Automotive Exhaust Systems Market Report By Fuel type (Gasoline, Diesel), By Component type (Manifold, Downpipe, Catalyst converter, Muffler, Tailpipe), By vehicle type (Passenger cars, Light commercial vehicles, Heavy commercial vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 57982

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

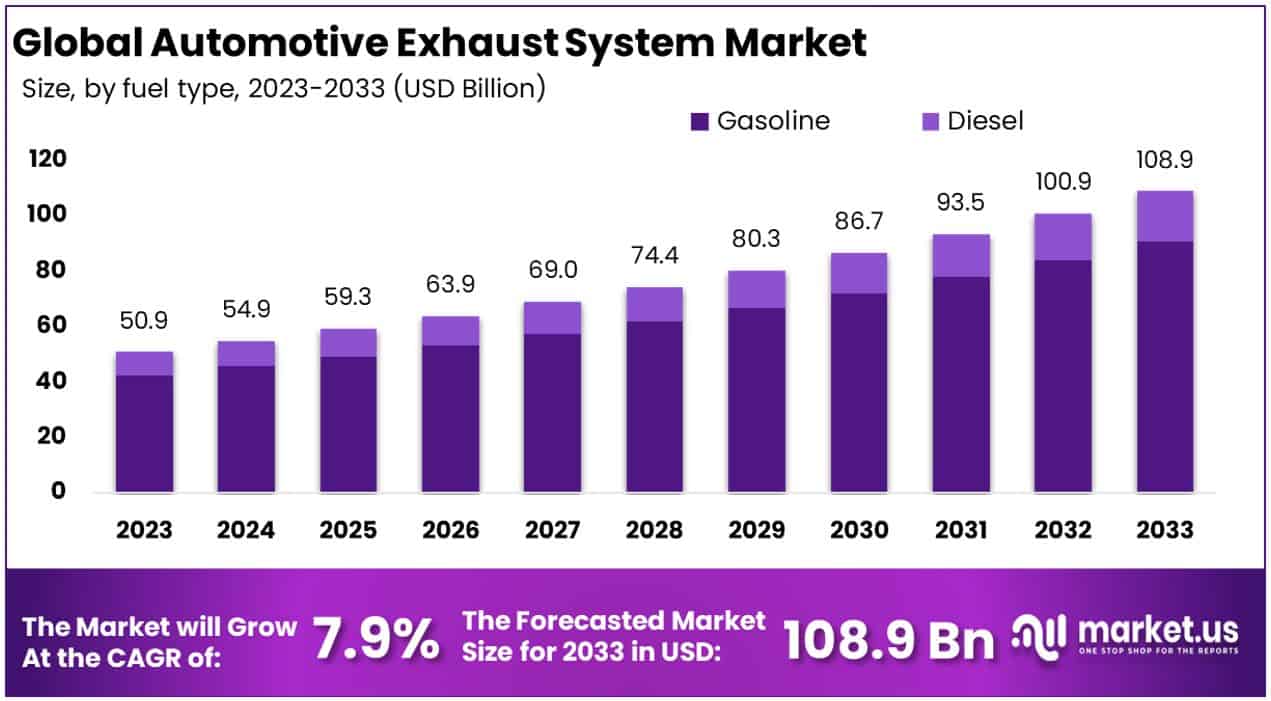

The Global Automotive Exhaust Systems Market size is expected to be worth around USD 108.9 Billion by 2033, from USD 50.9 Billion in 2023, growing at a CAGR of 7.90% during the forecast period from 2024 to 2033.

The Automotive Exhaust Systems Market encompasses the production and distribution of crucial components designed to manage and reduce vehicle emissions. Key products include mufflers, exhaust pipes, catalytic converters, and oxygen sensors. This market serves automotive manufacturers globally, addressing regulatory demands for lower emissions and enhanced fuel efficiency.

Innovations focus on lightweight materials and advanced technologies to improve performance and environmental compliance. As stricter emission standards emerge, the market is poised for growth, offering significant opportunities for development and investment.

In the automotive industry, the Automotive Exhaust Systems Market plays a pivotal role in addressing both environmental concerns and regulatory standards. With the forecast for automotive production in 2023 showing a modest projection by Cox Automotive, anticipating U.S. new vehicle sales to reach 14.1 million units, the demand for advanced exhaust systems is anticipated to parallel this growth trajectory.

