Global Fitness App Market By Type (Exercise & Weight Loss, Diet & Nutrition, Activity Tracking, and Lifestyle Management), By Operating System (Android, iOS, and Other Operating Systems), By Device (Smartphones, Tablets, and Wearable Devices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 64267

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

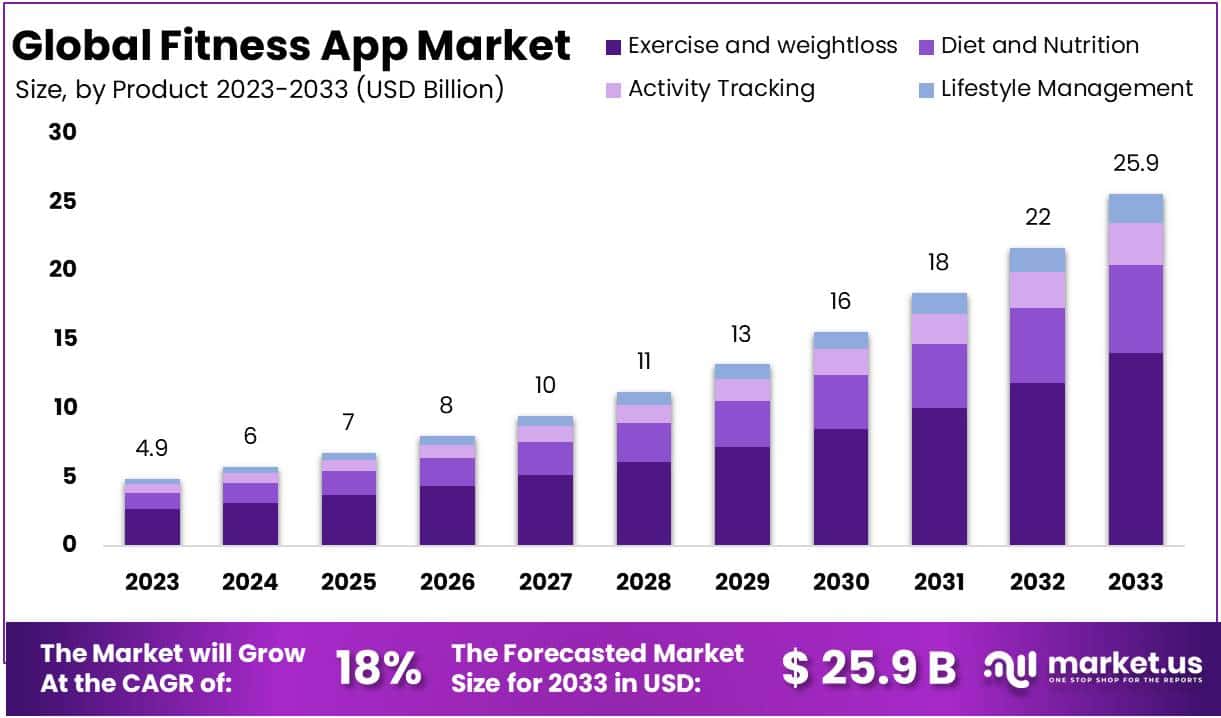

The Global Fitness App Market size is expected to be worth around USD 25.9 Billion by 2033 from USD 4.9 Billion in 2023, growing at a CAGR of 18% during the forecast period from 2024 to 2033.

Fitness apps offer small specialized programs to keep users motivated when they run, walk, cycle, or engage in any form of physical activity. Most fitness applications track workout statistics, calories burned, and data from bike runs, or walk trips. Additionally, they connect users with personal trainers or nutritionists for specific challenges or general workout issues. When performing exercises such as running or fitness classes, many fitness applications also provide coordinated playlists of tunes with the same beat for added motivation.

The growing awareness of the benefits of living a healthy lifestyle and the increasing use of smartphones, tablets, and wearable devices have all had a positive effect on the growth of the fitness app market size. Additionally, rising awareness about diet-related diseases has propelled the global fitness app market share upward. However, factors such as technical problems in apps and high costs of in-app purchases, as well as concerns over data security and stringent regulations are hindering growth in this market.

Conversely, technological advances in AI and machine learning, combined with rising disease prevalence among hypertension, obesity, and cardiac issues are anticipated to provide lucrative growth prospects for the fitness app market over the forecast period.

