Home Healthcare Market By Product Type (Equipment (Therapeutic (Home respiratory therapy equipment, Insulin delivery devices, Home IV pumps, Home dialysis equipment, and Others), Diagnostic (Diabetic care unit, Multi para diagnostic monitors, Home pregnancy and fertility kits, Holter monitors, Heart rate monitors, BP monitors, Apnea and sleep monitors, Others), and Mobility Assist (Wheel chair, Walking assist devices, Home medical furniture)) and Services (Skilled Home Healthcare Services (Physician primary care, Physical/occupational/speech therapy, Nutritional support, Nursing care, Hospice & palliative care, Others)) and Unskilled Home Healthcare Services))), By Application (Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Cancer, Wound Care, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 64786

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

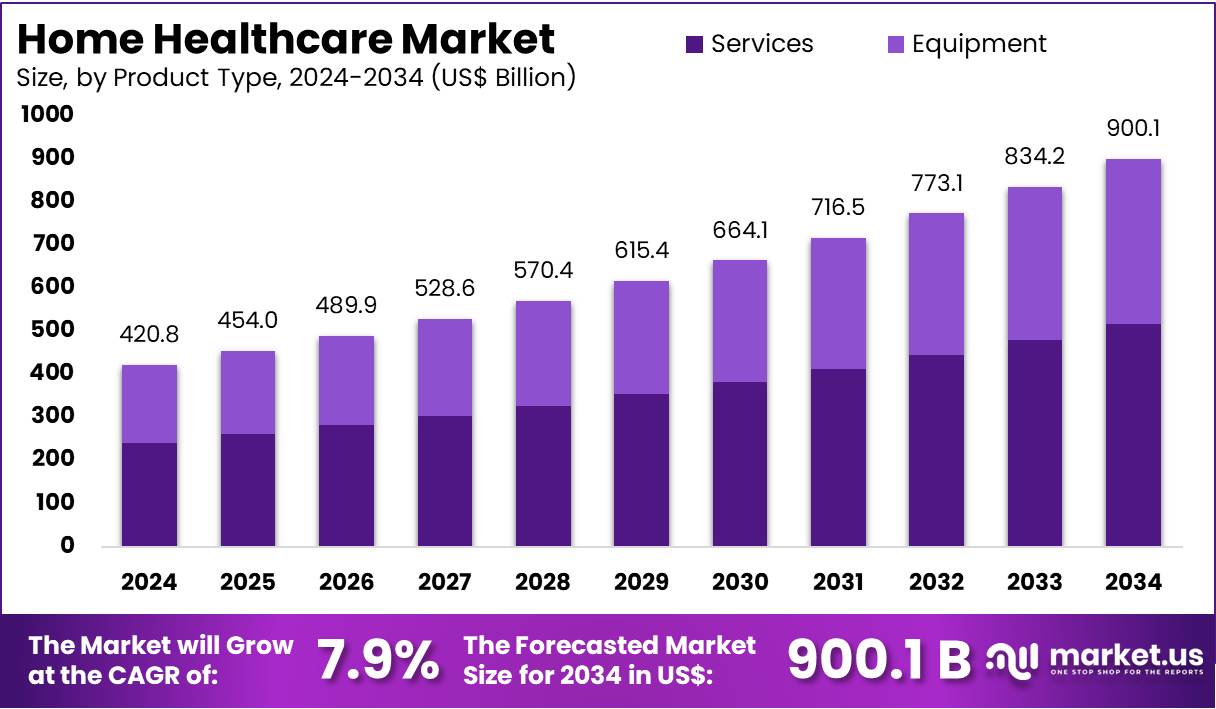

The Home Healthcare Market size is expected to be worth around US$ 900.1 billion by 2034 from US$ 420.8 billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.2% share and holds US$ 169.2 Billion market value for the year.

Growing demand for cost-effective and patient-centric healthcare solutions is driving expansion in the home health market. The increasing prevalence of chronic diseases, including diabetes, cardiovascular disorders, and respiratory conditions, is fueling the need for continuous monitoring and long-term care outside traditional hospital settings. A 2022 study published by NCBI analyzed the cost differences between inpatient hospitalization and home healthcare, revealing that home-based treatment was approximately USD 5,000 more affordable than hospital stays.

This cost-effectiveness has driven increased adoption of home healthcare solutions. The rising geriatric population, which requires specialized care for age-related illnesses, is accelerating demand for skilled nursing, physical therapy, and palliative care services at home. Expanding telehealth integration is enhancing remote patient monitoring capabilities, allowing healthcare providers to offer virtual consultations and real-time health assessments.

