Global Stainless Steel Market By Type (Austenitic Stainless Steels, Martensitic Stainless Steels, etc), By Application (Automotive, Construction, and Heavy Industries), By Grade (200, 300, and 400 Series, Duplex Series), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 16008

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

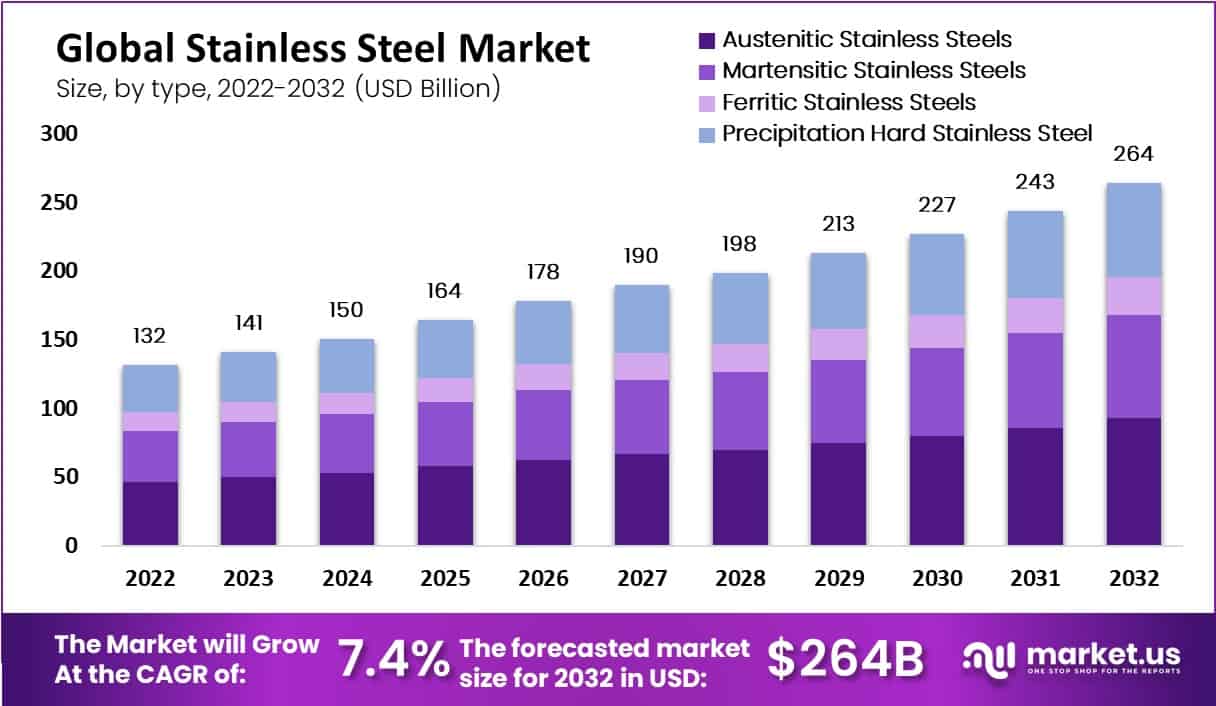

The Global Stainless Steel Market size is expected to be worth around USD 264 billion by 2032 from USD 131.5 billion in 2022, growing at a CAGR of 7.4% during the forecast period 2023 to 2032.

A family of alloy steels, stainless steel has a chromium content of 10–30%. Some elements, such as nickel, molybdenum, titanium, aluminum, niobium, copper, nitrogen, sulfur, or selenium, improve oxidation resistance, increase corrosion resistance in particular environments, and confer unique properties.

Stainless steels are polished in various steelmaking vessels after melting in an electric arc or a basic oxygen furnace to reduce the carbon content.

A mixture of oxygen and argon gas is added to the liquid steel during the argon-oxygen decarburization process. The response for stainless steel will likely increase due to residential housing, and private and public infrastructure investments.

In industrial settings like infrastructure, automotive production and transportation, railroads, building and construction, and process industries, stainless steel is crucial.

Because it combines abilities like strength, aesthetic qualities, an average product life cycle low maintenance costs, and corrosion resistance flexibility, stainless steel (SS) has a distinct advantage over carbon steel. These features and rising application penetration are predicted for the stainless steel market expansion.

Key Takeaways

- Market Developments: In 2022, the global stainless steel market reached USD 264 billion and is projected to experience substantial expansion by 2032 with an anticipated compound annual growth rate of 7.4% between 2023-2032.

