Global Oxygen Therapy Market By Product Type (Oxygen Source Equipment, Oxygen Delivery Devices), By Device Type (Stationery and Portable), By Application, By End-User By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 106052

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

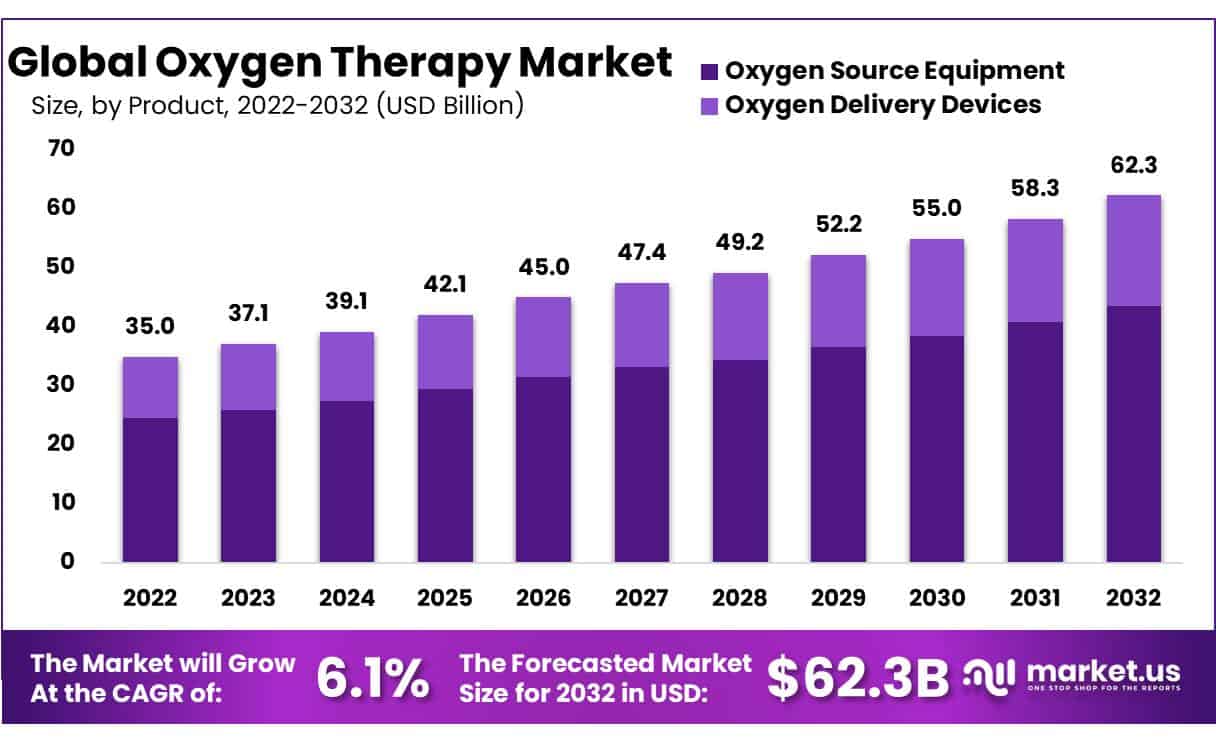

Global Oxygen Therapy Market size is expected to be worth around USD 62.3 Billion by 2032 from USD 35.0 Billion in 2022, growing at a CAGR of 6.1% during the forecast period from 2023 to 2032.

Oxygen therapy is a medical treatment that provides oxygen to people who need it. Oxygen therapy is mainly used to treat diseases like asthma, chronic obstructive pulmonary disease (COPD), sleep apnea, and other conditions where patients don’t get enough oxygen. According to the National Institutes of Health (NIH), nearly 12 million individuals in the U.S. have been diagnosed with COPD, and 120,000 deaths occur due to the disease every year. The Global Asthma Network (GAN) reports that about 334 million people globally suffer from asthma.

The oxygen is supplied in either liquid or gaseous form and is transported through the cannula face mask, or a hyperbaric oxygen chamber. Additionally, they are connected to other medical instruments to enhance the effectiveness of the treatment, including ventilators, and Continuous Positive Airway Pressure (CPAP) machines.

*Actual Numbers Might Vary in the final report

Key Takeaways

- Market Growth: The Global Oxygen Therapy Market is expected to reach approximately USD 62.3 billion by 2032, growing at a CAGR of 6.1%.

- Oxygen Therapy Definition: Oxygen therapy provides oxygen to individuals with conditions like asthma, COPD, and sleep apnea. It’s a critical treatment for those who don’t receive enough oxygen.

- Disease Prevalence: COPD affects 12 million individuals in the U.S., causing 120,000 deaths annually. Globally, about 334 million people suffer from asthma.