Fitness apps include workout or exercise plans, such as push-ups, cycling, rope skipping, and pull-ups, to assist users in achieving their weight loss and fitness goals. These applications also provide balanced meal plans to help you reach your fitness goals. With the help of step counters, workout timers, and excellent goal tracking, fitness applications have proven helpful for the general public. Users can workout at home without paying money like at the gym thanks to fitness apps, which offer an effective option for people who don’t have time to go to the gym but still want to lead an active lifestyle.

Key Takeaways

- Diverse Solutions: Fitness apps come in all forms: workout and exercise apps, meal planning apps, mindfulness/mental health apps or comprehensive health and wellness platforms are among those available today.

- Features and Functionalities: Fitness apps feature features for workout planning, tracking, coaching, monitoring of heart rate, sleep quality and nutrition as well as social and community elements to encourage engagement with users.

- Customized Workout Plans: Numerous fitness apps use algorithms and user input to develop personalized workout plans tailored specifically to an individual’s goals, fitness level and preferences.

- Wearable Device Integration: Integrating wearable fitness devices like smartwatches and fitness trackers into an overall program is often recommended, providing real-time tracking data as a foundation of effective monitoring and feedback loops.

- Nutrition and Meal Planning: Many fitness apps now include meal planning features like meal tracking and nutrition guidance that enable users to better manage their nutrition as part of a holistic health and fitness journey.

- Mental Fitness and Wellbeing: Apps now also address mental fitness and well-being by offering meditation and stress reduction exercises designed to promote overall well-being.

Driving Factors

Due to increasing awareness of health among people, there is a rising demand for fitness apps that help individuals track their progress toward fitness goals. With the proliferation of smartphones and mobile devices, more individuals are using fitness applications to stay fit and healthy. With rising disposable incomes, consumers are willing to invest in fitness apps that help them reach their fitness objectives. Thanks to technological advances such as the integration of wearable devices with fitness applications, tracking progress and setting goals have never been simpler.

Social media platforms have driven the popularity of fitness apps, enabling users to share their fitness achievements and progress with friends and followers. The COVID-19 pandemic has further spurred interest in fitness apps as more people work out from home instead of going out in public places such as gyms.

Restraining Factors

Fitness apps often need high-speed internet connectivity to function properly, which could be a hindrance in areas with slow internet. Traditional fitness programs like gyms and personal trainers remain popular and could pose obstacles to the growth of fitness apps. Many fitness apps require users to share personal information, leaving them vulnerable to cyber attacks or identity theft.

Furthermore, fitness apps may not be compatible with all devices, operating systems, or software versions – potentially restricting their accessibility for certain individuals. Some users may find fitness apps lack customization or personalization to meet their individual needs and fitness objectives. Some fitness applications require users to pay for premium features or subscriptions, which may deter some from using them.

Growth Opportunities

The demand for fitness apps has seen a marked uptick due to increased health awareness among individuals and the rise of wearable fitness devices. Furthermore, the COVID-19 pandemic has only served to further accelerate the adoption of fitness apps as people look for alternatives to traditional gyms and fitness centers. The fitness app market provides opportunities for a range of apps, such as workout and exercise apps, nutrition/diet apps, activity tracking apps, and specialized ones designed specifically for certain sports or fitness activities.

Companies competing in the fitness app market must offer innovative features and a user-friendly experience. Integration with wearable devices and personalized coaching capabilities can set an app apart from competitors. Furthermore, partnerships with fitness influencers or experts can enhance the credibility of the app and expand its reach to a larger audience.

Trending Factors

The rise of wearable devices like fitness trackers and smartwatches has spurred an explosion in demand for fitness apps. These gadgets give users real-time data about their workouts that can be synced with fitness apps to monitor progress. Fitness apps are becoming more and more integrated with other devices and programs to offer a unified user experience.

For instance, some fitness applications can be synced up with nutrition applications to track calorie intake and provide personalized meal plans. Fitness apps are becoming more personalized, offering personalized workout plans and recommendations based on a user’s fitness level and goals. Some even utilize AI or machine learning algorithms for personalized recommendations.

Due to the COVID-19 pandemic, many are opting to work out from home. Fitness apps are responding by offering virtual coaching and classes as a way of motivating users and making workouts more enjoyable. Many fitness applications now include gamification elements like rewards and challenges to motivate users further during their workout sessions.