- Type Analysis: Beautiful yet practical – making this type of material the go-to material for automobile parts, architectural pieces, and many other applications. Cleanliness, simplicity of production, and environmental sustainability all combine together for excellent environmental practices that help it remain the go-to material for automotive, architecture, and various other uses.

- Application Analysis: Automakers now must develop lightweight cars. In the past, light metals were the go-to material; however, their high-cost prohibitiveness made welding less viable; steel has superior mechanical properties making this material suitable.

- By Grade: This model is widely utilized for manufacturing medical and surgical instruments due to its wear resistance, quality construction, and strength properties as well as manufacturing capability.

- Drivers: The stainless steel market’s growth can be attributed primarily to its surging demand in infrastructure and construction projects as well as automotive. With its superior strength, durability, and aesthetic qualities, stainless steel remains an extremely desirable material choice.

- Restrictions: While stainless steel markets boast numerous benefits, they do face unique obstacles related to price fluctuation that may hinder their development and hamper overall market expansion.

- Opportunities in the Market: The stainless steel market presents several exciting prospects, driven by advances in manufacturing technology and increased investment in R&D as well as evolving industrial practices that utilize stainless steel in environmentally responsible ways.

- Trends: Key trends in the stainless steel market include an increasing need for eco-friendly materials, innovations in stainless steel alloys, and expanding applications of this metal in modern architecture and renewable energy projects.

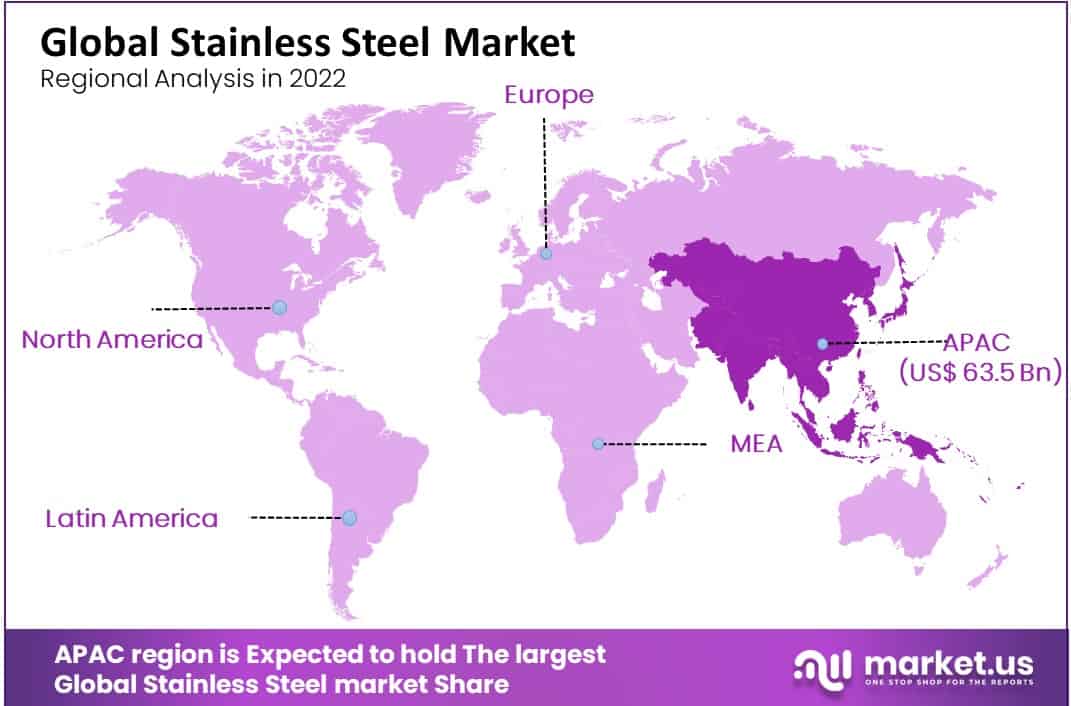

- Regional Dominance: Based on the analysis conducted, the Asia Pacific stainless steel market is expected to experience further expansion in the near future. Asia Pacific boasts an impressive market share of 45% which makes this an impressive region to study in detail.

- Key Players in Stainless Steel Market: Leading companies in this space include Acerinox S.A, Aperam Stainless Steel, Acre lot Mittal, and Baosteel Group among many others – these stainless steel industry titans play an instrumental role in driving market expansion, innovation, and global presence.

