Global Cycling Sunglasses Market By Type(Men’s Cycling Sunglasses, Women’s Cycling Sunglasses, Kids Cycling Sunglasses), By Product Type(Polarized, Non-Polarized), By Distribution Channel(Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: May 2024

- Report ID: 31434

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

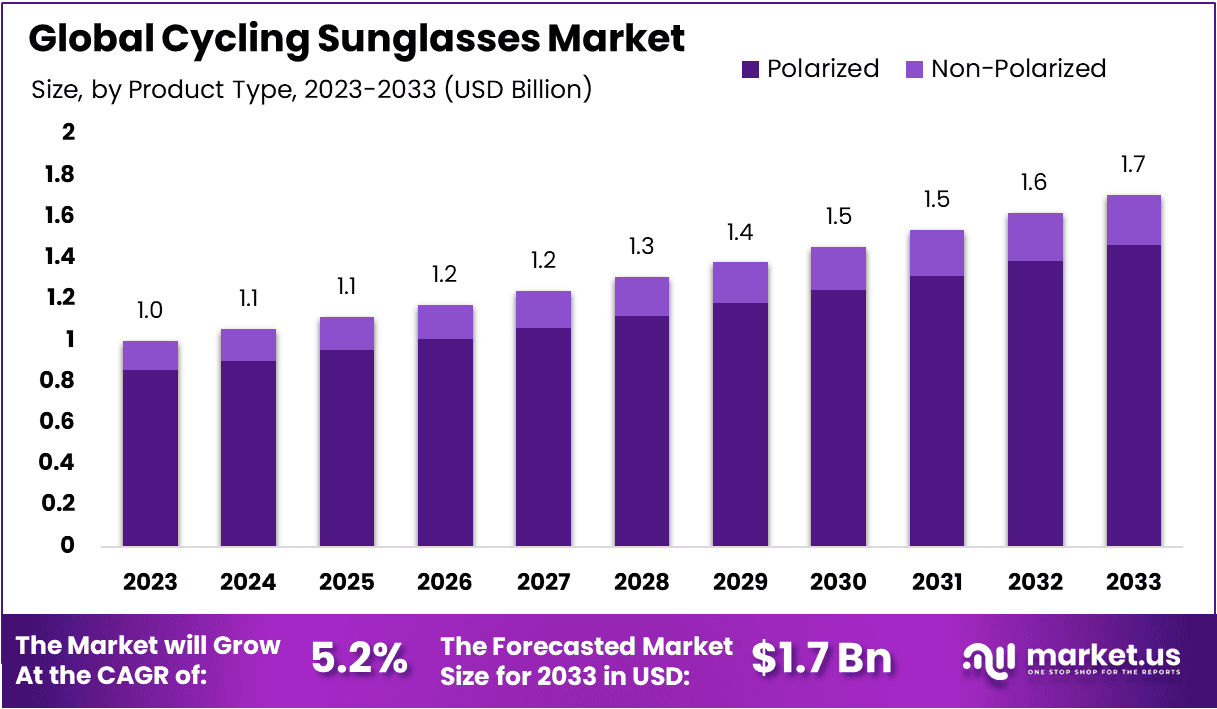

The Global Cycling Sunglasses Market size is expected to be worth around USD 1.7 Billion by 2033, From USD 1.0 Billion by 2023, growing at a CAGR of 5.50% during the forecast period from 2024 to 2033.

The cycling sunglasses market comprises manufacturers and distributors of specialized eyewear designed primarily for cyclists. These sunglasses are engineered to provide enhanced visual clarity, protection from ultraviolet rays, and resistance to impact, catering to both amateur enthusiasts and professional athletes.

The market targets innovations that offer comfort, style, and performance, addressing the needs of cyclists in varying environmental conditions. As cycling grows in popularity as both a recreational and competitive activity, the demand for these specialized sunglasses increases, presenting significant opportunities for growth and innovation within this niche segment.

The market for cycling sunglasses is anticipated to experience robust growth, driven by increasing consumer awareness of eye protection and the rising popularity of cycling as both a recreational and professional sport.