Type Analysis

The Exercise and Weight Loss Segment Accounted for the Largest Market Share in the Global Fitness App Market

In 2023, Based on type, the exercise and weight loss segment held a large revenue share of over 54.8%. Apps designed specifically for this purpose usually offer scheduled notifications with audio cues, video demos, and fitness-tracking tools that encourage users to stay motivated during their workout sessions. Examples include Nike Training Club, Daily Workouts Fitness Trainer, Aaptiv’s 7 Minute Workout, Garmin Connect’s SworkIt app for daily yoga routines, FitOn’s 8fit Workouts app, and Adidas Training by Runtastic.

The growing adoption of exercise and weight loss apps among the large consumer base is fueling the segment’s growth. these apps make tracking calorie intake (daily) easier, provide customized lifestyle plans based on user feed data, as well as simplify/modify tracking/monitoring steps related to macronutrients such as fats or carbohydrates. As a result, these applications have seen high demand over the past few years due to their ease of use and user-friendliness.

Activity tracking is projected to experience the fastest growth rate of 24% over the forecast period. Key brands in fitness activity monitoring, such as Jawbone, Fitbit, and Nike, lead this market. LG Pebble Samsung and other companies that incorporate activity tracking features into their wearable devices follow behind.

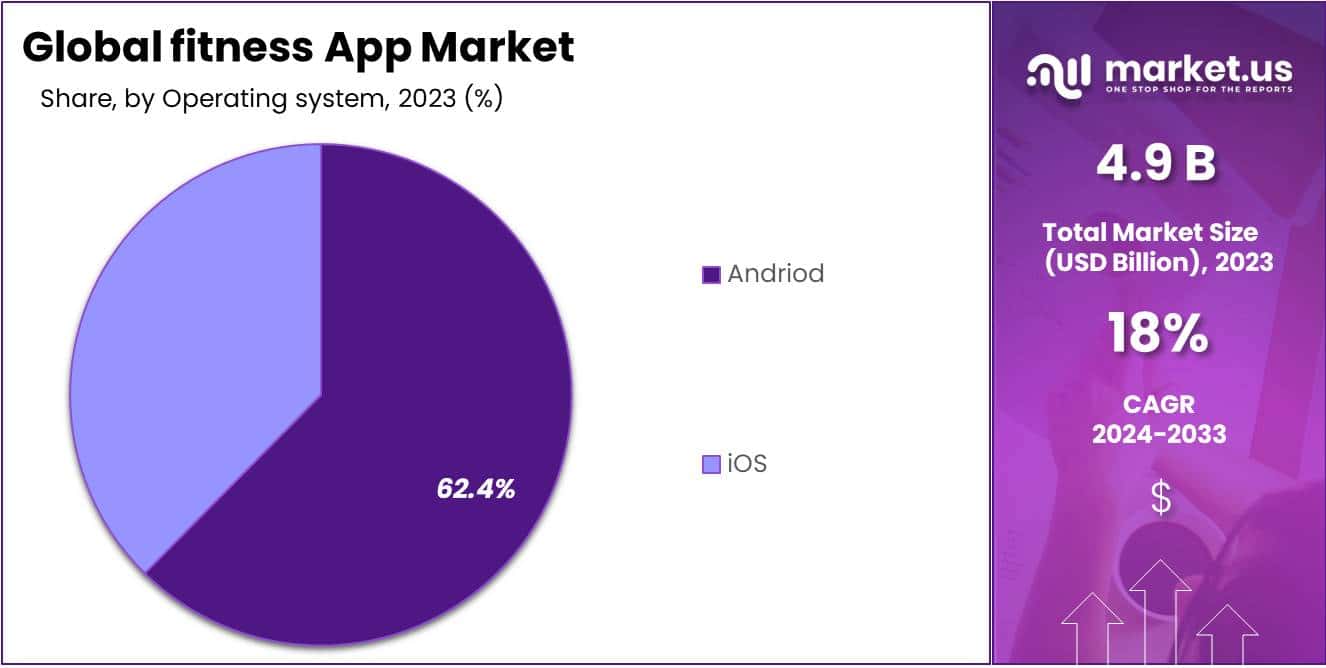

Operating System Analysis

The iOS Segment Accounted for the Largest Market Share in the Global Fitness App Market

In 2023, By Operating System, The iOS market held 62.4% of the market share. Apple Inc. claims that the number of Apple device users who are active has increased in recent years. Fitness apps for iOS include coaching, activity monitoring, and streaming workout classes. Popular fitness apps for the iPhone, iPad, and Apple Watch include Centr, MyFitnessPal, and Sworkit Freeletics. Keelo JFIT Strava and PEAR are also available.