The steady increase in vehicle registration, with over 105 million automobiles registered in the U.S. alone, underscores the expanding market base for exhaust system manufacturers. Furthermore, the data indicating that the average American household owns at least one vehicle, with a notable 22.1% of households possessing three or more vehicles, highlights the sustained demand for automotive maintenance and upgrades, including exhaust systems.

The market for automotive exhaust systems is thus positioned at a critical juncture, where innovation and sustainability are key drivers of growth. Manufacturers are challenged to develop products that not only meet stringent emission regulations but also cater to the consumer demand for performance and fuel efficiency. This necessitates a strategic focus on R&D, leveraging lightweight materials, and integrating cutting-edge technologies to enhance system functionality and environmental compliance.

The Automotive Exhaust Systems Market is anticipated to witness substantial growth, driven by regulatory pressures and the rising awareness towards reducing vehicular pollution. As companies navigate this competitive landscape, strategic investments in product innovation and sustainability practices are expected to yield significant returns, positioning industry leaders at the forefront of the green revolution in automotive technologies.

Key Takeaways

- Market Value Projection: The Global Automotive Exhaust Systems Market is expected to reach approximately USD 108.9 Billion by 2033, showing substantial growth from USD 50.9 Billion in 2023, with a projected CAGR of 7.90% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Fuel Types: Gasoline engines dominate the market with an 83.3% share, driven by factors such as lower manufacturing costs, broader application in passenger vehicles, and advancements in technology improving efficiency and performance.

- Component Types: Manifolds hold a significant share of 39.8%, crucial for optimizing engine performance and emission levels. Other components like downpipes, catalyst converters, mufflers, and tailpipes also contribute significantly to market dynamics.

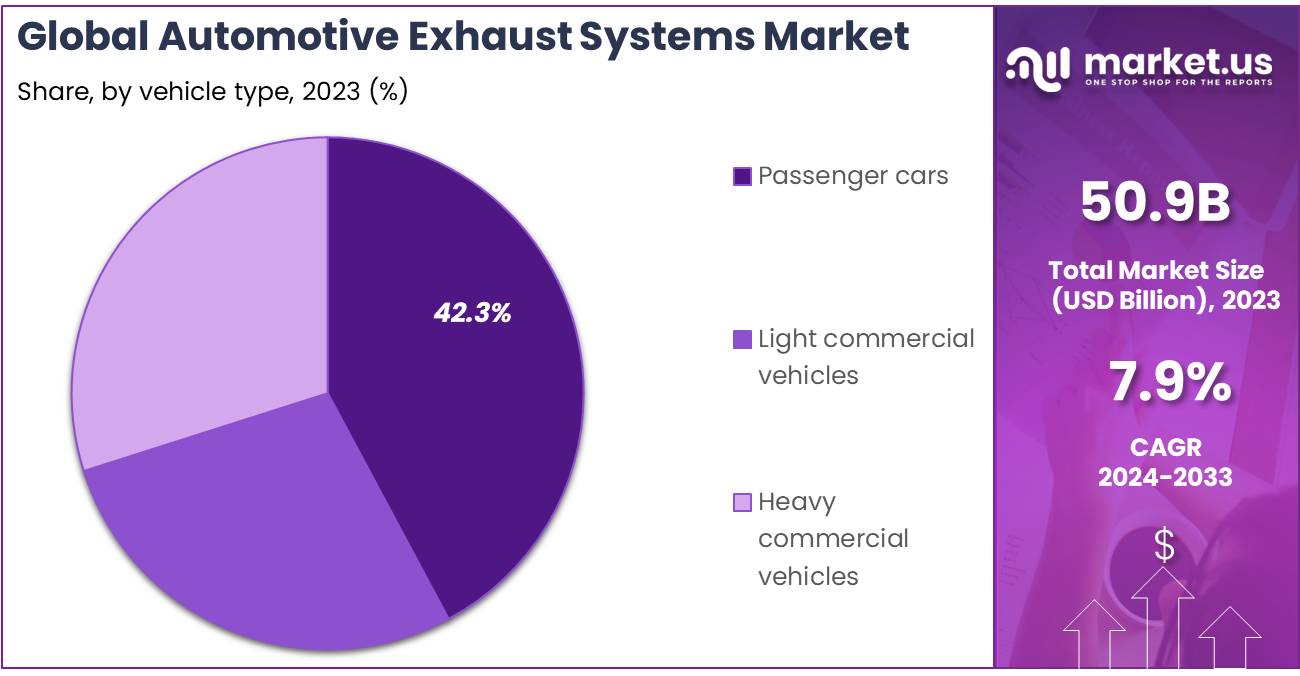

- Vehicle Types: Passenger cars constitute the dominant sub-segment with 42.3% market share, followed by light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs).