The growing popularity of home infusion therapy is reducing hospital readmissions by enabling safe and efficient medication administration for patients with chronic illnesses. Increasing advancements in wearable health technology and mobile health applications are improving patient compliance and enabling proactive disease management. The surge in demand for post-surgical and rehabilitation care is boosting the need for home-based physical and occupational therapy services.

Rising healthcare workforce shortages are encouraging greater reliance on home health aides and certified caregivers to support non-medical assistance for elderly and disabled individuals. The shift toward value-based care models is incentivizing healthcare providers to offer personalized home-based treatment plans that improve patient outcomes while reducing hospital resource strain.

Expanding government support and reimbursement policies for home health services are creating opportunities for service providers to scale operations and enhance care quality. The growing integration of artificial intelligence and predictive analytics in home health solutions is enabling early disease detection and personalized intervention strategies.

Increasing adoption of home palliative and hospice care services is addressing the growing need for compassionate end-of-life care. As healthcare providers and patients prioritize convenience, affordability, and quality of care, the home health market is expected to experience sustained growth in the coming years.

Key Takeaways

- In 2024, the market for home healthcare generated a revenue of US$ 420.8 billion, with a CAGR of 7.9%, and is expected to reach US$ 900.1 billion by the year 2034.

- The product type segment is divided into equipment and services, with services taking the lead in 2024 with a market share of 57.4%.

- Considering application, the market is divided into cardiovascular disorder & hypertension, diabetes & kidney disorders, cancer, wound care, others. Among these, cardiovascular disorder & hypertension held a significant share of 38.6%.

- North America led the market by securing a market share of 40.2% in 2024.

Product Type Analysis

The services segment led in 2024, claiming a market share of 57.4% owing to the increasing demand for personalized care in home settings. As the aging population grows, more patients prefer to receive care at home, especially for chronic conditions and recovery after surgeries. This trend is driving the need for home healthcare services, including nursing care, physical therapy, and occupational therapy.

Home health services provide patients with comfort, reduce hospital readmissions, and offer more cost-effective solutions compared to inpatient care. The rise in healthcare costs and advancements in telemedicine further contribute to the increasing reliance on home health services, making it a crucial segment in the market. Additionally, insurers are increasingly offering coverage for home healthcare, further expanding its accessibility.

Application Analysis

The cardiovascular disorder & hypertension held a significant share of 38.6% due to as chronic conditions like hypertension, heart disease, and stroke continue to rise globally. With the increasing prevalence of cardiovascular diseases, patients are seeking home care options for monitoring and management. Home healthcare allows patients to receive regular monitoring of blood pressure, heart function, and other related metrics in the comfort of their own home.

The growing awareness of preventive care and the need for long-term management of cardiovascular conditions will drive demand for home health services in this segment. Additionally, the convenience of home-based care for elderly patients with hypertension, coupled with technological advancements in remote monitoring devices, is expected to further boost the growth of this segment.

Key Market Segments

By Product Type

- Equipment

- Therapeutic

-

-

- Home respiratory therapy equipment

- Insulin delivery devices

- Home IV pumps

- Home dialysis equipment

- Others

- Diagnostic

- Diabetic care unit

- Multi para diagnostic monitors

- Home pregnancy and fertility kits

- Holter monitors

- Heart rate monitors

- BP monitors

- Apnea and sleep monitors

- Others

- Mobility Assist

- Wheel chair

- Walking assist devices

- Home medical furniture

-

- Services

- Skilled Home Healthcare Services

- Physician primary care

- Physical/occupational/speech therapy

- Nutritional support

- Nursing care

- Hospice & palliative care

- Others

- Unskilled Home Healthcare Services

- Skilled Home Healthcare Services

By Application

- Cardiovascular Disorder & Hypertension

- Diabetes & Kidney Disorders

- Cancer

- Wound Care

- Others

Drivers

Increasing Awareness About Diabetes Driving the Home Health Market

Increasing awareness about diabetes is expected to fuel the growth of the home health market. In June 2023, Abbott partnered with the American Diabetes Association to explore the impact of diabetes technology, such as continuous glucose monitoring (CGM) systems, on improving patient health outcomes. This collaboration contributed to a growing demand for Abbott’s diabetes care products, particularly in home healthcare settings.

