Global Wearable Payment Devices Market By Device Type (Smart Watches, Fitness Trackers, Smart Rings, Payment Wristbands), By Technology (Near Field Communication Technology, Quick Response & Barcodes, Radiofrequency Identification), By Application (Retail & Grocery Stores, Restaurants & Bars, Entertainment Sources, Hospital & Pharmacies), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115523

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

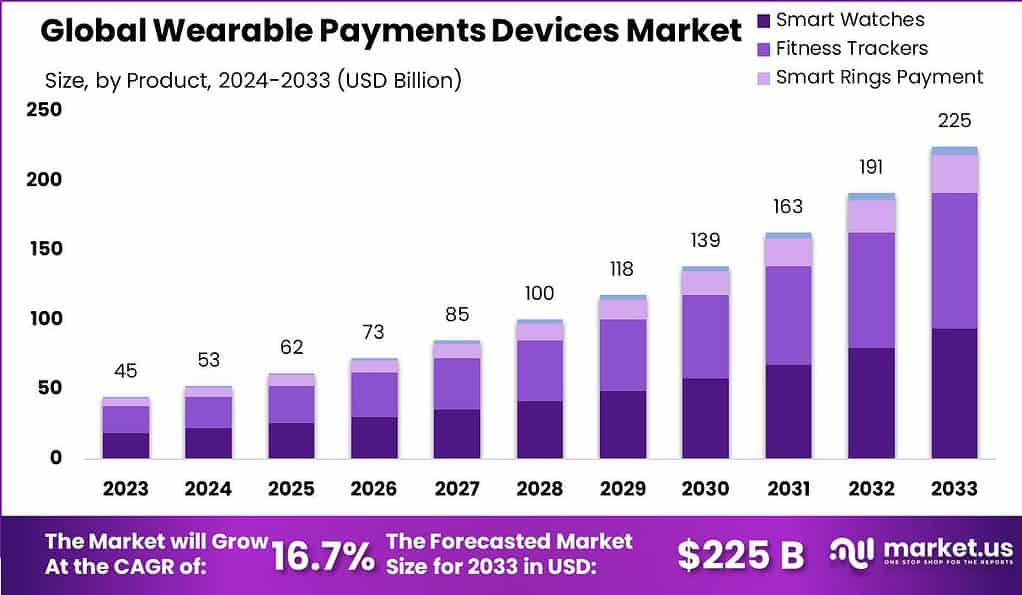

The Global Wearable Payment Devices Market size is expected to be worth around USD 225 Billion by 2033, from USD 45 Billion in 2023, growing at a CAGR of 16.7% during the forecast period from 2024 to 2033.

Wearable Payment devices are a form of contactless payment technology that allow users to make transactions conveniently and securely using wearable devices such as smartwatches, fitness trackers and payment-enabled accessories. These devices are equipped with near field communication (NFC) technology, which enables them to communicate with point-of-sale terminals and complete payment transactions with a simple tap or gesture.

The Wearable Payment devices market has witnessed significant growth in recent years. The increasing popularity of wearable technology, coupled with the rising adoption of contactless payment systems, has fueled the demand for Wearable Payment devices. Consumers are drawn to the convenience and ease of use offered by these devices, as they eliminate the need to carry physical wallets or cards. With a Wearable Payment device, individuals can make payments on-the-go, whether they are at a retail store, a restaurant, or even while participating in outdoor activities.

The global wearable payment industry has experienced remarkable growth and is expected to continue its upward trajectory in the coming years. The number of wearable payment users saw a substantial increase of 40.6% from 2022 to 2023, reaching a significant milestone of 173.3 million users. This growth is projected to continue, with estimates suggesting that the number of users will reach 278.3 million by 2025.

A survey conducted by PYMNTS.com revealed that 79% of smartwatch owners utilized their devices for contactless payments in 2023, showcasing a substantial rise from the 53% reported in 2021. This indicates a growing acceptance and adoption of wearable payment technologies among consumers.