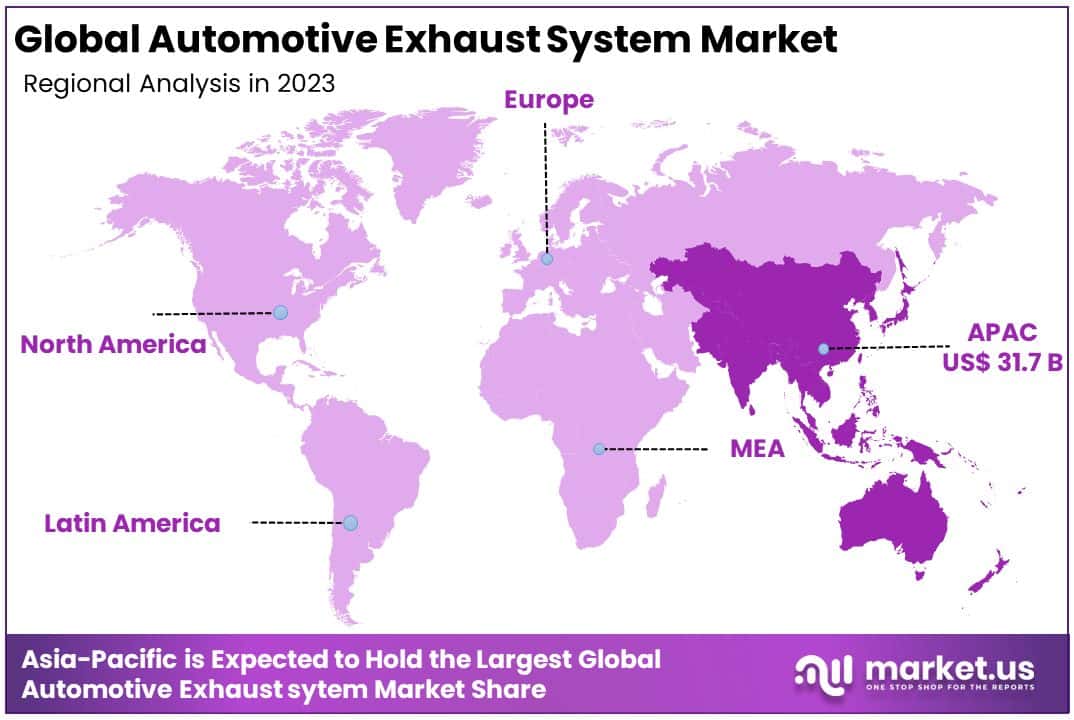

- Regional Dynamics: Asia-Pacific dominates the market with a 62.3% market share, followed by North America with a significant share of 20.5%. Asia-Pacific’s dominance is attributed to factors such as high vehicle production and stringent emission norms.

- Analyst Viewpoint: The market’s growth is fueled by factors such as increasing vehicle production, stringent emission regulations, technological advancements in exhaust system components, and consumer demand for cleaner and more efficient vehicles.

- Growth Opportunities: Opportunities for market growth lie in innovations aimed at reducing emissions and improving engine efficiency, catering to the growing demand for hybrid and electric vehicles, and expanding into emerging markets with increasing vehicle sales. Collaboration with automakers to develop advanced exhaust system solutions could also drive growth in the market.

Driving Factors

Stringent Emission Regulations and Environmental Concerns Drive Market Growth

Governments worldwide are tightening emission regulations to combat environmental degradation and promote sustainable transportation, directly impacting the Automotive Exhaust Systems Market. The enforcement of stringent standards, such as the Euro 6 in Europe, mandates the adoption of advanced technologies like Selective Catalytic Reduction (SCR) systems and Diesel Particulate Filters (DPFs). These regulations necessitate the development of sophisticated exhaust systems capable of significantly reducing vehicle emissions.