With more individuals becoming aware of diabetes management solutions, the adoption of home-based glucose monitoring devices and telehealth consultations is rising. Patients prefer home healthcare services to manage diabetes efficiently while reducing hospital visits and associated costs. Digital health platforms and mobile applications are making diabetes monitoring more accessible and convenient. Insurers and healthcare providers are expanding reimbursement policies to encourage the use of at-home monitoring tools.

The growing availability of personalized diabetes care plans further strengthens the demand for home-based services. Healthcare companies are investing in remote patient monitoring solutions to enhance real-time glucose tracking and improve patient adherence to treatment. Advancements in wearable diabetes management devices are expanding the market for home healthcare services. The integration of AI-driven insights in diabetes care allows for predictive health analytics, leading to better preventive measures. As diabetes cases continue to rise globally, the demand for home-based healthcare solutions is projected to increase significantly.

Restraints

Rising Cost of Skilled Home Healthcare Professionals as a Restraint in the Home Health Market

Increasing labor costs are expected to challenge the expansion of the home health market. The demand for skilled nurses, home aides, and therapists has surged due to the growing preference for home-based care, but the supply of qualified professionals remains insufficient. Healthcare providers face rising wages and benefits expenses, increasing the overall cost of home health services. Many professionals in the industry are seeking better compensation and job security, leading to workforce shortages in critical areas.

The rising cost of training and certifying home healthcare workers further impacts service accessibility and affordability. Families often struggle to cover the costs of private home healthcare services, limiting market growth. Government reimbursement policies may not always keep pace with increasing labor costs, creating financial pressure on home healthcare providers. Despite the demand for home-based care, the escalating cost of skilled professionals remains a significant constraint on market expansion.

Opportunities

Rising Global Geriatric Population as an Opportunity in the Home Health Market

Rising global geriatric populations are expected to create significant opportunities in the home health market. According to an October 2024 World Health Organization (WHO) report, the proportion of the global population aged 60 and older is projected to rise significantly, with one in six people expected to fall into this age group by 2030. The senior population, which stood at 1 billion in 2020, is forecasted to grow to 1.4 billion by 2030 and surpass 2.1 billion by 2050, driving demand for eldercare services and age-related healthcare innovations.

Many elderly individuals prefer to receive healthcare in their homes rather than institutional settings, increasing the need for home-based nursing, physical therapy, and chronic disease management services. The rise in age-related conditions such as dementia, osteoporosis, and cardiovascular diseases further accelerates demand for personalized home healthcare solutions.

Remote patient monitoring tools are improving access to continuous care, allowing seniors to receive real-time health updates from medical professionals. Government initiatives promoting aging-in-place programs are supporting the expansion of home healthcare services. Insurance companies are expanding coverage for home-based care, making it a more viable option for aging populations. As the elderly demographic continues to grow, the home healthcare sector is anticipated to see sustained expansion in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the home health market. On the positive side, the increasing aging population and rising healthcare costs drive the demand for home healthcare services, as individuals seek more affordable and convenient alternatives to traditional hospital care. Governments in many countries are focusing on expanding healthcare access and affordability, which encourages the growth of home health solutions.

However, economic downturns and budget constraints in healthcare systems can hinder investments in home healthcare infrastructure. Geopolitical factors, such as changes in healthcare regulations, trade policies, and cross-border healthcare access, can disrupt the flow of necessary medical supplies and labor, leading to temporary shortages in certain regions. Despite these challenges, technological advancements, growing consumer interest in personalized care, and the continued emphasis on reducing hospital admissions ensure that the home health market remains poised for long-term growth.

Latest Trends

Integration of AI Driving the Home Health Market

The integration of artificial intelligence (AI) is a rising trend driving the home health market. High demand for more efficient and precise healthcare solutions has led to the incorporation of AI-driven technologies in remote patient monitoring and disease management. These advancements are expected to improve decision-making, predict patient conditions more accurately, and enhance overall treatment outcomes in home settings. AI-powered devices, such as smart health monitors, offer real-time feedback and alert healthcare providers to potential issues before they escalate, leading to better management of chronic conditions and reducing hospital readmissions.

The rising use of AI in healthcare, particularly in home health, is likely to revolutionize patient care, making it more personalized and efficient. In April 2023, OMRON Corporation joined forces with Tricog, an artificial intelligence company, to advance blood pressure monitoring and personal healthcare solutions in India. This collaboration aims to improve remote health tracking and early detection of cardiovascular conditions. The growing adoption of AI in home health services is expected to continue driving the market’s expansion.