Drivers

Rapid growth in Industrialization

Rapid growth in the automotive & transportation industry and construction industries will fuel the consumption of the product. Stainless steel has high anti-resistance, high strength, and high heating properties. Such properties make the perfect choice for the stainless steel automotive, seat belt clips, and building industries.

Due to its expanding use of stainless steel in several sectors, including the chemical industries, petrochemicals, oil and gas, food and beverage industries, and power generation industries, the global stainless steel market is anticipated to expand significantly during the forecast period.

Demand for products is expected to be driven by superior product attributes like high strength, low weight, and high corrosion resistance, particularly against stress corrosion cracking. Due to these qualities, duplex series stainless steel is widely used to make storage tanks, process chemicals, and make chemical transport containers. It will continue to be a great alternative to carbon steel, and the stainless steel market is expected to grow due to its low price.

Rising Product Consumption in the Automotive and Building Industries

Additionally, the market for stainless steel will experience continued growth due to global Industrialization, rising power consumption, and other factors. Further, expanding residential, public, and commercial construction and reconstruction projects and using renewable energy will increase market value.

The development of infrastructure is also anticipated to support market expansion. Additionally, the expanding population will use more kitchenware, cookware, and cutlery, which will boost the stainless steel market key factor throughout the forecast period.

The inclination of Manufacturers toward Research and Development Fuels Stainless Steel Market Growth.

On the other hand, the manufacturer’s growing investment in R&D has aided in the creation of cutting-edge methods for enhancing the properties of stainless steel, expanding lucrative opportunities for market participants in the forecast period of 2023 to 2032.

The future expansion of the stainless steel market will also be aided by the growing adoption of innovative technologies like Building Information Management (BIM) and innovative materials and processes.

Restraints

Availability of Carbon Fibers as an Alternative to Stainless Steel.

Due to their lighter weight, carbon fibers are increasingly being used in place of stainless steel in the automotive industry. Because of their lightweight, high strength, and load-bearing capacities, carbon fibers will restrict the growth of the stainless steel market.

The availability of alternative products such as aluminum, galvanized steel, and carbon steel restrains product adoption. Stainless steel is not water resistant and heavy in weight; this impacts the stainless steel market.

Type Analysis

The Austenitic Stainless Segment is the Dominant

Depending on the type of stainless steel, it is classified into austenitic stainless steel, martensitic stainless steel, ferritic stainless steel, and precipitation-hardenable stainless steel. The austenitic stainless steel segment is dominant as austenitic stainless steel is famous for its strength, durability, and corrosion resistance.

It is aesthetically pleasing, easy to manufacture, clean and maintain, and environmentally friendly, making it the first choice for components used in architecture, automobiles, and many other products.

Martensitic stainless steel has excellent strength, corrosion resistant hence it is a good choice for various applications. Ferritic stainless steel is defined as a chromium non-hardening class of stainless alloys with a chromium content between 10.5% and 30% and a carbon content below.

20% These steels are mainly unhardened during heat treatment and only slightly hardened during cold rolling.

The precipitation-hard Stainless steel is corrosion-resistant. It is usually aluminum, nickel, titanium, and some steel alloys.

Duplex stainless steel is a two-phase metal alloy with an equal amount of ferritic and austenitic phases in its structure. It combines the corrosion resistance and strength of austenitic stainless steel.

Application Analysis

The Automotive and Transportation Segment is Dominant

By application of stainless steel, it is classified into the automotive and transportation, building and construction, and heavy industries.

Today, car manufacturers must build lightweight vehicles. In the past, so-called light metals were the only alternative to traditional materials. However, they are expensive and suitable for welding. Stainless steel has excellent mechanical properties.

The exceptional weldability and formability allow designers to make stainless parts as light as possible. Stainless steels have been used in construction since their invention over a century ago.

Stainless steel products are attractive and corrosion resistant, low maintenance, and offer good strength, durability, and fatigue properties.

While the use of stainless steel in everyday applications such as cutlery, medical equipment, metal products, and cars is well documented, heavy industry is also an area where the proliferation of this extreme metal has transformed.

When we talk about heavy industry, we mean any industry based on large equipment, facilities, and complexes. Traditionally, this included large-scale construction, steel production, mining, shipbuilding, and aircraft production. It also includes energy production and processing, such as oil and gas, hydropower, nuclear power, and long-distance energy transmission.