As cyclists seek enhanced visual clarity and protection against UV rays, dust, and other environmental factors, the demand for high-quality cycling sunglasses is expected to rise. Technological advancements in lens and frame materials have led to the development of lighter, more durable, and flexible sunglasses, thereby attracting a broader consumer base.

Moreover, the integration of performance-enhancing features, such as interchangeable lenses and anti-fog technologies, is further propelling market expansion. Additionally, trends toward customization and personalization in cycling gear, aligned with aesthetic appeal, are influencing product innovation and variety, thereby enriching the consumer choice spectrum.

The market’s growth trajectory is reinforced by strategic marketing campaigns targeting health-conscious and outdoor enthusiast demographics, which amplify the visibility and desirability of these specialized sunglasses.

The resurgence in U.S. manufacturing, particularly in the solar industry, underscores a broader trend affecting related markets, including cycling sunglasses. The anticipated expansion of the U.S. solar fleet to 673 GW within the next decade, as propelled by the Inflation Reduction Act, signals a shift towards more sustainable and domestically secured manufacturing landscapes.

This growth is further catalyzed by substantial investments in U.S. solar manufacturing, with over 100 GW of solar module production capacity announced since early 2022. These developments are not only pivotal for the solar sector but also create ripple effects in associated industries, enhancing supply chain robustness and potentially stabilizing material costs for products like cycling sunglasses.

Key Takeaways

- Market Growth: The Global Cycling Sunglasses Market size is expected to be worth around USD 1.7 Billion by 2033, From USD 1.0 Billion by 2023, growing at a CAGR of 5.50% during the forecast period from 2024 to 2033.

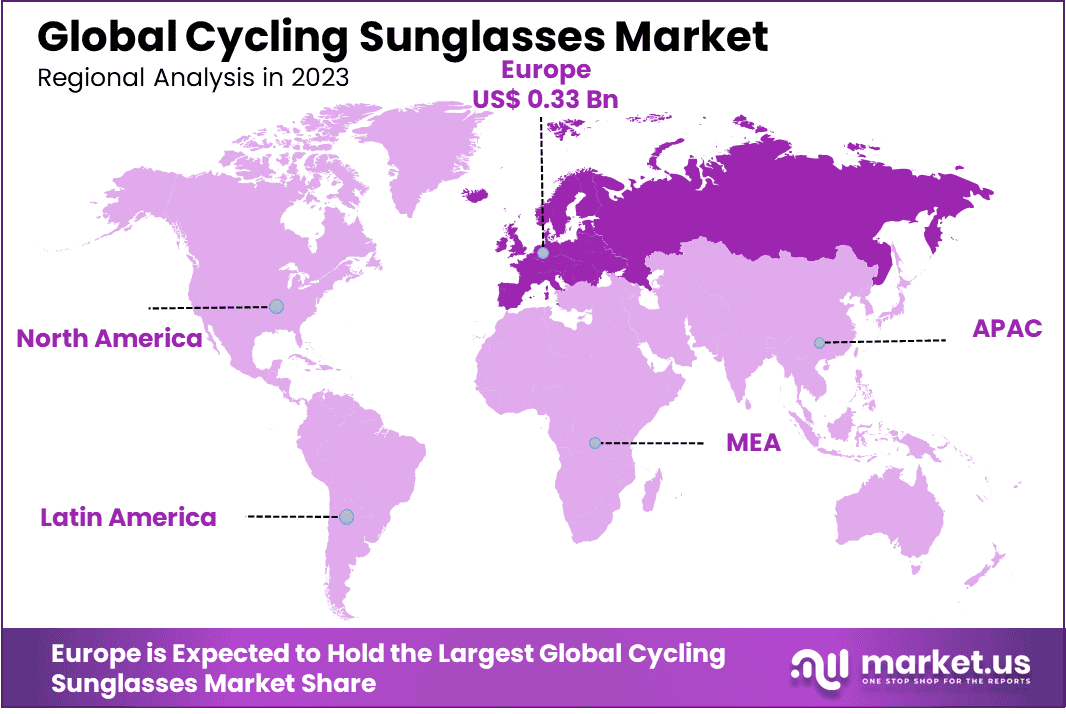

- Regional Dominance: Europe holds a 33.6% share of the global cycling sunglasses market.