As a result, automotive manufacturers are propelled to innovate, leading to increased investment in R&D for exhaust systems that not only comply with regulatory requirements but also enhance vehicle efficiency and performance. This regulatory push is a primary driver of demand in the exhaust systems market, compelling companies to evolve their product offerings to meet both environmental standards and consumer expectations, thereby fueling market growth.

Increasing Demand for High-Performance Vehicles Fuels Market Expansion

The surge in consumer interest for high-performance vehicles, including sports and luxury cars, has markedly influenced the demand for advanced exhaust systems. These vehicles necessitate exhaust solutions that fulfill dual roles—minimizing emissions and maximizing performance, including power output and acoustic signature.

Leading automotive brands such as BMW, Mercedes-Benz, and Porsche are at the forefront, developing exhaust systems that contribute to the enhanced driving experience while adhering to strict emission norms. This demand drives innovation within the market, encouraging manufacturers to explore new materials and technologies that improve exhaust system efficiency, durability, and performance characteristics. The popularity of high-performance vehicles thus significantly contributes to the expansion of the Automotive Exhaust Systems Market, as manufacturers strive to meet these specialized requirements.

Rise of Electric and Hybrid Vehicles Opens New Market Avenues

The automotive industry’s pivot towards electrification, with an increasing focus on electric (EVs) and hybrid vehicles, presents unique challenges and opportunities for the exhaust systems market. While EVs do not require traditional exhaust systems, the demand for hybrid vehicles, which combine internal combustion engines with electric propulsion, introduces a need for specialized exhaust systems.

These systems are designed to address the specific requirements of hybrid powertrains, incorporating advanced catalytic converters and particulate filters to ensure compliance with emission regulations. This shift towards hybrid vehicles stimulates the development of innovative exhaust solutions tailored for reduced emissions and optimized performance in hybrid applications. The evolution towards electrification and hybridization thus represents a significant growth area for the Automotive Exhaust Systems Market, reflecting the industry’s adaptation to changing technological landscapes and regulatory environments.

Restraining Factors

High Manufacturing Costs and Complex Design Restrain Market Growth

The production of automotive exhaust systems is marked by complex design requirements and high manufacturing costs. These systems necessitate the use of specialized materials and precision fabrication techniques, alongside stringent quality control measures to meet regulatory standards.

This complexity significantly elevates the production costs, making advanced exhaust systems less accessible for entry-level or budget-oriented vehicle segments. The financial implications of adopting such technologies can deter manufacturers targeting cost-sensitive markets, thus limiting the market penetration of innovative exhaust systems. Additionally, the high cost of research and development (R&D) required to innovate and comply with evolving emission regulations can strain manufacturers’ resources, posing a barrier to the widespread adoption of advanced exhaust solutions.

Weight Considerations and Packaging Constraints Hinder Market Expansion

The impact of exhaust systems on vehicle weight and the inherent packaging constraints present significant challenges to the Automotive Exhaust Systems Market. As these systems add considerable weight, they can adversely affect fuel efficiency and vehicle performance—factors increasingly important to consumers and regulatory bodies. Manufacturers are thus tasked with designing exhaust systems that are not only compliant with emission regulations but also lightweight and compact enough to mitigate negative impacts on performance.

The need to integrate complex components within the limited space of modern vehicle designs further complicates this issue. These constraints can limit the scope for innovation and the implementation of advanced technologies in exhaust systems, thereby restraining market growth. Addressing these challenges requires ongoing advancements in materials science and component design to develop more efficient, lighter exhaust systems that meet both regulatory and consumer demands without compromising vehicle design and performance.

Fuel Type Analysis

In the Automotive Exhaust Systems Market, fuel type plays a crucial role in segmenting market demand and technological development. The distinction between gasoline and diesel engines, with their unique emission characteristics and performance requirements, necessitates differentiated exhaust system designs and technologies. The dominance of gasoline engines as a sub-segment, commanding a significant share of 83.3%, is reflective of several underlying market dynamics and consumer preferences.

Gasoline engines have historically been favored for their lower initial manufacturing costs, broader range of application in passenger vehicles, and the perception of being cleaner in terms of certain pollutants when compared to diesel engines. This preference is underpinned by the stringent emission regulations in key markets, which have increasingly favored gasoline over diesel due to concerns over nitrogen oxides (NOx) and particulate matter (PM) emissions associated with diesel engines. Moreover, the advancements in gasoline engine technology, including direct injection and turbocharging, have improved their efficiency and performance, making them more competitive with diesel engines in terms of fuel economy and power output.