Regional Analysis

North America is leading the Home Healthcare Market

North America dominated the market with the highest revenue share of 40.2% owing to the rising adoption of remote monitoring technologies and an increasing preference for in-home care services. The introduction of Tyto Care’s telehealth-integrated pulse oximeter in January 2021 expanded access to remote patient monitoring, allowing users to track oxygen saturation levels and share real-time data with healthcare providers. The growing aging population and the prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders fueled demand for home-based medical services.

Advancements in wearable health devices and AI-driven telemedicine platforms improved the efficiency of virtual consultations and personalized care. Government initiatives supporting home healthcare reimbursement and Medicare expansion contributed to increased patient adoption. The shift toward value-based care models encouraged healthcare providers to invest in remote monitoring solutions, reducing hospital readmissions and healthcare costs. Additionally, partnerships between technology firms and home care agencies strengthened service delivery, reinforcing North America’s leadership in the digital health transformation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an aging population and increasing healthcare accessibility. China’s senior population, aged 60 and above, reached 297 million in January 2024, accounting for 21.1% of the total population, with projections indicating a rise to over 500 million by 2050. This demographic shift is likely to drive demand for elderly care solutions, including remote patient monitoring, telemedicine, and home-based nursing services. Government policies promoting long-term care insurance and elderly-friendly healthcare infrastructure are expected to support market expansion.

Increasing investments in smart medical devices and AI-driven virtual care platforms are anticipated to enhance remote diagnostics and treatment options. Collaborations between global health tech companies and regional healthcare providers are projected to improve accessibility and affordability of personalized home-based care. Additionally, the expansion of medical tourism and private healthcare services is likely to create further opportunities for home-based patient management across Asia Pacific.

Home Healthcare Market Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the home health market focus on expanding remote patient monitoring, telehealth services, and personalized care programs to enhance patient outcomes. Companies invest in advanced medical devices and digital platforms to improve real-time health tracking and care coordination. Strategic partnerships with healthcare providers and insurers help increase service accessibility and reimbursement coverage.

Emphasis on skilled nursing, physical therapy, and chronic disease management drives market growth. Many players also prioritize workforce training and regulatory compliance to maintain high-quality care standards. Amedisys Inc. is a leading company in this market, offering a wide range of home-based healthcare services, including nursing, hospice, and personal care. The company focuses on integrating technology and data analytics to enhance patient-centered care. Amedisys’ commitment to innovation and quality positions it as a key player in the home healthcare industry.

Home Healthcare Market Top Key Players Are

- Sunrise Medical

- OMRON Corporation

- Medtronic PLC

- CommScope

- Cardinal Health Inc.

- Air Liquide

- Abbott

- 3M Healthcare

Recent Developments

- In October 2022, OMRON Corporation enhanced its lineup of blood pressure monitors by introducing smart connectivity features. These upgraded devices sync with smartphones via the “OMRON connect” app, allowing real-time health tracking for both patients and healthcare providers, improving hypertension management and remote monitoring capabilities.

- In October 2022, CommScope introduced HomeSight, an advanced connected care system designed to revolutionize remote healthcare and homecare services. The platform integrates digital health monitoring solutions, enabling seamless communication between patients and healthcare providers while enhancing the accessibility of virtual care.

Report Scope

Report Features Description Market Value (2024) US$ 420.8 billion Forecast Revenue (2034) US$ 900.1 billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment (Therapeutic (Home respiratory therapy equipment, Insulin delivery devices, Home IV pumps, Home dialysis equipment, and Others), Diagnostic (Diabetic care unit, Multi para diagnostic monitors, Home pregnancy and fertility kits, Holter monitors, Heart rate monitors, BP monitors, Apnea and sleep monitors, Others), and Mobility Assist (Wheel chair, Walking assist devices, Home medical furniture)) and Services (Skilled Home Healthcare Services (Physician primary care, Physical/occupational/speech therapy, Nutritional support, Nursing care, Hospice & palliative care, Others)) and Unskilled Home Healthcare Services))), By Application (Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Cancer, Wound Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sunrise Medical, OMRON Corporation, Medtronic PLC, CommScope, Cardinal Health Inc., Air Liquide, Abbott, and 3M Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sunrise Medical

- OMRON Corporation

- Medtronic PLC

- CommScope

- Cardinal Health Inc.

- Air Liquide

- Abbott

- 3M Healthcare