- Segmentation Insights:

- By Type: Men’s cycling sunglasses dominate the market with a share of 46.6%.

- By Product Type: Polarized sunglasses lead product preferences with an 85.6% share.

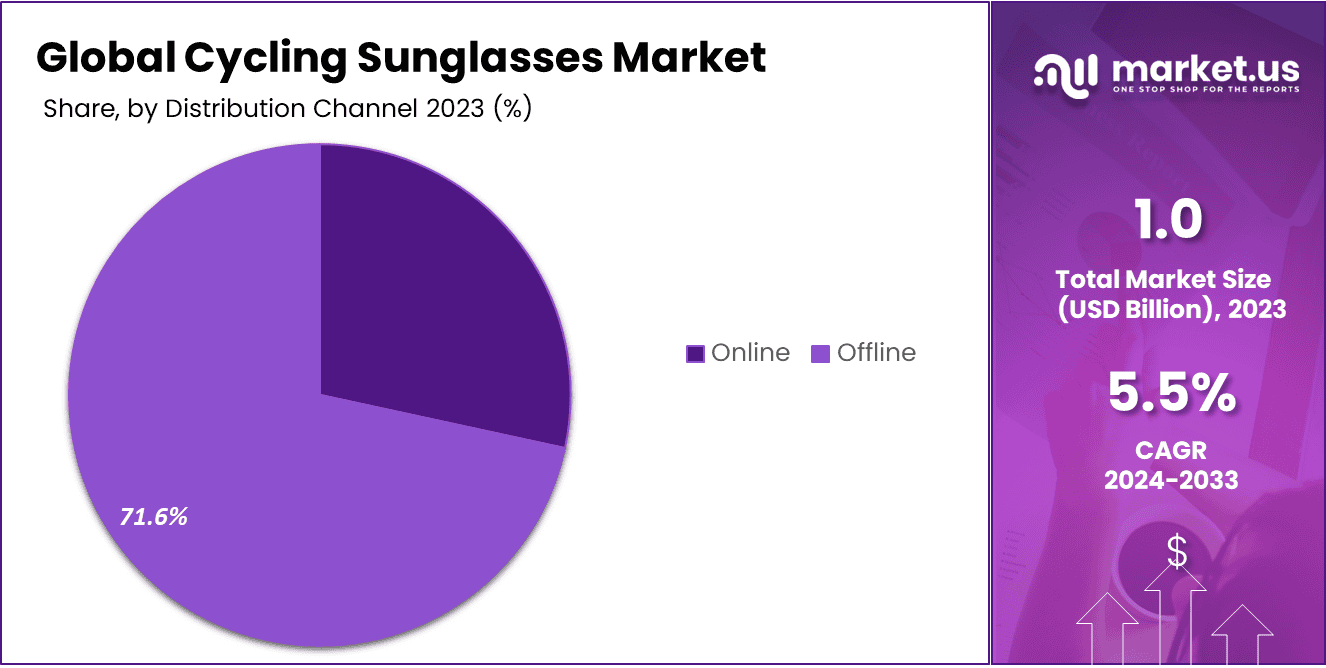

- By Distribution Channel: Offline channels prevail, capturing 71.6% of distribution preferences.

- Growth Opportunities: In 2023, the global cycling sunglasses market is growing through enhanced marketing and broader consumer targeting, including digital campaigns and diversifying products for wider demographic appeal.

Driving Factors

Expansion of the Cycling Industry and Competitive Racing

The burgeoning growth in cycle sales, coupled with the escalating popularity of cycling races, directly correlates with the expansion of the Cycling Sunglasses Market. As cycling gains traction as both a professional sport and a leisure activity, the demand for specialized gear, including sunglasses that provide clarity and protection during high-speed rides, intensifies. These sunglasses are designed to shield cyclists from environmental elements such as wind, dust, and ultraviolet rays, enhancing both performance and safety.