Over the forecasting period, their Android segment is expected to grow. Android smartphones are becoming more and more popular for tracking health and fitness. we can download fitness applications for Android to perform tasks such as finding motivation during workouts, setting goals, counting calories burned, and much more.

Device Analysis

The Smartphone Segment Accounted for the Largest Market Share in the Global Fitness App Market

In 2023, Based on devices, the fitness app industry is divided into smartphones, tablets, and wearable devices. The smartphone market accounted for 53.4% revenue share. The global expansion of smartphone use is one factor driving this segment’s expansion.

As fitness sector technology evolves rapidly, more individuals are opting to supplement their regular workouts on their phones rather than visiting gyms or fitness clubs; using smartphones to access fitness platforms may save them from paying hefty subscription fees which further fuels its expansion.

Key Market Segments

Based on Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

- Lifestyle Management

Based on Operating System

- Android

- iOS

- Others

Based on Device

- Smartphones

- Tablets

- Wearable Devices

Regional Analysis

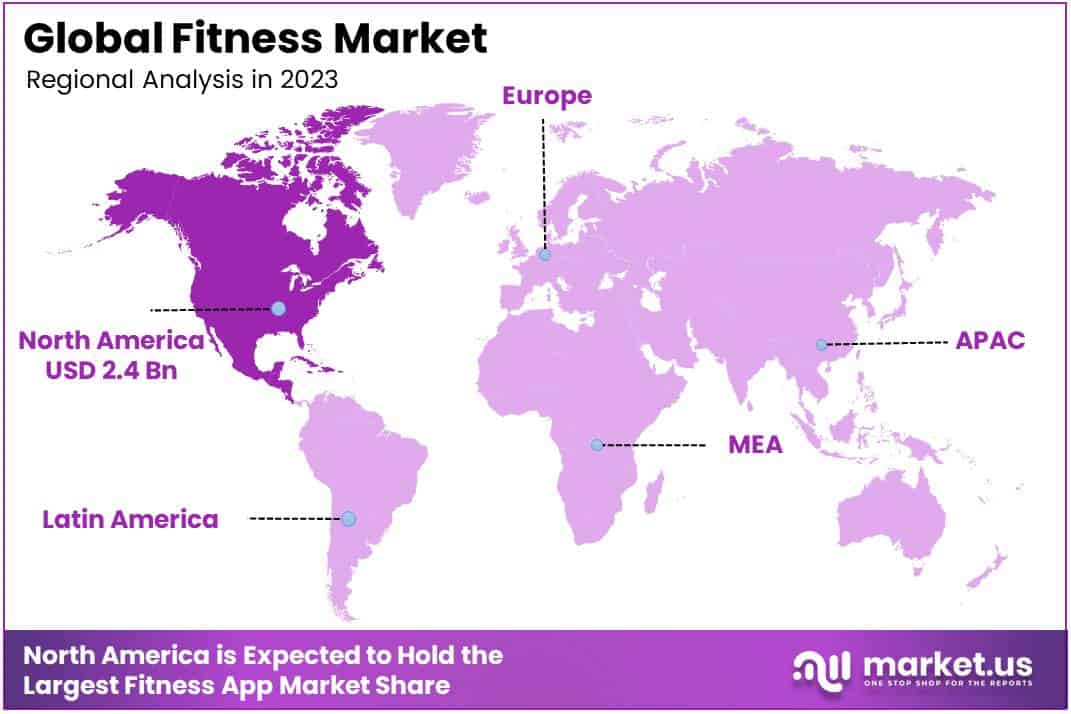

In 2023, North America held a dominant market position, capturing more than a 49.1% share and holding USD 2.4 Billion market value for the year.

North America is a prime market for fitness apps, to high smartphone adoption and an enthusiastic fitness culture. Here you’ll find many renowned fitness applications like Peloton, MyFitnessPal, and Fitbit; in the United States specifically, these services have seen tremendous growth.

Europe has emerged as an important market for fitness apps, driven by consumers’ growing interest in health and wellness. As a result, the region has seen the emergence of many new fitness applications, including popular ones like Body by Apple.

Asia Pacific is experiencing a meteoric rise in the popularity of fitness apps, driven by rising smartphone penetration and expanding interest in health and fitness. China, India, and Japan are among the largest markets within this region with many local fitness apps catering to local preferences.

Latin America has a small but growing fitness app market, with Brazil leading the pack. There have been several new fitness applications launched there such as 99FIRE and Asana Rebel.