Apple Pay, specifically on the Apple Watch, has witnessed notable success in the global contactless payment landscape. As of 2023, Apple Pay on the Apple Watch accounted for over 5% of global contactless transactions on Visa’s network, a significant increase from the mere 1% reported in 2019. This highlights the increasing popularity and usage of the Apple Watch as a preferred device for making payments.

Furthermore, there is a strong interest among consumers in adopting wearable payment devices. According to Mastercard, approximately 17 million individuals in the UK are ready to pay with wearable devices, and 26% of them anticipate initiating payments through this method. Moreover, it is predicted that the number of wearable devices in use will witness a staggering growth of 1,500% by 2024.

Key Takeaways

- The Wearable Payment Devices Market is estimated to reach USD 225 billion by 2033, Riding on a Strong 16.7% CAGR throughout the forecast period.

- In 2023, the Fitness Trackers segment held a dominant market position within the Wearable Payment devices market, capturing more than a 43.6% share.

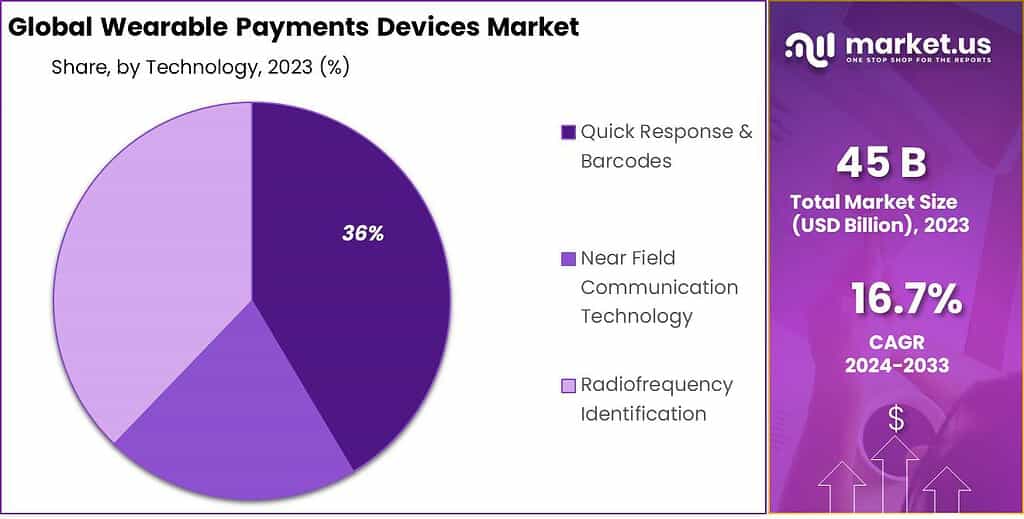

- In 2023, the Quick Response (QR) & Barcodes segment held a dominant market position within the Wearable Payment devices market, capturing more than a 36.2% share.

- In 2023, the Retail & Grocery Stores segment held a dominant market position within the Wearable Payment devices market, capturing more than a 31.4% share.

- In 2023, Europe held a dominant market position in the Wearable Payment devices market, capturing more than a 30.7% share.

Device Type Analysis

In 2023, the Fitness Trackers segment held a dominant market position within the Wearable Payment devices market, capturing more than a 43.6% share. This significant market share can be attributed to the widespread adoption of fitness trackers by consumers seeking a blend of health monitoring and convenient payment solutions.

Fitness trackers have evolved from simple step-counting devices to sophisticated wearable technologies that integrate seamlessly with various payment platforms, offering users the ability to make transactions effortlessly while on the move. The increasing focus on health and wellness, coupled with the growing consumer preference for contactless payments, has propelled the demand for fitness trackers equipped with payment functionalities.

Moreover, the expansion of this segment is further supported by continuous technological advancements and the introduction of multifunctional devices by leading manufacturers. These devices not only track physical activity and health metrics but also incorporate Near Field Communication (NFC) chips, allowing for secure and swift payment transactions. The convenience of not having to carry wallets or smartphones for payments at point-of-sale terminals has resonated well with active, health-conscious consumers.