The commercial success of large cycling events often features prominent branding of sunglasses, which not only helps in marketing but also solidifies their importance in enhancing athletic performance. This trend is backed by the growing consumer interest in maintaining a fit lifestyle and engaging in sports, which further stimulates sales in related sports apparel and accessories.

Cycling as a Sustainable Transportation Solution

The increasing adoption of bicycles as a primary mode of transportation, particularly in urban areas seeking sustainable solutions, substantially contributes to the demand for cycling sunglasses. With more cities focusing on reducing carbon footprints, bicycles emerge as eco-friendly alternatives to motor vehicles.

This shift not only promotes physical health but also increases the everyday use of cycling gear, including sunglasses, which protect commuters from potential hazards and improve visibility in varying weather conditions. This factor is particularly influential in regions with high commuter cycling rates and supports ongoing market growth through regular consumer engagement with cycling products.

Strategic Industry Collaborations

Strategic partnerships between cycling sunglasses manufacturers and bicycle companies serve as a pivotal growth lever within the market. These collaborations often result in co-branded products that align closely with the specific needs of cyclists, offering integrated solutions that combine style, comfort, and functionality. By associating with established cycling brands, sunglasses companies gain enhanced credibility and access to a wider market base.

These partnerships typically involve joint marketing efforts, special edition releases, and cross-promotional activities, which not only boost brand visibility but also encourage consumer loyalty by providing a holistic cycling experience. Such initiatives are instrumental in driving both innovation and consumer interest in specialized cycling sunglasses.

Restraining Factors

Economic Constraints: The Impact of High Costs

The high cost of premium cycling sunglasses can act as a significant barrier to market growth. These products are often equipped with advanced features such as UV protection, polarization, and lightweight, durable materials, which elevate their price point. This pricing strategy can exclude budget-conscious consumers who are unwilling or unable to invest in specialized eyewear solely for cycling. The economic factor becomes particularly restrictive in less affluent regions or among casual cyclists who may opt for more affordable alternatives that offer less functionality.

Consequently, while the premium segment captures a niche market of enthusiasts and professional athletes, the overall penetration rate in the broader consumer base remains limited. This scenario underscores the need for a more diversified product range that can cater to different economic segments, potentially boosting market accessibility and growth.

Market Limitations Due to Specialized Utility

The specificity of cycling sunglasses, designed primarily for cycling activities, can also restrain their market expansion. Unlike general sports or outdoor sunglasses, which users might wear for various activities, cycling sunglasses are often optimized for the ergonomics and conditions unique to cycling. This specialization reduces their perceived utility for non-cycling purposes, thereby narrowing their potential consumer base.

For many potential buyers, the investment in a product that serves only one aspect of their lifestyle is less appealing compared to more versatile alternatives. This restriction in versatility underscores a significant challenge for the cycling sunglasses market, as it limits the product’s appeal to only cycling enthusiasts rather than a broader audience that participates in multiple outdoor activities.

By Type Analysis

Men’s cycling sunglasses dominate, capturing 46.6% of the market by type.

In 2023, Men’s Cycling Sunglasses held a dominant market position in the “By Type” segment of the Cycling Sunglasses Market, capturing more than 46.6% share. This significant market share underscores the robust demand among male cyclists for sunglasses that combine functionality with style, offering protection against UV rays and enhancing visibility during rides. Men’s Cycling Sunglasses are preferred for their durability and variety of lens technologies, which cater to different lighting conditions and weather scenarios, making them indispensable for both amateur and professional cyclists.

Following closely, Women’s Cycling Sunglasses accounted for approximately 34.7% of the market share. These sunglasses are designed with specific aesthetic and ergonomic considerations that appeal to female cyclists, including lighter frame materials and more dynamic color options. They also feature similar advanced lens technologies as men’s sunglasses, prioritizing eye protection and comfort during prolonged use.