The gasoline engine segment’s dominance is further reinforced by the shift in consumer preference towards gasoline-fueled SUVs and crossovers, particularly in markets like the United States. Additionally, the tightening of emission standards globally has placed significant pressure on diesel engines, leading to a decline in their market share in certain regions. Manufacturers have been prompted to invest heavily in exhaust after-treatment technologies for diesel engines, such as advanced particulate filters and SCR systems, to meet these regulatory requirements.

Component Type Analysis

Within the Automotive Exhaust Systems Market, component types such as manifolds, downpipes, catalyst converters, mufflers, and tailpipes play distinct roles, each contributing uniquely to the system’s overall functionality. The manifold, with a notable dominance of 39.8% in this segment, stands out as a critical component. The exhaust manifold collects gases emitted from multiple cylinders of the engine and directs them into the exhaust system. Its efficiency and design are crucial for minimizing back pressure and optimizing the engine’s performance and emission levels.

The prominence of the manifold is attributable to several factors. Firstly, technological advancements have allowed for the development of manifolds that significantly reduce emissions while enhancing engine efficiency. Materials like stainless steel are increasingly used to withstand high temperatures and corrosion, extending the lifespan of the manifold. Moreover, the growing emphasis on reducing emissions has led to innovations in manifold design to ensure more effective catalytic converter operation by quickly reaching optimal operating temperatures.

While the manifold is a key component, other segments like downpipes, catalyst converters, mufflers, and tailpipes also contribute significantly to market dynamics. Catalyst converters, for example, are essential for reducing harmful emissions, and their demand is closely tied to regulatory requirements for cleaner emissions. Mufflers and tailpipes, while primarily concerned with noise reduction and emissions’ final exit, respectively, have seen innovations aimed at enhancing performance and aesthetic appeal.

Vehicle Type Analysis

In the segmentation by vehicle type, passenger cars emerge as the dominant sub-segment, holding 42.3% of the market. This predominance is influenced by the sheer volume of passenger vehicles on the road, coupled with stringent emission norms applied globally to this vehicle type. Passenger cars are a primary focus for advancements in exhaust system technology, driven by consumer demand for vehicles that offer a balance of performance, fuel efficiency, and environmental compliance.

The demand for advanced exhaust systems in passenger cars is bolstered by the shift towards smaller, turbocharged engines that require efficient exhaust systems to manage increased pressure and temperatures. Furthermore, the push for electrification and hybrid technologies in passenger vehicles introduces new complexities and opportunities in exhaust system design, particularly for hybrid models that still rely on internal combustion engines.

Light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) represent other significant segments. LCVs, used predominantly for transport and commercial activities in urban and semi-urban areas, require robust exhaust systems that can handle frequent start-stop cycles and varying load conditions. HCVs, including trucks and buses, demand exhaust systems designed for durability and high performance under heavy-duty conditions. These segments, while smaller than passenger cars, are essential to the market’s overall dynamics, particularly in the context of commercial transportation.

Key Market Segments

By Fuel type

- Gasoline

- Diesel

By Component type

- Manifold

- Downpipe

- Catalyst converter

- Muffler

- Tailpipe

By vehicle type

- Passenger cars

- Light commercial vehicles

- Heavy commercial vehicles

Growth Opportunities

Integration of Exhaust System Components with Vehicle Electronics Offers Growth Opportunity

The fusion of exhaust system components with vehicle electronics heralds a significant growth opportunity within the Automotive Exhaust Systems Market. This technological integration involves embedding sensors, actuators, and control modules directly into exhaust systems, facilitating real-time monitoring and diagnostics. Such advancements not only improve vehicle efficiency and emission control but also open avenues for over-the-air software updates and system customization.

This progression towards smarter exhaust systems can significantly enhance the user experience by allowing for adaptive performance changes and easier maintenance protocols. The demand for vehicles equipped with such advanced diagnostics and control capabilities is increasing, driven by consumer expectations for performance, fuel efficiency, and environmental compliance. This trend underscores a broader shift towards connected and intelligent automotive technologies, positioning manufacturers who can innovate in this space for substantial market growth.