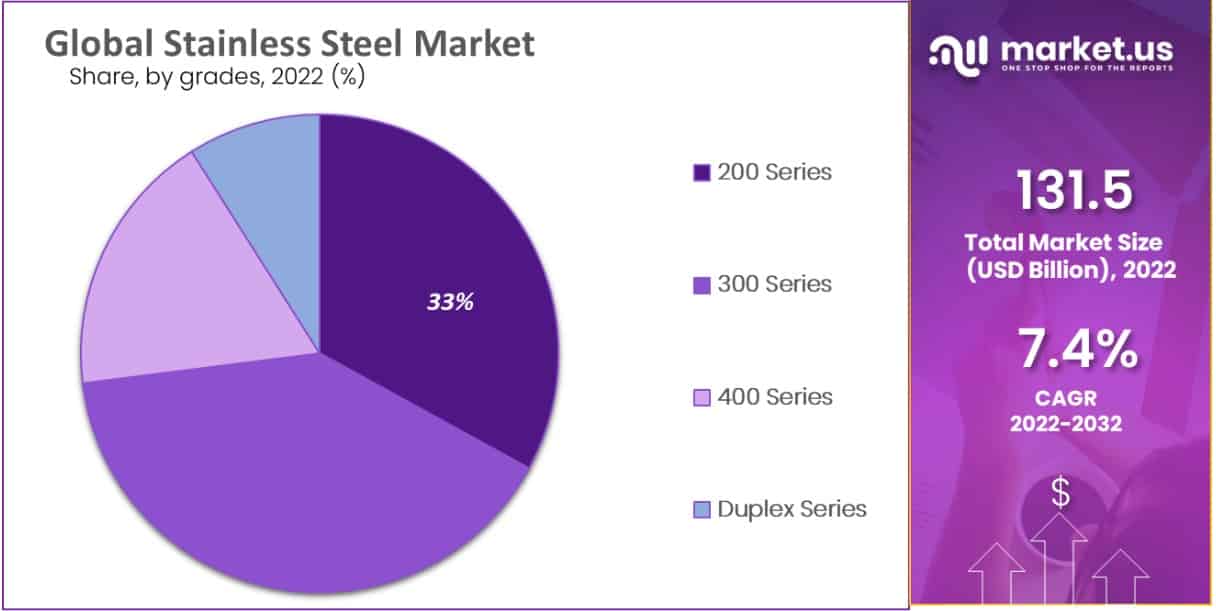

By Grade

Duplex Series Stainless Steel Segment is Dominant

By grade stainless steel market is segmented into 200 series, 300 series, 400 series, and Duplex series. The 200 series stainless steel contains a meager amount of nickel. 200 series stainless steel is widely used in automotive, food and beverage, cutlery, and washing machines.

300 series stainless steel is commonly used in movable parts requiring polishing and grinding machinery where corrosion is strictly prohibited.

This type of stainless steel is used in the aerospace, automotive, and construction industries. It is non-magnetic, pliable, and extremely tough. The stainless steel 400 series market is also widely used in medical applications.

This series is used for producing surgical and medical instruments due to its good wear resistance, high strength, and machinability.

The increasing global demand for surgical tools due to efficient healthcare facilities and services worldwide is expected to drive the segment’s growth from 2022 to 2032.

The Duplex series stainless steel is dominant as it has high strength, lightweight, and high corrosion resistance, especially stress corrosion cracking, which is expected to increase the demand for the products during the forecast period. The product is used in the pharmaceutical, oil and gas, water desalination, and chemical and petrochemical industries.

Key Market Segments

Based on Type

- Austenitic Stainless Steels

- Martensitic Stainless Steels

- Ferritic Stainless Steels

- Precipitation Hard Stainless Steel

Based on Application

- Automotive and Transportation

- Building and Construction

- Heavy Industries

Based on Grades

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

Opportunity

High Demand and Consumption in Industries Create Great Opportunities in Stainless Steel Industry.

The need for steel will likely increase exponentially over time as more and more nations place a priority on infrastructure and development. Over the years, steel demand has been determined by various factors, including unresolved structural problems, political unpredictability, volatile financial markets, and more.

Steel consumption is anticipated to increase steadily over the upcoming years, and this expectation may exceed all expectations. Whether steel producers or the industry can meet this expanding demand is debatable. The increase in globalization, increasing consumer demands, and disposable income worldwide have led to great opportunities in the stainless steel market in the forecast period.

Trends

Growing Demand for Stainless Steel in Automotive Industry Creates Positive Outlook.

Manufacturers are now more inclined toward raw material procurement at competitive pricing. Raw material procurement involves engaging in long-term supply contracts with raw material suppliers. Some independent manufacturers hire third-party suppliers to sell their products.