- Product Types: The market consists of oxygen source equipment (over 70% of revenue) and oxygen delivery devices. Oxygen source equipment includes concentrators, liquid devices, and cylinders.

- Device Types: Portable devices (63.1% of market share) dominate, driven by innovations, increased mobility needs, and an aging population.

- Applications: Chronic Obstructive Pulmonary Disease (COPD) holds the largest market share (34.6%) due to its increasing prevalence, affecting approximately 65 million people worldwide.

- End Users: Home healthcare leads with a 58.5% market share due to the adoption of Long-Term Oxygen Therapy (LTOT) devices for their user-friendliness and portability.

- Drivers: Market growth is fueled by the need for smaller, reliable portable oxygen products and technological advancements, including improved battery life.

- Technological Advancements: These include flow-controlling devices, sensors, and the integration of delivery devices and pulse dosage meters.

- Opportunities: As wearable technology, PPG sensors, and 5G connectivity advance, digital health data transfer for oxygen therapy monitoring is expected to grow.

- Trends: Home oxygen therapy is on the rise, offering various medical equipment options for patients requiring supplemental oxygen.

- COVID-19 Impact: Disruptions in supply chains and increased demand for oxygen concentrators during the pandemic influenced market dynamics.

- Regional Analysis: North America dominated the market in 2022, driven by research investments and increasing demand for hyperbaric and topical oxygen therapy. Asia Pacific is expected to exhibit high growth.

- Market Share & Key Players: The market is competitive, with key players like Philips Healthcare, Linde Healthcare, and GE Healthcare leading the industry through investments, mergers, and acquisitions.

- Notable Innovation: GE Healthcare’s CARESCAPE R860 ventilator integrates oxygen therapy seamlessly, offering advanced monitoring and notification features.

Product Type Analysis

Global Oxygen Source Equipment accounted for the largest market share in 2022 with a revenue share of over 70% owing to the rising incidence of respiratory ailments.

Based on the product, the market is bifurcated into oxygen source equipment and oxygen delivery devices. Furthermore, based on oxygen source equipment the market is sub-segmented into oxygen concentrators, liquid oxygen devices, and oxygen cylinders. oxygen delivery device is further sub-segmented into oxygen masks, nasal cannulas, venture masks, non-rebreather masks, and bag value masks.

Oxygen therapy equipment is now an essential component in properly managing several illnesses, such as chronic obstructive pulmonary disease, asthma, and other respiratory discomfort conditions. In 2022, the oxygen source equipment segment accounted for the largest share of the market. Oxygen concentrators in the oxygen source equipment segment are expected to expand at a rapid pace. This device is one of the most cost-effective solutions that produces oxygen by sucking nitrogen from the surrounding air. These portable devices are the best alternative in remote and/or resource-poor areas, where there are no oxygen plants or cylinder delivery networks.

Device Analysis

Advancements in technology and the rising popularity of on-demand and continuous Portable Oxygen concentrators.

Based on the Device type, the oxygen therapy equipment market is segmented into portable and stationary devices. Portable devices dominated the market with a revenue share of 63.1% in 2022. On-demand and continuous portable oxygen therapy is becoming increasingly popular and adopted in a variety of sectors, including emergency medicine. The surge in demand can be attributed to the entry of new players into the market, the manufacturing such devices, the need for portable technology among patients.

For instance, the clinical need for mobility support among geriatric patients is driving the segment growth. The business is expected to grow due to continuous innovation resulting in more effective units and lower prices.

Application Analysis

The Increasing Prevalence of Chronic Obstructive Pulmonary Has Led To A Rise in the Demand for Oxygen Therapy

Based on applications, the market is further divided into chronic obstructive pulmonary disease, asthma, obstructive sleep apnea, respiratory distress syndrome, pneumonia, and other applications. among these applications, Chronic Obstructive Pulmonary Disorder (COPD) accounted for the largest market share of over 34.6% in 2022 owing to the increasing prevalence of COPD.

The World Health Organization (WHO) estimates that Chronic Obstructive Pulmonary Disease affects about 65 million people worldwide and is the 3rd leading cause of death. The increasing number of people with COPD is raising the clinical need for COPD treatment, which is driving the growth of the business.

End User Analysis

The home healthcare segment accounted for a significantly large revenue share in the market.

Based on the end users, the market is segmented into hospitals, home healthcare, ambulatory surgical centers, and others. The home healthcare segment held the largest market share of 58.5% in 2022 and is expected to grow at a steady rate over the forecast period. The increasing use of Long-Term Oxygen Therapy (LTOT) devices in residential settings is expected to drive market growth in the near future. This is due to the increasing number of physicians prescribing these devices due to their advantages over traditional alternatives, which include user-friendliness, reduced hospitalization rate, ease of use and portability.