Additionally, strategic partnerships between wearable device manufacturers and financial institutions have expanded the ecosystem of supported payment platforms, enhancing the utility and appeal of fitness trackers for everyday transactions.

Technology Analysis

In 2023, the Quick Response (QR) & Barcodes segment held a dominant market position within the Wearable Payment devices market, capturing more than a 36.2% share. This leadership can largely be attributed to the universal applicability and ease of use associated with QR codes and barcodes in payment transactions.

Unlike Near Field Communication (NFC) and Radiofrequency Identification (RFID), which require specialized hardware, QR codes and barcodes can be scanned using standard smartphone cameras, making them a more accessible and cost-effective solution for both consumers and merchants. The simplicity of scanning a QR code or a barcode to complete a transaction has facilitated widespread adoption, especially in regions with high smartphone penetration but lower access to advanced payment infrastructure.

The QR & Barcodes technology has been particularly effective in bridging the gap between traditional and digital payment methods, enabling a seamless transition for users new to Wearable Payment. The technology’s versatility has allowed it to be integrated into a wide range of wearable devices, from smartwatches to payment wristbands, further expanding its market reach.

Additionally, the low implementation cost for merchants, who can display QR codes with minimal investment, has encouraged the rapid expansion of this payment method across various retail environments. This broad merchant acceptance has, in turn, driven consumer adoption, as the convenience of being able to pay with a simple scan caters to the growing demand for quick and hassle-free transactions.

Moreover, the QR & Barcodes segment benefits from high levels of security and the ability to incorporate additional information into the payment process, such as loyalty points and promotional offers, enhancing the overall customer experience. The adaptability of QR and barcode technology to support a range of applications beyond payments, including identity verification and access control, further underscores its utility and potential for growth.

As businesses continue to innovate and consumers increasingly seek out convenience and efficiency in their transactions, the QR & Barcodes segment is poised to maintain its leading position in the Wearable Payment market.

Application Analysis

In 2023, the Retail & Grocery Stores segment held a dominant market position within the Wearable Payment devices market, capturing more than a 31.4% share. This segment’s leading status is primarily due to the high frequency of transactions in retail and grocery settings, where convenience and speed are paramount for both consumers and businesses.

Wearable payment devices, such as smartwatches and payment wristbands, offer a quick and effortless way to conduct transactions, significantly reducing checkout times and enhancing the overall shopping experience. The adoption of Wearable Payment in retail and grocery stores caters to the modern consumer’s preference for contactless and cashless payment methods, especially in a post-pandemic world where such considerations have become increasingly important.

The Retail & Grocery Stores segment has benefitted from the widespread network of point-of-sale (POS) terminals equipped to handle contactless payments. The compatibility of wearable devices with these terminals means that consumers do not have to rely on their smartphones or physical cards, offering an added layer of convenience and security.

Moreover, the integration of loyalty programs and personalized offers with Wearable Payment devices has incentivized consumers to adopt this technology for their everyday purchases. Retailers and grocery stores have leveraged these features to enhance customer loyalty and encourage repeat business, further driving the segment’s growth.

Key Market Segments

By Device Type

- Smart Watches

- Fitness Trackers

- Smart Rings

- Payment Wristbands

By Technology

- Near Field Communication Technology

- Quick Response & Barcodes

- Radiofrequency Identification

By Application

- Retail & Grocery Stores

- Restaurants & Bars

- Entertainment Sources

- Hospital & Pharmacies

Driver

Increased Adoption of Contactless Payments

The surge in adoption of contactless payment methods serves as a primary driver for the Wearable Payment devices market. In the wake of the global health crisis, consumers and merchants alike have shown a heightened preference for contactless transactions to minimize physical contact and enhance convenience. Wearable payment devices, with their inherent ability to facilitate quick, secure, and hygienic transactions, align perfectly with this growing demand.