Expansion into Emerging Markets Offers Growth Opportunity

The burgeoning automotive sectors in emerging economies present substantial growth avenues for the Automotive Exhaust Systems Market. Countries like China, India, and Brazil are witnessing rapid growth in vehicle demand, propelled by increasing consumer purchasing power and urbanization. These markets are also adopting stricter emission standards, mirroring trends in more developed economies, which amplifies the need for advanced exhaust system technologies.

The opportunity for exhaust system manufacturers lies in tailoring their offerings to meet the unique demands and regulatory environments of these regions. Establishing a presence in emerging markets could involve strategic partnerships, local manufacturing initiatives, and R&D investments focused on region-specific solutions. As these economies continue to grow, the demand for vehicles—and by extension, advanced exhaust systems—is expected to rise, offering a lucrative expansion pathway for players in the global exhaust system industry.

Trending Factors

Modular and Customizable Exhaust Systems Are Trending Factors

The development of modular and customizable exhaust systems is a significant trend within the Automotive Exhaust Systems Market. This trend is fueled by the increasing consumer demand for vehicle personalization, covering performance, sound, and visual appeal. Manufacturers are responding by offering exhaust systems that can be tailored to individual preferences, allowing for a range of configurations that cater to different performance levels and aesthetic desires.

This flexibility not only enhances the consumer’s ability to personalize their vehicle but also enables manufacturers to streamline production and inventory management by utilizing modular components that can be adapted across multiple vehicle models. The move towards modular and customizable designs is indicative of the market’s shift towards more adaptive and consumer-centric products, reflecting a broader trend in automotive manufacturing towards customization and flexibility.

Integration of Active Noise Control (ANC) Technologies Are Trending Factors

The integration of Active Noise Control (ANC) technologies into automotive exhaust systems represents another trending factor, driven by the increasing consumer expectation for comfort and luxury within the cabin environment. ANC technologies utilize sophisticated algorithms and actuators to detect and counteract unwanted engine and exhaust noise, creating a quieter and more pleasant driving experience. This trend is particularly pronounced in the premium and luxury vehicle segments, where manufacturers are leveraging ANC to differentiate their offerings and enhance the overall value proposition.

As consumers become more attuned to the quality of the driving experience, the demand for vehicles equipped with ANC systems is expected to rise, pushing manufacturers to innovate and integrate these technologies into their exhaust system designs. The emphasis on reducing cabin noise aligns with broader automotive trends focusing on comfort, driving pleasure, and technological advancement, marking ANC integration as a key area of development and growth in the exhaust systems market.

Regional Analysis

Asia-Pacific Dominates with 62.3% Market Share

The Asia-Pacific region’s commanding 62.3% share of the Automotive Exhaust Systems Market is attributed to several pivotal factors. Firstly, the region is home to some of the world’s largest automotive markets, including China and India, driven by vast population bases and growing middle-class affluence. Rapid industrialization and urbanization have fueled vehicle demand, necessitating advanced exhaust systems.

Additionally, governments in the region have implemented stringent emission regulations, pushing manufacturers to adopt sophisticated exhaust technologies. The presence of major automotive players and component manufacturers in Asia-Pacific also facilitates local sourcing and supply chain efficiencies, further bolstering the region’s dominance.

Market Dynamics in Other Regions

North America commands a significant market share of 20.5%, primarily due to stringent environmental regulations and a strong demand for passenger vehicles. The adoption of advanced technologies aimed at reducing emissions and enhancing fuel efficiency serves as a major catalyst for growth in this region.

Europe, with a market share of 18.2%, stands out for its rigorous emission standards, exemplified by Euro 6, which drive continuous advancements in exhaust system technologies. Moreover, the presence of a substantial number of luxury and performance vehicle manufacturers further solidifies its position in the market.

In the Middle East & Africa, though holding a comparatively smaller market share of 5.8%, there is noticeable growth fueled by increasing vehicle sales and a rising environmental consciousness. Noteworthy trends include investments in infrastructure and a rising demand for luxury vehicles, signaling promising prospects for expansion.

Latin America, despite facing economic fluctuations, exhibits resilience with a steady demand for automotive components, including exhaust systems, contributing to its 4.2% market share. The emergence of regulatory frameworks aimed at curbing vehicle emissions and preserving the environment is anticipated to stimulate further growth in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Automotive Exhaust Systems Market, key players such as Tenneco Inc, Faurecia, Eberspacher, and others play pivotal roles. Tenneco Inc and Faurecia, for instance, are renowned for their innovative approaches to emissions control technologies, leveraging extensive R&D resources to meet stringent global emission standards. Eberspacher is similarly positioned, focusing on high-performance exhaust systems that cater to both passenger and commercial vehicles.