Kids’ Cycling Sunglasses, though a smaller segment, still held a respectable 18.7% share of the market. This segment benefits from growing awareness among parents about the importance of protecting children’s eyes from UV rays during outdoor activities. Kid-specific designs, characterized by durability and safety features such as impact-resistant contact lenses and flexible frames, support the expansion of this segment.

The overall distribution of market shares within the Cycling Sunglasses Market reflects a diversified consumer base, with each segment addressing specific demographic needs and preferences. This diversification not only stabilizes the market but also drives innovation and product development tailored to meet the nuanced demands of different user groups.

By Product Type Analysis

Polarized cycling sunglasses lead with 85.6% market share, preferred for reducing glare.

In 2023, Polarized sunglasses held a dominant market position in the “By Product Type” segment of the Cycling Sunglasses Market, capturing more than an 85.6% share. This overwhelming preference for polarized lenses among cyclists can be attributed to their superior ability to reduce glare, enhance contrast, and improve visual clarity, which is crucial for safety and performance during cycling. Polarized sunglasses are particularly favored in environments with high light reflections, such as on roads or trails near water bodies where the reduction of blinding glare significantly improves the cycling experience.

On the other hand, Non-Polarized sunglasses accounted for the remaining 14.4% of the market. These sunglasses continue to hold relevance in the market primarily due to their cost-effectiveness and variety of stylistic options. They are suitable for low-light conditions where polarization is less beneficial, and thus, they cater to cyclists who might ride under overcast or heavily shaded conditions. Additionally, non-polarized sunglasses are often lighter, which appeals to cyclists who prioritize minimalistic gear.

The stark contrast in market shares between polarized and non-polarized sunglasses underscores the critical importance that performance-oriented features hold in the purchasing decisions of cycling enthusiasts. While the market for non-polarized sunglasses remains modest, the overwhelming preference for polarized sunglasses is likely to drive continued innovations in lens technology, further cementing their status as a staple in cyclist gear. The focus on enhancing the functionality of polarized lenses could potentially expand their applications, even more, appealing to a broader audience within the active lifestyle and sports communities.

By Distribution Channel Analysis

Offline channels prevail in sales, distributing 71.6% of cycling sunglasses.

In 2023, Offline channels held a dominant market position in the “By Distribution Channel” segment of the Cycling Sunglasses Market, capturing more than a 71.6% share. This substantial market share is indicative of consumers’ preference for purchasing cycling sunglasses through traditional retail outlets like sports stores, specialty bike shops, and optician’s offices.

The preference for offline shopping can be attributed to the tactile buying experience it offers, allowing customers to physically assess the fit, comfort, and style of the sunglasses—factors that are crucial in a consumer’s decision-making process. Furthermore, the immediate product accessibility and the advantage of expert in-store advice play significant roles in steering consumers towards offline purchases.

Conversely, Online channels accounted for 28.4% of the market share. Despite the lower share, the online segment is growing, driven by the increasing penetration of e-commerce platforms and the shift in consumer behavior toward digital shopping. Online stores offer a wider range of products and the convenience of home delivery, which appeals to a segment of consumers who value convenience and variety. Additionally, online platforms often provide competitive pricing and seasonal promotions, which can attract cost-conscious buyers.

The disparity in market shares highlights the continued importance of physical retail experiences in the purchase of performance-based products like cycling sunglasses. However, as digital platforms enhance their customer experience with improved virtual try-on technologies and augmented reality features, the gap between online and offline shares may narrow, reflecting a gradual shift in consumer preferences in the coming years.

Key Market Segments

By Type

- Men’s Cycling Sunglasses

- Women’s Cycling Sunglasses

- Kids Cycling Sunglasses

By Product Type

- Polarized

- Non-Polarized

By Distribution Channel

- Online

- Offline

Growth Opportunities

Enhanced Marketing and Branding Efforts

The global cycling sunglasses market is poised for significant growth, driven primarily by enhanced marketing and branding efforts. In 2023, leading companies have leveraged innovative marketing strategies that not only highlight the functional attributes of cycling sunglasses, such as UV protection and durability but also emphasize their fashion appeal. By collaborating with renowned athletes and influencers, brands have effectively broadened their visibility and appeal.