Key Market Segments

By Product Type

- Oxygen Source Equipment

- Oxygen Concentrators

- Liquid Oxygen Devices

- Oxygen Cylinders

- Oxygen Delivery Devices

- Oxygen Masks

- Nasal Cannulas

- Venturi Masks

- Non-rebreather Masks

- Bag-value Masks

- Other Oxygen Delivery Devices

By Device

- Stationery

- Portable

By Application

- Chronic Obstructive Pulmonary Disease

- Asthma

- Obstructive Sleep Apnea

- Respiratory Distress Syndrome

- Cystic Fibrosis

- Pneumonia

- Other Applications

By End User

- Hospitals

- Home Healthcare

- Ambulatory Surgical Centers

- Other End User

Drivers

The surge in the latest oxygen therapy solutions

The need for the smallest, most reliable portable oxygen products is growing. This is mainly because they prefer not to carry a bulky and hefty oxygen device as well as patients are less likely to pay attention to their therapy when utilizing portable home oxygen therapy equipment.

In addition, one of the areas where oxygen-conserving techniques and lithium-ion battery technology have made significant strides lately is the enhancement of battery life. Modern portable oxygen concentrators weigh about 5-7 pounds and can deliver oxygen treatment for up to 8–13 hours after a battery charge, depending on the liter flow parameters selected by each patient. These technological advancements are further driving the overall market growth.

Technological advancements

The development of modern oxygen sources and delivery technologies that provide effective patient care is projected to drive market growth. Flow-controlling devices, sensors, and the integration of delivery devices and pulse dosage meters are among the developments. Because of the potential benefits such as regulated flow, effective dosage, faster reaction rates, and higher durability and stability, oxygen therapy is becoming increasingly popular.

Restraints

Nasal dryness and skin irritation

Oxygen concentrators can cause nasal drying and skin irritation when used for therapy. Pure oxygen can dry out your nasal passages and irritate your skin. In some cases, the dryness can lead to nose bleeds. In addition, regular use of a nose cannula or mask can cause some skin irritation, including rashes and breakouts, thereby, restraining the market growth.

Regulatory policies

The oxygen treatment equipment market is facing a number of challenges. First, the market is subject to strict regulatory requirements that can hold up product approval. Second, Medicare reimbursement rates for home oxygen treatment and the availability of low-cost replacements made by local manufacturers are going to act as market inhibitors and impede the growth of the market.

Opportunity

Technology advancements in therapeutic equipment

As the number of people with respiratory conditions requiring oxygen therapy devices increases, so does the need for healthcare facilities to manage patients who need oxygen therapy on a regular basis. With the development of wearable technology and the improvement of PPG sensors and 5G connectivity, the trend for digital health data transfer to oxygen therapy monitoring is expected to grow quickly.

The PPG device measures volumetric changes in blood circulation through a light source and photodetector placed at the skin’s surface. Wearable PPG sensors can only be placed on specific body parts, such as the fingertips, the earlobes and the forehead.

Patients can also become more involved in their care with the increasing use and adoption of remote patient monitoring systems and proper instruction on how to use them. All of these factors will contribute to the profitable prospects of the oxygen therapy market.

Trends

The Oxygen therapy market is driven by several market trends including Home Oxygen Therapy

Many types of Medical Equipment are available for home oxygen therapy which Includes concentrators, liquid systems, cylinders, and generators. The primary purpose of home oxygen therapy is to provide supplemental oxygen to the body in order to improve respiratory function. Home oxygen therapy can be beneficial for individuals with hypoxia, a health condition that results in a decrease in oxygen levels in the blood.

This can lead to symptoms such as shortness of breath, fatigue, swelling around the ankles, and blue lips. By inhaling air with a higher oxygen concentration than usual, the oxygen in the blood can be increased, making it easier to perform activities and potentially reducing symptoms.

Regional Analysis

North America Region Accounted for Significant Share of the Global Oxygen Therapy Market

Based on a regional analysis, the global oxygen therapy market has been divided into the following sub-regions: North America, Europe, Asia Pacific, Middle East and Africa (MEA), and Latin America. In 2022, North America held the largest revenue share of more than 32.0% due to the high level of research and development investments and trials related to oxygen therapy in the region.

Furthermore, the growing demand for hyperbaric and topical oxygen therapy in this region is further contributing to the growth of the market. Furthermore, the urbanization and occupational risks in this region are likely to increase the risk of respiratory disorders, thus, further contributing to the market growth.

The oxygen therapy market in Asia Pacific is expected to grow at a high CAGR over the next five years. This is because the global players are investing heavily in research and development (R&D) and are increasing the commercialization of the equipment they develop for oxygen therapy. Furthermore, the high demand for new systems and the need to replace and upgrade the medical infrastructure are expected to provide lucrative growth opportunities for the business in the coming years. The constant technological innovation and the expansion of distribution networks of global players are driving the growth of the market in thes North America region.