Friedrich Boysen GmbH and Co KG and Benteler International are recognized for their expertise in engineering and manufacturing exhaust systems that enhance vehicle performance and efficiency. Bosal International N.V, with its global footprint, excels in delivering cost-effective and durable exhaust solutions, demonstrating strong strategic positioning in both aftermarket and OEM sectors.

Continental AG’s entry into the exhaust system market underscores the importance of integrating exhaust systems with vehicle electronics and emission control technologies, indicating a shift towards more sophisticated, system-wide solutions. Futaba Industrial Co. Ltd, Johnson Matthey, and Yutaka Giken Company Ltd are distinguished by their contributions to advancing catalytic converter technologies and materials science, enhancing the market’s overall technological landscape.

Klarius Products Ltd and Sango Co Ltd emphasize aftermarket services and replacement parts, addressing the demand for maintenance and upgrade of existing vehicles. Collectively, these companies shape the market through innovation, strategic expansion, and a focus on sustainability and regulatory compliance, ensuring their continued influence and market leadership in the Automotive Exhaust Systems sector.

Market Key Players

- Tenneco Inc

- Faurecia

- Eberspacher

- Friedrich Boysen GmbH and Co KG

- Benteler International

- Bosal International N.V

- Continental AG

- Futaba Industrial Co.ltd

- Johnson Matthey

- Klarius Products ltd

- Sango Co ltd

- Yutaka Giken Company ltd

Recent Developments

- On October 2023, Purem AAPICO inaugurated a new plant in Thailand, located 100 kilometers southeast of Bangkok, to manufacture exhaust systems for a prominent US automotive manufacturer’s pick-up truck.

- On October 2023, Doug Dahl, the communications director of the Washington Traffic Safety Commission, addressed concerns about modifying vehicle exhaust systems to increase noise levels.

- On September 2023, Mercedes-Benz’s design chief, Gorden Wagener, highlighted that Daytime Running Lights (DRLs) are becoming the new design signature for the brand’s future electric vehicles, akin to exhaust pipes in traditional combustion cars.

Report Scope

Report Features Description Market Value (2023) USD 50.9 Billion Forecast Revenue (2033) USD 108.9 Billion CAGR (2024-2033) 7.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel type (Gasoline, Diesel), By Component type (Manifold, Downpipe, Catalyst converter, Muffler, Tailpipe), By vehicle type (Passenger cars, Light commercial vehicles, Heavy commercial vehicles) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tenneco Inc, Faurecia, Eberspacher, Friedrich Boysen GmbH and Co KG, Benteler International, Bosal International N.V, Continental AG, Futaba Industrial Co.ltd, Johnson Matthey, Klarius Products ltd, Sango Co ltd, Yutaka Giken Company ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Automotive Exhaust Systems Market by 2033?The Global Automotive Exhaust Systems Market is expected to be worth around USD 108.9 Billion by 2033.

Which region dominates the Automotive Exhaust Systems Market, and why?Asia-Pacific dominates the market with a 62.3% share due to factors such as large automotive markets, stringent emission regulations, and rapid industrialization.

What are the dominant segments within the Automotive Exhaust Systems Market?Dominant segments include gasoline engines (83.3% market share), manifolds (39.8%), and passenger cars (42.3%).

What are the growth opportunities within the Automotive Exhaust Systems Market?Opportunities lie in integrating exhaust system components with vehicle electronics, expanding into emerging markets, and developing modular and customizable exhaust systems.

Which companies are key players in the Automotive Exhaust Systems Market?Major players include Tenneco Inc, Faurecia, Eberspacher, Friedrich Boysen GmbH, Benteler International, among others.

Automotive Exhaust Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Exhaust Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BENTELER International

- Faurecia

- Magneti Marelli

- Tenneco

- BASF

- Bekaert

- Calsonic Kansei

- Eberspacher

- MAHLE

- Wuxi Longsheng Technology

- MAGNAFLOW

- Flowmaster Mufflers

- BORLA

- CORSA Performance

- Gibson Automotive

- Banks Power

- Holley Performance Products

- JBA Headers