Furthermore, the adoption of digital marketing tools has enabled personalized advertising, which targets consumers based on their buying behavior and preferences. These sophisticated marketing initiatives are pivotal in driving consumer awareness and preference, thereby catalyzing market growth.

Targeting a Broader Consumer Base

Expanding the consumer base beyond professional cyclists to include casual enthusiasts and outdoor sports aficionados represents a substantial growth opportunity for the cycling sunglasses market in 2023. Brands are diversifying their product portfolios to cater to a wider range of consumers, offering varying designs, price points, and features that appeal to different segments.

Additionally, there is a growing emphasis on inclusivity, with products designed for diverse demographics, including women and youth. This strategy not only taps into a larger market but also fosters a stronger connection with a broader audience. By addressing the specific needs and preferences of these expanded consumer groups, companies can further penetrate the market and enhance their overall market share.

Latest Trends

Cycling Sunglasses as Fashion Statements

In 2023, cycling sunglasses have transcended their traditional role as mere protective sportswear to become significant fashion statements. This shift is largely influenced by the growing trend of integrating sportswear into everyday fashion. As consumers increasingly seek versatility in their apparel and accessories, cycling sunglasses are being designed with aesthetics in mind, featuring sleek, stylish frames and a variety of colors that complement daily outfits as well as athletic gear.

This fashion-forward approach is attracting a new demographic of consumers who value style and functionality, thereby expanding the market and influencing design trends across the industry.

Popularity of Polarized Lenses

Polarized lenses are becoming a cornerstone in the cycling sunglasses market due to their enhanced functionality in reducing glare from reflective surfaces such as water, roads, and other flat surfaces. As more cyclists and outdoor enthusiasts recognize the benefits of polarized technology—improved visual clarity and reduced eye strain—demand for these lenses has surged.

Manufacturers are responding by increasingly incorporating polarized options into their product lines, often combining them with other high-performance features such as UV protection and impact resistance. This focus on high-tech, high-comfort solutions is driving consumer preference and setting new standards in the eyewear industry, particularly in markets with strong outdoor cultures.

Regional Analysis

Europe holds a 33.6% share of the global cycling sunglasses market in 2023.

The global cycling sunglasses market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each contributing differently to the market dynamics.

Europe is the dominant region, commanding a substantial 33.6% market share. This leadership is attributed to a high prevalence of cycling as both a recreational and commuting activity in countries like the Netherlands, Germany, and France. Additionally, Europe benefits from the presence of leading cycling sunglasses manufacturers who emphasize advanced technology and fashion trends.

North America also represents a significant segment of the market, driven by a strong culture of outdoor and fitness activities, coupled with high disposable income levels that facilitate spending on premium sporting goods. The region’s market is further bolstered by the United States hosting numerous cycling events, which promote cycling gear, including sunglasses.

The Asia Pacific region is experiencing rapid growth due to increasing awareness about fitness and outdoor sports among the population, especially in emerging economies such as China and India. The growing middle-class consumer base in these countries is likely to increase the demand for cycling sunglasses.

The markets in Latin America and the Middle East & Africa are smaller but growing. These regions are witnessing gradual increases in consumer spending on sports accessories, driven by rising health consciousness and the popularity of cycling as a fitness regimen. Latin America, in particular, shows potential for growth with improving economic conditions and a young population.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global cycling sunglasses market of 2023, key players are diversifying their product portfolios to cater to the evolving needs of cyclists, emphasizing durability, style, and advanced UV protection technology. NIKE Inc., renowned for its innovation in sports apparel, is likely to leverage its strong brand identity and extensive distribution network to expand its market share. Luxottica Group Spa, a leader in the luxury eyewear segment, may continue to excel by integrating high fashion with high function, appealing to both casual and professional cyclists.