The convenience of tapping a wristband, ring, or smartwatch against a payment terminal without the need to handle cash or cards has significantly boosted consumer adoption. Furthermore, advancements in Near Field Communication (NFC) technology and increased merchant acceptance of contactless POS systems have reinforced this trend, making Wearable Payment an attractive option for a wide user base, thereby driving market growth.

Opportunity

Increasing Adoption of Advanced Technologies

The Wearable Payment devices market stands to significantly benefit from the increasing adoption of advanced technologies such as Near Field Communication (NFC), Radio Frequency Identification (RFID), and Host Card Emulation (HCE). These technologies enhance the functionality, convenience, and security of wearable payment devices, making transactions faster and more seamless for users. NFC and RFID enable contactless communication between the wearable device and payment terminals, facilitating quick and easy payments with a simple tap.

Host Card Emulation allows for the virtual representation of a physical debit or credit card in a secure manner, further broadening the scope of wearable payment capabilities. As consumers become more tech-savvy and open to adopting novel payment methods, the incorporation of these advanced technologies into wearable devices presents a significant growth opportunity. It allows for the expansion of the Wearable Payment market into new sectors and demographics, offering users a more diverse and enriched payment experience.

Restraint

Battery Drain Issues

One of the primary restraints facing the Wearable Payment devices market is the issue of battery drain. Wearable devices, given their compact size and the need for continuous operation, often suffer from limited battery life. The integration of advanced payment technologies such as NFC and continuous data synchronization with smartphones or other devices can exacerbate battery consumption, leading to frequent recharges that may deter users from adopting wearable payment technologies.

This challenge is particularly acute in devices that offer a wide range of functionalities beyond payments, such as fitness tracking and notifications. Manufacturers are tasked with balancing the inclusion of advanced features with the need for efficient power consumption, as the inconvenience of regular charging can undermine the convenience that Wearable Payment are supposed to offer, potentially slowing market growth.

Challenge

Security Concerns

Security concerns related to wearable payment devices represent a significant challenge for the market. As these devices become more integrated into daily financial transactions, they become attractive targets for cybercriminals looking to exploit vulnerabilities for unauthorized access to financial and personal data. The challenge is compounded by the diverse range of wearable devices and platforms, each with varying levels of security measures. Ensuring robust encryption, secure authentication methods, and regular software updates to guard against breaches is paramount.

Additionally, there is the task of maintaining user trust by demonstrating that wearable payment technologies are not only convenient but also secure. Addressing these security concerns requires ongoing collaboration between technology providers, financial institutions, and regulatory bodies to establish stringent security standards and practices, ensuring the safety and integrity of transactions conducted through wearable payment devices.

Regional Analysis

In 2023, Europe held a dominant market position in the Wearable Payment devices market, capturing more than a 30.7% share. This leadership is primarily attributed to the region’s strong financial infrastructure, high consumer adoption of digital payment methods, and supportive regulatory environment. The demand for Wearable Payment Devices in Europe was valued at US$ 13.8 billion in 2023 and is anticipated to grow significantly in the forecast period.

Europe has been at the forefront of embracing contactless payment technologies, with countries like Sweden, the UK, and Germany leading the way in cashless transactions. The region’s consumers are well-versed in the use of digital and mobile payment solutions, setting a solid foundation for the rapid adoption of wearable payment devices. Furthermore, the presence of major payment technology companies and financial institutions in Europe has facilitated widespread acceptance of these devices across various retail and service sectors.

The European market’s growth is also bolstered by the European Union’s regulatory framework, which promotes innovation and security in digital payments. Initiatives such as the Revised Payment Services Directive (PSD2) have encouraged the development of open banking solutions, enabling third-party developers to create new payment services, including those for wearable devices.

