfaces, playing games, and interacting with virtual reality environments.

How big is Gesture Recognition in Consumer Electronics Market?The Global Gesture Recognition in Consumer Electronics Market size is expected to be worth around USD 68.7 Billion by 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 24.8% during the forecast period from 2024 to 2033.

Who are the key players in Gesture Recognition in Consumer Electronics Market?Microsoft, Samsung Electronics, Intel, Sony, Texas Instruments, Softkinetic, Apple Inc., Cipia, NXP Semiconductors, Cognitec Systems, OmniVision Technologies Inc., Other key players are the major companies operating in the Gesture Recognition in Consumer Electronics Market.

Which region has the biggest share in Gesture Recognition in Consumer Electronics Market?In 2023, Asia-Pacific emerged as the frontrunner in the gesture recognition market within the consumer electronics sector, securing a dominant position with over a 45% share.

Gesture Recognition in Consumer Electronics MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Gesture Recognition in Consumer Electronics MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Samsung Electronics

- Intel

- Sony

- Texas Instruments

- Softkinetic

- Apple Inc.

- Cipia

- NXP Semiconductors

- Cognitec Systems

- OmniVision Technologies Inc.

- Other key players