Decathlon Group, known for offering cost-effective sporting goods, might capture a significant portion of the budget-conscious segment by providing quality cycling sunglasses at competitive prices. Under Armour Inc., with its focus on performance-enhancing sports gear, is expected to introduce new technologies in lens and frame design, enhancing visual clarity and comfort.

Shimano Inc., primarily known for its expertise in bicycle components, might enhance its visibility in the eyewear market by offering products that complement its existing cycling gear. Uvex Group and Rudy Project Spa are set to maintain their positions by focusing on safety and customization, providing options that cater to various face shapes and sizes, a critical factor in cycling sunglasses.

Rapha Racing Limited, Kopin Corporation, and POC Sports are likely to push the boundaries in integrating technology and design aesthetics, potentially introducing smart sunglasses that provide real-time data to cyclists. Tifosi Optics Inc., KASK America Inc., and ASSOS of Switzerland GmbH, while smaller in market size, are anticipated to carve out niche segments by focusing on specific cyclist needs such as mountain biking and road racing, offering specialized products that emphasize precision, aerodynamics, and extreme condition durability.

Market Key Players

- NIKE Inc

- Luxottica Group Spa

- Decathlon Group

- Under Armour Inc.

- Shimano Inc.

- Uvex Group

- Rapha Racing Limited

- Kopin Corporation

- POC Sports

- Rudy Project Spa

- ASSOS of Switzerland GmbH

- Tifosi Optics Inc.

- KASK America Inc.

Recent Development

- In April 2023, Hindsight, a British cycling glasses brand, launched V2 rear-view cycling glasses, featuring stylish designs and patented semi-transparent mirrored lenses for enhanced safety.

- In January 2022, Ninety One, a Mumbai-based cycle startup, recently raised $30 million to expand manufacturing and enter the US and European markets with its innovative bicycles.

Report Scope

Report Features Description Market Value (2023) USD 1.0 Billion Forecast Revenue (2033) USD 1.7 Billion CAGR (2024-2033) 5.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Men’s Cycling Sunglasses, Women’s Cycling Sunglasses, Kids Cycling Sunglasses), By Product Type(Polarized, Non-Polarized), By Distribution Channel(Online, Offline) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NIKE Inc, Luxottica Group Spa, Decathlon Group, Under Armour Inc., Shimano Inc., Uvex Group, Rapha Racing Limited, Kopin Corporation, POC Sports, Rudy Project Spa, ASSOS of Switzerland GmbH, Tifosi Optics Inc., KASK America Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Cycling Sunglasses Market Size in 2023?The Global Cycling Sunglasses Market Size is USD 1.0 Billion in 2023.

What is the projected CAGR at which the Global Cycling Sunglasses Market is expected to grow at?The Global Cycling Sunglasses Market is expected to grow at a CAGR of 5.50% (2024-2033).

List the segments encompassed in this report on the Global Cycling Sunglasses Market?Market.US has segmented the Global Cycling Sunglasses Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Men’s Cycling Sunglasses, Women’s Cycling Sunglasses, Kids Cycling Sunglasses), By Product Type(Polarized, Non-Polarized), By Distribution Channel(Online, Offline)

List the key industry players of the Global Cycling Sunglasses Market?NIKE Inc, Luxottica Group Spa, Decathlon Group, Under Armour Inc., Shimano Inc., Uvex Group, Rapha Racing Limited, Kopin Corporation, POC Sports, Rudy Project Spa, ASSOS of Switzerland GmbH, Tifosi Optics Inc., KASK America Inc.

Name the key areas of business for Global Cycling Sunglasses Market?The Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, Eastern Europe, Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe are leading key areas of operation for Cycling Sunglasses Market.

-

-

- NIKE Inc

- Luxottica Group Spa

- Decathlon Group

- Under Armour Inc.

- Shimano Inc.

- Uvex Group

- Rapha Racing Limited

- Kopin Corporation

- POC Sports

- Rudy Project Spa

- ASSOS of Switzerland GmbH

- Tifosi Optics Inc.

- KASK America Inc.