Key Regions

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Investments and mergers & acquisitions by key players are driving the portable oxygen concentrators market

The market is characterized by a highly competitive environment, with a selected few players holding a significant portion of the revenue. Companies are adopting stratergies like the introduction of new products and technological progress to maintain the competitive edge, and improved market penetration. Invacare Corporation, GCE Group, and Koninklijke Philips N.V. are some of the market leaders in the global portable oxygen concentrators market. These companies are focusing on mergers and acquisitions, as well as investing in the development and distribution of portable oxygen concentrators.

GE Healthcare is a Market player who begun development in CARESCAPE R860 ventilator with Integrated Oxygen Therapy

CARESCAPE R860 ventilator allows for a smooth transition between mechanical ventilation and oxygen therapy without the need to modify the patient’s breathing circuit, both single- and double-limb. Additionally, a unique Circuit Pressure Bar graph is available to provide notifications of potential occlusions prior to the patient’s desaturation. Additionally, a swipe-screen navigation feature is available to display trend lines to facilitate the tracking of patient’s condition changes and progresses.

Recent Development

- In November 2021, United Nations Children’s Fund (UNICEF) and the UK government have joined forces to develop a state-of-the-art oxygen concentrator specifically designed for low-resource environments. The oxygen concentrator is part of UNICEF’s COVID-19 campaign to combat the COVID-19 pandemic and meet the oxygen needs of critical care environments.

- In June 2022, Armstrong Medical announced the second generation FD140i, a superior dual treatment flow driver with an easier transition from Continuous Positive Airway Pressure (CPAP) to high-flow oxygen therapy (HFOT).

Market Key Players

Some of the major players in the industry are as follows:

- Philips Healthcare

- Linde Healthcare

- Chart Industries, Inc.

- Invacare Corporation

- Smiths Medical

- Drägerwerk AG & Co. KGaA

- Teleflex Incorporated

- Fisher & Paykel Healthcare Corporation Limited

- GE Healthcare

- Other Key Players

Report Scope

Report Features Description Market Value (2022) USD 35.0 Billion Forecast Revenue (2032) USD 62.3 Billion CAGR (2023-2032) 6.1% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oxygen Source Equipment, Oxygen Delivery Devices), By Device (Portable and Stationary), By Application (Chronic Obstructive Pulmonary Disease, Asthma, Obstructive Sleep Apnea, Pneumonia, and Other Applications) By End-User (Hospitals, Home Healthcare, Ambulatory Surgical Centers & others) Regional Analysis North America The US, Canada, Europe Germany, France, The UK, Spain, Italy, Russia & CIS, Netherlands, Rest of Europe, APAC China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC Latin America Brazil, Mexico, Rest of Latin America, Middle East & Africa South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips Healthcare, Linde Healthcare, Chart Industries, Inc., Invacare Corporation, Smiths Medical, Drägerwerk AG & Co. KGaA, Teleflex Incorporated, Fisher & Paykel Healthcare Corporation Limited, GE Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is oxygen therapy?Oxygen therapy is a medical treatment that involves administering oxygen to patients who have low oxygen levels in their blood to improve their breathing and overall health.

How big is the Oxygen Therapy Market?The global Oxygen Therapy Market size was estimated at USD 35.0 billion in 2022 and is expected to reach USD 62.3 billion in 2032.

What is the Oxygen Therapy Market growth?The global Oxygen Therapy Market is expected to grow at a compound annual growth rate of 6.1%. From 2023 To 2032

Who are the key companies/players in the Oxygen Therapy Market?Some of the key players in the Oxygen Therapy Markets are Philips Healthcare, Linde Healthcare, Chart Industries, Inc., Invacare Corporation, Smiths Medical, Drägerwerk AG & Co. KGaA, Teleflex Incorporated, Fisher & Paykel Healthcare Corporation Limited, GE Healthcare, Other Key Players

Why is oxygen therapy used?Oxygen therapy is used to treat various medical conditions, such as chronic obstructive pulmonary disease (COPD), pneumonia, and respiratory distress, where the body's oxygen levels are insufficient.

How is oxygen delivered in therapy?Oxygen can be delivered through different methods, including nasal cannulas, oxygen masks, and oxygen concentrators, depending on the patient's needs and condition.

Who benefits from oxygen therapy?Oxygen therapy benefits individuals with respiratory disorders, severe infections, and those recovering from surgery. It can also help athletes and mountaineers acclimatize to high altitudes.

-

-

- Philips Healthcare

- Linde Healthcare

- Chart Industries, Inc.

- Invacare Corporation

- Smiths Medical

- Drägerwerk AG & Co. KGaA

- Teleflex Incorporated

- Fisher & Paykel Healthcare Corporation Limited

- GE Healthcare

- Other Key Players