The Middle East and Africa are rapidly becoming hotspots for fitness apps, with consumers showing an increasing interest in health and wellness. Recently, several new fitness applications have been launched such as Fiit Arabia and 7 Minute Workout to meet this growing need.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The details include information about the company’s financials, revenues generated, market potential, and investment in R&D. New market initiatives, global presence, production facilities and sites, production capacities, strengths and weaknesses of the company, product launch, product breadth, and breadth, as well as company dominance. This information is only relevant to the company’s attention to the global fitness app market.

Market Key Players

Listed below are some of the most prominent Fitness App Market industry players.

- Adidas

- Appster

- FitnessKeeper

- Fitbit Inc.

- Azumio Inc.

- MyFitnessPal Inc.

- Noom

- Nike Run Club

- Under Armour Inc.

- WillowTree Inc.

- Polar Electro

- Kayla Itsines

- Google LLC

- Fooducate

- ASICS America Corporation

- RunKeeper

- JEFIT Workout Tracker

- Sworkit

- Other Key Players

Recent Developments

- In December 2023, Under Armour, a prominent player in the fitness app industry, joined forces with Apple Health. This collaboration meant that Under Armour’s popular apps, MapMyRun and Endomondo, seamlessly integrated with Apple Health. Now, users can effortlessly share their workout data and track their progress across both platforms, catering especially to Apple Watch users and widening Under Armour’s user base.

- In November 2023, Google made a significant move into the fitness tech scene by acquiring Fitbod, a well-known AI-powered workout app. The exact amount exchanged in this deal remained confidential, but it’s clear that Google is keen on expanding its presence in the personalized fitness arena. This acquisition hints at potential integrations with existing Google platforms like Google Fit or other Wear OS applications.

- In October 2023, JEFIT Workout Tracker secured a significant boost by raising $15 million in funding. This funding injection is a testament to the increasing demand for specialized strength training apps. JEFIT plans to use this capital to enhance its personalized workout plans, expand its exercise library, and strengthen its community features, reflecting the growing interest in targeted strength training programs.

- In September 2023, Azumio, known for its focus on sleep and meditation, expanded its offerings by launching “Yogi,” a yoga-specific app. This new addition to their portfolio provides users with personalized yoga routines and tutorials on various poses. The introduction of Yogi aligns with the rising popularity of yoga and mindfulness practices in the fitness app market.

Report Scope

Report Features Description Market Value (2023) USD 4.9 Billion Forecast Revenue (2033) USD 25.9 Billion CAGR (2023-2032) 18% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type (Exercise & Weight Loss, Diet & Nutrition, Activity Tracking, Lifestyle Management) Based on Operating System(Android, iOS, Others) Based on Device (Smartphones, Tablets, Wearable Devices) Regional Analysis North America – The US, Canada, Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape MyFitnessPal Inc, Nike Run Club, Adidas, Polar Electro, Kayla Itsines, Google LLC, Fooducate and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Fitness App market in 2023?The Fitness App market size is USD 4.9 billion in 2023.

What is the projected CAGR at which the Fitness App market is expected to grow at?The Fitness App market is expected to grow at a CAGR of 18% (2024-2033).

List the segments encompassed in this report on the Fitness App market?Market.US has segmented the Fitness App market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Exercise & Weight Loss, Diet & Nutrition, Activity Tracking, and Lifestyle Management. By Operating System the market has been segmented into Android, iOS, and Other Operating Systems. By Device the market has been segmented into Smartphones, Tablets, and Wearable Devices.

List the key industry players of the Fitness App market?Adidas, Appster, FitnessKeeper, Fitbit Inc., Azumio Inc., MyFitnessPal Inc., Noom, Nike Run Club, Under Armour Inc., WillowTree Inc., Polar Electro, Kayla Itsines, Google LLC, Fooducate, ASICS America Corporation, RunKeeper, JEFIT Workout Tracker, Sworkit, Other Key Players

Which region is more appealing for vendors employed in the Fitness App market?North America is expected to account for the highest revenue share of 49.1% and boasting an impressive market value of USD 2.4 billion. Therefore, the Fitness App industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Fitness App?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Fitness App Market.

-

-

- Adidas

- Appster

- FitnessKeeper

- Fitbit Inc.

- Azumio Inc.

- MyFitnessPal Inc.

- Noom

- Nike Run Club

- Under Armour Inc.

- WillowTree Inc.

- Polar Electro

- Kayla Itsines

- Google LLC

- Fooducate

- ASICS America Corporation

- RunKeeper

- JEFIT Workout Tracker

- Sworkit

- Other Key Players