Stainless steel manufacturers are increasingly focused on product innovation and differentiation as they are steadily moving toward consolidation through mergers & acquisitions, joint ventures, and collaborative partnerships.

Such trends are currently being witnessed in this market, thereby bolstering the demand for stainless steel products in the process.

Regional Analysis

Asia Pacific region Holds the Largest Market Share

Based on regional analysis, the Asia Pacific stainless steel market share is anticipated to increase in revenue during the forecast period. Asia Pacific is a major region that holds a lucrative market share of 45%.

An increase in the use of chemical and petrochemical products, medical supplies, energy, consumer goods, and heavy and vehicle transportation is driving market revenue growth. The market size of Asia Pacific stood at 45%. China holds the highest stainless steel market in the Asia Pacific region.

In Europe, increased demand for stainless steel is associated with rapid growth in automotive industries and technological advancement. In North America, the improvements in R&D facilities and the technology adoption rate is greater. As such, the market for stainless steel is anticipated to grow.

The North American market is growing due to increasing demand for the duplex series stainless steel in electronic and engineering applications. In South America, Brazil and Mexico are the leading countries. The growth of the construction industry in the Middle East and Africa will show significant market growth due to the increase in construction activities in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key companies are focused on various strategic policies to develop their respective businesses in foreign markets. Several stainless steel market companies are concentrating on expanding their existing operations, capacity expansion, and R&D facilities.

Furthermore, firms in the stainless steel market are developing new products and expansion strategies through investments, mergers, and acquisitions.

Market Key Players

- Acerinox S.A

- Aperam Stainless Steel

- Acre lot Mittal

- Baosteel Group

- Jindal Stainless

- Nippon Steel Corporation

- Outolkumpu

- POSCO

- Yieh United Steel Corporation

- ThyssenKrupp Stainless GmbH

- AK Steel Corporation

- JFE Steel Corpo.

- Other Key Players

Recent Developments

- In December 2021, Aperam acquired ELG, a global recycler of stainless steel, for a value of USD 358.3 Million.

- In February 2021, VINCO launched a new line of steel wires and slings. These wires have significant applications in the Fishing, industrial, elevation, and lifting sectors.

- In April 2022, ArcelorMittal stainless steel company agreed to acquire an 80% interest in voestalpine’s well-known Hot Briquetted Iron (“HBI”) located in Corpus Christi, Texas.

Report Scope

Report Features Description Report Features Description Market Value (2022) US$ 141.2 Bn Forecast Revenue (2032) US$ 283.2 Bn CAGR (2023-2032) 7.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, and Precipitation Hard Stainless Steel; By Application- Automotive and Transportation, Building and Construction, Heavy Industries; By Grades- 200 Series, 300 Series, 400 Series, and Duplex Series Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Acerinox S.A, Aperam Stainless Steel, Acre lot Mittal, Baosteel Group, Jindal Stainless, Nippon Steel Corporation, Outolkumpu, POSCO, Yieh United Steel Corporation, ThyssenKrupp Stainless GmbH, AK Steel Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Stainless Steel Market is expected to grow at?The Stainless Steel Market is expected to grow at a CAGR of 7.4% (2023-2032).

Which region is more appealing for vendors employed in the Stainless Steel Market?The Asia Pacific stainless steel market share is anticipated to increase in revenue during the forecast period. Asia Pacific is a major region that holds a lucrative market share of 45%.

Name the key business areas for the Stainless Steel Market.The US, Canada, China, India, Brazil, South Africa, Singapore, Indonesia, Portugal, etc., are leading key areas of operation for the Stainless Steel Market.

List the segments encompassed in this report on the Stainless Steel Market?Market.US has segmented the Stainless Steel Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented Based on Type Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, and Precipitation Hard Stainless Steel. Based on Application Automotive and Transportation, Building and Construction, and Heavy Industries. Based on Grades 200 Series, 300 Series, 400 Series, and Duplex Series.

What is the size of the Stainless Steel Market in 2022?The Stainless Steel Market size is USD 131.5 billion in 2022.

-

-

- Acerinox S.A

- Aperam Stainless Steel

- Acre lot Mittal

- Baosteel Group

- Jindal Stainless

- Nippon Steel Corporation

- Outolkumpu

- POSCO

- Yieh United Steel Corporation

- ThyssenKrupp Stainless GmbH

- AK Steel Corporation

- JFE Steel Corpo.

- Other Key Players