This regulatory support has led to increased competition and innovation within the market, resulting in a wider variety of wearable payment options for consumers. Additionally, the region’s focus on data protection and privacy, as evidenced by the General Data Protection Regulation (GDPR), has built consumer trust in digital transactions, further driving the adoption of wearable payment technologies.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market is moderately fragmented and competitive. Prominent vendors are adopting various business strategies such as mergers & acquisitions, joint ventures, strategic collaborations, and product launches to strengthen their geographical presence and market positioning. These vendors compete based on product differentiation, app availability, portfolio, digital content, and pricing. Continuous innovations in product portfolios are expected to increase market competition in the future.

In 2023, the landscape of the global Wearable Payment devices market has been significantly shaped by the contributions and strategic movements of key players, including Garmin Ltd., Barclays, Samsung Electronics Co., Ltd., Xiaomi Corporation, Visa, Google LLC, Mastercard Inc., Apple Inc., and other pivotal firms. The growth of this market can be attributed to the increasing adoption of contactless payment technologies, the rising demand for wearable technology, and the growing consumer preference for convenience and seamless payment solutions.

Garmin Ltd. has distinguished itself through the integration of payment functionalities into its range of smartwatches and fitness trackers, catering to the health-conscious consumer who values the blend of fitness tracking and financial transactions. Barclays, on the other hand, has innovated in the banking sector by offering wearable payment solutions that augment its traditional banking services, thereby enhancing customer engagement and satisfaction.

Top Market Leaders

- Garmin Ltd.

- Barclays

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Visa

- Google LLC

- Mastercard Inc.

- Apple Inc

- Other Key Players

Recent Developments

- Samsung Electronics Co Ltd: February 2023: Acquired LoopPay, a mobile payments technology company, to enhance its wearable payment capabilities. This acquisition strengthens Samsung’s position in the market and could lead to the development of new and innovative wearable payment solutions.

- Xiaomi Corporation: October 2023: Launched the Redmi Watch 3 Pro, a new smartwatch with NFC support for contactless payments. This launch indicates Xiaomi’s continued focus on expanding its presence in the Wearable Payment market, particularly in the affordable segment.

Report Scope

Report Features Description Market Value (2023) US$ 45 Bn Forecast Revenue (2033) US$ 225 Bn CAGR (2024-2033) 16.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type (Smart Watches, Fitness Trackers, Smart Rings, Payment Wristbands), By Technology (Near Field Communication Technology, Quick Response & Barcodes, Radiofrequency Identification), By Application (Retail & Grocery Stores, Restaurants & Bars, Entertainment Sources, Hospital & Pharmacies) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Garmin Ltd., Barclays, Samsung Electronics Co Ltd, Xiaomi Corporation, Visa, Google LLC, Mastercard Inc., Apple Inc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are wearable payments devices?Wearable payments devices are electronic devices that can be worn on the body, such as smartwatches, fitness trackers, and payment-enabled jewelry, that allow users to make payments without the need for physical cash or cards.

How big is Wearable Payments Devices Market?The Global Wearable Payments Devices Market size is expected to be worth around USD 225 Billion by 2033, from USD 45 Billion in 2023, growing at a CAGR of 16.7% during the forecast period from 2024 to 2033.

Which are the top players in the wearable payment device market?The major vendors operating in the wearable payment device market include Garmin Ltd., Barclays, Samsung Electronics Co Ltd, Xiaomi Corporation, Visa, Google LLC, Mastercard Inc., Apple Inc, Other Key Players

What are the key drivers of growth in the wearable payments devices market?The growth of the wearable payments devices market can be attributed to factors such as the increasing adoption of contactless payment technology, the convenience of wearable devices, and the growing popularity of mobile payment solutions.

What are the major challenges facing the wearable payments devices market?Some of the challenges facing the wearable payments devices market include concerns about security and privacy, the need for interoperability between different devices and payment systems, and the potential for regulatory hurdles.

What is the leading application of Wearable Payment Devices Market?In 2023, the Retail & Grocery Stores segment held a dominant market position within the wearable payments devices market, capturing more than a 31.4% share.

Wearable Payment Devices MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Wearable Payment Devices MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Garmin Ltd.

- Barclays

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Visa

- Google LLC

- Mastercard Inc.

- Apple Inc

- Other Key Players